How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

What Are The Risks Of Enrolling Late In Medicare Part B

Remember that if you do not enroll in Medicare Part B during your Special Enrollment Period, youll have to wait until the next General Enrollment Period, which happens from January 1 to March 31 each year. You may then have to pay a late-enrollment penalty for Medicare Part B because you could have had Part B and did not enroll. If you owe a late-enrollment penalty, youll pay a additional 10% on your premium for every 12-month period that you were eligible for Medicare Part B but didnt sign up for it. You may have to pay this higher premium for as long as youre enrolled in Medicare.

Read Also: How Much Do Medicare Plans Cost

Enrolling In Medicare B

Since you did not enroll in Part B when you enrolled in Part A, you will have to submit documentation to show you had creditable coverage from your 65th birthday or your Part A start date . You will need the Request for Employment Information to apply for Part B.

- Send this to your employer first for completion. See more information below about completing this form.

- Once you receive the completed copy back from your employer, you can apply for Part B.

Go to Apply Online for Medicare Part B During a Special Enrollment Period and complete online form.

- In the notes/comments section please write: I would like my Medicare Part B to begin ___/01/202__.

- At the end of the application you will upload your evidence of Group Health Plan or Large Group Health Plan by clicking the click to attach Employment Verification button in the form.

After you digitally sign the application, you will receive an email asking you to confirm your digital signature. YOUR SIGNATURE IS NOT COMPLETE AND YOUR APPLICATION WILL NOT BE PROCESSED UNTIL YOU COMPLETE THE INSTRUCTIONS IN YOUR EMAIL. If you do not receive an email within a few minutes, please check your Junk folder

Apply by Fax

Complete forms CMS-40B and CMS-L564

- In the notes/comments section of the Part B application please write: I would like my Medicare Part B to begin ___/01/202___.

Fax your forms to your local Social Security field office

Apply by Mail

Complete forms CMS-40B and CMS-L564

Apply in Person

Recommended Reading: What Is A Medicare Point Of Service Plan

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medicare hospital insurance if they have worked and paid Medicare taxes long enough. You can sign up for Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

To Qualify For Medicare You Need To Get Disability Benefits From:

- Social Security

- Railroad Retirement Board

Youll automatically get Part A and Part B after you get disability benefits for 24 months. Well mail you a welcome package with your Medicare card.

If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

If you live in Puerto Rico or outside the U.S.

You May Like: How Long Does It Take For Medicare To Become Effective

The Cost Of Medicare Part B

Unlike Medicare Part A, Medicare Part B requires a premium from everyone. The standard premium for Medicare Part B in 2022 is $170.10 a month, which applies to most people, including new enrollees. That premium changes each year, usually increasing. In 2023, the Part B premium drops to $164.90 a month.

Youll also have an annual deductible of $226 in 2023 as well as a 20 percent coinsurance rate for covered services under Part B.

New for 2023: People who had successful kidney transplants may be able to enroll in new, limited Part B coverage. This applies to people who were only eligible for Medicare because of end-stage renal disease and who would otherwise lose Medicare coverage because its been 36 months since a successful kidney transplant. In this case, these enrollees can enroll in a limited Part B plan that only covers immunosuppressive drugs. The monthly premium for this limited benefit is $97.10 a month in 2023.

If this applies to you, talk to Medicare directly about enrollment. Youll still need to meet the Part B deductible and Part B cost sharing amounts in addition to paying the premium for this limited coverage.

There are penalty fees for not signing up during your Initial Enrollment Period , but well discuss those in a separate section.

The above IRMAA rates are for 2023. You can learn more about IRMAA charges and how they might affect you personally by talking to Medicare directly.

Contact Social Security To Sign Up For Medicare

You can either:

Know when to sign up for Part BYou can only sign up for Part B at certain times. If you dont sign up for Part B when you turn 65, you might have to wait to sign up and pay a monthly late enrollment penalty. Find out when you can sign up. How much is the Part B late enrollment penalty?

Don’t Miss: Will Medicare Pay For A Transport Wheelchair

Mistake #: Signing Up For Part B While Youre Still On Your Employer Coverage

If youre 65 or older, still working and are covered under a group health plan from your current employer, you may qualify for a Special Enrollment Period . In these cases, you can typically delay your Medicare Part B enrollment without incurring late-enrollment penalties.

To qualify for an 8-month Special Enrollment Period:

- You or your spouse must be working

- You must be covered by a group health plan through the employer or union based on that work

If thats the case, your SEP starts:

- The month after your employment ends

- The month after your group health plan insurance ends

Mistake #: Not Signing Up For Part B Because You Have Retiree Coverage

COBRA and retiree health plan benefits aren’t based on current employment and therefore arent considered current employer health coverage. If you have either COBRA or retiree health plan benefits, you should still sign up for Medicare Part B when you first become eligible.

Check out our Medicare checklist for a step-by-step guide to enrollment.

You May Like: What Insulin Pumps Does Medicare Cover

Medicare Supplement Plan G Rate Increase History

Like the monthly premium, many factors impact your Medicare Supplement planâs rate increases. These factors include your age at the time of enrollment and the pricing method used by your Medicare Supplement plan when you enrolled. The average Medicare Supplement Plan G rate increase is between 2% to 6% annually. Remember, this percentage can be higher or lower based on your carrier.

Understanding the rate increase history for the carrier you choose to enroll is essential. Researching carrier reviews before enrolling is a key determinant when selecting your Medicare Supplement insurance company.

Why Should You Choose Medicare Supplement Plan G

Medicare Supplement Plan G is among the highest-rated and most popular Medicare Supplement plans. Whether you are new to Medicare or looking for a policy to better fit your budget or healthcare needs, Medigap Plan G may be the right fit.

Medigap Plan G covers 100% of your costs after the Medicare Part B deductible. So, you will see that by enrolling in this plan, you could save thousands of dollars per year on healthcare.

Recommended Reading: Is Rytary Covered By Medicare

What Is The Penalty For Delaying Enrollment In Medicare Part B

An increasing number of Americans are putting off enrolling in Medicare Part B when they first qualify for it. Medicare-eligible individuals can delay enrolling in Part B only if theyre covered by an employer-sponsored group health plan through a current job . Those who postpone enrollment and arent covered by a GHP will owe a 10 percent Part B late-enrollment penalty for every year they delay signing up.

The Part B premium in 2020 is $144.60 per month for most people. Consider an individual who qualified for Part B five years ago but didnt enroll until this year and didnt have qualifying GHP coverage. They will owe a 50 percent LEP that increases their monthly cost for Part B this year to about $217.

While the percentage of the premium increase is fixed for as long as an individual has Medicare, the penalty amount would actually get higher over time. This is because the penalty is set as a percentage of the monthly Part B premium which usually increases each year.

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

Note: Important Upcoming Change Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month youre first eligible. Beginning January 1, 2023, if you sign up during the month you turn 65 or during the last three months of your IEP, your coverage starts the first day of the month after you sign up.

The following chart shows when your Medicare Part B becomes effective in 2022:

| In 2022, if you sign up during this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| One to three months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65 | One month after the month you turn age 65. |

| One month after you reach age 65 | Two months after the month of enrollment. |

| Two or three months after you reach age 65 | Three months after the month of enrollment. |

The following chart shows when your Medicare Part B becomes effective in 2023:

Don’t Miss: When Do I Receive Medicare

What Does Medicare Supplement Plan G Cover

Medigap Plan G helps you keep out-of-pocket costs as low as possible. Benefits of Medicare Supplement Plan G include:

- 100% coverage for Medicare Part A deductible

- 100% coverage for hospice copayments and coinsurance

- Additional foreign travel emergency benefits

- 100% coverage for Medicare Part B excess charges

- Guaranteed renewable policy, regardless of health

The only cost Medicare Supplement Plan G does not cover is the annual Medicare Part B deductible.

Once you meet the Medicare Part B deductible, you will not have to worry about additional copayments or unexpected medical bills. Further, because the federal government standardized Medicare Supplement plans, Medigap Plan G provides the same benefits regardless of the carrier. However, monthly premium rates vary by state and carrier.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Compared to other Medicare Supplement plans, Medicare Supplement Plan G is one of the most comprehensive, second only to Plan F. However, not all Medicare beneficiaries are eligible for Medigap Plan F coverage.

Due to the Medicare Access and CHIP Reauthorization Act of 2015 , if you receive Medicare after January 1, 2020, you are no longer eligible for Medicare Supplement Plan F. Due to this change, new Medicare seniors tend to enroll in Medigap Plan G, as it is the next best option.

See the chart below for a complete summary of Medigap Plan G benefits.

Medicare Part B Financial Assistance

Because Medicare Part B requires a monthly payment for its services, some people may find it difficult to pay for the monthly costs associated with this portion of Medicare. Those with limited incomes, in particular, may wonder if there are cost assistance programs in place to help mitigate the financial burden.

In fact, there are a few ways that you can reduce your monthly premiums, or at least make your healthcare more affordable using different programs. One such way is to enroll in a Medicare Savings Program. Run by individual states in conjunction with Medicare, Medicare Savings Plans help you pay for medical costs associated with deductibles, coinsurance and copayments, in some cases. There are four Medicare Savings Programs available, but only three of them relate to Medicare Part B. They are:

The Qualified Medicare Beneficiary Program

- The Qualifying Individual Program

- The Specified Low-Income Medicare Beneficiary Program

Each program has its own eligibility requirements. For example, members of the QI Program must apply every year for assistance. Acceptance is based on a first-come, first-served basis, with priority given to past recipients. You also wont qualify for the QI Program if you receive Medicaid benefits. If you think that you qualify for one of these programs or need financial assistance, then you should contact the Medicaid program in your state to find out more information.

Recommended Reading: Does Medicare Cover Dental Visits

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

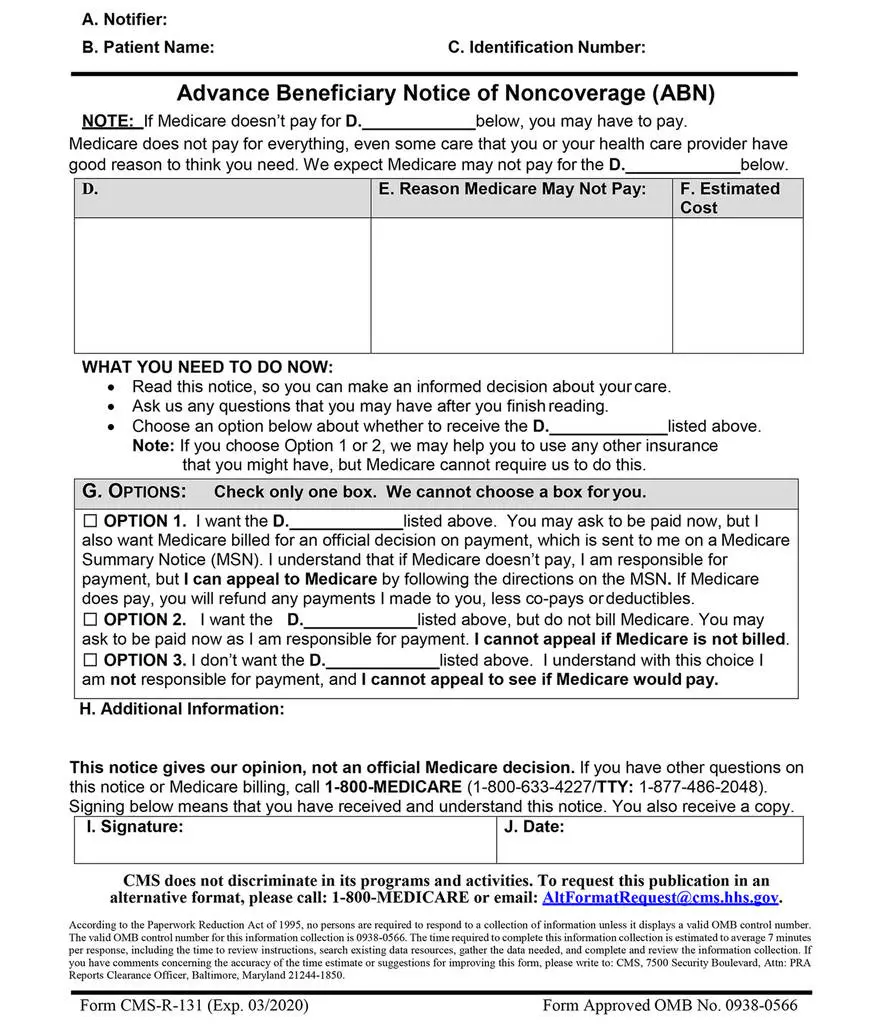

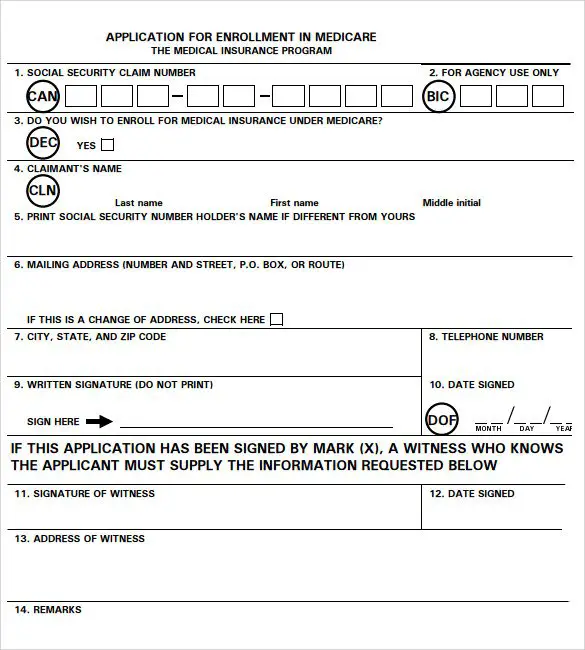

If you are enrolled in Medicare Part A and you want to sign up for Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on their behalf and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

B Doctor And Outpatient Services

This part of Medicare covers doctor visits, lab tests, diagnostic screenings, medical equipment, ambulance transportation and other outpatient services.

Unlike Part A, Part B involves more costs, and you may want to defer signing up for it if you are still working and have insurance through your job or are covered by your spouses health plan. But if you dont have other insurance and dont sign up for Part B when you first enroll in Medicare, youll likely have to pay a higher monthly premium for as long as youre in the program.

The federal government sets the Part B monthly premium, which is $170.10 for 2022. It may be higher if your income is more than $91,000.

Youll also be subject to an annual deductible, set at $233 for 2022. And youll have to pay 20 percent of the bills for doctor visits and other outpatient services. If you are collecting Social Security, the monthly premium will be deducted from your monthly benefit.

Recommended Reading: What Is Medicare Chronic Care Management

When Can I Enroll In Medicare Part B

If you are receiving retirement benefits before age 65 or qualify for Medicare through disability, generally youre automatically enrolled in Medicare Part A and Part B as soon as you become eligible.

If you do not enroll during your initial enrollment period and do not qualify for a special enrollment period, you can also sign up during the annual General Enrollment Period, which runs from January 1 to March 31, with coverage starting July 1. You may have to pay a late enrollment penalty for not signing up when you were first eligible.

If youre not automatically enrolled, you can apply for Medicare through Social Security, either in person at a local Social Security office, through the Social Security website, or by calling 1-800-772-1213 from 8AM to 7PM, Monday through Friday, all U.S. time zones.

Keep in mind that once you are both 65 years or older and have Medicare Part B, your six-month Medigap Open Enrollment Period begins. This is the best time to purchase a Medicare Supplement insurance plan because during open enrollment, you have a guaranteed-issue right to buy any Medigap plan without medical underwriting or paying a higher premium due to a pre-existing condition*. Once you are enrolled in Medicare Part B, be careful not to miss this one-time initial guaranteed-issue enrollment period for Medigap.