There’s A Lot Of Good News For Seniors

Medicare’s annual open enrollment period is just around the corner. Between Oct. 15 and Dec. 7, seniors can make changes to their plans for 2023. But before you dive into the new options, it’s helpful to know about some big changes the government has made to the program for next year. Here are five to keep in mind.

Fact Sheetcontract Year 2024 Policy And Technical Changes To The Medicare Advantage And Medicare Prescription Drug Benefit Programs Proposed Rule

Background

On December 14, 2022, the Centers for Medicare & Medicaid Services issued a proposed rule that proposes revisions to regulations governing Medicare Advantage , the Medicare Prescription Drug Benefit , Medicare cost plans and Programs of All-Inclusive Care for the Elderly . The proposed rule includes policies that would improve beneficiary protections and shore up guardrails that help CMS work to best meet the needs of beneficiaries. In addition, the proposed policies would increase access to care, including behavioral health services, and promote equity in coverage and care. The proposed rule is informed by feedback from the approximately 4,000 responses received to the July 2022 MA request for information.

This fact sheet discusses the major provisions of the proposed rule. The proposed rule can be downloaded here: .

Enhancements to Medicare Advantage and Medicare Part D

Ensuring Timely Access to Care: Utilization Management Requirements

Protecting Beneficiaries: Marketing Requirements

Strengthening Quality: Star Ratings Program

AdvancingHealth Equity

Improving Access to Behavioral Health

Improving Drug Affordability and Access in Part D

Making Permanent: Limited Income Newly Eligible Transition Program

People With Esrd Can Join Medicare Advantage Plans

Under longstanding rules, Medicare Advantage plans used to be unavailable to people with end-stage renal disease unless there was an ESRD Special Needs Plan available in their area. But starting in 2021, Medicare Advantage plans are guaranteed issue for all Medicare beneficiaries, including those with ESRD. This is a result of the 21st Century Cures Act, which now gives people with ESRD access to any Medicare Advantage plan in their area.

Many people with ESRD will find that Original Medicare plus a Medigap plan and Medicare Part D plan is still the most economical option overall, in terms of the coverage provided. But in some states, people under 65 cannot enroll in guaranteed-issue Medigap plans, or can do so only with exorbitantly high premiums. And some of the states that do protect access to Medigap for most beneficiaries under 65 do not extend those protections to people with ESRD. Without supplemental coverage, there is no cap on out-of-pocket costs under Original Medicare.

Medicare Advantage plans do have a cap on out-of-pocket costs, as described below. So for ESRD beneficiaries who cannot obtain an affordable Medigap plan, a Medicare Advantage plan could be a viable solution, as long as the persons doctors and hospitals are in-network with the plan.

Read Also: Is Portable Oxygen Covered By Medicare

Big Changes To Medicare In 2023

Medicare plays a crucial role in providing health and financial security to nearly 63 million people in the United States. Those who use it can access essential health care services including physician services, hospital stays, and prescription drugs.

Right here in Texas, more than 14% of people have Medicare plans. Now that the federal government is making changes to Medicare, it is vital to understand how you may be affected.

Heres what you need to know about the upcoming changes to Medicare in 2023.

What is Medicare?

Medicare is a national insurance program that began in 1965 to serve people over 65 and younger disabled people. Medical bills and other healthcare services are paid for from a trust fund that is paid into via taxpayers. Those on Medicare pay part of their medical cost through hospital deductibles and other healthcare-related costs.

Medicare is broken down into four parts: Part A through Part D. Each part provides a different level of coverage or benefits for recipients. While Part A provides inpatient and hospital coverage, Part B provides outpatient and medical coverage.

Medicare Part C offers a different way to receive your Medicare benefits, while Part D provides coverage for your prescriptions.

Medicare vs Medicaid

Types of Medicare Plans

Medicare has different types of plans available for those who need them. For example. Medicare Advantage Plans are a common way to get Medicare Part A and B coverage.

Medicare Rules

Largest Part B Monthly Premium Ever

The Medicare beneficiaries are not happy with the increase in the Part B monthly premium that took place earlier in the year.

Let me remind you that Part B covers doctor visits and other outpatient services such as diagnostic screenings and lab tests. The monthly premium has increased to $170.10 for 2022, which is a $21.60 rise compared to the last year.

According to the officials, the leap couldnt have been avoided because of the following factors:

- COVID-19 care has taken a toll on the healthcare industry, causes health care prices to rise

- CMS was directed to start paying back the reduced premium starting this year.

- The new Alzheimers drug appeared on the market called Aduhelm. The CMS decided to set the money aside considering that the drug was to be covered by the Medicare plans. Initially, the annual price for Aduhelm was set at $56,000, but it was revised to $28,200 when the company faced pressure from health advocates.

Those who enrolled in Social Securitys annual cost of living adjustment will not have to worry too much about the increase. The social security beneficiaries enrolled in Medicare have their premium deducted from their monthly check. The part B premium increase will be somewhat offset by the 5.9 percent increase in COLA. However, not everyone is getting their Social Security benefits yet.

There was some opposition to this price increase earlier this year.

Read Also: What Is Traditional Medicare Plan

Limits On Insulin Costs

Beginning Jan. 1, 2023, all Medicare Part D and Medicare Advantage plans with prescription coverage will cap the cost of select insulin products at $35.

With this change, you’ll pay no more than $35 for a month’s supply of insulin.

Starting on July 1, people on Original Medicare who use an insulin pump will also pay no more than $35 for a month’s supply of insulin.

Are Part A Premiums Increasing In 2023

Roughly 1% of Medicare Part A enrollees pay premiums the rest get it for free based on their work history or a spouses work history. Part A premiums have trended upwards over time and theyre increasing again for 2023.

For 2023, the Part A premium for people with 30+ quarters of work history will be $278/month, up from $274/month in 2022. And for people with fewer than 30 quarters of work history, the premium for Part A will be $506/month in 2023, up from $499/month in 2022.

Also Check: Is Any Dental Covered By Medicare

What Is The Medicare Deductible For 2023

The annual Medicare Part B deductible has decreased in 2023 to $226, which is $7 less than last year. The standard Part B premium is lowered to $164.90 monthly, which is $5.20 less per month than before.

Medicare Part A is does not have a premium for most people. However, the premium does increase each year. In 2023, the Medicare Part A deductible will be $1,600 for each benefit period. That makes the increase $44 more than last year. But, those who buy into Medicare could pay a full Part A premium of $506 each month. And, those who paid 30-39 quarters could pay $278 per month.

The inpatient hospital benefit period costs are rising slightly for 2023. For days 1-60 beneficiaries will continue to pay $0 each day. Days 61-90 now cost $400 per day. Finally, for days 91 and beyond, youll pay $800 coinsurance for each day. Now, skilled nursing facility copayments also saw an increase days 21-100 cost $200 per day.

Four Key Changes In The Biden Administrations Final Rule On Medicare Enrollment And Eligibility

The Centers for Medicare & Medicaid Services issued a final rule on October 28, 2022 to implement several changes in Medicare enrollment and eligibility that were included in the Consolidated Appropriations Act of 2021 . These changes are designed to minimize gaps in coverage for people who sign up for Medicare and improve access to care by shortening the gap between Medicare enrollment and coverage creating new Special Enrollment Periods for individuals whose coverage would otherwise be delayed due to challenging circumstances, such as a natural disaster and extending coverage of immunosuppressive drugs for certain beneficiaries with end-stage renal disease who would otherwise lose coverage for these drugs after their kidney transplant.

This brief highlights four key changes related to Medicare enrollment and eligibility under the final rule, and summarizes the estimated impact of these provisions on coverage and costs. These provisions are expected to reduce gaps in coverage for people when they first sign up for Medicare, and have a negligible impact on Medicare spending, according to CMS estimates.

Figure 1: Summary of Four Key Changes in the Biden Administrations Final Rule on Medicare Enrollment and Eligibility

Read Also: What Is Medicare Fraud And Abuse

What Are The Medicare Part C Changes For 2021

Medicare Part C costs are variable and are set by the private plan carrier you choose.

Medicare Part C, or Medicare Advantage, combines the elements of Medicare Part A and Part B, plus additional services not covered under those two plans.

Since costs for these plans are set by private companies, not much changed this year at the federal level. However, there was one major change that goes into affect this year for people who have end stage renal disease .

Due to a law passed by Congress, people with ESRD are eligible to enroll in a broader range of Medicare Advantage plans in 2021. Before this law, most companies selling Medicare Advantage plans would not let you enroll or would limit you to a Chronic Condition SNP if you had a diagnosis of ESRD.

How Existing Beneficiaries Could Be Enrolled

If your primary care provider participates in an ACO, you could automatically be “aligned” with it. That occurs through a review of claims history by the CMS. You’d receive a letter informing you that your healthcare provider is part of an ACO opting out would require shifting to a doctor who is not part of an ACO. For many beneficiaries, that would be a damaging disruption in care and actually difficult to do in rural parts of the country where healthcare provider choices are limited.

Recommended Reading: Does Medicare And Medicaid Cover Dentures

Get The Scoop On Changes To Medicare Benefits For 2023

Let this Q& A shed light on how these updates will impact patients and reimbursement.

Every year Medicare makes changes, and you need to be aware of whats being revised year to year so you can modify how your eye care practice operates accordingly. To help you start the year off right, weve compiled a list of the most frequently asked questions on key changes for 2023, with answers from the experts.

Q: Did the Medicare Part B standard premium and deductible increase for 2023?

No. Part B costs are on the decline. Because Medicare Part B spending was lower than expected in 2022, there was a surplus left over that is being used to decrease premiums for 2023. The standard Part B premium dropped from $170.10 in 2022 to $164.90. This is the first year-over-year drop since 2012. Similarly, the Part B deductible has decreased for the first time in over a decade from $233 to $226 in 2023.

Q: Did Part A premiums, deductible, and coinsurance increase for 2023?

Yes. Part A premiums, which have trended upward over time, are increasing again. In fact, Part A premiums, deductible, and coinsurance all increase in 2023. For 2023, the Part A premium for people with 30-plus quarters of work history is $278/month, up from $274/month in 2022. And for people with fewer than 30 quarters of work history, the premium for Part A is $506/month in 2023, up from $499/ month in 2022.

Q: How are Medicare Advantage premiums changing for 2023?

5 Tips to Help Boost Your Practices Performance

The Final Rule Shortens The Gap Between Enrollment And Medicare Coverage For Beneficiaries Who Enroll During The General Enrollment Period

Policy prior to January 1, 2023

If an individual misses their Initial Enrollment Period for Medicare, they can enroll during the General Enrollment Period, which runs from January 1 to March 31 each year. Under the policy in effect until January 1, 2023, for individuals who enrolled at any point during the General Enrollment Period, Medicare coverage would begin on July 1, resulting in up to a six-month gap between Medicare enrollment and the start of coverage.

New policy

Individuals who sign up for Medicare at any point during the General Enrollment Period will be covered under Medicare the first day of the month after they sign up, rather than waiting until July 1.

Examples of how this new policy will affect Medicare coverage

Read Also: Is Medicare Plus Blue A Medicare Advantage Plan

Will Patients Have To Pay More

Most of the changes are to hospital-based procedures, where the MBS only covers part of the fee, with much of the rest covered by private health insurance, and the remainder as out-of-pocket payments for patients. Our recent Grattan Institute report shows only about one-quarter of in-hospital services are billed at the MBS fee:

The MBS rebate is, on average, just less than half the fee charged private insurers pay about 40% and the balance is the patient out-of-pocket fee.

What private health insurers are prepared to pay determines the size of any gap a patient has to pay.

The response of private health insurers to the new MBS items is crucial. Insurers will have no-gap and known-gap arrangements with surgeons, and all of these will need to be reviewed as a result of the MBS restructure in the three specialties.

Insurers should negotiate with specialists to ensure they recognise the MBS umpire has decided what the base MBS fee is and that specialists dont respond by increasing patients out-of-pocket expenses.

Indeed, insurers might use this opportunity to bring down excess fees, which is a core part of making the insurance product more attractive.

Each insurer will have their own separate process for doing this, and each will do it on their own timeline.

This will almost inevitably mean that patients will face increased out-of-pocket costs.

Contact

Cost Savings Through Medicare Advantage

The ACA gradually reduced costs by restructuring payments to Medicare Advantage, based on the fact that the government was spending more money per enrollee for Medicare Advantage than for Original Medicare. But implementing the cuts has been a bit of an uphill battle.

In 2011, the law froze the benchmark amount at 2010 levels for the maximum amount paid for MA plans in each county. Then, in 2012, the government began phasing in payment reductions to Medicare Advantage in an effort to bring Medicare Advantage spending in line with the fee-for-service program , although benchmark amounts could also increase based on plan quality.

For 2021, Medicare Advantage plans saw an increase in their reimbursement rates, as was the case in 2020, 2019, 2018, and 2017. And these increases came on the heels of similar increases in 2014, 2015, and 2016 despite the fact that in all three years, payment cuts had been proposed and then essentially reversed or off-set with payment increases.

However, insurers said that their average payment amounts decreased by about 6% in 2014, and by about 3 or 4% in 2015 clearly, not everyone agrees on the impact of the budgetary changes from one year to the next. And for 2020, the amount that Medicare Advantage plans received was based more on patient encounter data, which is a rule change that insurers did not want.

Don’t Miss: Can A New Immigrant Apply For Medicare

Medicare Changes Supported By Republicans

The most controversial change to Medicare has been promoted by two GOP senators. Sen. Rick Scott wants to require all federal programs, including Medicare and Social Security, to be put up for reauthorization by Congress every five years. Sen. Ron Johnson has called for annual approval of the two programs.

Neither of those ideas appears to have gained much traction with fellow Republicans. However, some Medicare proposals have picked up significant GOP support. The proposed 2023 budget put forward by the Republican Study Committee , which includes more than 150 current GOP representatives, features several Medicare reforms.

The biggest proposed Medicare change in the RSC’s budget is to align the eligibility age with the Social Security full retirement age. The RSC also wants to gradually increase the eligibility age by indexing it to life expectancy. This change would help ensure the solvency of the federal program, according to its proponents.

The RSC also would like to create an integrated “Fed plan” that includes all of the traditional benefits provided by Medicare Parts A, B, and D. This “Fed plan” would compete against private Medicare Advantage plans and stand-alone Part D prescription-drug plans on regional exchanges. Seniors would receive premium support, based on their income, to purchase the plan that suited them best.

Impact Of Taxes Medicare Premiums

While the COLA increase will be a welcome boost for Social Security’s roughly 70 million recipients, there are some implications to be aware of, Johnson noted.

The benefits hike could result in higher taxes for some recipients, for instance. Single taxpayers who receive more than $25,000 in retirement income need to pay taxes, while the threshold kicks in at $32,000 for married couples, according to the Social Security Administration.

The average Social Security benefit for 2023 will be below that amount, almost reaching $22,000 per single recipient next year. However, many seniors also have other sources of retirement income that could push them above the taxation threshold, especially after accounting for the 8.7% boost from their monthly benefit checks.

Of course, taxes are dependent on a number of variables, including the standard deduction, which is increasing in 2023 to reflect inflation, and every person’s tax situation will vary.

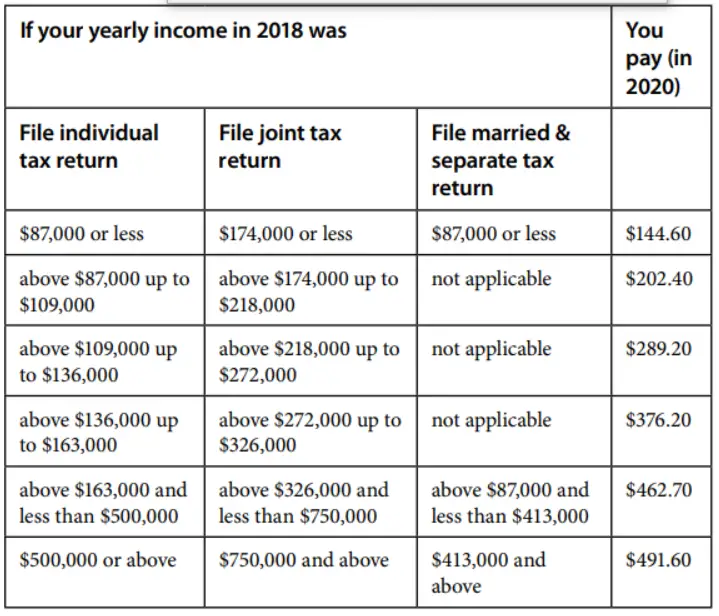

Another issue that seniors should be aware of is the impact of their higher Social Security benefits on Medicare premiums, Johnson said. This is mostly an issue that will impact higher-income seniors, since Medicare premiums work on a sliding scale based on income.

Read Also: How To Stop Medicare Calls