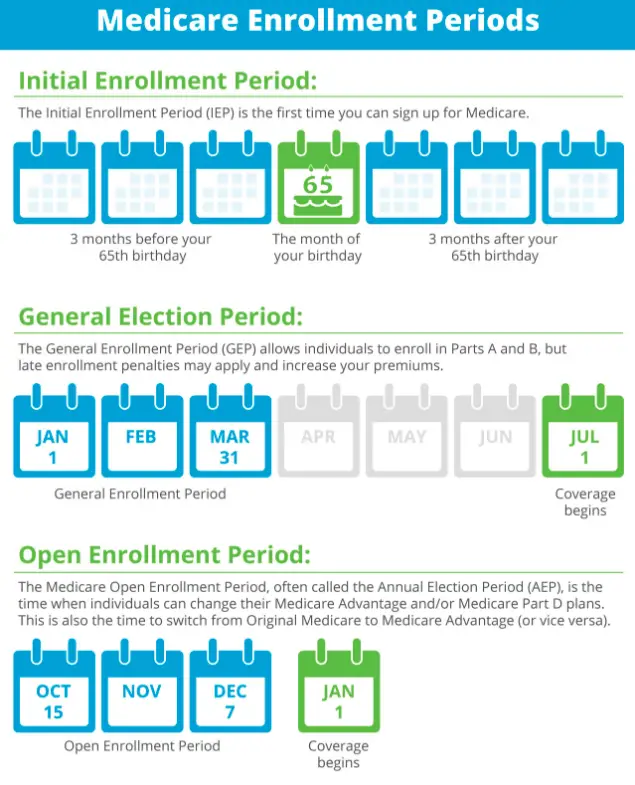

When You First Get Medicare

- I’m newly eligible for Medicare because I turned 65.

-

What can I do?

Sign up for a Medicare Advantage Plan and/or a Medicare drug plan.

When?

During the 7-month period that:

- Starts 3 months before the month you turn 65

- Includes the month you turn 65

- Ends 3 months after the month you turn 65

If you join

Disenrollment From Your First Medicare Advantage Plan

If you enrolled in a Medicare Advantage plan when you first became eligible for Medicare, you have 12 months to disenroll from the plan and transition back to Original Medicare.

If you dropped a Medicare Supplement Insurance plan to enroll in a Medicare Advantage plan but wish to revert back again, you have 12 months to do so .

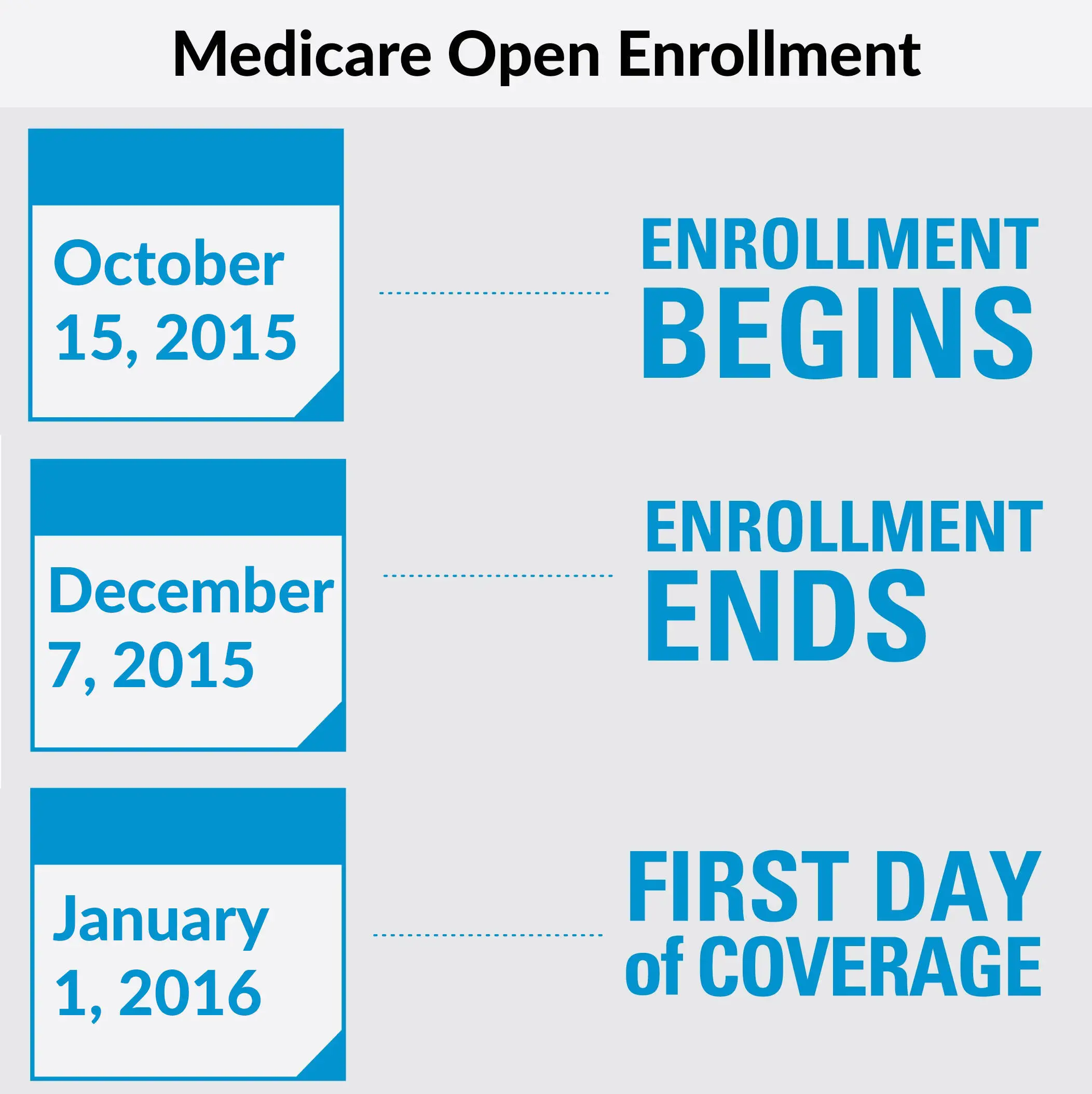

When Is The Open Enrollment Period For Medicare

The Medicare Open Enrollment period runs from October 15 through December 7 each year. During this period, people on Medicare can make a change in their coverage. If you are covered by Medicare, and you are interested in reviewing and comparing your Medicare coverage options, make sure the plans you are considering during the Medicare Open Enrollment period are Medicare plans, not Marketplace plans. Medicare plans are not sold through the federal or state Marketplace websites. You can review and compare your Medicare options on the Medicare Plan Finder, a searchable tool on the Medicare.gov website, or by calling 1-800-MEDICARE . You can also contact the State Health Insurance Assistance Program in your state. SHIPs offer local, personalized counseling and assistance to people with Medicare and their families. You can call 877-839-2675 to get the phone number for the SHIP in your state.

Recommended Reading: How Much Is Medicare Supplement Plan F

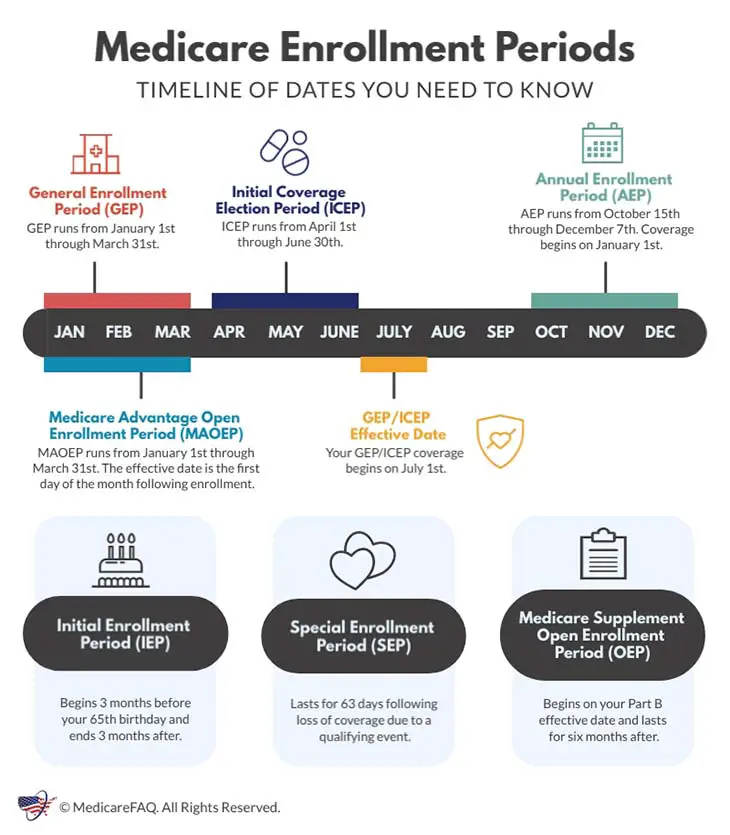

General Enrollment Period For Those Who Delay Medicare Coverage

Suppose you do not enroll in Original Medicare during your Initial Enrollment Period and do not have creditable coverage in place. In this case, you will need to wait until the General Enrollment Period to enroll in Original Medicare.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

The General Enrollment Period runs annually from January 1 to March 31. When you enroll during this time, your coverage will go into effect on July 1.

Keep in mind, when you enroll in Original Medicare during the General Enrollment Period, you may be responsible for paying late enrollment fees. This depends on how long you delayed Medicare benefits without creditable coverage. Creditable coverage is health insurance that provides at least equal benefits to Original Medicare. We recommend that you enroll in Medicare coverage as soon as you are eligible or lose creditable coverage to avoid paying the late enrollment penalty.

‘exceptional Circumstances’ May Offer Flexibility

Starting next year, individuals may be able to sign up outside of current enrollment periods if they have “exceptional circumstances.” This is already a flexibility available with Part D, as well as Medicare Advantage Plans , Schwarz said.

“It’s really designed to provide relief for people who are impacted by exceptional situations and need access to health insurance,” she said.

Additionally, beneficiaries who qualify for the special enrollment period will not face Part B late enrollment penalties.

Until this rule change, the only way to qualify was if a government official provided bad information or made a mistake that caused you not to enroll.

“There are situations where people make mistakes,” Schwarz said. “So these rules allow some flexibility.”

Some qualifying circumstances could include an employer providing inaccurate information about Medicare enrollment, or they were in a situation where it was impossible or impractical to enroll, such as being in a natural disaster or incarcerated.

Don’t Miss: Does Medicare Cover Cpap Cleaner

Medicare Part D Prescription Drug Plan Enrollment

When youre eligible to enroll in Original Medicare, you also become eligible to enroll in a Medicare Part D prescription drug plan.

If you want Medicare prescription drug coverage, you typically have two options:

- Enroll in a Medicare Advantage plan that includes prescription drug coverage

- Enroll in a Medicare Part D standalone prescription drug plan

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent.

You can also enroll in a prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.1

Signup Rules For Medicare Can Be Confusing

Medicare’s enrollment rules can be confusing at best and costly at worst, experts say.

For people who tap Social Security before age 65, enrollment in Medicare is automatic when they reach that eligibility age.

Otherwise, you are required to sign up during your “initial enrollment period” when you hit age 65 unless you meet an exception, such as having qualifying health insurance through a large employer .

Don’t Miss: Does Medicare Pay For Hospital Beds At Home

What Is The Medicare Special Enrollment Period

There are actually two kinds of Medicare Special Enrollment Periods. A Medicare Special Enrollment Period allows you to switch plans or sign up for Medicare outside of the standard Medicare enrollment periods.

- Special Enrollment Period Qualifying Life Events: 2 months

- Special Enrollment Period Working Past 65: 8 months

If you have Medicare: For people who already have Medicare and who experience a qualifying life event, there is a two-month Special Enrollment Period for switching a Medicare Advantage or Part D plan.

If you dont yet have Medicare: For people who qualified to delay Medicare because they had creditable coverage usually from an employer there is an 8-month Special Enrollment Period for enrolling in Medicare Parts A, B, C and D.

Lets look at each closely.

What Happens If You Miss Open Enrollment For Health Insurance At Work

Usually, you’ll be enrolled in the same plan you had and you won’t be given an opportunity to make changes until the next open enrollment period unless you become eligible for a special enrollment period.

But when it comes to your Flexible Spending Account, the tax-free money you can set aside to pay for medical expenses if you have job-based health insurance, you may not automatically have the same funds available if you do nothing during open enrollment.

You May Like: What Is A Medicare Card

Option : Join A Medicare Advantage Plan

For an all-in-one plan that offers comprehensive coverage, many choose a Medicare Advantage plan. These plans cover all the things Original Medicare covers, plus the 20 percent of medical costs that it doesnt. In addition, many Medicare Advantage plans include Part D prescription drug coverage and valuable extras like dental and vision benefits at no extra cost.

Also, some Medicare Advantage plans, like BayCarePlus , offer $0 premiums and low copays. They also include a built-in safety net that puts a limit on the amount youll have to pay out of your own pocket each year.

When Can I Enroll In Medicare Part D

The first opportunity for Medicare Part D sign up is when youre initially eligible for Medicare during the seven-month period beginning three months before the month you turn 65, or during the seven-month period beginning three months before your 25th month of disability.

In both of these cases whether youre turning 65 or are eligible for Medicare because of a disability you likely have the option of selecting a Medicare Advantage plan that includes Part D prescription drug coverage, and using that in place of Medicare A, B, and D.

If you enroll in Medicare during the , you can enroll in a Medicare Advantage plan between April 1 and June 30. But if you already had premium-free Medicare Part A and youre just using the General Enrollment Period to sign up for Part B, youll have to wait until the fall open enrollment period to sign up for a stand-alone Part D plan. This is because Part D can be purchased when you have Part A or Part B, whereas Medicare Advantage requires you to have both. So if youve already had premium-free Part A, you were eligible for Part D as of when your Part A coverage took effect. But your eligibility for Medicare Advantage would only begin when youre enrolled in both Part A and Part B.

If youre enrolled in a Medicare Advantage plan and use the Medicare Advantage open enrollment period to switch to Original Medicare, youll also have the option to sign up for a Part D plan to supplement your Original Medicare coverage.

Read Also: Do You Need A Medicare Supplement

Medicare Open Enrollment Period

There are several different Open Enrollment Periods when it comes to Medicare. Those include:

For clarification, enrollment and election are used interchangeably. Youre not voting for anything youre electing to enroll in specific forms of coverage.

Some of these periods will occur only once in your lifetime and if you miss them, you could be in trouble. Other periods happen annually, so if you arent happy with your coverage, you wont have to wait too long to change it.

When Does A Special Enrollment Period Start

The beginning and end dates of your Special Enrollment Period will differ from one qualifying scenario to the next.

If you have a particular situation that prevented you from enrolling in any type of Medicare coverage for which you were eligible, you are encouraged to call 1-800-MEDICARE and request a Special Enrollment Period.

You May Like: Does Medicare Cover Nursing Home Care

Special Enrollment Period Sep For Those Enrolled In Medicare Advantage Or Prescription Drug Plans

If you have special circumstances in your life, , you may qualify for a Medicare SEP to change your Medicare Advantage or Part D plan coverage. The special enrollment period options and length will be different for each circumstance.

For example, you could qualify for an SEP if you:

- Retire from a job after age 65

- Have your Medicare plan terminated by the insurer

- Lose other medical or drug coverage

To learn more about Medicare SEPs, check out our guide on special enrollment periods.

Whats The Medicare Open Enrollment Period

Medicare health and drug plans can make changes each yearthings like cost, coverage, and what providers and pharmacies are in their networks. October 15 to December 7 is when all people with Medicare can change their Medicare health plans and prescription drug coverage for the following year to better meet their needs.

Don’t Miss: Is Prolia Covered By Medicare Part B Or Part D

Enrolling Dropping Or Switching Medicare Advantage Or Medicare Drug Plans Annual Enrollment Period

The next most widely utilized enrollment period is the Annual Enrollment Period, which takes place from October 15 to December 7 each year .

This enrollment period commonly referred to as AEP or open enrollment only involves beneficiaries who wish to add, drop or switch private Medicare Advantage or Medicare Part D prescription drug plans.

In other words, this enrollment period is not focused on beneficiaries enrolling for the first time in Original Medicare . Remember, your initial Medicare enrollment is based on when you turn 65.

Medicare Enrollment Periods Chart

This chart can help you understand Medicare open enrollment vs annual enrollment, along with special enrollment periods.

| Medicare Annual Enrollment | Medicare Advantage Open Enrollment | Medicare Advantage & Part D Special Enrollment |

|---|---|---|

| Start Date | When a qualifying even occurs | |

| End Date | ||

| Any Medicare beneficiary can make any changes | Medicare Advantage enrollees only, limited changes | Details depend on the qualifying event |

You May Like: When Can I Start Collecting Medicare Benefits

Changing Medicare Advantage Plans Or Part D Plans Outside Of Open Enrollment

Many Medicare beneficiaries enroll in a Medicare Advantage plan or a Medicare Part D prescription drug plan during the Medicare Open Enrollment Period for Medicare Advantage and prescription drug plans.

During this period , you can make a number of coverage changes:

- You can change from one Medicare Advantage plan to another, whether or not either plan includes prescription drug coverage.

- You can disenroll from your Medicare Advantage plan and switch back to Original Medicare .

- If you switch back to Original Medicare during this period, you can join a Medicare Part D prescription drug plan.

If you dont enroll in a Medicare plan during this annual period, you may qualify for a Special Enrollment Period.

There are many ways to qualify for a Medicare Advantage Special Enrollment Period or a Medicare Part D Special Enrollment Period.

Some of the situations that may qualify you for one of these types of Special Enrollment Periods include:

The above list does not necessarily include every and all qualifications for a Special Enrollment Period.

Million Are Enrolled In Advantage Plans

Fall open enrollment touches most beneficiaries in one way or another due to the coverage they select. For instance, of Medicare’s 64.5 million beneficiaries , roughly 29 million choose to get their Parts A and B benefits delivered through Advantage Plans, which are likely to include prescription drug coverage. Another 20.5 million or so have standalone Part D plans.

Also be aware that the upcoming enrollment period is not related to Medicare supplement plans, aka “Medigap,” which have separate rules for enrolling

Generally, unless you live in a state whose rules differ or you meet an exception, you get a six-month window when you first enroll in Part B to purchase Medigap without having to answer health questions and potentially be penalized for pre-existing conditions. After that, while you can generally enroll in these policies at any time, you’d be subject to medical underwriting and could be rejected.

Recommended Reading: Does Medicare Pay For Wigs

When Working Past : 8

For people who work past 65 and qualify to delay Medicare with creditable employer coverage, there is an 8-month Special Enrollment Period that allows you to enroll in Part A , Part B , Part C and Part D without late penalties.

This Special Enrollment Period is tricky though. Why? Because while you have the whole 8 months to get Parts A & B, you only get the first 2 months to enroll in Part C or Part D without penalty. If you enroll after the two-month mark, youll face late enrollment penalties for Part D .

To qualify for the Part B Special Enrollment Period, you must have creditable employer or union health coverage based on current employment. Your Special Enrollment Period will begin eight months after your employer coverage ends or you leave your job, whichever happens first.

Option : Add A Part D Plan To Original Medicare

To pick up where Original Medicare leaves off, one option is to purchase a private stand-alone Part D prescription drug plan. These plans are offered by private insurance companies, and the monthly premium for these plans can vary based on how much they cover. Though this option will help cover some of the cost of prescriptions, it still leaves you exposed for the 20 percent of medical costs that Original Medicare doesnt cover.

Recommended Reading: When Can I Buy A Medicare Supplement Plan

Medicare Advantage Plan Enrollment

When youre eligible to enroll in Original Medicare, you also become eligible to enroll in a Medicare Advantage plan. You need to enroll in Original Medicare before you enroll in Medicare Advantage. Before enrolling in a plan, it may be a good idea to compare Medicare Advantage quotes.

To be eligible for Medicare Part C, you must already be enrolled in Part A and Part B.

If you are interested in joining a Medicare Advantage plan, you typically can only do so during specific times of the year.

The first time you may be able to enroll is during your Medicare Initial Enrollment Period, as outlined above.

If you sign up for a Medicare Advantage plan during your Initial Enrollment Period, you can change to another Medicare Advantage plan or switch back to Original Medicare within the first 3 months that you have Medicare.

Medicare Supplement Open Enrollment

Your Medicare Supplement Open Enrollment Period is another enrollment period thats a bit complicated. Your MSOEP begins the first of the month your Medicare Part B becomes effective.

For someone whose birthday falls on February 15 and whose Part B benefits go live on March 1, you will be able to enroll in a Medicare Supplement plan starting in March.

Enrolling during this period is vital because you will automatically qualify for a guaranteed issue right. Having a guarantee issue right means you will be accepted into the plan of your choice regardless of your current health status. If you wait too long and your MSOEP expires, you may have to pay more or be rejected for coverage altogether.

Read Also: Does Medicare Cover Massage Therapy

Contract Violations Or Enrollment Errors

If you are enrolled in a Medicare Advantage plan that failed to provide benefits in accordance with the plans terms or provided misleading information about coverage or other circumstances, you may be given an opportunity to disenroll from or switch to a new Medicare Advantage plan.

The timeframe in which you may do so will depend on the situation.

Medicare Sign Up: What You Cant Do

The annual Medicare open enrollment period does not apply to Medigap plans, which are only guaranteed-issue in most states during a beneficiarys initial enrollment period, and during limited special enrollment periods.

If you didnt enroll in Medicare when you were first eligible, you cannot use the fall open enrollment period to sign up. Instead, youll use the Medicare general enrollment period, which runs from January 1 to March 31.

Medicares general enrollment period is for people who didnt sign up for Medicare Part B when they were first eligible, and who dont have access to a Medicare Part B special enrollment period. Its also for people who have to pay a premium for Medicare Part A and didnt enroll in Part A when they were first eligible.

If you enroll during the general enrollment period, your coverage will take effect July 1.

Learn more about Medicares general enrollment period.

Don’t Miss: What Percentage Does Medicare Part A Cover