What Are The Advantages Of Medicare Advantage Over Medicare Supplement Insurance

The biggest advantage of Part C plans over Medicare Supplement insurance is cost. Every Medigap plan has a monthly premium. This premium will tend to rise over time. Medicare Advantage plans have lower premiums. In fact, they often have no premium requirement at all.

Medicare Advantage plans also outperform Medigap when it comes to extra benefits provided. Medigap policies only cover what Original Medicare covers. Therefore, they do not cover things like:

- Meal delivery programs

It is true that many Medigap plans have savings programs for some of these things. However, they do not offer anything like comprehensive coverage. The extra benefits often found in Part C plans are much more complete than the discount programs available from Medigap plans.

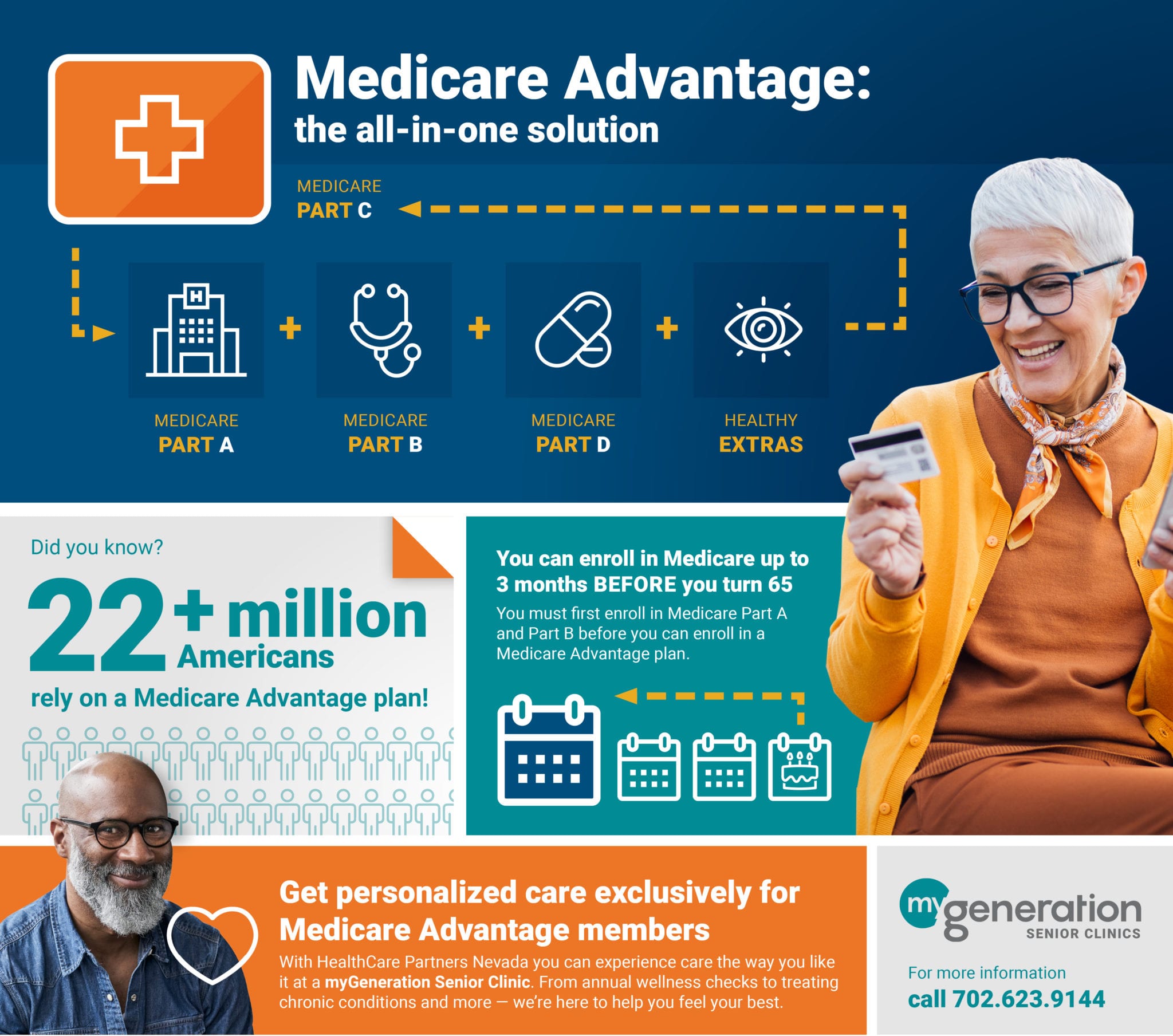

How Do Medicare Advantage Plans Work

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

These “bundled” plans include

, and usually Medicare drug coverage .

How Much Does A Medicare Advantage Plan Cost

Many Medicare Advantage plans have a $0 premium, so be sure to explore your options. Baethke explains it like this: If you enroll in a plan that does charge a premium, you must pay this fee every month in addition to your Medicare Part B premium, which is around $149 .

Medicare Part Bs coinsurance and the deductible is $203, according to Medicare.gov, and once they are met, your copay under Medicare Advantage is typically 20% of the Medicare-approved amount for most services and products, such as durable medical equipment like glucometers, walkers, hospital beds and more.

What gets many people into financial trouble is not following the rules of their plan, such as using an out-of-network provider or facility or getting products or services from a supplier not approved by Medicare.

Sometimes, patients urgently need this medical equipment and arent thinking about reading the fine print, says Baethke. This is why its so important to understand Medicares DME requirements from the beginning.

Nebulizers, for instance, are DME commonly used to treat conditions that cause difficulty breathing, such as asthma and COVID-19. If your doctor recommends one, Medicare requires you to get the machine through a Medicare-approved supplier. Not doing so will mean a denied claim from your Medicare Advantage insurerand a sizable surprise bill.

To learn more about your costs in specific Medicare Advantage plans, contact the plan or visit Medicare.gov/plan-compare.

Read Also: Do I Qualify For Medicare If I Am Disabled

Types Of Medicare Health Plans

People in Medicare are either in Original Medicare, or fee-for-service Medicare, or theyre in a Medicare Advantage plan, says Gretchen Jacobson, Ph.D., vice president of Medicare at The Commonwealth Fund, a foundation that supports independent research on health care issues and makes grants to improve health care practice and policy.

Generally, you need to pay a portion of the cost for each service Original Medicare covers out of pocket. And, according to the U.S. governments official Medicare handbook for 2022, theres no limit to what you may pay in a year unless you have other coverage, such as a Medicare Supplement, Medicaid or employee or union coverage, or you enroll in a Medicare Advantage plan.

Confused About Medicare Supplement Insurance Options?

Find committed, licensed agents who work to understand your coverage needs and find you the best Medicare option.

Things To Know About Medicare Advantage Plans

Also Check: Do I Need To Keep Medicare Summary Notices

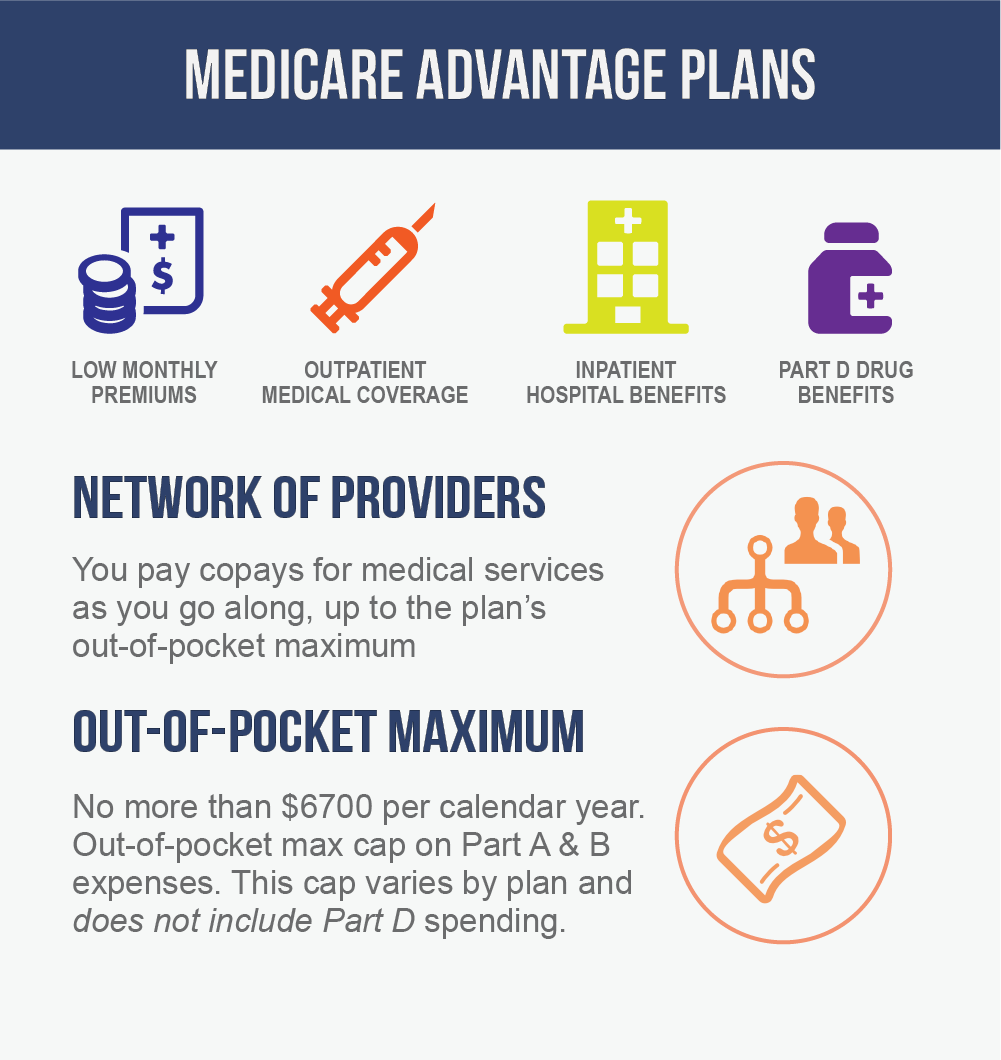

Costs For Medicare Advantage Plans

What you pay in a Medicare Advantage Plan depends on several factors. In most cases, youll need to use health care providers who participate in the plans network. Some plans wont cover services from providers outside the plans network and service area.

Medicare Advantage Plans have a yearly limit on your out-of-pocket costs for all Part A and Part B services. Once you reach this limit, youll pay nothing for services Part A and Part B cover.

How To Know What Type Of Plan Is Right For You

Ask yourself these three questions to help you figure out if Medigap or Part C coverage is best for you:

- Are you OK using a network of providers and needing referrals to see specialists?

- Do you travel internationally or have homes in more than one state?

- Can you afford Medigap premiums?

If you answer no to more than one of these questions, you may want to consider Medicare Advantage coverage.

If you want help with Medicare, work with a licensed professional. You can work together to review the plans available in your area. You can also compare quotes for Medicare Supplement, Medicare Advantage, and prescription drug plans. Once you find a plan, these experts can help you enroll in it online or by phone.

AgingInPlace.org keeps our resources free by working as an affiliate partnerwith some companies mentioned on our site. We may earn a commission when you click on certain product links.

You May Like: Does Medicare Pay For Prep

Cons Of Medicare Advantage Plans

The following are some disadvantages of Medicare Advantage plans:

- If you select an HMO Medicare Advantage plan, you may have a small selection of providers to choose from. If you see a provider out-of-network, it can cost you more. However, other plan options will offer a wider provider network.

- With certain plans, you may see additional costs for things like drug deductibles and specialist visit copays.

- If you travel a lot, your plan may not cover services outside your service area.

What Are The Advantages And Disadvantages Of Medicare Advantage Plans

What Are The Advantages And Disadvantages Of…

Every year, millions of Americans enroll in Medicare Advantage plans. This year, you may be among them, and you will want to feel confident that you are picking the best plan for you.

With this guide, we will review some of the basics of the Medicare Advantage program. Then, we will compare them to Original Medicare and Medicare Supplement insurance plans. Lastly, we will give you some tips on how to know if Medicare Advantage fits your needs.

Medicare Advantage plans close the gaps in Original Medicare with small copays and coinsurance.

Recommended Reading: Do I Have To Have Medicare When I Turn 65

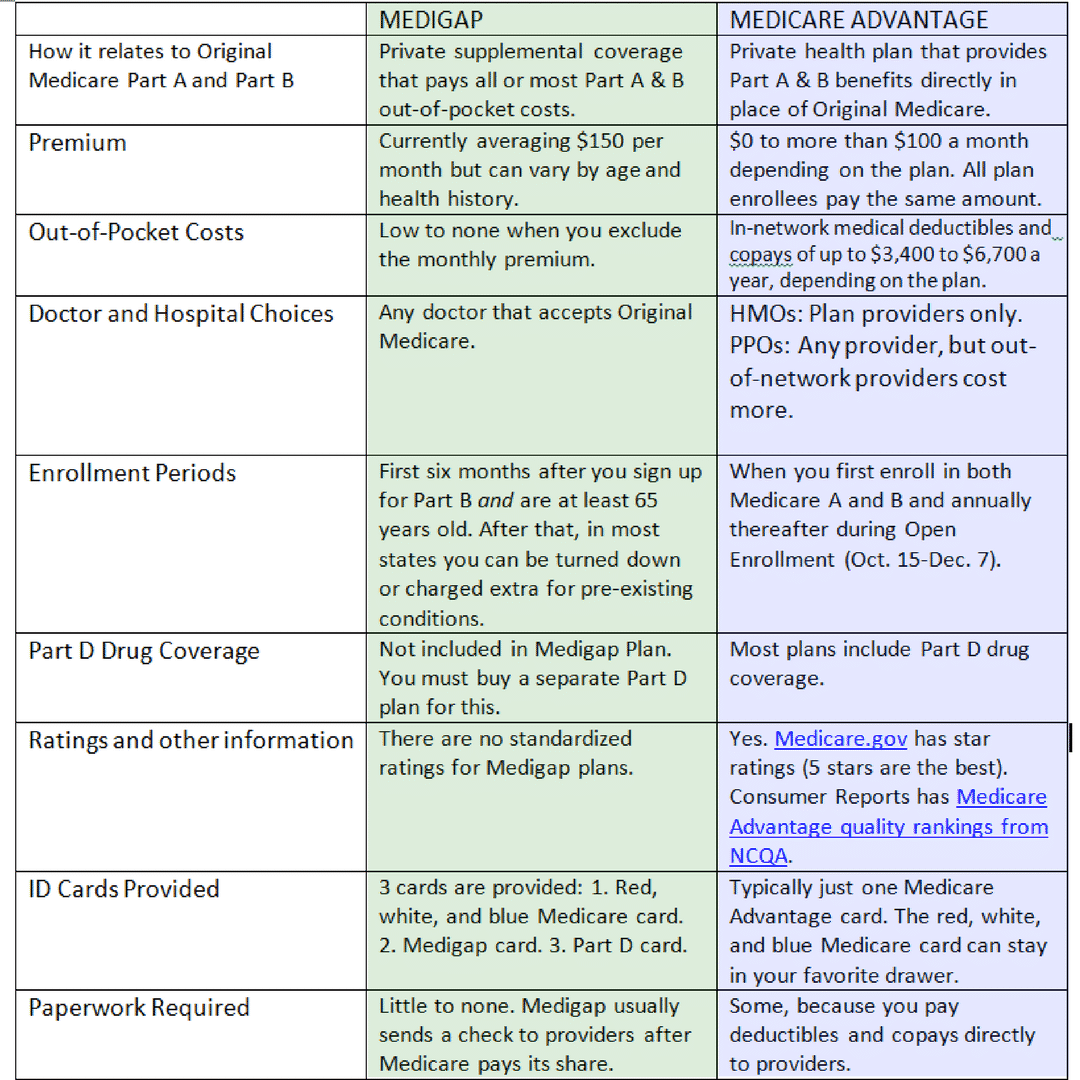

Medicare Advantage Compared To Original Medicare

A simple way to understand Medicare Advantage is to contrast it with original Medicare. Heres a side by side comparison of Original Medicare and Medicare Advantage

Original Medicare:

- Includes Part A and Part B. Drug Coverage must be purchased separately under Part D.

- Out-of-Pocket costs such as your 20% coinsurance can only be covered through a Medicare Supplement plan

- You can use any doctor or hospital in the US that takes Medicare

- You can buy supplement coverage to make up for coverage gaps

- Does not cover you outside of the US

Medicare Advantage:

- Includes Part A, B, and sometimes D.

- Out-of-Pocket costs are lower than Original Medicare

- You will need to use the doctors in the plans network

- Many plan offer extra benefits such as vision, hearing, and dental

- You cant buy or use separate supplemental coverage

- Does not cover you outside of the US

Advantages and Disadvantages of Medicare Advantage Plans

Lets talk about the various pros and cons and potential pitfalls of Medicare Advantage Plans.

Before getting into specifics, remember that individual Medicare Advantage plans may have different:

- Networks of providers

- Cost-sharing for covered services

- Company Considerations. Even plans of the same type may have different rules depending on the individual insurance carrier.

How Do You Choose A Medicare Advantage Plan

Its important to compare the benefits between your current coverage and the different types of Medicare Advantage plans . Be sure that you understand the additional benefits and any benefits that you may lose.

You may want to consider:

- If you can change your current doctors

- If your medications are covered under the plans formulary

- The monthly premium

- The cost of coverage. This could include annual deductible, copays, and coinsurance.

- What additional services are offered

- Any treatments you need that arent covered by the plan

Also Check: When Did Medicare Advantage Start

Cap On How Much You’ll Pay For Covered Services

Unlike traditional Medicare, Medicare Advantage plans have out-of-pocket limits that cannot be more than $7,500 a year for beneficiaries who access care through plan networks. This is especially good for those who have ongoing medical conditions because if you have Parts A and B alone, you won’t have a cap on your medical spending.

Going outside of the network is allowed under many Medicare Advantage preferred provider plans, though medical costs are higher than they are when staying within the plan network. The highest out-of-pocket maximum for health care spending both inside and outside of networks is $11,300 annually.

What Are The Disadvantages Of Medicare Advantage Compared To Medigap

There are two potential drawbacks to Medicare Advantage when compared to Medigap. First, Medigap plans do not require you to see a specific network of doctors. Instead, they give you the same flexibility as Original Medicare. You wont need to get referrals either, which means that Medigap plans offer more freedom than Medicare Advantage plans.

The other reason you might prefer Medicare Supplement plans relates to copays and cost sharing. You can expect to pay copays or coinsurance every time you receive covered services with Part C. With some Medigap plans, you would pay less, or even zero, for the same procedures. Some people like the idea of not paying any medical bills, so much so, they dont mind paying a higher premium for it.

Recommended Reading: Does Medicare Cover Lasik Eye Surgery

What Are The Benefits Of A Medicare Supplement Plan

A Medicare Supplement plan makes your out-of-pocket costs more predictable and easier to budget.

From a cost-sharing perspective, many people like it because you dont need to worry about how much is owed every time you go to the doctor or are hospitalized, said Jacobson. You can literally see any doctor around the country that you would like to see. For example, if you live in Arizona, you can fly to Minnesota to go to the Mayo Clinic.

Unfortunately, Jacobson says having this benefit tends to be much more important for people when theyre sicker. When people first go on Medicare, theyre usually relatively healthy and not thinking necessarily about when theyre sick and what type of plan would be best for them in that situation. The inability to easily switch back and forth between Medicare Advantage and Medicare Supplement makes it pretty complicated for people, she says.

For example, if you join a Medicare Advantage plan for the first time and arent happy with it, federal law grants you special rights if you return to Original Medicare within the first 12 months. After that, you can only disenroll or change plans during the Open Enrollment Period or if you qualify for a Special Enrollment Period. Depending on the type of Special Enrollment Period, you may or may not have the right to buy a Medigap policy.

At the end of the day, the decision often comes down to whether you can afford a Medigap plan, as they can be more expensive.

How Do I Sign Up For A Medicare Advantage Plan

A licensed insurance agent can help you compare Medicare Advantage plans that are available in your area.

You can review information such as plan costs, prescription drugs that might be covered by the plan and whether your doctor is part of the plans provider network.

Find Medicare Advantage plans in your area

Or call 1-800-557-6059TTY Users: 711 24/7 to speak with a licensed insurance agent.

1 Centers for Medicare and Medicaid Services. Medicare Enrollment Dashboard. Retrieved Dec. 2020, from www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Dashboard/Medicare-Enrollment/Enrollment%20Dashboard.html.

2 Kaiser Family Foundation . Average Marketplace Premiums by Metal Tier, 2018-2021. Retrieved Dec. 2020 from https://www.kff.org/health-reform/state-indicator/average-marketplace-premiums-by-metal-tier.

3 Boccuti, Cristina Fields, Christa Casillas, Giselle Hamel, Liz. Primary Care Physicians Accepting Medicare: A Snapshot. KFF. . Retrieved from www.kff.org/medicare/issue-brief/primary-care-physicians-accepting-medicare-a-snapshot.

About the author

Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. He is also a licensed health insurance agent. Christian is well-known in the insurance industry for the thousands of educational articles hes written, helping Americans better understand their health insurance and Medicare coverage.

Don’t Miss: Can You Have More Than One Medicare Supplement Plan

Medicare Advantage Plans Coverage For Some Services And Procedures May Require Doctors Referral And Plan Authorizations

Medicare Advantage plans try to prevent the misuse or overuse of health care through various means. This might include prior authorization for hospital stays, home health care, medical equipment, and certain complicated procedures. Medicare Advantage plans may also require your primary care doctorâs referral to see specialists before they will pay for services.

What Are The Disadvantages Of Medicare Advantage Compared To Original Medicare

There are two disadvantages to Part C plans:

- Network and referral restrictions

Some Medicare Advantage plans have a monthly premium. In this case, you are paying your standard Part B premium plus a monthly premium for your Part C coverage.

Medicare Advantage plans almost always have a network of preferred or required providers. It is important to note that you must use providers that are covered by the plan.

However, many Medicare Advantage plans do not have a monthly premium. Those that do often have quite low premiums, which would be comparable to the premium you would pay for standalone Part D coverage. Cost is only a very slight disadvantage, and it only applies if your MAPD plan does indeed have a premium.

Medicare Advantage plans almost always have a network of preferred or required providers. It is important to note that you must use providers that are covered by the plan. Also, you will often need a referral from a primary care physician if you want to see a specialist.

With Original Medicare, there are no set networks. This means that you can see any doctor in the nation that takes Medicare patients. You also usually wont need any kind of referral in order to do so.

You May Like: Are Colostomy Bags Covered By Medicare

Surprising Benefits To Medicare Advantage Plans

Choosing a Medicare plan may be one of the most important decisions youll make as a mature adult. And it can be a little intimidating. While Original Medicare may seem safe and easy, you may find yourself missing out on some pretty valuable options only available through Medicare Advantage.

Here are just 4 of them.

Advantages And Disadvantages Of Medicare Advantage Plans

Medicare Advantage plans are an alternative to Medicare Part A and Part B. Medicare Advantage plans must cover at least the same benefits as Original Medicare.

One advantage of joining a Medicare Advantage plan is that some plans also cover things like prescription drugs and routine vision and dental care.

You can also choose from different types of Medicare Advantage plans, such as health maintenance organization plans and preferred provider organization plans, depending on where you live.

Some Medicare Advantage plans also offer $0 monthly premiums, and all Medicare Advantage plans include an annual out-of-pocket spending limit.

Find $0 premium Medicare Advantage plans in your area

Or call 1-800-557-6059TTY Users: 711 24/7 to speak with a licensed insurance agent.

Don’t Miss: Can You Get Medicare If You Retire At 62

What Is A Medicare Advantage Plan And Why Should I Buy It

A Medicare Advantage plan is a type of health plan offered by a private company that contracts with Medicare to provide you with all your Medicare Parts A and B benefits. MA plans include health maintenance organizations, preferred provider organizations, private fee-for-service plans, and Special Needs Plans.

Medicare Advantage In 202: Premiums Out

Medicare beneficiaries have the option of receiving their Part A and Part B Medicare benefits through a private Medicare Advantage plan. The federal government contracts with private insurers to provide Medicare benefits to enrollees, and plans are required to meet federal standards. For example, Medicare Advantage plans are required to provide an out-of-pocket limit, and may provide additional benefits or reduced cost sharing compared to traditional Medicare. They are also permitted to limit provider networks, and may require prior authorization for certain services, subject to federal standards. This brief provides information about Medicare Advantage plans in 2022, including premiums, cost sharing, out-of-pocket limits, supplemental benefits, prior authorization, and star ratings, as well as trends over time. A companion analysis examine trends in Medicare Advantage enrollment.

Also Check: How To Sign Up For Medicare And Tricare For Life