The Benefit Of A Medicare Supplement

Medigap policies are great because they give you the freedom to see any doctor, anytime, without hassle. Plus, since it works with Medicare to cover you, there are little to no costs when you see the doctor.

If you have serious medical conditions or serious medical conditions run in your family, a Medigap plan could be a huge money saver. Its better to have the insurance coverage you need before you need it.

Medigap plans can deny coverage if your health conditions become too serious and youre not eligible for a Guaranteed Issue right. Its best to buy Medigap when youre younger and healthier.

With Medigap insurance, you can enroll or change your plan any time of the year, if you qualify medically.

If youre okay with the freedom to see any doctor, predictable healthcare costs, and predictable coverage then Medigap could work for you.

Medigap Helps Pay Your Part B Bills

In most Medigap policies, the Medigap insurance company will get your Part B

information directly from Medicare. Then, they pay the doctor directly. Some Medigap insurance companies also provide this service for Part A claims.

If your Medigap insurance company doesn’t provide this service, ask your doctors if they “participate” in Medicare. This means that they “accept

” for all Medicare patients. If your doctor participates, the Medigap insurance company is required to pay the doctor directly if you request it.

Is There An Enrollment Or Switching Period

There is a 6-month open enrollment period for Medigap policies. The period begins in the first month during which a person qualifies for Part B and lasts for 6 months.

The open enrollment period is often the most cost-effective time to purchase a Medigap policy. This is because private insurance companies cannot refuse to sell a person a Medigap policy or require them to provide information on preexisting medical conditions during this time.

If a person wants to purchase a Medigap policy outside of the open enrollment period, they can. However, an insurance company may require medical underwriting and exclude preexisting conditions from coverage.

As a result, the person may need to undergo a physical examination or provide information about their health before the insurance company offers them a Medigap policy.

Also, outside of the open enrollment period, the insurance company can deny a person coverage.

Read Also: When Do Medicare Benefits Kick In

Can You Switch Yes But Theres A Catch

Its logical to consider enjoying the cost savings of a Medicare Advantage plan while youre relatively healthy, and then switching back to regular Medicare if you develop a condition you want to be treated at an out-of-town facility. In fact, switching between the two forms of Medicare is an option for everyone during the open enrollment period. This Annual Election Period runs from October 15 to December 7 each year.

Heres the catch. If you switch back to regular Medicare , you may not be able to sign up for a Medigap insurance policy. When you first sign up for Medicare Part A and Part B, Medigap insurance companies are generally obligated to sell you a policy, regardless of your medical condition. But in subsequent years they may have the right to charge you extra due to your age and preexisting conditions, or not to sell you a policy at all if you have serious medical problems.

Some states have enacted laws to address this. In New York and Connecticut, for example, Medigap insurance plans are guaranteed-issue year-round, while California, Massachusetts, Maine, Missouri, and Oregon have all set aside annual periods in which switching is allowed. If you live in a state that doesn’t have this protection, planning to switch between the systems depending on your health condition is a risky business.

What Companies Sell Medicare Supplements

Disclaimer: By clicking the button above, you consent to receive emails, text messages and/or phone calls via automated telephone dialing system or by artificial/pre-recorded message from representatives or licensed insurance agents of Elite Insurance Partners LLC, its affiliates or third-party partners at the email address and telephone number provided, including your wireless number , regarding Medicare Supplement Insurance, Medicare Advantage, Medicare Part D and/or other insurance plans. Your consent is not a condition of purchase and you may revoke your consent at any time. This program is subject to our Privacy Policy and Terms of Use. This website is not connected with the federal government or the federal Medicare program.

You May Like: What’s Better Medicare Or Medicare Advantage

Medicare Advantage Doctor Network

There are strict doctor networks with Medicare Advantage plans, especially HMO options. While the PPO option provides coverage for out-of-network doctors, the cost is substantially higher.

Medicare Advantage plans only cover you within the service area, and dont provide foreign travel emergency coverage.

The Benefit Of Medicare Advantage

Medicare Advantage plans are great for healthy people. You may want a Part C plan for the basic dental, vision, or gym membership coverage. Sometimes these plans cover Part D prescriptions. So, yes there are benefits to Part C.

But before you decide which option to choose, make sure you fully understand all sides. If youre okay with strict doctor networks, higher out-of-pocket costs, and annual changes to coverage, Part C could work for you.

Also Check: When Do My Medicare Benefits Start

When Should You Get A Medicare Supplement Plan

It is crucial to get a Medicare supplement plan when you sign up for Medicare Part B, warns Ari Parker, co-founder of Chapter, an insurance agency that specializes in Medicare.

Medigap plans are offered by private insurance companies, but the Affordable Care Act rule that prohibits insurers from denying coverageor charging higher premiumsbased on pre-existing conditions does not apply to Medigap plans.

With Medicare supplement plans, in most states you have just six months from when your Part B coverage kicks in to qualify for a Medigap policy with no underwriting. Thats the only time your previous conditions will not count against you and the price of your policy will be the same as someone who is perfectly healthy, says Parker.

However, if you live in certain statesincluding Connecticut, California, Maine, Massachusetts, Missouri, New York, Oregon and Washingtonyou are able to change your Medigap policy without obtaining additional underwriting during either an annual open enrollment window or at any time, though you may be limited to plans with the same or fewer benefits.

How Does Medicare Supplement Insurance Work With Medicare

Medicare Supplement Insurance works with Original Medicare Parts A and B. If you choose to buy a standalone Part D Prescription Drug plan, Medicare Supplement works with that, too.

Medicare Supplement Insurance is different from Medicare Advantage. You can have either a Medicare Advantage Plan or a Medicare Supplement Plan, but not both at the same time.

Don’t Miss: Does Medicare Cover Artificial Disc Replacement

Who Needs Medigap Insurance

If you have Medicare, you should consider a Medigap plan. A Medicare supplement plan can provide you with peace of mind during a major health event.

Those that have a lot of doctors should consider a Medigap policy, since Medigap allows you to see any doctor that takes original Medicare, you have a plethora of options.

Beneficiaries with chronic health conditions, a strict budget, lower risk tolerance, and those that travel need to sign up for Medigap.

If one of those applies to you, talk to a Medicare advisor to find out which option is going to provide you with the most value.

Hypothetical Medicare Supplement Premium

- Premium for Plan G: $95.00 per month

- + Medicare Part B premium base rate: $170.10 per month

- + Medicare Part B annual deductible: $233

Total: $3,414.20 per year.2

Plan G covers all of your medical expenses at 100%, except the Part B deductible. So you can expect this to be your total annual cost.

Example 2: Plan G High-Deductible

- Premium for Plan G high-deductible: $20.00 per month

- + Medicare Part B premium base rate: $170.10 per month

- + Medicare Part B deductible: $233

Total: $2,514.20 per year.3

This is your best case scenario, which means you only pay the monthly premium assuming no other out-of-pocket medical expenses if you do not utilize medical services.

Your worst case scenario:

- $2,514.50 premium and Part B deductible

- + $2,490 annual high deductible

Total: $5,004.20 per year.

Comparison: Example 2 costs $1,590more over the course of a year if you meet the deductible. However, Example 1 will cost you $924.20 more in premium if you dont use any services or your medical needs are minimal.

In this example, you might want to consider taking the Plan G high-deductible option if you are healthy.

Why? Because you could save just over $900 a year if you have a good year. Over multiple good years, the savings could add up.

But the math flips if your health changes for the worse. In that case, you could find yourself paying the high deductible for multiple years. And in some states, you wont be able to change plans because you may not pass medical underwriting.

Read Also: How To Apply For Medicare In Illinois

What Is A Medigap Plan And Why Should I Buy It

A Medigap plan , sold by private companies, can help pay some of the health care costs Original Medicare doesn’t cover, like copayments, coinsurance and deductibles.

Some Medigap plans also offer coverage for services that Original Medicare doesn’t cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap plan, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then your Medigap plan pays its share.

What Is Medigap Actually

Medigap is actually a Medicare Supplement policy. These plans cover the gaps of Medicare, which is why they are called Medigap.

With Traditional Medicare, youll pay 20% of the cost of your medical bills, with no Maximum Out-of-Pocket. Plus, there are deductibles and other gaps in coverage.

The perk of Original Medicare is that you can go to any doctor across the nation since Medicare is a national program. Luckily, Medigap plans follow Medicare.

So, if Medicare covers the medical service, your Medigap plan will pay its portion. The freedom to choose any doctor is one reason choosing Medigap makes sense.

Recommended Reading: Can I Sign Up For Medicare Advantage At Any Time

Medicare Select Insurance Policies

Medicare SELECT policies are a type of Medicare Supplement insurance sold by a few private insurance companies. A Medicare SELECT policy is one of the 8 standardized supplement policies.

It differs from Medicare Supplement insurance because you are expected to use a network of hospitals associated with the insurance company. In return, you will usually pay lower premiums. Also, in order to enroll in a Medicare SELECT plan, you must live within the service area of a network facility.

Medigap Vs Part C Premium

When it comes to premiums, Medigap is rightfully more expensive. Part C premiums are as low as $0, and some options have Part B give-back options where you get money back. With insurance, you get what you buy.

The premium cost is only one factor when it comes to healthcare. Medigap costs more because the premium is really the only thing you worry about. Depending on your policy of course.

The cost of Medigap can range from $50-$300 a month depending on where you live, eligibility, the plan you choose, and other factors.

Also Check: Does Medicare Cover Cgm For Type 2 Diabetes

Whats The Difference Medigap Vs Medicare Advantage

There are plenty of differences between Medigap and Medicare Advantage including doctor networks, coverage benefits, and the need for referrals. Of course, the cost is different, but well get to that.

If you want coverage that gives you the most flexibility, a Medigap plan could be your ideal policy.

Are You Considering A Medicare Supplement Plan

SHIIP’s interactive tool allows you to compare Medicare supplement by entering your age, gender the Medicare supplement plan you want to compare and whether or note you use tobacco products to receive a list of companies offering that plan along with their estimated premiums.

You will not be auto enrolled into a Medicare supplement policy and must make application directly with the insurance company. You will need to contact the insurance company that sells the specific policy that you wish to purchase, or you may contact an agent who sells the specific policy you want. We recommend that you apply at least 30 days before you want the policy to start. If you do not have thirty days, apply as soon as possible. Supplement premiums are paid directly to the insurance company and are not deducted from your Social Security payments.

What’s New for Medicare beneficiaries under age 65?

Medicare Supplemental Insurance federal regulations do not guarantee eligibility to individuals under age 65 who are eligible for Medicare due to disability. However, thirty-three states have adopted state legislation extending guarantee issue to that group of individuals. North Carolina is one of the states that legislatively mandates eligibility to individuals eligible for Medicare due to disability.

Below is the link to review the new regulation.

What is the Open Enrollment Period?

Cost of Medigap Policies

Recommended Reading: What Is The Difference Between Medicare & Medicaid

What Are The Most Popular Medicare Supplement Plans

According to Americas Health Insurance Plans, Plans F, G and N have the highest enrollment.

| Plan Type | |

|---|---|

| 10% | 1.4 million |

All other plans combined made up the other 2.8 million Medicare enrollees in that same year.

Plans G and N over the four-year period in the report are the fastest-growing plan options. With changes to Medicare effective January 1, 2020, Plan F is not available for newly eligible Medicare beneficiaries.

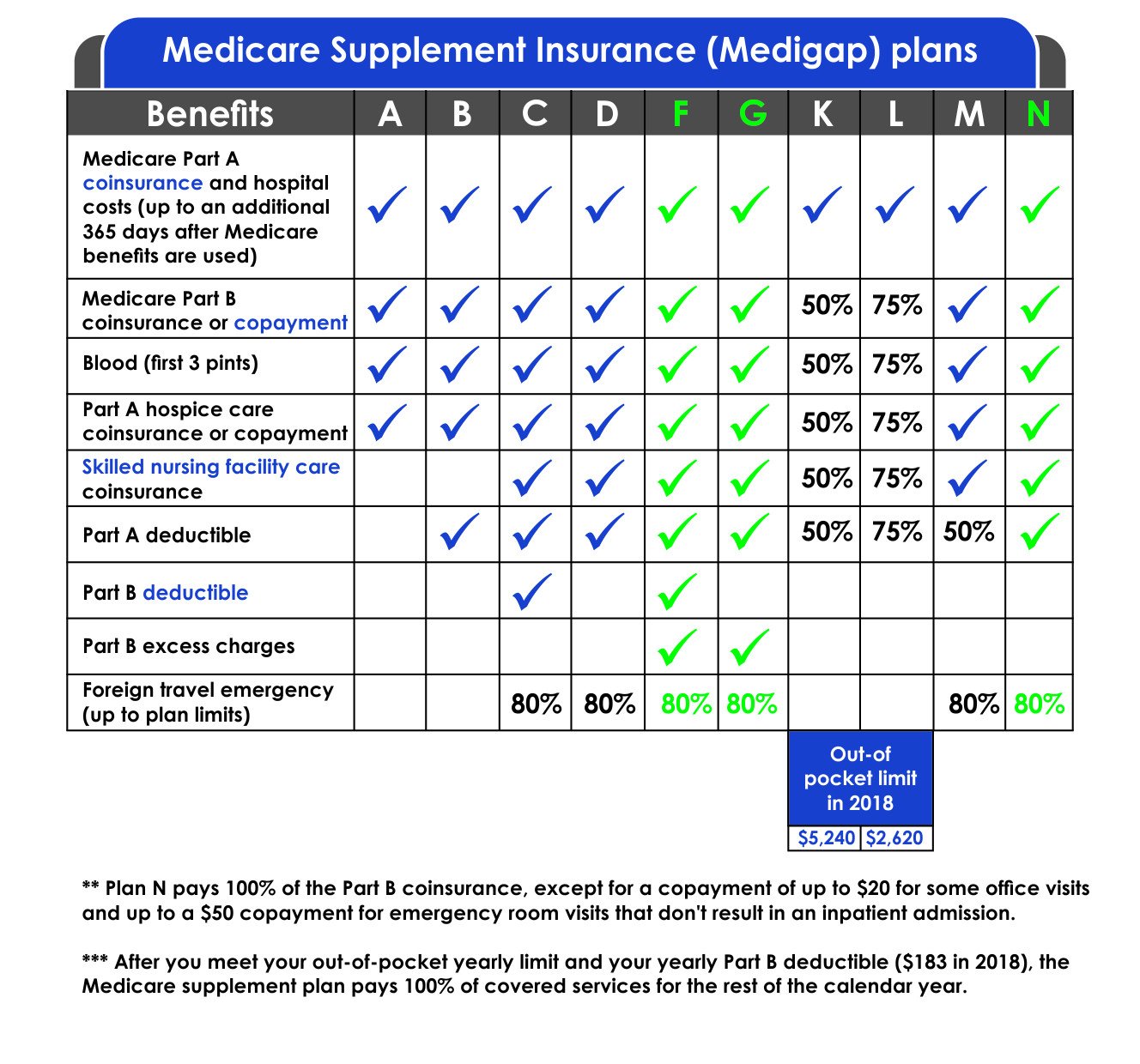

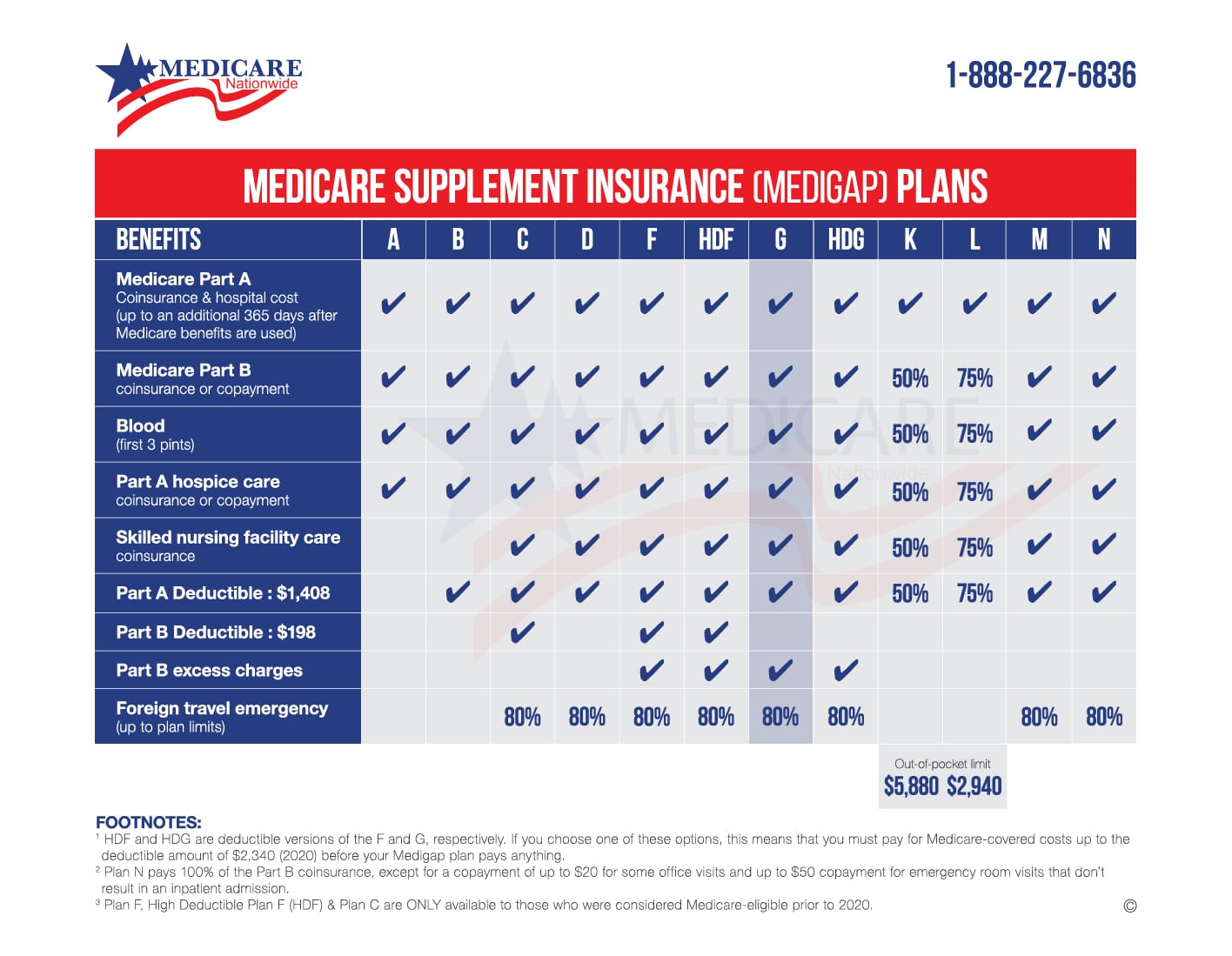

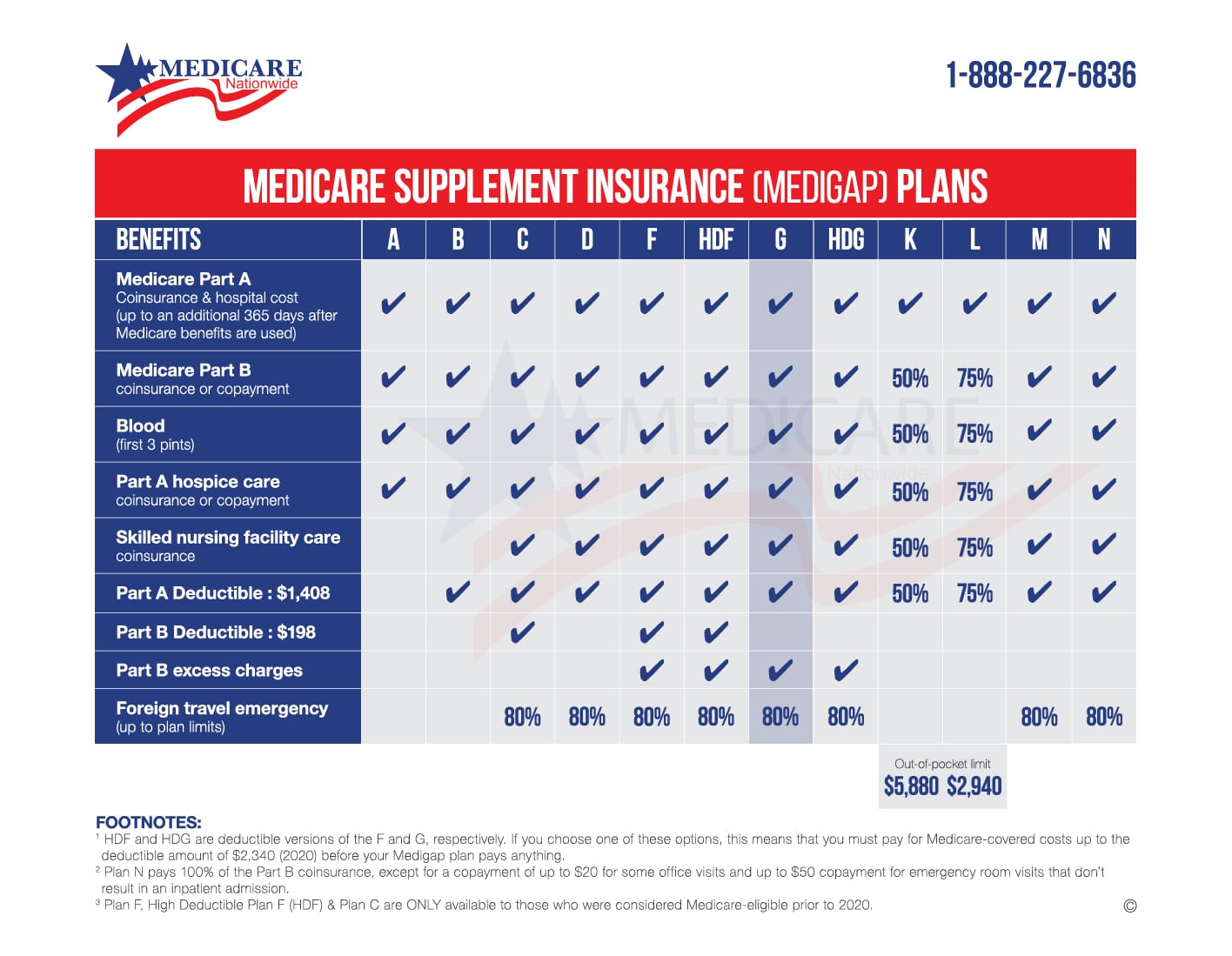

General Features Of Medicare Supplement Insurance Plans

Medicare Supplement insurance plans work with Original Medicare to help with out-of-pocket costs not covered by Parts A and B. The following are also true about Medicare Supplement insurance plans:

- Predictable costs help you stay ahead of unexpected out-of-pocket expenses.

- No network restrictions mean you can see any doctor who accepts Medicare patients.

- You don’t need a referral to see a specialist.

- Coverage goes with you anywhere you travel in the U.S.

- There is a range of plans available to fit your health needs and budget goals.

- Purchasing a Medigap plan and a Medicare Part D prescription drug plan could give you more complete coverage.

- Guaranteed coverage for life means your plan can’t be canceled.

As long as you pay your premiums when due and you do not make any material misrepresentation when you apply for this plan.

For PA residents only: As long as you pay your premiums when due. You do not misstate one or more material facts when you apply for this plan. UnitedHealthcare has 2 years to act on misstatements. The 2 year limit does not apply to fraud.

Rates are subject to change. Any change will apply to all members of the same class insured under your plan who reside in your state. can provide peace of mind by helping with some of these costs.

Read Also: How Does A Medicare Supplement Plan Work In General

What Is Medigap Plan M What You Need To Know

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here’s how we make money.

Medigap Plan M is a Medicare Supplement Insurance plan that covers certain out-of-pocket expenses for Medicare members, including copays, coinsurance and deductibles.

Plan M is nearly identical to Medigap Plan D, which is one of the more comprehensive plans. Heres the difference: While Plan D covers 100% of the Medicare Part A deductible, Plan M covers only 50%, but Plan M might have lower premiums as a result.

Is Medigap And Medicare Advantage The Same Thing

Many people compare Medigap vs Medicare Advantage, these two policies arent the same thing. The Medigap options give you the freedom to choose doctors, predictable costs, and the ability to travel.

Medicare Advantage plans may have lower premiums, but the out-of-pocket costs can add up quickly. Also, Part C plans require you to stay in the provider network, using doctors only in your service area.

Sure, either plan could be beneficial depending on what you find important, but generally speaking, Medigap takes the cake.

Don’t Miss: When Is The Special Enrollment Period For Medicare

How Much Do Medicare Supplement Plans Cost

Premium costs vary by region, and different insurers offering the same plan in the same region can have vastly different premiums.

For example, in New York City a Plan G this year ranges from around $270 to almost $600, and a Plan N ranges between $190 to $380. In Dallas a Plan G monthly premium in 2021 ranges between $96 and $924, and a Plan N ranges between $74 and $656.

But remember: By law, different insurers must provide identical coverage for a given plan type. Thats why its important to shop around before committing to a given Medicare supplement plan.

Insurers have three ways to set premiums:

- Attained age: Your premium changes annually based on your age.

- Issued age: The price is set by your age when you first buy a policy and does not change.

- Community rated: Everyone with that policy pays the same rate, regardless of age.

Attained age is the most common way insurers set premiums.

Medigap & Medicare Advantage Plans

Medigap policies can’t work with Medicare Advantage Plans. If you have a Medigap policy and join a

, you may want to drop your Medigap policy. Your Medigap policy can’t be used to pay your Medicare Advantage Plan copayments, deductibles, and premiums.

If you want to cancel your Medigap policy, contact your insurance company. If you leave the Medicare Advantage Plan, you might not be able to get the same, or in some cases, any Medigap policy back unless you have a “trial right.“

If you have a Medicare Advantage Plan, it’s illegal for anyone to sell you a Medigap policy unless you’re switching back to

. Contact your State Insurance Department if this happens to you.

If you want to switch to Original Medicare and buy a Medigap policy, contact your Medicare Advantage Plan to see if you’re able to disenroll.

If you join a Medicare Advantage Plan for the first time, and you arent happy with the plan, youll have special rights under federal law to buy a Medigap policy. You have these rights if you return to Original Medicare within 12 months of joining.

| Note |

|---|

| If you dont drop your Medicare Advantage Plan and return to Original Medicare within 12 months of joining, generally, you must keep your Medicare Advantage Plan for the rest of the year. You can disenroll or change plans during the Open Enrollment Period or if you qualify for a Special Enrollment Period. Depending on the type of Special Enrollment Period, you may or may not have the right to buy a Medigap policy. |

Read Also: Who To Talk To About Medicare