Compare Medicare Advantage Plans Today

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Do I Need To Notify Anyone If Im Delaying Medicare

You don’t need to provide notice that you’d like to delay enrolling unless you’re receiving Social Security or Railroad Retirement Board benefits. If you are receiving either, you’ll be automatically enrolled in Medicare Parts A & B when you turn 65, and you’ll need to let Social Security know you wish to delay Part B. By law though, if you receive Social Security benefits and are eligible for Medicare, you must also have Medicare Part A.

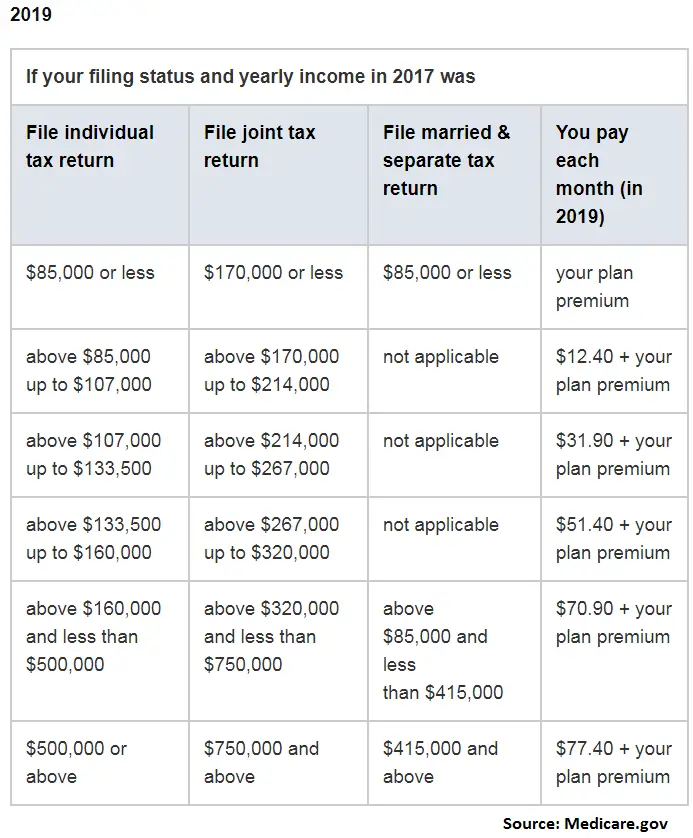

How Much Does Medicare Cost At Age 65

The standard premium for Part B modestly increases year over year. Part A costs also can increase, including the annual deductible and other coinsurance. Known as hospital insurance, Part A doesnt require a monthly premium as long as you have paid Medicare taxes through employment for at least 10 years.

Part B, known as medical insurance, typically pays 80% of the covered cost while you pay the deductible and then 20%.

You May Like: What Does Aarp Medicare Supplement Cost

Medicaid Or Medicare Savings Programs

Medicare beneficiaries with limited income or very high medical costs may be eligible to receive assistance from the Medicaid program. There are also Medicare Savings Programs for other limited-income beneficiaries that may help pay for Medicare premiums, deductibles, and coinsurance. There are specified income and resources limits for both programs. Contact your local county Department of Social Services or SHIIP to apply for one of these programs.

How To Get Health Insurance Before Age 65

If youre retiring at 62 and losing your employers health insurance, youll need to find other coverage until Medicare begins. You have several options. Most of these options also can help if you need coverage for other reasons, such as losing your job or facing the two-year waiting period for Medicare if you receive SSDI.

Read Also: Are Tetanus Shots Covered By Medicare

Medicare Eligibility For People Under 62

There are a few exceptions for Medicare age limits that can allow people younger than 65 and under age 62 to enroll in Medicare.

- If you have ALS , you are immediately eligible for Medicare regardless of your age as soon as your Social Security or Railroad Retirement Board disability benefits begin.

- You may also qualify for Medicare if you have kidney failure that requires dialysis or a kidney transplant, which is known as end-stage renal disease .

- You may also qualify for Medicare at age 62 or any age before 65 if you receive disability benefits from either Social Security or the Railroad Retirement Board for at least 24 months.

If you qualify for Medicare under the age of 65 because of a disability, you might also qualify for a Medicare Advantage Special Needs Plan.

What Is The Earliest Age You Can Get Medicare

Due to there being circumstances where someone can enroll in Medicare due to a disability, there is no minimum age to enrolling in Medicare with a disability. However, you must have been receiving Social Security Disability Benefits for at least two years.

The only circumstance where this two-year limit can be waived is if you are diagnosed with End-Stage Renal Disease or Amyotrophic Lateral Sclerosis. However, if you do not receive Social Security disability or are not diagnosed with one of the qualifying illnesses, you will need to wait until you are 65 to enroll in Original Medicare.

You May Like: Is Chantix Covered By Medicare

When Should I Sign Up For Medicare

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application. However, because you must pay a premium for Part B coverage, you have the option of turning it down. You will receive a Medicare card about two months before age 65. If you would like to file for Medicare only, you can apply by calling 1-800-772-1213. Our representatives there can make an appointment for you at any convenient Social Security office and advise you what to bring with you. When you apply for Medicare, we often also take an application for monthly benefits. You can apply for retirement benefits online.

If you didnt sign up when you were first eligible for Medicare, you can sign up during the General Enrollment Period between January 1 and March 31 each year, unless you are eligible for a Special Enrollment Period.

Do You Pay Taxes On Social Security

Some people who get Social Security must pay federal income taxes on their benefits. However, no one pays taxes on more than 85% percent of their Social Security benefits. You must pay taxes on your benefits if you file a federal tax return as an individual and your combined income exceeds $25,000.

Read Also: File Taxes On Ssi Benefits

Also Check: Does Medicare Pay For Entyvio

Can I Get Pet Insurance For An Older Cat

There are several types of cat insurance your senior pet may qualify for, the most popular being Accident & Illness coverage, which offers comprehensive coverage for new illnesses and injuries.

However, each pet insurance company has different policy terms and restrictions regarding aging felines.

In addition, many pet insurance companies offer pet wellness plans that you can add to the basic pet insurance policy for coverage of routine care costs. This includes expenses for things like flea and tick preventatives, annual heartworm testing, pet wellness exams, and more.

While some providers set a maximum age limit on enrollment, others have no upper age limits and will keep covering your cat regardless of their age. For instance, if you insure your feline companion when they are a kitten, they can be covered for the rest of their life as long as you keep paying your premiums.

Recommended Reading: What Is Medicare A Or B

When You’re Eligible For Social Security

Today, older adults become eligible for full Social Security retirement benefits at age 66 or 67 depending on their birth year and whether they or their spouse have met the work credit requirement.

For anyone born in 1929 or later, the minimum work credit requirement for Social Security benefits is 40 credits or 10 years of work. The year you can start taking full Social Security benefits is known as your full retirement age or normal retirement age. If you were born on Jan. 1 of any year, refer to the previous year when calculating your full retirement age.

| Age for Receiving Full Social Security Benefits | |

|---|---|

| Birth Year | |

| 1960 and later | 67 |

Unlike Medicare, older people can opt to start taking their benefits before their full retirement age. The earliest you can begin taking Social Security benefits is age 62. However, if you begin taking Social Security payments before your full retirement age, you will receive a reduced monthly benefit for the remainder of your life.

Also Check: When You Have Medicare And Medicaid Which Is Primary

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

Note: Important Upcoming Change Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month youre first eligible. Beginning January 1, 2023, if you sign up during the month you turn 65 or during the last three months of your IEP, your coverage starts the first day of the month after you sign up.

The following chart shows when your Medicare Part B becomes effective in 2022:

| In 2022, if you sign up during this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| One to three months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65 | One month after the month you turn age 65. |

| One month after you reach age 65 | Two months after the month of enrollment. |

| Two or three months after you reach age 65 | Three months after the month of enrollment. |

The following chart shows when your Medicare Part B becomes effective in 2023:

Medicare Before Retirement Age

For some, benefits can start before the age of 65. This includes the categories of people above, including those who have a disability and those who have certain illnesses. At age 65, both those who are retired and those who are still working qualify for health insurance through Medicare enrollment.

Alternatively, Medicaid is a U.S. public assistance program for U.S. citizens of all ages.

Find out more about the differences between Medicare and Medicaid.

You May Like: When Do You Start Medicare Coverage

How Can I Get Assistance Paying My Health Care Costs

If you have a limited income, you may be able to get assistance with your health care costs through certain programs:

- Medicaid: If you have a low monthly income and minimal assets, you may be eligible for coverage through Medicaid to pay Medicare costs, like copays and deductibles, and for health care not covered by Medicare, such as dental care and transportation to medical appointments.

- Medicare Savings Programs : If you do not qualify for Medicaid but still have problems paying for health care, you may qualify for an MSP, a government-run program that helps cover Medicare costs. There are three types of MSP, and all of them pay the monthly Medicare Part B premium. The Qualified Medicare Beneficiary program covers deductibles and coinsurances as well.

- Extra Help: Also known as the Part D Low-Income Subsidy , this is a federal program that helps pay for some to most of the costs of Medicare Part D prescription drug coverage. You may be eligible for Extra Help if you meet the income and asset limits. Also, in many cases, enrollment in an MSP automatically leads to enrollment in Extra Help.

- State Pharmaceutical Assistance Programs: SPAPs are offered in some states to help eligible individuals pay for prescriptions. Most SPAPs have income guidelines. Many also require you to enroll in a Medicare Part D plan and to apply for Extra Help.

Getting Medicare Under The Age Of 65

Many people think of Medicare as a government health-care program for Americans and legal permanent residents who are at least 65 years old. But some people qualify for Medicare before age 65.

Here are the most common ways you may be eligible for Medicare if youâre under age 65:

- You receive disability benefits from the Social Security Administration or from the Railroad Retirement Board . Youâre automatically enrolled in Original Medicare, Part A and Part B, after 24 continuous months of receiving disability benefits.

- You have Lou Gehrigâs disease . Youâre automatically enrolled in Medicare the same month that your disability benefits start.

- You have end-stage renal disease . In this case, you may qualify for Medicare, but youâre not automatically enrolled. To enroll, contact Social Security .

If you have questions about your eligibility for Medicare if youâre under 65, or about Medicare open enrollment, you can contact Social Securityat 1-800-772-1213. TTY users can call 1-800-325-0778. Representatives are available Monday through Friday, from 7AM to 7PM. Or, you can contact Medicare, or a licensed insurance agent at eHealth .

Recommended Reading: Where Can I Go To Apply For Medicare

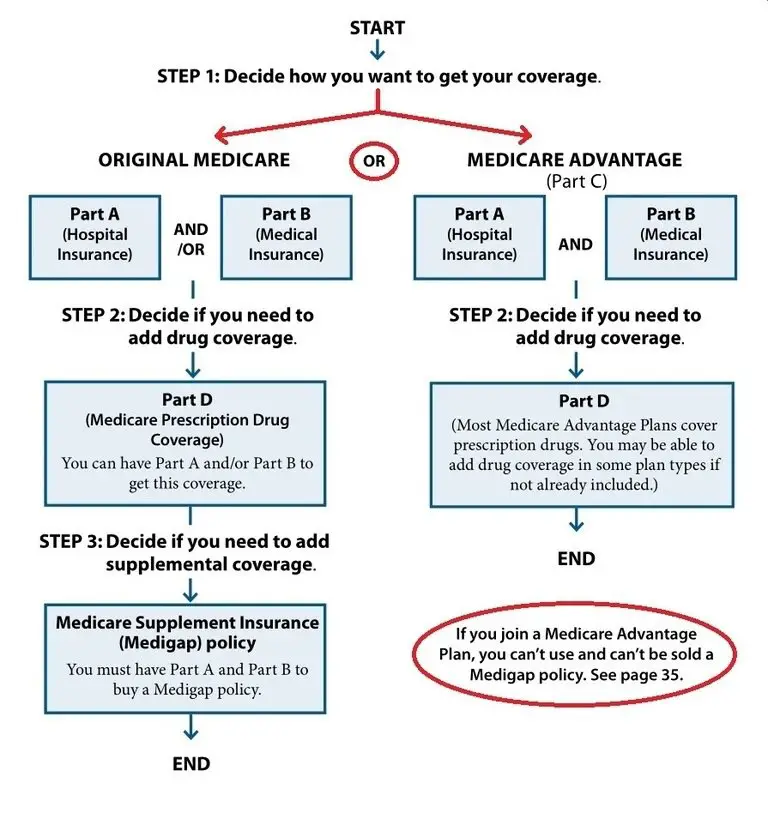

How Do I Enroll In A Prescription Drug Plan

The Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date. All people with Medicare are eligible to enroll in a PDP however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans.

For assistance with Part D plan comparisons and enrollments, please call our team of Medicare specialists at 1-855-408-1212 or you may log onto MyMedicare.gov to shop for prescription drug plans available in your area.

If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to Extra Help through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.

Delaying Medicare Parts A & B

If you qualify to delay both Medicare Parts A & B, you can do so without penalty as long as you enroll within eight months of either losing your employer coverage or ceasing to work, whichever comes first. You will enroll during a Special Enrollment Period and will need to also provide written proof of creditable drug coverage to avoid Part D penalties.

Don’t Miss: How To Pay Medicare Premium

Born In 1955 Or Later You May Have To Work Until Youre 67

Once upon a time, turning 65 years old meant you could get your full Social Security retirement benefits and Medicare coverage at the same time. But over the last couple of years, the Social Security Administration changed the full retirement age twice first to age 66 for people born from 1948 to 1954, then again to age 67 for people born in 1955 or later.

No matter what full retirement age is required for you to get full Social Security benefits , Medicare eligibility still begins at age 65.1

Retirement age by year of birth| Year of birth | |

|---|---|

|

66 years and 2 months |

|

|

1956 |

66 years and 4 months |

|

1957 |

66 years and 6 months |

|

1958 |

66 years and 8 months |

|

1959 |

66 years and 10 months |

|

1960 |

67 years |

Reaching Age 62 Can Affect Your Spouses Medicare Premiums

Although reaching age 62 does not qualify you for Medicare, it can carry some significance for your spouse if they receive Medicare benefits.

When one spouse in a couple turns 62 years old, the other spouse who is at least 65 years old may now qualify for premium-free Medicare Part A if they havent yet qualified based on their own work history.

- For example, Gerald is 65 years old, but he doesnt qualify for premium-free Part A because he did not work the minimum number of years required for eligibility. He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

- Lets say Geralds wife, Jessica, reaches age 62 and has worked for the required number of years to qualify for premium-free Part A once she turns 65. Because Jessica is now 62 years old and has met the working requirement, Gerald may now receive premium-free Part A.

In the above example, Jessica has not become eligible for Medicare by turning 62. Her husband Gerald, however, is now eligible to receive his Medicare Part A benefits without paying a monthly premium any longer.

You May Like: What Does Medicare Part E Cover

Read Also: What If I Can T Afford Medicare Part B

The Age When You Begin Claiming Social Security Benefits

You can begin claiming Social Security retirement benefits as early as age 62. However, claiming before your full retirement age will lead to a permanent reduction in your benefit amount. The longer you wait, the larger your benefit will beuntil you reach age 70, at which point additional delays do not result in further increases.

Waiting has a positive impact on your benefit amount. For instance, if you were born in 1961, earned $100,000 each year, and claimed your benefits in 2023 at age 62, you could receive $19,704 per year. If instead you wait until your FRA and continue to work, your benefits would increase to $30,408 per yeara 54% boost. If you wait until age 70, your benefits would be $38,760 per year, or 97% more than your early benefits. These increases are permanent.

The trade-off with any decision to delay is that you wont receive benefits during those early years. For many people, it makes sense to delay claiming, says Young. If you live a normal life expectancy, then the effective rate of return you get by waiting for a higher payment is reasonable. However, if you dont expect to live long, or are single and not worried about outliving your funds, then it may be wise not to delay.

Your Full Retirement Age