Other Ways To Get Medicare Coverage

If you do not qualify on your own or through your spouses work record but are a U.S. citizen or have been a legal resident for at least five years, you can get full Medicare benefits at age 65 or older. You just have to buy into them by:

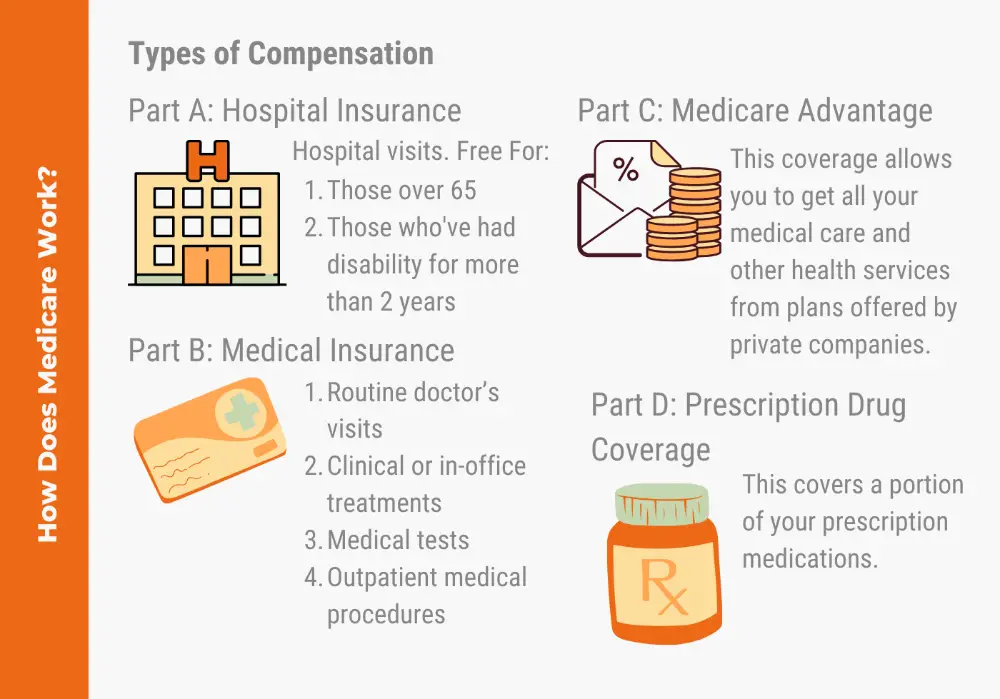

- Paying premiums for Part A, the hospital insurance. How much you would have to pay for Part A depends on how long youve worked. The longer you work, the more work credits you will earn. Work credits are earned based on your income the amount of income it takes to earn a credit changes each year. In 2022 you earn one work credit for every $1,510 in earnings, up to a maximum of four credits per year. If you have accrued fewer than 30 work credits, you pay the maximum premium $499 in 2022. If you have 30 to 39 credits, you pay less $274 a month in 2022. If you continue working until you gain 40 credits, you will no longer pay these premiums.

- Paying the same monthly premiums for Part B, which covers doctor visits and other outpatient services, as other enrollees pay. In 2022 the amount is $170.10 for individuals with a yearly income of $91,000 or less or those filing a joint tax return with $182,000 in income or less. Rates are higher for people with higher incomes.

- Paying the same monthly premium for Part D prescription drug coverage as others enrolled in the drug plan you choose.

You can enroll in Part B without buying Part A. But if you buy Part A, you also must enroll in Part B.

You can get Part D if youre enrolled in either A or B.

Medicare In Ohio Explained

There are four parts to Medicare:

Did you know that almost 49% of Medicare-eligible Ohioans who applied for a Low-Income Subsidy in 2020 were approved for the Extra Help program, which assists with paying for drug coverage costs?6Use the Extra Help calculator to see if you may qualify.

Medicare-eligible Ohio residents also have the option of purchasing a Medicare Supplement plan, which is also called Medigap. These plans assist with expenses not covered by Original Medicare, such as your Part A deductible, copayments, and coinsurance. There are 10 standardized Medicare Supplement plans to choose from, which are sold by private insurance companies.

Who Can Get Medicaid In Ohio

You should apply for Medicaid if your income is low and you match one of the descriptions below:

- You think you are pregnant

- The parent or caretaker of a child and/or teenager under the age of 19.

- You are a child or teenager age 18 or under.

- An adult age 65 or older.

- You are legally blind.

- Living with a disability or disabled.

- You are in need of nursing home care.

Also Check: Why Choose Medigap Over Medicare Advantage

Can You Delay Medicare Enrollment If You Are Still Employed

If you or your spouse is still employed and covered by a group health plan through the employer, you may choose to delay your enrollment in Medicare. However, if you delay your enrollment, you should be aware of the following:

- You will have an eight-month special enrollment period in which to sign up for Medicare Part B after the employer health coverage ends or employment ends . You will not be subject to a late enrollment penalty if you sign up during this special enrollment period.

- If the employer has more than 20 employees, your employer health plan will be the primary payer of covered hospital and medical expenses. Your STRS Ohio plan will be the secondary payer.

- If you discontinue the employer health coverage and fail to enroll in Medicare, you may not be eligible for an STRS Ohio medical plan.

Who Is Eligible For Medicare

Medicare eligibility rules and requirements are basic and apply for almost everyone:

You must be 65 or older You must be a permanent U.S. resident or citizen If you are younger than 65, you may qualify if you have certain disabilities

When you sign up for Medicare, your spouse and dependents will not be covered by your Medicare plan. Medicare doesn’t include family coverage and each person must individually meet the eligibility requirements.

Recommended Reading: How To Report A Death To Medicare

Ohio Medicaid Long Term Care Programs Benefits & Eligibility Requirements

SummaryMedicaid is a joint federal and state program, so its rules, coverage plans and even its name all vary by state. This article focuses on Ohio Medicaid Long Term Care, which is different from regular Medicaid. In Ohio, Medicaid is also called Medical Assistance. Medicaid will help pay for long term care for Ohio residents in a nursing home, in their home and in other residential settings through one of three programs Nursing Home / Institutional Medicaid, Home and Community Based Service Waivers or Aged Blind and Disabled Medicaid / Regular Medicaid.

Selecting Your Plan As A Medicare Enrollee

To select a plan, call STRS Ohio toll-free at 8882277877. You may select a new plan up to three months after your 65th birthday. The effective date of coverage under your new plan will be the first of the month following notification to STRS Ohio, if received by the 15th of the month. There will be no interruption in your health care coverage.

Be aware, your plan selection cannot be processed until STRS Ohio receives proof of Medicare enrollment. This applies even if you are selecting a plan offered by your current plan administrator. STRS Ohio must receive proof of Medicare enrollment by the 15th of the month to begin your participation in the plan the first of the following month. Any delay in submitting this proof will delay your enrollment in the plan you select as a Medicare enrollee.

Note: If you change plan administrators, your medical deductible and out-of-pocket maximums will transfer to the new plan administrator only if you move between an Aetna plan and a Medical Mutual plan.

Don’t Miss: Where To Apply For Medicare In California

Get Started With Medicare

Medicare is health insurance for people 65 or older. Youre first eligible to sign up for Medicare 3 months before you turn 65. You may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease , or ALS .

Follow these steps to learn about Medicare, how to sign up, and your coverage options. Learn about it at your own pace.

Understand Medicare In Ohio

Medicare, the United States federal medical insurance program, provides coverage for more than 2.4 million people in Ohio who qualify for Medicare. You can get Medicare if youre 65 or older or have a qualifying disability.

Your disability typically qualifies if youve received at least 24 Social Security or Railroad Retirement Board disability insurance payments. You can also enroll in Medicare Advantage Plans if you have End-Stage Renal Disease or amyotrophic lateral sclerosis .

Most people have premium-free Part A but, if you have to buy it, the cost can reach up to $506 per month in 2023. Part B costs $164.90 per month but can be more if you have higher income. There are 216 Medicare Advantage Plans in the state that are an alternative to Original Medicare. Learn more about your Medicare options in Ohio.

Recommended Reading: Do I Have Medicare Advantage

Medicare Part B Reimbursement

SERS retirees who are eligible for Medicare Part B and enrolled in SERS health care coverage are eligible to receive a Medicare Part B reimbursement. You must have SERS coverage to receive this benefit.

SERS currently reimburses eligible benefit recipients $45.50 per month to help pay Medicare Part B premiums. If your Medicare Part B coverage is cancelled, or your Part B premium is paid by any other source, such as your state, union, employer, Medicaid or other entity, you are not eligible for the reimbursement.

Reimbursement starts after SERS receives proof of Medicare Part B enrollment. The reimbursement is not retroactive.

Spouses and dependents are not eligible for this reimbursement.

Ohio Medicaid Long Term Care Programs

Nursing Home / Institutional Medicaid

Ohio Medicaid will cover the cost of long term care in a nursing home for eligible Ohio residents through its Nursing Home / Institutional Medicaid. This includes payment for room and board, as well as all necessary medical and non-medical goods and services. These can include skilled nursing care, physicians visits, prescription medication, medication management, mental health counseling, social activities and assistance with Activities of Daily Living .

Some of the things that Ohio Medicaid wont cover in a nursing home are a private room, specialized food, comfort items not considered routine , personal reading items, plants, flowers, and any care services not considered medically necessary.

Any Ohio Medicaid beneficiary who receives Nursing Home Medicaid coverage must give most of their income to the state to help pay for the cost of the nursing home. They are only allowed to keep a personal needs allowance of $50 / month. This can be spent on any personal item clothes, snacks, books, haircuts, cell phones, etc. It can not be spent on any item that Medicaid covers, including hygiene basics like toothbrush, soap, deodorant, razors and incontinence supplies, unless the Medicaid beneficiary wants a specific brand that is not covered by Ohio Medicaid. In this case, they could spend their personal needs allowance on the item.

Home and Community Based Service Waivers

Aged Blind and Disabled / Regular Medicaid

Don’t Miss: Does Medicare Pay For Telephone Psychotherapy

Lawmakers Voted To Freeze Medicaid Expansion In 2017 Kasich Vetoed

Lawmakers in Ohio came to a compromise on their budget bill on in June 2017 and sent it to Governor Kasich, who had just two days to review it before the June 30 deadline for the state to enact the budget for the 2018 fiscal year, which began July 1, 2017. The Senates version of the bill had included a freeze on new Medicaid expansion enrollments after July 1, 2018, and that provision remained in the bill after it went through the conference committee process to reconcile the differences between the House and Senate versions of the budget.

Kasich had noted that the Medicaid expansion freeze would result in 500,000 people losing coverage in the first 18 months, since people would lose coverage if their income increased and would then be unable to get back on Medicaid if their income subsequently decreased .

Kasich used his line-item veto power to eliminate the Medicaid expansion freeze, and he also vetoed a provision that would have required Medicaid expansion enrollees to pay monthly premiums for their coverage. Monthly premiums for Medicaid expansion populations require approval from CMS the Obama Administration only approved limited premium requirements, and had rejected a more far-reaching premium requirement that Ohio had proposed in 2016 . But the Trump Administration has made it easier for states to impose these types of requirements on Medicaid expansion enrollees.

Ohio Department Of Insurance

The Ohio Department of Insurance is responsible for regulating insurance policies sold within the state. It advocates on behalf of residents to help ensure everyone has access to fair coverage. The department also provides a directory of Ohio State Insurance Information Program coordinators who can connect you with agencies and information about Medicare and the Medicare Savings Program.

Contact information: Website | 644-2658

Don’t Miss: When Is The Earliest You Can Apply For Medicare

Learn How To Apply For Medicaid In Ohio

UPDATE: In 2020, Medicaid is not expected to undergo any significant changes.

Ohio State residents who are in need of health care can find out how to apply for Medicaid through various avenues. Applicants can apply for Medicaid at any point in the year. There is no deadline to apply for Medicaid online or via any other method, because a persons income status may change overnight. As long as the applicant meets the Ohio eligibility requirements for Medicaid, he or she will be provided with coverage.

Those who are interested in completing Medicaid application forms are encouraged to check their eligibility and discover where to apply for Medicaid before proceeding to the next step. This way, an applicant can avoid wasting his or her time filling out the Ohio Medicaid application if he or she is not eligible for coverage in the first place.

Review the many different ways to apply for Ohio Medicaid below:

Submit The Following Forms To Odh At The Address Below

- CMS-1572 Home Health Agency Survey and Deficiencies Report

- CMS-1561 Health Insurance Benefit Agreement

- Civil Rights Verification or Package

- HHS 690 Assurance of Compliance forms

Ohio Department of HealthBureau of Regulatory Operations, HHA246 North High Street, 3rd FloorColumbus, OH 43215

On the second line after the term Social Security Act, enter the entrepreneurial name of the enterprise, followed by the trade name . Ordinarily, this is the same as the business name used on all official IRS correspondence concerning payroll withholding taxes, such as the W-3 or 941 forms. For example, the ABC Corporation, owner of the Community General Hospital, would enter on the agreement, “ABC Corporation D/B/A Community General Hospital.” A partnership of several persons might complete the agreement to read: “Robert Johnson, Louis Miller and Paul Allen, partners, D/B/A Easy Care Home Health Services.” A sole proprietorship would complete the agreement to read: “John Smith D/B/A Mercy Hospital.” The person signing the Health Insurance Agreement must be someone who has the authorization of the owners of the enterprise to enter into this agreement. NOTE: Complete the form in its entirety and sign & date under Accepted For The Provider of Services By. No other signatures are required on the form at this time.

Also Check: Can T Find My Medicare Card

Where Can I Apply For Medicaid In Ohio

Medicaid is administered by the State Department of Medicaid in Ohio. You can apply for Medicaid or an MSP using this website or by visiting a county Job and Family Services office.

Josh Schultz has a strong background in Medicare and the Affordable Care Act. He coordinated a Medicare ombudsman contract at the Medicare Rights Center in Ohio City, and represented clients in extensive Medicare claims and appeals. In addition to advocacy work, Josh helped implement federal and state health insurance exchanges at the technology firm hCentive. He has also held consulting roles, including at Sachs Policy Group, where he worked with hospital, insurer and technology clients.

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

You May Like: Who Qualifies For Medicare Vs Medicaid

Do You Qualify To Get Medicare And Other Coverage At The Same Time

If you qualify to get Medicare at the same time as you get employer-sponsored coverage, Medicaid, or Medicaid Buy-In for Workers with Disabilities , having those other benefits may impact your Medicare decisions:

- If you also qualify for Medicaid or Medicaid Buy-In for Workers with Disabilities, they may help pay for some medical expenses that Parts B and D would not pay for.

- If you also qualify for employer-sponsored coverage, you may wish to decline Part B and Part D coverage, so that you dont have to pay their premiums. However, your private coverage must meet certain standards, or else you may have to pay monthly penalties if you choose to sign up for Parts B and D later.

- Important: Before you decline Part B, ask your employer-sponsored coverage to see if you would have to pay monthly penalties if you sign up for Part B in the future. Before you decline Part D, ask if your private insurance is considered by Part D. If it isn’t, you would have to pay monthly penalties for Part D if you sign up later. If you have any questions about this, contact the Ohio Senior Health Insurance Information Program .

You may have other options as well, such as retirement benefits, Veterans benefits, or military benefits. Learn more about how Medicare interacts with other types of coverage.

Medicaid If You Are 19 Or Older

If you are 19 or older, you may qualify for income-based Medicaid if your familys income is 138% of FPG or less . If you are pregnant, you can have income up to 205% FPG . It doesnt matter how much your family has in resources or whether you have a disability.

Check whether your income is low enough for you to get income-based Medicaid:

Your family size:If you have a disability, dont get SSI, and make too much for income-based Medicaid, you may qualify for disability-based Medicaid or for MBIWD.

You may see the income limit for income-based Medicaid listed as 133% of the Federal Poverty Guidelines in some places. However, when Medicaid counts your income, theyll knock 5% of FPG off your income if you make more than 133% of FPG. Thats why we say that you can make up to 138% of FPG, because it more accurately shows how much income you could have and still get Medicaid. For pregnant women, this means we show 205% of FPG as the limit, rather than 200%.

Read Also: Medicaid Rules For Assisted Living

Don’t Miss: Does Medicare Cover Capsule Endoscopy