Changes During Annual Open Enrollment

There are many plan changes that Medicare beneficiaries might want to make from one year to the next.

For most of them, the applicable open enrollment period is October 15 to December 7, with changes effective on January 1. During that timeframe, you can:

- Switch from Original Medicare to Medicare Advantage, or vice versa.

- Switch from one Medicare Advantage plan to another.

- Enroll in a Part D Prescription Drug Plan for the first time

- Switch from one Part D plan to another.

- Drop your Part D coverage altogether .

Medicare eligibility goes hand-in-hand with Social Security eligibility.

Individuals in the below-listed categories can get Medicare coverage.

- Persons age 65 or older eligibility begins four months before their 65th birthday

- Disabled persons 64 and under can qualify if receiving disability benefits from Social Security or the RRB for 24 months

- Persons with end-stage renal disease can get premium-free Medicare Part A. Eligibility based on End-Stage Renal Disease requires current dialysis treatment, a kidney transplant, and filing an application for Medicare.

Recommended Reading: Do You Have Dental With Medicare

How Do You Check Your Medicare Coverage Status

There are several ways Social Security Administration and Medicare allow you to monitor the status of your coverage. Because SSA handles your initial enrollment in Original Medicare Part A and/or Part B, it is important that you stay in touch with them throughout the process and beyond. They can be contacted in the following ways:

| How to Check Your Medicare Coverage Status | |||

|

|

|

If You or Your Spouse Worked For a Railroad

|

Once your application is processed, you will receive a notification letter in the mail to inform you of whether your application was approved.

What Is A Diagnosis Related Group For Medicare

Learn how to create an online Medicare account. You can use your online MyMedicare account to view your Medicare premium bills, check your payment history and set up Medicare Easy Pay for auto payments.

by Zia Sherrell | Published March 22, 2021 | Reviewed by John Krahnert

Senior Americans are embracing technology at a rapid rate. In 2000, just 14% of Americans aged 65 and older used the internet. A Pew Research Center report released in 2019 found that the number had grown to 73%.1

If youre one of these digitally-savvy people, youre probably interested in the ways technology can simplify your life. Signing up for Medicares MyMedicare online portal is a great way to save time and help you make and track your payments.

Also Check: How To Apply For Medicare Insurance

Recommended Reading: Does Medicare Part B Go Up Every Year

How Long Does It Take For A Medicare Application To Be Approved

Once your application has been reviewed, you should receive a letter in the mail to confirm whether youve been enrolled in the program or not. If your application has been denied, the letter will explain why this decision was made and what to do next.

If your application has been approved, youll receive a red, white, and blue Medicare card in the mail. Your card will show your name, Medicare number, which Medicare plans you benefit from, and the start dates for each plan.

Youll receive your card within about 3 weeks from the date you apply for Medicare. You should carry your card with you whenever youre away from home.

You can sign in to your MyMedicare.gov account if you need to print a replacement card.

Also Check: When Do I Receive Medicare

What Happens If One Of You Becomes Eligible For Medicare Before The Other

Unless you and your spouse were born in the same month of the same year, one of you will become eligible for Medicare before the other. If you both are covered by your employer health insurance, and one of you turns 65, youll have decisions to make about Medicare. In this case, it will depend on the employer and their rules around covered dependents of Medicare age. Some employers may require spouses who are eligible to get Medicare to do so at age 65 in order to remain on the employer plan.

You can learn more about your potential options by talking with your employer benefits administrator.

Also Check: How To Pay For Medicare Without Social Security

Understanding Original Medicare Coverage

Original Medicare is government-run medical care and insurance coverage. It uses a fixed price for services a type of managed care. Members have freedom to choose any doctor or hospital in the network. They do not need referrals or special permissions for the majority of available services.

The Original Medicare network is broad ad diverse. It includes thousands of doctors and medical care facilities across the United States.

Differences Between Medicare Vs Medicaid Vs Private Insurance

When choosing a health insurance plan, you should consider all your options. Youll want to check if you qualify for government-run programs like Medicare and Medicaid based on age, income, and disability status. Even if you qualify for one of these programs, you could still choose a private insurance plan from the insurance marketplace.

Its important to note that Aflac does not offer primary health insurance. However, we offer supplemental insurance that works alongside your existing plan to help offset gaps in coverage.

We have various targeted plans that can help provide financial relief in distinct categories. For example, our hospital insurance helps pay for the costs associated with a trip to the emergency room. In contrast, our critical illness insurance helps cover whatever you need after a covered life-changing illness, like a heart attack or stroke.

Peace of mind doesn’t have to break the bank

Dont wait until its too late. Help cover yourself and your family with affordable coverage from Aflac.

Also Check: Does Medicare Part D Cover Vitamins

Does Medicare Cover Testing For Covid

Yes, testing for COVID-19 is covered under Medicare Part B. Under rulesannounced on April 30, 2020, an order from a beneficiarys treating physician is no longer required for COVID-19 testing to be covered under Medicare, which will better enable beneficiaries to use community testing sites, such as drive-through testing at hospital off-site locations. Medicare Advantage plans are required to cover all Medicare Part A and Part B services, including COVID-19 testing. Medicare will also cover serology tests that can determine whether an individual has been infected with SARS-CoV-2, the virus that causes COVID-19, and developed antibodies to the virus.

Read Also: Do I Need To Apply For Medicare Every Year

Ama Disclaimer Of Warranties And Liabilities

CPT is provided “as is” without warranty of any kind, either expressed or implied, including but not limited to, the implied warranties of merchantability and fitness for a particular purpose. No fee schedules, basic unit, relative values or related listings are included in CPT. The AMA does not directly or indirectly practice medicine or dispense medical services. The responsibility for the content of this file/product is with CMS and no endorsement by the AMA is intended or implied. The AMA disclaims responsibility for any consequences or liability attributable to or related to any use, non-use, or interpretation of information contained or not contained in this file/product. This Agreement will terminate upon notice if you violate its terms. The AMA is a third party beneficiary to this Agreement.

Read Also: What Is The Penalty For Not Signing Up For Medicare

License For Use Of Current Dental Terminology

End User License Agreement:These materials contain Current Dental Terminology , copyright& copy 2021 American Dental Association . All rights reserved. CDT is a trademark of the ADA.

The license granted herein is expressly conditioned upon your acceptance of all terms and conditions contained in this agreement. By clicking below on the button labeled “I accept”, you hereby acknowledge that you have read, understood and agreed to all terms and conditions set forth in this agreement.

If you do not agree with all terms and conditions set forth herein, click below on the button labeled “I do not accept” and exit from this computer screen.

If you are acting on behalf of an organization, you represent that you are authorized to act on behalf of such organization and that your acceptance of the terms of this agreement creates a legally enforceable obligation of the organization. As used herein, “you” and “your” refer to you and any organization on behalf of which you are acting.

Applied Behavior Analysis Medical Necessity Guide

The Applied Behavior Analysis Medical Necessity Guide helps determine appropriate levels and types of care for patients in need of evaluation and treatment for behavioral health conditions. The ABA Medical Necessity Guide does not constitute medical advice. Treating providers are solely responsible for medical advice and treatment of members. Members should discuss any matters related to their coverage or condition with their treating provider.

Each benefit plan defines which services are covered, which are excluded, and which are subject to dollar caps or other limits. Members and their providers will need to consult the members benefit plan to determine if there are any exclusions or other benefit limitations applicable to this service or supply.

The conclusion that a particular service or supply is medically necessary does not constitute a representation or warranty that this service or supply is covered for a particular member. The members benefit plan determines coverage. Some plans exclude coverage for services or supplies that Aetna considers medically necessary.

Please note also that the ABA Medical Necessity Guide may be updated and are, therefore, subject to change.

Recommended Reading: Tax Benefits Of Whole Life Insurance

Don’t Miss: How To Find Out What My Medicare Number Is

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

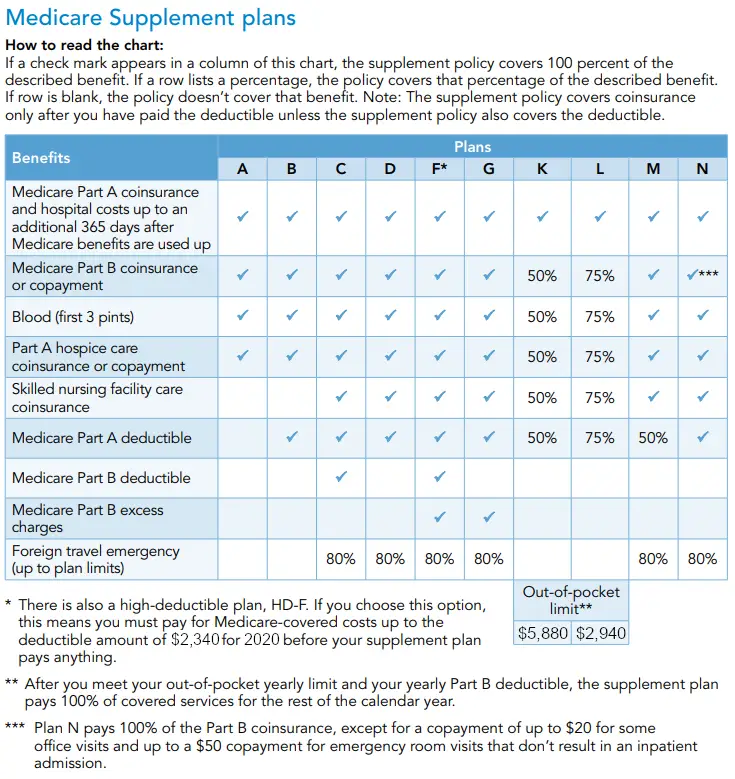

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medicare hospital insurance if they have worked and paid Medicare taxes long enough. You can sign up for Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

What Is Medicare Part A Hospital Insurance

Medicare Part A covers the following services:

- Inpatient hospital care: This is care received after you are formally admitted into a hospital by a physician. You are covered for up to 90 days each benefit period in a general hospital, plus 60 lifetime reserve days. Medicare also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital.

- Skilled nursing facility care: Medicare covers room, board, and a range of services provided in a SNF, including administration of medications, tube feedings, and wound care. You are covered for up to 100 days each benefit period if you qualify for coverage. To qualify, you must have spent at least three consecutive days as a hospital inpatient within 30 days of admission to the SNF, and need skilled nursing or therapy services.

- Home health care: Medicare covers services in your home if you are homebound and need skilled care. You are covered for up to 100 days of daily care or an unlimited amount of intermittent care. To qualify for Part A coverage, you must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care.

- Hospice care: This is care you may elect to receive if a provider determines you are terminally ill. You are covered for as long as your provider certifies you need care.

Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

Read Also: Is Humana Medicaid Or Medicare

Medicare Plan Options Beyond Original Medicare

You might also be enrolled in other types of Medicare coverage, such as a Medicare Part D Prescription Drug Plan or a Medicare Advantage plan. These Medicare plan options are available from private insurance companies.

- If you have a Medicare Advantage plan, your Medicare benefits are provided through the plan instead of directly from the government. You should have a wallet-sized card with the planâs name and contact information on it. You can call the plan to ask about your coverage status and effective dates.

- If youâre enrolled in Original Medicare, you also might have signed up for an optional Medicare Part D Prescription Drug Plan. As with Medicare Advantage, you should have a card from the plan that shows the phone number you can call.

- Itâs also possible that you have a Medicare Supplement plan.to supplement your Original Medicare coverage. Again, the plan should have sent you a card for your wallet that lists the planâs contact information.

Make sure you pay your plan premiums on time to ensure continuous coverage. And donât forget the Medicare Part B monthly premium noted above.

The product and service descriptions, if any, provided on these eHealth Web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

Do Medicare Advantage Plans Include Assisted Living Coverage

Medicare Advantage, sometimes called Medicare Part C, may help cover some long-term care costs. Medicare Advantage plans are offered through private insurers and include everything covered by Part A and Part B. These plans also sometimes help pay for services not offered by Part A and Part B, like personal or custodial care. Not all Medicare plans are the same. Costs and coverage options may vary from plan to plan or between insurance providers.

Read Also: Does Medicare Offer Dental And Vision

Can Medicare Beneficiaries Get Extended Supplies Of Medication

The Department of Homeland Security recommends that, in advance of a pandemic, people ensure they have a continuous supply of regular prescription drugs. In light of the coronavirus pandemic, a provision in the CARES Act requires Part D plans to provide up to a 90-day supply of covered Part D drugs to enrollees who request it during the public health emergency.

According to CMS, for drugs covered under Part B, Medicare and its contractors make decisions locally and on a case-by-case basis as to whether to provide and pay for a greater-than-30 day supply of drugs.

Dont Miss: How Do You Get Dental Insurance On Medicare

What Is A Medicare Deductible

A deductible is the amount you must pay each year before Medicare begins paying its portion of your medical bill. There are deductibles for both the Part A and Part B portions of Medicare. Your deductible is taken out of your claims when Medicare receives them. Medicare will not start paying on your claims until you have met your annual deductible. If you have any questions on the status of your deductible please contact your Medicare carrier.

Also Check: How To Find Out If My Medicare Is Active

Make Changes To Your Medicare Plan Coverage During The Right Time Of Year

One especially useful time to review your Medicare coverage is during the fall Annual Enrollment Period, or AEP.

The Medicare AEP lasts from every year. During this time, Medicare beneficiaries may do any of the following:

- Change from Original Medicare to a Medicare Advantage plan

- Change from Medicare Advantage back to Original Medicare

- Switch from one Medicare Advantage plan to another

- Enroll in or drop Medicare Part D coverage

- Switch from one Part D plan to another

Outside of AEP, your opportunities to make changes to your Medicare plan can be limited.

Another time you may be able to change your Medicare plan include:

- Special Enrollment Periods You could potentially qualify for a Special Enrollment Period at any time throughout the year, if you meet one of a set of certain circumstances. This can include moving out of the area serviced by your current plan, losing your current plan because it is no longer offered in your area, and a number of other certain circumstances.

Understanding Medicare Advantage Coverage

Medicare Advantage plans use many styles of managed care to deliver services and savings to subscribers. Medicare Advantage plans have some High Deductible Health Plans that can work with Medicare Savings Accounts. The accounts receive funds that consumers can use to pay out-of-pocket expenses. The below-listed descriptions show the basic elements.

HMO is the health maintenance organization. It uses a primary care physician to deliver care, and refer the patient to other network resources. The HMO does not use outside resources.

PPO is the preferred provider organization. These Medicare Advantage plans do not require referrals or a primary care doctor. They permit the use of outside resources but cover them at a lower rate of cost sharing than for network resources.

EPO is the exclusive provider organization. This type of Medicare Advantage plan offers low prices and a simple network. The members must use network resources except for emergency care.

HMOPOS is the Point of sale option for health maintenance organization. This type of Medicare Advantage plan uses a primary care physician. The doctor can make referrals to outside resources, and the insurance will cover with a lower rate of cost sharing than if using network resources.

FFFS is the fixed-fee-for-services type of Medicare Advantage plan. This type of managed care offers a wide network and freedom of choice for the consumer. The FFFS can standalone or connect to another network for regional or national coverage.

You May Like: Is Part B Of Medicare Mandatory