How To Shop & Compare Medicare Supplement Plans

Researching the plan thats right for you is key to getting the coverage you need. Each plan offers specific benefits depending on your state, which benefits you desire, and the costs.

Step 1: Determine if You Are Eligible to Enroll

In general, if you’re approaching your 65th birthday, but you haven’t started taking Social Security benefits yet, you are eligible for Medicare. For more information, please visit Medicare.gov.

Step 2: Find a List of Medicare Supplement Plans Available in Your State or ZIP Code

Using the tool available on Medicares website, you can search for coverage plans based on your location.

If you live in Massachusetts, Minnesota, or Wisconsin, Medicare Supplement policies have different rules. You have guaranteed issue rights to buy a Medicare Supplement policy, but the policies are different.

Step 3: Determine Which Aspects of Coverage Are Most Important to You

Perhaps you are concerned about out-of-pocket copays or high deductibles or you have a preexisting condition and want to know if there is a waiting period for coverage for it. Be sure to check each plan for the details that matter most to you.

Step 4: Compare the Difference in Cost Among Medicare Supplement Plans

Step 5: Consider Talking to a Broker or Consultant

Step 6: Sign Up

Once youve found a plan that works for you, contact that insurance company directly to enroll.

Is Supplemental Insurance Worth It

It depends. Most seniors do supplement Medicare in some way. Those that dont have access to group health coverage will often invest in a Medigap policy to supplement Original Medicare or Medicare Advantage plan in lieu of Original Medicare. The right choice between these two really hinges on what you need. Medicare Advantage has lower premiums, which can keep costs down for healthy seniors. Medigap has higher premiums than Medicare Advantage plans. But those higher premiums may be worth it when:

- You have health issues that require frequent doctor visits.

- You travel frequently out of your home state or out of the country.

- You prefer to choose your own doctors and specialists, rather than seeing only the healthcare providers that are in your plans network.

Compare Medicare Supplement Insurance Plans

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

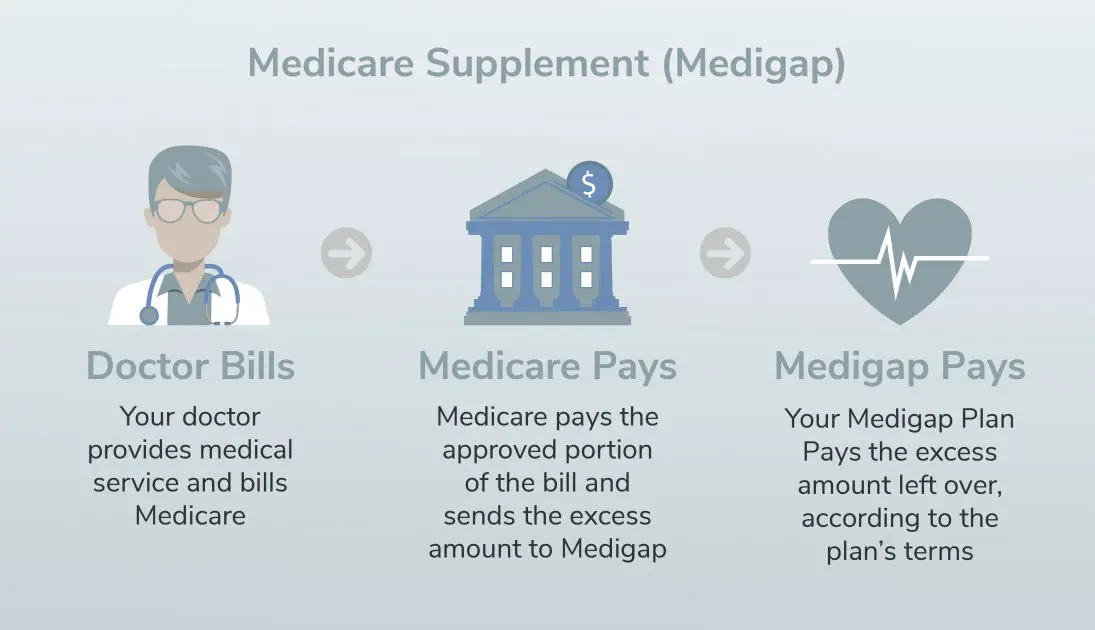

Medicare Supplement Insurance, or Medigap, is insurance that pays for some costs that arent covered in Original Medicare. A Medicare Supplement Plan might cover copayments, coinsurance or deductibles you owe under Original Medicare.

Medicare Supplement Plans operate as additional not primary insurance coverage. You must have Medicare Part A and Part B to buy a Medigap plan. These policies are sold by private companies, and the plans are standardized, so Medicare Supplement Plan G in New York will offer the same coverage as Medicare Supplement Plan G in Ohio .

Don’t Miss: Does Medicare Cover Family Counseling

Best Medicare Supplement Companies

Unlike health insurance, where policies differ among providers, Medicare supplement plans are standardized so that the benefits for each plan letter are the same for each company. This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna.

However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans. Itâs important that you take this into account along with each providerâs financial strength and history of rate increases. Some companies may offer cheap rates but will increase your rates more quickly as you age.

Cigna, similar to UHC and Aetna, currently has an AM Best rating of A, meaning that it has the financial strength to continue to pay health insurance claims in the future. Cigna Medicare supplement has some added benefits when compared to other companies, such as a household premium discount. The discount is available in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.

What Do Medicare Supplement Plans Not Cover

Most Medicare Supplement plans have limits and exclusions to what they cover. For example, Plans C, D, F, G, and N cover 80% of medically necessary emergency care outside the U.S., but each of those four plans has other areas that they dont cover. Medicare.gov offers a detailed explanation of benefits for each plan.

Most common things not covered by Medicare Supplement plans:

- Part B Deductible

- Part B Excess Charge

- Foreign Travel Exchange

- Skilled nursing facility care coinsurance

Also Check: Is Bevespi Covered By Medicare

Find A Secondary Health Insurance Quote With First Quote Health

If youre still wondering if a secondary health insurance plan is for you, its best to talk to a health insurance professional. Health insurance agents and brokers are a great tool and resource when it comes to shopping for a plan, or even just getting answers to your health insurance questions. First Quote Health makes finding a qualified agent easy. Simply enter your zip code here so we can locate someone licensed near you, and get started today.

Popular Articles

Can You Be Covered By Two Health Insurance Plans

Yes, you can be covered by two health insurance plans.

In some cases, each member of a couple might have health insurance through their employer. Children up to the age of 26 also might have coverage through their employer and their parents.

It is also possible for others such as members of the military and those who are on Medicare but are still working to have more than one form of coverage.

However, being covered by two plans is the exception to the rule. If youre covered by one solid employer-based health insurance plan, thats usually sufficient for most people, Mordo says.

Youre really not getting any benefit by being covered by two different employer-based plans, he says.

You May Like: How To Sign Up For Medicare And Tricare For Life

Aarp By United Healthcare

Most Experience Working with Seniors

AARP is a special interest group that has served seniors since 1958. The company was founded with the goal of keeping aging Americans informed, empowered, and independent. Through various programs and services, it works to make the world more accessible and enjoyable for seniors across the country.

AARP is not an insurance company itself, but it does frequently team up with insurance providers to bring seniors affordable and accessible insurance solutions. To provide Medicare Supplement plans, it has teamed up with United Healthcare, an experienced nationwide health insurance company.

| Number of States Covered |

|---|

| Enrollment discount, household discount |

Coverage

AARP offers plans A, B, C, F, G, K, L, and N. Plans are available in all 50 states, but the plans that are available will vary by location. Customers only need to enter their zip code to see an estimate for a Medicare Supplement plan with AARP. The website will then display all of the plans available in your area. The premium estimates displayed assume that you are turning 65 and do not use tobacco products. So your actual premium may vary depending on your age and habits. Alternatively, customers can contact an agent to discuss their options over the phone.

Customers will also have the option to purchase Medicare Part D directly through United Healthcare when they sign up for a Medicare Supplement plan if they wish to have coverage for prescription medications.

Sample Pricing:

How Does Medicare Work As A Secondary Payer

Knowing what it means for Medicare to be the secondary payer for health coverage can help you understand how your health care is paid for and what you can expect from the way Medicare coordinates with other insurance providers.

Understanding What Primary and Secondary Payer Means

In the simplest of terms, a primary payer will cover the cost of a health care bill according to its policy rules and up to the limit established therein.

A secondary payer assumes coverage of whatever amount remains after the primary payer has satisfied its portion of the benefit, up to any limit established by the policies of the secondary payer coverage terms.

When Medicare coordinates benefits with other health insurance coverage providers, there are a variety of factors that play into whether Medicare is the primary, secondary or, in very rare cases, a tertiary payer.

Common Circumstances Where Medicare is the Secondary Payer

Generally, a Medicare recipients health care providers and health insurance carriers work together to coordinate benefits and coverage rules with Medicare. However, its important to understand when Medicare acts as the secondary payer if there are choices made on your part that can change how this coordination happens. This will reduce the risk of you winding up with any unexpected out-of-pocket charges.

Medicare is the secondary payer if the recipient is:

Related articles:

You May Like: How To Apply For Medicare Insurance

Medicare Secondary Insurance Vs Supplemental Policy

Soon after the Federal government implemented Medicare in July 1965, private insurance companies began offering policies covering areas that Medicare did not. In 2010, the government mandated uniform Medicare Supplemental Insurance policies, often called Medigap. Medicare secondary insurance is also offered by private insurance companies, and supplements your primary Medicare Part A and Part B coverage. In other respects, the two insurance types are very different.

Best Medigap Coverage Information: Aetna

Aetna

-

Need to enter personal information to get pricing

-

Coverage documents are lengthy

Aetna stands out because it offers several Medicare Supplement plans, including Parts A, B, C, D, F, G, and N, with each plans information and coverage clearly laid out on the company website. Consumers are supplied with ample details to really understand the options before making a decision. Aetna also provides price information in multiple formats to better help a potential customer understand the details. However, the downloadable document with all the coverage details can be difficult to get through without guidance. Overall, we found Aetna to be very helpful and informative throughout the entire process of deciding upon a Medigap plan.

Aetna, now owned by CVS Health Corporation, has been in business since 1853 and earns an A with AM Best for financial strength. You can contact the company online, over the phone, or in person, assuming the offices are open in your area. Aetna offers two apps through Google Play and the App Store: Aetna Health tracks your account information, and Attain by Aetna encourages healthy habits.

Recommended Reading: Does Aspen Dental Accept Medicare

Primary Insurance Vs Secondary Insurance: Who Pays First

Coordination of benefits isnt always standard. Plans can differ, so its vital to talk to your employers benefits department and health plan if you have two health plans.

That said, here are situations when you may have more than one health plan and which one would likely be the primary insurer and which would be secondary:

| Situation |

|---|

The Best Medicare Supplement Companies Of 2021

- Monthly Plan Premiums Start at $0

- Zero Cost, No Obligation Review

- Find Plans That Cover Your Doctors and Prescription Drugs

| 10 | 18 |

Medicare is an extremely valuable healthcare resource for many seniors. However, Medicare alone does not cover all of the healthcare costs one is likely to face later in life. And since unexpected medical expenses can lead to stress and financial strain, many seniors prefer to be prepared for what might lay ahead.

Medicare Supplement Insurance is one way seniors can plan ahead for these unexpected costs. Customers pay a monthly premium for insurance that lowers or totally covers the out of pocket costs for expenses. These expenses can include deductibles, copays, hospital stays, and doctors appointments. Some plans offer more extensive benefits for expenses such as international healthcare and skilled nursing facilities. There are many different plans available to accommodate people who desire different levels of coverage. And while having so many options makes it easy to get the right level of coverage, it can be overwhelming to sort through all of the companies that offer Medicare Supplement plans to find the right one for you.

Recommended Reading: Does Medicare Pay For Inogen Oxygen Concentrator

When Can I Buy Medicare Supplemental Insurance

Remember, the best time to purchase a Medigap policy is during the 6-month open enrollment period, which begins the day you have Medicare Part B insurance if youre 65 or older. During open enrollment, you can purchase any Medigap policy in your state, regardless of health problems. If you wait until this period closes, you may not be able to buy a Medicare supplemental insurance plan. This makes it especially smart to start comparing your options and getting quotes from Benzingas recommended providers early so you dont miss your enrollment window.

Can I Have Other Insurance And Use Champva

Yes! If the beneficiary has Other Health Insurance , the OHI should be billed first.

The VA Explanation of Benefits from the OHI should then be submitted with the claim for reimbursement to CHAMPVA.

By law, CHAMPVA is always the secondary payer except to Medicaid, State Victims of Crime Compensation Programs, Indian Health Services, and Supplemental CHAMPVA Policies.

Don’t Miss: What States Have Medicare Advantage Plans

Are There Any Other Instances When Medicare Works With Employer Health Insurance

There are some cases where you can use Medicare and employee health insurance. For example, if you are over 65 and returning to work, the above primary and secondary insurance rules for large and small companies still apply.

If you enroll in Medicare Part B, you may drop the coverage without penalty. Then you can re-enroll once you retire. You will have an eight-month sign-up period.

Also, some people with disabilities need to have Medicare benefits before they turn 65. If they are actively employed, Medicare will often serve as the primary form of insurance. However, if the person works for a company with 100 or more employees, Medicare will be the secondary insurance.

Additionally, consider whether to use a Health Reimbursement Account or Health Savings Account.

How does affordable Medicare work with employer insurance subsidy accounts? If you have an HRA, your employer will put money into an account to reimburse you for any payments you make to Medigap plans.

Note that your employer can only contribute to an HRA when you are on Medicare. This is covered under Section 105 of the Internal Revenue Service Tax Code. Also, you can only qualify for the HRA if enrolled in your employers health plan.

Neither you nor your employer may contribute to an HSA when you are on Medicare.

When And How To Enroll In Medicare

As we mentioned above, people who want to enroll in Medicare must be at least 65 years old if they are under 65, they must either have a covered disability or suffer from end-stage renal disease. Here well discuss these requirements in full.

If Youre Age 65 or Older

As you near your 65th birthday, you must start thinking about Medicare.

If you receive benefits from the Social Security Administration or the Railroad Retirement Board , you will be automatically enrolled in Parts A and B.

If you dont receive these benefits yet, youll have to enroll yourself. Youll have three months before your birthday month, the month of your birthday, and three months after your birthday month to submit the paperwork. This total of seven months is called the Initial Enrollment Period.

If youre 65 but youre covered by your or your spouses employers group health plan, you dont have to enroll in Medicare immediately. You can choose to enroll at any point during your coverage or you can enroll within eight months of the employment termination date.

For example, if youre still working, youre enrolled in your workplace group plan, and you turn 65, you can choose to enroll while you still have coverage but youre not obligated to. Once your job ends, because you retire or youre terminated, you have eight months to enroll in Part A and Part B from the date the employment or the coverage ends. This is called a Special Enrollment Period or SEP.

If Youre Under 65 With a Disability

You May Like: How Does An Indemnity Plan Work With Medicare

What Does Secondary Health Insurance Cover

Secondary health insurance can cover pretty much anything. They can provide money so that you can cover your dental or vision-related expenses, or provide accident insurance. Car crashes are an incredibly common problem that can be covered by secondary medical insurance, as there were 6,296,000 car crashes reported in 2016.

Accident insurance can also be important if your children play sports, where concussions and other accidents can be very common. It can also cover costs associated with chronic or terminal illness, for example, cancer. Serious illnesses are terrifying, and they also can cause thousands of dollars in medical bills, which makes everything more terrifying. Secondary health insurance plans can soothe some of this anxiety.

Can You Have Two Health Insurance Plans

Yes, you can have two health plans.

The most common example of carrying two health insurance plans is Medicare recipients, who also have a supplemental health insurance policy, says David Mordo, former national legislative chair and current regional vice president for the National Association of Health Underwriters.

Its also possible that a married couple could have two health insurance plans, even if each spouse is covered through a health insurance plan at their workplace.

Theyre both covered under their own policies with their companies, but one of the spouses decides to jump on their spouses plan, Mordo says.

You also might have two health insurance plans if you have health insurance but also receive Medicaid coverage. Or, perhaps you are under the age of 26 and have group coverage both through an employer and your parents’ health insurance.

Other examples of when you might have two insurance plans include:

- An injured worker who qualifies for worker’s compensation but also has his or her own insurance coverage.

- A military veteran who is covered by both Veterans Administration benefits and his or her own health plan.

- An active member of the military who is covered both by military coverage and his or her own health insurance.

You May Like: What Is A Medicare Special Needs Plan