The Kaiser Advantage Plan

We always look forward to helping our fellow seniors. And we bring only the best insurance providers for you. Kaiser has always been one of our favorite medical insurance providers for the Advantage Plans.

And why shouldnt it be? Kaiser helps its customers like you with added benefits and perks while not charging anything extra.

Here are some of the benefits offered by Kaiser:

Kaiser will help you locate Healthcare providers and Pharmacies around.

- They offer Group Plans

- Online Access to your Plan

- Discounts on non-essential medical services

- Affordable & Competitive Prices

- Many More

To find more about the perks offered by Kaiser as per your location, please contact one of their representatives.

Kaiser is quite customer-centric. Their fair rates and great value are indicative of their professional and caring attitude. While you research, youll know their plans are highly rated and a good choice. And, Kaiser Permanente Medicare Advantage plan is a great choice for an average customer.

We know that you, as a senior, want to save money and get covered as well. And, seniors like you save a lot by choosing a reputed provider like Kaiser offering plans such as the Medicare Advantage.

Designed by keeping seniors in mind, these plans tend to make your healthcare costs low and pretty affordable. So, the majority of people could make the most of these plans.

Kaiser Permanente Medicare Health Plans 2022

Please tell us your location so we can take you to information customized for that area.

Kaiser Permanente health plans around the country: Kaiser Foundation Health Plan, Inc., in Northern and Southern California and Hawaii Kaiser Foundation Health Plan of Colorado Kaiser Foundation Health Plan of Georgia, Inc., Nine Piedmont Center, 3495 Piedmont Road NE, Atlanta, GA 30305, 404-364-7000 Kaiser Foundation Health Plan of the Mid-Atlantic States, Inc., in Maryland, Virginia, and Washington, D.C., 2101 E. Jefferson St., Rockville, MD 20852 Kaiser Foundation Health Plan of the Northwest, 500 NE Multnomah St., Suite 100, Portland, OR 97232 Kaiser Foundation Health Plan of Washington or Kaiser Foundation Health Plan of Washington Options, Inc., 1300 SW 27th St., Renton, WA 98057

Selecting these links external site icon will take you away from KP.org. Kaiser Permanente is not responsible for the content or policies of external websites.

Adobe Acrobat is required to read PDFs.

Importante

Medicare Plans Offered By Kaiser Foundation Health Plan Inc In Washington

Learn what Medicare Advantage plans are offered by Kaiser Foundation Health Plan, Inc. in Washington. Select a plan below to learn such details as plan premiums, deductibles, and the sort of coverage it provides.

12Medicare Advantage Plans Offered by Kaiser Foundation Health Plan, Inc. Found in Washington See Plans

11Medicare Advantage Prescription Drug Plans Offered by Kaiser Foundation Health Plan, Inc. Found in Washington See Plans

Recommended Reading: How Old To Be Covered By Medicare

How Do Kaiser Medicare Advantage Plans Cover Prescription Drugs

Standard and High Kaiser Medicare Advantage Plans provide Medicare Part D prescription medication coverage. Coverage depends on the plan, the medications cost-sharing tier on the Kaiser formulary and whether the enrollee uses a network pharmacy or nonaffiliated entity. Enrollees can sign on to their account and use Kaisers drug pricing tool to determine how much their prescription drugs will cost.

How Can Seniors Enroll In A Kaiser Medicare Advantage Plan

Eligible seniors should sign up as soon as possible for Medicare Parts A and B to get their Medicare cards. This could take up to eight weeks. Information on the card is needed to enroll in a Medicare Advantage plan. Seniors must reside in the Kaiser Permanente Medicare Advantage plan service area in which they enroll.

Kaiser Permanente recommends completing its Turning 65 Checklist four to six months before turning 65. This resource includes a guide to understanding Medicare, star quality ratings and specific Kaiser Medicare Advantage health plans.

You May Like: When Do I Apply For Medicare Part B

What Are The Medical Benefits Of Having Medicare Advantage

Kaiser Medicare Advantage plans 2021 can assist you in paying for your medical expenses. These expenses are not covered by Original Medicare. MA plans will cover most of the Original Medicare but it also covers other medical expenses, like urgent care and emergency medical care services.

If you think about it, that is a lot of coverage that you can have when you choose to purchase an MA plan. In that case, any expenses when you visit an emergency room will be covered. it also takes care of ambulance medical care, some medical tests, and drugs. The coverage you will obtain depends on your situation and the medical treatment you need.

Kaiser adds extra to the basic coverage to help the plans stand out. The additional coverage will give you a powerful health plan that can pay for your prescription drug costs. This drug plan will cover you for all types of generic and brand name drugs. In that case, you will be left with little to pay for your prescription medicines.

You can also choose to purchase Advantage plans that can handle routine checkups. These plans will take care of the entire cost of routine visits to the optometrist, dentist, general practitioner, and others. Some plans will cover only one visit per specialist while others will handle multiple visits a year.

There are also plans that will cover dental cleaning, medical tests, x-rays, and other services. And if you need a new pair of eyeglasses and hearing aids, these plans may also cover them.

Pers Kaiser Permanente Senior Advantage

Get more. More control, convenience, and quality with a plan that goes beyond Original Medicare. With care under one roof, online health management tools, worldwide emergency coverage, and comprehensive care that builds in wellness programs and supportive services to promote your total health, Kaiser Permanentes Medicare Senior Advantage plan offers comprehensive care and coverage.

Read Also: Does Medicare Cover Disposable Briefs

I Am Enrolled In A Medicare Advantage Plan But Have Recently Made Plans To Do Some Traveling Throughout The United States Will My Plan Provide The Same Coverage In All The States I Visit

Not necessarily. You will need to contact the company that is offering your plan to find out if/which benefits are available out-of-state. If your plan does not offer out-of-state coverage, there may be another plan offered by the same firm that does, or a similar plan offered by another firm in your area. If you decide that you would like to switch to a different plan, however, note that you will need to wait until the annual Medicare Open Enrollment period . You can also use the annual Medicare Advantage Open Enrollment period to switch to a different Medicare Advantage plan or switch to traditional Medicare.

Little Evidence Those Higher Payments Are Justified

Legal or not, the rise in Medicare Advantage coding means taxpayers pay much more for similar patients who join the health plans than for those in original Medicare, according to Kronick. He says there is “little evidence” that higher payments to Medicare Advantage are justified â there’s no evidence their enrollees are sicker than the average senior.

Kronick, who has studied the coding issue for years, both inside government and out, says that risk scores in 2019 were 19% higher across Medicare Advantage plans than in original Medicare. The Medicare Advantage scores rose by 4 percentage points between 2017 and 2019, he says â faster than the average in past years..

Kronick says that if CMS keeps the current coding adjustment in place, spending on Medicare Advantage will increase by $600 billion from 2023 through 2031. While some of that money would provide patients with extra health benefits, Kronick estimates that as much as two-thirds of it could be going toward profits for insurance companies.

AHIP, the industry trade group, did not respond to questions about the coding controversy. But a report prepared for AHIP warned in September that payments tied to risk scores are a “key component” in how health plans calculate benefits they provide and that even a slight increase in the coding adjustment would prompt plans to cut benefits or charge patients more.

Also Check: How To Apply For Medicare Without Claiming Social Security

Kaiser Plans Offer Savings But Fewer Extra Benefits

Every Kaiser Medicare Advantage plan has a $0 health deductible. This means that your care is covered from the very first dollar you spend . Like other carriers, Kaiser also offers plans with $0 premiums. Here are a few other advantages youll receive if you join a Kaiser Medicare Advantage plan:

- Complementary gym membership from participating facilities

- Discounts at Kaiser network pharmacies

- Almost all plans cover emergency and urgent care received outside the United States

Medicare Advantage plan members may also opt to purchase an Advantage Plus add on, in addition to their regular plan . Doing so adds a bundle of dental, hearing, and vision benefits to your Medicare Advantage plan. The monthly premium in 2020 is $15.

Kaiser Permanente Medicare Plans Review

Kaiser Permanente Medicare plans can include Medicare Advantage plans and Medicare Part D prescription drug plans. Learn more about Kaiser Permanente and the Medicare health plans that may be available where you live.

Kaiser Permanente is fairly popular among Medicare beneficiaries. In fact, 7% of all Medicare Advantage plan beneficiaries are members of a Kaiser Permanente Medicare plan.1

Kaiser offers a number of Medicare Advantage plans also known as Medicare health plans or Medicare Part C and they offer some Medicare Part D prescription drug plan options. Below is an review of Kaiser Permanente Medicare plans, including the types of plans they sell, the markets in which you might find them and the benefits they offer.

Kaiser Permanente has been a leader in health care innovation since 1945. What began as a health care program for shipyard and steel mill workers now serves around 12 million members in eight states and the District of Columbia.

Headquartered in Oakland, CA, Kaiser Permanente is among the nations largest not-for-profit health plans and reported revenue of more than $88 billion in 2020. There are 39 Kaiser Permanente hospitals and 723 medical offices employing more than 217,000 doctors, nurses and other workers.

Kaiser Permanente offers Medicare plans in the following areas:

- California

- Washington

- District of Columbia

Plan selection will vary within each location, and each type of Kaiser Permanente Medicare plan may not be available where you live.

You May Like: What Is Better Original Medicare Or Medicare Advantage

Kaiser Foundation Medicare Advantage Plan Review

Reviewed by: Kelly Blackwell, Certified Senior Advisor®Updated: November 16, 2021Does Kaiser Foundation have good Medicare Advantage plans? See ratings and learn what Kaiser Foundation covers.

Kelly Blackwell

Kelly Blackwell is a Certified Senior Advisor ®. She has been a healthcare professional for over 30 years, with experience working as a bedside nurse and as a Clinical Manager. She has a passion for educating, assisting and advising seniors throughout the healthcare process.

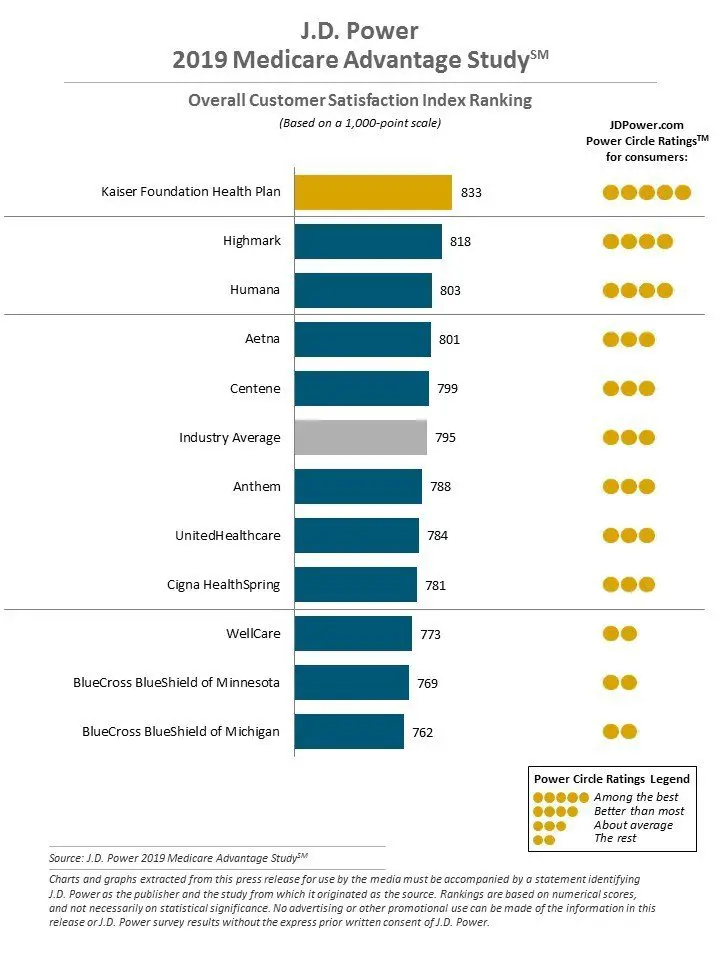

| Medicare rating: 5 stars | A.M. Best financial strength rating: A | BBB rating: A- | NCQA rating: 4.5 to 5 stars | Consumer Affairs rating: 4 | J.D. Power ranking: 1st out of 10 |

Quick Kaiser Permanente Medicare Advantage plans review: Kaiser Permanente offers Medicare Advantage Plans that emphasize coordinated care, but options are limited to eight states.

Kaiser Permanente started in 1945 as a health care program for local workers in California. After WWII, the company expanded to include public members. Kaiser Permanente has several subsidiaries, all working together to provide affordable, premier health care to its members. The Foundation Health Plan manages the companys insurance aspect, while the Kaiser Foundation Hospitals and Permanente Medical Groups provide expert medical care. The company works on a coordinated-care model, offering its members hospital, pharmacy, and doctor services, all of which accept Kaisers insurance offerings.

Medicare Advantage Plans Cost Taxpayers More

In other reports on Medicare, the savings in drug price legislation won’t be felt immediately, but rather over a decade or more advice on the Medicare gap and appealing income-related charges.

KHN:Researcher: Medicare Advantage Plans Costing Billions More Than They ShouldSwitching seniors to Medicare Advantage plans has cost taxpayers tens of billions of dollars more than keeping them in original Medicare, a cost that has exploded since 2018 and is likely to rise even higher, new research has found. Richard Kronick, a former federal health policy researcher and a professor at the University of California-San Diego, said his analysis of newly released Medicare Advantage billing data estimates that Medicare overpaid the private health plans by more than $106 billion from 2010 through 2019 because of the way the private plans charge for sicker patients.

AP:Real Medicare Drug Savings In Dems’ Bill But Not OvernightMedicare enrollees who take expensive medicines could save thousands of dollars a year under the Democrats sweeping social agenda bill, but those dividends wont come overnight. Instead, theyll build gradually over the decade. Unveiled late last week, the bills Medicare prescription drug compromise barely survived a pharmaceutical industry lobbying blitz. Experts whove analyzed the complex plan say it would also offer people with private insurance some protection from the escalating cost of their medicines.

On worries about Medicaid changes

You May Like: How To Pay For Medicare Without Social Security

Kaiser Advantage Plan Options

Kaiser Permanente Senior Advantage Plans

Our Medicare Senior Advantage plans work much like an HMO plan, where members have set copays for services.

- Medical, mental health, prescription, and vision coverage are all through Kaiser Permanente.

- Enrollment into this plan requires enrollment into Medicare Parts A and B.

- This plan is a local plan. Retired employees must live in the Fresno coverage area to enroll.

Provider Information:

This plan uses a provider network. You may only access services at a Kaiser facility, unless otherwise approved by Kaiser.

- Physicians:

- You will have an assigned primary care physician.

24/7 Care By Phone

454 – 8855

Kaiser Permanente members also have access to Kaiser’s website and smartphone application. Both allow users to keep in contact with their doctors with ease, and the smartphone application allows for both phone and video conference appointments so members can see their doctor without the hassle of going to the doctor’s office.

Kaiser Permanente Senior Advantage – High Option

The High Option: This plan is called the “High Option,” because it has higher monthly premiums, but lower copays for services. Enrollment into this plan requires enrollment into Medicare Parts A and B.

Deductibles & Copays :

Researcher: Medicare Advantage Plans Costing Billions More Than They Should

Switching seniors to Medicare Advantage plans has cost taxpayers tens of billions of dollars more than keeping them in original Medicare, a cost that has exploded since 2018 and is likely to rise even higher, new research has found.

Richard Kronick, a former federal health policy researcher and a professor at the University of California-San Diego, said his analysis of newly released Medicare Advantage billing data estimates that Medicare overpaid the private health plans by more than $106 billion from 2010 through 2019 because of the way the private plans charge for sicker patients.

Nearly $34 billion of that new spending came during 2018 and 2019, the latest payment period available, according to Kronick. The Centers for Medicare & Medicaid Services made the 2019 billing data public for the first time in late September.

They are paying way more than they should, said Kronick, who served as deputy assistant secretary for health policy in the Department of Health and Human Services during the Obama administration.

Medicare Advantage, a fast-growing alternative to original Medicare, is run primarily by major insurance companies. The health plans have enrolled nearly 27 million members, or about 45% of people eligible for Medicare, according to AHIP, an industry trade group formerly known as Americas Health Insurance Plans.

Seniors and taxpayers alike have come to expect high-quality, high-value health coverage from MA plans, said AHIP spokesperson David Allen.

Don’t Miss: How Much Does Medicare Pay For Hospice

Some Insurers See ‘eye

The payment issue has been getting a closer look as some Democrats in Congress search for ways to finance the Biden administration’s social spending agenda. Medicare Advantage plans also are scrambling to attract new members by advertising widely during the fall open-enrollment period, which ends next month.

“It’s hard to miss the big red flag that Medicare is grossly overpaying these plans when you see that beneficiaries have more than 30 plans available in their area and are being bombarded daily by TV, magazine and billboard ads,” says Cristina Boccuti, director of health policy at West Health, a group that seeks to cut health care costs and has supported Kronick’s research.

Kronick called the growth in Medicare Advantage costs a “systemic problem across the industry,” which CMS has failed to rein in. He says some plans saw “eye-popping” revenue gains, while others had more modest increases. Giant insurer UnitedHealthcare, which in 2019 had about 6 million Medicare Advantage members, received excess payments of some $6 billion, according to Kronick. The company had no comment.

“This is not small change,” says Joshua Gordon, director of health policy for the Committee for a Responsible Federal Budget, a nonpartisan group. “The problem is just getting worse and worse.”

Making any cuts to Medicare Advantage payments faces stiff opposition, however.

How We Reviewed Medicare Providers

Even Medicare health plans with a national presence can vary locally in their cost, quality, and customer satisfaction. To evaluate Medicare plans, we looked at health insurance industry ratings from the primary accrediting agency for health plans, NCQA, and the Medicare Star Ratings from CMS, the regulatory agency that oversees Medicare. We included the National Association of Insurance Commissioners complaint index, and AM Bests financial stability ratings. We also considered information from the companies on their programs and strategies.

You May Like: Does Medicare Pay For Private Duty Nursing