Plan N Offers Full Coverage For A Number Of Costs

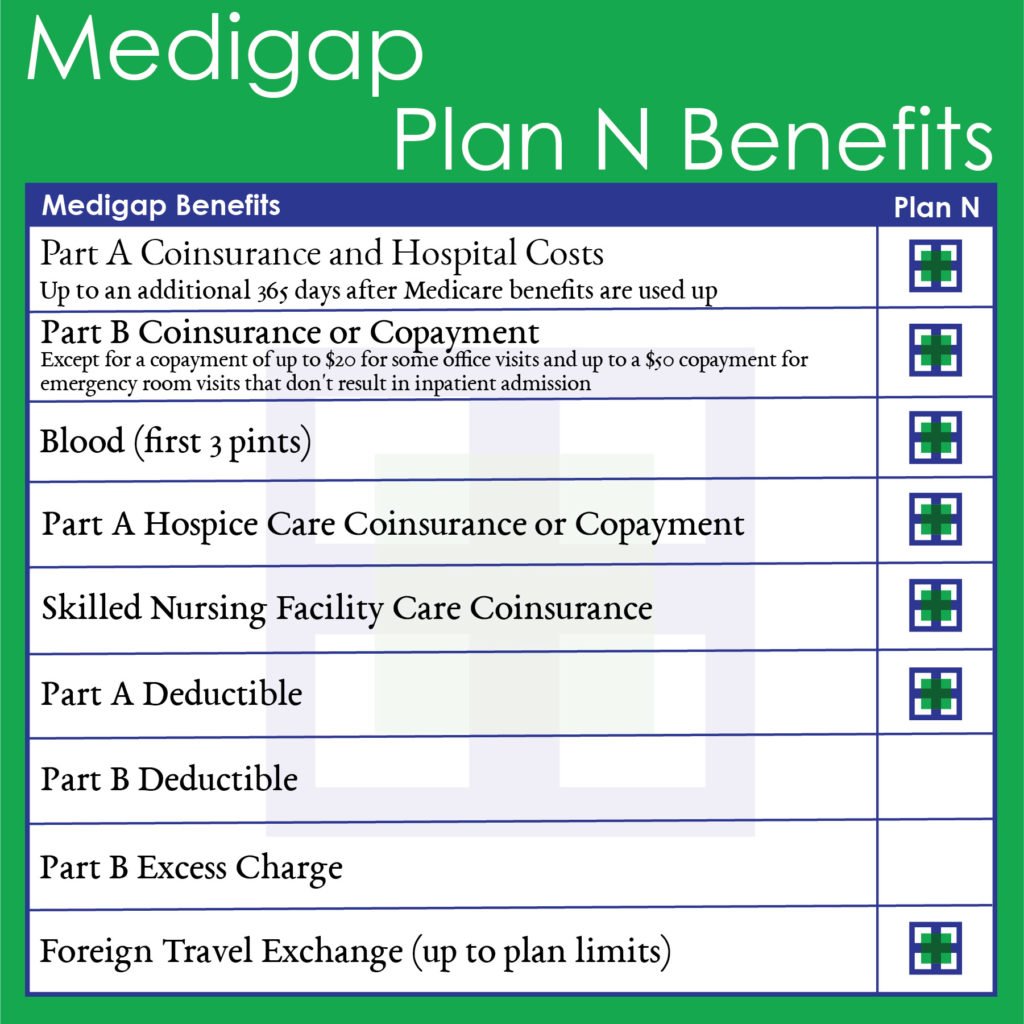

Medigap Plan N covers the following Medicare costs in full:

How Much Does A Medigap Plan N Cost

You pay a monthly premium for Plan N. This premium varies depending on when you purchase your policy, how it is priced, and in which state you reside. Because Medigap plans are offered through private insurance companies, the companies set their own premiums. Monthly premium costs may increase each year based on age, inflation, or other factors.

The other variable costs associated with Plan N include copays for some office and emergency room visits and excess charges from providers who dont accept Medicare assignment. If you access your Part B benefits, you will pay the annual Part B deductible .

See how costs and plan availability compare for these Medigap Plans N for a 65-year-old female who doesnt use tobacco in three different states in 2022:

| State |

*Attained age pricing: Premiums are low for younger buyers, but go up as you get older and can eventually become the most expensive.^Community pricing: Premiums are the same no matter how old you are. Premiums may go up because of inflation and other factors.~Issue age pricing: Premiums are low for younger buyers and wont change as you get older.

Medicare Supplement Plan N Benefits

Similar to Medicare Supplement Plan G in many ways, Plan N offers significant cost-sharing benefits to policyholders.

These benefits include:

- Medicare Part A deductible

- Foreign travel emergency care

- Medicare Part B 20% coinsurance

Additionally, you may be responsible for additional charges if you live or receive care in a state that allows excess charges. However, most doctors accept Medicare assignment, so excess charges are rare.

You May Like: Does Aarp Medicare Complete Cover Dental

What States Prohibit Excess Charges

Some states, by law, do not allow Excess Charges. This law is the Medicare Overcharge Measure or MOM law. So if you live or travel to any of these states you wont have excess charge billing in those states.

The following states prohibit Excess Charges:

Most doctors and providers today accept Medicare and Medicare assignment, so balance billing is rare. You should still make sure your doctors are fully participating in Medicare before seeing them.

If you see the Doctor once or more per month, then the co-pays can add up and youll be better off getting a Plan G. If youre healthy now, and worried about paying lots of co pays if your health changes down the road, then plan G may give you more peace of mind.

Is Medigap Plan N A Good Deal For You

Plan N can be a particularly good option for those in good health or those that do not go to the doctor much. You can look at the premium savings you would receive by going with Plan N, subtract out the deductible and add in as many co-pays as you would have in an average year. The only variable is the Part B Excess charges. You can usually call your primary physician or other physicians you see regularly to find out if they accept Medicare assignment. If they do not, that means that they can charge these excess charges. So thats a good idea if you are considering Plan N.

One additional consideration that many people do not realize is that you have to qualify medically to change Medigap plans after your initial turning 65 open enrollment period. Contrary to popular misconception, there is not an annual enrollment period that allows you to change plans. You can change Medigap plans at any time, but you have to answer medical questions and qualify to do so. This is important to understand because, if you choose Medigap Plan N, you should feel comfortable with it long-term. If your health changes, its possible you would not be eligible to switch to one of the other plans.

There are many companies that are now offering this plan as it has become a viable alternative for some people. It is advisable to compare costs extensively with a broker or by calling each company, as costs can vary as much as 50% for the exact same coverage.

Read Also: When To Sign Up For Medicare Part D

Disadvantages Of Medigap Plan N

Plan N is one of the few Medigap options that doesnt fully cover Part B copay and coinsurance costs. With Plan N, youll pay $20 for some doctors visits and $50 if you go to the emergency room.

Plan N also doesnt cover Part B excess charges, which is the fee you pay if your healthcare provider charges more than Medicare will pay for services.

What Are Plan N Excess Charges

Excess charges are an amount providers can charge more than what Medicare allows. For example, a doctor can charge up to 15% more than what Medicare allows.

A recent study shows that the national percentage of doctors implementing excess charges is around 5%.

Some states dont allow excess charges, and many doctors dont charge this higher fee. If access charges or a concern for you, call your doctor and ask if they bill extra charges on Part B to their Medicare patients.

The doctors office can give you an answer, and in most cases, doctors that accept Medicare dont subscribe to this extra fee. Also, when extra charges are implemented, the costs are manageable.

Whats the Medigap Plan N Copayment?

With the Medicare Supplement Plan N, copayments of up to $20 when you visit some doctors offices and up to $50 for emergency room visits that dont result in you being admitted to the hospital.

Its important to note that Medicare covers preventive care, so you pay nothing for any of these standard Medicare preventive services.

Am I Eligible for Medicare Plan N?

If you have Medicare Part A and Part B, youre eligible to enroll in Plan N. The Medigap Open Enrollment Period is the most beneficial time to enroll in plan N.

Outside of this, a Special Enrollment Period is suggested but not required. You can apply for a Medigap policy anytime there are no annual enrollment windows like with Medicare Advantage plans.

How Much Does Medicare Supplement Plan N Cost?

Also Check: Which Cgm Is Covered By Medicare

First 3 Pints Of Blood

Original Medicares coverage of blood needed for a blood transfusion begins with the fourth pint, leaving beneficiaries responsible for the first three pints. If your hospital doesnt provide free blood from a blood bank, youll have to pay for the costs out of your own pocket.

Plan N covers the complete cost of the first three pints of blood.

How Medicare Supplement Plan N Works

You cover the Part B deductible and excess charges in exchange for a smaller premium. While also being responsible for copayments at office visits or in the ER.

Plan N covers the Part A coinsurance up to 365 days after the traditional Medicare benefit limits. Also, Part A Hospice care and the Part A deductible have coverage.

Plan N covers the first three pints of blood in a medical procedure every year. Like many other plan options, the skilled nursing facility care coinsurance has coverage.

Further, Plan N provides foreign travel emergency care for those who like to travel, which includes 80% coverage up to the plans limits.

Plan N does NOT cover Part B excess charges and does include copayments on certain services.

You May Like: Does Social Security Disability Qualify You For Medicare

How To Choose The Best Medicare Supplement Plan

The average cost of a Medicare Supplement plan is $163 per month in 2022. However, rates can vary widely from $50 to more than $400 per month.

The best Medicare Supplement plan for you will depend on which policy provides the best benefits for your medical needs and fills in the coverage gaps where you expect to spend the most on health care.

For example, if you need skilled nursing coverage or want more protection for foreign travel emergencies, then consider how well each plan covers those categories of care. If you expect to need hospital care, a plan that pays for the Medicare Part A deductible can help protect you from a large hospital bill.

Say you need surgery in the upcoming year. For the 2022 plan year, the Medicare Part A deductible is $1,556. Some Medicare Supplement policies, such as Plan A, provide no coverage for this deductible. Therefore, you would be responsible for paying the entire $1,556 out of pocket before your Original Medicare coverage would kick in.

On the other hand, if you choose Medigap Plan G, the $1,556 deductible would be fully covered by your Supplement policy. This means you would begin having your claims covered immediately, rather than first having out-of-pocket costs for medical care. However, you should also consider the cost of the plan since Plan G can be more expensive than Plan A.

Find Cheap Medicare Plans in Your Area

How Do I Enroll In Medicare Supplement Plan N

You can enroll in Plan N over the phone with a licensed insurance agent. Enrollment only takes a few minutes, and the agent can answer all your questions.

In most cases, this policy provides a balance of benefits. The only time a beneficiary should not consider a Plan N would be if they see their doctor so often every month that the copay costs dont outweigh the savings between Plan N and Plan G.

The best way to find the most suitable coverage is by talking to a licensed insurance agent for filling out an online rate form.

You May Like: How Do I Get In Touch With Medicare

How To Purchase A Medicare Supplement Plan For 2023

Enrolling in the right coverage for your healthcare needs is essential, but it can be frustrating to do alone. Let one of our licensed insurance agents that specialize in Medicare help.

They can help you understand what Medicare covers and what youre responsible for. Then help analyze your situation to ensure you have the best coverage for you.

Give us a call now, or fill out our online rate form. Youll be connected with the best rates in your area.

How Popular Is Plan N

Plan N is one of the most widely available Medigap plans.

- In 2019, 62 percent of all insurance companies that sold Medicare Supplement Insurance offered Plan N.2

- In 2019, 10 percent of all Medigap beneficiaries were enrolled in Plan N, which was the third-highest enrollment rate of all plans.

As of 2019, total Plan N enrollment was nearing 1.39 million Americans.

Plan N is available everywhere Medicare is accepted.

Learn more about Medicare Supplement Plan N in your state.

Read Also: Does Medicare Pay For Tummy Tuck

What To Know Before Enrolling In Medicare Supplement Plan N

If you are interested in enrolling in Medicare Supplement Plan N, or any Medigap plan, there are five things you should know beforehand:

47333-HM-1121

Who Should Get A Medicare Supplement Plan N

A Medicare Supplement Plan N may be a good choice for you if you:

- Have Original Medicare and want coverage for most out of pocket expenses you incur when you receive your Part A and Part B benefits.

- Want to see any Medicare provider in the U.S. If you use providers who accept Medicare assignment, you can avoid excess charges.

- Want a lower monthly premium and are willing to pay a copay for doctor and emergency room visits.

Read Also: How Much Is Medicare Copay For A Doctor’s Visit

Shopping For Medicare Supplement Insurance Plan N

Medicare Supplement Insurance is sold by private insurance companies, meaning the cost and availability of plans can differ from state to state.

A licensed insurance agent can help you learn about Medicare Supplement Insurance Plan N and other Medigap plans that may be available where you live. Call to speak with a licensed agent today.

Medicare Plan N Eligibility

You are eligible to enroll in Plan N as long as you have Medicare Parts A and B. You must also live in the plans service area. The best time to enroll in Medicare Plan N is during your Medigap Open Enrollment Period. This six-month window starts with your Part B effective date. Its your one chance to enroll in any Medigap plan without health underwriting. No insurance company can turn down your application due to health conditions.

If youve missed your one-time Medigap Open Enrollment Period, you can still apply for a Medigap Plan N. We can explore the health questions on various companys applications to see if you are able to pass.

Also Check: Can You Get Medicare At Age 60

Medigap Plan G Vs Medigap Plan N: Which Is Right For You

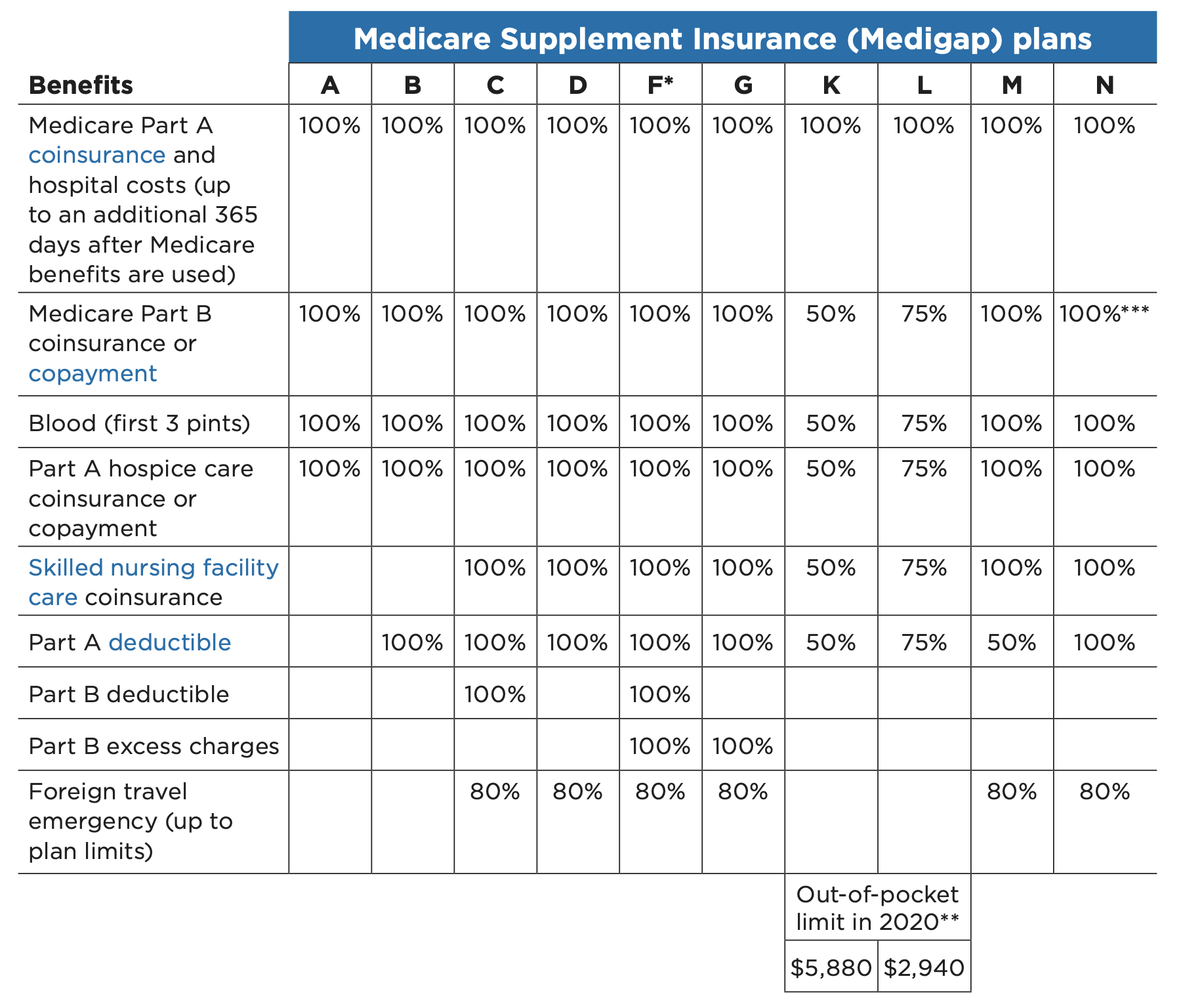

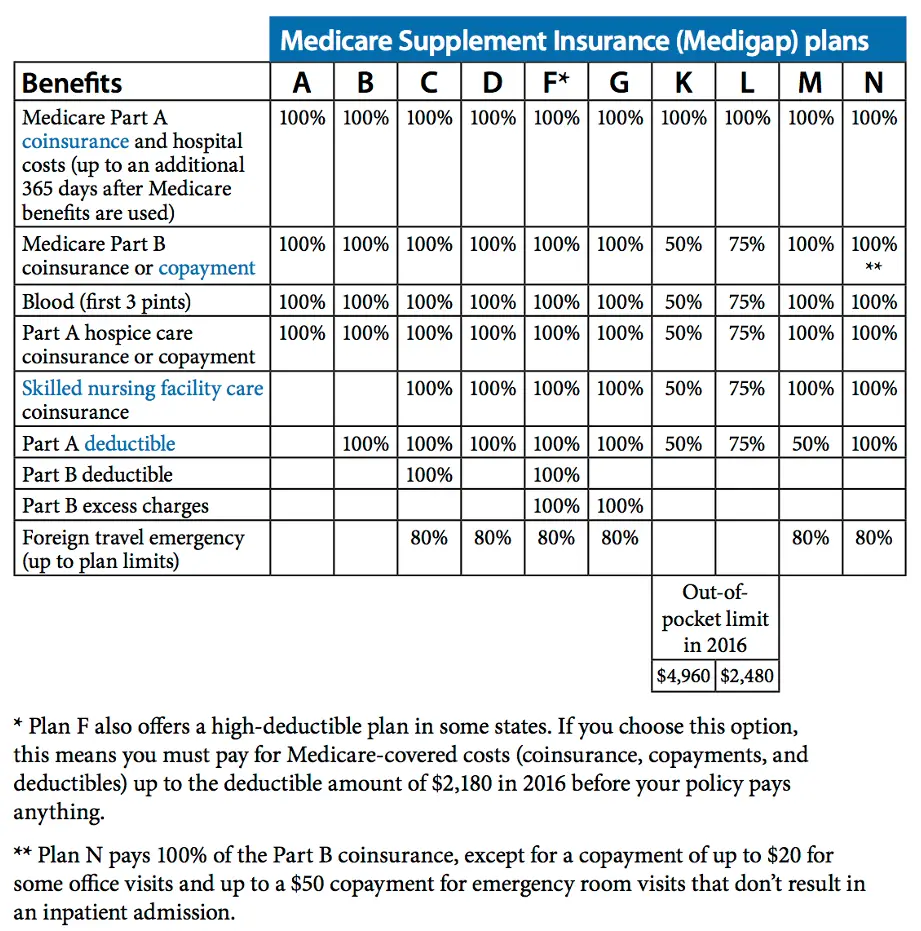

Medigap insurance is a type of insurance that has 10 different standardized plans, from Plan A through Plan N. The private insurance companies that offer these policies must sell them according to these lettered Medicare standards, and each plan offers specific types of coverage. Your particular fees and private insurance provider will vary according to your region, but the coverage of each lettered plan will stay uniform. Here’s what Medigapâs Plan G and Plan N offer.

How Does Plan N Work

Like other supplemental policies, Plan N fills coverage gaps in traditional Medicare, thus making it easier for beneficiaries to meet their overall health care expenses.

Because only about 80% of medical costs are covered by Medicare Part A and Medicare Part B , supplemental plans can help eliminate the cost by paying for the remaining 20% of costs.

Among other benefits, Plan N covers the coinsurance costs for Medicare Part A, Medicare Part B, hospice care and skilled nursing facilities. This means that instead of an enrollee being charged 20% of the bill, as would happen with Original Medicare, the supplemental plan would pay that 20% of the bill.

One of the most important features of Medigap Plan N is its copays you pay a $20 copay for each physician visit and a $50 copay for each emergency room visit that does not result in hospitalization. Even though the supplemental plan pays the coinsurance charged by Original Medicare, the supplemental policy has its own copayments for these services. Most Medigap Plan N policies do not charge for visits to urgent care centers, though.

Beneficiaries buy supplemental Medigap plans through private insurance companies such as Aetna, Cigna and UnitedHealthcare, among others. Each supplemental plan category bears a distinct letter, denoting differences in coverage, monthly premiums and out-of-pocket expenses.

How supplemental policies work

Recommended Reading: Do Any Medicare Supplement Plans Cover Dental

Medicare Plan N: Coverage Cost And How It Works

Find Cheap Medicare Plans in Your Area

Medicare Supplement Plan N reduces how much Original Medicare enrollees have to pay out of pocket for health care. For example, Plan N pays 100% of the coinsurance for hospitalization and medical care .

Plan N, one of 10 Medicare Supplement or Medigap policies, provides greater coverage than most of the other supplemental plans on the market. This includes Plans A, B, D, K, L and M.

It isn’t the most comprehensive plan available. However, Plan N is best for those who want a good value with most medical expenses covered for an average cost of $152 per month.

Out Of Pocket Costs With Plan N

With Plan N, once youve met the Part B deductible during the year, you could have up to a $20 co-pay for primary or specialist office visits.Telehealth visits, where you consult with a doctor over the phone, are not office visits. So theres no co-pay for this service.

Another co pay you could have is if you go to the Emergency room, then you could have up to a $50 co-pay. But, if you get admitted as an inpatient to the hospital,, the co-pay is waived.

Also Check: Does Medicare Cover Plantar Fasciitis