Does My Health Play Any Role In My Costs

No. If youre enrolled in Original Medicare , your health wont play a role in how much you pay for your Medicare coverage. Part A is determined by how long you paid Medicare taxes. For Part B, all enrollees pay the same deductible while premiums are calculated using income and whether you signed up on time.

Medicare Part B Financial Assistance

Because Medicare Part B requires a monthly payment for its services, some people may find it difficult to pay for the monthly costs associated with this portion of Medicare. Those with limited incomes, in particular, may wonder if there are cost assistance programs in place to help mitigate the financial burden.

In fact, there are a few ways that you can reduce your monthly premiums, or at least make your healthcare more affordable using different programs. One such way is to enroll in a Medicare Savings Program. Run by individual states in conjunction with Medicare, Medicare Savings Plans help you pay for medical costs associated with deductibles, coinsurance and copayments, in some cases. There are four Medicare Savings Programs available, but only three of them relate to Medicare Part B. They are:

The Qualified Medicare Beneficiary Program

- The Qualifying Individual Program

- The Specified Low-Income Medicare Beneficiary Program

Each program has its own eligibility requirements. For example, members of the QI Program must apply every year for assistance. Acceptance is based on a first-come, first-served basis, with priority given to past recipients. You also wont qualify for the QI Program if you receive Medicaid benefits. If you think that you qualify for one of these programs or need financial assistance, then you should contact the Medicaid program in your state to find out more information.

Government May Scale Back Medicare Part B Premium Increase

- This year’s standard premium, which jumped to $170.10 from $148.50 in 2021, was partly based on the potential cost of covering Aduhelm, a drug to treat Alzheimer’s disease.

- The manufacturer has since cut the estimated per-patient annual treatment cost to $28,000, from $56,000.

- Medicare officials are expected this week to issue a preliminary determination of whether or to what extent the program will cover the drug.

There’s a chance that your Medicare Part B premiums for 2022 could be reduced.

Health and Human Services Secretary Xavier Becerra on Monday announced that he is instructing the Centers for Medicare & Medicaid Services to reassess this year’s standard premium, which jumped to $170.10 from $148.50 in 2021.

About half of the larger-than-expected increase was attributed to the potential cost of covering Aduhelm a drug that battles Alzheimer’s disease despite not knowing yet to what extent the program would cover it. Either way, the manufacturer has since cut in half its estimated per-patient price tag to $28,000 annually from $56,000 meaning Medicare’s cost estimate was based on now-dated information.

More from Personal Finance:

“With the 50% price drop of Aduhelm on Jan. 1, there is a compelling basis for CMS to reexamine the previous recommendation,” Becerra said.

A CMS spokesperson said the agency is “reviewing the secretary’s statement to determine next steps.”

Don’t Miss: Does Medicare Cover Scooters For Seniors

What Does Medicare Part B Cost In 2022

Medicare Part B enrollees have to pay a monthly premium in order to be covered. For 2022, the standard premium for Medicare Part B is $170.10.

All individuals covered by Part B must pay this premium. If you receive Social Security, the Part B fee is deducted from your monthly benefit payment. Those not on Social Security receive a quarterly bill for their Part B premium.

Along with the standard premium, Part B has an income-based monthly adjustment. The adjustment varies based on your modified adjusted gross income reported on your federal income tax return. Your premium for 2022 is determined by your MAGI from the 2020 tax year.

For example, if you filed taxes individually and reported a 2020 adjusted gross income of $100,000, then your Part B premium for 2022 would be $238.10, based on the standard monthly premium amount of $170.10 plus an income adjustment of $68.

Premiums for Medicare Part B are based on your taxable income filed on your 2020 federal return. Income levels and monthly Part B rates are outlined below:

| Individual taxable income |

|---|

| $578.30 |

What Is The Best Alternative To Medicare Part B

When Medicare was created in 1965, it consisted of two parts: Part A was free, covered hospitalizations, and was given to everyone who had hit 65 and had worked long enough. Part B covered everything else except prescription drugs and had a monthly premium set so that the government paid 80% of the total cost of the program, and enrollees paid the other 20%. Enrollment in Part B was voluntary.

Recommended Reading: Do You Need Additional Insurance With Medicare

Medicare Part B Late Enrollment Fee

It is important to note that if you don’t sign up for Medicare Part B during the initial enrollment period when you are first eligible, you may have to pay a late enrollment fee of up to 10% for each 12-month period that you are not enrolled.

For example, say you’re in the first income bracket and would pay the standard Part B rate of $170.10. But you signed up for Medicare Part B exactly 12 months after your initial enrollment period. You would be required to pay an additional $17.01 each month for Medicare Part B , for a total of $187.11. If you wait two years to enroll, your rate increases by 20% based on the Part B premium in effect that year.

What Is The Average Cost Of Medicare Supplement Insurance

The average premium paid for a Medicare Supplement Insurance plan in 2019 was $125.93 per month.3

Its important to note that each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

Other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates.

Medicare Supplement Insurance plans help pay for some of the out-of-pocket expenses youll face when you use Medicare Part A and Part B benefits. Medigap plans are sold by private insurance companies.

These costs can include certain Medicare deductibles, coinsurance, copayments and other charges.

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover.

Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

| 80% | 80% |

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Also Check: Is Unitedhealthcare Dual Complete A Medicare Plan

Premium Surcharge Is Based On 2020 Tax Return You Can Appeal It If Your Income Has Changed

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. 2020 tax returns were filed in 2021, so those were the most current returns available when income-related premium adjustments are determined for 2022.

But if a life-change event has subsequently reduced your income, theres an appeals process you can use. In the appeal, you can request that the income-related premium adjustment be changed or eliminated without having to wait for it to reflect on a future tax return.

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

Read Also: How To Get Motorized Wheelchair Through Medicare

How Much Does Part B Cost For Most Enrollees

Most people new to Medicare will pay $170.10 a month for Part B premiums in 2022. This is the standard premium that most people pay based on income. Social Security will deduct your Part B premium from your Social Security check monthly. If you have not enrolled in Social Security income benefits yet, theyll bill you quarterly.

Since some people pay more based on income, use the tables below to determine your personal Medicare cost for Part B. It shows the amount that you will pay in 2022 for Part B, per the preview notice released by the Department of Health and Human Services in November.

The Medicare Part B deductible for 2022 is $233.

What You Pay In A Medicare Advantage Plan

Your

depend on:

- Whether the plan charges a monthlypremium. Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium .

- Whether the plan pays any of your monthlyMedicare Part B premium. Some plans will help pay all or part of your Part B premium. This is sometimes called a “Medicare Part B premium reduction.”

- Whether the plan has a yearlydeductible or any additional deductibles.

- How much you pay for each visit or service . For example, the plan may charge a copayment, like $10 or $20 every time you see a doctor. These amounts can be different than those underOriginal Medicare.

- The type of health care services you need and how often you get them.

- Whether you go to a doctor orsupplierwho acceptsassignmentif:

- You’re in a PPO, PFFS, or MSA plan.

- You goout-of-network.

Recommended Reading: Is Jakafi Covered By Medicare

The Cares Act Of 2020

On March 27, 2020, President Trump signed into law a $2 trillion coronavirus emergency stimulus package called the CARES Act. It expands Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increases flexibility for Medicare to cover telehealth services.

- Increases Medicare payments for COVID-19ârelated hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarifies that non-expansion states can use the Medicaid program to cover COVID-19ârelated services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

How To Avoid Medicare Part B Excess Charges

There are several ways to avoid Part B Excess Charges. The most obvious, of course, is to live in a state that prohibits them .

Beyond that, you can always check with your regular doctors to see if he/she does use balance billing . If so, you can choose a doctor that does not.

Or, as previously discussed, you can pick a Medigap plan that covers these Part B Excess charges in full. The plans that do so currently are Medigap Plan G and Medigap Plan F.

If you have questions about how Medicare Part B Excess charges work, or anything else regarding Medicare or Medicare Supplement plans, feel free to contact us here or call us at 877.506.3378.

You May Like: How Much Does Medicare Pay For Inpatient Psychiatric Care

In What Cases Are Recliners Not Covered By Medicare

The recliners are not covered under Medicare in the following cases:

- If you are hospitalized or are staying at a nursing home

- In case you have already claimed Medicare for another motorized device such as a scooter or wheelchair

- If there is a spring device mechanism in the recliner to help you lift out

Read Also: How To Calculate Medicare Tax

Which Lenses Are Covered By Medicaid

If you need a new pair of glasses, you must find out the types of lenses covered by Medicaid. Medicaid will pay for regular single-vision lenses, meant to correct near and distance vision.

If you need bifocals or trifocals, no need to worry, Medicaid will also pay for them. Bifocals and trifocals are expensive, so Medicaid only covers one pair per year.

For single-vision glasses, Medicaid will cover two pairs per year because they are relatively cheap.

Some of the lenses not covered by Medicaid include:

If youd like to get any of the above lenses, you can still use your Medicaid coverage. However, you will incur out-of-pocket costs because these are specialty lenses.

Read Also: How To Get Medicare Insurance License

Why Do Some People Pay Less For Their Medicare Part B Premium

Some people who get Social Security benefits will still pay less than $170.10 in 2022. This affects around 2 million Medicare beneficiaries. Legislation prevents the cost of Medicare Part B from increasing more than the Social Security annual cost-of-living increase.

In recent years, we have had low COLA increases, so these individuals have only been paying less than the standard base Part B premium. Though the Social Security COLA increases for the last couple of years have been somewhat larger, there is still a small group of beneficiaries being protected by the hold harmless provision.

Though this all very confusing, remember that you do not have to calculate this yourself. Again, Social Security will determine your Part B premium for 2022 and notify you by mail if you exceed the Medicare income limits and must pay a higher adjusted amount.

Most Medicare beneficiaries qualify for premium-free Part A. However, the Medicare Part B premium is deducted from your Social Security check if you are receiving Social Security benefits. In 2022, the Part B premium is $170.10.

You can also request your Part D premium be deducted from your Social Security check.

Most People Pay the Standard Part B Premium

Youll pay the standard Medicare Part B premium amount if:

The Cost Of Medicare Part B

Unlike Medicare Part A, Medicare Part B requires a premium from everyone. The standard premium for Medicare Part B in 2021 is $148.50 a month, which applies to most people, including new enrollees. That premium changes each year, usually increasing. In 2022, the Part B premium jumps to $170.10 a month.

Youll also have an annual deductible of $233 in 2021 as well as a 20 percent coinsurance rate for covered services under Part B.

There are penalty fees for not signing up during your Initial Enrollment Period , but well discuss those in a separate section.

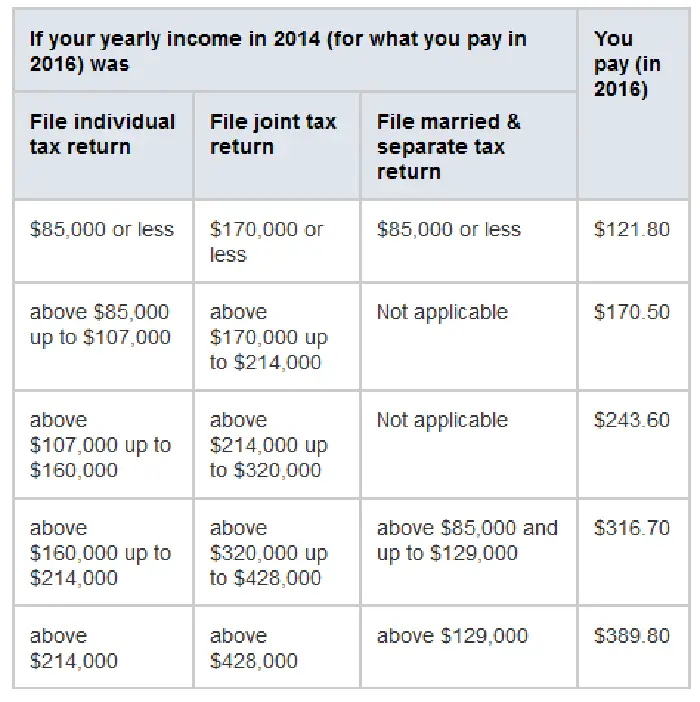

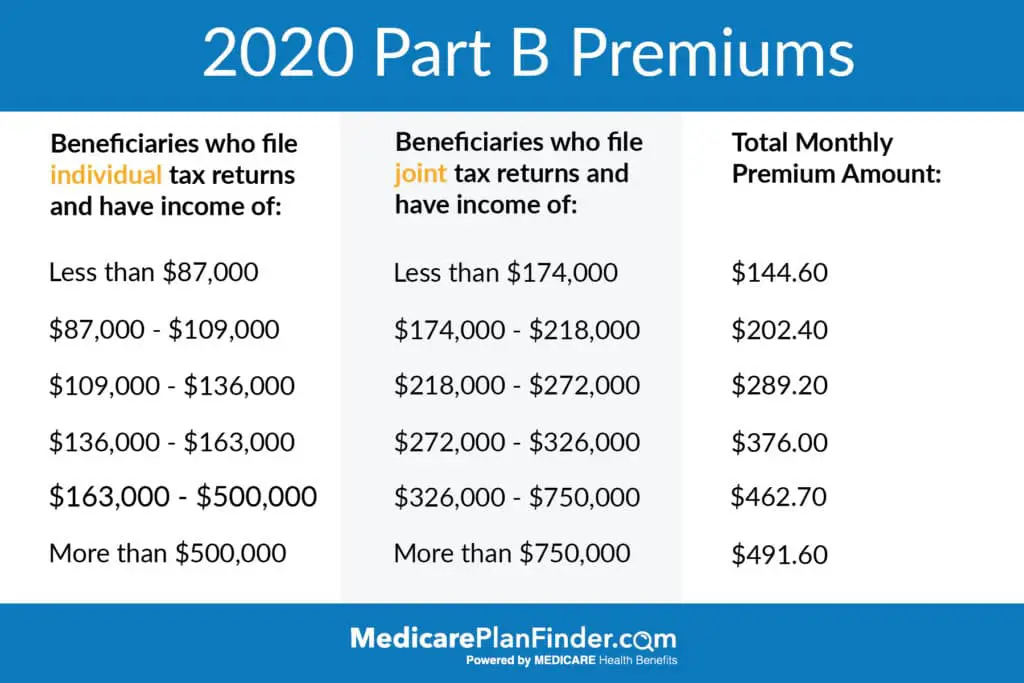

While most people pay the standard amounts for premiums and deductibles, some people will pay more, depending on their income. The more you make, the higher your likelihood will be for paying more than the standard amount. The extra fee per month is called the Income Related Monthly Adjustment Amount . How much more can you expect to pay if you fall outside of the standard range? The Medicare website offers a handy chart on the rates for those with higher incomes, which is updated each year. These are the rates for 2022, based on the income reported on your 2020 tax return:

These amounts reflect individual incomes only. Married couples will pay the same rates, but for different, higher thresholds. For example, a couple that earns over $182,000 per year and files a joint tax return will pay $238.10 per month for Medicare Part B premiums. Married couples who file separate tax returns also have different thresholds.

You May Like: Does Medicare Part D Cover Sildenafil

Medicare Part B Deductible

Medicare Part B comes with an annual deductible amount that must be met before coinsurance or copay benefits kick in. In 2022, the deductible amount is $233, meaning that after you pay out of pocket for expenses that total $233, cost sharing begins.

Typically, after you reach the deductible for the year, you are required to pay 20% of Medicare Part B approved expenses out of pocket.

For example, say you went to the doctor for a screening that cost you $150, then had a separate therapy visit that cost you $83. The total cost of these medical expenses adds up to $233, meaning you would have met your Medicare Part B deductible for the year. Then, later in the year you had another screening that cost you $150. Since you already met your deductible, you would pay just 20%, or $30 , while Medicare would pay the remaining $120.

Can You Change How You Pay For Medicare

If you have Social Security benefits, your Part B premiums will be automatically deducted from them. If you dont qualify for Social Security benefits, youll get a bill from Medicare that youll need to pay via:

- Your online Medicare account

- Medicare Easy Pay, a tool that lets you automatically transfer monthly payments

- Online bill pay through your bank account

- Check, money order, or credit card payment

If you are having trouble paying your bill, you can contact someone at Medicare for help.

Medicare Advantage and Part D premiums arent automatically deducted from your Social Security benefits, so youll typically receive a bill and pay the insurer directly. If youd prefer to have your premiums for these plans deducted from your benefits check, you can contact your insurer to request this change.

You May Like: Does Medicare Require A Referral For A Colonoscopy

What Is The Medicare Part B Premium

The Medicare Part B premium is a monthly fee that Medicare beneficiaries pay if they choose to enroll in it to supplement the services available to most seniors for free with Medicare Part A.

- Medicare Part A is hospital insurance. It is available primarily to U.S. citizens and permanent residents age 65 and older. Most pay no premium for it.

- Medicare Part B covers other medically necessary services and preventative care like doctor’s services, lab tests, and outpatient care. Most pay a flat monthly premium for it, which is adjusted annually.

There is also a Medicare Part D, which covers prescription costs. It is available from insurance companies that are approved to offer it.