Medicaid Recipients And The $50000 Pip Option

Under the new auto no-fault law, recipients of Medicaid can select a $50,000 PIP medical expense option. This option is only available if:

Does Medicaid Cover Auto Accident Injuries Under the New Law?

If you are considering opting for this level of PIP coverage, it is absolutely crucial you first understand which services are not available through Medicaid but may be needed in the event of an auto accident. Again, CPAN has created a remarkable brochure for consumers to compare coverages.

Please visit .

Read Also: Can I Get Medicaid If I Have Medicare

Do You Have To Sign Up For Medicare At 65 If You Are Still Working

If you have medical coverage under a group health insurance plan offered by an employer or a spouses employer, you generally do not have to sign up for Medicare at age 65. You are able to delay your enrollment until your group coverage ends, without paying a penalty. Medicare gives you a special enrollment period that lasts eight months after the group coverage ends. The exception is for employers with less than 20 employees, so check with your employer or Social Security because if you dont enroll in medicare, your employer might pay less or not at all.

You can also sign up for Medicare Parts A and B while youre still working, if you choose to. As long as you were previously covered by a group health insurance plan, you wont have to pay a penalty.

If you have Medicare Part B and return to work after the age of 65, you can drop Part B, as long as you have coverage under your employers group plan. When the group plan coverage ends, you can sign up for Part B again without paying a penalty.

What Happens If You Dont Enroll During Your Iep

Failure to enroll during your Initial Enrollment Period may cause a lapse in coverage and lead to late penalties.

- Part A penalty: If you wait a year or more to sign up for Part A and do not qualify for premium-free benefits, you pay a 10 percent penalty for twice the number of years you waited to enroll.

- Part B penalty: If you wait to enroll in Part B and do not qualify for a Special Enrollment Period, you pay a 10 percent penalty for every year you failed to sign up. This penalty lasts for the entire time you have Medicare.

If you qualify for premium-free Part A, it is nearly always recommended you enroll as soon as you are able.

Recommended Reading: How To Sign Up For Medicare And Tricare For Life

Do You Automatically Get Medicare When You Turn 65

If you are already receiving Social Security retirement benefits, you will automatically get Medicare at age 65 if you qualify for premium-free Medicare Part A. If you have to buy Medicare Part A, you will need to sign up manually online or by contacting your local Social Security office.

Youll know if you were automatically enrolled because youll receive a Welcome to Medicare package in the mail. This package includes details about Medicare Part A and Part B, along with your Medicare card. It will also help you answer the question, How much will I have to pay for Medicare when I turn 65? If you are uncertain or have questions about your Medicare eligility, you can contact Social Security direction, either via phone, online or visiting a local SSA office.

You have the option to reject Medicare Part B if you dont want it. However, if you change your mind and enroll later, you may have to pay a late enrollment penalty.

How To Avoid The Late

You might not be getting retirement benefits when you turn 65 because you are still working. In this case, you will have to sign up for Medicare coverage options when you retire and lose your employer health care coverage. When your employer coverage ends, you may have a special enrollment period to sign up for Medicare Part B without receiving a late-enrollment penalty.

Generally your monthly premium for Part B may go up 10% for each full 12-month period that you could have had Part B but didnât sign up for it. Similarly, your Part A monthly premium may go up by 10% if you didnât enroll when you were first eligible. However, most people qualify for premium-free Part A and therefore are also exempt from the Medicare Part A late-enrollment penalty.

You May Like: Can You Get Medicare If You Retire At 62

Do I Automatically Get Medicare When I Turn 65

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Most people who automatically get Medicare at age 65 do so because they have been receiving Social Security benefits for at least four months before turning 65. Traditionally, Medicare premiums are deducted from your Social Security check. For the longest time, you could retire with full Social Security benefits at 65 and start on Medicare at the same time.

You are still automatically enrolled in Medicare Part A and Part B at 65 if youre drawing Social Security, but not as many people draw Social Security that early these days because of changes to the eligibility age for full Social Security benefits.

In 2000, the Social Security Amendments of 1983 began pushing back the standard age for full Social Security benefits. The progressive changes are nearing their conclusion: Beginning in 2022, the standard age for full benefits will be 67 for anyone born after 1960.

Besides the Medicare eligibility age of 65, what remains unchanged is that you can opt to begin drawing partial Social Security benefits as early as age 62. So, if you opt for accepting partial Social Security benefits before age 65, you are automatically enrolled in Medicare.

A smaller group of people also automatically get Medicare at age 65: people who receive Railroad Board benefits for at least four months before 65.

When Do You Apply For Original Medicare

You might not even have to apply for Original Medicare, which includes Part A and Part B . Many people are enrolled automatically. That applies to you if youre already getting Social Security benefits when you turn 65.

But even if youre automatically enrolled in traditional Medicare, you do have to take action if you want other Medicare coverage. For example, say you want to buy a Medicare Supplement insurance plan. The government doesnt enroll you. You need to do that if thats what you want. Well get into this more later on.

Also Check: How To Get Prior Authorization For Medicare

Ask These Questions Before You Delay Medicare

Whether or not you can delay Medicare past 65 when youre working really depends on a few simple questions.

If you can answer Yes! to all the above, you likely qualify for a Medicare Special Enrollment Period and can delay enrolling without penalty. Whats the next step?and information sent directly to your inbox.

Signing Up For Medicare

Follow the steps below if you need to actively enroll in Medicare.

If you decide to enroll in Medicare during your Initial Enrollment Period, you can sign up for Parts A and/or B by:

- Visiting your local Social Security office

- Mailing a signed and dated letter to Social Security that includes your name, Social Security number, and the date you would like to be enrolled in Medicare

- Or, by applying online at www.ssa.gov

If you are eligible for Railroad Retirement benefits, enroll in Medicare by calling the Railroad Retirement Board or contacting your local RRB field office.

Keep proof of when you tried to enroll in Medicare, to protect yourself from incurring a Part B premium penalty if your application is lost.

- Take down the names of any representatives you speak to, along with the time and date of the conversation.

- If you enroll through the mail, use certified mail and request a return receipt.

- If you enroll at your local Social Security office, ask for a written receipt.

- If you apply online, print out and save your confirmation page.

Related Answers

Recommended Reading: Which Medicare Plan Is Free

Do You Have Alternatives To Original Medicare When You Turn 65

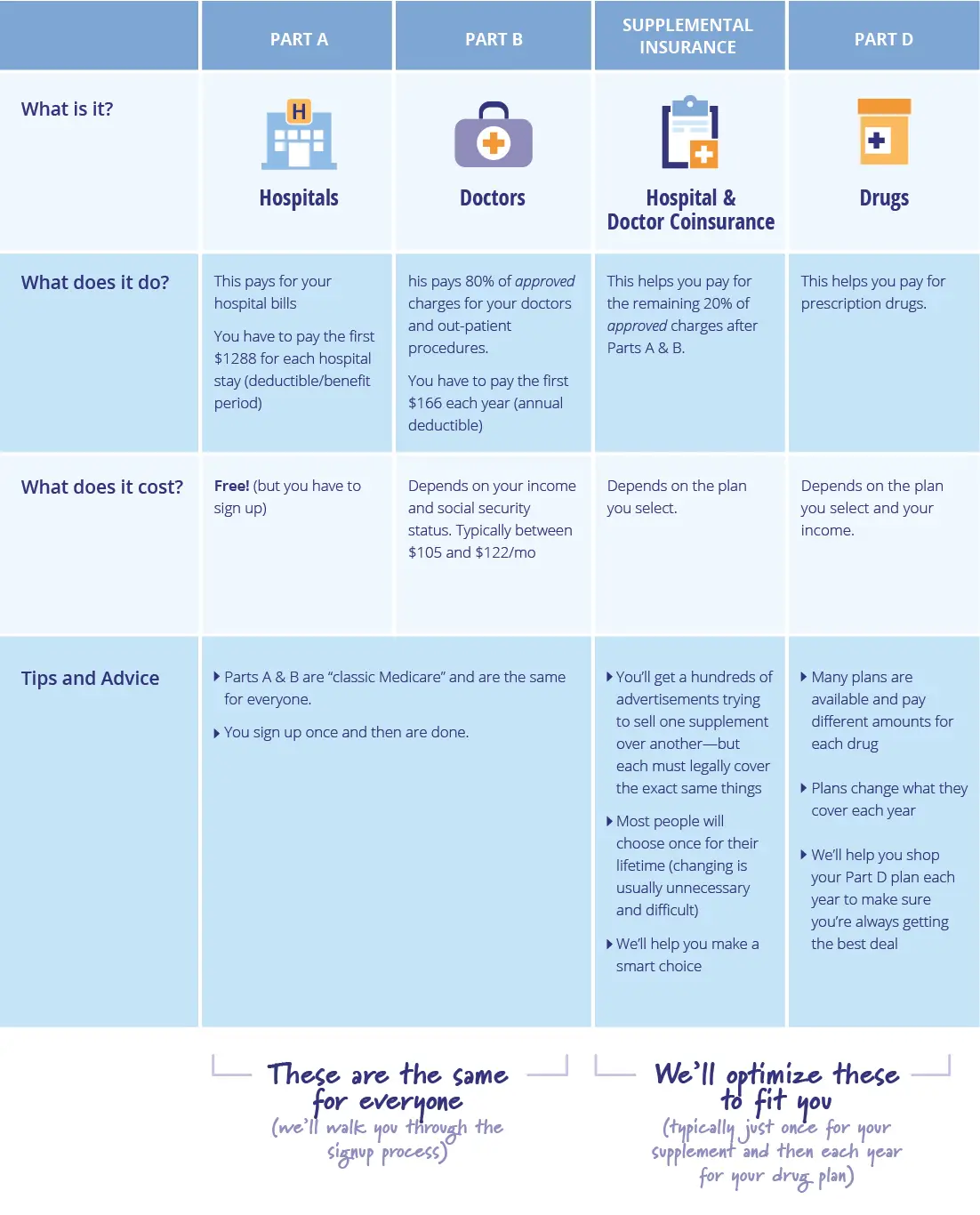

When you are eligible to sign up for Medicare coverage at 65 you may want coverage in addition to Original Medicare . This could include:

- Medicare Supplement Insurance plans: Medicare Supplement insurance plans help pay out-of-pocket costs such as copayments, coinsurance and deductibles. You have a six month Medicare Supplement Open Enrollment Period that begins the month you turn 65 and are enrolled in Medicare Part B.

- Medicare Part D: Medicare Part D is prescription drug coverage. Original Medicare generally doesnât cover most of the prescription drugs you take at home which is why some Medicare beneficiaries chose Part D coverage. You have a 7-month Initial Enrollment Period for Part D which starts three months before the month you turn 65, includes the month you turn 65, and lasts three months after the month you turn 65.

You also may want a Medicare Advantage plan.

- Medicare Advantage is an alternative way to get your Part A and Part B benefits from a private insurance company. Medicare Advantage plans must cover everything that Medicare Part A and Part B covers, with the exception of hospice care, which is still covered by Medicare Part A. The Medicare Advantage Initial Enrollment Period is the same as the Medicare Part D Initial Enrollment Period, which is 7 months. It starts three months before you turn 65, includes the month of your 65th birthday, and ends three months after your 65th birthday.

When Youre Ready Contact Social Security To Sign Up:

- Apply online This is the easiest and fastest way to sign up and get any financial help you may need. Youll need to create your secure my Social Security account to sign up for Medicare or apply for Social Security benefits online.

- Contact your local Social Security office.

- If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

You May Like: Does Medicare Pay For Part D

Getting To Know The Options

There are several different options to consider when and how to sign up for Medicare at age 65. There are four primary parts of Medicare:

- Part A This covers any time you have to spend in a hospital.

- Part B This covers fees from doctors and physicians.

- Part C This allows those receiving Medicare to receive their medical care from a number of different delivery options.

- Part D Covers your prescription medication.

There are also Medigap policies, which offer you extra coverage when you enroll in Medicare Part A and B.

Medicare Part Bit Depends On The Size Of Your Employer

Medicare Part B covers doctors services, outpatient care, medical supplies and preventive services. The primary consideration in deciding if you need Part B is how many employees work at your company.

- If your company has 20 or more employees, your company would remain your primary insurer and you can delay enrolling in Part B without worrying about a late-enrollment penalty or lapse of coverage. When you leave your job, you then have eight months to sign up for Part B under a Special Enrollment Period.

- If your company has fewer than 20 employees, Medicare is considered your primary insurer, whether youve enrolled in Medicare or not. Your company plan is the secondary, which means that your employer plan wont pay for anything thats assumed to be covered by Medicare. If you dont sign up for Part B as soon as youre eligible, you may have to pay a penalty, and there could be a delay in coverage.

You May Like: How Much Does Medicare Cost Me

When Do I Apply For Medicare If Im Still Working At 65

What if youre still working when you hit 65? If you qualify for Medicare, but youre not getting Social Security benefits yet, you usually dont get enrolled automatically in Medicare.

Some people decide to:

- Enroll in Medicare Part A as soon as theyre eligible. Even if your employer plan has hospital coverage, Part A is premium-free for most people. If your employer plan has hospital coverage, and you have a hospital stay, your plan and Medicare Part A will coordinate benefits to work out payment of your hospital costs.

- Delay enrollment in Medicare Part B. Theres typically a monthly Part B premium, and if youre covered by an employer plan for now, you may be able to save money by delaying enrollment in Part B.

But youll want to make sure you sign up for Medicare Part B when your employer-based coverage ends. Theres a Part B late enrollment penalty, but you can generally avoid it if you sign up for Part B during a Special Enrollment Period when your other coverage stops.

Its important to be sure about what youre doing so that you can avoid Medicare late enrollment penalties. Contact your employer- or union-based health plan administrator with any questions you have to help ensure a smooth transition to Medicare coverage.

Does My Current Health Insurance Status Affect Whether I Can Get Va Health Care Benefits

No. Whether or not you have health insurance coverage doesnt affect the VA health care benefits you can get.

Note: Its always a good idea to let your VA doctor know if youre receiving care outside VA. This helps your provider coordinate your care to help keep you safe and make sure youre getting care thats proven to work and that meets your specific needs.

Dont Miss: When Can You Collect Medicare Benefits

You May Like: What Is The Difference Between Medicare And Medicaid And Medical

When Should I Enroll

There is a seven-month period when you can first enroll in Medicare. Its called the Initial Enrollment Period and it happens three months before the month you turn age 65, the month of your 65th birthday and the three months after. If your birthday is on the 1st of the month, your coverage can begin on the first day of the previous month.

If you are disabled and under age 65, there is a seven-month period surrounding the 25th month you begin receiving Social Security Disability payments. Enrollment time frames are different for people who become eligible because of end-stage renal disease or Lou Gehrigs Disease .

Sign Up: Within 8 Months After You Or Your Spouse Stop Working

- Most people dont have to pay a premium for Part A . So, you may want to sign up for Part A when you turn 65, even if you or your spouse are still working.

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Also Check: Will Medicare Cover Cataract Surgery

Don’t Miss: What Does Medicare Cover For Home Health Services

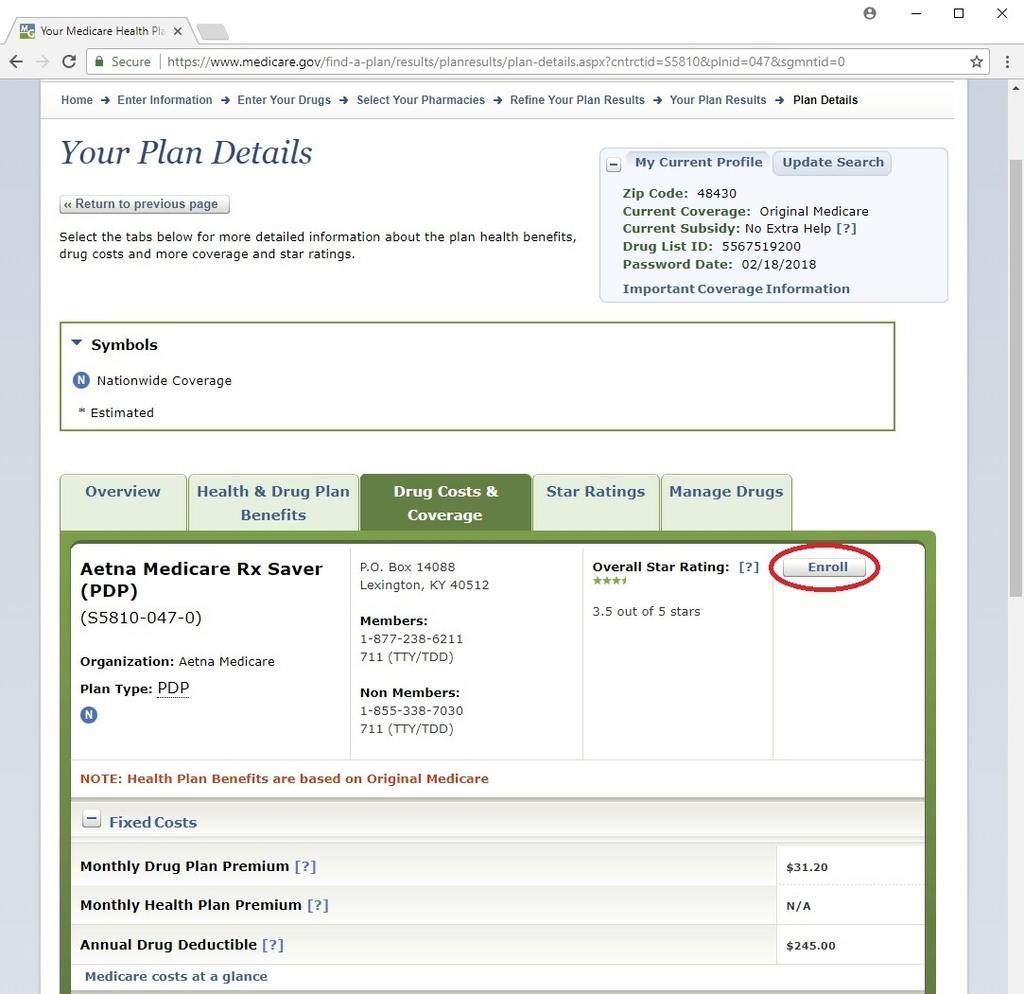

Signing Up For Medicare Part D

Signing up for Medicare Part D is simple. Once you enroll in Medicare Part A and Part B, you can enroll in Medicare Part D.

Like other parts of Medicare, unless you have creditable coverage, it is best to enroll during your initial enrollment period to avoid future penalties. To enroll, you must apply through Medicare and choose to enroll in any plan in your service area.

Do I Have Alternatives To Original Medicare When You Turn 65

When you are eligible to sign up for Medicare at 65 you may want coverage in addition to Original Medicare . This could include:

- Medicare Supplement Insurance plans: Medicare Supplement insurance plans help pay out-of-pocket costs such as copayments, coinsurance and deductibles. You have a six month Medicare Supplement Open Enrollment Period that begins the month you turn 65 and are enrolled in Medicare Part B.

- Medicare Part D: Medicare Part D is prescription drug coverage. Original Medicare generally doesnât cover most of the prescription drugs you take at home which is why some Medicare beneficiaries chose Part D coverage. You have a 7-month Initial Enrollment Period for Part D which starts three months before the month you turn 65, includes the month you turn 65, and lasts three months after the month you turn 65.

You also may want a Medicare Advantage plan.

- Medicare Advantage is an alternative way to get your Part A and Part B benefits from a private insurance company. Medicare Advantage plans must cover everything that Medicare Part A and Part B covers, with the exception of hospice care, which is still covered by Medicare Part A. The Medicare Advantage Initial Enrollment Period is the same as the Medicare Part D Initial Enrollment Period, which is 7 months. It starts three months before you turn 65, includes the month of your 65th birthday, and ends three months after your 65th birthday.

Recommended Reading: Does Medicare Cover Scooters For Seniors

Who Should Enroll In Medicare At Age 65

Many people dont need to enroll in Medicare because it happens automatically. If youre already receiving Social Security retirement benefits or Railroad Retirement Board benefits, then youll be automatically enrolled in Medicare. Do you have to sign up for Medicare at age 65 if you are still working? You dont. If you have health insurance already through your employer , you may not want to sign up right away for part B of Medicare as youll have to pay monthly premiums. However, make sure you check with your employer to see if your coverage changes once you become eligible for Medicare. Keep in mind you may have to pay a higher premium for part B when you do enroll, if you dont sign up right away. If you dont have retirement benefits already and you dont have an insurance plan through your work, then you should enroll in Medicare as soon as possible once your 65th birthday approaches.

Free Medicare Insurance Comparison – Save up to 30%