Is Medicare Part A Free

Medicare Part A seems free, but its one of those benefits you have actually paid for through the taxes you paid during your working years. Many people will pay no monthly premium for Medicare Part A, which covers inpatient hospital and hospice care, as well as limited skilled nursing and home healthcare services.

Exact costs for Part A depend on your situation and how long you worked. You will pay no monthly premium for Medicare Part A if you are older than age 65 and any of these apply:

- You receive retirement benefits from Social Security.

- You receive retirement benefits from the Railroad Retirement Board.

- You or your spouse worked for the government and received Medicare coverage.

You may also qualify for premium-free Medicare Part A if you are under age 65 and any of these apply:

- You have received Social Security disability benefits for 24 months.

- You have received Railroad Retirement Board disability benefits for 24 months.

If you do not quality for premium-free Medicare Part A, you will pay a premium based on the number of quarters you worked in your lifetime.

| Amount of time worked |

|---|

How Can I Reduce My Medicare Premiums

How Can I Reduce My Medicare Premiums?

Datos Breves Sobre La Insulina Y La Diabetes

1 de cada 4 adultos mayores de 65 en Estados Unidos tienen diabetes.1 La diabetes se produce cuando el cuerpo no produce suficiente insulina, no puede utilizar bien la insulina o ambas cosas.

La insulina es una hormona que se produce en el páncreas. Permite que el cuerpo utilice la glucosa para obtener energía y ayuda a equilibrar los niveles de glucosa en la sangre. Si tiene diabetes de tipo 1, de tipo 2 o gestacional, la terapia con insulina puede ser una forma eficaz de sustituir o complementar la insulina natural de su cuerpo.

Exploremos las opciones de cobertura para insulina de Medicare.

You May Like: How To Switch Medicare Advantage Plans

What Is The Cost Of Medicare Part B For 2021

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

As Soon As You Are Automatically Enrolled In Medicare

You will no longer qualify for financial help to pay for your Covered California plan after your two-year waiting period ends. You will need to cancel your health plan through Covered California at least 14 days before you want your coverage to end. If you were enrolled in Medi-Cal instead of Covered California, you can ask your local county office if you will continue to qualify for other Medi-Cal programs that can lower your Medicare costs.

Also Check: How To Decide Between Medicare Advantage And Medigap

What Does Part A Cost

With Medicare Part A, you may have to pay copays and deductibles for hospital stays, but may not have to pay a monthly premium. Copays and deductibles apply to hospital benefit periods, which start when you enter a hospital or skilled nursing facility, and end 60 days after youve left the facility . Its important to note that:

- For each hospital benefit period, you pay a deductible.

- You pay a copay if youve stayed in a hospital for more than 60 days.

- Theres no deductible or copayment for home health care or hospice care.

For many people, Part A comes without a monthly premium. You may have no monthly premium if you paid a certain amount toward Medicare taxes while working. In this case, you are often automatically enrolled in premium-free Part A.

If you dont automatically get premium-free Part A, you may be able to buy it if you :

- Are age 65 or older and allowed to Part B to meet the citizenship and residency requirements.

- Are under age 65 and are disabled but no longer get premium-free Part A because you returned to work.

Medicare Part A And Part B:

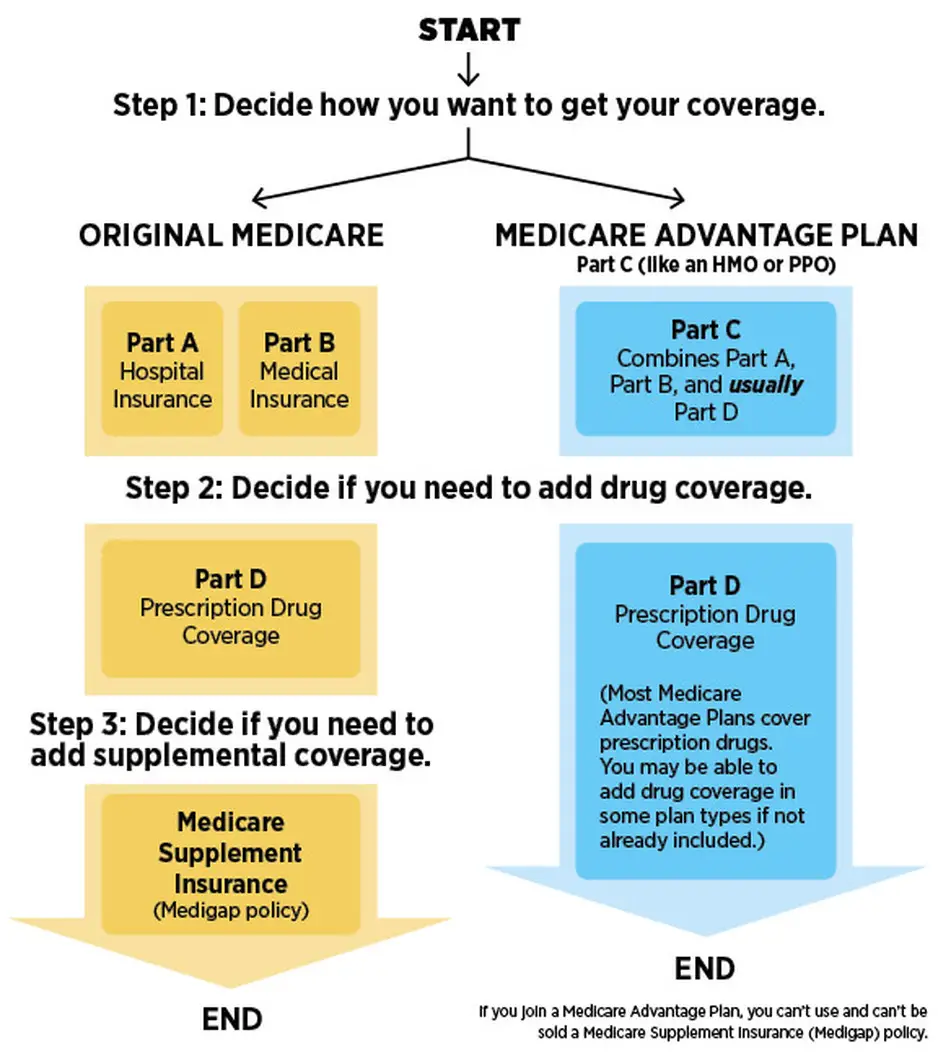

Medicare Part A and Part B is offered by the federal government. It provides basic inpatient and outpatient health coverage. You must be 65 years or older to be eligible. You must be 65 years or older to be eligible, or you must have a qualifying disability.

Some individuals who need frequent medical care find that out-of-pocket costs may be unaffordable with Medicare Part A and Part B alone. Thats because Medicare Part A and Part B does not have a limit or cap on out-of-pocket costs.

Medicare Part A and Part B also provides prescription drug coverage only to those under inpatient care. In other words, those who regularly take prescription medication might end up paying for some of their drug costs out of their own pocket. Additionally, Medicare Part A and Part B does not provide coverage for dental, vision, certain long term care, health care when traveling overseas, and other benefits.

Learn more about Medicare Part A and Part B here.

Also Check: Do I Need Medicare If I Have Medicaid

Delaying Enrollment In Medicare When You’re Eligible For It Could Result In A Penalty That Will Remain In Effect For The Rest Of Your Life

Your initial window to enroll in Medicare begins three months before the month of your 65th birthday, and ends three months after that month.

While Medicare Part A which covers hospital care is free for most enrollees, Part B which covers doctor visits, diagnostics, and preventive care charges participants a premium. Those premiums are a burden for many seniors, but heres how you can pay less for them.

When Can I Apply For Medicare Part B

There are four enrollment periods during which you may choose Medicare coverage.

Initial Enrollment Period: You can sign up for Medicare during a seven-month Initial Enrollment Period . This period includes the three months before your 65th birthday, the month of your birthday, and the three months after you turn 65.

General Enrollment Period: If you miss your Initial Enrollment Period for Medicare coverage, you may sign up for Medicare between January 1 and March 31 each year during a General Enrollment Period. You could face a late penalty for missing your initial opportunity to enroll in Medicare, but you will be able to apply for coverage during this time.

Annual Election Period: Each year from October 15 to December 7, you may sign up for Medicare coverage or prescription drug coverage to begin January 1 of the following year. Additionally, changes may be made to any existing Medicare plan during this time.

Special Election Period: If you experience a loss of health insurance coverage that was previously covered by your job or union health insurance, you may qualify for a Medicare special enrollment period. This eligibility period will be determined based on the date you lost coverage.

If you fall within one of the four enrollment periods for Medicare coverage, compare Medicare plans with Blue Cross and Blue Shield of Alabama today.

Don’t Miss: How To Choose A Medicare Supplement Plan

Who Is Eligible For Private Medicare Insurance And When Can I Enroll

Those who are eligible for, or currently signed up with, Medicare Part A and Part B are generally also eligible for Private Medicare insurance.

Enrollment for Private Medicare insurance differs by the type of plan. For Medigap plans, the best time to enroll is during the Medigap Enrollment Period. This period begins on your 65th birthday and ends 6 months after you turn 65. If you miss this period, you may have to pay a higher premium for Medigap, so it is important to enroll within 6 months of turning 65.

For both Medicare Advantage and Medicare Part D, you can enroll during the Initial Enrollment Period, which begins 3 months before you turn 65, includes the month you turn 65, and ends 3 months after you turn 65. You can also enroll during the annual Open Enrollment Period, which begins on October 15 and ends on December 7 in 2022. Open Enrollment is a great time to make changes to your existing plan, or switch to a new plan. If you miss these enrollment periods, you may still be eligible to enroll a plan if you have certain life changes, such as moving, or losing coverage. For Medicare Advantage, you may also still get a plan if a 5-star-rated plan becomes newly available in your state. A 5-star Special Enrollment Period may be used one time between December 8 and November 30, provided you meet the plans enrollment requirement.

Learn more about the different enrollment periods here.

Do You Have To Have Medicare Part B

Medicare Part B isnt a legal requirement, and you dont need it in some situations. In general, if youre eligible for Medicare and have creditable coverage, you can postpone Part B penalty-free. Creditable coverage includes the insurance provided to you or your spouse through work.

What is the penalty for dropping Medicare Part B?

What is the Penalty for Not Taking Medicare Part B? The Medicare Part B penalty increases your monthly Medicare Part B premium by 10% for each full 12-month period you did not have creditable coverage. The penalty is based on the standard Medicare Part B premium, regardless of the premium amount you actually pay.

Also Check: Does Medicare Cover Rides To Medical Appointments

How Much Does Medicare Part A Cost

Medicare Part A is free for those who have paid Medicare taxes for at least 40 quarters. You can buy Medicare Part A if you didn’t work enough quarters. The amount you’ll pay is based on the number of quarters you worked. Those who worked less than 30 quarters will pay $499 per month in 2022. Those who worked at least 30 quarters are eligible for a reduced premium rate of $274 per month.

What Services Does The Partnership Provide

- Medicare and Medicaid information and education

- Help with original Medicare eligibility, enrollment, benefits, complaints, rights and appeals

- Explain Medicare Supplemental insurance policy benefits and comparisons

- Explain Medicare Advantage and provide comparisons and help with enrollment and disenrollment

- Explain Medicare Prescription Drug coverage, help compare plans and search for other prescription help

- Information about long-term care insurance

The partnership also helps with the following programs. Benefit Counselors are specially trained to help you understand all the fine print to find and apply to a plan that works for you. They advocate for you with these programs and help you get the services you need.

Also Check: Are Medicare Advantage Plans Hmos

What Is The Medicare Part B Giveback Benefit

The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C plans.

If you enroll in a Medicare Advantage plan with this benefit, the plan carrier will pay some or all of your Part B monthly premium. The amount covered can range from 10 cents to the full Part B premium cost .

Is Medicare Part B Free

Medicare Part B is the Medicare portion that funds doctors visits and other related costs. If a person chooses Medicare Part B, they will pay a monthly premium. For 2022, the standard premium is $170.10.

Some people may pay a higher monthly premium depending on their income. People earning over a certain amount will pay slightly more for Part B.

Other out-of-pocket costs apply alongside the premium. Medicare Part B has a deductible of $233 for 2022, as well as a 20% coinsurance for consulting with Medicare-approved doctors.

Read Also: When Are You Eligible For Medicare Part B

Should I Terminate Part B Of Medicare

You can voluntarily terminate your Medicare Part B . However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763.

Should I drop Medicare Part B?

Medicare only pays 80% on your Part B medical expenses. Part B covers doctor office visits and outpatient medical services. In my professional opinion you cannot afford to drop your Part B coverage. The 20% Medicare leaves off will cost you a lot more than the Part B premium when faced with serious and chronic health conditions.

Why Is Medicare Part B Cheaper In 2023

The Centers for Medicare and Medicaid Services recommended in May that any excess Supplementary Medical Insurance Trust Fund money be passed along to those with Medicare Part B coverage. This is to help decrease the costs of the premium and deductibles. While most Medicare recipients, get Part A for free, everyone has to pay for Part B.

This year’s Part B premium was projected to cover spending for a new drug called Aduhelm, which is intended to treat Alzheimer’s disease. Since less money was spent on that drug and other Part B items, there were more reserves left over in the Part B account of the SMI fund, which will now be used to limit future Part B premium increases.

Medicare Part A premiums will rise a little in 2023.

Read Also: Is Medicare Part B Based On Income

How Do You Enroll In Original Medicare

To enroll in Original Medicare , you must be 65 and dont necessarily have to be retired. Initial enrollment period packages are sent to people 3 months before they turn 65 or during their 25th month of disability benefits.

If youve received Social Security disability benefits for 24 months, you are automatically enrolled in Part A and Part B.

Cundo Cubre Medicare Parte D La Insulina

Los planes de medicamentos recetados de Medicare Parte D pueden cubrir la insulina inyectable que no se utiliza con una bomba de infusión de insulina y la insulina inhalada.4 Los planes de la Parte D que participan en el modelo de ahorro para personas mayores de la Parte D, que Humana llama el , también pueden ofrecer opciones de cobertura que incluyen varios tipos de insulina por un copago máximo de $35 para un suministro de 30 días.5

Algunos suministros para diabéticos que Medicare Parte D puede ayudar a cubrir son:6

- Plumas de insulina con o sin insulina incluida

- Dispositivos de insulina inhalada con o sin insulina incluida

Also Check: What Is Troop In Medicare

Get Help From A Medicare Savings Program

Medicare Savings Programs, or MSPs, are special programs designed to help low-income seniors pay their Medicare expenses Part B premiums included. These programs are funded via Medicaid, so theyre run at the state level .

To qualify, your monthly income cant exceed a certain limit. Also, your personal resources must fall within a specific limit. But if youre deemed eligible for assistance via an MSP, you could lower your Part B premium costs.

To apply for one of these programs, youll need to visit or call your local Medicaid office.

Maurie Backman has been writing professionally for well over a decade, and her coverage area runs the gamut from healthcare to personal finance to career advice. Much of her writing these days revolves around retirement and its various components and challenges, including healthcare, Medicare, Social Security, and money management.

Medicare Cost Changes For 202: How Much Cheaper Will Part B Premiums Be

We’ll explain how Medicare prices are changing next year.

Katie Teague

Writer

Katie is a writer covering all things how-to at CNET, with a focus on Social Security and notable events. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

The Social Security Administration each year adjusts costs associated with the Medicare program by raising or lowering premiums and deductibles using rules set out in the Social Security Act. For 2023, Medicare Part B premium prices are going down, while premiums and deductibles for Part A are going up slightly.

The income brackets and amounts for adjustments to Part D prescription drug coverage have also been slightly revised. Additionally, if you receive Social Security payments, the cost-of-living benefits increase for 2023 has been announced. “This means that seniors will have a chance to get ahead of inflation, due to the rare combination of rising benefits and falling premiums,” press secretary Karine Jean-Pierre said during a White House briefing.

Here’s how much the prices will go down for those who receive Medicare Part B and what the new costs will be next year. Note: The open enrollment period for Medicare ends Dec. 7.

Also Check: What Is The Best Secondary Insurance With Medicare

How Do I Cancel My Medicare Part B Online

You cant disenroll online. If your employers coverage is primary and you decide to drop Part B, you need to submit Form CMS-1763 to the Social Security Administration.

Should you decline Medicare Part B?

If someone is not yet collecting Social Security benefits when they enroll in Medicare at age 65, the option to decline Part B is given as part of the application process, both online and in-office .

Is Medicare Part A Free At Age 65

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

You May Like: What Is Medicare Catastrophic Coverage

Covered California And Medicare

Transitioning from Covered California to Medicare is an important step. Make sure you take action and keep track of important dates and deadlines to avoid unwanted consequences.

In general, people who are eligible for Medicare even if they do not enroll in it arent eligible to receive financial help to lower the cost of a Covered California health plan.

People who are eligible for Medicare must report their Medicare eligibility to Covered California within 30 days and will usually need to cancel their Covered California. Your Covered California plan wont be automatically canceled when you become eligible for Medicare, even if you enroll in a Medicare plan with the same insurance company. You must cancel your plan yourself at least 14 days before you want your coverage to end by contacting Covered California.

If you are eligible for Medicare and you keep your Covered California plan, you may face serious consequences. For example:

- You may have to pay back all or some of your premium tax credits to the Internal Revenue Service .

- Or, there could be a delay in your Medicare coverage start date. If you dont sign up for Medicare Part B during your initial enrollment period, you will have to wait for the general open enrollment period , and then your coverage wouldnt begin until July of that year.

- In addition, you may have to pay lifetime penalties for late enrollment in Medicare and your premiums may increase by 10 percent or more.