Medigap Plan Comparison In Massachusetts Minnesota And Wisconsin

In 47 of 50 states nationwide plus Washington, D.C. Medigap plans are standardized using the lettered naming convention we describe above. However, that is not the case in Massachusetts, Minnesota, and Wisconsin. These three states have unique Medigap plans that are only available in each.

Even though the plans are only available in their respective state, they still offer comparable benefits to the most popular Medigap plans and beneficiaries can use them with Medicare-accepting practitioners nationwide, just like a standardized Medigap plan in any other state.

- Was this article helpful ?

Disclaimer: By clicking the button above, you consent to receive emails, text messages and/or phone calls via automated telephone dialing system or by artificial/pre-recorded message from representatives or licensed insurance agents of Elite Insurance Partners LLC, its affiliates or third-party partners at the email address and telephone number provided, including your wireless number , regarding Medicare Supplement Insurance, Medicare Advantage, Medicare Part D and/or other insurance plans. Your consent is not a condition of purchase and you may revoke your consent at any time. This program is subject to our Privacy Policy and Terms of Use. This website is not connected with the federal government or the federal Medicare program.

Top 4 Medigap Carriers

When researching Medigap carriers, its important to take into consideration their rate increase history, current ratings through AM Best, and the overall history of the company. Yes, benefits remain the same from carrier to carrier when it comes to Medigap plans, but the best carrier may not be the one with the lowest premium.

This is another way a Medicare agent can help. They can provide you a simple-to-understand comparison of all the carriers side by side to help you make the best decision.

Why Is Medicare Plan F Being Phased Out

Although Plan F is the most popular Medigap plan, that is likely to change in coming years. Federal legislation passed in 2019 changed the eligibility rules for Plan F and Plan C, making them only available to those who became eligible for Medicare before January 1, 2020.

The reason for the change was to end Medigap coverage of the Part B deductible, for which Plan F and Plan C are the only Medigap plans to provide coverage. The rationale is that if a beneficiary does not have to pay anything out-of-pocket to see a doctor, they might visit the doctor for every minor issue and further overwhelm the health care system by virtue of over-utilization.

Stripping away coverage of the Part B deductible forces all beneficiaries to be more invested in their coverage, which may make beneficiaries think twice about making a doctors appointment for small health issues.

You May Like: Does Medicare Cover In Home Help

Learn About Medicare Supplement Plans Available Where You Live

TTY 711, 24/7

1 Freed M. et al. . Medicare Advantage 2022 Spotlight: First Look. Kaiser Family Foundation. https://www.kff.org/medicare/issue-brief/medicare-advantage-2022-spotlight-first-look.

2 AHIP. . State of Medigap: Trends in Enrollment and Demographics. Retrieved from https://www.ahip.org/wp-content/uploads/AHIP_State_of_Medigap-2020.pdf.

3 MedicareAdvantage.com’s The Best States for Medicare report. .

4 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

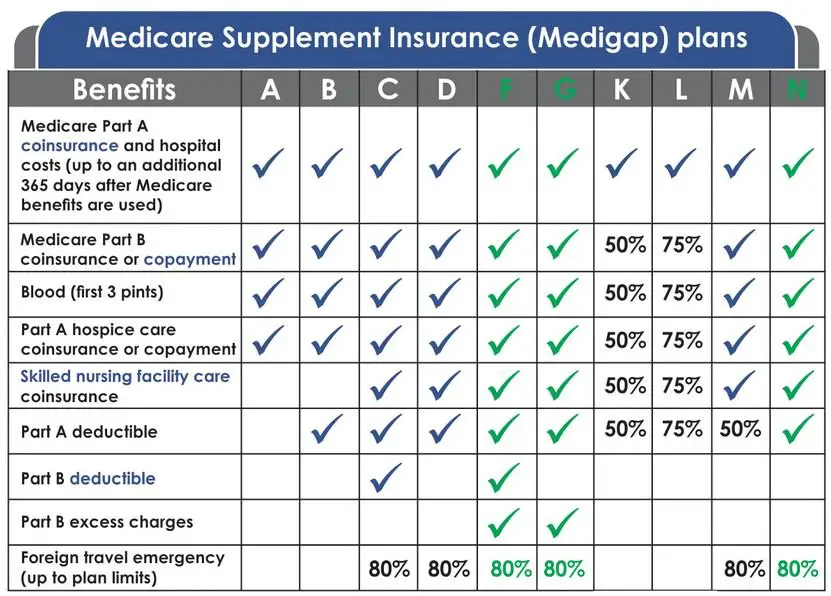

How To Choose The Best Medicare Supplement Plan

The best Medicare Supplement plan for you will depend on which policy provides the best benefits for your medical needs and fills in the coverage gaps where you expect to spend the most on health care.

For example, if you need skilled nursing coverage or want more protection for foreign travel emergencies, then consider how well each plan covers those categories of care. If you expect to need hospital care, a plan that pays for the Medicare Part A deductible can help protect you from a large hospital bill.

Say you need surgery in the upcoming year. For the 2022 plan year, the Medicare Part A deductible is $1,556. Some Medicare Supplement policies, such as Plan A, provide no coverage for this deductible. Therefore, you would be responsible for paying the entire $1,556 out of pocket before your Original Medicare coverage would kick in.

On the other hand, if you choose Medigap Plan G, the $1,556 deductible would be fully covered by your Supplement policy. This means you would begin having your claims covered immediately, rather than first having out-of-pocket costs for medical care. However, you should also consider the cost of the plan since Plan G can be more expensive than Plan A.

It is for this reason that you should carefully analyze what each Medigap plan covers and costs so that you can choose the best one for your situation. Often, there is an ideal supplemental policy for your health care needs.

Also Check: Is It Medicaid Or Medicare

Can You Enroll In Medicare Supplement Plan F Insurance

Medicare Supplement Plan F is no longer available to people newly eligible for Medicare. You had to be eligible to enroll in Medicare before January 1, 2020, to purchase a policy.

You may be able to apply for a Medicare supplement policy if you were eligible for Medicare before January 1, 2020, and if a company offers the plan. Insurance companies do not have to sell all Medigap policies.

People who had a Medicare Supplement Plan F prior to the phase out can generally keep their plan.

Medigap Plan G now provides the most comparable level of benefits to Medicare Supplement Plan F.

Medigap Plan G also offers a high-deductible version in some states. You have to pay $2,490 in out-of-pocket costs before Plan G pays anything in 2022.

Eight Medigap plans are currently available, but none cover your Medicare Part B deductible. You should compare all available Medicare Supplement plans in your area to determine the best one for your health and financial needs before purchasing one.

You Can’t Have Both So You Must Choose Wisely

Consumer ReportsOncology TimesMEDICAThe New York Times MagazinePsychology TodaySports Illustrated

Our editors independently research and recommend the best products and services. You can learn more about our independent review process and partners in our advertiser disclosure. We may receive commissions on purchases made from our chosen links.

Anyone who’s ready to sign up for Medicare has a lot of decisions to make. But one decision is especially importantshould you choose Medicare Advantage or use Medigap to supplement your Original Medicare plan?

You May Like: Does Medicare Cover Long Term Health Care

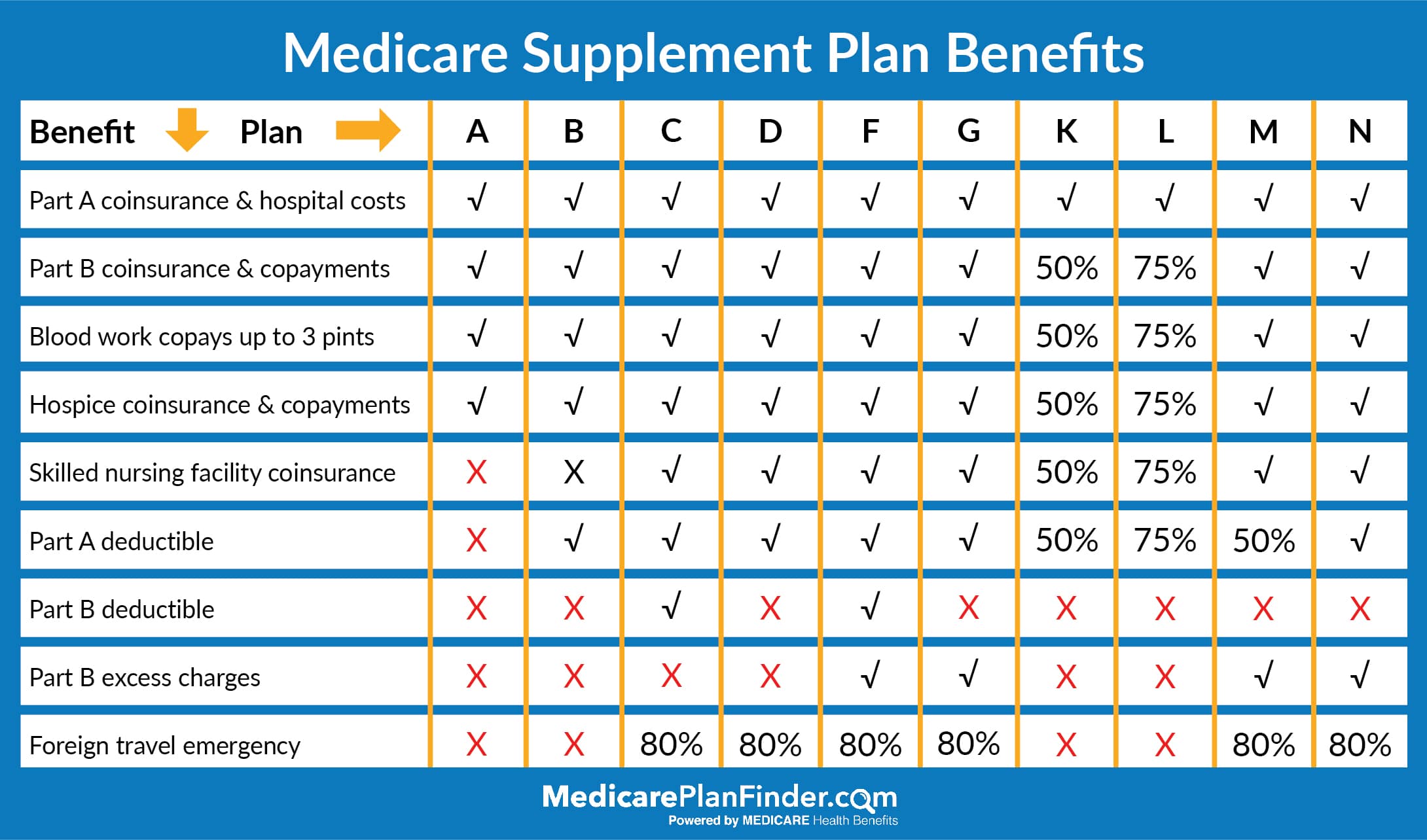

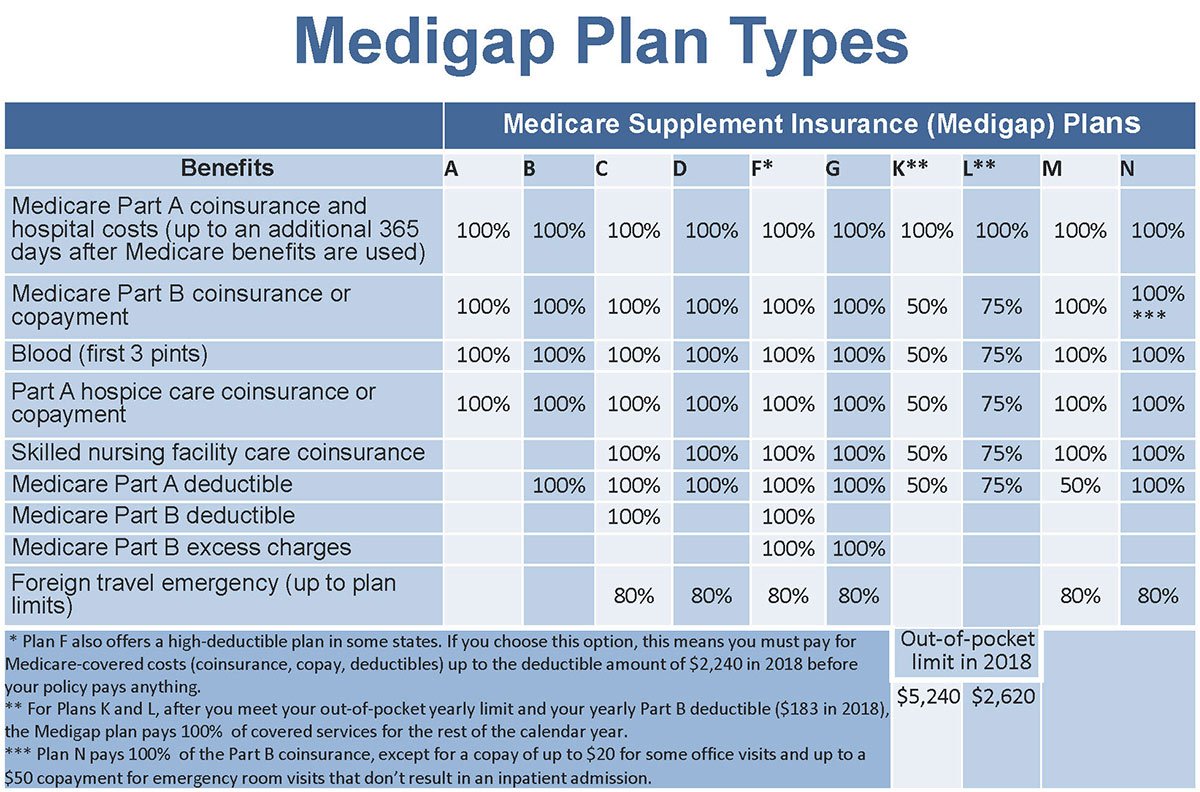

Medicare Supplement Plans Comparison Chart For 2022

Dont confuse Medigap Plan A and Medigap Plan B with Medicare Parts A and B. Original Medicare includes Medicare Part A, which is inpatient hospital coverage, and Medicare Part B, which covers outpatient physician visits. Medigap Plans A and Plan B are supplemental insurance to cover the costs Original Medicare leaves behind.

No matter which Medigap plan you choose to enroll in, you can use the plan at any doctor or hospital nationwide that accepts Original Medicare. A Medicare-accepting doctor can never turn you away because of the carrier you choose for your Medigap plan.

What Are The Costs For Medicare Supplement Plans

Medicare Supplement Insurance plan premiums are sold by private insurance companies. This means that plan availability and plan premiums may vary.

The average premium cost for a Medicare Supplement Insurance plan in 2018 was $152 per month.1

The average cost of each type of Medigap plan can vary quite a bit from one plan type to another. Each type of Medigap plan offers a different combination of standardized benefits, which means that plans with fewer benefits may offer lower premiums.

Your age, gender, smoking status, health and the location where you live can all also affect the average cost of Medigap plans near you.

Also Check: Does Medicare Cover Cell Phones

What Is Medicare Plan F

Medicare Plan F is a supplemental Medigap health insurance plan that is offered to individuals who are disabled or over the age of 65. Known better as simply Plan F, the policy is the most comprehensive of the 10 Medigap plans offered in each state. Plan F is a supplemental policy to the standard Medicare parts A and B plans and can fill many of the gaps of standard Medicare policy and provide broader assistance with out-of-pocket costs. However, not all health insurance gaps will be covered by Plan F.

Recommended Reading: Does Medicare Pay For A Portable Oxygen Concentrator

Medicare Supplement Plan G Vs Plan N: What Is The Difference

Medicare Supplement insurance can help you cover the gaps in Medicare, but many people have difficulty deciding which plan is right for them. If youre unsure which plan to choose, you arent alone. Fortunately, Medicare Supplement Plan G and Medicare Supplement Plan N, two of the most popular plans, are relatively simple to compare. Their coverage varies in two ways from each other, and these differences may be enough to help you make your decision.

Read Also: Which Is Better Medicare Supplement Or Medicare Advantage

Hypothetical Medicare Supplement Premium

- Premium for Plan G: $95.00 per month

- + Medicare Part B premium base rate: $170.10 per month

- + Medicare Part B annual deductible: $233

Total: $3,414.20 per year.2

Plan G covers all of your medical expenses at 100%, except the Part B deductible. So you can expect this to be your total annual cost.

Example 2: Plan G High-Deductible

- Premium for Plan G high-deductible: $20.00 per month

- + Medicare Part B premium base rate: $170.10 per month

- + Medicare Part B deductible: $233

Total: $2,514.20 per year.3

This is your best case scenario, which means you only pay the monthly premium assuming no other out-of-pocket medical expenses if you do not utilize medical services.

Your worst case scenario:

- $2,514.50 premium and Part B deductible

- + $2,490 annual high deductible

Total: $5,004.20 per year.

Comparison: Example 2 costs $1,590more over the course of a year if you meet the deductible. However, Example 1 will cost you $924.20 more in premium if you dont use any services or your medical needs are minimal.

In this example, you might want to consider taking the Plan G high-deductible option if you are healthy.

Why? Because you could save just over $900 a year if you have a good year. Over multiple good years, the savings could add up.

But the math flips if your health changes for the worse. In that case, you could find yourself paying the high deductible for multiple years. And in some states, you wont be able to change plans because you may not pass medical underwriting.

Blue Cross Blue Shield

Blue Cross Blue Shield is among the leading health insurance carriers in the U.S., and BCBS companies were the very first to work in conjunction with Medicare.

There are now 36 different locally operated BCBS companies administering coverage in all 50 states.

Blue Cross Blue Shield offers several Medigap plans, including Plan F, Plan G and Plan N.

Plan availability may vary, depending on where you live.

Learn more about Blue Cross Blue Shield Medicare Supplement plans by visiting MedicareSupplement.com.

Don’t Miss: How Much Do I Have To Pay For Medicare

The Cares Act Of 2020

On March 27, 2020, President Trump signed a $2 trillion coronavirus emergency stimulus package, called the CARES Act, into law. It expanded Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increased flexibility for Medicare to cover telehealth services.

- Increased Medicare payments for COVID-19-related hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarified that non-expansion states can use the Medicaid program to cover COVID-19-related services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

Do not pay a Medicare broker directly for their assistance. They are paid by the insurance company to sell their insurance. If you suspect Medicare Advantage fraud, please call the Medicare Drug Integrity Contractor at 1-877-772-3379.

Top Rated Medicare Supplement Insurance Companies

When seniors choose a top-rated insurance company, they are choosing the best company based on several attributes such as competitive pricing, plan selection, and customer and claim service.

In reality, the top five Medicare Supplement providers will change year over year as far as position but the top companies will generally remain in the top 5 years after year.

Here are our top Medicare Supplement insurance companies in no particular order:

Read Also: When Can I Start Medicare Part B

Guide To Medicare Supplement

To purchase Medicare Supplement Insurance you must be enrolled in Medicare Part A and Part B. Medicare Supplement Insurance provides coverage for gaps in medical costs not covered by Medicare. Medicare Supplement plans are standardized and offer various benefits to help offset your healthcare cost.

The California Department of Insurance regulates Medicare Supplement policies underwritten by licensed insurance companies. The CDI assists consumers in resolving complaints and disputes concerning premium rates, claims handling, and many other problems with agents or companies. The Consumer Hotline 800-927-4357 is serviced by experienced professionals who will answer your questions, or assist you in filing a complaint.

To find information on Medicare Supplement Insurance, the names of companies authorized to sell it and compare premiums, please visit our Guide to Medicare Supplement page.

Which One Is Better

Both Medicare Advantage and Medigap provide advantages and disadvantages.

Some advantages of Medicare Advantage include:

- More coverage and benefits, which can include services like gym memberships, long-term care, and disability equipment

- Lower premiums

- An all-in-one plan which covers Medicare Part A, B, and D

Some disadvantages of Medicare Advantage include:

- Having to make sure your preferred provider is in your plan

- No coverage while traveling

- A likelihood of higher out-of-pocket and emergency costs

Some advantages of Medigap plans include:

- Fewer out-of-pocket expenses

- Access to all providers who accept Medicare

- Coverage while traveling overseas

Some disadvantages of Medigap plans include:

- Higher monthly premiums

- Having to navigate the different types of plans

- No prescription coverage

Read Also: Is Silver Sneakers Part Of Medicare

Medicare Supplement Plans Comparison Chart

Perhaps youve begun this search already, and youve come across the Medicare Supplement Plans comparison chart shown below.

Lets cover the chart for a moment and Ill explain how to read it as it can be a tad confusing.

Then well dive into those most popular plans.

View the Plans

This is going to be very helpful to you if youre new to Medicare.

Now, on the left-hand side of the chart youve got a list of benefits that the various plans will be covering, and at the top is a list of Medicare supplement plans A through N.

You will see that there are a few letters missing. The reason is Medicare eliminated a few letters over the years. Plans I and J are gone, and they added M and N in as well.

So each of these checkmarks simply means that this particular plan letter covers the benefit in the column on the right.

As you can see, Plan A has a lot of white squares in there that it doesnt cover. Very few people enroll in Plan A, except if youre under 65 and you did qualify for Medicare, sometimes certain states only offer that Plan.

Can You Change From A Medicare Advantage Plan To A Medicare Supplement Plan

During the Annual Enrollment Period, which runs from October 15 to December 7 each year, you are free to reconsider your Medicare coverage. If you decide you want to try a Medicare Supplement plan vs. Medicare Advantage plan, you can make that change during this period.4

Considering Medicare Advantage vs. Medicare Supplement? One is not better than the other. They provide different types of coverage. Finding the right fit for you depends on what kind of Medicare coverage youre seeking, as well as your health care needs. Review all details of plans when shopping and be open to considering alternatives when your needs change.

You May Like: Do You Have To Pay For Part B Medicare

Medigap Plans Work Alongside Original Medicare

Medicare Supplement Insurance plans help cover certain Medicare out-of-pocket costs, such as deductibles, coinsurance, copays and other fees.

There are 10 standardized Medigap plans in most states, and each provides its own level of coverage. A licensed insurance agent can help you find Medigap plans in your area and get you enrolled in one that works for you.

Mutual Of Omaha Medicare Supplement Plans

United Health Medicare supplement

AARP Medicare Supplement Plans are available through United Healthcare. They offer protection from the gaps in the traditional Medicare system like copays and deductibles, which is especially important for people with low incomes. These plans are designed to help fulfill AARPs mission: empowering people to choose how they live as they age

Seniors can easily compare pricing and get all of the pertinent information to discover if a United Health Medicare Supplement Plan is the best fit for your circumstances and budget, by calling us at

Aetna Medicare Supplement Plans are designed to help with costs that Original Medicare doesnt cover.

There are ten different Medicare supplemental Insurance Programs that are listed from A to N. Of these plans Aetna offers Medicare Supplement plan A, plan B, plan G, plan N, plan F, and the high deductible Plan F.

Additionally, Aetna is one of the few companies that offers a discount when both the husband and spouse have an Aetna Medicare Supplement plan.

If youre looking for a comparison of Medicare Supplement Plans, call us to learn about the best option for your location, circumstances, and budget. Were unbiased and well help you find the plan that works best for you.

View Mediagap Quotes-Enter Your Zip Code:

View Mediagap Quotes-Enter Your Zip Code:

There are many reasons to choose Cigna as your Medicare Supplement provider, but here are three that are very important:

Recommended Reading: Does Medicare Pay For A Portable Oxygen Concentrator