Choosing A Type Of Plan

MSAs can be really nice for retirees in good health, since any money that you don’t spend during the year just stays in the savings account for use in future years. If you don’t have access to an MSA but are in fairly good health, an HMO will likely minimize your healthcare expenses — but check first to make sure that the network in your area is fairly robust, since you don’t want to be caught without access to a particular type of specialist if you should need one. PPOs and PFFSs are typically more costly, but if you have significant health problems, they may end up being the cheapest choice in the end. When choosing a plan it’s always important to look at what the specific plans in your area cover and how much they cost that’s what will matter the most when it comes time to get treatment.

What Does Medicare Part C Cover

All Medicare Advantage plans include the same standard benefits as Original Medicare.

Most Medicare Advantage plans also provide prescription drug coverage.

Some Part C plans may also cover benefits such as:

Some Medicare Advantage plans may also cover services such as non-emergency medical transportation, home health care and home modifications such as bathroom grab bars.

Some types of plans restrict your coverage to in-network health care providers.

More info: What does Medicare Part C cover?

Rules For Medicare Advantage Plans

Medicare pays a fixed amount for your care each month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare.

Each Medicare Advantage Plan can charge different

. They can also have different rules for how you get services, like:

- Whether you need areferralto see a specialist

- If you have to go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care

These rules can change each year.

Read Also: Where Do I Get Medicare Part D

Medicare Preferred Provider Organization Plans

A PPO is a Medicare Advantage plan that also has a network of doctors, other health care providers and hospitals. Just like HMO plans, you pay less if you use doctors, hospitals and other health care providers that belong to the plans network.

However, with Medicare PPO, you dont have to choose a primary care doctor or get a referral to see a specialist. Also, like HMO plans, in most cases prescription drugs are covered in PPO plans. However, be certain to ask if the plan offers Medicare drug coverage. Remember, if you join a PPO plan that doesnt offer prescription drug coverage, you cant join a Medicare prescription drug plan .

What Are Medicare Advantage Plans

A Medicare Advantage Plan is another way to get your Medicare coverage. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, youll still have Medicare but youll get most of your Medicare Part A and Medicare Part B coverage from the Medicare Advantage Plan, not Original Medicare. Most plans include Medicare prescription drug coverage . In most cases, youll need to use health care providers who participate in the plans network. However, many plans offer out-of-network coverage, but sometimes at a higher cost. Remember, you must use the card from your Medicare Advantage Plan to get your Medicare-covered services. Keep your red, white, and blue Medicare card in a safe place because youll need it if you ever switch back to Original Medicare.

Medicare Advantage Plans cover almost all Medicare Part A and Part B benefits

In all types of Medicare Advantage Plans, youre always covered for emergency and urgent care. Medicare Advantage Plans must cover almost all of the medically necessary services that Original Medicare covers. However, if youre in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care, some new Medicare benefits, and some costs for clinical research studies.

Plans can offer extra benefits

Medicare Advantage Plans must follow Medicare’s rules

Recommended Reading: Do I Need To Keep Medicare Summary Notices

What Is A Medicare Advantage Hmo Plan

Generally,Medicare Advantage Health Maintenance Organization plans do a good job ofhelping you control healthcare costs, but theyre less flexible than otherkinds of Advantage plans.

Theframework for Medicare Advantage HMO plans is:

- Premium:Your carrier may charge a monthly premium

- Networks:You need to stay in the plans network

- Referrals:Referrals are required to see a specialist

- Prescription medications:Prescription drug coverage may be included

For More Information On Medicare Advantage Plans

Hopefully, you now have a better idea of the different types of Medicare Advantage plans types and how they work. If you have questions about the specific plan options that may be available in your service area, an eHealth licensed insurance agent would be happy to discuss your coverage needs with you over the phone just call the number on this page to get started. Or, if you prefer to browse plans now, enter your zip code into the plan finder tool on this page to view plan options in your location.

To learn about Medicare plans you may be eligible for, you can:

- Contact the Medicare plan directly.

- Contact a licensed insurance agency such as Medicare Consumer Guides parent company, eHealth.

- Or enter your zip code where requested on this page to see quote.

You May Like: Where Do I Apply For A Medicare Card

Local Conditions And Convenience

In some areas where physicians and hospitals are scarce, its important to check out both the networks of available Medicare Advantage plans and the locations of providers who accept regular Medicare. Are the doctors accepting new patients? Will you have to travel far to see a provider or be treated in an emergency room? Advice from local professionals, neighbors, and licensed insurance brokers can help you find Medicare Advantage plans that do business in your area. Compare plans to find one that may suit your needs.

How Medicare Advantage Plans Work

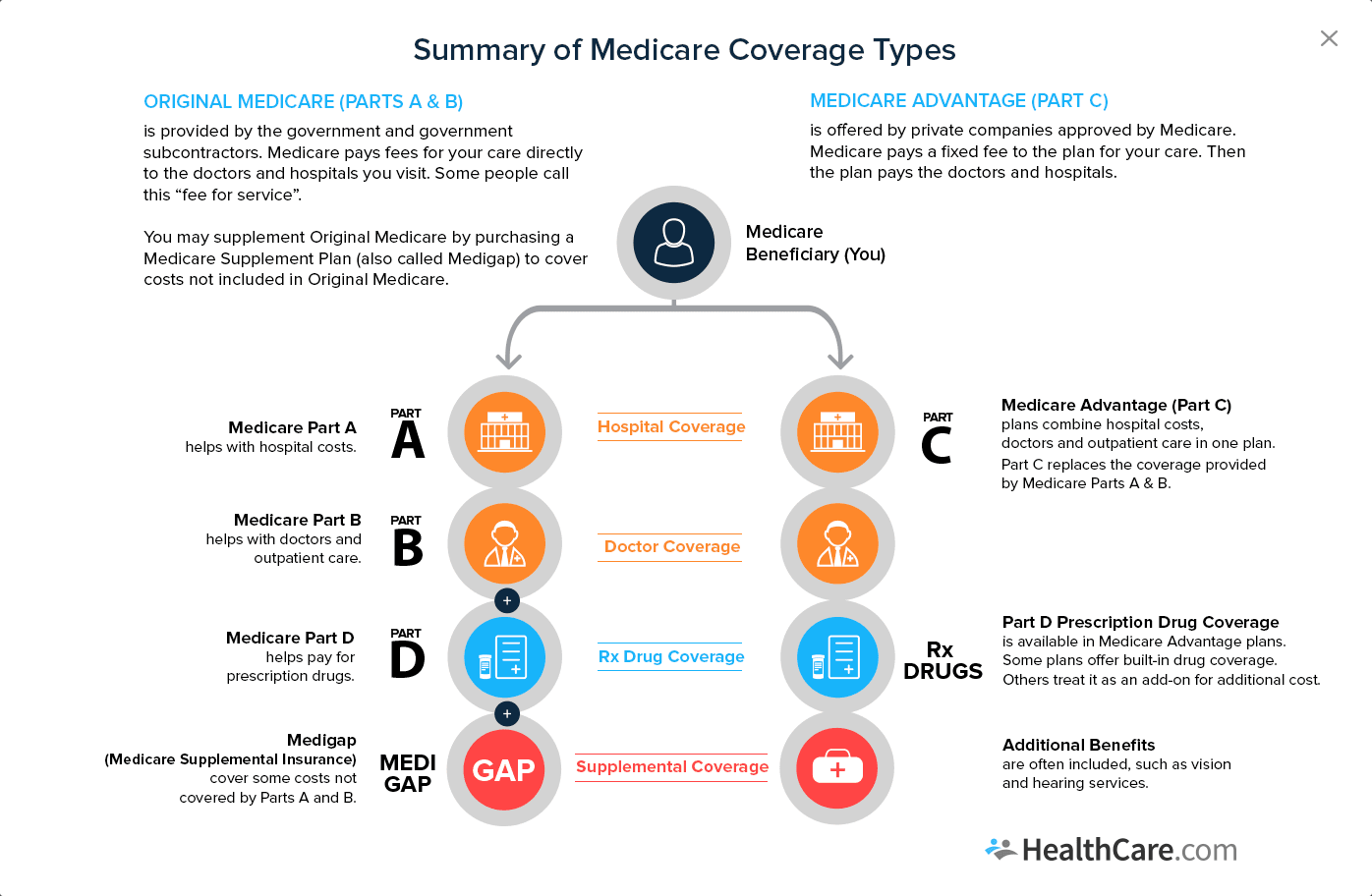

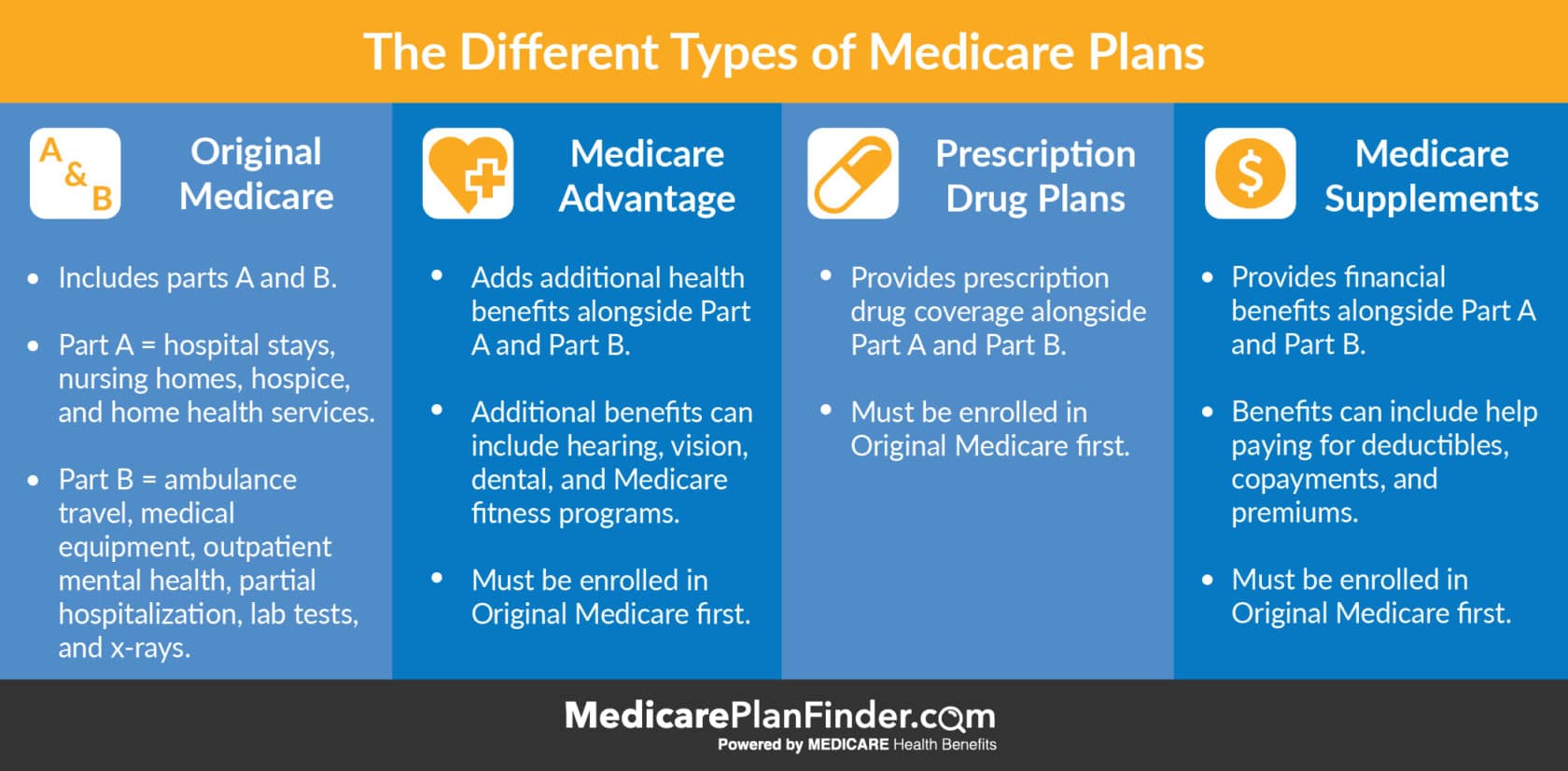

Seniors can get Medicare coverage in two ways: Original Medicare or a Medicare Advantage Plan. Original Medicare is administered by the federal government and includes Medicare Part A and Part B. If you want drug coverage, you’ll need to enroll in Part D. You pay a monthly premium for Part B , and you’ll be on the hook for 20% of the Medicare-approved amount of Part-B services you receive. Similarly, if you need to fill the gaps in Original Medicare coveragefor example, to cover copayments, coinsurance, and deductiblesyou’ll need Medicare Supplement Insurance . Unless you have Medigap, there’s no annual limit on your out-of-pocket costs.

Medicare Advantage Plans, a bundled service offered by federally regulated private companies that contract with the Medicare program, include Medicare Part A, Part B, and usually Part D coverage. This means individuals don’t have to sign up separately for Part D. In addition, Medicare Advantage may result in lower out-of-pocket costs than Original Medicare, though out-of-pocket costs vary by plan. But even if you rack up high out-of-pocket costs for Part-A and Part-B services, MA plans place an annual limit on these costs. Some plans even come with benefits beyond what Original Medicare offers, such as vision, hearing, and dental care, avoiding the need for additional insurance. In fact, you can’t get Medigap insurance if you have an MA plan.

You May Like: How Much Does Medicare Part C And D Cost

Types Of Medicare Plans

En español | Do you know that there are different ways you can get your Medicare health and prescription drug coverage? You can choose Original Medicare. This is the traditional fee-for-service plan provided by Medicare. Or, you can choose Medicare Advantage .

You can also get Medicare prescription drug coverage to help cover some of the costs of your prescription drugs. AARPs Medicare Question and Answer Tool is a starting point to guide you through the different Medicare plans.

A: There are different parts to Medicare: Part A , Part B , Part C and Part D . Read Full Answer

Q: What is Original Medicare ?

A: Original Medicare, also known as traditional Medicare, includes Part A and Part B. It allows beneficiaries to go to any doctor or hospital that accepts Medicare, anywhere in the United States. Medicare will pay its share of the charge for each service it covers. You pay the rest, unless you have additional insurance that covers those costs. Original Medicare provides many health care services and supplies, but it doesnt pay all your expenses. Read Full Answer

Q: Does Original Medicare automatically include Part A, Part B and Part D?

A: You get Part A and Part B of the Original Medicare plan when youre automatically signed up for Medicare. To get drug coverage under Original Medicare, you must choose and join a Medicare-approved Part D private drug plan. Read Full Answer

Q: How do I enroll in Original Medicare?

Medicare Advantage Special Needs Plans

A Special Needs Plans is a type of Medicare Advantage plan that limits membership to people who fit specific eligibility criteria. There are three types of Special Needs Plans, each targeting people with certain characteristics:

- Chronic-Condition Special Needs Plan: You must have a specific chronic or disabling medical condition to be a member, such as end-stage renal disease, AIDS, or diabetes. If the Special Needs Plan targets more than one health condition, you must have at least one of the conditions it targets to be eligible for the plan.

- Dual-Eligible Special Needs Plan: You must have both Medicare and Medicaid to be a member.

- Institutional Special Needs Plan: You must live in an institution, such as a nursing home, to be a member.

Youll usually have a primary care physician and need referrals to see specialists. You may not need a referral for certain preventive services, such as screening mammograms. Unlike other types of Medicare Advantage plans that may or may not include prescription drug coverage, all Special Needs Plans include prescription drug benefits.

Special Needs Plans usually require that members use in-network providers to be covered, unless its a medical emergency. Each Special Needs Plan usually has providers, formularies, and benefits that are tailored to the specific member needs for that plan. For example, a Dual Eligible Special Needs Plan might have special social services to help you manage your Medicare and Medicaid benefits.

Recommended Reading: Who Can Get Medicare Part D

Medicare Advantage Plan Comparison

The benefits of Medicare Advantage plans can make them a great alternative to Original Medicare. However, its important to understand the differences of each plan before making a decision.

To help you choose whats best for your needs, let’s take a look at the types of Medicare Advantage plans and how they compare.

The Cares Act Of 2020

On March 27, 2020, President Trump signed a $2 trillion coronavirus emergency stimulus package, called the CARES Act, into law. It expanded Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increased flexibility for Medicare to cover telehealth services.

- Increased Medicare payments for COVID-19-related hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarified that non-expansion states can use the Medicaid program to cover COVID-19-related services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

Do not pay a Medicare broker directly for their assistance. They are paid by the insurance company to sell their insurance. If you suspect Medicare Advantage fraud, please call the Medicare Drug Integrity Contractor at 1-877-772-3379.

You May Like: Does Medicare Cover Ear Cleaning

What Are Medicare Advantage Plans And Which Plans Are Available In Iowa

Medicare Advantage plans are offered by private companies which contract with Medicare to provide Medicare Part A, B and sometimes D benefits. When you enroll in a Medicare Advantage plan you do not lose Medicare, you just get your benefits in a different way.

There are four types of Medicare Advantage plans in Iowa: HMO , POS , PPO , PPFS , and SNP . In addition, a special type of health plan called a Cost Plan is offered in some counties.

Before you enroll in a Medicare Advantage plan its important to know the following:

- Do all of your providers accept the plan?

- You must have both Medicare Parts A and B and live in the service area for the plan.

- You must stay in the plan until the end of the calendar year.

- Each year plans can change benefits, premiums, service areas, provider networks , and can terminate their contract with Medicare

- You do not need a Medicare supplement insurance policy. In fact, Medicare supplements cannot pay benefits when you are enrolled in a Medicare Advantage plan.

Compare Common Medicare Advantage Plans Side By Side

This material is provided for informational use only and should not be construed as medical advice or used in place of consulting a licensed medical professional. You should consult your doctor to determine what is right for you.

Humana is a Medicare Advantage HMO, PPO and PFFS organization and a stand-alone prescription drug plan with a Medicare contract. Humana is also a Coordinated Care plan with a Medicare contract and a contract with the state Medicaid program. Enrollment in any Humana plan depends on contract renewal.

Some links on this page may take you to Humana non-Medicare product or service pages or to a different website.

Y0040_GNHKU39EN_2022

Also Check: Does Medicare Cover Home Health Care After Surgery

Medicare Advantage Plans: Common Elements

- All plans have a contract with the Centers for Medicare and Medicaid Services .

- The plan must enroll anyone in the service area that has Part A and Part B, except for end-stage renal disease patients.

- Each plan must offer an annual enrollment period.

- You must pay your Medicare Part B premium.

- You pay any plan premium, deductibles, or copayments.

- All plans may provide additional benefits or services not covered by Medicare.

- There is usually less paperwork for you.

- The Centers for Medicare and Medicaid Services pays the plan a set amount for each month that a beneficiary is enrolled.

The Centers for Medicare and Medicaid Services monitors appeals and marketing plans. All plans, except for Private Fee-for-Service, must have a quality assurance program.

If you meet the following requirements, the Medicare Advantage plan must enroll you.

You may be under 65 and you cannot be denied coverage due to pre-existing conditions.

- You have Medicare Part A and Part B.

- You pay the Medicare Part B premium.

- You live in a county serviced by the plan.

- You pay the plan’s monthly premium.

- You are not receiving Medicare due to end-stage kidney disease.

Another type of Medicare Managed Health Maintenance Organization is a Cost Contract HMO. These plans have different requirements for enrollment.

Medicare Advantage Plan Types

There are 6 different types of Medicare Advantage plans. These are network type plans, with the most popular being HMOs & PPOs. These plans are similar to the coverage youve always had through an employer while working and under age 65.

With a PPO you can see doctors and providers IN the network AND out of the network. If you go out of the network then youll typically pay more for services. And with a PPO, you wont need a referral to see a specialist.

With and HMO the plan pays for care received inside the plans network and if you go out of the network youll pay 100% out of pocket. Also with some HMOs youll need a referral to see a specialist.

Recommended Reading: Who Is Eligible For Medicare In Georgia

Can You Switch Yes But Theres A Catch

Its logical to consider enjoying the cost savings of a Medicare Advantage plan while youre relatively healthy, and then switching back to regular Medicare if you develop a condition you want to be treated at an out-of-town facility. In fact, switching between the two forms of Medicare is an option for everyone during the open enrollment period. This Annual Election Period runs from October 15 to December 7 each year.

Heres the catch. If you switch back to regular Medicare , you may not be able to sign up for a Medigap insurance policy. When you first sign up for Medicare Part A and Part B, Medigap insurance companies are generally obligated to sell you a policy, regardless of your medical condition. But in subsequent years they may have the right to charge you extra due to your age and preexisting conditions, or not to sell you a policy at all if you have serious medical problems.

Some states have enacted laws to address this. In New York and Connecticut, for example, Medigap insurance plans are guaranteed-issue year-round, while California, Massachusetts, Maine, Missouri, and Oregon have all set aside annual periods in which switching is allowed. If you live in a state that doesn’t have this protection, planning to switch between the systems depending on your health condition is a risky business.

Who Can Join A Medicare Advantage Plan

You can generally join one of these Medicare Advantage Plans:

If all of these apply:

- You live in the service area of the plan you want to join. The plan can give you more information about its service area. If you live in another state for part of the year, ask if the plan will cover you there.

- You have Medicare Part A and Part B.

- You’re a U.S. citizen or lawfully present in the U.S.

| Note |

|---|

|

Starting January 2021, people with ESRD can choose either Original Medicare or a Medicare Advantage Plan when deciding how to get Medicare coverage. Learn more. |

Don’t Miss: What Is A Ppo Medicare Plan

How Many Americans Have Medicare Advantage Coverage

As of September 2021, there were nearly 28 million Americans enrolled in Medicare Advantage plans more than 43% of all Medicare beneficiaries.

Enrollment in Medicare Advantage has been steadily growing since 2004, when only about 13% of Medicare beneficiaries were enrolled in Advantage plans. Managed care programs administered by private health insurers have been available to Medicare beneficiaries since the 1970s, but these programs have grown significantly since the Balanced Budget Act signed into law by President Bill Clinton in 1997 created the Medicare+Choice program.