When Can I Join A Medicare Part D Prescription Drug Plan

En español | You can get Medicare prescription drug coverage in one of two ways: through a stand-alone Part D drug plan or through a Medicare Advantage managed care plan which includes Part D drug coverage in its benefits package. Both types of plan are offered by private insurance companies that are regulated by Medicare.

Whether you choose a stand-alone Part D drug plan or a Medicare Advantage plan, you must enroll during a designated enrollment period:

- Your initial enrollment period , which runs for seven months, of which the fourth is the month of your 65th birthday.

- A special enrollment period , which youre entitled to in certain circumstances:

If you qualify for Extra Help or enter or leave a nursing home, you can join a Part D drug plan or switch to another at any time of the year.

If you lose creditable drug coverage from elsewhere such as an employer, union, retiree benefits, COBRA, Medicaid, or the Veterans Affairs health care program you can sign up with a drug plan within two months of this coverage ending.

If you move outside of your current drug plans service area , you can sign up with a new plan, either before or within two months of the move.

If your current Part D plan withdraws service from your area, you can switch to another plan before or when your current coverage ends.

If a plan violates its contract with you, you can ask Medicare to investigate if Medicare agrees, you can switch to another plan at that time.

Beware The Medicare Part D Late

Every month you delay, you will owe an additional 1% of the base monthly premium rate tracked by Medicare. The 2021 base rate is $31.47. Granted thats a penalty of less than 33 cents a month, but it can add up fast.

Lets say someone who became eligible in 2016 waited until 2021 to sign up for Part D, for example. Thats a 60-month lag. This someone would owe a late-sign up penalty equal to 60% of the base rate. In 2021, that works out to a monthly penalty of $18.88 on top of any premium . The penalty percentage stays with you for life and is recalculated each year according to that years base rate.

If you have creditable coverage , you wont be subject to the penalty at the point you decide to switch to Medicare Part D. But timing is crucial here. Your special enrollment period for Part D lasts for just two months after your creditable coverage ends. After that, you have to wait for the annual enrollment period, and a penalty fee will be levied for each month youre late.

When Can I Enroll In Part D

Enrolling in Medicare is an important step for many people in protecting their health and their finances as they age. The Medicare program assists millions of seniors and certain individuals with qualifying disabilities, and without Medicare, some Americans would struggle to afford the cost of healthcare and related expenses. The Medicare program is broken down into parts, and each part covers various types of medical care to include, among others, hospital admittance and outpatient services.

Although the program was comprehensive enough at the time of its inception, over the years, the need for prescription drug coverage became a concern among an aging American population. In 2006, Medicare recipients were able to access this coverage through the introduction of Medicare Part D. These Medicare benefits deliver a low-cost option to Medicare members, and the Part D benefits can be used at retail pharmacies across the country for self-administered drugs.

When Can I Enroll in Part D?

Failing to enroll within this time period, also known as the initial enrollment period, means that you may face a late enrollment penalty if you choose to add Part D coverage at a later date. Although this penalty is added only after adding Part D coverage following the initial enrollment period, it may stick around for the duration of your Medicare enrollment even if you choose to remove Part D coverage in the future.

Understand Your Potential Future Needs

Related articles:

You May Like: Why Does Medicare Not Cover Shingles Vaccine

How To Apply For Medicare Part D Online

Prescription drug coverage is important for many older adults, especially those who rely on monthly prescription medications. With so many plan options available, finding the right coverage for your needs can be overwhelming. The good news is, you dont have to go at it alone. There is help available! Working with a licensed independent insurance agent to apply for Medicare Part D online ensures you receive the best prescription drug coverage for your needs. The best part, help is completely free! Keep reading to find out what you need to know about applying for Medicare Part D online with a licensed insurance agent.

Do I Need To Enroll In The Same Medicare Plan As My Spouse

There is no need to join the same Medicare Part D plan as your spouse. Medicare is an individual health plan, there are no joint plans. When choosing a Part D plan it is important to consider your individual health needs. While one plan may work well for you, it may not work for your spouse.

Do I have to enroll in Medicare Part D to keep Original Medicare ?

No. Enrollment in a Medicare Part D plan is optional. However, to enroll in a prescription drug plan you must first enroll in Original Medicare or a Medicare Advantage Plan.

Where can I get help with choosing a Part D drug plan?

Before enrolling in a Medicare Part D drug plan, it is important you feel comfortable with your decision. There are various resources you can utilize to gather more information, like Medicare.gov and The Medicare Rights Center to name a few. Another way to get help choosing a Part D drug plan is by consulting with an independent licensed insurance agent. Medicare Concierge can help connect you with an licensed insurance agent or direct you to online resources to enroll online. Independent licensed insurance agents represent multiple plans which allow them to give an unbiased opinion on your health plan choices. Because they represent many carriers, they have a better understanding of how each plan compares to the next. Most independent licensed insurance agent services are free, so there is really no downside to using their services.

Read Also: Does Medicare Cover Eye Refraction Test

Prescription Drugs Not Covered By Medicare Part D

Over-the-counter medications generally arent covered by Part D plans, which includes:

- vitamins

- cosmetic and weight loss medications

Prescription drugs not covered by Medicare Part D include:

- your plan doesnt offer Part D services

- you want to switch to a plan with a higher star rating

You can also change plans during open enrollment each year.

Find A Medicare Drug Plan In Your Area

Use the online Medicare Plan Finder tool for a list of the stand-along Part D plans and Medicare Advantage plans with drug insurance available in your ZIP code.16 The comparison tool shows the drugs covered by each plan, cost-sharing amounts, and whether you need prior authorization and preferred pharmacies.

Don’t Miss: Is Kaiser A Medicare Advantage Plan

Tips For Choosing Medicare Drug Coverage

If youre wondering how to choose a Medicare drug plan that works for you, the best way is to start by looking at your priorities. See if any of these apply to you:

- I take specific drugs.

-

Look at drug plans that include your prescription drugs on their

formulary

. Then, compare costs.

- I want extra protection from high prescription drug costs.

-

Look at drug plans offering coverage in the

coverage gap

, and then check with those plans to make sure they cover your drugs in the gap.

- I want my drug expenses to be balanced throughout the year.

-

Look at drug plans with no or a low

deductible

, or with additional coverage in the

coverage gap

- I take a lot of generic prescriptions.

-

Look at Medicare drug plans with

tiers

that charge you nothing or low copayments for generic prescriptions.

- I don’t have many drug costs now, but I want coverage for peace of mind and to avoid future penalties.

-

Look at Medicare drug plans with a low monthly

premium

for drug coverage. If you need prescription drugs in the future, all plans still must cover most drugs used by people with Medicare.

- I like the extra benefits and lower costs available by getting my health care and prescription drug coverage from one plan, and Im willing to pick a drug plan with restrictions on what doctors, hospitals, and other health care providers I can use.

-

Look for a

Special Notice About The Medicare Part D Drug Program

Please read this notice carefully. It explains the options you have under Medicare prescription drug coverage and can help you decide whether or not you want to enroll in Medicare Part D.

Medicare prescription drug coverage became available in 2006 to everyone with Medicare through Medicare prescription drug plans and Medicare Advantage Plans that offer prescription drug coverage.

All approved Medicare prescription drug plans must offer a minimum standard level of coverage set by Medicare. Some plans may offer more coverage than required. As such, premiums for Medicare Part D plans vary, so you should research all plans carefully.

The State of Florida Department of Management Services has determined that the prescription drug coverage offered by the State Employees Health Insurance Program is, on average, expected to pay out as much as or more than the standard Medicare prescription drug coverage pays and is considered Creditable Coverage.

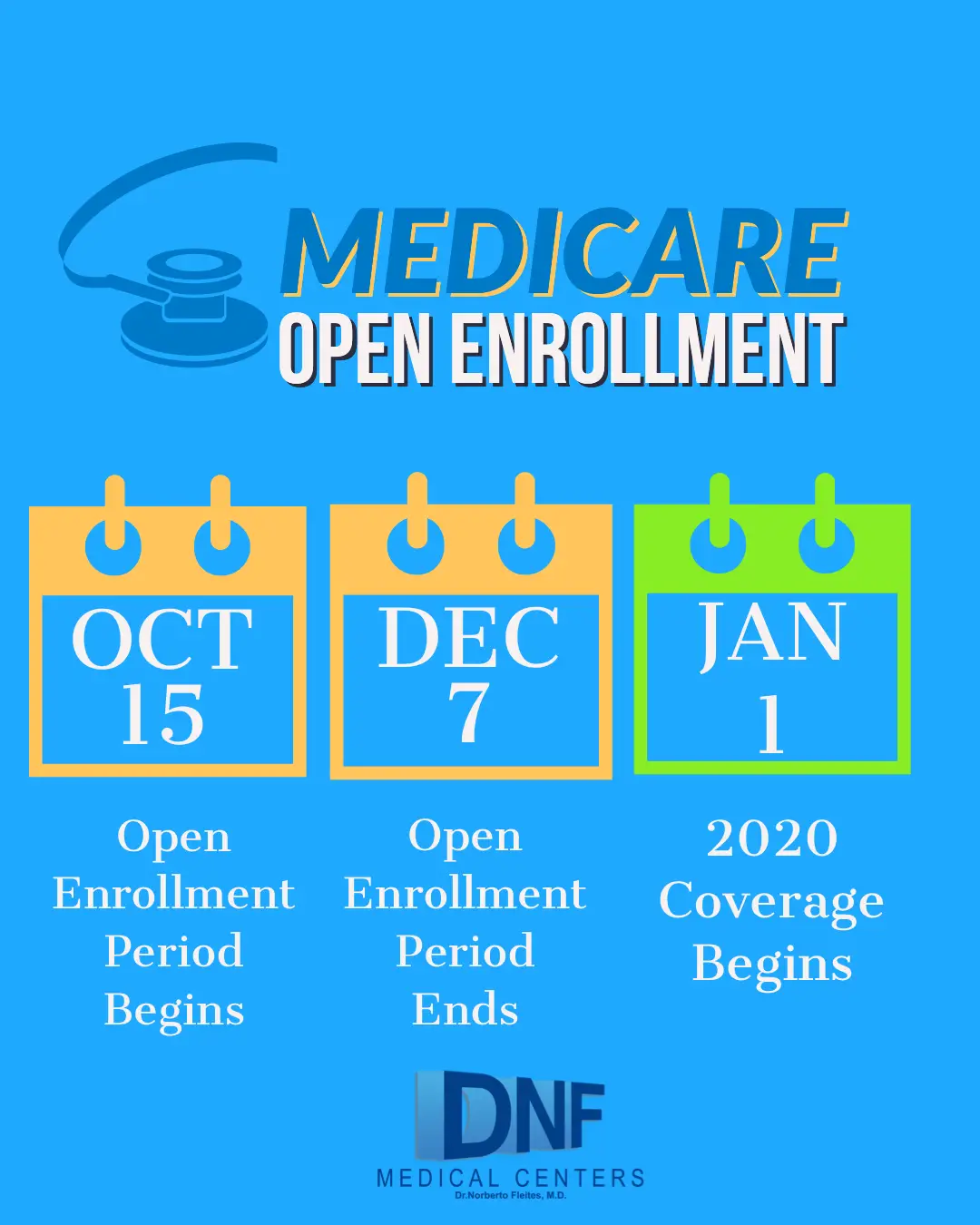

You can join a Medicare drug plan when you first become eligible for Medicare and each year from Oct. 15 to Dec. 7. However, if you lose your current creditable prescription drug coverage, through no fault of your own, you will also be eligible for a two-month Special Enrollment Period to join a Medicare drug plan.

Additional information about Medicare prescription drug plans is available from:

- MEDICARE or . TTY users should call 1-877-486-2048

You May Like: Does Medicare Part B Pay For Prescription Drugs

When You Can Change Or Cancel Your Plan

When you sign your contract, you are committing to pay monthly premiums through January 1 of the following year, so you cannot change or cancel your Part D plan whenever you want.

Not paying those premiums could result not only in loss of your prescription drug coverage but could also affect your credit history. But, Medicare recognizes that needs change.

The government allows you to change your plan once a year during the Open Enrollment Period and if you have a Medicare Advantage plan, and also during the Medicare Advantage Open Enrollment Period. They also allow you to make changes under special circumstances, when the Open Enrollment Period may be too far away.

Understanding when you can make these changes could save you money and get you Part D coverage that better meets your needs.

Open Enrollment Period

You can change your prescription drug coverage during the Open Enrollment Period every year from October 15 to December 7. During this time, you can swap Part D plans, change between Medicare Advantage plans with drug coverage, or switch from a Part D plan to a Medicare Advantage plan with drug coverage and vice versa. Since each of these options allows you to continue Medicare benefits uninterrupted, no late penalties will result with any of these changes.

Medicare Advantage Open Enrollment Period

Special Enrollment Periods

You have financial hardships.

You move to another address.

Your Part D plan changes.

You want a Five-Star plan.

How To Sign Up For Medicare

Some people are automatically enrolled in Original Medicare while others need to sign up on their own. In this guide, we explore the step-by-step process of enrolling in Medicare Part A and Part B as well as Part D drug plans, Medigap policies and Medicare Advantage plans.

On This Page

Don’t Miss: What Age Does A Person Qualify For Medicare

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it, unless you qualify for a “” .

If you dont enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a general enrollment period from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our publication for more information.

Enrollment For Medicare Part D: Prescription Drug Coverage

Your search for affordable Health, Medicare and Life insurance starts here.

Call us 24/7 at or Find an Agent near you.

Medicare Part D enrollment takes place each year during the annual open enrollment period. During this time, you can maximize your savings by choosing the Medicare Part D plan to fit your needs. These plans help make your medicines more affordable, and there are a variety of options available.

Medicare Part D plans are available through a number of different insurance providers. If you are enrolled in Medicare Part A or B, you will also need prescription drug coverage through a Part D plan. A Part D plan is sometimes called a PDP, or prescription drug plan.

Also Check: Does Social Security Disability Qualify You For Medicare

Signing Up For A Medigap Policy

To purchase a Medigap supplement insurance policy, you must first enroll in Medicare Part A and Part B.

Medigap policies are not required but enrolling in one can help you pay out-of-pocket costs, including deductibles, coinsurance and copayments.

The best time to enroll in a Medigap plan is when you are first eligible.

This is a six-month enrollment period that begins the month youre 65 and enrolled in Medicare Part B.

If you apply for Medigap coverage after this six-month window, private insurance companies may not sell you a policy if youre in poor health.

You can find a Medigap policy by using an online tool on the Medicare website, contacting your local SHIP or calling your State Insurance Department.

How to Sign Up for a Medigap Policy Online

How To Enroll In Medicare

Enrolling in Medicare is easy once you understand how to do so. Its important to know that how you enroll in Medicare Part A and Part B is different from how you enroll in Medicare Advantage , Part D or Medicare supplement insurance.

See the table below for a quick overview of how to enroll in a Medicare or Medigap plan and read on for how-to steps for both Original Medicare and the three kinds of Medicare and Medigap plans.

Original Medicare Medicare Advantage plan Medicare Prescription Drug plan Medicare Supplement Insurance plan How to Enroll

Enroll in Original Medicare online at the Social Security website or by calling or visiting your local Social Security office.

Enroll directly in the plan e.g., on the plans website or Medicare.gov .

Enroll directly in the plan e.g., on the plans website or Medicare.gov .

Enroll directly in the plan e.g., on the plans website

Original Medicare

How to Enroll

Enroll in Original Medicare online at the Social Security website or by calling or visiting your local Social Security office.

Medicare Advantage plan

Enroll directly in the plan e.g., on the plans website or Medicare.gov .

Medicare Prescription Drug plan

Enroll directly in the plan e.g., on the plans website or Medicare.gov .

Medicare Supplement Insurance plan

Dont Miss: Does Quest Diagnostics Accept Medicare

Recommended Reading: What Do You Need To Sign Up For Medicare

That Is Everything You Need To Know About Medicare In All Its Forms False

This article has given you a motherlode of information on many aspects of Medicare, and I hope you have learned a lot.

But has this article given you everything you need to know? Has it prepared you to move ahead and enroll without fear of making any mistakes? Unfortunately, no.

Your success enrolling in Medicare in all its shapes and sizes will be greatly improved if you work with a licensed Medicare advisor, like one of the Medicare Concierges at CoverRight.

CoverRight is on a mission to make the Medicare plan selection process easy to understand and help you find the best Medicare plans suited to your specific situation. Try our self-guided quiz to see for yourself.

Free Medicare Resources

If You Already Have Prescription Drug Coverage

If you already have , you may be able to keep it without the risk of paying a late enrollment penalty if you decide to enroll in a Medicare prescription drug plan later.

Your options differ, depending on which type of existing drug coverage you have:

- Current employer plan, union plan or retiree plan

- TRICARE, Department of Veterans Affairs or the Federal Employee Health Benefits Program

If you are covered by a current employer, union or retiree plan and are about to become eligible for Medicare, you should receive a notice from the company explaining how your benefits will change and what your options are regarding Medicare Part D. If you are about to become eligible for Medicare and have not received a notice or did not understand the notice you received, call your former employer or the company that processes your claims.

If at some point in the future your employer, union or retiree plan stops offering prescription drug coverage, you will be able to join a Medicare drug plan without penalty as long as you join that plan within 63 days of the end of your current coverage.

Note: Keep any letter or notice from your employer, union or retiree plan stating that your prescription drug coverage is creditable to use for documentation if you apply for Part D drug coverage at a later time.

Talk to your plans benefits administrator to get more information. If your benefits are not creditable, you may still be able to:

Recommended Reading: Is Medicare The Same As Ahcccs