Enrollment Period For Medicare Part D

Like Medicare Part C, you are eligible to enroll in Medicare Part D during the seven-month period around your 65th birthdaybeginning three months before the month of your 65th birthday, including the month of your birthday, and up to three months after the end of your birthday month. You must enroll directly through an insurance company.

Medicare Part A Hospital Coverage

- What Medicare Part A covers: Part A covers expenses associated with hospital care. It includes coverage for services like nursing care and hospital stays. It also covers some hospital-related care that takes place outside a hospital setting, like skilled nursing care after you leave the hospital.

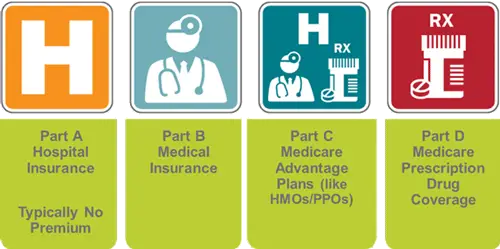

- What Medicare Part A costs: You generally wont have to pay a monthly premium for Medicare Part A if you or your spouse paid Medicare payroll taxes for 40 quarters or more. But you do need to pay deductibles before Medicare will cover any hospitalization costs.

When Does Medicare Coverage Start

Medicare coverage may start the first day of the month you turn 65. For example, if your birthday is 10/10/1948, your Medicare will start 10/01/2013. However, if your birthday is on the first of the month, your Medicare will start a month before your birth month on the first. For instance, if your birthday is 10/01/1948, then your Medicare will start 09/01/2013.

You may have a different Medicare start date if you delay Medicare coverage.

You May Like: Does Medicare Cover Bladder Control Pads

Medicare Parts A And B

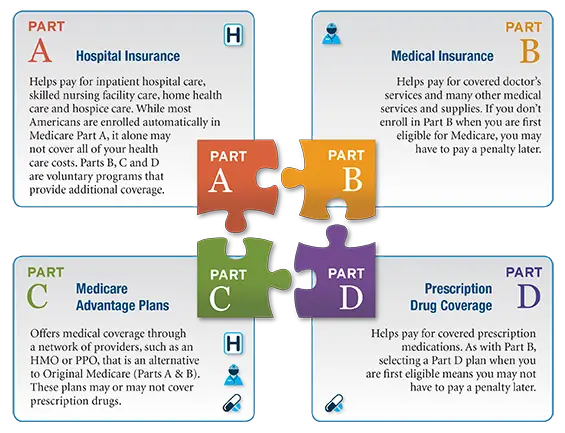

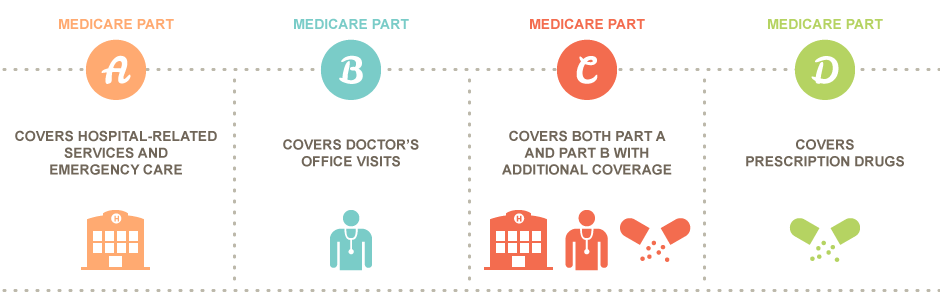

Medicare Parts A and B refer to the two oldest parts of Medicare. You may hear people group these two parts of Medicare together under the names Original Medicare or Traditional Medicare or basic Medicare. Together, these two Medicare parts provide very broad coverage for inpatient and outpatient care however, they wont cover everything.

You might hear people describe Medicare Part A as hospital insurance and Medicare Part B as medical insurance.

- Medicare Part A: Medicare Part A mostly focuses on covering bills for inpatient medical care. This could include services in a hospital, skilled nursing facility, or hospice.

- Medicare Part B Medicare Part B concentrates on covering outpatient care, such as healthcare received in a doctors office or clinic. Part B may also cover some services you get at home, like durable medical equipment and home healthcare.

Basic Medicare Parts A and B dont have an out-of-pocket maximum and dont cover prescription drugs, routine vision, nor routine dental. Medicare beneficiaries may choose to buy a Medicare supplement or join a Medicare Advantage plan to help control their costs in ways that Part A and Part B dont do.

How Do I Choose A Plan

The right plan for you will depend on your budget and healthcare needs.

For example, if you take multiple prescriptions, you might want to purchase a comprehensive Part D plan with a low deductible. If you know youll need vision care services, you might want to select a Medicare Advantage plan that offers vision coverage.

The options available to you will depend on your city, region, or state, but most areas have a variety of plans to choose from at different price points.

Tips for selecting plans that meet your needs

- Assess your current and potential healthcare needs. Are there doctors, facilities, or medications that you cant compromise on for your care? This may impact your policy choice, particularly when deciding between original Medicare and Medicare Advantage.

- Consider your income. If you have a fixed or limited income, paying monthly premiums may be difficult. However, if you need care that only Medicare Advantage would cover, this might be a good option to save costs in the long run.

- Look for cost savings programs. You may qualify for certain programs to help with your costs, including Medicaid and Extra Help.

- Find the right plan. Use Medicares plan finder tool to compare available Medicare Advantage plans in your area. You can search by prescription drugs you need, as well as covered providers and services.

Read Also: How To Prevent Medicare Fraud

Why Do I Need Medicare Part A

If you have not needed hospital or inpatient coverage in the past, you might wonder why you need Part A. Without proper coverage, hospital stays can be costly. The cost of services and amenities quickly adds up.

Should you need hospital and inpatient services in the future, Part A will provide coverage. Under Part A, your hospital meals, some hospital rooms, lab tests, x-rays, and more are covered, as well as the initial 60 days of your stay. It is important to enroll in both Part A and Part B, as described below.

What Factors Should You Consider When Choosing A Medicare Plan

Choosing a Medicare plan means taking a few moments to consider what would best fit your needs and lifestyle. You may want to consider the following factors when comparing Medicare plans:

- What are your health care needs?

- Do you see your primary care provider once a year for your annual checkup? Do you also need to see specialists for additional care?

- Do you expect to be hospitalized for a surgical procedure or need outpatient surgery?

- Do you take any prescription medications? If so, do you take specialty medications, things like insulin or other injectables, or do you take generic medications?

- Do you have a chronic condition that puts you at risk for needing more care?

- Do you have a chronic condition or disability for which you are already receiving Medicaid or disability benefits?

- Do you need dental care or vision care?

- Do you want coverage to include access to behavioral health providers such as therapists and counselors?

- Are you okay seeing a doctor in a network or do you want to have the flexibility to see any doctor?

- If you travel, do you want coverage wherever you go?

Having the answers to these questions, and others like it, may help guide you when deciding which type of Medicare coverage is right for you.

You May Like: Can Medicare Take Your House

Speak With A Licensed Agent Today

To learn more about your Medicare options Part A, B, C or D and to learn more about the benefits that might be available in Medicare Advantage plans in your area, call today to speak with a licensed insurance agent.

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

1 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

S To Choosing A Medicare Plan

This graphic shows the steps you might take when choosing Medicare coverage thats right for you. Its a great place to start if you want to compare Medicare plans or need a quick review of Medicare and all its parts.

Youll see the main features of each Medicare coverage option side-by-side to help you understand how the different parts of Medicare work with each other.

Recommended Reading: Does Cigna Have A Medicare Supplement Plan

Why Do I Need Medicare Part D

If you have not taken any prescription medications recently, you might be wondering why you would need a prescription drug plan. Remember that it is essential to consider the future when selecting this coverage. If you need to pay for prescription drugs in the future, you will have coverage in place and fewer out-of-pocket costs.

When you enroll in a Part D prescription drug plan, you pay a monthly premium. In exchange, your copays for your prescriptions will be lower.

What Is My Medicare Claim Number

Your Medicare Claim Number used to be your social security with a letter after it. However, your social security number on Medicare cards were replaced with a new Medicare Number to prevent identify theft and taxpayer fraud.

Each new Medicare Number is unique to each beneficiary, has 11 characters, and composed of numbers and uppercase letters. It excludes the letters which could be interpreted as numbers.

You May Like: When Is Medicare Supplement Open Enrollment

Enrollment Period For Medicare Part C

You are eligible to enroll in Medicare Part C during your Initial Enrollment Period . This is the seven-month period around your 65th birthday. Your IEP begins three months before the month of your 65th birthday, includes the month of your birthday, and lasts up to three months after the end of your birthday month.

Enrollment is optional and not automatic. You must first have Medicare Parts A and B, and then you can sign up for Medicare Part C with a private insurance company. With this plan, you make payments directly to your insurance provider.

How Much Does Medicare Part A Cost

If you or your spouse have worked at least 40 calendar quarters in any job where you paid Social Security taxes, you do not have to pay a premium for Part A.

- Premium: $0 per month

- 2020 Deductible: $1,408 for each benefit period

The 2020 Medicare Part A premium for those who do not qualify for $0 premiums is either $252 or $458 per month, depending on how long you worked and paid Medicare taxes.

You May Like: Does Medicare Pay For Entyvio

Types Of Medicare Supplement Plans

Medicare supplement insurance, commonly known as Medigap, covers some out-of-pocket expenses for people with Medicare Parts A and B.

Medigap covers deductibles, co-payments, and coinsurance. A person must have Parts A and B to qualify for a Medicare supplement plan.

Those enrolled in Medicare Advantage should not have a Medigap plan. A person cannot use their Medigap policy to pay their Medicare Advantage Plan copayments, deductibles, and premiums.

Private insurers sell Medigap policies, so coverage varies according to the insurance company. These policies may cover services that are not available under Medicare.

Medigap is a single user policy, so spouses must buy their own coverage.

The costs and benefits of different Medigap policies depend on the insurance company. When it comes to pricing Medigap plans, insurance providers may use one of several methods. These include:

- Community pricing: Premiums are the same regardless of age.

- Issue age-related: When a person starts the policy, the insurance provider factors their age into the premium. That means buying the policy promptly after reaching 65 years of age is more cost-effective.

- Attain age-related: The insurer bases the original premium on the persons current age, but premiums rise as time passes.

The price of Medigap plans varies by state. As noted, prices are lower when the person buys a policy as soon as they reach the age of Medicare eligibility. Individual insurance companies may also offer discounts.

How Do I Pay For Medicare

Discover the easy way to pay your Medicare premiums. Medicare Easy Pay is a free, electronic payment option. It automatically deducts your Medicare premium from your bank account each month. In other words, it automatically pays your Medicare premiums every month and removes the burden of you paying it yourself.

Recommended Reading: Is Medicare Advantage A Good Choice

What Parts A And B Don’t Cover

The largest and most important item that traditional Medicare doesn’t cover is long-term care if the only care you need is custodial. If you are diagnosed with a chronic condition that requires ongoing long-term personal care assistance, the kind that requires an assisted-living facility, Medicare will cover none of the cost. However, Medicare will cover the costs for acute-care hospital services, for patients who are transferred from an intensive care or critical care unit. Services covered could include head trauma treatment or respiratory therapy.

Medicare Part A B C And D: What You Need To Know

Your search for affordable Health, Medicare and Life insurance starts here.

Call us 24/7 at or Find an Agent near you.

Medicare Parts A, B, C, and D are the four distinct types of coverage available to eligible individuals. Each Medicare part covers different healthcare-related costs. While Medicare Part A and Medicare Part B are administered by the Centers for Medicare and Medicaid Services , Medicare Part C and Medicare Part D are managed by private insurance companies.

Medicare is similar to the health insurance coverage youve probably had with an employer or an individual policy. It can cover doctor visits, inpatient and outpatient hospital care, prescription drugs, and lab tests. Depending on the plan you choose, your Medicare plan can also cover dental and vision, if you like.

Heres a brief overview of each of the parts of Medicare.

Read Also: How To Renew Medicare Benefits

Find Medicare Supplement Plans That Help Cover Your Medicare Costs

If you receive treatment that is covered by Medicare, you may likely face out-of-pocket Medicare costs such as deductibles, coinsurance and copayments.

A Medicare Supplement Insurance plan can help cover some of these costs.

For example, each of the 10 standardized Medigap plans that are available in most states provide at least partial coverage for the Medicare Part B coinsurance or copayments you might face when you receive covered outpatient treatments.

A licensed agent can help you decide on a Medicare option that works for you. Call today to speak with a licensed agent and compare the Medigap plans that are available where you live.

How To Enroll In Medicare Advantage

Medicare Advantage, or Part C, is a separate pathway to receiving your Medicare benefits. These plans include Part A and Part B and usually include Part D . They may also include dental, vision, and other benefits.

1. Enroll in Part A and Part B

You must enroll for Part A and Part B before you can enroll in a Medicare Advantage plan.

2. Compare plans in your area

Advise can help you find a plan in your area that meets your healthcare needs and contracts with your preferred providers.

Read Also: What Are All The Medicare Parts

What You Need To Know About Medicare Parts A B C And D

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

There are four parts of Medicare: Part A, Part B, Part C, and Part D. In general, the four Medicare parts cover different services, so it’s essential that you understand the options so you can pick your Medicare coverage carefully.

A Few Words On Medigap

Medigap is Medicare supplemental insurance that can ameliorate some of the costs that aren’t covered by Medicare Parts A and B. This insurance is provided by private companies, and typically requires that a beneficiary already have Medicare Parts A and B to enroll. Premiums are generally paid monthly, and it’s best to enroll as close as possible to enrollment in Parts A and B.

Read Also: Does Medicare Cover Hepatitis A Vaccine

American Disabilities Act Notice

In accordance with the requirements of the federal Americans with Disabilities Act of 1990 and Section 504 of the Rehabilitation Act of 1973 , UnitedHealthcare Insurance Company provides full and equal access to covered services and does not discriminate against qualified individuals with disabilities on the basis of disability in its services, programs, or activities.

Original Medicare Medicare Advantage Part D And Medigap

The way Medicare plans are alphabetized from A to D one might be fooled into thinking that there are but a few options to consider.

But deciding which Medicare coverage is right for you is definitely not as easy as a multiple-choice question with a single right answer.

Medicare was designed with the idea that the vast majority of Americans would eventually receive a uniform level of coverage and care once they became eligible. And recipients do receive a basic level of coverage. But that basic level also has some gaps, including a lack of coverage for prescription drugs, dental care, and vision care, and the lack of a cap on out-of-pocket costs.

To figure out how you can fill those gaps, youll need to have a basic understanding of the parts of Medicare and what each one covers.

You May Like: What Is The Difference Between Medicare

Understanding Medicare Part D

Medicare Part D covers your prescription drug costs and is offered by private insurance companies.

If you have Original Medicare, you can choose a standalone Part D plan to provide coverage of your prescription medications. If you choose a Medicare Part C plan, Part D coverage may already be included in your plan.

Each Part D plan must meet minimum coverage requirements set by the federal government. Plans can offer coverage of a variety of different medications and charge set fees based on the “tiers” in which the medications are categorized.

You’ll likely pay a yearly premium, and you may be required to meet a yearly deductible as well. Certain medications may require copays on top of those costs.

Most plans also have what is known as a coverage gap â sometimes referred to as a donut hole. This means once you and your plan spend a certain amount toward your Part D costs, your plan covers less of the costs and you cover more until you reach a certain threshold.

While the coverage gap, or donut hole, was a significant area of concern for consumers in the past, Medicare Part D has changed the rules to make costs more affordable for consumers. The gap in prescription drug coverage has been reduced dramatically, and Medicare now shares the cost with the drug manufacturer and the drug plans to make it less burdensome for you.

Courtney Schmidt is a medical communications professional and clinical pharmacist with pediatric and adult hospital experience.