Humana Vs Mutual Of Omaha: Medigap Plan Selection

Humana offers a robust selection of plans, with eight of the 10 policies included in its lineup. Humana Medigap plan selection consists of Plans A, B, C, F , G , K, L and N. Its important to note, however, that not every plan is guaranteed to be available in each location.

The Mutual of Omaha plan lineup is slightly smaller than what Humana offers, with Plans A, F , G and N.

Please note that not all plans are available in every location. You can compare your local plan availability to find your best Medigap plan option.

| Humana |

|---|

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Pros And Cons Of Humana Medicare Supplement Plans

| Pros | |

|

Value and Healthy Living plans with extra benefits such as dental, vision, and SilverSneakers |

Premiums are higher than average in some areas |

|

HumanaFirst 24-hour nurse hotline |

Higher than average number of customer service complaints in some areas |

|

Easy online application process with fast approval |

|

|

Discount program for health items such as contact lenses, prescription and over-the-counter medications, and massage therapy |

You May Like: What Is The Monthly Premium For Medicare Plan G

Coverage And Plan Features

Humana is one of the largest insurance companies in the U.S., and the company offers Medicare Supplement plans in all 50 states.

The coverage for each Medicare Supplement plan is consistent across all insurance companies. This means a Humana plan will have the same medical cost-sharing benefits as a plan you get from another company.

Humana offers all plan options except for Plan D and Plan M. For those specifically seeking these plans, a good alternative is Plan G, which is our recommendation for the best overall coverage, and it covers 100% of skilled nursing facility coinsurance. If you specifically want Plan D or M, you can also consider one of our best-rated Medicare Supplement companies.

In addition to the standard Medicare benefits, such as being able to go to almost any doctor or medical facility, Humana policyholders also get access to the following programs:

- Telemedicine

- Discount on Lifeline medical alert

- MyHumana app to review claims or find health information

- Meal delivery program after an overnight stay at a hospital or nursing facility

What Does Medicare Part F Cover

With Medicare Supplement Plan F, you get the most complete coverage available. First, it includes all the benefits of Medicare Supplement Plans A, B and C. In addition, Plan F provides coverage for skilled nursing facility care, Medicare Part A and B deductibles, and international travel medical emergency help.

Because the plan also covers costs in excess of Medicare-approved amounts, you may have no out-of-pocket costs for hospital and doctors office care with this plan.

Recommended Reading: Is The Watchman Device Covered By Medicare

How Medicare Advantage Plans Work

Medicare Advantage plans combine doctor, hospital and, in many cases, even drug coverage into one plan. Most MA plans also include coverage for routine dental, vision and hearing care, as well as other services. These plans are offered by private insurers who contract with the federal government. They are required by law to provideat minimumall the benefits of Original Medicare, with the exception of hospice care.

While you cant add a to a Medicare Advantage plan, the added benefits MA plans provide help make up the difference when it comes to out-of-pocket costs. One great feature is the security of an annual limit on out-of-pocket costs, after which you pay nothing for covered services.

Humana Vs Mutual Of Omaha: Which Company Is Right For You

Humana and Mutual of Omaha are two of the leaders in Medicare Supplement Insurance, and for good reason. Both companies offer a diverse selection of plans with attractive enrollment incentives backed by strong consumer and financial ratings.

Ultimately, its hard to go wrong with either Humana or Mutual of Omaha. A licensed insurance agent can help you review the plan options available in your area from both companies and guide you in your path to determining the best Medicare Supplement Insurance policy for you and your unique needs.

Read Also: How Do I Know If I Have Part D Medicare

If I Have A Humana Medicare Supplement Insurance Plan Will I Still Need Medicare Parts A And B

Yes. Medicare supplement policies only help you fill in the gaps of your cost-sharing requirements they dont offer full health insurance benefits. You can only enroll in a Medicare supplement insurance plan if youre enrolled in original Medicare .

Medicare requires you to share the costs of your healthcare. Medigap plans are private insurance policies that help you pay your part of Medicares:

- coinsurance

- copayment

- deductibles

Although Medicare requires insurers to offer standardized benefits in each plan, not every plan is offered in every state.

To find out which plans Humana and other insurers offer near you, youll need to use the search tool on the insurance companys website or Medicares plan comparison tool. You may need to enter some of your health and age information to get an accurate quote.

Humana Medicare supplement plans like all Medigap policies are available only to people enrolled in original Medicare .

So, if you have a Humana Medicare Advantage plan or a Medicare Advantage plan with another insurer, you wont be able to enroll in a Medicare supplement plan.

Humana offers Medicare supplement plans nationwide, but it doesnt offer every plan in every area. These policies can help you plan for medical expenses by covering Medicare coinsurance, copays, and deductibles.

Humanas Medicare supplement plans vary in cost depending on:

- your age

- the area where you live

They may offer extra benefits, such as:

Medicare Advantage Is Growing In Popularity

The trend is undeniable. In 2021, more than 26 million people are enrolled in a Medicare Advantage plan, accounting for 42% of the total Medicare population.1

By 2030, more than 51% of Medicare members are expected to choose .2

*Costs for Medicare Supplement plans vary by the state you live in and the plan you choose. Medicare Supplement plans can only be paired with Original Medicare.

Explore Medicare

This material is provided for informational use only and should not be construed as medical advice or used in place of consulting a licensed medical professional. You should consult your doctor to determine what is right for you.

Humana is a Medicare Advantage HMO, PPO and PFFS organization and a stand-alone prescription drug plan with a Medicare contract. Humana is also a Coordinated Care plan with a Medicare contract and a contract with the state Medicaid program. Enrollment in any Humana plan depends on contract renewal.

Some links on this page may take you to Humana non-Medicare product or service pages or to a different website.

Y0040_GNHKHNSEN

Also Check: When Can You Join Medicare

How Does Medicare Supplement Part F Work

Medicare Supplement Plan F offers basic Medicare benefits including:

- Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end

- Medical Expenses: pays Part B coinsurancegenerally 20% of Medicare-approved expensesor copayments for hospital outpatient services

- Blood: pays for the first 3 pints of blood each year

- Hospice care: pays Part A coinsurance

In addition to the basic benefits, Plan F also provides coverage for:

- Medicare Part B excess charges

- Skilled nursing facility care

- Medicare Part A deductible for hospitalization

- Medicare Part B deductible for medical and hospital outpatient expenses

- International travel medical emergency help

Plan F also has a high-deductible option. If you choose this option, you have to pay a deductible of $2,370 for 2021 before the plan pays anything. This amount can go up each year.

High-deductible policies have lower premiums, but if you need to use your benefits, you may have higher out-of-pocket costs.

Explore plans

Humana Medicare Supplement Pros And Cons

Humana Medicare Supplement plans average 4.1 stars based on nearly 300 reviews on consumeraffairs.com in the past year. Many of the most negative reviews focus on coverage concerns and customer service . Positive reviews mention factors like low prescription drug costs and copays.

Here are a few other pros and cons about Humana Medicare Supplement plans:

Recommended Reading: Are Dental Implants Covered By Medicare

Healthy Living Vision And Dental Benefits

In addition to the standardized Medicare coverage, Humanas Healthy Living plans also include some cost sharing for dental cleanings, extractions, fillings, oral exams and oral cancer screenings, as well as routine eye exams and an allowance for eyeglasses or contact lenses. These plans cost more than the same plan type without the extras.

What Extra Benefits Are Available With Humana Medicare Supplement Plans

Because Humana is a large company with an extensive health insurance network, it can offer many extra perks and benefits to its Medicare Supplement plan members. Depending on where you live and the plan you choose, you may be eligible for the following benefits and savings programs at no extra cost:

- HumanaFirst A 24-hour nurse hotline you can call for information and advice

- Lifeline Medical Alert A personal emergency response system that helps you live independently at home

- MyHumana Savings Program Discounts on vision and hearing care, prescription eyewear, hearing aids, prescription and over-the-counter medications, massage therapy, weight loss programs, vitamins, and other nutritional supplements

- A program that brings together multiple medical professionals to help you plan, prepare for, and recover from surgery

- SilverSneakers Fitness Membership Fitness classes and exercise for free at participating gyms and health clubs*

- Well Dine Meal Program A program that provides up to 10 precooked meals delivered to your home after youre discharged from the hospital or skilled nursing facility.

*If you dont live near a participating gym, you may qualify for SilverSneakers Steps, which provides you with a free pedometer and personalized walking program to help you stay fit.

Read Also: Does Medicare Cover Memory Care Units

The Basics Of Humana Medicare Supplement Insurance

Original Medicare provides valuable but limited health coverage, so many seniors turn to Humana Medicare Supplement Insurance to fill their coverage gaps. With Medicare Supplement plans , customers pay the insurance company monthly premiums, and in exchange the insurance company agrees to pay certain copays, coinsurance, deductibles, and other costs as they arise.

This arrangement often makes medical bills both lower and more predictable. Its a great solution for many seniors since theyd otherwise be left paying about 20% or more of their total medical costs under Medicare. Note that with most Medicare Supplement plans, you will still need to pay premiums for Medicare Part B and possibly Part A.

If youre considering a Medicare Supplement plan, its important to remember that Medicare does not provide or pay for this insurance, it only regulates it. Furthermore, there are some important restrictions you should keep in mind when shopping for plans.

Medicare Supplement Restrictions:

Supplement Plans Also Known As Medigap

Medicare Supplement plans are commonly known as Medigap policies. These plans were created by the federal government to pick up expenses Original Medicare does not cover. These policies are tightly regulated by the government and coverages are identical for every private insurance company that administers and sells the plans.

Here are the basic plans that Humana offers across the country. It is important to remember that each company like Humana does not have the same plans in every state. There are even several outlier states that have their own structure of Medicare Supplement plans .

Humana offers Medicare Supplement policies for 11 of the 12 standardized plans A, B, C, D, F, G, K, L, and N.

Medicare Supplement Plans A & B

All Supplement Plans are built of the base of Plans A & B. These are basic plans that provide some out-of-pocket expenses but will not cover as much as the more comprehensive plans like F, G, & N.

Plan A will cover the Part A coinsurance and Part B copayments and preventative care coinsurance.

Plan B picks up the Medicare Part A hospital deductible.

Humana Medicare Supplement Plan F

Supplement Plan F has been Humanas most popular plan because of the comprehensive coverage it offers. It has gone through many changes due to government regulations. Today, it is only available to seniors who entered Medicare prior to 2020.

Plan F covers:

Humana Medicare Supplement Plan G

Recipients of Supplement Plan G will receive coverage for:

Don’t Miss: What Is My Medicare Number Provider

Important Things To Know About Medicare Supplement Insurance Plans2

- Medicare Supplement insurance plans are not the same as Medicare Advantage plans.

- A Medigap policy only covers 1 person. If you and your spouse both want Medigap coverage, you must buy separate policies.

- Medigap policies do not include prescription drug coverage. If you want prescription drug coverage, you can join a .

- You will pay a monthly premium when you have a Medicare Supplement plan in addition to the Part B premium to Original Medicare.

- A Medicare Supplement policy is guaranteed renewable even if you have health problems. This means your private insurance company cant cancel your policy as long as you pay the premium and provided accurate information on your application.

- Medigap policies generally dont cover long-term care, vision or dental care, hearing aids, eyeglasses or private-duty nursing.

Humana Medicare Supplement Plan G

Plan G is the Medigap policy offering the most complete coverage after Plan F. Plan G covers everything Plan F does except for the Medicare Part B deductible.

Unlike Plan F, Plan G is open to new beneficiaries. And with new enrollees barred from joining Plan F, Plan G is in position to one day take over most of the market share from Plan F.

Read Also: When Do Have To Apply For Medicare

What Extra Medigap Benefits Do Humana And Mutual Of Omaha Offer

Medicare Supplement Insurance benefits are standardized, but some insurance companies may add some extra incentives to those who enroll.

Humana Medigap plans can include a range of benefits including a fitness club membership, discounts on vision, hearing and prescription drugs and a 24-hour nurse line. Humana also offers Medigap plans that include insurance riders for basic vision and dental coverage, typically with a small fee in addition to the plan premium.

Mutual of Omaha also includes a fitness program membership with its Medicare Supplement Insurance plans called Mutually Well, in addition to discounts on healthy living products and routine vision and hearing care.

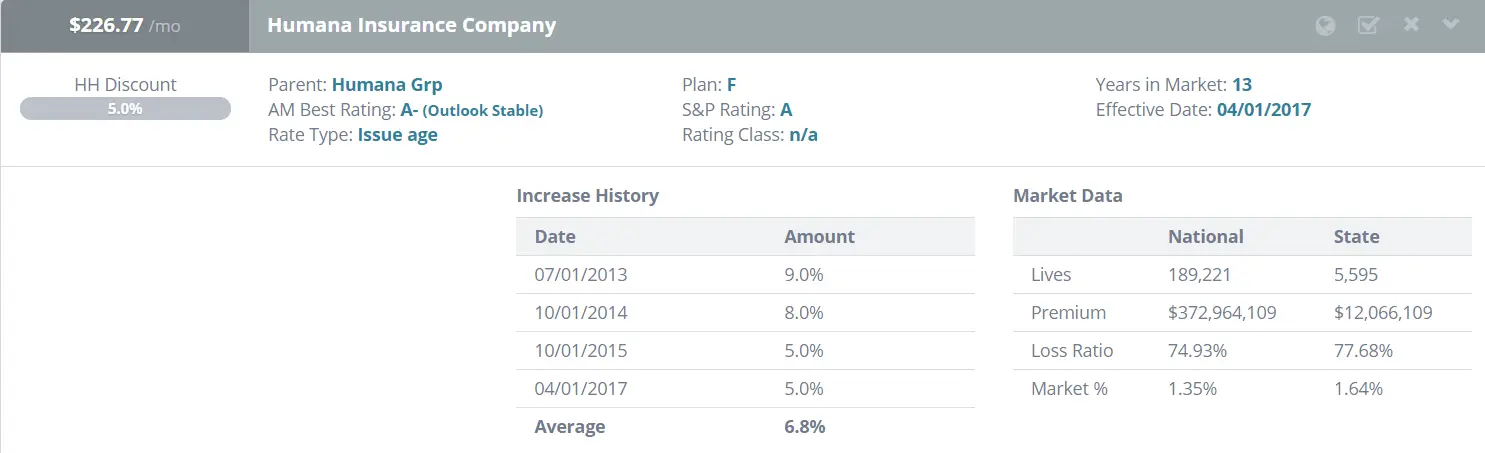

Humana Financial Strength Ratings

All three rating agencies have Humana rated as a strong company. A.M. Best has given them an A- rating, Standard and Poors has placed them as B++, and Moodys has rated them Bb3.

These ratings indicate that the company is very financially stable and is likely to be able to meet its financial obligations. This gives policyholders confidence that their claims will be paid promptly.

Read Also: How To Enroll In Medicare Part B Online

Competition: Humana Vs Unitedhealthcare

Humana and UnitedHealthcare are the Medicare Advantage plans with the broadest geographical coverage 88% of counties have Humana options, 74% have UnitedHealthcare, and 68% have both. UnitedHealthcare is the nations largest health insurer, with more than 14% market share.

UnitedHealthcare also has an exclusive partnership with AARP, giving it a unique advantage in a trusted brand affiliation. UnitedHealthcare has slightly higher average Star Ratings, but both companies offer online tools or apps and multiple channels for customer support. UnitedHealthcare helps members choose a plan with customized recommendations and cost estimators.

In a head-to-head comparison, the difference may come down to specific quality ratings in your local area and cost, which vary depending on where you are.

Humana Medicare Supplement Insurance 2022 Review

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Humana offers Medicare Supplement Insurance, or Medigap, in every state but Virginia, plus Washington, D.C., and Puerto Rico.

Humana offers a lot of options for Medigap plan types, membership perks and extra insurance coverage beyond the Medicare benefits. However, its prices can be expensive, and complaint rates about Humana policies are significantly higher than the market average.

Heres what you should know about Humana Medicare Supplement Insurance.

Also Check: How To Sign Up For Medicare Part A

What We Like About Humana Medigap

Licensed sales agents are easy to reach

- Online platform and mobile app are clear and easy to navigate

- Dental, vision, and prescription plans are often available as add-ons

- Extensive online educational and lifestyle resources for policyholders

- Up to five percent household discount and six percent online application discount

How Options Change After Your Initial Enrollment Period

The best time to sign up for a Medicare supplemental plan is during your initial enrollment period when you turn 65. Otherwise, your application will go through a different underwriting process.

Humana Medigap changes after initial enrollment:

- Higher monthly premiums: During your initial enrollment period, Humana offers preferred pricing. If you sign up after this, you’re only eligible for standard pricing rates, which average about 15% higher in Texas.

- Coverage denials for preexisting conditions: If you sign up after the initial enrollment period, your application can be denied during Humana’s underwriting process, and the company denies the application on the spot for conditions such as HIV, dementia, uncontrolled diabetes, heart disease and more.

After your initial enrollment period, you could qualify for guaranteed issue rights in certain circumstances such as when you move or if a plan is no longer available to you. Only four states have guaranteed issue rights during annual open enrollment or at other times during the year.

Also Check: Does Usaa Have Medicare Supplement Insurance