Compare The Costs Of Medigap Plans

Insurance companies may charge different premiums for the same exact policy. As you shop for a policy, be sure you’re comparing the same policy. For example, compare Plan A from one company with Plan A from another company.

In some states, you may be able to buy another type of Medigap policy called

. If you buy a Medicare SELECT policy, you have the right to change your mind within 12 months and switch to a standard Medigap policy.

| Note |

|---|

General Features Of Medicare Supplement Insurance Plans

Medicare Supplement insurance plans work with Original Medicare to help with out-of-pocket costs not covered by Parts A and B. The following are also true about Medicare Supplement insurance plans:

- Predictable costs help you stay ahead of unexpected out-of-pocket expenses.

- No network restrictions mean you can see any doctor who accepts Medicare patients.

- You don’t need a referral to see a specialist.

- Coverage goes with you anywhere you travel in the U.S.

- There is a range of plans available to fit your health needs and budget goals.

- Purchasing a Medigap plan and a Medicare Part D prescription drug plan could give you more complete coverage.

- Guaranteed coverage for life means your plan can’t be canceled.

As long as you pay your premiums when due and you do not make any material misrepresentation when you apply for this plan.

For PA residents only: As long as you pay your premiums when due. You do not misstate one or more material facts when you apply for this plan. UnitedHealthcare has 2 years to act on misstatements. The 2 year limit does not apply to fraud.

Rates are subject to change. Any change will apply to all members of the same class insured under your plan who reside in your state. can provide peace of mind by helping with some of these costs.

Medigap Or Supplement Insurance

Original Medicare still leaves significant costs and gaps in your coverage, so you can purchase a supplemental plan to lower your out-of-pocket expenses.

There are a number of different plans to choose from, some that cover virtually all of your expenses. Of course, the cost of your premiums increase as your coverage increases. Theres a good chart on the governments website that compares the features of the different Supplement plans.

You May Like: Can You Have Medicare Part D And Private Insurance

Reasons To Enroll In A Medicare Supplement

The cost of healthcare services Medicare wont cover can be high. Especially for those that need extensive treatments or long-term hospital stays.

Suppose you like to travel, enjoy having the freedom to see any doctor or healthcare providers you like, or dont want unexpected medical expenses. In that case, you should buy a Medicare Supplement plan.

You Can’t Have Both So You Must Choose Wisely

Consumer ReportsOncology TimesMEDICAThe New York Times MagazinePsychology TodaySports Illustrated

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

Anyone who’s ready to sign up for Medicare has a lot of decisions to make. But one decision is especially importantshould you choose Medicare Advantage or use Medigap to supplement your Original Medicare plan?

Also Check: When Can I Enroll In A Medicare Supplement Plan

Medicare Supplement Plan Benefits

Medicare Supplement plans are extra insurance purchased from private companies to help cover costs associated with the Medicare program. These policies help cover Medicare Parts A and B expenses that beneficiaries are otherwise responsible for paying themselves.

Medicare benefits are standardized and regulated by the Centers for Medicare & Medicaid Services, meaning the plans must offer the same coverage. The company you choose to buy your insurance policy must provide the same benefits.

Whats The Difference Between A Medicare Advantage Plan And A Supplemental Plan

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage.Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

Recommended Reading: How To Sign Up For Medicare Advantage

Companies That Offer Medigap Health Insurance

Many insurance companies offer Medigap insurance. Youll find many options in your state, from well-known to underrated carriers.

You may have seen many major private insurance companies through employer insurance offer Medigap plans. These companies include Aetna, Cigna, Humana, UnitedHealthcare, and many more.

When To Sign Up For Medicare

As you approach age 65, its important to know which enrollment deadlines apply to your circumstances. Begin by checking on your eligibility. To avoid costly penalties and gaps in coverage, most people should for Medicare Part A and Part B in the seven-month window that starts three months before the month you turn 65 and runs for another three months following your 65th birthday.

If you currently get Social Security, you will be automatically enrolled if not, you need to sign up either online or at your Social Security office.

Read Also: What Brand Of Diabetic Test Strips Does Medicare Cover

What Are The Exceptions

You may have both Medicare Advantage and Medicare Supplements briefly in some situations. For example, if you are in a transition from a Medicare Supplement plan to Medicare Advantage or from Medicare Advantage to Medigap, you may have both plans temporarily.

If youre enrolled in Medicare Advantage, and you later decide to drop the plan in favor of Original Medicare, you can purchase Medigap if:

Suppose you were enrolled in Medigap, and you decide to drop your coverage and enroll in a Medicare Advantage plan for the first time. In that case, you may also have both plans briefly during the transition.

You can apply for a Medigap plan beginning from 60 days before your Part C coverage stops. If you drop your Part C plan in favor of Original Medicare and try to enroll in your former Medigap plan, you may not be able to do so unless you have a guaranteed issue right or a trial right. Apart from these cases, you cannot purchase a Medicare Advantage plan while you have a Medigap plan.

What Is The Biggest Disadvantage Of Medicare Advantage

Medicare Advantage can become expensive if you’re sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient’s choice. It’s not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Read Also: Is Dexcom Covered By Medicare

Applying For Medicare A Supplement Health Plan Outside Of Enrollment Periods

Suppose youre changing policies to find a lower premium or missed a Guaranteed Issue opportunity. In that case, youll likely undergo an underwriting process. But, in most cases, underwriting isnt a big deal.

Sure, there are questions about your health, but these companies understand that there are health issues with age. You can expect your policy to be approved if your health issues are under control, even with medications.

Working with an insurance expert can save you time determining which company will most likely approve your application. The agent can also inform you if changing policies isnt in your best interest its their fiduciary duty to lead you in the right direction.

What Are The Medigap Insurance Plans

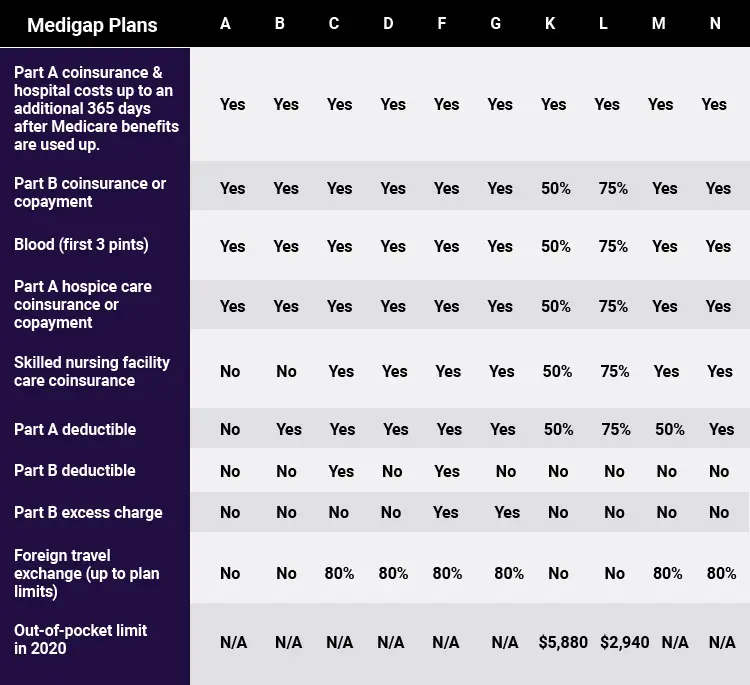

There are 10 standardized Medigap insurance plans denoted by the letters A through N in 47 states . Massachusetts, Minnesota, and Wisconsin have their own standardized Medigap plans.

- Plans having different letter names have different levels of coverage.

- Plans having the same letter name include the same coverage no matter where you buy them. However, not every Medigap insurance Plan L will necessarily charge the same premium.

- Please note that some companies may offer additional innovative benefits.

Because Medigap insurance plans are offered by private insurance companies, the cost and availability of each lettered plan may differ. Not every insurance company offers all 10 plans. Some popular Medigap insurance plan types are more comprehensive than other Medigap insurance plan types they cover the basic benefits and may also cover foreign travel emergencies and excess charges.

Recommended Reading: How To Sign Up For Medicare In Arkansas

What Is The Medigap Open Enrollment Period

If you recently turned 65 or youre turning 65, youre eligible for the Open Enrollment Period. You can enroll in a policy without dealing with underwriting during this time. No underwriting means youre guaranteed enrollment into the policy of your choice.

You can only enroll in a policy without underwriting if you qualify for a Special Enrollment Period. Outside of these two enrollment periods, youll likely have your application for coverage reviewed by an underwriter.

You can sign up for Medigap anytime if you dont have a Medicare Advantage plan. Unfortunately, you cant have both Medigap and Medicare Advantage.

For those that need to go through underwriting, using the help of a Medicare expert can save you time. In one conversation, youll know which company will most likely approve your application for the most reasonable price.

Are Medigap Premiums Based On Income

Medigap isnt based on premium. Higher-income earners could pay a Part B or Part D Income Related Monthly Adjustment Amount .

The Medicare premiums for Part B and Part D could be higher depending on how high your taxable income is from two years ago. If your income is substantially lower than two years ago, you can file a Part B or Part D IRMAA appeal.

Recommended Reading: Does Medicare Cover Shower Chairs

There Are 10 Standardized Medigap Options

You can compare the basic benefits of each type of Medigap plan to find the one that works for your situation.

Not every insurance company is required to offer each of the 10 standardized plans. However, the basic benefits for each Medigap plan are standardized by Medicare.

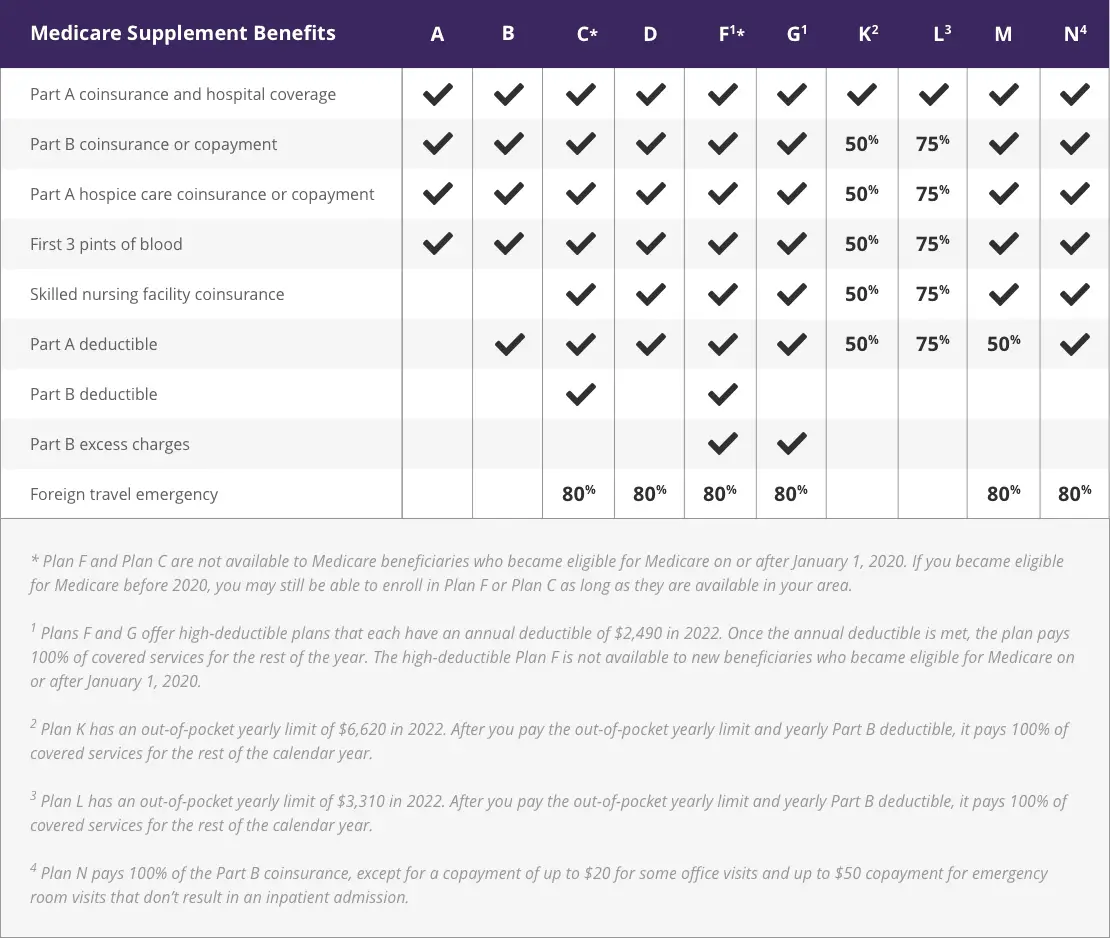

Compare the basic benefits of each type of Medigap plan below.

| 80% | 80% |

* Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,490 in 2022. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

2 Plan K has an out-of-pocket yearly limit of $6,620 in 2022. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

3 Plan L has an out-of-pocket yearly limit of $3,310 in 2022. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

Comparing Medicare Supplement Plans

After comparing costs and benefits, many people may find Plan N the most beneficial policy. Plan N provides a balance of lower prices in premiums and the ability to pay less when going to the doctor, saving you out-of-pocket expenses. But Plan N wont be the best option for everyone everywhere.

Two good plans are Plan F, which, if youre eligible, covers all the costs Medicare would expect you to pay. Then, Plan G covers almost the same as Plan F. The only difference is it doesnt cover the Part B deductible.

Read Also: What Is The Top Rated Medicare Supplement Plan

What Is Medicare Supplement

Medicare Supplement plans are sold by private insurance companies to help fill the gaps of Original Medicare coverage.

In 2018, 34% of people enrolled in Original Medicare had coverage provided by Medicare Supplement plans to cover some of the costs of approved servicesthats roughly 11 million people, according to a report from the Kaiser Family FoundationKoma W, Cubanski J, Neuman T. A Snapshot of Sources of Coverage Among Medicare Beneficiaries in 2018. Kaiser Family Foundation. Accessed 9/4/2021. .

There are 10 Medigap plans to choose fromall with letter names ranging from A to Nthat provide standardized coverage and help pay for things like deductibles, coinsurance and copays. However, Medigap policies dont cover prescription drugs youll need to purchase a Medicare Part D plan in addition to a Medicare Supplement plan.

Whats The Difference Between Medigap Plan F Vs Plan G Vs Plan N

Medicare Supplement plans work alongside Original Medicare to cover the costs it typically leaves you to pay. The level of coverage you receive depends on the Medicare Supplement plan in which you enroll. Nationally, the most popular Medicare Supplement plans are Medigap Plan F, Plan G, and Plan N. These are the most popular due to their comprehensive coverage.

When comparing Medicare Supplement Plan F vs. Plan G vs. Plan N, youll notice they provide similar coverage. Note that all premiums are different per state and carrier, but the benefits remain the same.

With Medicare Supplement Plan F, youll have zero out-of-pocket costs outside your monthly premium. This is because Medigap Plan F is a first-dollar coverage plan. Your Medicare Supplement Plan F plan will cover benefits from the first dollar remaining after Original Medicare pays its portion.

You have no deductible, no coinsurance, and no copays. All you have to pay is your monthly premium. Additionally, due to its high level of coverage, Medicare Supplement Plan F has the highest monthly premium of the three plans. A typical Medicare Supplement Plan F policy can range from $180-$300 per month.

With Medicare Supplement Plan G, your only out-of-pocket expense is the Medicare Part B deductible. After you meet the deductible, Medigap Plan G will cover the rest, just like Plan F. The average monthly premium for Medigap Plan G is between $150-$220, putting it in the middle of the three plans for coverage and cost.

Read Also: Do We Have To Pay For Medicare

Tell Me The Difference Between Medicare Supplement Insurance Plans And Medigap Plans

What is the difference between the Medicare Supplement and Medigap name? Both are names. Medigap is another name for a health plan you can use. To explain this concept, you could consider Medigap as a program that fills in some gaps that Original Medicare does not cover. Its possible to view a Medicare supplemental plan as an option to expand or supplement your existing Medicare coverage.

You Can’t Join A Medicare Prescription Drug Plan And Have A Medigap Policy With Drug Coverage

If your Medigap policy covers prescription drugs, you’ll need to tell your Medigap insurance company if you join a Medicare Prescription Drug Plan. The Medigap insurance company will remove the prescription drug coverage from your Medigap policy and adjust your premium. Once the drug coverage is removed, you can’t get that coverage back, even though you didn’t change Medigap policies.

Recommended Reading: Is Medicare Different In Each State

How Do I Change From One Medigap Plan To Another

The good thing about Medicare Supplement plans is theres no Annual Enrollment Period like there is with Medicare Advantage and Part D prescription drug coverage. You can enroll or change plans at any time. The best time to enroll is during your Medigap Open Enrollment. During this time, carriers cant deny you coverage or charge you more in monthly premiums due to pre-existing health conditions.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Outside this enrollment window, you can still apply or change your plan. However, you may need to answer underwriting health questions to gain entry to the plan.

- Was this article helpful ?

Whats The Difference Between Medicare Supplement Insurance Plans And Medigap Plans

Summary:

Medicare Supplement and Medigap are different names for the same type of health insurance plan â you can use either name. Medicare Supplement and Medigap are different names for the same type of health insurance plan â you can use either name. To explain the terms themselves, you can think of âMedigapâ as a plan that fills in some of the âgapsâ for benefits that Original Medicare doesnât cover. You can think of âMedicare Supplementâ as a plan that adds to or supplements Original Medicare coverage by paying for some of Medicareâs out-of-pocket costs. You may find both terms used by the Centers for Medicare & Medicaid Services , the government entity that administers Medicare.

Don’t Miss: What Is A Medicare Point Of Service Plan

Member Benefits And Extras

Aetna has several overall member benefits that it offers to its policyholders. These benefits include:

- Ask a Nurse: This is a 24-hour nurse line that allows you to contact a registered nurse if you are feeling sick or have questions about your policy.

- Over-the-counter health solutions: This allows you to get select items such as vitamins and medicines over the counter with no added costs.

- Meal-at-home program: This is a program that brings meals to your home after a hospital stay, which is a crucial time for recovery.

However, some other more robust benefits are exclusive to Medicare Advantage plans, and Aetna is considered one of the best cheap Advantage options in the marketplace. Examples of such benefits include:

- Dental, vision and hearing: Medicare Advantage policies through Aetna usually provide coverage for dental, vision and hearing expenses. This can include exams and even surgery in these areas.

- Fitness memberships: The SilverSneakers program and exclusive gym discounts throughout the nation are offered to Advantage members.

- Prescription mail order: Since Aetna is partnered with CVS Health, Advantage members have the option to have their prescription drugs mailed directly to their homes.