Can I Delay Enrolling In Medicare Part B

Some people may get Medicare Part A premium-free, but most people have to pay a monthly premium for Medicare Part B. Because Medicare Part B comes with a monthly premium, some people may choose not to sign up during their initial enrollment period if they are currently covered under an employer group plan .

If you are still working, you should check with your health benefits administrator to see how your insurance would work with Medicare. If you delay enrollment in Medicare Part B because you already have current employer health coverage, you can sign up later during a Special Enrollment Period without paying a late penalty. You can enroll in Medicare Part B at any time that you are still covered by a group plan based on current employment. After your employer health coverage ends or your employment ends , you have an eight-month special enrollment period to sign up for Part B without a late penalty.

Keep in mind that retiree coverage and COBRA are not considered health coverage based on current employment and would not qualify you for a special enrollment period. If you have COBRA after your employer coverage ends, you should not wait until your COBRA coverage ends to sign up for Medicare Part B. Your eight-month Part B special enrollment period begins immediately after your current employment or group plan ends . This is regardless of whether you get COBRA.

How Much Does Part B Cost In 2022

Medicare Part B uses your tax return from two years earlier to determine the monthly premium you will pay.

The standard Part B premium amount in 2021 was $148.50. Unless your individual income exceeded $88,000 or your joint income was more than $176,000, you will pay this monthly premium. Whether you choose a Medicare Advantage plan or go with Original Medicare, both will come with a premium for Part B.

According to the Philadelphia Inquirer, Both types of plans have a premium for Part B , about $158 a month for most people in 2022, and a deductible, which is expected to be $217 in 2022.

How To Get A Medicare Part B Give Back Plan

To get a Part B premium reduction plan, you must be enrolled in Part A and Part B. You must also not be accepting government assistance that pays part of the Part B premium already. But, if you dont qualify for a give-back plan, there are plenty of plan options on the market.

Its important to compare Medicare Advantage & Medigap before enrolling in either option. Many beneficiaries are unaware of the many limitations that come with Advantage plans. A Part B reduction may not be worth the additional cost-sharing.

Disclaimer: By clicking the button above, you consent to receive emails, text messages and/or phone calls via automated telephone dialing system or by artificial/pre-recorded message from representatives or licensed insurance agents of Elite Insurance Partners LLC, its affiliates or third-party partners at the email address and telephone number provided, including your wireless number , regarding Medicare Supplement Insurance, Medicare Advantage, Medicare Part D and/or other insurance plans. Your consent is not a condition of purchase and you may revoke your consent at any time. This program is subject to our Privacy Policy and Terms of Use. This website is not connected with the federal government or the federal Medicare program.

Don’t Miss: Is Bevespi Covered By Medicare

Who Is Automatically Enrolled

Groups that are automatically enrolled in original Medicare are:

- those who are turning age 65 and already getting retirement benefits from the Social Security Administration or the Railroad Retirement Board

- people under age 65 with a disability who have been receiving disability benefits from the SSA or RRB for 24 months

- individuals with amyotrophic lateral sclerosis who are getting disability benefits

Its important to note thateven though youll be automatically enrolled, Part B is voluntary. You canchoose to delay Part B if you wish. One situation where this may occur is ifyoure already covered by another plan through work or a spouse.

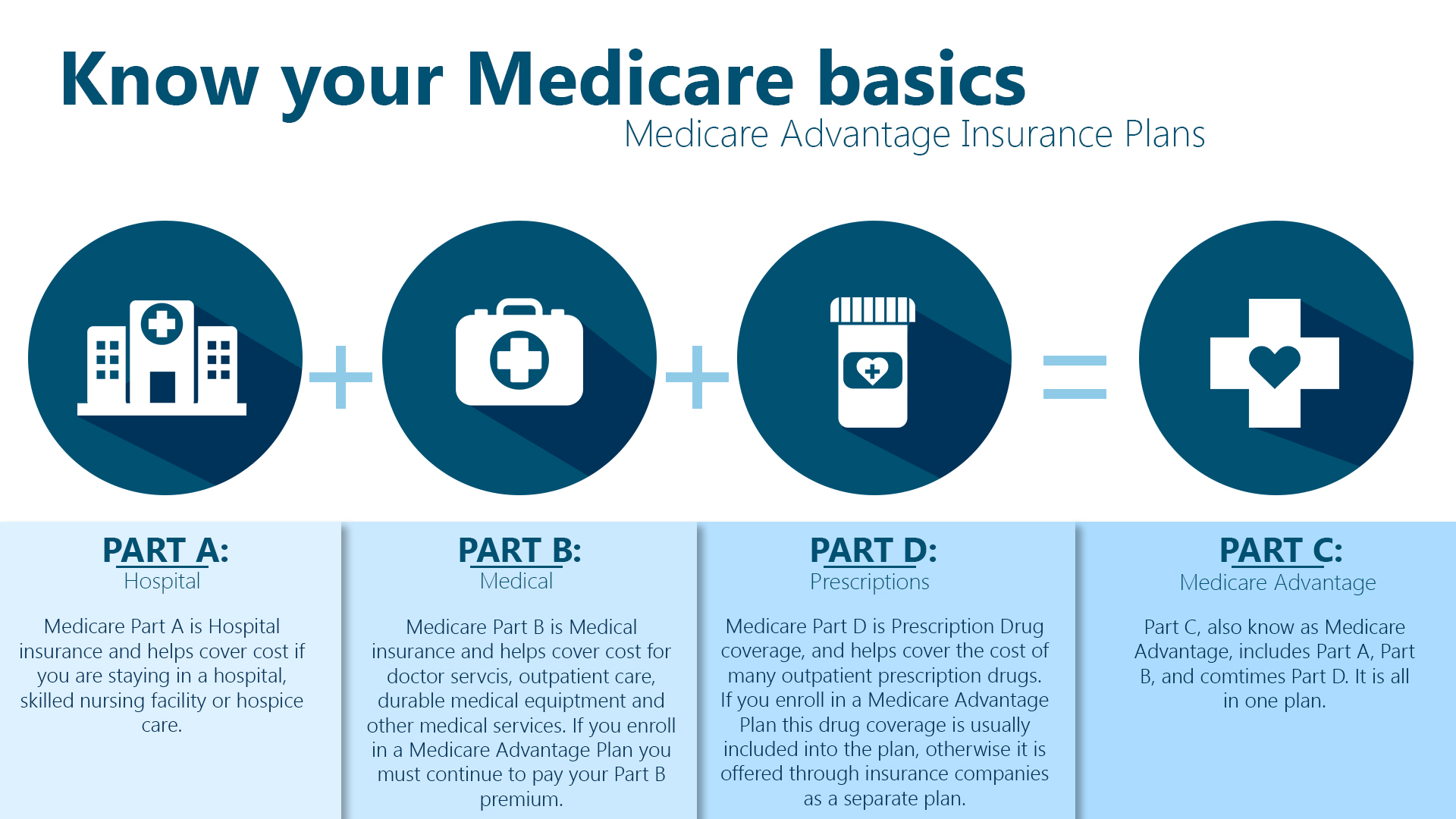

What Is Medicare Part B

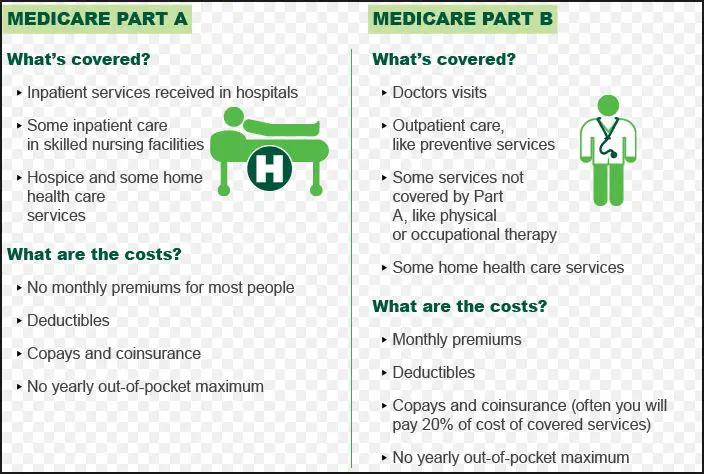

Medicare Part B helps cover medical services like doctors’ services, outpatient care, and other medical services that Part A doesn’t cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem.

Cost: If you have Part B, you pay a Part B premium each month. Most people will pay the standard premium amount. Social Security will contact some people who have to pay more depending on their income. If you don’t sign up for Part B when you are first eligible, you may have to pay a late enrollment penalty.

For more information about enrolling in Medicare, look in your copy of the “Medicare & You” handbook, call Social Security at 1-800-772-1213, or visit your local Social Security office. If you get benefits from the Railroad Retirement Board , call your local RRB office or 1-800-808-0772.Learn More:

Recommended Reading: How Can I Get My Medicare Card Number

How To Sign Up For Medicare Part B

Beneficiaries collecting Social Security benefits when they age into Medicare at 65 will automatically be enrolled. Youll receive your Medicare card the month before your birthday. If youre not collecting Social Security benefits, youll need to enroll yourself. You can apply online, over the phone, or in-person.

All beneficiaries will have an Initial Enrollment Period for both Part A & Part B. This period begins three months before the month you turn 65th birthday and ends three months after. If you dont enroll during your Initial Enrollment Period and dont have , you could be subject to a penalty.

You wont pay the penalty if you meet certain conditions that allow you to sign up for Part B during a Special Enrollment Period. An example would be if you continued working past 65 and had creditable coverage through an employer group health insurance.

Late Enrollment Penalties For Medicare Part A And Part B

Both Medicare Part A and Part B can have late enrollment premium penalties.

The Part A Late Enrollment Penalty

If you must pay a Part A premium and enroll late, you could pay a penalty. The Part A late enrollment penalty is 10% of the Part A premium. You pay the penalty in addition to your Part A premium for twice the number of years you delay enrollment.

Example: If you delay 2 years, you will pay an additional 10% of the Part A premium for 4 years .

The Part B Late Enrollment Penalty

The Part B penalty is 10% of the monthly premium amount for each full 12-month period enrollment is delayed. You pay the Part B premium penalty in addition to your Part B premium for as long as you have Medicare Part B.

Example: You delayed Part B 3 years. To calculate how much your penalty will cost, you’ll multiply x . In this case, x . Thus, your Part B premium penalty will be 30% of the Part B premium.

Also Check: What Is The Best Medicare Advantage Plan In Washington State

Merging Medicare Parts B And D

The American Patients First plan considers moving Part B prescription drug coverage into Part D. Unfortunately, if you have certain medical conditions, this could actually raise how much you pay under the current system.

First, not all Medicare beneficiaries purchase Part D coverage alone or as part of a Medicare Advantage plan. In order to gain drug coverage, this proposal would require that they purchase a Part D plan and pay monthly premiums. With basic premiums costing $32.74 per month in 2020, this would add an extra $392.88 per year in healthcare costs to people who may least be able to afford it. Keep in mind that it does not include the cost of copayments or coinsurance.

Second, it is unclear if all medications or only a select group of drugs would be included in this proposal. There could be significant implications for people who require frequent IV medications, especially biologics for autoimmune and rheumatologic conditions.

These medications may be less expensive for people under Part B, especially since Part D plans can charge expensive copayments or coinsurances for higher-tiered medications on their formulary. They may even require prior authorizations or choose to not cover certain medications at all.

While the Medicare program itself could save money in the long run, the American Patients First proposal is likely to increase costs for many people on Medicare.

Does Medicare Cover Tetanus Shots

Coverage includes shots of severe diseases such as tetanus, pertussis, and diphtheria. Without treatment, these diseases can become deadly. In some cases, even with the best treatment and medical attention it can kill those with the infection.

Before the development of vaccines, hundreds of tetanus cases were found each year in the United States. Now, we have vaccines to protect us from such diseases.

99% fewer examples of Diptheria are found each year due to the shot.

Lockjaw is a common nickname for this disease. Symptoms include a painful, widespread stiffness and tightening of the muscles.

When the head and neck muscles begin to stiffen and tighten, the ability to open your mouth becomes difficult. Likewise, it becomes challenging to swallow or even breathe.

Unlike the others, tetanus infections happen by bacteria entering the body through open scratches, wounds, or cuts. Part B coverage pays for tetanus shots when given as treatment for an injury or illness.

Part D covers vaccines given to prevent illness. Check with your plan for availability in your service area.

Part D plans are not all the same benefits may vary among insurance carriers. Finding a Top Part D plan is easy when you give us a call at the number above.

You May Like: When Can I Enroll For Medicare Part B

How Do You Enroll In Original Medicare

To enroll in Original Medicare , you must be 65 and dont necessarily have to be retired. Initial enrollment period packages are sent to people 3 months before they turn 65 or during their 25th month of disability benefits.

If youve received Social Security disability benefits for 24 months, you are automatically enrolled in Part A and Part B.

Medicare Advantage Plans Negotiate Costs

The anti-kickback statute prohibits manufacturers from giving or offering to give anything of value to someone to induce the purchase of any item or service for which payment may be made by a federal healthcare program. This includes medications from Medicare Part B and Part D. This is the reason you cannot use coupons, rebates, or vouchers to keep your drug costs down when you are on Medicare.

Although you cannot negotiate with the pharmaceutical companies yourself, your Medicare Advantage plan may be able to do so on your behalf. Until recently, only Medicaid and the Veteran’s Health Administration have been able to do so. Now CMS will allow Medicare Advantage plans to negotiate prices of medicines covered under Medicare Part B. This took into effect in 2019.

Medicare Advantage plans will do so by using step therapy to keep costs down. In this scenario, your plan may require that you try a less expensive medication before moving you up to a more expensive alternative if the first treatment is not effective. Private insurance plans that have used this model have achieved discounts of 15-20% whereas Medicare has paid full price.

Read Also: Is Prolia Covered By Medicare Part B Or Part D

To Qualify For Part B Benefits You Need To Be:

- a United States citizen who is age 65 or older or

- a permanent legal resident who is 65 or older and who has lived in the United States for at least five years or

- a green card holder age 65 or older who has been married for at least one year to a U.S. citizen or green card holder provided that your spouse is at least 62 and is fully insured or

- entitled to Medicare under age 65 on the basis of receiving Social Security disability benefits.

Can You Get Insurance To Help Cover Part A And Part B Expenses

As youve seen in this article, Medicare Part A and Part B generally come with out-of-pocket costs for you to pay. Did you know that you might be able to buy a Medicare Supplement insurance plan to help cover those expenses? There are up to 10 standardized Medicare Supplement plans available in most states. Learn more about Medicare Supplement insurance.

You can compare Medicare Supplement plans and Medicare coverage options anytime you like, with no obligation. Type your zip code in the box on this page to begin.

The product and service descriptions, if any, provided on these Medicare.com Web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Don’t Miss: Is Rollator Walker Covered By Medicare

What Original Medicare Doesn’t Cover

Original Medicare doesn’t cover everything. With a few exceptions, Original Medicare doesn’t include coverage for prescription drugs. It also does not cover health care benefits you may have been used to getting with an employer plan such as dental, vision, hearing health care or wellness items like fitness memberships.

Does Medicare Cover Shingles Shots

Proper diagnosing and treatment for shingles must first begin with a doctors visit. Part B pays for 80% of the doctors fee-for-service. Although, you must first have met your annual deductible amount.

Most Supplement plans cover your medical bills and filling in your gaps. But, once your doctor diagnoses you with the Shingles, medication, and vaccines are essential for treatment.

Don’t Miss: When Can You Start Collecting Medicare

What Does Medicare Part B Cover

Part B provides coverage for a mixture of outpatient medical services. This includes coverage for preventive vaccines, cancer screenings, annual lab work, and much more.

It will cover preventive services in addition to specialist services. Part B even covers services for mental healthcare, durable medical equipment that your doctor finds medically necessary.

Also, Part B will cover some services you receive while in the hospital. This includes surgeries, diagnostic imaging, chemotherapy, and dialysis if you obtain drugs while at the hospital, it will also provide coverage for those.

What Doesnt Medicare Part B Cover

Medicare Part B doesnt cover every possible medical expense. Heres a partial list of what Part B doesnt generally cover.

- Hospital inpatient care, such as a semi-private room, meals, and more. These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B.

- Some tests and services that your doctor might order or recommend for you. If your doctor wants you to have lab tests, or any services beyond your standard annual wellness visit, you might want to ask whether Medicare covers them. Medicare Part B might cover some of these services.

- Routine dental care

- Routine vision care

- Most prescription drugs you take at home. Medicare Part B may cover certain medications administered to you in an outpatient setting.

- Hearing aids

- 24-hour home health care

- Long-term care, such as you might get in a nursing home. If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesnt generally cover it.

Some of these services, such as routine dental and vision care, might be covered under a Medicare Advantage plan.

Recommended Reading: How Much Does Medicare Cost Me

Medicare Part B Costs

While some people may be eligible for premium-free Medicare Part A if theyve worked at least 10 years and paid Medicare taxes during that time, most beneficiaries must pay a monthly premium for Medicare Part B insurance unless they qualify for low-income assistance. This premium amount may change from year to year. Learn how much you may have to pay for your Medicare Part B premium here.

If your income falls above a certain threshold, you may have to pay a higher amount for Medicare Part B coverage. This is known as an Income Related Monthly Adjustment Amount , which is an extra amount youll pay on top of your monthly Part B premium. Social Security will contact you if this applies to you.

In addition, you may owe certain out-of-pocket expenses for Medicare Part B-covered services, including copayments, coinsurance, and the Part B annual deductible. Once youve met your yearly deductible, youll usually pay 20% of the Medicare-approved amount for most medical services and supplies. However, this may vary, depending on the specific service or equipment.

Do you have questions about what Medicare Part B covers? Or perhaps youre interested in finding additional benefits beyond Original Medicare, such as through a Medicare Advantage plan. If youd like to discuss your Medicare coverage options with a licensed insurance agent, call eHealth today to learn about Medicare plan options that may work for your situation.

New To Medicare?

B Deductible & Coinsurance

The deductible is the amount of money you will need to pay in out-of-pocket costs before the plan starts coverage. For example, in 2022, the yearly deductible for Medicare Part B is $198, and coinsurance of 20% for several covered services.

How much you will pay for Part B-covered services depends if you visit a participating or non-participating provider.

Participating providers accept Medicares approved amount for a service, and you will be responsible for the Part B deductible along with 20% of the approved amount.

Some providers, however, do not accept Medicares approved amount. These non-participating providers did not sign an agreement with Medicare and can charge up to 15% more than Medicares approved amount, meaning youd be responsible for the 20% coinsurance plus 15%.

Under Original Medicare, if the Part B deductible applies, you must pay all costs until you meet the yearly Part B deductible. After you meet your deductible, Medicare begins to pay its share and you typically pay 20% of the Medicare-approved amount of the service . Theres no yearly limit on what you pay out-of-pocket. There may be limits on expenses you pay through supplemental coverage you may have, like Medigap, Medicaid, or employer or union coverage.Medicare and You Handbook 2022

Also Check: Should I Get Medicare Part C