What Does Medicare Part D Cover

Under Medicare Part D, prescription drug plans are available from private, Medicare-approved insurance companies, so benefits and cost-sharing structures differ from plan to plan. However, the Center for Medicare and Medicaid Services sets minimum coverage guidelines for all Part D plans. These rules require all plans to cover medications to treat most illnesses and diseases.

Each Medicare prescription drug plan uses a formulary, which is a list of medications covered by the plan and your costs for each. Most plans use a tiered copayment system. Prescription drugs in the lowest tiers, usually generic medications, have lower copayments. Brand-name and specialty medications in the higher tiers cost more out-of-pocket.

Medicare Part D only covers prescription drugs that are FDA approved. Experimental medications are generally not covered.

D Eligibility With Medicare

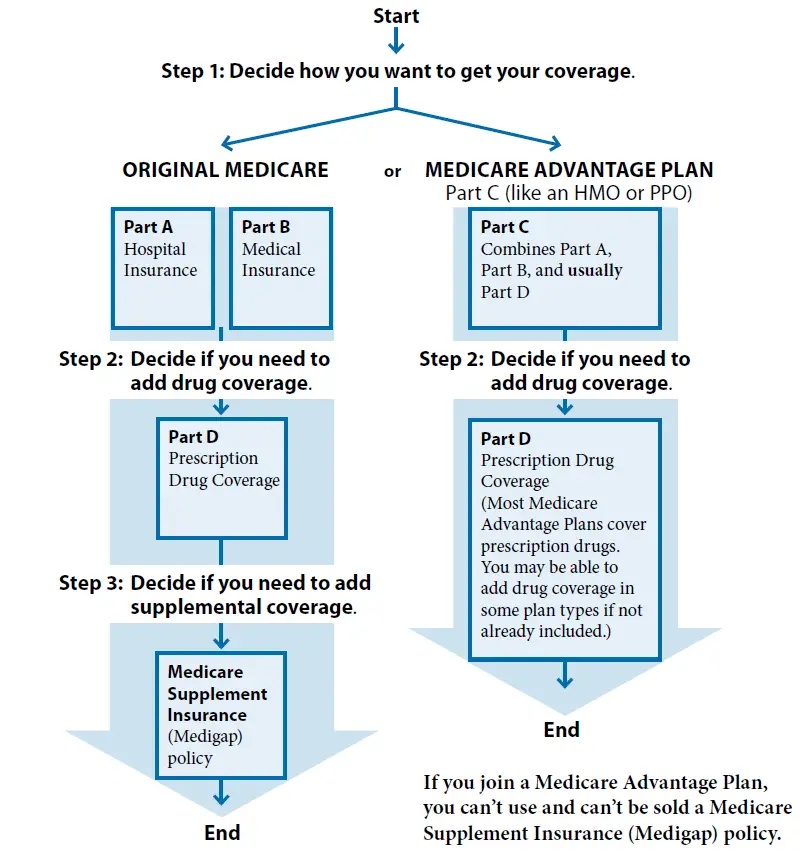

Once you are eligible for Medicare, you can decide which parts you want to sign up forParts A, B, C, or D.

Your first decision will be whether to opt for Original Medicare or a Medicare Advantage plan. You cannot have both. For clarification, Medicare Advantage plans offer everything that Parts A and B do but may provide additional benefits for an added cost.

In order to apply for Part D, you may enroll in Part A, Part B, or both. There is no option to apply for Part D alone.

Alternatively, you can choose to sign up for a Medicare Advantage plan. There are Medicare Advantage Prescription Drug Plans that include Part D coverage.

In summary, you will need to have one of these Medicare plans or combinations to be eligible for Part D coverage:

- Part D + Part A

- Part D + Original Medicare

There are times you may be eligible for Medicare but are not allowed to enroll in a Part D plan. This occurs when you reside outside of the country or U.S. territories. When you return to the United States, you will be eligible to sign up. When you are incarcerated, you receive benefits from the prison system, not Medicare. You may enroll in Part D after you are released.

When Is The Best Time For Medicare Part D Enrollment

There are different times when you might qualify for Medicare Part D enrollment:

Initial Enrollment Period for Medicare Part D Enrollment

Your Initial Enrollment Period occurs when you first become eligible for Medicare. For most people, eligibility happens when you turn 65. The IEP begins three months before the month you turn 65. It includes your birthday month and the three months following for a total of seven months. During that time, you can enroll in a Part D Prescription Drug plan or a Medicare Part C plan that includes prescription drug coverage.

Fall Open Enrollment Period for Medicare Part D Enrollment

Medicare also offers a Fall Open Enrollment Period every year that runs from October 15 to December 7. This period allows for Medicare Part D enrollment as well. You can also switch from one prescription drug plan to another during this time.

Special Enrollment Period for Medicare Part D Enrollment

Special Enrollment Periods or SEPs offer the chance for Medicare Part D enrollment when certain events happen in your life. Those events might include changing where you live or losing your current coverage. If your current plan changes its contract with Medicare or you have an opportunity to get other coverage, you might also qualify for an SEP.

You May Like: What Is A Hmo Medicare Plan

Do I Need Medicare Part D

Medicare Part D is technically voluntary coverage you arent required to enroll in a plan. However, if you go without prescription drug coverage before you enroll in a plan, you may pay a late penalty with your monthly premium. If you have prescription drug coverage through an employer group or retiree plan, you dont have to enroll in a Medicare Part D plan until your coverage ends.

Am I Eligible For Part D

Medicare prescription drug coverage is an optional benefit offered to people who have Medicare. If youre enrolled in Original Medicare Part A and/or Part B, you can get Part D regardless of income. You dont need to have a physical exam and you cannot be denied for health reasons. Part D is also a part of some Medicare Advantage plans.

Read Also: How To Apply For A Replacement Medicare Card

Medicare Part D: Key Takeaways

- For Medicare beneficiaries, prescription drug coverage is only available through private insurance companies.

- Most Medicare Advantage plans include prescription drug coverage.

- You can also purchase a stand-alone prescription drug plan if youre enrolled in a PFFS or MSA plan that doesnt include prescription coverage.

- Your first opportunity to enroll in Part D is when youre initially eligible for Medicare.

- You have the option of selecting an Advantage plan and using that in place of Medicare A, B, and D.

- In most cases, enrollment outside of your initial enrollment period is limited to an annual enrollment period.

- If you dont enroll in prescription drug coverage during your initial open enrollment and then enroll during a subsequent annual enrollment period, a late enrollment penalty will be added to your premium.

As of April 2022, more than 50 million Medicare beneficiaries had prescription drug coverage through Medicare Part D. The total is split between those who have Part D coverage in conjunction with a Medicare Advantage plan , and those who have stand-alone Part D prescription drug plans , most of which are purchased to supplement Original Medicare.

The number of people with Part D coverage through an MA-PD is now higher than the number of people with PDP coverage. As of April 2022, there were 26.7 million people with MA-PD plans, and 23.4 million with PDPs.

Phases Of Part D Coverage

The way the coverage works under Part D is probably different than what youre used to, so weve broken it down into more understandable pieces.

Medicare Part D has a few things in common with typical health insurancefor instance, monthly premiums, coverage for drugs included in a plan, and a system of copays or coinsurance. Beyond these few components, however, Medicare Part D works a bit differently.

For example, one way Part D is different from a typical health insurance plan is that within a year, you could possibly pay four different prices for the same drug. Your costs all depend on which phase of coverage you fall into.

There are four phases of coverage:

Phase 1: Deductible period

If your plan has a deductible, you pay the full cost of your drugs until that deductible is met. Some Part D plans dont have a deductible and begin with phase 2.

Phase 2: Initial coverage period

In this phase, you pay the copayment or coinsurance for your medications. This phase lasts until your drug costs reach a certain limit .3 Once you meet this threshold, you enter the coverage gap, but you may have heard of it by its more popular name, “the medicare donut hole.”

Phase 3: Coverage gap, A.K.A., the donut hole

Previously, there was zero coverage provided by your insurance in this phase, but since the Affordable Care Act in 2010, the donut hole has been steadily shrinking.

Once your out of pocket costs for the year reach $6,350 , you enter phase 4.4

Phase 4: Catastrophic coverage

Recommended Reading: Who Has The Best Medicare Advantage Plans

Basics Of Medicare Part D

There are two ways to get prescription drug coverage through Medicare Part D.

- Enroll in a stand-alone Medicare prescription drug plan . If you enroll in a stand-alone prescription drug plan, it works alongside your Original Medicare benefits.

- Or, enroll in a Medicare Advantage plan with prescription drug coverage, or an MA-PD. A Medicare Advantage plan is an alternative way to get your Original Medicare benefits. These plans might also offer coverage for additional services like routine vision or dental care, and prescription medications.

Medicare Part D enrollment provides you with choices of plans in most service areas. All plans are required by Medicare to offer a standard level of coverage. Some plans may offer additional benefits beyond this standard. The cost of plans may include monthly premiums, deductibles, copayments, and coinsurance. The amounts can vary from plan to plan.

Prescription Drug plans include formularies, which are a list of the medications that are covered under the plan. Some formularies have tiers. Medications in lower tiers may have lower costs. Generic medications are often included in the lower tiers. When you are preparing for Medicare Part D enrollment, it is important to make sure the medications you take are included in the plans formulary.

Introduction To Medicare Part D

This section constitutes an introduction to Part D. For more detailed information on any of the topics in this section, please click on the links within the topics. There, you will also find relevant legislative, statutory and CFR citation.

Prior to 2006, Medicare paid for some drugs administered during a hospital admission , or a doctors office . Medicare did not cover outpatient prescription drugs until January 1, 2006, when it implemented the Medicare Part D prescription drug benefit, authorized by Congress under the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. This Act is generally known as the MMA.

The Part D drug benefit helps Medicare beneficiaries to pay for outpatient prescription drugs purchased at retail, mail order, home infusion, and long-term care pharmacies.

Unlike Parts A and B, which are administered by Medicare itself, Part D is privatized. That is, Medicare contracts with private companies that are authorized to sell Part D insurance coverage. These companies are both regulated and subsidized by Medicare, pursuant to one-year, annually renewable contracts. In order to have Part D coverage, beneficiaries must purchase a policy offered by one of these companies.

The costs associated with Medicare Part D include a monthly premium, an annual deductible , co-payments and co-insurance for specific drugs, a gap in coverage called the Donut Hole, and catastrophic coverage once a threshold amount has been met.

Don’t Miss: Does Medicare Cover Sleep Apnea Studies

You Automatically Get Medicare When You Turn 65

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

Note: Important Upcoming Change Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month youre first eligible. Beginning January 1, 2023, if you sign up during the month you turn 65 or during the last three months of your IEP, your coverage starts the first day of the month after you sign up.

The following chart shows when your Medicare Part B becomes effective in 2022:

| In 2022, if you sign up during this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| One to three months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65 | One month after the month you turn age 65. |

| One month after you reach age 65 | Two months after the month of enrollment. |

| Two or three months after you reach age 65 | Three months after the month of enrollment. |

The following chart shows when your Medicare Part B becomes effective in 2023:

Recommended Reading: Does Medicare Cover Ent Specialist

What Is A Medicare Part D Prescription Drug Plan

Medicare Part D is prescription drug coverage thats available to people on Medicare. Unlike Part A and Part B, Medicare Part D is offered by private companies, either as a standalone prescription drug plan or as part of a Medicare Advantage Plan with prescription drug coverage . Medicare drug plans cover most outpatient prescriptions.

Medicare Part D Prescription Drug Plans: What You Need To Know

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Big changes are coming to Medicare Part D prescription drug coverage following the passage of the Inflation Reduction Act of 2022, which gives Medicare the power to negotiate for lower prescription drug prices. The act also includes caps on out-of-pocket spending, limits on increases in Medicare Part D premiums and drug prices, and more.

Certain changes will take effect in 2023, while others start as late as 2026.

» Read more:What the Inflation Reduction Act means for your Medicare coverage

Medicare Part D covers prescription drugs and is offered by private insurers approved by the federal government. Most recipients pay a monthly premium that varies by plan based onf your state, county and ZIP code, plus copays and other potential costs. Introduced in 2006, Part D is Medicares most recent addition. While Part D is technically optional, there are steep and permanent penalties if you don’t sign up on time.

If you choose Medicare Advantage , most of those plans include prescription drug coverage. If yours doesnt, it’s unlikely you’ll be able to add a separate, stand-alone Part D plan.

You May Like: How To Opt Back Into Medicare

Ways To Battle High Drug Costs

A few programs can help cover the costs of your prescription drugs or even plan premiums. The Low-income Subsidy program or Extra Help is a federal plan based on income. This program can help lower or remove costs associated with deductibles, copays, coinsurance, premiums, and even the Part D penalty.

You can also check with your State Pharmaceutical Assistance Program for additional assistance.

What’s Medicare Part D

Medicare Part D is a federal medication insurance program administered through private insurance companies. More simply put, its insurance for your Rx needs. You can enroll in a standalone Part D plan to supplement your Part A and Part B benefits, or you can choose a Medicare Advantage plan with Parts A, B and D included. You can purchase a Part D plan from a private insurance company. You get access to the companys pharmacy network and pay a copay for prescriptions.

Find a local Medicare plan that fits your needs

Also Check: When Does Medicare Cover Nursing Home Care

Choose The Right Prescription Drug Plan For You

Here are some tips for finding a plan that meets your budget, needs and preferences.16

- Check the prices. The monthly premium is an important consideration but look too at cost-sharing, such as deductibles, coinsurance and copays. A low premium may cost you more in the long run.

- If you prefer one-stop shopping and are willing to choose a plan that limits you to a network of providers, you may have lower premium costs with a Medicare Advantage plan with prescription drug coverage.

- If you take no or very few medications, you may want to opt for a low-premium plan. It will still cover most of the drugs that people on Medicare need.

- If you are taking specific long-term medications, check their availability and costs in various plans. If the drugs you take are generics, look for plans that charge you little or nothing for these.

- If you expect large medication expenses, it may pay to look for a plan that extends additional coverage if you reach high spending levels.

- When selecting a plan, check to see if they have a convenient preferred pharmacy, where you can often get added savings on prescription drugs.

Annual Notice Of Change

Your plan must send your ANOC out before the Annual Enrollment Period, and the ANOC will outline the changes to Medicare Part D that will occur in your current program. These changes can include pricing, changes to your covered drugs on the formulary, new tier determinations, and more.

Of course, in most cases, you can remain on your current plan if the changes are acceptable. Still, you could miss out on more comprehensive coverage. Remember, every plan is making changes, so there may be other options that will cover your prescription medications better.

Recommended Reading: Does Medicare Part A Pay For Doctor Visits

Joining A Medicare Drug Plan May Affect Your Medicare Advantage Plan

If you join a Medicare Advantage Plan, youll usually get drug coverage through that plan. In certain types of plans that cant offer drug coverage or choose not to offer drug coverage , you can join a separate Medicare drug plan. If youre in a Health Maintenance Organization, HMO Point-of-Service plan, or Preferred Provider Organization, and you join a separate drug plan, youll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare.

You can only join a separate Medicare drug plan without losing your current health coverage when youre in a:

- Private Fee-for-Service Plan

- Certain employer-sponsored Medicare health plans

Talk to your current plan if you have questions about what will happen to your current health coverage.

How Do Medicare Enrollees Get Medicare Part D Prescription Drug Coverage

All prescription drug coverage for Medicare beneficiaries is provided by private insurance companies, as Medicare A and B dont cover outpatient prescriptions. Most Medicare Advantage plans do include prescription drug coverage .

If youre enrolled in a Medicare Savings Account plan or Private Fee-for-Service plan that doesnt include Part D coverage, you have the option to enroll in a stand-alone Part D plan to supplement your coverage.

However, a stand-alone Medicare Part D plan cannot be used to supplement a regular Medicare Advantage plan that doesnt include prescription drug benefits. Medicare Advantage enrollees who want prescription drug benefits need to enroll in a Medicare Advantage plan that has integrated Part D coverage.

Don’t Miss: What Brand Of Diabetic Supplies Are Covered By Medicare