What Costs Count Towards Getting Out Of The Coverage Gap

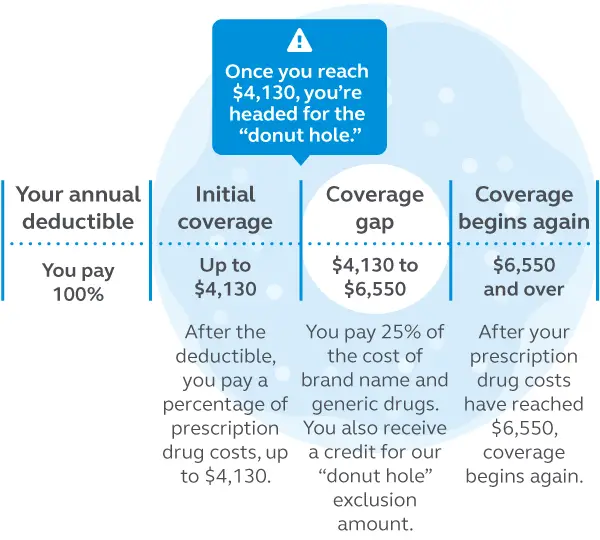

Once youve entered the coverage gap , its important to understand which out-of-pocket costs count towards helping you reach the catastrophic coverage phase. Remember, if your prescription drug spending reaches $6,350 in 2020, youll have catastrophic coverage for the rest of the year.

The following costs count towards your out-of-pocket spending and getting you out of the coverage gap:

- Your prescription drug plans yearly deductible

- The amount you pay for your prescription medications

- The 70% manufacturer discount for brand-name drugs while youre in the coverage gap

What Is Medicare Gap Coverage

When we talk about Medicare gap coverage, we arent referring to prescription drug coverage. Gap coverage in this context pertains to Part A and Part B . Again, these parts of Original Medicare do not cover some vital parts of health care. To achieve this, youll need supplemental insurance and ancillary policies, such as a dental/vision/hearing plan.

Many Americans believe they wont need to worry about certain expenses once they turn 65. Yet, this couldnt be further from the truth. While Medicare alone covers most of your basic expenses, a small percentage is left for the beneficiary to pay.

A Medigap plan will cover what Medicare leaves for the patient in hospital and outpatient settings. Specifically, it works with your Medicare to ensure one hundred percent of your standard health care costs are handled. Plus, these plans include additional coverage that can save you a great deal of money in the future. In the content below, we will explain three ways gap coverage can help you save money and secure your future.

Get A Free Quote

Find the most affordable Medicare Plan in your area

When Do I Leave The Coverage Gap

Youll remain in the coverage gap until your out-of-pocket expenses reach the amount set by CMS. For 2021, that amount is $6,550. To help you move through the coverage gap more quickly, these out-of-pocket expenses include the costs that you have paid toward your drug coverage for the year, like your deductible, copays and/or coinsurances, as well as a portion of the cost of brand name drugs paid by the manufacturer.

Your plans premium and what you pay for drugs that arent covered by your plan do not count towards your out-of-pocket expenses.

After you leave the coverage gap, you enter the catastrophic coverage stage where you only pay whichever is more for the rest of the year: 5% of drug costs, or a copay of $3.70 for generic drugs/$9.20 for brand-name drugs. Your Medicare Part D coverage resets to the pharmacy deductible stage on Jan. 1 of each new year.

Don’t Miss: Does Medicare Cover Nerve Blocks

When Should You Enroll In A Medigap Policy

The best time to purchase your Medicare Supplement plan is during the Medigap Open Enrollment Period, the six-month period that begins on the first day of the month in which you are 65 or older and enrolled in Medicare Part B. During those six months, private insurers cannot deny you an available policy for any reason, and you have more options and lower pricing. You may also have other options for purchasing a Medigap policy later, depending on your situation. For example, a canceled policy, a loss of insurance, an insurance carrier bankruptcy, and other circumstances may qualify.

But outside of open enrollment, insurers can use medical underwriting things like your age, gender, area of the country, and previous health conditions when deciding to sell a policy. That means you may be denied a policy or have to wait for preexisting condition coverage, often for six months after your policy is in effect, pay higher premiums, or have fewer options than when enrolling during the open enrollment period.5

Your state may have additional rules regarding open enrollment so check to be sure.

Dont Miss: What Is The Window To Sign Up For Medicare

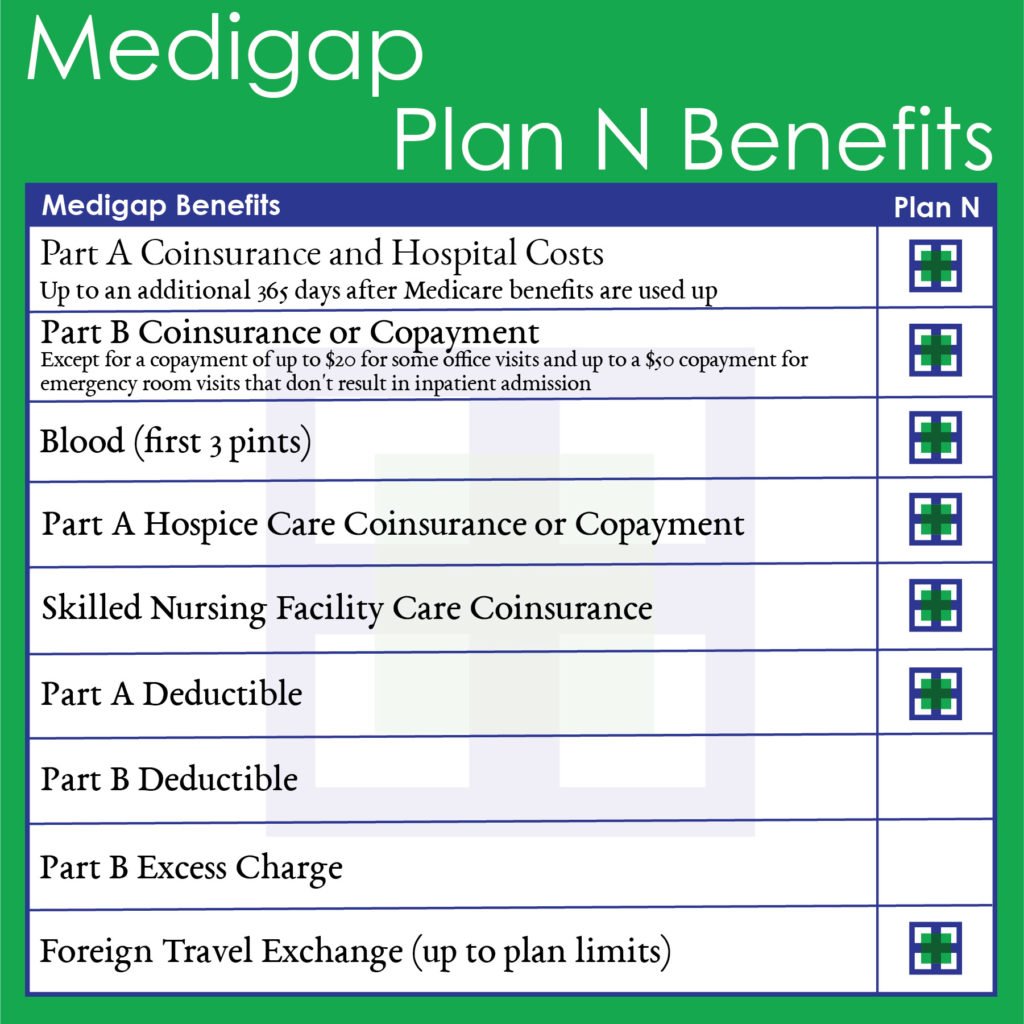

Standard Medicare Supplement Coverage

To make it easier for you to compare one Medicare Supplement policy to another, Indiana allows 8 standard plans to be sold. The plans are labeled with a letter, A through N. Plans H, I, and J are no longer offered, and Plans C and F are only available to people who were eligible for Medicare before January, 2020. There are high deductible versions of Plans F and G..

These 8 plans are standardized, which means that benefits will be the same no matter which company sells the policy to you. Plan A is the basic benefit package. Plan A from one company is the same as Plan A from another company. Since Medicare Supplement policies are standardized, you are free to shop for the company with the best price and customer service. To see what benefits are offered with each plan,.

Generally, Medicare Supplement policies pay most, if not all, Medicare copayment amounts, and policies may pay Medicare deductible amounts except for the Part B deductible. Although the benefits are the same for each standard plan, the premiums may vary greatly. Before purchasing a supplement policy, determine how the company calculates its premiums.

An insurance company can calculate premiums one of three ways.

- Issue Age: If you were 65 when you bought the policy, you will pay the same premium the company charges people who are 65 regardless of your age.

- Attained Age: The premium is based on your current age and will increase as you grow older.

- No Age Rating: Everyone pays the same premium regardless of age.

Read Also: Does Aetna Medicare Cover Home Health Care

Extended Coverage For Skilled Nursing Facilities

All Medigap plans except for those offering only the most basic benefits provide gap coverage for care at skilled nursing facilities. Medicare alone only offers up to 20 days of full coverage for this care, after which youre responsible for coinsurance payments each day until coverage runs out on the hundredth day.

While you may not currently foresee needing care at a skilled nursing facility, youll be grateful to have a safety net if you eventually find yourself in such a situation. The coinsurance cost alone is over $175 each day and rises each year. Cost-sharing Plans K and L cover 50% and 75% of this coinsurance respectively. The rest of the plans providing this benefit cover the entire amount.

Services Medicare Doesnt Cover

- Most long-term care. Medicare only pays for medically necessary care provided in a nursing home.

- Custodial care, if its the only kind of care you need. Custodial care can include help with walking, getting in and out of bed, dressing, bathing, toileting, shopping, eating, and taking medicine.

- More than 100 days of skilled nursing home care during a benefit period following a hospital stay. The Medicare Part A benefit period begins the first day you receive a Medicare-covered service and ends when you have been out of the hospital or a skilled nursing home for 60 days in a row.

- Homemaker services.

- Most dental care and dentures.

- Health care while traveling outside the United States, except under limited circumstances.

- Cosmetic surgery and routine foot care.

- Routine eye care, eyeglasses , and hearing aids.

Also Check: How To Lower Medicare Premiums

What Is Medigap Insurance

Medigap, also called Medicare Supplement Insurance, is health insurance coverage provided by private companies designed to pay for costs not covered by Original Medicare. Depending on which plan you get, these costs might include copayments, coinsurance, and deductibles, as well as services Original Medicare doesn’t cover, such as travel outside of the U.S.

What Plans Provide Gap Coverage

A Part D drug plan or Part C Medicare Advantage plan may include gap coverage, though these plans arent available everywhere and may have a higher premium. Plans are available by location, if you dont live in the service area, youre not eligible for that policy.

Online you can compare the total annual cost of your medications with all the plans in your area to find your most affordable option. You can even see if youre expected to hit the gap based on your prescriptions, the pharmacy you use, and the available policy.

If youre unsure how to compare plans or want an expert opinion, working with an insurance agent is a great way to discover the most cost-effective plan for you.

Recommended Reading: Does Medicare Pay For Mattresses

Learn More About Your Medicare Advantage Prescription Drug Coverage Options

The cost of a Medicare Part D plan may vary from one insurance company to the next and from one location to another.

One way to learn about your Medicare prescription drug coverage options is to speak with a licensed insurance agent. You can compare Medicare Advantage plan costs in your area and find a plan that covers the prescription drugs you need.

What Is Gap Health Insurance

These plans are also sometimes called âmetal gap insuranceâ because they can âfill the gapsâ in individual healthcare spending that may be left by bronze and silver ACA plans, which often come with lower premiums but higher costs when you need care.

Medical gap insurance is a type of supplemental insurance so isnât considered ACA-qualifying coverage.

This type of insurance works alongside your major medical policy to pay a lump sum benefit of covered costs.

What other healthcare or financial coverage gaps may you have?

Recommended Reading: What Is The Disadvantage Of A Medicare Advantage Plan

Applying For A Medicare Supplement Insurance Plan

The best time to enroll in a Medicare Supplement plan is during your Medicare Supplement Open Enrollment period because your acceptance is guaranteed. It starts on the first day of the month in which you’re both age 65 or older and enrolled in Medicare Part B. Some states have additional Open Enrollment periods and Guaranteed Issue requirements.

If you apply outside of Open Enrollment or Guaranteed Issue periods, you may be denied coverage or charged more based on your health history. This does not apply to residents of Connecticut and New York where Open Enrollment and Guaranteed Issue is ongoing and Medicare supplement plans are guaranteed available.

Scroll for Important Disclosures

UnitedHealthcare pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers.

AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals.

Please note that each insurer has sole financial responsibility for its products.

AARP® Medicare Supplement Insurance Plans

AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare.

In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease.

WB27382ST

Extra Days For Inpatient Stays

You never know when you could need to stay at the hospital. One thing is certain, though: with a Medigap plan, youll have fewer financial worries than you would with Medicare alone. All Medigap plans cover Part A coinsurance, much like how they handle the costs for skilled nursing facilities.

On standard Medicare, each day in the hospital after the first 60 days costs hundreds of dollars in coinsurance. After 90 consecutive days, youll need to start using your lifetime reserve days, of which Medicare provides 60. All Medigap plans, however, cover up to 365 extra days of inpatient hospital costs beyond Medicares 60 lifetime reserve days.

Get A Free Quote

Find the most affordable Medicare Plan in your area

- Was this article helpful ?

Don’t Miss: Can You Get Medicare If You Retire At 62

How Does Medicares Standard Drug Benefit Work

Medicare Part D is the Medicare program that covers prescription medications. Once you become eligible for Medicare, youll need to purchase a Part D plan unless you have creditable drug coverage from another source. If you wait too long, youll owe a penalty when you do enroll.

Medicare Part D plans are sold by insurance companies but must meet requirements set by Medicare. For example, each plan must provide a formulary, or approved drug list, that covers all disease states and has at least two chemically distinct drugs in each class.

You pay your monthly Part D premium to the company running the plan.

Medigap Vs Medicaid Vs Managed Care

Wondering whether you need medigap insurance at all? First, if your income is low, you may qualify to receive Medicaid or “Medicare Savings Programs” that will pay some of these costs for you, including the deductibles, premiums, and coinsurance amounts.

Second, if you’re a fan of HMOs, consider a Medicare managed care plan, which will pay many of these costs for you, possibly at a slightly lower cost than many medigap policies. For more information, see Nolo’s article Medicare Managed Care Plans: An Aternative to Medigap Insurance.

For more information on medigap insurance, Medicaid, Medicare, and Medicare managed care plans, get Social Security, Medicare & Government Pensions: Get the Most Out of Your Retirement & Medical Benefits, by Joseph L. Matthews & Dorothy Matthews Berman .

You could be eligible for up to $3,148 per month In SSDI Benefits

Don’t Miss: Is Kaiser A Medicare Advantage Plan

Reaching The Other Side Of The Medicare Donut Hole

Where the donut hole beginsGetting to the other side of the coverage gap

- The Part D planâs yearly deductible, coinsurance and copayments

- The discount received on the brand-name drugs while in the coverage gap

- What you pay in the coverage gap

donât

- The Part D plan premium

- Pharmacy dispensing fee, if any

- What is paid for uncovered drugs

Post-donut hole drug coverageLearn more about Medicare and avoiding the donut hole at a free seminar on Understanding How Medicare Works. To register, call or visit sharp.com/newtomedicare.

What Does Medicare Supplement Insurance Cover

Medicare Supplement insurance is sold in 12 standard plans. Plans C and F are only available to people who were eligible for Medicare before January 2020.

Every company must sell Plan A, which is the basic plan, or the “core benefit” plan. The standard plans are labeled A through L. Remember, the plans are standardized. So, Plan F from one company will be the same as Plan F from another company. Select the supplement policy which fits your needs, and then purchase that plan from the company which offers the lowest premiums and best customer service. Core Benefits: Included in all plans.

- Pays Part A Hospital copayment

- Pays for an additional 365 days of hospitalization after Medicare benefits end.

- Pays Part B copayment

You will have to pay part of the cost-sharing of some covered services until you meet the annual out-of-pocket limit. Plan K has a $6,220 out-of-pocket limit. Plan L has a $3,110 out-of-pocket limit . Once you meet the annual limit, the plan pays 100% of the Medicare copayments, coinsurance, and deductibles for the rest of the calendar year. These amounts can change each year.

Read Also: What Is Traditional Medicare Plan

When Can I Enroll In Medigap

There are multiple enrollment periods for Medicare plans, but there are only certain times when you can add a Medigap policy to your plan. The Medigap enrollment periods are:

- Initial enrollment period. You are eligible to apply for a Medicare plan, and add a Medigap policy during the 3 months before, 3 months after, and month of your 65th birthday.

- Open enrollment period. If you miss initial enrollment, you can apply for a policy during the Medigap open enrollment period. If youve already turned age 65, this period begins when you enroll in Part B. If youre turning age 65, this period runs until 6 months after your turn 65 years old and have enrolled in Part B.

Insurance companies arent required to sell you a Medigap policy, especially if youre under age 65.

Once the initial enrollment period and open enrollment period have passed, you may have a harder time finding an insurance company that will sell you a plan. As soon as you enroll in Medicare Part B, you should apply for a Medigap policy if youd like one.

Also, keep in mind that you cant buy a Medigap policy if you have a Medicare Advantage plan. You can only add Medigap to your coverage if you have original Medicare.

How Can I Get Medicare Supplement Plan G Prices

Unfortunately, most insurance companies no longer openly publish their rates online without requiring you to meet with an agent or enter your personal information first. So, although some companies put their Medicare Supplement Plan G prices online, the information will be slanted towards that one company and will not be a full picture of what is available to you.

There are two options for obtaining the prices for a Medicare Supplement Plan G. One, you can contact your state department of insurance to get a list of all the companies offering supplement plans in your state usually around 30-35 companies. From there, you can contact each insurance companys call center and set an appointment to have an agent from each company come to your home so you can meet with them and obtain the rates for their plans. Sounds enjoyable, right?!?!

The much-simpler, more consumer-friendly alternative is to contact a trusted, verified independent Medicare insurance broker. Whether that broker is 65Medicare.org or someone else, using an independent broker gives you the opportunity to compare multiple options in a centralized, unbiased place. The broker works with you based on your needs and is incentivized to put you in a plan that you are happy with and that fits your needs, not one that helps their employers bottom line.

Recommended Reading: Are Legal Residents Eligible For Medicare

Open Enrollment For Texans With Disabilities

People under age 65 who get Medicare because of disabilities have a six-month open enrollment period beginning the day they enroll in Medicare Part B. This open enrollment right only applies to Medicare supplement Plan A.

Note: People who have Medicare because of disabilities have another open enrollment period during the first six months after turning 65.