Your First Chance To Sign Up

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Avoid the penaltyIf you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called Premium-Part A.

Dont Miss: How Do I Get My Medicare Premium Reduced

What Are Cob Rules

Coordination of benefits allows plans that provide health and/or prescription coverage for a person with Medicare to determine their respective payment responsibilities (i.e., determine which insurance plan has the primary payment responsibility and the extent to which the other plans will contribute when an

You Currently Have Tricare Or Champva Coverage

Active duty and retired military members and their families are typically eligible for TRICARE health insurance through the Department of Defense. Those who arent eligible, such as surviving spouses and children, may be eligible for CHAMPVA coverage.

If you have TRICARE or CHAMPVA coverage and are eligible for premium-free Part A, you must also enroll in Part B to keep your current coverage.

If you arent eligible for premium-free Part A, youre not required to sign up for Part A or Part B. If you dont sign up during initial enrollment, though, you will incur a lifetime late enrollment penalty whenever you do sign up.

If you want to defer Medicare coverage, you dont need to inform Medicare. Its simple: Just dont sign up when you become eligible.

You can also sign up for Part A but not Part B during initial enrollment.

Recommended Reading: When Can I Apply For Medicare In California

Medicare Part B Enrollment Avoiding The Part B Penalty

There are a few situations when you may be able to delay Medicare Part B without paying a late-enrollment penalty. For example, if you were volunteering overseas or if you were living out of the country when you turned 65 and werenât eligible for Social Security benefits, you may be eligible for a Special Enrollment Period when you return to the United States. The length of your SEP will depend on your situation. If you arenât sure if you qualify for a Special Enrollment Period, call Medicare to confirm at 1-800-633-4227 , 24 hours a day, seven days a week.

Have more questions about Medicare coverage? You can talk to one of eHealthâs licensed insurance agents â youâll find contact information below.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

How To Disenroll From Medicare Part B

Medicare Part B helps qualified Americans pay health care costs related to doctor visits, lab testing, preventative services, and more, but this coverage isn’t free, and not everyone needs it. Those who dont need Part B can disenrollbut its not a straightforward process.

The Centers for Medicare and Medicaid Services doesnt make it easy to drop this coverage, and you’ll need to speak with a representative to disenroll. If you cancel Part B, it could also impact your ability to afford coverage in the future, so read this entire article before you begin the process.

Don’t Miss: Can An Immigrant Get Medicare

How To Avoid Medicare Late Enrollment Penalties

When it comes to Medicare, there are lots of rules for enrollment. Many of them are there to protect you, but a few can result in penalties if youre not aware of them.

Heres some straightforward information that can help you avoid Medicare late enrollment penalties and keep you on track as you explore your Medicare options.

Do I Have To Sign Up For Medicare When I Turn 65

It depends. Most people whove worked and paid taxes are eligible for premium-free

, on the other hand, requires that you pay a monthly premium , so if you feel you dont want it or need it, you may assume you can just delay your enrollment.

But depending on your circumstances, it may be in your best interest to to avoid any late enrollment penalties.

Read Also: Can I Be On Medicare And Still Work

How To Cancel Medicare Part B Coverage

If youre sure you dont want Medicare Part B, there are a couple of ways to cancel it.

-

If you were automatically enrolled recently and received a welcome packet, follow the instructions in the packet for dropping Part B and return the enclosed Medicare card.

-

If youve been actively enrolled, contact Social Security to cancel your Part B coverage. You can call Social Security at 800-772-1213 or use the Social Security office locator to contact a local office. Youll need to submit Form CMS-1763 and may have to schedule a personal interview with Social Security to complete the process.

Deferring Enrollment Before It Starts

If you want to defer your enrollment, you will have to contact the Social Security Administration to make sure that you arent enrolled in Medicare. This should be a straightforward process, but make sure that you do it as soon as you can, so you dont pay any premiums and then have to cancel later.

Also Check: What Is Medicare Open Enrollment

Medicare Part B Start Date

When do Medicare Part A and Part B start?

Original Medicare includes Part A and Part B . Your Medicare Part A and Medicare Part B start date is based on when you sign up and your sign-up period. More on this below.

Your first chance to sign up

Your Medicare Initial Enrollment Period lasts for seven months, starting three months before your 65th birthday month and ends three months after your 65th birthday month.

If you or a spouse has health insurance through work and will continue to work, you can delay enrolling in Medicare if you prefer your group health plan over Medicare, with no penalties.

Medicare Part A and Medicare Part B start date

Your coverage starts depending on which month you sign up during your Initial Enrollment Period. Coverage always begins on the first of the month.

If you qualify for premium-free Part A : Your Part A coverage starts the month you turn 65.

Medicare Part B start date: Coverage starts based on the month you sign up:

| If you sign up: | |

|---|---|

| 1 month after you turn 65 | 2 months after you sign up |

| 2 or 3 months after you turn 65 | 3 months after you sign up |

Signing up for Premium-free Medicare Part A later

Your Part A coverage starts six months back from when you sign up or apply for Social Security benefits . Coverage cant start earlier than the month you turn 65. You can sign up for Part A any time after you turn 65.

After your Initial Enrollment Period ends, you can only sign up for Part B during one of the other enrollment periods.

Special Situations

Canceling Part B Because You Got A Job With Insurance

If you have had Part B for a while but no longer need it because youve rejoined the workforce with access to employer-sponsored health insurance, congratulations! But before you drop Part B, find out if your jobs coverage is primary or secondary to Medicare.

A primary payer health plan pays before Medicare. That means your employer-provided health plan will cover its share of your health care costs first, and if theres anything left over that Medicare covers, Medicare will pay what remains.

Conversely, a secondary payer health plan covers only costs left over after Medicare covers its share.

If your health plan at work is a primary payer, thats great. Feel free to drop your Part B coverage if you wish. The Part B premiums might not be worth any additional coverage you receive. But if you have secondary-payer insurance at work, its usually better to keep Part B, or you could get stuck paying Medicares share of your health care expenses.

Talk to your human resources department at work to find out if your employer-sponsored plan is primary or secondary to Medicare. Generally, businesses with 20 or fewer employees have secondary payer plans, while larger companies have primary payer plans.

You May Like: When Can I Be On Medicare

You Want To Keep Contributing To An Hsa

You may also want to defer signing up for original Medicare if you currently have a health savings account . Once youre enrolled in original Medicare, youre no longer able to contribute funds to an HSA.

The money you put in an HSA increases on a tax-free basis and can be used to pay for many healthcare expenses.

HSAs are available to people with high-deductible health insurance plans. If your current health insurance meets Medicares requirements for creditable coverage, you wont incur a penalty if you defer for this reason.

Dont Register For Medicare Alone

No one should have to enroll in Medicare alone. Licensed Medicare agents are available to you at no additional cost to help you enroll in the right plan and clear any confusion you may have. If youre uncomfortable with applying for Medicare, we can help!

When enrolling, an agent who understands different Medicare plan types and the coverage associated with Medicare is essential. Plus, when you enroll through an agent, you will never have to pay a fee or be charged extra for your monthly premium. Agents are paid directly by insurance companies.

- Was this article helpful ?

You May Like: Does Medicare Part B Cost The Same For Everyone

Also Check: How To Check For Medicare Coverage

Cancelling Medicare During A Special Enrollment Period

Certain circumstances may make you eligible for a Medicare Special Enrollment Period.

A Special Enrollment Period may be granted at any time outside of the Annual Enrollment Period to people who move outside of their plans coverage area, lose Medicaid coverage or other experience other specific life events.

If you qualify for a Special Enrollment Period, you may be able to switch or cancel your Medicare Advantage or Part D plan.

Signing Up For Medicare Part D

Signing up for Medicare Part D is simple. Once you enroll in Medicare Part A and Part B, you can enroll in Medicare Part D.

Like other parts of Medicare, unless you have creditable coverage, enrolling during your initial enrollment period is best to avoid future penalties. To enroll, you must apply through Medicare and choose to enroll in any plan in your service area.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Read Also: When Can You Change Your Medicare Supplement Plan

Recommended Reading: Is Xeljanz Covered By Medicare

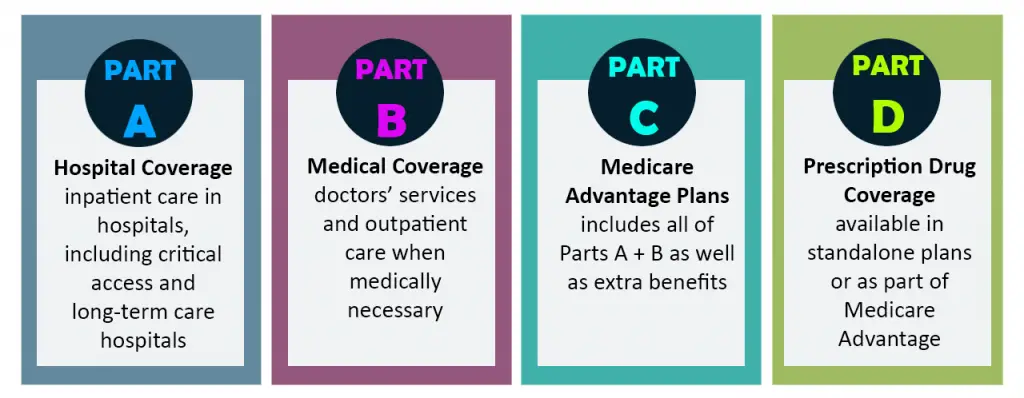

What Is Medicare Part A

Medicare Part A, commonly known as hospital insurance, covers inpatient care in hospitals, skilled nursing facilities, and hospices. It also covers some home health care services like physical therapy.

In general, Part A covers medically necessary services that are considered essential for the diagnosis and treatment of your condition. This means that a doctor or other health care provider must prescribe the service for it to be covered.

Read Also: What Is A Medicare Claim Number

Terminating Other Medicare Plans

You May Like: When Can You Get Medicaid And Medicare

Can Medicare Part B Be Suspended

Asked by: Demetris Jenkins

You can voluntarily terminate your Medicare Part B . However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763. You can also contact your nearest Social Security office

helping maintain the basic well-being and protection of the people we serve

You May Like: Can I Get Medicaid With Medicare

How Do You Cancel Medicare Part B

How do I terminate my Medicare Part B ?

You can voluntarily terminate your Medicare Part B . Because this is a serious decision that could have negative ramifications for you in the future, youll need to have a personal interview with a Social Security representative first. The representative will help you complete Form CMS 1763. This form isnt available online. To schedule your interview, call us at 1-800-772-1213 from 7 a.m. to 7 p.m. weekdays, or contact your nearest Social Security office. For more information, go to www.medicare.gov.

Valerie Fisher is district manager of the Social Security office at 3310 Route 66, Neptune, NJ 07753. Call 800-772-1213 for information.

You May Like: What Is Medicare On My Paycheck

Late Enrollment Penalty For Part B

If you are planning on deferring your coverage, its also important to understand the late penalties you may face. Medicare Part B has a distinct late penalty from Medicare Part A hospital insurance.

The Part B late penalty is especially important to understand because it will stay with you the entire time that you have Medicare. The way the penalty works is that you pay a 10 percent increase for every 12-month period that you could have had Medicare coverage, but didnt. And, this increase will stay with you forever.

If you didnt enroll in Medicare for 2 years after your Initial Enrollment Period, for example, then you could face a 20 percent increase in your monthly premiums for the rest of the time that you have Part B. This can add up to a huge amount of money paid in Part B premiums over the years.

There won’t be a change to your deductible or coinsurance fees.

There are a few situations in which you can delay your enrollment and not face late penalties. This includes things like already being covered by your employer.

Is It Mandatory To Have Medicare Part B

Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem. Cost: If you have Part B, you pay a Part B premium each month.

Recommended Reading: Does Medicare Cover Hearing Aids In 2020

What Is Medicare Part B

Medicare Part B helps cover medical services like doctors’ services, outpatient care, and other medical services that Part A doesn’t cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem.

Cost: If you have Part B, you pay a Part B premium each month. Most people will pay the standard premium amount. Social Security will contact some people who have to pay more depending on their income. If you don’t sign up for Part B when you are first eligible, you may have to pay a late enrollment penalty.

For more information about enrolling in Medicare, look in your copy of the “Medicare & You” handbook, call Social Security at 1-800-772-1213, or visit your local Social Security office. If you get benefits from the Railroad Retirement Board , call your local RRB office or 1-800-808-0772.Learn More:

What Is The Medicare Part B Special Enrollment Period

The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouses current job. You usually have 8 months from when employment ends to enroll in Part B. Coverage that isnt through a current job such as COBRA benefits, retiree or individual-market coverage wont help you qualify for this SEP, but the SEP lasts for 8 months, so you may still qualify if your employment ended recently.

Recommended Reading: What Is The Medicare Out Of Pocket Maximum

Recommended Reading: How To Stop Medicare Calls

You Already Have Health Insurance From Your Current Employment

If you already have employer coverage and have enrolled in Part B, then Part B will function as your secondary insurance. In this case, if you cancel Part B, you may face late penalties when you re-enroll, depending on the timing.

Usually, when you lose employer-based coverage, you trigger a Special Enrollment Period during which you can enroll in Medicare without facing additional late penalties.