How Much Does Original Medicare Part A Cost

What it helps cover:

- Home healthcare

What it costs:

Most people generally don’t pay a monthly premium for because they paid Medicare taxes while they were working. However, there are costs you may have to cover.

Other Part A costs for 2022 and 2023:

- An annual deductible of $1,600 in 2023 for in-patient hospital stays .

- $400 per day coinsurance payment in 2023 for in-patient hospital stays for days 61 to 90 .

- After day 91 there is a $800 daily coinsurance payment in 2023 for each lifetime reserve day used .

- After the maximum 60 lifetime reserve days are exhausted, there is no more coverage under Part A for inpatient hospital stays.

What Is The Part A Premium

If you or your spouse paid Medicare taxes while working for 40 quarters or more, you are eligible for Premium-free Part A, which means you dont owe any monthly premiums for coverage. If you paid Medicare taxes for 30-39 quarters, youll pay $274 per month in 2022 those whove paid less than 30 quarters in Medicare taxes will pay $499 a month in premiums.1

Medicare Part D Donut Hole Coverage Gap Costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

After you and your plan combine to spend at least $4,660 on covered drugs in 2023, you enter the Part D coverage gap.

In 2023, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit, which is $7,400, on covered drugs.

Once you enter the catastrophic coverage phase, you pay only a limited copay for covered drugs for the rest of the year.

Recommended Reading: How To Choose The Best Medicare Plan

How Do I Make My Medicare Payments

If youre on federal retirement benefits, your Medicare Part B premiums get deducted from your Social Security checks. You can elect to get your Medicare Part D premiums deducted from your benefit checks, too. Contact your insurer.

If youre not on federal retirement benefits, youll get a Medicare Premium Bill for any parts of Medicare that youre paying for each month. You can pay this bill via your banks online service or by mailing back a credit card, debit card, check or money order payment.

However, Medicare Easy Pay is probably the simplest way to pay your Medicare Premium Bill. It automatically deducts your payment from a linked bank account around the 20th of each month. Deductibles and copays are generally paid directly to health care providers at the time of service.

Does Medicare Part A Cost Anything

Medicare Part A costs will vary person-to-person, but for most people, Medicare Part A is premium-free. It still has a deductible, which you pay per benefit period, and it also requires copays for covered services in the hospital, a skilled nursing facility or for hospice.

The costs for Medicare Part A can change each year. Below are the Part A costs as of January 1, 2022, and if you want to also learn more about Part B costs for 2022, read this article.

Don’t Miss: What’s The Medicare Deductible

How Do Part B Premiums And Deductibles Work

If you are enrolled in Part B of Original Medicare, you are responsible for paying a premium each month that keeps your coverage active.

Your deductible is the amount you pay before your insurance policy will cover its portion of your medical bills. So when you use your Part B coverage by visiting a doctor or purchasing durable medical equipment for example, you typically are responsible for the costs out of pocket until you meet your deductible. After that, you still may be responsible for copays or coinsurance for covered services, but Part B will cover 80% of costs for most services.

B Premiums And Medicare Advantage

You can elect to have Original Medicare or a Medicare Advantage plan. Medicare Advantage plans are offered by private insurance companies and will cover everything that Original Medicare offers and more.

Even if you decide on a Medicare Advantage plan and pay premiums to the insurance company, you still have to pay Part B premiums to the government. You must take that added cost into consideration.

Don’t Miss: How Do I Sign Up For Medicare In Massachusetts

What Is The Part A Late Payment Penalty

If you have to pay Medicare Part A premiums but dont enroll at age 65, your monthly premiums may cost 10% more. And you may be required to pay those higher premiums for twice the number of years you didnt sign up.5

A Word of Advice

While calculating the costs of Medicare can feel overwhelming, figuring out the cost of each part can help you devise a good estimate of your total Medicare costs.

Medicare Part B Premiums

The Part B standard premium for 2023 is $164.90. However, you may have to pay more, depending on your income. This can range all the way up to $560.50 per month for those who earned more than $500,000 in the relevant tax year. You’ll have to check the information on your tax return to know which bracket you fall into.

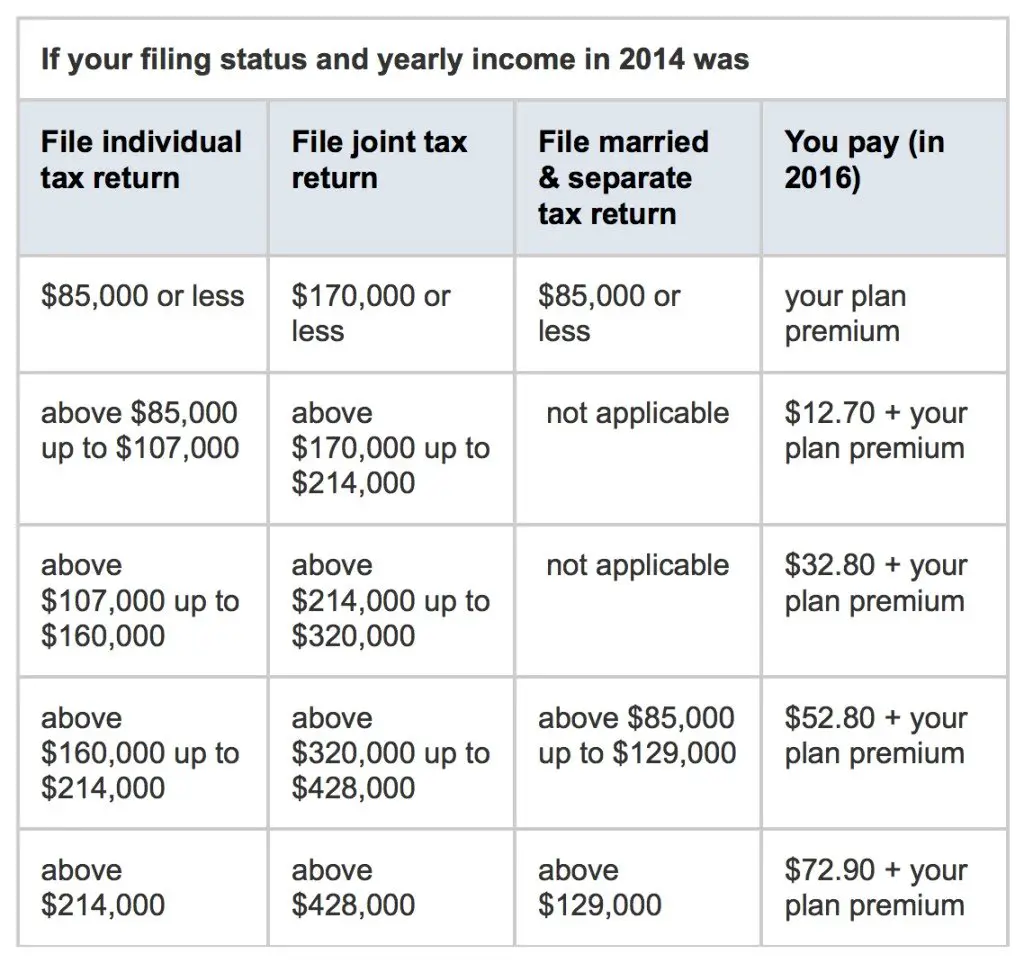

This chart lists the IRMAA surcharge for both Part B and Part D.

You May Like: Does Medicare Have Silver Sneakers

How Social Security Determines You Have A Higher Premium

We use the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your modified adjusted gross income . Your MAGI is your total adjusted gross income and tax-exempt interest income.

If you file your taxes as married, filing jointly and your MAGI is greater than $182,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, youll pay higher premiums. See the chart below, Modified Adjusted Gross Income , for an idea of what you can expect to pay.

If you must pay higher premiums, well send you a letter with your premium amount and the reason for our determination. If you have both Medicare Part B and Medicare prescription drug coverage, youll pay higher premiums for each. If you have only one Medicare Part B or Medicare prescription drug coverage youll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, well apply an adjustment automatically to the other program when you enroll. You must already be paying an income-related monthly adjustment amount. In this case, we wont send you another letter explaining how we made this determination.

Remember, if your income isnt greater than the limits described above, this law does not apply to you.

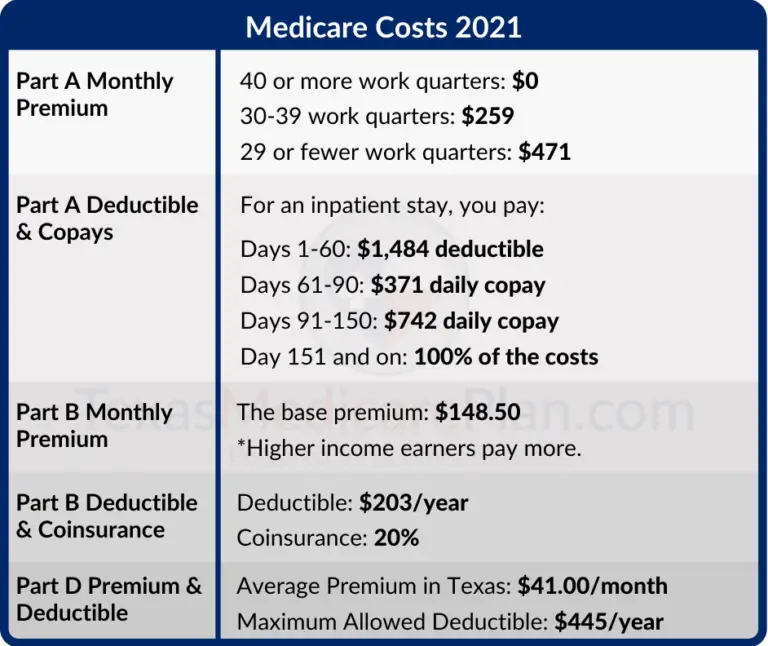

Medicare Part A Costs For 2022

Ninety-nine percent of people dont have to pay a monthly premium for Medicare Part A, commonly referred to as hospital insurance. But if you do receive treatment in a hospital or other approved facility, you are responsible for some costs.

- For 2022, the inpatient hospital deductible is $1,556, an increase from $1,484 in 2021. After you pay the benefit period deductible, your Medicare-approved inpatient care for the first 60 days costs you nothing.

- For Days 61-90, you are responsible for $389 of daily coinsurance, up from $371 in 2021.

- For lifetime reserve days , you pay $778 coinsurance per day used up from $742 in 2021.

- For approved stays in a skilled nursing facility, Medicare Part A doesnt require you to pay a deductible or coinsurance for the first 20 days. You pay $194.50 coinsurance for Days 21-100, up from $185.50 in 2021.

Also Check: What If Someone Gets Your Medicare Number

Medicare Costs That You Need To Know

Summary:

Your Medicare costs depend partly on what coverage choices youâve made. How much does Medicare coverage usually cost per month? Here is a breakdown to get a better idea of these costs:

- For Medicare Part A, many people pay no monthly premium. If you worked less than 10 years, you may pay a premium.

- You probably pay the Medicare Part B monthly premium, which for many people is } in }. You might pay more if you have a high income.

- If you have other coverage, like Medicare Part D prescription drug coverage or a Medicare Supplement insurance plan, your costs can vary.

Since Medicare is a federal government-sponsored health insurance program, you may think it covers every dollar of your health-care costs, but it doesnât. Read on to learn about your Medicare costs and other Medicare plan options to consider. What Medicare coverage do you have? The various categories are laid out below. If youâre not sure what kind of coverage you have, check your health insurance cards. You can also call Medicare at 1-800-MEDICARE . TTY users should call 1-877-486-2048. Medicare representatives are available 24 hours a day, seven days a week.

What Are The Parts Of Medicare

The different parts of Medicare help cover specific services:

- Medicare Part A Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

- Medicare Part B Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services.

- Medicare Part D Helps cover the cost of prescription drugs .

Also Check: How Much Is Aarp Medicare Supplement Insurance

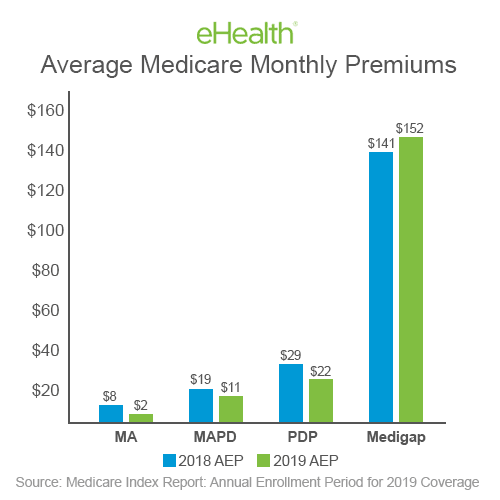

What Is The Monthly Cost Of A Plan F

The plan’s average cost is around $230.00 per month. However, many factors impact the premium price. Premium costs for Medigap Plan F can range from as low as $150.00 per month to as high as $400.00 per month or more. Factors that determine your cost include your ZIP Code, gender, age, tobacco use, and more.

Medicare Part A Deductible

Most Part A costs come from the inpatientInpatient refers to medical care that requires admission to the hospital, usually overnight. hospital deductible. Inpatient care provided at a hospital or skilled nursing facilitySkilled nursing facilities provide in-patient extended care with trained medical professionals to recover from injury or illness and activities of daily living. These facilities provide physical and occupational therapists, speech pathologists and medical professionals assist with medications, tube feedings and wound care. Skilled nursing stays are usually covered under Medicare Part A. will require you to pay the annual deductible.

For the year 2022, the Plan A deductible increased from 2022:

- Medicare Part A deductible 2021: $1,484

- Medicare Part A deductible 2022: $1,556

Read Also: How Do I Order Another Medicare Card

So How Much Does Medicare Cost Per Month

As you can see, Medicare costs are built up out of many building blocks. Theres no way to tell exactly how much you will pay each month, but this should give you the resources to do those calculations based on your own plans, income level, and healthcare needs. For someone with a premium-free Part A plan or a $0 monthly premium Part C plan, monthly costs can vary quite a lot compared to someone who pays the full amount for Part A or has a low-deductible, high-premium plan.

What If I Can’t Afford Part B

If youre at least 65 and cant afford your Medicare Part B premium or deductible, there may be help. Medicare Savings ProgramsMedicare Savings Programs help those with low incomes pay premiums and sometimes coinsurance for Medicare expenses. are designed for low-income individuals who have trouble affording healthcare. To help you get started, here are the four types of MSPs, and their most-recent eligibility requirements from 2021:

- Qualified Medicare Beneficiary Program : helps pay premiums, copays, deductibles and coinsurance for Parts A and B.

- Whos eligible: individuals with income up to $1,094 per month couples making up to $1,472

If you need help finding an affordable Medicare plan, contact GoHealth. Our licensed insurance agents can help you navigate the different options and see what makes the most sense for you.

Also Check: How Do I Know What Medicare Coverage I Have

Medicare Costs To Go Down In 2023

Lower-than-expected spending on an expensive drug and other things means beneficiaries will pay less next year.

Medicare beneficiaries are getting a rare bit of good news as their Part B premiums and deductibles will tick down next year after the government health insurance plan spent less than projected in 2022. Unfortunately, the cost reductions beneficiaries will see next year are much smaller than the increases they shouldered this year. But costs will also go down for Medicare Advantage and Medicare Part D prescription drug plans. At the same time, deductibles for hospitalization costs under Part A will be going up. If youre new to Medicare and wondering what these letters are all about, well get to that see Medicare Open Enrollment Presents Choices, below.

The Centers for Medicare and Medicaid Services has announced the standard Medicare premiums for Part B beneficiaries will be $164.90 a month in 2023, down $5.20 from the $170.10 monthly charge in 2022, or about 3% less. The annual deductible for all Medicare Part B beneficiaries will be $226 in 2023, which is $7 less than the 2022 deductible of $233.

Medicare Prescription Drug Coverage Costs

If youâre enrolled in a stand-alone Medicare Part D Prescription Drug Plan, you might pay a monthly plan premium .

With any type of Medicare Prescription Drug Plan, including Medicare Advantage prescription drug plans, your costs may vary and might include copayment or coinsurance for prescription drugs, as well as a deductible amount .

If you have many or costly prescriptions, you might reach a threshold known as the Medicare Part D coverage gap where you might pay a different amount for your prescriptions. For more details, see .

Read Also: Does Medicare Pay For Laser Spine Surgery

How Much Does Medicare Part D Cost

What it helps cover:

- helps cover prescriptions drugs.

- Plan premiums, the drugs that are covered, deductibles, coinsurance and copays will vary by Part D plans, so you should check and compare plans each year based on your needs, the prescription drugs you take, etc.

What it costs:

- Like Medicare Advantage , prescription drug plans are offered by private insurance companies contracted by the federal government.

- Plans vary in cost, coverage, deductibles and copays.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Which Insulin Pumps Are Covered By Medicare

Late Enrollment Penalties For Original Medicare

Finally, lets take a look at late enrollment penalties for Original Medicare. These are fees that you will have to pay if you dont enroll in Original Medicare at the proper time, during the relevant enrollment period. Enrollment details vary for each person, so make sure to explore this in more detail.

How Do I Enroll For Medicare Part B

Enrollment began on October 1, 2022, for kidney transplant recipients whose Medicare has ended. Kidney transplant recipients whose Medicare entitlement ends on or after January 1, 2023, can enroll for immunosuppressive coverage anytime.

Contact the Social Security Administration at 1-877-465-0355 to enroll.

Have questions? Our Patient Helpline, NKF Cares, is here to help! Call toll-free at 855.NKF.CARES or email [email protected] to get answers.

Read Also: How To Sign Up For Silver Sneakers With Medicare

A Is Free For People Who:

-

Are 65 and have worked at least 10 years and paid into Medicare

-

Are under 65 but have been receiving disability benefits for 24 months

If you don’t qualify for premium-free Part A, it will cost

-

$499 a month if you worked less than 30 quarters

-

$274 a month if you worked less than 30-39 quarters

In most cases, if you choose to buy Part A, you must also:

-

Have Medicare Part B

-

Pay monthly premiums for both Part A and Part B

If you sign-up late for Part A, you may have to pay a 10% penalty for twice as many 12 months periods as you went without signing up.

Example: Signed up 2 years late for Part A, you will pay a 10% penalty for both years for 4 years.