What Is Medicare Supplement Health Insurance

Medicare Supplement or Medigap policies are designed to offset the cost of copayments, coinsurance, deductibles, and other expenses not covered by Original Medicare, which includes Medicare Part A hospital insurance and Medicare Part B medical insurance.

Medigap policies are sold to Medicare beneficiaries by private insurance companies, including Blue Cross Blue Shield and its affiliates, such as Anthem. Customers pay a monthly premium for their Medigap plan, in addition to the monthly premium for Medicare Part B. The monthly premium for Medicare Part B in 2020 is $144.60.

The Best Medicare Plan For You: Plan F +rx

The recommended plan is the best fit based on a few questions. There are other personal circumstances that may change this recommendation, including receiving employer sponsored retiree benefits or having specific medical circumstances to consider. Please note that CMS will impose a penalty if you do not have prescription drug coverage . We strongly encourage you review all options with an agent before applying.

How Much Does A Blue Cross Blue Shield Medicare Yearly Wellness Visit Cost

Medicare Part B covers the annual wellness visit in full, meaning beneficiaries are not responsible for any deductibles, copayments or coinsurance for the visit.

Some Medicare Advantage plans may cover the annual wellness visit and other preventive care in full. Check with your Blue Cross Blue Shield plan to find out if there are any costs associated with the annual wellness visit.

You May Like: Does Medicare Cover Dupuytren’s Contracture

Third Party Website Disclaimer

You are about to leave Blue Cross and Blue Shield of Alabama’s website and enter a website operated by Prime Therapeutics, LLC. Prime is our business associate and is an independent company that provides pharmacy benefit management services to Blue Cross health plans. Prime has agreed to follow Blue Cross’ privacy and security policies regarding the confidentiality and protection of your personal health information.

To continue to the Prime website, click “Accept.” If you want to stay on the Blue Cross website, click “Cancel.”

Bcbs Medicare Supplement Rates

While the coverage that is offered on all Medicare Supplement insurance plans of the same letter is the same, regardless of which insurer is offering them, the premium can differ sometimes significantly from one insurance carrier to another.

For that reason, it is always recommended that you obtain quotes from at least two or three carriers before making a commitment to purchase a plan.

If you are interested in seeing a quote for Blue Cross Blue Shield Medicare Supplement insurance or from any of the other Medigap carriers that we represent feel free to reach out to us, toll-free, at . Or, you can also use our online quoting tool.

You May Like: When You Are On Medicare Do You Need Supplemental Insurance

What Options Does Blue Cross And Blue Shield Of Illinois Provide For Medicare Supplement Insurance

Blue Cross and Blue Shield of Illinois offers two options for Medicare Supplement coverage Standard and Med-Select plans. There are two key differences between them.First, with Med-Select, to receive benefits for the Part A deductible, your client must use participating Blue Cross and Blue Shield of Illinois Med-Select hospitals . If your client does NOT use a Med-Select hospital, he or she must pay the Part A deductible. The second difference is price. With Med-Select, your client’s premiums will be even lower than our already competitive Standard rates.

Product Features

- No Claim Forms in Most Cases

- Membership Card Recognition Guaranteed Nationwide

- No Waiting Period for Pre-Existing Conditions Immediate Coverage

- Coverage for All Medicare-Approved Services

- Protection to Keep Pace with Medicare Cost Increases

- Choice of Physicians and Hospitals*

- Save up to 30% on services at spas, wellness and fitness centers, and Complementary Alternative Medicine therapies with our BlueExtrasSM discount program

- Free Subscription to LifeTimes® Newspaper

- Billing Options E-Z Blue Payment OptionSM for Monthly Pre-Authorized, Automatic Withdrawals or Pay by Check Every Two Months.

*Med-Select Plans require that your client use Blue Cross and Blue Shield of Illinois participating Med-Select hospitals for non-emergency admissions to receive coverage for the Medicare Part A deductible.

When Do I Enroll In A Medicare Supplement Plan

There is an Open Enrollment Period for a Medicare Supplement plan when you first turn 65. Beginning on the first day of the month of your 65th birthday, you have a six-month window to apply for a Medigap policy. Or, if you sign up for Medicare Part B at another time, you have within six months to select a Medigap policy.

During this initial Open Enrollment Period, you will receive the best possible rate for your Medigap policy, regardless of medical condition. At this time, you also cannot be denied for a pre-existing condition. However, after your six month enrollment window closes, your Medigap rates may increase, and coverage for any pre-existing conditions may be delayed for up to six months.

Medigap policies are guaranteed renewable, which means you can continue with your same Medigap policy unless you stop paying your premium, were untruthful on your application, or the insurance company becomes bankrupt or insolvent.

Unlike Medicare Advantage plans , Medicare Supplement plans are not part of Medicare. These plans are provided by private insurers like Blue Cross and Blue Shield of Alabama. Choose your Medicare Supplement plan today.

You May Like: Is Medicare A Federal Program

How We Reviewed Medicare Providers

Even Medicare health plans with a national presence can vary locally in their cost, quality, and customer satisfaction. To evaluate Medicare plans, we looked at health insurance industry ratings from the primary accrediting agency for health plans, NCQA, and the Medicare Star Ratings from CMS, the regulatory agency that oversees Medicare. We included the National Association of Insurance Commissioners complaint index and AM Bests financial stability ratings. We also considered information from the companies on their programs and strategies.

Find A Blue Cross Blue Shield Medicare Advantage Plan That Covers Dental Benefits

A Blue Cross Blue Shield standalone dental plan that covers dental implants may be available where you live, though plan benefits can vary. BCBS may not offer Medicare Advantage plans in your area that cover dental implants, so its important to carefully compare plans online or call to speak with a licensed insurance agent who can help you review the benefits of plans available in your area.

You May Like: Can You Sign Up For Medicare Part B Anytime

Blue Cross Blue Shield Medicare Supplement Prices

The cost of Blue Cross Blue Shields Medicare Supplement premiums varies depending on where you live, how old you are, and when you first became eligible for Medicare.

There are three ways insurance companies like Blue Cross Blue Shield determine Medigap prices:

- Community-rated Everyone pays the same price, regardless of age.

- Issue-age-rated Premium price depends on how old you are when you are issued a Medigap policy. Premiums dont increase with age.

- Attained-age-rated Premiums are priced based on age, and they increase as the enrollee grows older.

The following are a few scenarios to show the cost of BCBSs Medigap premiums depending on location, gender, and age:

The ideal time to sign up for a Medigap policy is during the Initial Enrollment Period. This seven-month timeframe includes the three months before you turn 65, your birthday month, and the three months thereafter. If you dont enroll during this time, the Medigap insurance provider may need to perform medical underwriting to assess your health history. If this happens, they can then charge you a higher premium.

To start shopping for Medicare Supplement plans, enter your zip code into the Medigap plan search tool to find the plan thats best for you. You can then find your states BCBS provider to review specific policies.

Bluecare & Blue Select Plans

With a BlueCare plan, you can go to any doctor or hospital that accepts Medicare anywhere, anytime. Theres no need to worry about networks, referrals or boundaries. Depending on your plan, you may have no out-of-pocket costs at all for medical expenses. BlueCare plans are available in all South Carolina counties.

Compare our .

Blue Select plans offer the same benefits as BlueCare plans, but at alower monthly rate. In exchange, you agree to use hospitals in the Blue Select network for scheduled inpatient care. The Part A deductible is waived if you use a Blue Select network hospital. You can go to any doctor or hospital that accepts Medicare for outpatient or emergency care, even when you travel.

Read Also: Is Medicare Medicaid The Same

Blue Cross Blue Shield Annual Wellness Visit

- Blue Cross Blue Shield Medicare plans will cover your Medicare annual wellness visit. Learn more about BCBS Medicare Advantage plans, the benefits they can offer and how you can enroll.

Medicare Advantage plans like the ones offered by Blue Cross and Blue Shield cover a yearly health checkup called the Medicare annual wellness visit.

Medicare Advantage plans are sold by private insurance companies but are required by law to cover everything covered by federally funded and administered Original Medicare . One of those required benefits is the annual wellness visit.

In this Medicare plan review, we explain what the annual wellness visit includes and how its different from a routine physical. Blue Cross and Blue Shield is part of the Anthem family of brands, and depending on where you live, you may be able to apply for a Medicare plan from BCBS or an Anthem affiliated brand.

Blue Cross Blue Shield Medicare Supplement Reviewwhat You Should Know

Blue Cross Blue Shield offers a wide range of Medicare Supplement plans. Medicare Supplement plans, or Medigap plans, are an essential part of health insurance that fills in the gaps in Original Medicare coverage, Part A and B, such as deductibles, coinsurance and copayments.

Heres everything you need to know about Blue Cross Blue Shield Medigap plans, such as:

Read Also: When Is Medicare Supplement Open Enrollment

What Does Medicare Supplement Plan F Cover

Medicare Supplement Plan F is one of the most popular Medicare Supplement Insurance plans because it offers the most comprehensive coverage of the currently available Medicare Supplement insurance plans.

Medicare Supplement Plan F covers the most amount of benefits compared to the other Medicare Gap plans. Plan F covers the gap in coverage associated with Parts A and B. This plan enables someone to be able to visit a doctors office or hospital to receive approved treatment and walk out without paying anything, virtually eliminating all out of pocket costs.

Plan F also includes coverage for other Medicare-approved expenses not associated with Parts A or B. This includes foreign travel emergencies and skilled nursing facility coinsurance. Importantly, Plan F is one of only two plans that include coverage for Medicare Part B excess charges.

Plan F Coverage Of Medicare Part A Expenses

Plan F covers the Medicare-approved expenses not covered under Medicare Part A . Part A is the hospitalization component of Original Medicare and covers Medicare expenses typically associated with a hospital stay.

Generally, Medicare covers approved charges for hospitalization at 80%. This leaves the remaining 20% of expenses to be the responsibility of the Medicare patient. Plan F covers the 20% of Medicare-approved hospital expenses not covered under Part A. Plan F also covers other costs, such as:

- Part A hospital deductible and coinsurance

- Hospital costs up to an additional 365 days after Medicare benefits are exhausted

- Part A Hospice care coinsurance or copayment

- Blood

- Other Medicare-approved expenses associated with Part A hospitalization

Read Also: Can I Use Medicare For Dental

Does Blue Cross Blue Shield Cover Medicare Deductible

What Do Blue Cross Blue Shield Medicare Supplement Plans Cover?

Medicare supplement plans helps cover costs such as coinsurance, deductibles, and co-payments after Original Medicare pays its share of health care costs.

The changes affect only individuals enrolling in Medicare supplement plans after 2019.

Blue Cross Blue Shield Medigap Plan Offerings

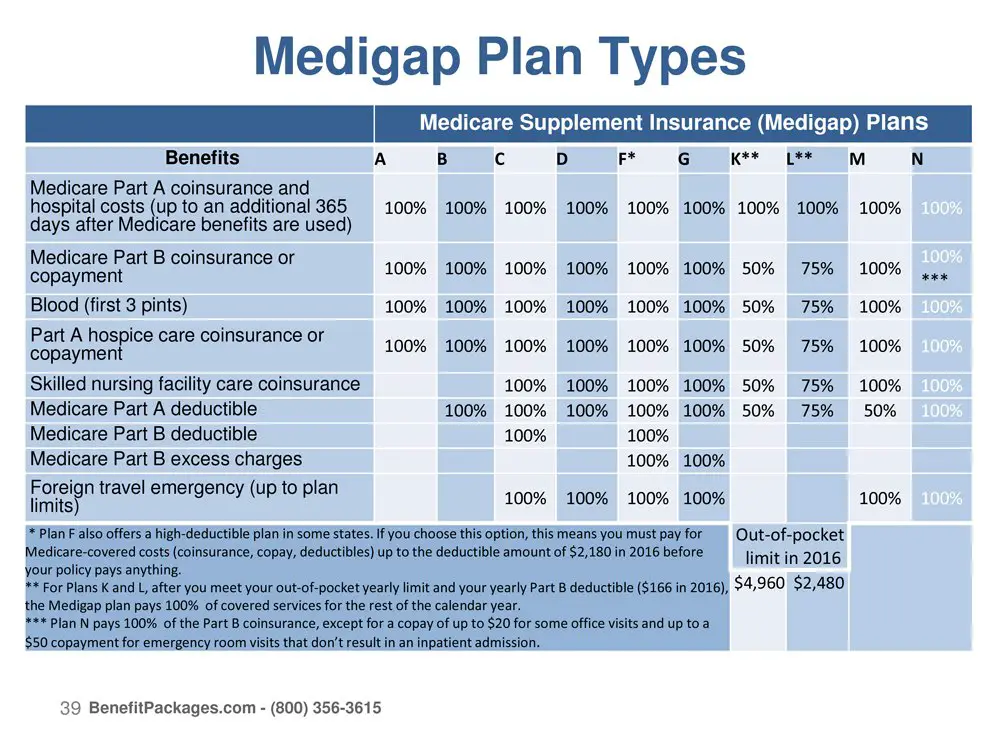

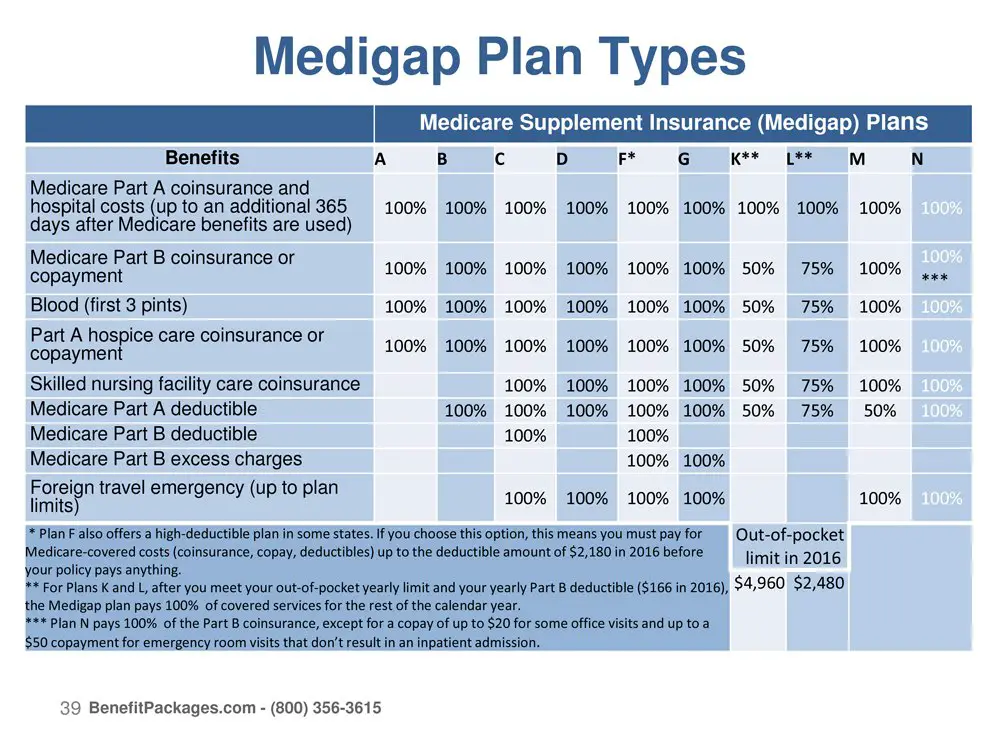

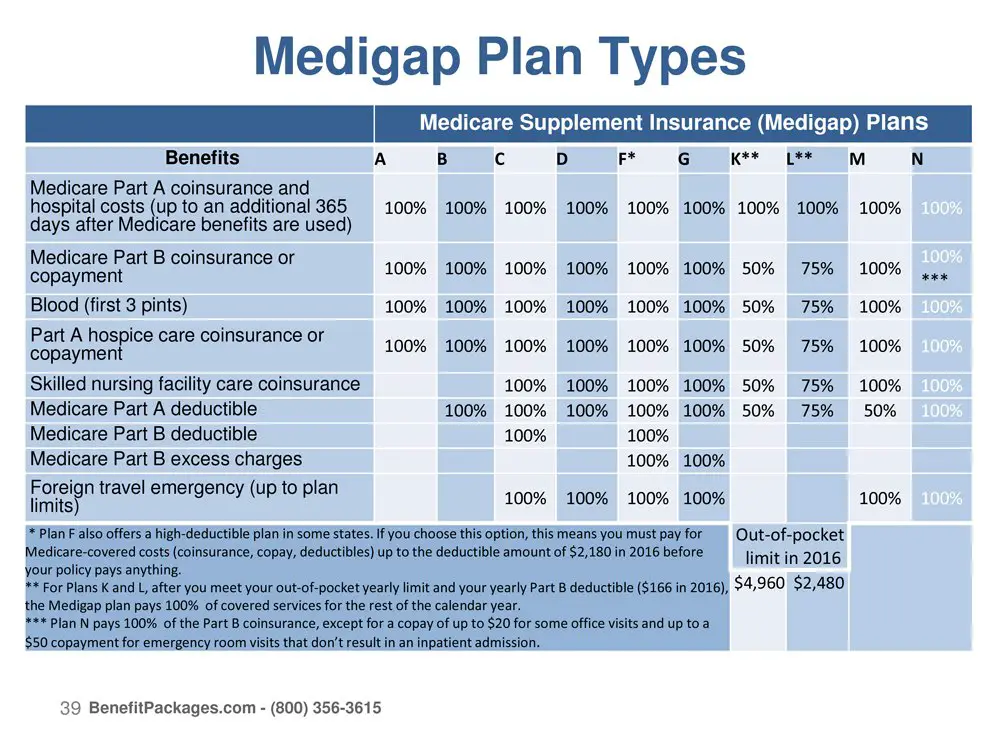

There are 10 subcategories of Medicare Supplement plans: A, B, C D, F, G, K, L, M, and N. Exact prices and benefits vary with each plan, but one common feature they all share is coverage for Medicare Part A hospital coinsurance and associated costs.

Some Medigap plans offer extra benefits, such as emergency healthcare coverage when you travel outside the United States. Others provide basic benefits and only partially cover out-of-pocket costs. For example, all but two types of plans cover Part B coinsurance or copayments. Plan K and Plan L only cover 50 percent and 75 percent of these costs, respectively.

To review each Medigap plan and what it covers, you can refer to this table from Medicare.gov.

- Hearing services, including hearing aids

- Prescription drugs

Medigap is best for people who are looking for a flexible policy that covers their out-of-pocket expenses and allows access to any healthcare provider who accepts Medicare.

For those looking for a plan that uses a network of providers and offers extra benefits, such as vision, dentalhearing and prescription drug coverage, a Medicare Advantage plan might be the better option.

You May Like: Does Medicare Pay For A Caregiver In The Home

What Do Medicare Supplement Plans Cover

Who is this for?

If you’re shopping for Medicare plans, this page will help you understand what you get from a Medicare supplement plan.

Medicare supplement plans don’t work like most health insurance plans. They don’t actually cover any health benefits. Instead, these plans cover the costs you’re responsible for with Original Medicare.

These costs can include:

- Hospital costs after you run out of Medicare-covered days

- Skilled nursing facility costs after you run out of Medicare-covered days

Here’s how it works: You pay a monthly premium for your Medicare supplement plan. These plans are also called Medigap. In return, the plan pays most of your out-of-pocket expenses. So when you go to the doctor, for example, you don’t have to pay the 20 percent coinsurance required by Medicare. Your Medigap plan pays it for you. With some Medigap plans, you might have a copay instead of the 20 percent coinsurance.

Medicare supplement plans aren’t your only option. Medicare Advantage plans help with your Medicare costs, too. They also offer additional health coverage that Medicare supplement plans don’t.

The table below breaks down the differences between Medicare supplement plans and Medicare Advantage plans. It might be a good place to start if you’re wondering which type of plan is right for you.

Medicare supplement vs. Medicare Advantage plans

| Medicare supplement |

|---|

Why Do Some People Get Dental Implants

Implants have some advantages over non-implanted dentures, such as more stability in the mouth, stronger chewing, and improved speech and appearance.

Good candidates for dental implants include those in good overall health, non-smokers, healthy gums with strong jaw bones, and a commitment to proper oral hygiene and future dental visits.

Dental implants are artificial tooth roots made of ceramic or metal that take the place of your natural roots in the upper and lower jaw bones. A bridge or denture is then attached the implant.

Dental implants can cost anywhere between $1,500 and $6,000 per tooth depending on several variables.

You May Like: Does Medicare Cover Total Knee Replacement

What Does The Medicare Annual Wellness Visit Cover

The annual wellness visit is different from a routine physical because it does not include any physical examination except for some basic height, weight and blood pressure measurements, along with possibly a vision test.

Here are a few important things to know about your Medicare annual wellness visit:

As the name implies, the annual wellness visit is something that a Blue Cross and Blue Shield Medicare Advantage plan will cover every year to help you and your doctor monitor your health and update your information.

Medicare Supplement Plan F Is Not Plan F Everywhere

There are some exceptions to Plan F benefits, specifically in the States of Massachusetts, Minnesota, and Wisconsin, where State laws provide for different versions of standardization in the plan. These states are often called a la carte states as there are no standardized plans. Medicare recipients essentially build their own plans benefit-by-benefit. However, individuals in these states would have the ability to build a plan identical to Plan F.

You May Like: How Much Income Before Medicare Goes Up

How Does Pricing Work With Bcbs And Can I Get Any Discounts

Your out-of-pocket costs, like premiums, deductibles, and copays, depend on the specific Medicare Supplement plan you select. This is true of all insurers. These costs will also vary on your specific state and zip code, your health, and your age, as well as whether or not you apply outside of a special enrollment period.

You may also be eligible for a 5 percent monthly premium discount if you and someone else living in your household are both enrolled in a BCBS Medicare Supplement plan. You don’t even need to be related. To put this in perspective, some insurance companies offer discounts of up to 14 percent, while others offer none at all.

Enrolling In A Blue Cross Blue Shield Medicare Advantage Plan

If youre not already enrolled in a Blue Cross Blue Shield Medicare Advantage plan, you can work with a licensed insurance agent to see if theres one available where you live. You must be at least 65 years old to enroll in most plans and must be enrolled in Medicare Part A and Part B. There are only certain times of the year in which you may enroll.

A licensed insurance agent can determine your eligibility, help review your coverage options and guide you through the enrollment process.

Recommended Reading: Does Medicare Have Life Insurance