How To Determine When Medicare Is Primary

MEDICARE | September 27, 2019

About a year ago, we posted an article about Medicare Premium Reimbursement Arrangements, which allow small employers to pay for the Medicare Part B, Part D, and supplement premiums for their active employees. As explained in the article, the employer cannot force older employees off of the group plan , but it can often be a win-win solution for both the employer and the employee.

The one caveat mentioned in the article is that this strategy only works when Medicare is primary. The Medicare Secondary Payer rules kick in when a group has 20 or more employees , and the MSP rules prohibit an employer from incentivizing an employee to drop off the group plan and sign up for Medicare.

So that raises a couple questions about timing:

The answer to both of these questions can be found in a 2017 training course developed by CMS. The course discusses employer size as it relates to MSP for working age adults, people with a disability, and people with ESRD . Some of those topics are beyond the scope of this article, but it is worth reviewing the CMS slides if you market either group or Medicare-related products.

To help clarify the rules, CMS provides the following example:

Read Also: Does Kaiser Permanente Take Medicare

Affordable Care Act Subsidies & Medicare

If you have an Affordable Care Act plan, you can keep your coverage once you turn 65. However, you cannot keep any premium tax credits once your Medicare Part A coverage begins. If you decide to keep your ACA plan, you must notify your insurance company to stop any subsidy payments. Otherwise, you may be required to pay them back when filing your taxes.

Am I Eligible For Medicare

To receive Medicare, you must be eligible for Social Security benefits.

Part A Eligibility

Most people age 65 or older are eligible for Medicare Part A based on their own employment, or their spouse’s employment. Most people have enough Social Security credits to get Part A for free. Others must purchase it.

You are eligible for Medicare Part A if you meet one of the following criteria:

- You are eligible for Social Security or Railroad Retirement benefits, even if you do not receive those benefits.

- You are entitled to Social Security benefits based on a spouse’s, or divorced spouse’s work record, and that spouse is at least 62 years old.

- You have worked long enough in a federal, state, or local government job to be eligible for Medicare.

If you are under 65, you are eligible for Medicare Part A if you meet one of the following criteria:

- You have received Social Security disability benefits for 24 months.

- You have received Social Security benefits as a disabled widow, divorced disabled widow, or a disabled child for 24 months.

- You have worked long enough in a federal, state, or local government job and meet the requirements of the Social Security disability program.

- You have permanent kidney failure that requires maintenance dialysis or a kidney transplant.

- You are diagnosed with ALS or Lou Gehrig’s disease.

Part B Eligibility

If you are eligible for Part A, you can enroll in Medicare Part B which has a monthly premium.

Will I Need To Prove My Age?

Automatic Enrollment

Read Also: A Medicare Supplement Policies Outline Of Coverage Must Include

What Happens When Your Medicare Insurance Lapses

Generally, Medicare Insurance lapses due to failure to pay premiums. This puts insureds at risk of losing coverage. However, insurance providers would not discontinue their coverage without proper notice and grace periods. For instance, there is usually a three-month grace period for Original Medicare, and all Part C and D plans have a two-month grace period. If you fail to pay your premiums when due, your insurer will send a notice of non-payment and inform you when your grace period ends. However, you will be at the risk of disenrollment if you fail to pay your premiums by the end of your grace period.

If your Medicare Advantage, Medigap, or Prescription Drugs disenroll you, you cannot join another plan until the next enrollment period. However, you will automatically be enrolled in Original Medicare, but you may lose drug coverage during that time. You can later enroll in Medicare Advantage again during the Annual Election Period . If you are disenrolled due to a failure to pay your premiums, you may be required to pay your outstanding premiums before getting back on the plan you once had. Also, if you go without drug plan coverage for about three months or more, you may be liable for a Part D late enrollment penalty once you enroll for a new plan.

How Do I Know If Im Eligible For Medicare Part A

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Recommended Reading: Is Ed Medication Covered By Medicare

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.Limited time offer. Must file by 3/31.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund and seewhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

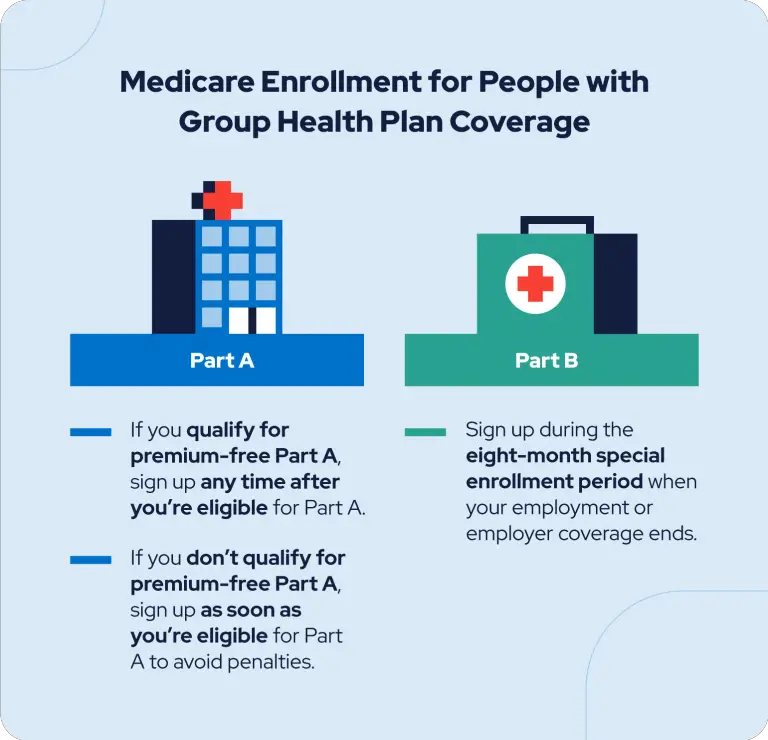

Do I Need Medicare Part B If I Have Employer Health Insurance

Summary: You are not required to have Medicare Part B coverage if you have employer coverage. You can drop Medicare Part B coverage and re-enroll in it when you need it. … You also may choose to defer enrollment in Medicare Part B coverage if you are employed at age 65 or older and eligible for Medicare.

You May Like: Does Medicare Cover Inspire Sleep

Why Do You Have To Pay For Medicare Part B

Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem. Cost: If you have Part B, you pay a Part B premium each month.

Who’s Eligible For Medicare

Medicare is a government-run health insurance program for people age 65 and older, as well as disabled individuals. To qualify for Medicare at age 65, you or your spouse must have:

- Worked and paid Medicare taxes for 10 years

- Medicare taxes were withheld from your wages, just like Social Security

To qualify with a disability, you must have been eligible for Social Security disability benefits for 2 years or have a condition that qualifies you for immediate benefitsLou Gehrig’s disease or permanent kidney failure, for example.

Read Also: Does Medicare Cover Flu Shots

Welcome To Medicare Visits

If you have recently enrolled in Medicare, a Welcome to Medicare preventive visit is covered during the first 12 months of Part B coverage. This is a one-time visit. During the visit, your health care provider will review your health, as well as provide education and counseling about preventive services and other care.

What Is Creditable Coverage For Medicare Part D

Prescription drug plans are the most common type of creditable coverage. A plan is creditable for Medicare Part D if it meets four qualifications.

- Pays at least 60% of the prescription cost

- Covers both brand-name and generic medications

- Offers a variety of pharmacies

- Does not have an annual benefit cap amount or has a low deductible

If you are eligible for Medicare Part D but delay enrollment, you accrue a penalty for each month you are eligible but do not enroll. This penalty will be assessed when you enroll in the future and you will need to pay it, in addition to your premium, each month you have Medicare Part D.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Don’t Miss: How To Apply For Medicare In San Diego

Cons Of Medicare Insurancewhy Is Medicare Insurance Bad

-

Medicare is expensive to run: Medicare spending in 2020 was estimated to reach $858.5 billion, with a projection of exceeding $1 trillion in 2023.

-

Hospital stays can be expensive: Hospital stays can be expensive for Medicare enrollees because it usually sums up to about hundreds of thousands of dollars. Most hospitalized insured have an issue with the high out-of-pocket Medicare expenses. Hence, although Medicare can assist in paying for inpatient care in hospitals, it can place huge pressure on enrollees who cannot afford to fund such hospital stays.

-

Medicare is expensive for taxpayers: Individuals employed in jobs covered by Social Security pay the Federal Insurance Contribution Act taxes. A portion of these taxes is used to finance the Medicare system.

-

Limited coverage of certain important health needs: Original Medicare often does not cover prescription drugs and routine dental, vision, and hearing care. Unfortunately, most older adults who have Original Medicare require these services. This would require them to get other Medicare coverage plans or pay out of pocket for these treatments. One can resolve this by getting Medicare Supplement Insurance or signing up for a Medicare Advantage plan that covers these needs.

You should talk to a Florida-licensed insurance agent who can help you evaluate the benefits and shortcomings of Medicare and determine whether it is a good fit for you. They can also help clarify any questions that you may have about Medicare Insurance.

Choosing A Health Insurance Plan

Reading the fine print is important when choosing health care plans. These questions may help:

- Can I go to any doctor, hospital, clinic, or pharmacy I choose?

- Are specialists, such as eye doctors and dentists covered?

- Does the plan cover special conditions or treatments such as pregnancy, psychiatric care, and physical therapy?

- Does the plan cover home care or nursing home care?

- Will the plan cover all medications my physician may prescribe?

- What are the deductibles? This is the amount you must pay each year before your insurance company will begin paying claims.

- Are there any co-payments? This is the amount of money you pay each time you receive medical services or a prescription.

- If there is a dispute about a bill or service, how is it handled?

Recommended Reading: Does Medicare Cover The Cost Of An Ambulance

The Downside Of Delaying Medicare

There are several parts of Medicare that will penalize you for enrolling after your Initial Enrollment Period is over. Also, you may face additional costs if you delay enrolling in a Medicare Supplement plan. Its important to note that only certain plans allow you to delay enrolling in Medicare without facing penalties.

| Increased Premiums | |

| Medicare Supplement Plans | There are no penalties for applying for a Medigap plan after your enrollment period. However, you wont get your best price possible. Thats because you qualify to enroll in a Medigap plan without any medical underwriting during your IEP. After this time has ended, your medical history, age, and other factors can be used to increase your premium. You could also be denied coverage based on your health. |

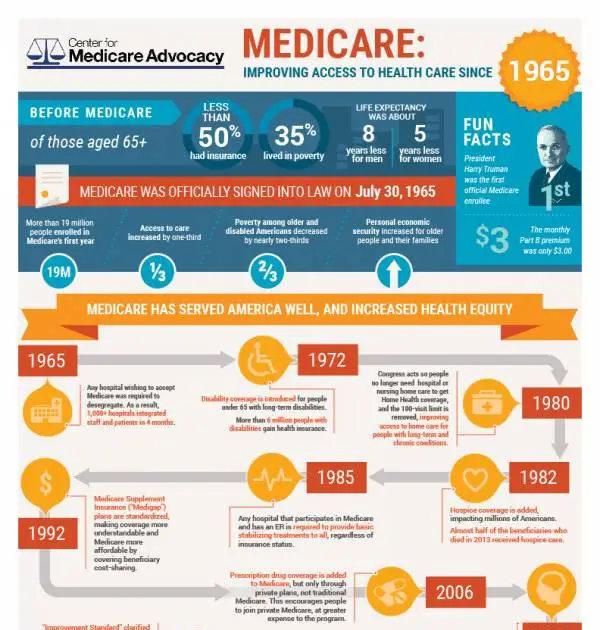

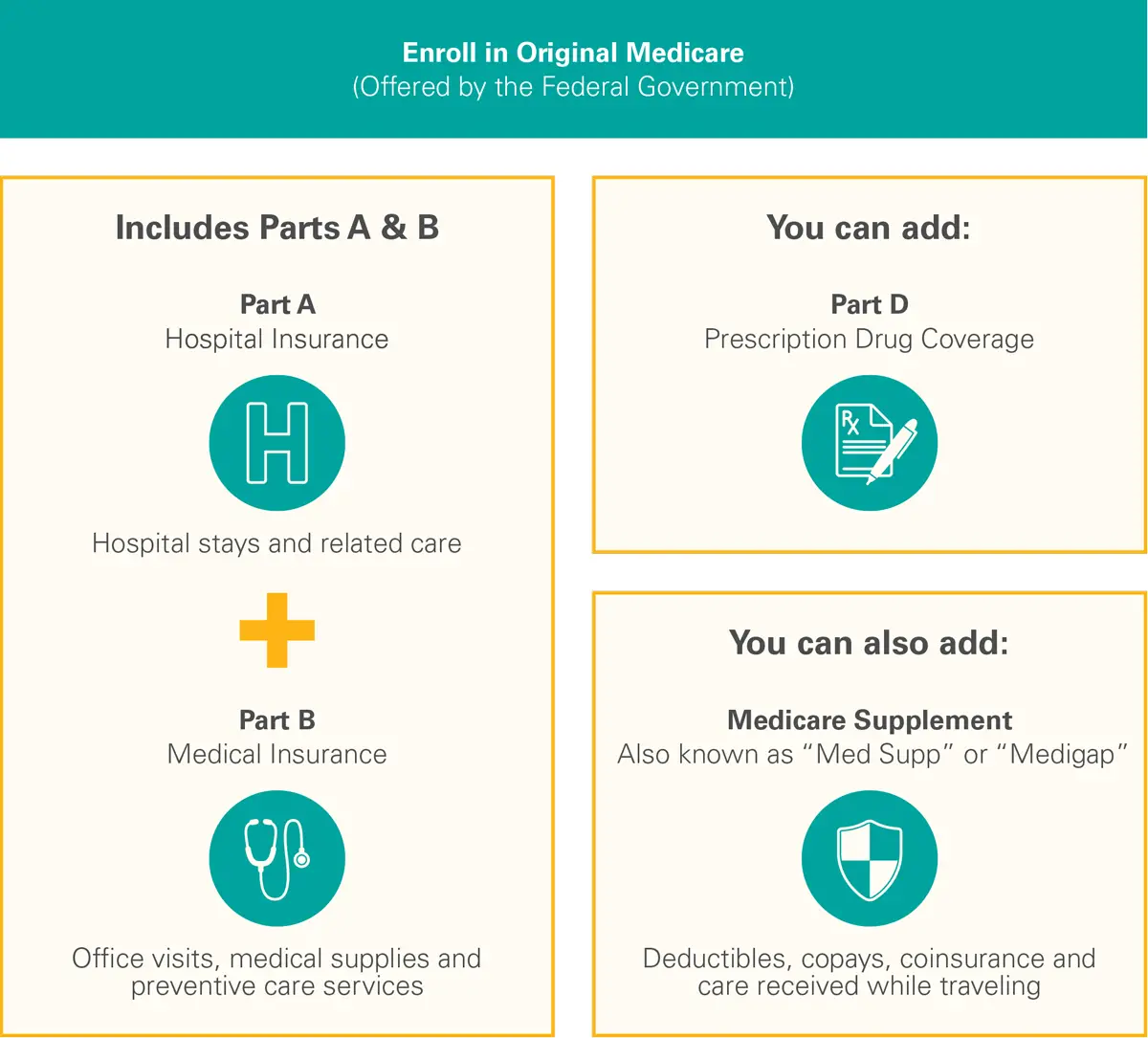

What Are The Parts Of Medicare

The different parts of Medicare help cover specific services:

- Medicare Part A Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

- Medicare Part B Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services.

- Medicare Part D Helps cover the cost of prescription drugs .

Recommended Reading: When Can I Get My Medicare Card

What Is Creditable Coverage For Medicare Part B

It is not uncommon to delay Medicare Part B due to creditable coverage. However, delaying Medicare Part B without creditable coverage can be detrimental to your wallet in the future. Once eligible for Original Medicare, if you do not enroll in Medicare Part B, the Medicare Part B penalty increases incrementally for every year you lack creditable coverage.

Thus, you will pay the penalty plus your Medicare Part B premium each month once you finally enroll in Medicare Part B.

To know if your coverage is creditable or not, you should receive a letter from your insurance carrier each year to notify the Medicare-eligible members of your household of the credibility of your coverage.

Does It Help Me In Any Way To Give Va My Health Insurance Information

Yes. Giving us your health insurance information helps you because:

- When your private health insurance provider pays us for your non-service-connected care, we may be able to use the funds to offset partor allof your VA copayment.

- Your private insurer may apply your VA health care charges toward your annual deductible .

Don’t Miss: Does Medicare Cover Laser Therapy

Applying For Medicare After Turning 65

If you apply for Medicare Part A after you turn 65, your Part A will become retroactive for up to 6 months. Therefore, if you plan on applying for Part A after you turn 65, you will want to stop contributing into your HSA up to 6 months prior to signing up for Medicare. If you dont, you could end up facing penalties.

However, if you plan on enrolling in Medicare before your 65th birthday month, then you can continue contributing to your HSA all the way up until the day before your Medicare is effective. This is because your Part A shouldnt be retroactive if you apply for it prior to turning 65.

For example, if Paul plans to sign up for Medicare at age 67 in June 2021, then his Part A will be retroactive 6 months to December 1, 2020. Therefore, Paul should stop his HSA contributions prior to December 1, 2020.

Heres another example of when someones Part A would be retroactive to the first of their 65th birthday month.

If Alex turns 65 in October 2020, but doesnt apply for Medicare until February 2021, then his Part A will be retroactive to the first of October, not the full 6 months. Therefore, Alex should stop his contributions no later than the day before October 1, 2020.

Youll need to speak with your accountant about anypenalties you may owe for contributing into your HSA over the prior six months.

You May Like: Is Medicare Good Or Bad

What Is Short Term Health Insurance

Short term health insurance, also called temporary health insurance or term health insurance, may be right for you if you need to fill a gap in coverage until you can choose a longer-term solution. It might be a good option if youre in between jobs, waiting for coverage to start, looking for coverage to bridge you to Medicare, turning 26 and coming off your parents insurance or many other situations. Short term health insurance offers flexible, fast coverage for those dynamic times of change in your life.

Recommended Reading: Can I Cancel My Medicare

Examples Of Creditable Coverage Under Medicare

If you are approaching Medicare eligibility and wish to delay Medicare Part B without penalty, you must have creditable health coverage. Some of the most common types of creditable coverage include:

If your employer or union covers more than 20 people and you are actively employed, your group health plan is creditable coverage to delay Medicare Part B. Additionally, the same is true when you are on your spouses union or large group health plan while they are employed. Thus, you will also have creditable coverage for Medicare under this circumstance.

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Don’t Miss: Does Medicare Cover Dexcom G5

Most Medicaid Enrollees Get Care Through Private Managed Care Plans

Over two-thirds of Medicaid beneficiaries are enrolled in private managed care plans that contract with states to provide comprehensive services, and others receive their care in the fee-for-service system . Managed care plans are responsible for ensuring access to Medicaid services through their networks of providers and are at financial risk for their costs. In the past, states limited managed care to children and families, but they are increasingly expanding managed care to individuals with complex needs. Close to half the states now cover long-term services and supports through risk-based managed care arrangements. Most states are engaged in a variety of delivery system and payment reforms to control costs and improve quality including implementation of patient-centered medical homes, better integration of physical and behavioral health care, and development of value-based purchasing approaches that tie Medicaid provider payments to health outcomes and other performance metrics. Community health centers are a key source of primary care, and safety-net hospitals, including public hospitals and academic medical centers, provide a lot of emergency and inpatient hospital care for Medicaid enrollees.

Figure 6: Over two-thirds of all Medicaid beneficiaries receive their care in comprehensive risk-based MCOs.