What Is The Average Cost Of Medicare Advantage Plans By State

As you can see in the chart below, the average cost of a Medicare Part C plan can vary significantly from one state to another.

In fact, plan prices and availability can vary by county or service area.

2021 Average Costs of Medicare Advantage Prescription Drug Plans| State | |

|---|---|

| 20% | $276.17 |

Working with a licensed insurance agent can help you find a plan in your area that suits your health care needs.

To shop for Medicare Advantage plans in your area or to learn more about the costs associated with this type of coverage, call today to speak with a licensed insurance agent. Or you can compare plans for free online.

Compare Medicare plan costs in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

1 MedicareAdvantage.com’s The Best States for Medicare in 2021 report. .

2 Digiacomo, Robert. Is dental insurance worth the cost? . Bankrate. Retrieved from https://www.bankrate.com/finance/insurance/dental-insurance-1.aspx.

When Does Permission To Contact Expire For Medicare Advantage Plans

Plans cannot market by approved methods for an upcoming plan year prior to Oct. 1. They are permitted to market for both the current and prospective years starting on Oct. 1, provided their marketing materials clearly indicate what plan year is being discussed. Approved marketing includes unsolicited marketing materials via traditional mail or email so long as there is an opt-out function. Unsolicited telephone calls to prospective enrollees are forbidden, as is text messaging, voicemail, door-to-door solicitation, and approaching you in a common area .

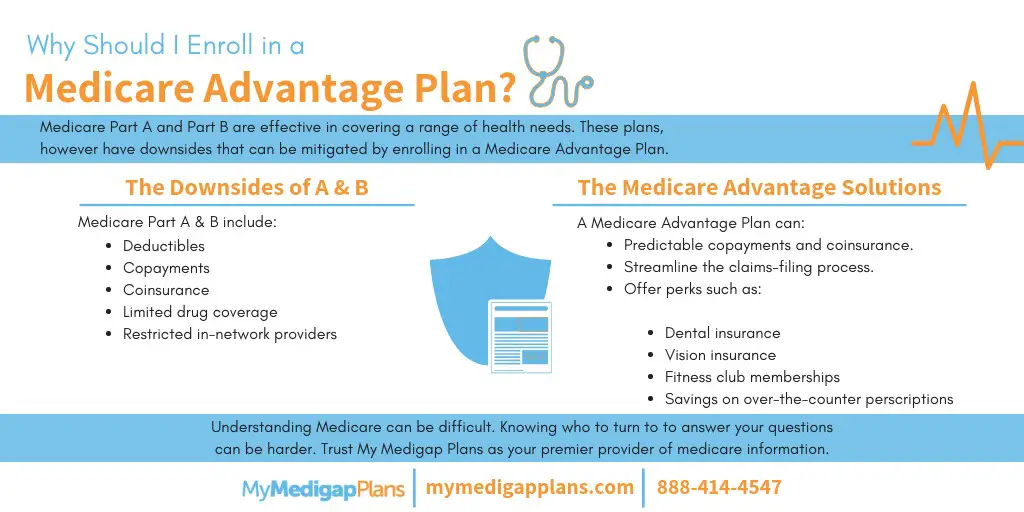

$0 Medicare Advantage Plans Arent Totally Free

Only your Part A Medicare is free. You will still need to pay for your Medicare Part B coverage, deductibles, copays and coinsurance.

Medicare Advantage plans are provided by private insurance companies. These companies are in business to make a profit. To offer $0 premium plans, they must make up their costs in other ways. They do this through the deductibles, copays and coinsurance.

Deductibles: Some deductibles can be high, depending on the plan you choose. If the plan quotes a $2,500 deductible, this means you must pay $2,500 out of pocket before Medicare Advantage pays your medical costs outside the hospital.

Copays: Keep in mind you must also pay copays for some medical services like X-rays, lab work and doctor visits. The copay may be as low as $10 to visit your primary care physician and $40 for specialty care.

Coinsurance: Your Medicare Advantage plan will often include coinsurance. Coinsurance usually kicks in for things like durable medical equipment, chemotherapy, radiation, dialysis and diagnostic imaging.

Read Also: What Does Medicare Part B Cover 2020

Who Is Eligible To Join Advantage Plans

If you live in the designated service area of the specific plan, and already have Part A and Part B , you may join a Medicare Advantage plan instead of Original Medicare . If you have union- or employer-sponsored insurance, you may be able to add an Advantage plan, but be forewarned that in some cases you may lose your employer or union coverage when you enroll in an Advantage plan.

Individuals with End-Stage Renal Disease were generally not eligible to enroll in Advantage plans prior to 2021 with the exception of Medicare Advantage ESRD Special Needs Plans, although these are not widely available. But this changed as of the 2021 plans year, as a result of the 21st Century Cures Act. Medicare Advantage plans are guaranteed-issue for all Medicare beneficiaries as of 2021, including those with ESRD.

You should know that if you enroll in a Medicare Advantage Plan, you will not need to purchase Medigap coverage, nor will you be able to buy it. If you already have Medigap coverage, you can keep the coverage , although it wont pay for Medicare Advantage out-of-pocket expenses, such as copayments and deductibles.

Best Medicare Advantage Providers Ratings

| Provider |

|---|

- Over-the-counter drug coverage

- Other services that promote health and wellness

You cant be enrolled in a Medicare Advantage plan and Original Medicare at the same time. To obtain Medicare benefits youve earned through payroll deductions before retirement, you must choose one of these plans.

During the open enrollment period, which runs from Oct.15 to Dec. 7 each year, you can join, switch or drop a plan for your coverage to begin on Jan. 1. If youre already enrolled in a Medicare Advantage plan, you can switch to a different Medicare Advantage plan or Original Medicare during the Medicare Advantage open enrollment period, which starts on Jan. 1 and ends on March 31 annually. You can only make one switch during that time period.

If youre already enrolled in Original Medicare , you may be eligible to switch to a Medicare Advantage plan . You must be at least 65 years old or have certain disabilities, such as permanent kidney failure or amyotrophic lateral sclerosis . If the Medicare Advantage plan you choose doesnt already have prescription drug coverage, you will have the option to enroll in Part D.

You May Like: How Soon Should You Sign Up For Medicare

When Can I Join Change Or Leave A Medicare Advantage Plan

You can join a Medicare Advantage plan when you first become eligible for Medicare.

If you are eligible for Medicare because of your age, then this includes the seven month period that starts three months before, and ends three months after the month in which you turn 65.

If you are eligible for Medicare because your are disabled, then this includes the seven month period that starts three months before, and ends three months after your 25th month of disability.

You can also join a Medicare Advantage plan, change plans, or drop your plan and return to original Medicare between October 15 – December 7. Your coverage will begin on the first day of the month after the plan receives your enrollment form.

Between January 1 – February 14, if you are already in a Medicare Advantage plan, you will be able to leave your plan and return to original Medicare. If you return to original Medicare during this period and you want to enroll in a Medicare Part-D prescription drug plan, you must enroll before the February 14 deadline.

In certain unusual situations, you may be able to switch plans at other times. For more information about joining and switching plans, visit www.medicare.gov on the web or call 1-800-MEDICARE to get help learning about and comparing plans in your area. TTY users should call 1-877-486-2048.

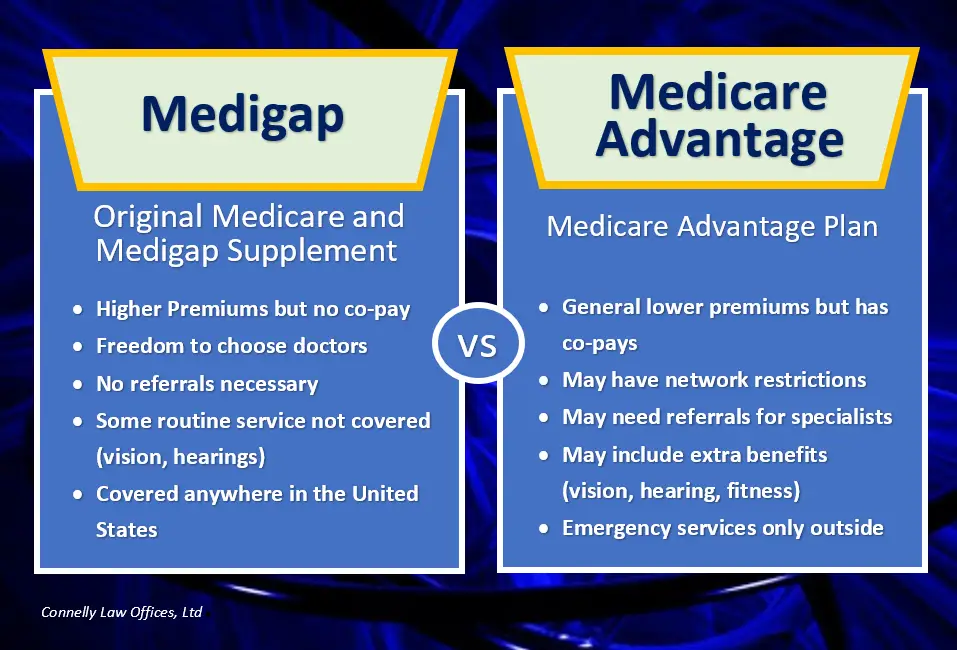

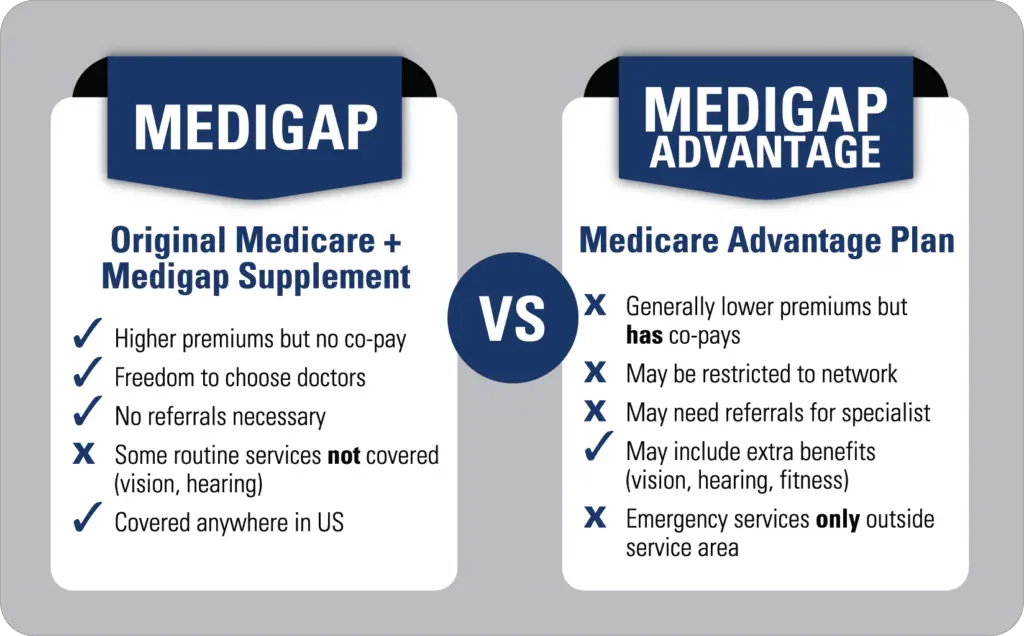

Medicare Supplement Insurance Plan Benefits

There are 10 Medigap insurance plans available in most states, and each plan type is designed by a different letter . Coverage is standardized across each plan letter, which means youll get the same basic benefits for Medicare Supplement coverage within the same letter category, no matter which insurance company you purchase from. However, even if basic benefits are the same across plans of the same letter category, premium costs may vary by insurance company and location. If you live in Massachusetts, Minnesota, or Wisconsin, keep in mind that these three states standardize their Medigap plans differently from the rest of the country.

Medigap plans cover out-of-pocket costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles. Some plans may help pay for other benefits Original Medicare doesnt cover, such as emergency health coverage outside of the country or the first three pints of blood. Medigap plans dont include prescription drug benefits. If you dont already have creditable prescription drug coverage , you should consider buying a separate stand-alone Medicare Part D Prescription Drug Plan to cover the costs of your prescription medications. Also, Medicare Supplement insurance plans generally dont offer extra benefits like routine dental, vision, or hearing coverage beyond whats already covered by Medicare.

You May Like: Does Aarp Medicare Supplement Plan Cover Silver Sneakers

Costs For Medicare Advantage Plans

What you pay in a Medicare Advantage Plan depends on several factors. In most cases, youll need to use health care providers who participate in the plans network. Some plans wont cover services from providers outside the plans network and service area. Learn about these factors and how to get cost details.

Don’t Give Personal Information To Plan Callers

Medicare plans aren’t allowed to call you to enroll you in a plan, unless you specifically ask to be called. Also, plans should never ask you for financial information, including credit card or bank account numbers, over the phone.

No one should call you without your permission, or come to your home uninvited to sell Medicare products. Call 1-800-MEDICARE to report a plan that does this. Learn more about how to prevent Medicare fraud and abuse.

Also Check: What Is The Difference Between Medigap Insurance And Medicare Advantage

How Are Medicare Advantage Plans Different From Other Medicare Options

With Original Medicare, your Medicare Part A and Part B benefits are managed by the government. Medicare Advantage plans are run by private insurance companies. The government pays the insurance companies to provide your Medicare services.

Medicare Advantage plans are available through many different types of insurance companies, and each state has different plans and providers. The best plan choice for someone else may not be ideal for you. However, youll have plenty of choices to choose the best plan for your unique situation.

Is Medicare Advantage Good Or Bad

Whether a Medicare Advantage plan is good for you will depend on your needs. If you are healthy and only visit the doctor for routine checkups, it may be a good idea. However, it may not be the best choice if you often travel outside of your providers coverage area or require frequent medical care.

Also Check: Which Cpap Machines Are Covered By Medicare

Small Networks Of Doctors

Medicare Advantage plans also come with much smaller networks of doctors compared to Medigap plans. Medigap will pay for all providers across the United States who accept Medicare assignment. Always check an Advantage plans provider directory before you enroll to confirm ALL your doctors are in the plans network.

Also, be aware that your doctor is free to leave the plans network at any time of the year. Unfortunately, you will still be stuck in that plan until the next Annual Enrollment Period. So, youll either need to pay 100% of your medical costs or find a new doctor in your plans network.

Why Medicare Advantage Plans Are Badbut Its Not What You Think

It is our opinion that Medicare Advantage Plans are bad because they are mostly improperly explained by the sales representatives.

There are a lot of moving parts to these Plans and when not thoroughly reviewed and discussed with the beneficiary, the outcome could be devastating to the member.

Thus, in these instances, the member believes he/she is enrolling in a plan that may be suitable. However, the unfortunate reality, is that the plan is not suitable for reasons like, accepting physicians, referrals may be required, prescription coverage and more.

Regardless of the reasons, we are here to set the record straight and share a non-biased opinion.

Our agency represents over 25+ top rated insurance carriers with a wide variety of Medicare products to suit your needs. Whether youre looking for a Humana HMO Gold Plus or United Health Care dual-complete plan, we have you covered and we are here to help you.

We strongly advise speaking to a professional Medicare agent prior to signing up for any Medicare plan. That way you can ensure you get the best plan for your individual needs and budget.

Need assistance choosing a Medicare Plan? We are here to help you every step of the way. Give us a call at 866-633-4427 to speak with a licensed agent today.

Also Check: How Can I Sign Up For Medicare Part D

Medicare Advantage Plan Annual Prices By Location

Most Medicare drug plans have a coverage gap called the donut hole, which means theres a temporary limit on what the drug plan will cover. A person gets limited coverage while in the donut hole. whether on a Medicare Advantage plan or a separate Part D plan, says Antinea Martin-Alexander, founder of Advocate Insurance Group in South Carolina. The individual will pay no more than 25% of the cost of the medication in the donut hole until a total out of $6,550 in out of pocket expenses is reached. There are different items that contribute to the out-of-pocket expenses while in the donut hole: any yearly drug deductible you may have, copays for any and all your medications, what the manufacturers discount is on that medication and what the insurance company pays for that medication, she says.

Medicare Advantage Plan Faqs

At first glance, a Medicare Advantage plan may seem like the best choice, but understanding its pros and cons is crucial to making the right decision for your needs. After all, you dont want to get stuck with high out-of-pocket health care costs. Review the most commonly asked questions about Medicare Advantage plans below to see if it is right for you.

Don’t Miss: Does Medicare Pay For A Registered Dietitian

What Does A Medicare Advantage Plan Cover

Medicare Advantage plans are sold by private insurance companies and are required by law to provide all of the same coverage included in Original Medicare .

In addition to those mandatory coverage requirements, Medicare Advantage plans may then provide some other benefits that are not covered by Original Medicare.

Coverage for prescription drugs, dental and vision care and free gym memberships are among the most attractive extra benefits found in Medicare Advantage plans, and these extra benefits are one reason why more than 40% of all Medicare beneficiaries are enrolled in a Medicare Advantage plan.

How Medicare Advantage Plans Work

Medicare Advantage plans also known as Medicare Part C are required to provide the same benefits as Medicare Part A, which covers hospitalization, and Medicare Part B, which covers doctors visits. Medicare Advantage plans also typically include Medicare Part D prescription drug coverage and may include benefits not covered by Medicare, providing some savings on routine dental care, eye exams and glasses, and hearing aids.

Also Check: Does Medicare Have A Maximum Out Of Pocket

What Else Should You Know About Free Medicare Advantage Plans

When signing up for a Medicare Advantage plan thats free , its important to calculate your out-of-pocket costs.

You should consider the following:

- The type of medical services you think youll need and how often you will need them.

- Whether the doctors or medical suppliers you use will accept Assignment. Assignment requires that they accept the Medicare-approved amount as full payment for covered services.

- Whether or not the Medicare Advantage plan provides additional benefits that may require you to pay an extra premium.

- Whether you are eligible for or getting Medicaid or assistance from your state for health care costs.

List Of Medicare Advantage Plans

A Medicare Advantage Plan is sometimes another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by Medicare-approved private companies that must follow the rules set out by Medicare. Most of the Medicare Advantage Plans include drug plans . In most cases, you may need to use health care providers that are in the network of the plan. Plans sometimes set a limit on what youll have to pay out-of-pocket each year for covered services. Some may offer non-emergency coverage out of the network but typically higher costs. Remember to use your Medicare Advantage Plan card to get your Medicare-covered services not your original Medicare Card. However, be sure to keep your red, white, and blue Medicare card in a safe place because youll need it if you ever switch back to Original Medicare.

Below are the most common types of Medicare Advantage Plans.

- Health Maintenance Organization Plans

For a list of Medicare Advantage Plans..go to

Medicare Advantage Plans Florida

Kentucky and Florida spotlight the diversity there can be from state to state and county to county within the state.

Also Check: Can You Sign Up For Medicare Part B Anytime

You May Like: Does Medicare Cover Family Counseling

Registered Nurse Types Required Skills Daily Tasks And More

What Is a Registered Nurse? A registered nurse is a licensed medical professional who offers hands-on care in several medical and community settings. Some of these settings: Hospitals Doctors offices Nursing homes Prisons Long-term care facilities Homes Other facilities In many ways, RNs form the backbone of the U.S. …

Why Compare Medicare Advantage Plans

Read Also: Does Medicare Cover Home Health Care After Surgery

Pros And Cons Of Original Medicare Vs Medicare Advantage Plans

|

Most doctors and hospitals in the United States accept Original Medicare. The federal government also limits how much health care providers can charge people on Medicare whether the doctors or hospitals participate in Medicare or not.

All Medicare Advantage plans must cover the same things Original Medicare covers. But Medicare Advantage plans may also cover other benefits such as hearing, vision, dental and prescription drug coverage.

Dont Leave Your Health to Chance

Dont Miss: Do Any Medicare Plans Cover Dental