Who Notifies Social Security Of A Death

When someone whoâs on Medicare dies, the family member or person responsible for their affairs may notify Social Security. However, in many cases, the funeral home will report the personâs death to Social Security. If you want the funeral home to do that, you will need to give the deceasedâs Social Security number to the funeral director so he or she can make the report. So, the task of reporting a death to Social Security might not fall upon you.

Jump Ahead To These Sections:

It is sometimes confused with Medicare, which is a federal health insurance program for people 65 or older or younger people who qualify based on specific health conditions.

This article will assist you with how to notify Medicaid that your loved one has died. We will give you step-by-step instructions on how to check this off of your to-do list. Well also tell you what documents you need to take care of this task.

You may also be interested in reading how to report a death to credit bureaus if you recently lost a loved one. Also, have a discussion with the funeral director who is organizing the end-of-life services for your loved one. These individuals are experts in the logistics of death, and they will help you complete any necessary paperwork to inform the appropriate authorities.

Post-planning tip: If you are the executor for a deceased loved one, it’s tough to handle both the emotional and technical aspects of their unfinished business without a way to organize your process. We have a post-loss checklist that will help you ensure that your loved one’s family, estate, and other affairs are taken care of.

» MORE:

Lost Or Stolen Federal Payments

Report your lost, missing, or stolen federal check to the agency that issued the payment. It’s usually one of these paying agencies. If your documentation indicates it’s a different agency, and you need its contact information, look in the A-Z Index of U.S. Government Departments and Agencies.

To get an update on your claim, contact the Treasury Department Philadelphia Financial Center at 1-855-868-0151, option 1.

You May Like: Can You Go On Medicare If You Are Still Working

What Documents Do You Need For Reporting Death To Medicare Social Security Banks And Others

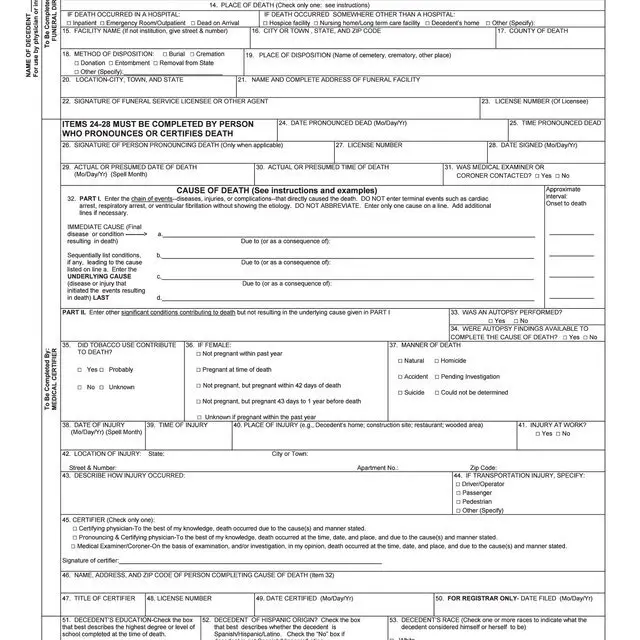

Reporting a death to SSA and Medicare does not require any specialized documentation for the person in charge of the arrangements for the deceased. The funeral director will submit a form to the SSA and only needs the deceaseds SSA number and date of death.

For banks, you may need the death certificate of the individual, their SSA number, and any legal documentation that gives you the power to make decisions for the persons estate.

Medicare does not pay for funerals, but the SSA may pay survivor benefits. These benefits depend on what you are eligible for and it is vital to apply for them as soon as possible.

If you are applying for survivors benefits, you may need the following:

- A birth certificate or other proof of birth

- A death certificate for the deceased worker

- Proof of U.S. citizenship or lawful alien status if you were not born in the U.S.

- U.S. military discharge paper if you had military service before 1968

- W-2 forms and/or self-employment tax returns for last year

It is important that you file for survivors benefits as soon as possible, even if you dont have all of the required paperwork. This ensures that you do not lose out on benefits you are entitled to. In some cases, benefits may not be retroactive.

Price supports his clients as an advocate, informing Medicare beneficiaries of their options and answering questions. Hes an active Medicare and insurance contributor on LinkedIn, Quora, and YouTube.

Other Family Member Dies

If a family member who isn’t the sponsor dies, please contact your local DEERS office to find out the necessary steps to report their death. Depending on your situation, your health plan options may also change from family to individual.

Are you an adult child you may qualify for TRICARE Young Adult?

You may be able to purchase TRICARE Young Adult when you turn 21 if:

Read Also: What Is A Coverage Gap In Medicare

What Happens Once You Report A Death To Medicaid

Once the Medicaid department is notified of your loved ones death, several things may take place.

If Medicaid paid for your loved ones medical costs, they may try to get paid back some of those funds from the estate of the deceased.

Heres a scenario to help you understand what may happen:

If your aunt was in a nursing facility for the last three years of her life, her Social Security check probably went straight to the facility to help cover her costs. Medicaid may have paid for the remaining costs associated with her care.

If your aunt died with any assets, that money is used to pay back Medicaid. This process differs from state to state. The assets may come from a house being sold or an inheritance that your aunt received prior to her death. It may also come from her personal belongings.

Some of these situations regarding this pay back become complicated. For example, what if the home that was owned by the deceased is lived in by adult children who cared for their loved one? What if a sibling had equity in the house and lived with the deceased? An attorney may be needed to sort through these complicated situations.

If your loved one was the recipient of Medicaid, contact an estate lawyer or an attorney specializing in elder care law.

Notifying The Social Security Administration

In most cases, a funeral director will report the person’s death to SSA. To ensure the death is reported promptly, a family member can make a report directly to an SSA representative by calling SSA toll-free, 1-800-772-1213 , between the hours of 7:00 a.m. and 7:00 p.m. Monday through Friday. For more information, visit SSA for How Social Security Can Help You When A Family Member Dies.

Also Check: How Do I Apply For Medicare Part B

What Youll Need To Gather Before You Report A Death To Medicare

It is simple to report a death to Medicare. The only thing you need is the beneficiarys social security number. This is a process that can be done on your own or through your funeral home.

This is also an excellent time to get several copies of your loved ones death certificate. There are many reasons you need a death certificate. However, you actually dont need one to report a death to Medicare. That being said, youll need a death certificate to tie up other affairs and finances. If youre wondering how to get a death certificate, check with your local record office or funeral home.

How To Report A Death To Medicare: Step

After the passing of a loved one, tying up loose ends may feel intimidating. Youll have to report their death to the proper avenues. This is one of the most critical executor duties, so start by taking a deep breath, making a list, and doing one at a time.

Jump ahead to these sections:

If your loved one was elderly, your loved one might have been on Medicare. If so, youll have to report their death to Social Security. Medicare is low-cost health insurance for senior citizens as well as those who qualify.

The process is easier than you might think, and it protects your family from fraud. Follow this step-by-step guide to make sure your loved ones identity is protected.

You May Like: Does Medicare Cover Enbrel Injections

Option : Ask Your Funeral Home Director To Report The Death To The Social Security Administration

As mentioned earlier, you can also request that the funeral home director file the Statement of Death to the Social Security Administration. Medicaid and Medicare will be notified of the death as a result of the Social Security Administration receiving the appropriate form.

While you may like being in control of the situation and notifying the Social Security Administration on your own, the process may be more cumbersome if you do it. When a funeral home director fills out the appropriate forms, they dont need to submit your loved ones death certificate. Depending on the situation, you may be required to provide a copy of the death certificate if you do this task yourself.

Tip: Get A Confirmation Number

Always get a confirmation number if you can when you make any phone call with an insurance company. You want to ensure thereâs a record of that conversation.

Whether itâs a phone call reporting a death or something else, we always recommend keeping a paper trail and having records of all phone calls with insurers.

Also Check: Can I Sign Up For Medicare But Not Social Security

How Do I Report A Death To Social Security And Medicare

Download Article Co-authored by wikiHow Staff

This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow’s Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards. There are 7 references cited in this article, which can be found at the bottom of the page. This article has been viewed 75,624 times. Learn more…

When someone you love dies, it may be difficult to inform everyone you need to while you are in the middle of grieving. However, one thing that should happen as soon as possible is to notify the Social Security Administration about the death. Letting them know that the person has died allows the Social Security Administration to mark the person as deceased and to halt any future payments going to them. Reporting a death promptly will also allow you to begin the process of applying for any survivors benefits that you or others in your family qualify for.

Documents You May Need To Provide

We may ask you to provide documents to show that you are eligible, such as:

- A birth certificate or other proof of birth

- Proof of U.S. citizenship or lawful alien status if you were not born in the United States

- U.S. military discharge paper if you had military service before 1968

- W-2 forms and/or self-employment tax returns for last year and

- A death certificate for the deceased worker.

Important

We accept photocopies of W-2 forms or self-employment tax returns, but we must see the original of most other documents, such as your birth certificate. We will return the documents to you.

Do not delay applying for benefits because you do not have all the documents. We will help you get them.

Recommended Reading: How To Get Dental With Medicare

Check Their Monthly Benefits

Last but not least, take a moment to check your loved ones monthly benefits. If they were receiving Social Security or Medicare benefits through their bank or by check, youll need to make sure they havent been paid for the month of their death.

If they received a check that month or any month after that, do not cash it. The check will need to be returned to Social Security as soon as possible, along with any other benefits paid after death.

For example, suppose they died in August, and you didnt report the death until September. In that case, youll need to report any payments for August and September. When in doubt, ask Social Security about whats owed. The sooner this is taken care of, the more secure your loved ones estate will be.

Express your condolences with a sympathy gift.

Show your support to a grieving friend. Browse our hand-picked selection of gifts.

Get Your Affairs In Order

Keep your loved ones from being left with a mess by getting your affairs in order. Here are some tips for completing this process.

- Put all of your essential documents and paperwork in one place. Check the paperwork each year to see if anything needs to be updated. While you may want to secure the documents, make sure your loved ones know how to access them.

- Tell a trusted family member where you put all your important papers . If you would rather keep this information private until after you die, leave the information with a lawyer.

- Tell your family members your end-of-life plans. Do you want to be buried or cremated? Where do you want your final remains to rest for eternity? What songs do you want at your funeral, and what color casket do you want?

As you can see, theres a lot to consider as you face the end of your life, and we have hardly scratched the surface. Complete an end-of-life plan today to make things easy for your loved ones after you die.

Don’t Miss: When Can You Start Medicare

Do You Have To Cancel Medicare After Your Loved One Dies

| Part A and B | ||

|

|

|

Medicare Summary Notices notify you of the charges and payments to Medicare, but keeping these on file is important to ensure that the Medigap plan continues to pay its portion. This will reduce the out-of-pocket expenses that the estate would be responsible for.

Dealing With Social Security Benefits After A Death

1Don’t keep Social Security benefits that are received after the death. If the deceased person was receiving Social Security benefits, any benefits paid out after the death must be returned. If a check is received, it shouldn’t be cashed and if there is a direct deposit made, you should ask the bank to return the funds.XTrustworthy Source US Social Security AdministrationIndependent U.S. government agency that administers Social Security and related information Go to source

Tip: While it may be tempting to keep the money, especially in such a time of need, the Social Security Administration will require you to return the funds once they figure out that the funds were received after death.

2Ask about whether existing benefits will be transferred automatically. If the deceased person was receiving Social Security benefits, those benefits should automatically transfer over to their widow or widower. When you report the death, confirm that this is the case for you.

- If you are the widow or widower but you are also receiving benefits, you will not receive the deceased’s benefits in addition to your own. In most cases the Social Security Administration will determine which benefits are higher, yours or your survivor benefits, and you will receive the higher amount.XResearch sourceGo to source

Don’t Miss: What Medications Are Covered By Medicare

Why Do You Need To Report The Death To Social Security

Whether your loved one is receiving Social Security benefits or is covered under Medicare, their benefits end the month they die. Under Social Security regulations, the individual must live for the entire month to qualify for benefits. They cannot be prorated.

It is part of the executors legal duty to notify Social Security of any event affecting the individuals benefits. This is especially true of death, which would mean halting all benefits. Failing to notify Social Security could result in fraud, as payments or benefits could be wrongly distributed after death.

Also, its in the estates best interest to report the death as soon as possible. Not only will this halt any payments into Medicare coverage, but it usually also triggers the one-time Social Security burial benefit. This money can be put towards funeral or burial expenses and is typically given to the surviving spouse or children.

The sooner you can report the death, the better. Any money paid from Social Security or benefits after the death will need to be paid back. Therefore, if you dont report the death promptly, you may need to return funds to the government.

Eirene: a modern approach to cremation

Eirene offers direct cremation packages. Your loved one is transferred into their care, they file the necessary paperwork, and the remains are returned to you.

Start With The People Who Knew Your Loved One:

- The deceased’s place of employment

- Caregivers or home-delivered meals volunteers

- The deceased’s church or place of worship

- Local newspapers will need information for an obituary

- Out-of-town newspapers if the deceased lived in another city besides the one in which he/she died

- And don’t assume all relatives have been notified, especially those who may have been out of contact for years

- Cell phone contacts

Be careful about notifying the deceased’s social media friends if not everyone is known. It can invite identity theft. Contact the administrators of these sites to begin closing these accounts.

Recommended Reading: What Is The Most Popular Medicare Supplement Plan

How Do Benefits Work And How Can I Qualify

While you work, you pay Social Security taxes. This tax money goes into a trust fund that pays benefits to:

- Those who are currently retired

- To people with disabilities

- To the surviving spouses and children of workers who have died

Each year you work, youll get credits to help you become eligible for benefits when its time for you to retire. Find all the benefits Social Security Administration offers.

There are four main types of benefits that the SSA offers:

-

Learn about earning limits if you plan to work while receiving Social Security benefits