Important 2022 Tax Information From Health Net Of California Inc And Health Net Life Insurance Company

Health Net will mail tax Form 1095-B to all who had individual or group health coverage with us in 2022. This includes:

- Individual & Family Plans, off-exchange.

What is Form 1095-B: Health Coverage?

Form 1095-B: Health Coverage is a tax form that is used to verify that you, and any covered dependents, have health coverage that qualifies as minimum essential coverage. This form shows:

- The type of health coverage you have

- Any dependents covered by your plan

- The dates of coverage for the tax year

Why do I need Form 1095-B?

The Affordable Care Act’s individual shared responsibility provision and the California Individual Health Care Mandate require that you have minimum essential coverage or qualify for an exemption. Form 1095-B shows when you had health coverage during the 2022 tax year.

When will I receive Form 1095-B?

Health Net will begin mailing Form 1095-B to members January 31, 2023.

What do I need to do with Form 1095-B?

Save it with your other tax-related documents so that you have it on hand when you or a tax professional prepares and files your taxes. Keep it with your other tax information. Do this in the event the IRS or California State Franchise Tax Board require you to provide the form as proof of your health care coverage.

Do I need to include my Form 1095-B when I file my taxes?

How does the IRS and state of California know that I had minimum essential coverage in 2022?

Documentation Individuals Can Gather In Advance

You are not required to send the IRS information forms or other proof of health care coverage when filing your tax return. However, its a good idea to keep these records on hand. This documentation includes:

- Form 1095 information forms

Form 1095-C, Employer-Provided Health Insurance Offer and Coverage

Certain employers send this form to certain employees, with information about what coverage the employer offered. Employers that offer health coverage referred to as self-insured coverage send this form to individuals they cover, with information about who was covered and when.

You can use Form 1095-C to help determine your eligibility for the premium tax credit. In addition, you can use Form 1095-C for information on whether you or any family members enrolled in certain kinds of coverage offered by your employer – sometimes referred to as self-insured coverage.”

Remember When Filing Your Taxes:

- If you received APTCs and you do not file your tax return with Form 8962 to reconcile your Premium Tax Credit amounts, you will not be able to receive Premium Tax Credits amounts in future years until you file your federal tax return.

- If your filing or income information has changed since you applied for healthcare coverage, you may have to pay back some or all of the Premium Tax Credit amounts you received.

Some related topics:

You May Like: Can Medicare Advantage Plans Deny Enrollment

Find Affordable Healthcare That’s Right For You

Answer a few questions to get multiple personalized quotes in minutes.

Affordable Care Act Open Enrollment Period Snapshot Survey Key Findings 44% of…

Updated: February 2nd, 2022ByDan Grunebaum×

We do not sell insurance products, but there may be forms that will connect you with partners of healthcare.com who do sell insurance products. You may submit your information through this form, or call 855-617-1871 to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

Our mission is to provide information that will help everyday people make better decisions about buying and keeping their health coverage. Our editorial staff is comprised of industry professionals and experts on the ACA, private health insurance markets, and government policy. Learn more about our content.

Contact Your Insurer Directly

Theres only one place where you can get a copy of your 1095 tax form: your insurance company. Contact them directly ONLY your insurer will have access to it and can provide you with a copy.

- if you purchased your plan via healthcare.gov.

- If you get healthcare from your employer, contact your companys benefits department.

- If you found your coverage through our plan comparison tool, youll still need to contact your insurer we dont have access to anyones 1095 tax form.

Read Also: Does Medicare Pay For Stem Cell Knee Replacement

Find Affordable Healthcare Thats Right For You

Answer a few questions to get multiple personalized quotes in minutes.

Updated: February 2nd, 2022ByDan Grunebaum×

We do not sell insurance products, but there may be forms that will connect you with partners of healthcare.com who do sell insurance products. You may submit your information through this form, or call 855-617-1871 to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

Our mission is to provide information that will help everyday people make better decisions about buying and keeping their health coverage. Our editorial staff is comprised of industry professionals and experts on the ACA, private health insurance markets, and government policy. Learn more about our content.

How To Find Your 1095

Note:

How you find out if you used the right amount of premium tax credit during the year. To reconcile, you compare two amounts: the premium tax credit you used in advance during the year and the amount of tax credit you qualify for based on your final income. Youâll use IRS Form 8962 to do this. If you used more premium tax credit than you qualify for, youâll pay the difference with your federal taxes. If you used less, youâll get the difference as a credit.

” â find out if there’s any difference between the premium tax credit you used and the amount you qualify for.

Recommended Reading: Does Medicare Cover Respite Care Services

Tax Forms And The Aca

If you had health insurance at any time during a calendar year, you may get a version of form 1095 for tax purposes.

This form details your health coverage. The table below explains the types of forms, where they come from, and who receives them.

Do I need form 1095 to file my taxes?

If you had insurance through healthcare.gov or a state exchange, you may need this form to help you fill out your taxes. But you dont need to send the form to the IRS.

If you had another type of health insurance, you dont need the form to file your taxes. Just keep it for your records.

For language services, please call the number on your member ID card and request an operator. For other language services: | | | | | | | | | | | | | | |

How Do I Get My Form 1095

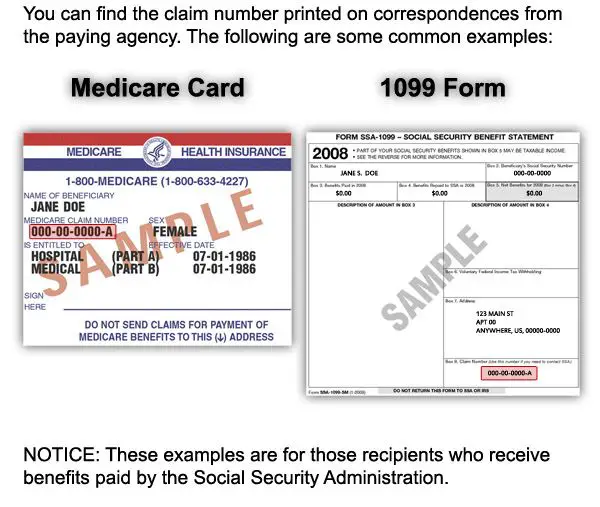

If you question how do I get my Form 1095-B from Medicare online?heres the answer:

You may receive Form 1095-B from Medicare via mail. You dont need to download the form yourself. If you need a replacement Form 1095-B, call 1-800-MEDICARE.

If you need Form 1095-B from another government-sponsored program such as Medicaid or the Childrens Health Insurance Program, visit the programs online portal or contact them to request a copy.

You May Like: What Is The Best Supplemental Insurance To Medicare

How To Use Form 1095

IMPORTANT: You must have your 1095-A before you file.Donât file your taxes

- Your 1095-A includes information about Marketplace plans anyone in your household had in 2021.

- It comes from the Marketplace, not the IRS.

- Keep your 1095-As with your important tax information, like W-2 forms and other records.

Why Is The 1095

The 1095-A is used by a primary tax filer to:

- Reconcile advance payments of the Premium Tax Credit , on their federal income tax return

- Complete IRS Form 8962 as part of ones federal income tax return, which the IRS uses to determine whether you received the correct amount of APTCs . Form 8962 forms can be downloaded at the irs.gov website. Please see a tax professional for help with completing Form 8962.

Read Also: Does Medicare Pay For Urolift

What Is The Health Insurance Deduction On Schedule 1

The deduction which youll find on Line 16 of Schedule 1 allows self-employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year.

What medical expenses are tax deductible?

If you face high medical bills and itemize your deductions, you might be able to deduct some of your medical expenses. The deduction found on Schedule A of your income tax return covers a wide range of medical expenses, and also includes premiums you pay for health insurance or qualified long-term care.

Can I deduct health insurance on my taxes in 2020?

Self-employed persons can deduct health insurance above the line on their 2020 Schedule 1, which also eliminates the hassle and limitations of itemizing. Other taxpayers can deduct the cost of health insurance as an itemized deduction only if their overall medical and dental expenses exceed 7.5% of their adjusted gross incomes in 2020.

How To Find Or Request Your Form 1095

Form 1095-B will still be produced for all UnitedHealthcare fully insured members and will continue to be made available on member websites, no later than the annual deadline set by the IRS. Members can view and/or download and print a copy of the form at their convenience, if desired.

Additionally, a request for a paper form can be made in one of the following ways:

- Complete the 1095B Paper Request Form and email it to your health plan at the email address listed on the form

A Form 1095-B will be mailed to the address provided within 30 days of the date the request is received. If you have any questions about your Form 1095-B, contact UnitedHealthcare by calling the number on your ID card or other member materials.

If you have had an address change in 2019 or 2020, please call customer care to request a printed copy of the 1095B. A phone call is necessary in this situation because of the private and confidential nature of the 1095B form.

Recommended Reading: What Are The Costs Of Medicare Advantage Plans

Also Check: Does Medicare Pay For Someone To Help At Home

Q: What Do I Do If I Received Multiple Forms 1095

If you received more than one Form 1095-A from the same Marketplace that reports coverage for different months, you will enter the information for the corresponding month on Form 8962.If you received more than one Form 1095-A that reports coverage for the same month, please see the instructions for Form 8962PDF for more information.

What Is The 1095

- The 1095-B is an informational form that lets each Medical Assistance member know which months during the previous calendar year he/she had health coverage. Individuals who show that they had the required coverage are not liable for the penalty imposed on those without such coverage. Starting with the 2020 plan year , the penalty no longer applies. This information is also provided to the IRS.

- Georgia Medical Assistance will need this form to file their taxes beginning in 2016.

You May Like: How To Find A Patient’s Medicare Number

Tax Year : Requirement To Repay Excess Advance Payments Of The Premium Tax Credit Is Suspended

The American Rescue Plan Act of 2021, enacted on March 11, 2021, suspended the requirement to repay excess advance payments of the premium tax credit for tax year 2020.

If you already filed a 2020 return and reported excess APTC or made an excess APTC repayment, you don’t need to file an amended return or take any other action.

If you have not filed your 2020 tax return, here’s what to do:

- If you have excess APTC for 2020, you are not required to report it on your 2020 tax return or file Form 8962, Premium Tax Credit .

- If you’re claiming a net premium tax credit for 2020, you must file Form 8962, Premium Tax Credit .

For details see Tax Year 2020 Premium Tax Credit:

Health insurance providers – for example, health insurance companies may send Form 1095-B to individuals they cover, with information about who was covered and when. Certain employers will send Form 1095-C to certain employees, with information about what coverage the employer offered.

The IRS has posted questions and answers about the Forms 1095-B and 1095-C. The questions and answers explain who should expect to receive the forms, how they can be used, and how to file with or without the forms.

You should not attach any of these forms to your tax return.

Do You Need Form 1095 To Pay Your Taxes

Your document may be called Form 1095-A, 1095-B, or 1095-C, depending on what type of health insurance you had last year.

- If you expect a 1095-A, you will need the form before you finish your taxes. People who receive health insurance subsidies generally get Form 1095-A.

- If you expect a 1095-B or a 1095-C, you can typically mail your taxes without the form, as long as you know whether or not you were insured. If you received health insurance through an employer or a government program like Medicaid or Medicare, youll probably get Form 1095-B or 1095-C.

Read Also: Does Aarp Medicare Supplement Plan Cover Dental

How Do I Get My Unitedhealthcare 1099

To download an electronic copy of your Form 1099-HC, you can log into your medical insurance companys online account or contact their Member Services at the number on your ID card for more information.

How do I get my Form 1095 from Unitedhealthcare online?

How to find your 1095-A online

Also Check: Do I Really Need A Medicare Advantage Plan

Q I Filed My Return Claiming The Premium Tax Credit Why Did I Get A Letter From The Irs Asking For More Information And A Copy Of My 1095

You do not have to send your Form 1095-A to the IRS with your tax return when you file and claim the premium tax credit. However, using the information on your Form 1095-A you must complete and file Form 8962, Premium Tax Credit. The IRS verifies the information on your Form 8962 by comparing it to information received from the Marketplace and to other information you entered on your tax return.

In some situations, before we can send your refund, the IRS may send you a letter, called a 12C letter, asking you to clarify or verify information that you entered on your income tax return. The letter may ask for a copy of your Form 1095-A.

Some common examples of issues or questions that may arise are:

- It appears that you are required to reconcile but did not include Form 8962.

- You submitted Form 8962 but it is incomplete.

- Based on the income that you reported, it appears that you are not eligible for the credit.

- The income or other entries on your Form 8962 are inconsistent with information on your tax return.

- The premium that you entered on your Form 8962 appears to be an annual amount, rather than monthly.

- There are questions about entries on your Form 8962 that may be clarified by a review of your 1095-A.

- We need to review your Form 1095-A to verify your Marketplace coverage.

Also Check: When To File For Medicare Part A

Healthcarecom Cannot Provide Your Form 1095

HealthCare.com connects you to health insurance brokers, who are unable to transfer you to health insurance customer service. Our partners would not know whether or not you had health insurance last year. Our partners do not have the information required to provide you with Form 1095. You will have to directly contact your insurer for Form 1095.

How Do 1095 Forms Relate To My Tax Returns

If you used premium tax credits to pay for your marketplace health insurance costs, these would be listed on your Form 1095-A. An advance premium tax credit helps lower your monthly health insurance premium. The sum of the credits and related details are required when filing your tax return, as any differences between what you used and the amount you are eligible for would need to be reconciled.

To reconcile this information, check the 1095-A form:

- If you used more credits than you were due, you would owe additional tax for the difference between the two amounts.

- If you used less than you were eligible for, you would receive a tax refund for the difference.

You do not need to file a tax return solely because you received either Form 1095-B or 1095-C. For instance, if you are enrolled in Medicaid, you would receive the 1095-B. If you had no other tax-filing obligations, there would be no need to file a tax return.

Recommended Reading: Do I Qualify For Extra Help With Medicare

Recommended Reading: Can I Get Medicare And Medicaid At The Same Time

What Is A 1095

A 1095-A is a tax form issued by Access Health CT. It is sent to the primary tax filer in the household and will include all members of the household who were enrolled in a qualified health plan.

Form 1095-A shows:

- Who had qualified coverage in your household,

- Your household plan information and the monthly payment , and

- The amount of money paid to your insurance company to help lower your monthly costs .