What Does Medicare Part C Cover For Inpatient Care

Medicare Part C generally provides the same inpatient benefits as Medicare Part A. These include:

- Inpatient hospital care if you have a doctors order and the hospital is in your plans network. Depending on your plans rules about how you obtain inpatient benefits, you may need a referral and prior authorization. Hospital care may be for acute illness or injury, rehabilitation, long-term care, or mental health.

- Cost-sharing is structured differently with a Medicare Advantage Plan. Original Medicare Part A charges a deductible for each benefit period. Medicare Advantage Plans typically charge a copay for the first several days of an inpatient stay. If you stay longer, your copay is $0. A transfer from one type of inpatient facility to another is considered a new admission and initial copays apply.

- Skilled nursing facility care and rehabilitation services provided on a continuous, daily basis in an in-network skilled nursing facility . Services are paid for in accordance with Medicare guidelines.

When you receive services in an inpatient setting, your Medicare Advantage Plan covers medically necessary care in accordance with Medicare guidelines and your plans rules. These services typically include:

- A semi-private room

- Physical, occupational, and speech therapy

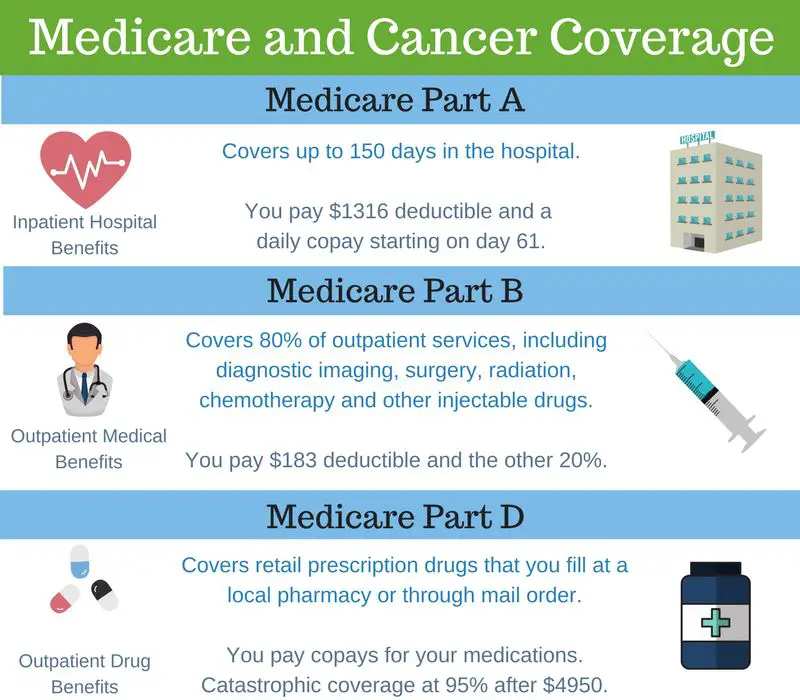

How Much Does Medicare Part B Coverage Cost

Medicare Part B generally pays 80% of approved costs of covered services, and you pay the other 20%. Some services, like flu shots, may cost you nothing.

Most people pay a monthly premium for Medicare Part B. The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount.

A Part B deductible applies to some covered services. The annual Part B deductible is $203 in 2021.

After you pay your deductible, you generally pay a 20% coinsurance for most covered services.

Is Medicare Supplement Plan G Available To Those Under 65

There are no federal mandates requiring Medicare Supplement plans to be available to those on Medicare under 65 due to disability. Yet, some states require insurance companies offering Medigap plans to provide at least one option to those under 65. Sometimes, these carriers allow you to enroll in Medicare Supplement Plan G.

The most common plan option available to those under 65 is Medicare Supplement Plan A. Medigap Plan A offers only the most basic benefits. However, some carriers understand the importance of widespread plan availability and will allow those on disability to enroll in Medicare Supplement Plan G.

However, when enrolling in a Medicare Supplement plan under age 65, it is important to know that your premium may be double or even triple that of someone over 65. Carriers increase the price to account for high medical costs due to your disability status.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Read Also: When Can You Start Collecting Medicare

Medicare Part D: Prescription Drug Coverage

This component of Medicare helps cover the cost of prescription drugs, including many recommended vaccines. You can get a Medicare drug plan in two ways: by joining a Part D plan in addition to Original Medicare or by enrolling in a Medicare Advantage Plan with drug coverage.

Medicare Part D is only offered through private insurance companies.

According to Dr. Anderson, the biggest recent change to Medicare has been the passage of certain drug provisions in the federal governments 2022 Inflation Reduction Act, as reported by the Centers for Medicare and Medicaid Services. This will allow Medicare to negotiate drug prices for certain drugs, penalize drug companies that raise prices, and prevent any Medicare beneficiary with Part D coverage from paying more than $2,000 out-of-pocket, he says.

How Do You Enroll In Medicare

If you are already collecting Social Security benefits, the government will automatically enroll you in Medicare Parts A and B. However, in certain circumstances you can choose to decline Part B since it has a monthly cost if you opt to keep the coverage, Medicare will deduct the cost from any Social Security benefits you are collecting.

If you arent drawing Social Security benefits yet, your first chance to sign up for Medicare is when you turn 65. Although Medicare provides your healthcare coverage, you have to sign up through Social Security or the Railroad Retirement Board to determine if youre eligible and to find out if you paid Medicare taxes long enough to get Part A without having to pay a monthly premium.

The seven-month enrollment period starts three months before you turn 65 and ends three months after the month of your birthday. Medicare coverage begins based on the month you signed up.

If you miss the seven-month initial enrollment period, you can sign up for Part B during general enrollment, which runs from January 1 to March 1, and coverage will begin on July 1. Note that you will pay a penalty for signing up late: The more years you delay, the higher the penalty.

There are some scenarios where you might want to wait to and you wont be penalized for example, if you or your spouse are still working, and you have health insurance through your job.

Read Also: Are Knee Scooters Covered By Medicare

What Does Medicare Cover

Medicare helps pay for certain health care services and durable medical equipment. To have full Medicare coverage, Medicare beneficiaries must have Part A and Part B .

The following is a partial list of Medicare-covered services. The covered services listed below may require payment of deductibles and Co-Payments.

If you have questions about covered services, call Medicare at 1-800-633-4227.

What Is The Biggest Disadvantage Of Medicare Advantage

Medicare Advantage can become expensive if you’re sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient’s choice. It’s not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Don’t Miss: Is Trelegy Ellipta Covered By Medicare

Medicare Doesn’t Cover Long

One of the largest potential expenses in retirement is the cost of long-term care. The median cost of a private room in a nursing home was roughly $105,800 in 2020, according to the Genworth Cost of Care Study a room in an assisted-living facility cost $51,600, and 44 hours per week of care from a home health aide cost $54,900.

Medicare provides coverage for some skilled nursing services but not for custodial care, such as help with bathing, dressing and other activities of daily living. But you can buy long-term-care insurance or a combination long-term-care and life insurance policy to cover these costs.

You can also get a long-term care rider on an annuity, which could help defray the cost of long-term care.

What Medicare Doesnt Cover

While Medicare covers a wide range of care, not everything is covered. Most dental care, eye exams, hearing aids, acupuncture, and any cosmetic surgeries are not covered by original Medicare.

Medicare does not cover long-term care. If you think you or a loved one will need long-term care, consider a separate long-term care insurance policy.

You May Like: What Is The Monthly Premium For Medicare Plan G

Medicare Part A Hospice Coverage

If your doctor has certified that you have a terminal illness with an estimated six months or less to live, you may be eligible for hospice care coverage. In hospice care, the focus is on palliative care, not curing your disease. The goal is to relieve pain and make the patient as comfortable as possible.

To qualify for Medicare-covered hospice care, you must meet all of the following conditions:

- You must be enrolled in Medicare Part A.

- Your doctor or health provider must certify that you are terminally ill and have six months or less to live.

- You must agree to give up curative treatments for your terminal illness, although Medicare will still cover palliative treatment for your terminal illness, along with related symptoms or conditions.

- You must receive hospice care from a Medicare-approved hospice facility.

Medicare Part A hospice care is usually received in the patientâs home. It may include, but is not limited to:

- Doctor services

- Short-term inpatient care

- Short-term respite care

If a patient is under hospice care, Medicare Part A may also cover some costs that Medicare normally does not include, such as spiritual and grief counseling. Medicare Part A only pays for room and board in a hospital if the hospice medical team orders short-term inpatient stays for pain or other symptom management.

What Are My Medicare Part A Costs

Many people get Medicare Part A without a premium if theyve worked the required amount of time under Medicare-covered employment, generally 10 years or 40 quarters and paid Medicare taxes while working . However, your Part A coverage may still include other costs, even after Medicare has paid its share. This may include deductibles, copayments, and/or coinsurance, which can all change from year to year. Your costs may depend on the type of service youre getting and how often.

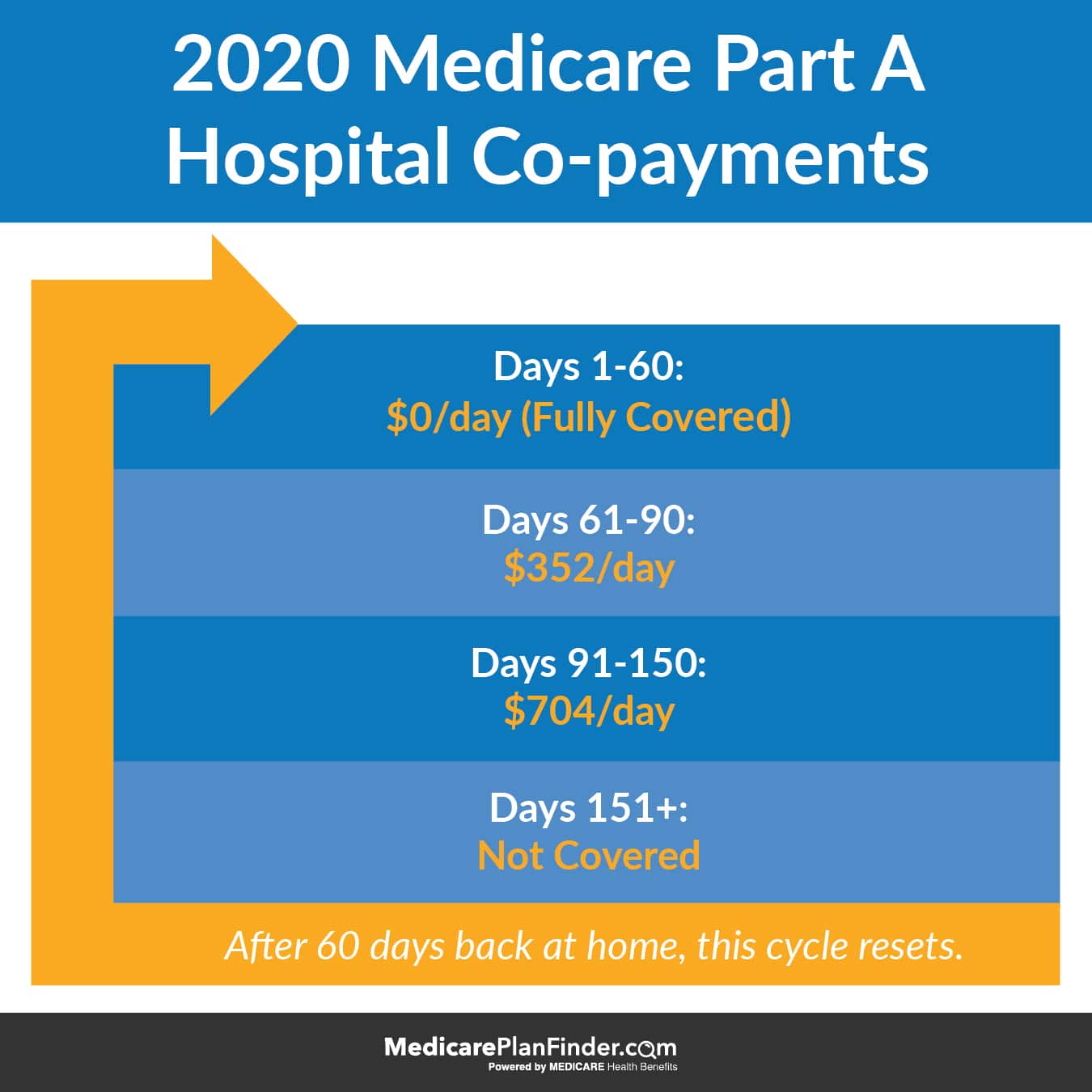

Medicare Part A cost-sharing amounts are listed below.

Inpatient hospital care:

- $0 coinsurance for the first 60 days of each benefit period

- $371 a day for the 61st to 90th days of each benefit period

- $742 a day for days 91 and beyond per each lifetime reserve day of each benefit period

- After lifetime reserve days are used up: You pay all costs

Skilled nursing facility care:

- $0 for days 1 to 20 for each benefit period

- $185.50 a day for the 21st to 100th days

- Days 101 and beyond: all costs

Don’t Miss: Is Rollator Walker Covered By Medicare

Why Do I Need Medicare Part C

Asked by: Mr. Verner Berge

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What Does Medicare Part A Cost

When you work, your employer takes out money for Medicare taxes. As long as you or your spouse works for 10 years paying Medicare taxes, you get Medicare Part A without a premium when youre 65 years old.

Thats not to say that you or a loved one can walk into a hospital and receive free care. Medical Part A requires you pay a deductible toward your inpatient care. For 2022, this is $1,556 for each benefit period.

If you dont automatically qualify for free Part A, you can still buy Part A. For 2022, the monthly premium for Part A is $499 if youve worked less than 30 quarters. If you paid Medicare taxes for 30 to 39 quarters, you would pay $274.

Recommended Reading: Does Medicare Pay For Air Evac

What Other Coverage Works With Medicare Part A

Medicare may not cover everything you need. But there are other ways you can help pay for some medical costs. One option is Medicare Supplement Insurance, also called Medigap. Although Medigap cant cover long-term care, it can help cover costs such as copayments, deductibles or coinsurance. Medigap is not the same as Medicare Advantage and can only be combined with Original Medicare.

Medicare Advantage is another option. Medicare Advantage plans are offered through private companies, and offer coverage for everything included in Original Medicare Part A and Part B. Many Medicare Advantage plans may also include coverage for services outside of Original Medicare, including vision, dental or Part D prescription drug coverage.

Explore Medicare

Do You Need Medicare Part B

The short answer is yes, especially if youll need the covered services mentioned above. However, if you have health insurance through a current job or are on your spouses active plan, you can delay your Medicare Part B enrollment without penalty. Once the spouse with employer coverage stops working whether its you or your partner you have eight months to sign up for Part B. Also, you need to be enrolled in Medicare Part B if you want to sign up for a Medicare Advantage plan.

You May Like: Where Can I Find My Medicare Number

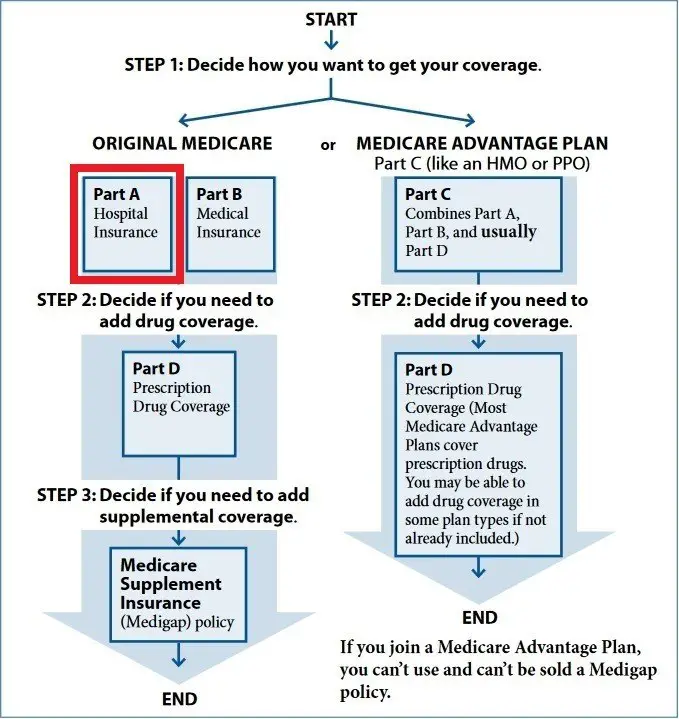

What Is Medicare Part C

A Medicare Advantage Plan is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by private companies approved by Medicare.

If you join a Medicare Advantage Plan, the plan will provide all of your Part A and Part B coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage .

Medicare pays a fixed amount for your care every month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare. However, each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services . These rules can change each year.

What Does Medicare Part C Cover

Learn about whats covered with Medicare Part C, also known as Medicare Advantage.

Contributing expert:Kelly Blackwell, Certified Senior Advisor®Updated: May 04, 2022

Kelly Blackwell

Kelly Blackwell is a Certified Senior Advisor ®. She has been a healthcare professional for over 30 years, with experience working as a bedside nurse and as a Clinical Manager. She has a passion for educating, assisting and advising seniors throughout the healthcare process.

The terms Medicare Part C and Medicare Advantage Plan are interchangeable. Medicare has four different parts: Part C is a bundle that covers Part A, Part B, and usually, Part D.

- Part A includes inpatient services such as hospitalization, skilled nursing home care, hospice care, and some home health care.

- Part B includes outpatient services such as doctors visits, ambulance transport, laboratory tests, x-rays, and preventive care.

- Part A + Part B = Original Medicare is administered by the federal government.

Don’t Miss: Does Medicare Cover A1c Test

How Much Does Medicare Cost

Original Medicare

Original Medicare is divided into Part A and Part B .

- Part A helps pay for inpatient hospital care, some skilled nursing care, home health care and hospice care.

- Part B helps pay for doctor services, outpatient hospital care, durable medical equipment, home health care not covered by Part A, and other services. Medicare was never intended to pay 100% of medical bills. Its purpose is to help pay a portion of medical expenses. Medicare beneficiaries also pay a portion of their medical expenses, which includes deductibles, copayments, and services not covered by Medicare. The amounts of deductibles and copayments change at the beginning of each year.

Part A – Monthly Premium

If you are eligible, Part A is free because you or your spouse paid Medicare taxes while you were working. You earn Social Security “credits” as you work and pay taxes. For each year that you work, you earn 4 credits.

| $471 | $499 |

You are 65 or older, and you receive or are eligible to receive full benefits fr om Social Security or the Railroad Retirement Board

You are under 65, and you have received Social Security disability benefits for 24 months You are under 65, and you have received Railroad Retirement disability benefits and you meet Social Security disability requirements You or your spouse had Medicare-covered government employment You are under 65 and have End-Stage Renal Disease

Other Parts Of Medicare That Cover Hospitalization Costs

Although Part A is generally known as hospital insurance, other parts of Medicare may also cover some of the costs of a hospital stay.

These may include:

- Part B. Generally, Medicare Part B doesnt cover costs for inpatient care, but it may cover services that occur before or after inpatient care. Part B covers doctors appointments, emergency room visits, urgent care visits, lab work, X-rays, and many other outpatient services.

- Part C .Medicare Advantage plans are sold by private insurance companies and include the services covered under parts A and B. They may also cover prescription drugs, dental care, or vision care.

- Medicare supplement insurance . These plans help you pay for out-of-pocket healthcare costs and fees from Part A and Part B, such as copays, coinsurance, and deductibles. Medigap plans are sold by private insurance companies, so coverage and costs vary by plan, provider, and location.

From year to year, there may be slight variations in coverage and costs for Medicare Part A. For 2022, the main changes are related to costs, including the deductible and coinsurance amounts.

Recommended Reading: Does Medicare Part B Cover Chiropractic Services

What Does Medicare Part A And Part B Cover

Original Medicare

You can enroll in Medicare Part A once you turn 65. If you’re already collecting Social Security disability benefits, you’ll be automatically enrolled in Part A.

Part B

Medicare pays 80 percent of approved charges and you pay about 20 percent.

Part B is optional because you have to pay a monthly premium and meet a deductible before Medicare will pay benefits.

Medicare Doesn’t Cover Prescription Drugs

Medicare doesnt provide coverage for outpatient prescription drugs, but you can buy a separate Part D prescription drug policy that does, or a Medicare Advantage plan that covers both medical and drug costs. You can sign up for Part D or Medicare Advantage coverage when you enroll in Medicare or when you lose other drug coverage. And you can change policies during open enrollment season each fall. Compare costs and coverage for your specific medications under either a Part D or Medicare Advantage plan by using the Medicare Plan Finder .

Recommended Reading: Does Medicare Cover Cgm For Type 2 Diabetes