Shopping For A Health Plan

- Know what youll have to pay. Plans with higher deductibles, copayments, and coinsurance have lower premiums. But you’ll have to pay more out of pocket when you get care.

- Consider things other than cost. To learn a companys financial rating and complaints history, call our Help Line or visit our website.

- Get help. If you buy health insurance from the federal marketplace, you can get free help choosing a plan. Call the marketplace for more information.

- Buy only from licensed companies and agents. If you buy from an unlicensed insurance company, your claim could go unpaid if the company goes broke. Call our Help Line or visit our website to check whether a company or agent has a license.

- Get several quotes and compare coverages. Know what each plan covers. If you have doctors you want to keep, make sure theyre in the plans network. If theyre not, you might have to change doctors. Also make sure your medications are on the plans list of approved drugs. A plan wont pay for drugs that arent on its list.

- Fill out your application accurately and completely. If you lie or leave something out on purpose, an insurance company may cancel your coverage or refuse to pay your claims.

Use our Health plan shopping guide to shop smart for health coverage.

Choosing A Health Insurance Plan

Reading the fine print is important when choosing health care plans. These questions may help:

- Can I go to any doctor, hospital, clinic, or pharmacy I choose?

- Are specialists, such as eye doctors and dentists covered?

- Does the plan cover special conditions or treatments such as pregnancy, psychiatric care, and physical therapy?

- Does the plan cover home care or nursing home care?

- Will the plan cover all medications my physician may prescribe?

- What are the deductibles? This is the amount you must pay each year before your insurance company will begin paying claims.

- Are there any co-payments? This is the amount of money you pay each time you receive medical services or a prescription.

- If there is a dispute about a bill or service, how is it handled?

Canceling Your Marketplace Plan When You Become Eligible For Medicare

In most cases, if you have a Marketplace plan when you become eligible for Medicare, youll want to end your Marketplace coverage.

IMPORTANT

Don’t end your Marketplace plan until you know for sure when your new coverage starts. Once you end Marketplace coverage, you cant re-enroll until the next annual Open Enrollment Period .

Your Medicare coverage start date depends on your situation.

Don’t Miss: What Is Trump Medicare Plan

Hybrid Plans: When Medicare And Private Insurance Work Together

For many seniors, a combination of Medicare and private insurance provides them with the most comprehensive coverage at the most affordable rate. Medicare is known to have many gaps in their coverage and if you are not aware of these gaps, out-of-pocket expenses can be quick to add up. However, there is one privatized insurance plan that is approved for sale by the government that can provide this combination for optimal coverage and costs.

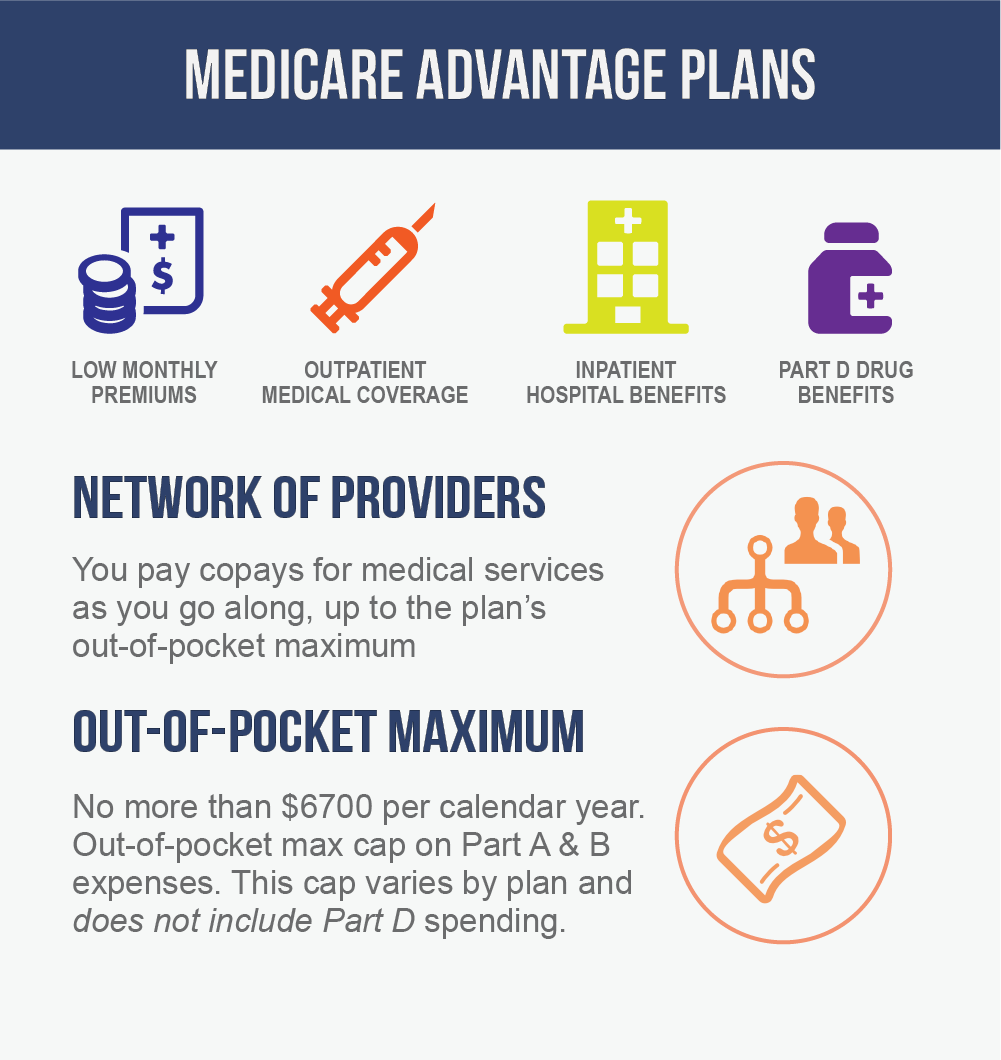

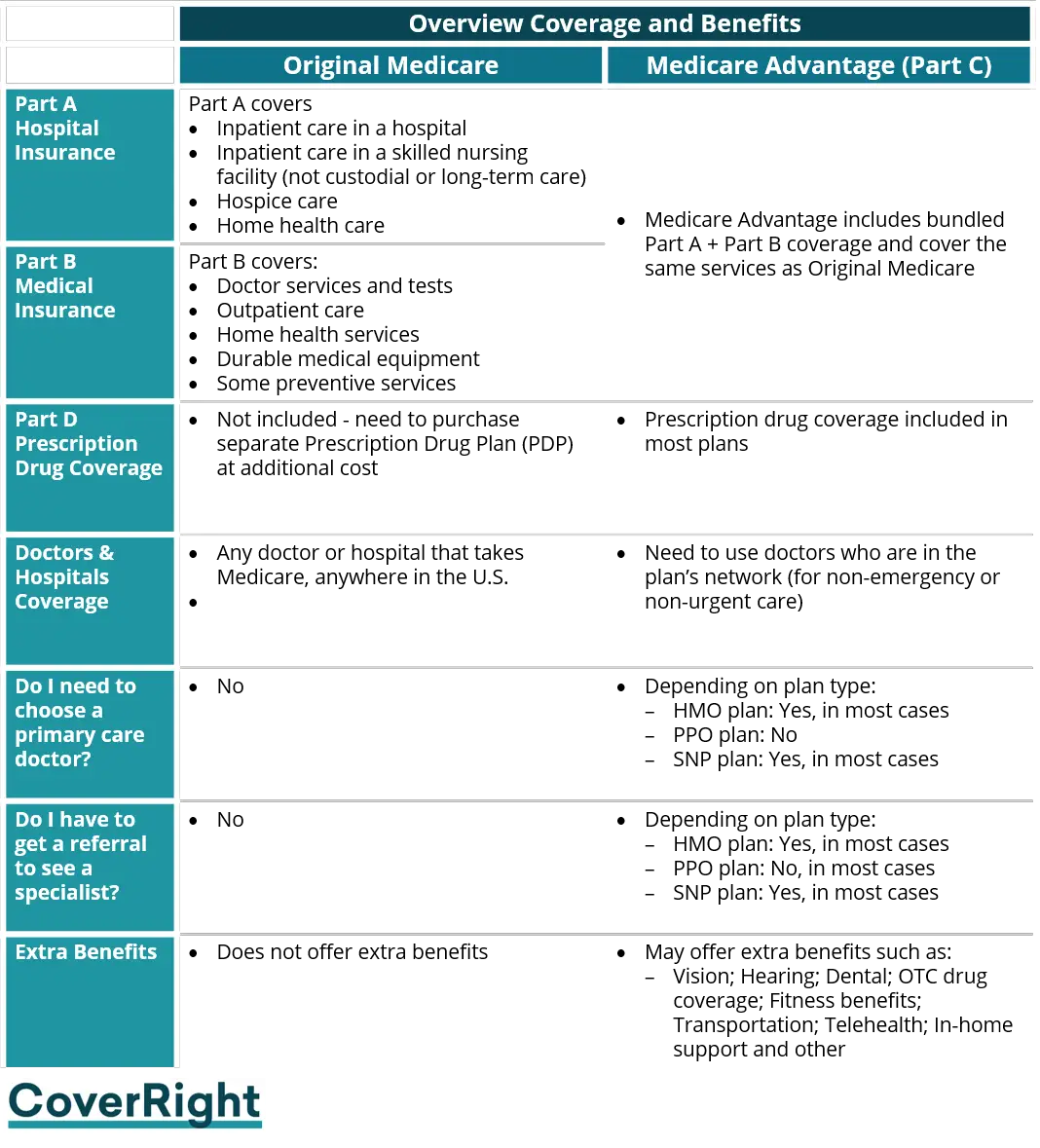

One part of Medicare that was not discussed earlier is Medicare Part C, otherwise known as Medicare Advantage. Part C was not mentioned earlier because it is not a standard form of Original Medicare. This part is actually a form of private insurance that is approved for sale by the government to provide equal or greater coverage than the Original Medicare plans. Medicare Advantage plans combine the benefits of Part A and Part B into one plan and typically includes coverage for prescription drugs as well. There are multiple types of Medicare Advantage plans with different policies on networks, coverage, and costs. A few of these plans are HMOs, PPOs, PFFSs, and SNPs.

Another way in which seniors use Medicare in conjunction with private health insurance companies is through Medicare Part D. Private companies work in tandem with the government to provide seniors with reasonably priced medications. Part D is a supplemental part of Medicare that is used to cover the costs of prescription drugs and is used alongside Original Medicare.

What Is Considered Marketplace Insurance

A service that helps people shop for and enroll in health insurance. The federal government operates the Health Insurance Marketplace®, available at HealthCare.gov, for most states. Some states run their own Marketplaces. … Coverage through the Medicaid and Children’s Health Insurance Program in your state.

Don’t Miss: When Does One Qualify For Medicare

When Can I Enroll In A Marketplace Plan

If you meet these general criteria, you can shop for Obamacare plans during the annual Open Enrollment Period . Each year, there is an Open Enrollment Period when almost all Americans can buy health insurance under the Affordable Care Act. The dates of the Open Enrollment Period change every year, and last for six weeks in most states. Almost everyone who enrolls during OEP will have insurance coverage beginning on January 1st of the upcoming calendar year.

You can also shop on the Marketplace during a Special Enrollment Period if you have a qualifying life event like getting married or welcoming a new child into your family. Here are three general categories of qualifying life events that can trigger a Special Enrollment Period: Loss of health coverage, changes in your household, and changes in residence.

There is no such thing as a pre-set Special Enrollment Period in the United States. Rather, a Special Enrollment Period begins when a person has a qualifying event.

You Can Keep Your Plan Longer With State Continuation

Texas law requires some group plans to continue your coverage for six months after COBRA coverage ends. Your plan must be subject to Texas insurance laws. State continuation doesnt apply to self-funded plans since the state doesnt regulate them.

State continuation lets you keep your coverage even if you cant get COBRA. If you arent eligible for COBRA, you can continue your coverage with state continuation for nine months after your job ends. To get state continuation, you must have had coverage for the three months before your job ended.

You usually cant get state continuation if you were fired.

Don’t Miss: Does Medicare Part D Cover Shingrix

Do I Need To Enroll In Medicare If I Have Coverage From The Aca Health Insurance Marketplace

Yes. If you have health insurance from the Affordable Care Act health insurance marketplace rather than from an employer, youll need to sign up for Medicare Part A and Part B when youre eligible at age 65.

Sign up during your initial enrollment period, which begins three months before the month you turn 65 and ends three months after your birthday month. Otherwise, youll have to wait to enroll during the next general enrollment period, from Jan. 1 to March 31. You may also have to pay a lifetime late enrollment penalty.

While you dont have to drop your ACA health insurance to enroll in Medicare, most people do. For people who qualify for premium-free Medicare Part A, marketplace insurance premium subsidies end after theyre eligible for Part A at age 65.

If you choose to keep the marketplace coverage, youll no longer be eligible for subsidies and will have to pay full price. And if the marketplace doesnt adjust your premiums right away, you may have to pay back the extra subsidies when you file your federal income tax return.

Even though you can keep your marketplace coverage after you enroll in Medicare, youre not able to get a new marketplace policy at that point. In fact, its against the law for someone who knows you have Medicare to sell you a marketplace health insurance plan, even if you have only Part A or Part B.

Can I Choose Marketplace Coverage Instead Of Medicare

Generally, no. You can choose Marketplace coverage instead of Medicare if you have to pay a Part A premium. Before making this decision, check if Marketplace coverage meets your needs and fits your budget. Also consider:

- If you dont sign up for Medicare when youre first eligible , you might have to wait to sign up. You might also have to pay monthly late enrollment penalties.

Also Check: Is Medicare Free In Usa

Q: How Does The Affordable Care Act Help Young Adults

Before the Affordable Care Act, many health plans and issuers could remove adult children from their parents’ coverage because of their age, whether or not they were a student or where they lived. The Affordable Care Act requires plans and issuers that offer dependent child coverage to make the coverage available until the adult child reaches the age of 26. Many parents and their children who worried about losing health coverage after they graduated from college no longer have to worry.

Health Insurance Open Enrollment: If You Need Health Insurance Coverage In Michigan Help Is Here

This site contains everything you need to know about health insurance, how to get covered, and how to use your coverage to keep yourself and your family healthy.

Open Enrollment for 2023 health insurance runs from November 1, 2022 through January 15, 2023. Consumers must select a plan no later than December 15, 2022 for coverage to start on January 1, 2023.

Open Enrollment gives Michiganders the chance to take advantage of newly extended tax subsidies that can help make insurance more affordable. During 2022, approximately 85% of enrolled Michiganders qualified for a subsidy, with many finding a plan for less than $10 per month.

Consumers who still need health insurance for 2022 may qualify for a Special Enrollment Period if they experience a qualifying life event, such as a birth, job loss, or divorce. In addition, Michiganders who qualify for the state’s Medicaid or MIChild programs can apply at any time. For help getting started, and to review their eligibility for these programs, consumers should visit Healthcare.gov/lower-costs.

Your local agent or assister can help with the application or answer your questions. Find Marketplace help near you by visiting LocalHelp.HealthCare.gov.

Don’t Miss: Does Medicare Cover Synvisc Shots

Getting Medicare If You Already Have Marketplace Coverage

Even if you have coverage through the Marketplace, you should generally sign up for Medicare when youre first eligible to avoid a delay in Medicare coverage and the possibility of a Medicare late enrollment penalty.

Once youre eligible to sign up for Part A:

- Your Marketplace plan may not renew your coverage at the end of the year. This means you and your family could have a gap in your coverage starting January 1 of next year.

- You wont qualify for help from the Marketplace to pay your Marketplace premiums or other medical costs. If you keep getting help to pay your Marketplace plan premiums after youre eligible for Part A, you may have to pay back all or part of the help you got when you file your federal income taxes.

Once you sign up for Medicare, you need to drop your Marketplace coverage the day before your Medicare coverage starts, to avoid an overlap in coverage.

What Are Medicare Medicaid And Obamacare

There are four typical ways that many Americans receive health insurance today:

- A group health plan sponsored by an employer

- Private insurance purchased through the

- Medicare, which is a federally-funded health insurance program for adults over age 65 and some younger people with certain disabilities and medical conditions

- Medicaid, which is a government health insurance program for people who have limited financial resources

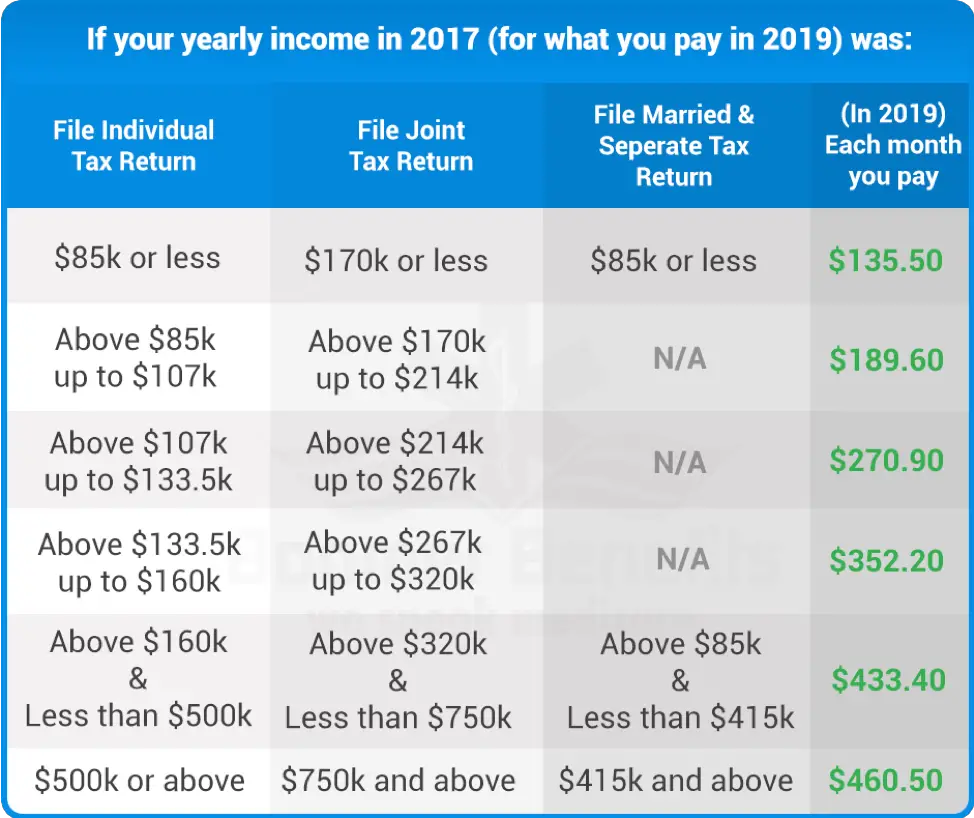

Recommended Reading: How Much Is Premium For Medicare

What Is The Affordable Care Act

The Affordable Care Act provides individuals and families greater access to affordable health insurance options including medical, dental, vision, and other types of health insurance that may not otherwise be available. Under the ACA:

-

You may be able to purchase health care coverage through a state or federal marketplace that offers a choice of plans.

-

Insurers can’t refuse coverage based on gender or a pre-existing condition.

-

There are no lifetime or annual limits on coverage.

-

Young adults can stay on their familys insurance plan until age 26.

-

Seniors who hit the Medicare Prescription Drug Plan coverage gap or “donut hole” can get a discount on medications.

Read the full text of the ACA and learn more about its provisions and relationship to patients, insurers, businesses, and families.

You Usually Must Buy A Plan During The Open Enrollment Period

The open enrollment period for marketplace and individual plans is from November 1 to December 15 each year. You can buy at other times only if you lose your coverage or have a life change. Life changes include things like getting married or divorced, having a baby, or adopting a child.

You can sign up for a work health plan when youre first hired or have a major life change. You have 31 days to decide whether you want to join the plan. You might have to wait up to 90 days for your coverage to start. If you join your work plan, you must wait until the next open enrollment period if you decide to drop out or change your coverage. The open enrollment period for work plans might be different from the marketplace period.

Don’t Miss: How Do I Find Out What My Medicare Number Is

What Is A State Based Exchange

Some states run their own Health Care Marketplace, in lieu of the one run by the federal government. If you live in California, Colorado, Connecticut, the District of Columbia, Idaho, , Massachusetts, Minnesota, New York, Rhode Island, Vermont, or Washington, youll apply for health insurance directly through your states exchange. The process will be almost identical to that with which you would apply on HealthCare.gov.

How To Enroll And Get Answers To Your Questions

You can learn more about and apply for ACA health care coverage in several ways.

-

Visit HealthCare.gov to apply for benefits through the ACA Health Insurance Marketplace or you’ll be directed to your state’s health insurance marketplace website. vary by state.

-

Find a local center to apply or ask questions in person.

-

Download an application form to apply by mail

Find the answers to common ACA questions about submitting documents, getting and changing coverage, your total costs for health care, tax options, and more.

You May Like: Will Medicare Pay For Botox For Migraines

What Is The Health Insurance Marketplace

The Health Insurance Marketplace is a service available so people can shop and enroll in affordable health insurance. The federal government runs the HealthCare.gov Marketplace, which serves the majority of states. A small number of states run their own state-run Marketplace.

You can shop the Marketplace a number of ways. You can shop online through HealthCare.gov. By phone, you can call the HealthCare.gov call center. You may also start a paper application and can do so with in-person support.

Theres also HealthSherpa, the first-of-its-kind partner to the federal government. HealthSherpa allows people to compare, shop, and enroll online in an easy, streamlined manner. HealthSherpas Consumer Advocate Team is available year-round to help field questions about your health insurance.

No matter how you shop the Marketplace, you will provide some basic information about your income and household. Then, you will find out if you qualify for any premium tax credits and any other health insurance savings. Youll also find out if you or any of your dependents qualify for Medicaid or the Childrens Health Insurance Program .

What Happens If I Have To Pay A Premium For Part A

The rules are different for those who arent eligible for premium-free Medicare Part A. If you or your spouse worked for at least 40 calendar quarters, the equivalent of 10 years, and had Medicare taxes deducted from your pay, you wont pay premiums for Part A.

If you or your spouse paid Medicare taxes for 30 to 39 quarters, you may have to pay Part A premiums of $274 a month in 2022, an amount often less than the least expensive marketplace premiums without a subsidy.

That amount increases to $499 a month if youve worked fewer than 30 quarters.

People who dont qualify for premium-free Medicare Part A can opt to keep their ACA marketplace health insurance rather than sign up for Medicare at 65. Youll continue to receive subsidies to help pay the premiums, but they end if you enroll in Medicare.

Think carefully before making this decision: If you decide to sign up for Medicare later, you may need to wait until the general enrollment period and have to pay a late-enrollment penalty for Part A in addition to a Part B late penalty.

Also Check: How Much Money Can I Make On Medicare

Q1: It Seems Like Plans And Insurers Can Terminate Dependent Child Coverage After A Child Turns 26 But Employers Are Allowed To Exclude From The Employee’s Income The Value Of Any Employer

Under the law, the requirement to make adult coverage available applies only until the date that the child turns 26. However, if coverage extends beyond the 26th birthday, the value of the coverage can continue to be excluded from the employee’s income for the full tax year in which the child had turned 26. For example, if a child turns 26 in March but is covered under the employer plan of his parent through December 31st , the value of the health care coverage through December 31st is excluded from the employee’s income for tax purposes. If the child stops coverage before December 31st, then the premiums paid by the employee up to the time the plan was stopped will be excluded from the employee’s income.

The Relationship Between Medicare And The Health Insurance Marketplace

This page contains a downloadable document listing frequently asked questions regarding the relationship between Medicare and the Health Insurance Marketplace. Topics include: general enrollment, End Stage Renal Disease , and coordination of benefits.

The majority of individuals with Medicare coverage have both Medicare Parts A & B and do not have other private health insurance, like a Marketplace plan. Those individuals receive all their health insurance coverage through the Medicare program, whether they have Original Medicare or have a Medicare health and/or drug plan. The frequently asked questions in this document do not apply to those individuals.

Please note that the FAQs in the document below are meant to provide information about situations where an individual:

- has Medicare Part A only, Part B only, or neither, but who is seeking coverage through a Marketplace plan,

- had Marketplace coverage before becoming eligible for Medicare, or

- has retained a Marketplace plan after enrolling in Medicare.

Check back regularly for updates including new questions and answers.

NOTE: Please bookmark this page and not the actual FAQ document so that you will always have access to the most current information.

10/3/2014 – UPDATE: We corrected the Table of Contents in addition to the prior update on 8/28/2014 which clarified the answers to questions A.3. and A.14.

4/27/2016 – UPDATE: We have added FAQs D.7., D.8., and D.9.

You May Like: How To Get Medicare Id Number