Determine Which Medicare Supplement Plan Gs Are Available

Medicare offers a Find a Plan database to help you search for Medigap plans by ZIP code. For more accurate pricing, enter your age, gender, and whether or not you use tobacco. Scroll to Medicare Plan G or Medicare Plan G High-Deductible to get a quick overview of costs and coverage. Finally, select View Policies for the list of specific insurance companies offering that plan in your area. You will need to reach out to those companies individually to get official quotes.

Best For Easy Application: Mutual Of Omaha

Mutual_of_Omaha

-

Multi-step process to pay online

-

Limited extra benefits other than the household discount

Mutual of Omaha prides itself on simplicity. It offers an easy-to-read chart for services covered under Medicare Supplement Plan G. It also allows you to create an account or apply as a guest, which allows for faster comparisons. Applying with either type of account requires information from your Medicare card, your social security number and your medications to allow for an accurate estimate. You also can save your application and return to it later, but you will have to create an account to do so.

Where Can You Buy Medicare Supplement Plan G

Private insurance companies sell Medigap policies. You can use Medicares search tool to find out which plans are offered in your area. Youll need to enter your ZIP code and select your county to see available plans. Each plan will be listed with a monthly premium range, other potential costs, and what is and isnt covered.

You can also look at the companies that offer each plan and how they set their monthly premiums. Because the cost of a Medigap policy can vary by company, its very important to compare several Medigap policies before selecting one.

Don’t Miss: How Much Medicare Is Taken Out Of Social Security Check

Medicare Supplement Plan G

Medigap is supplemental insurance plan sold by private companies to help cover original Medicare costs, such as deductibles, copayments, and coinsurance.

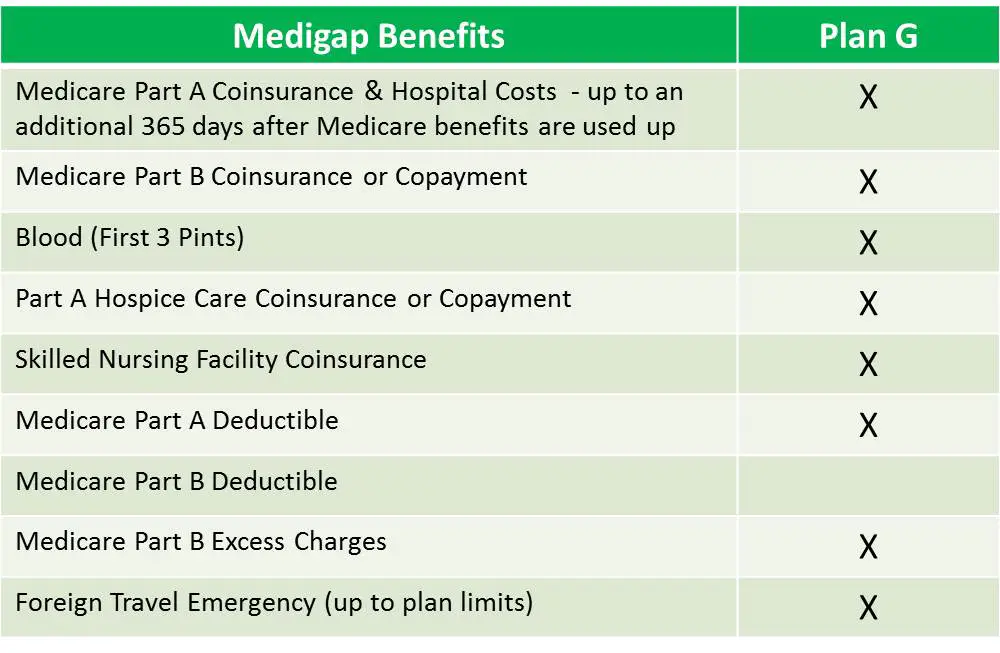

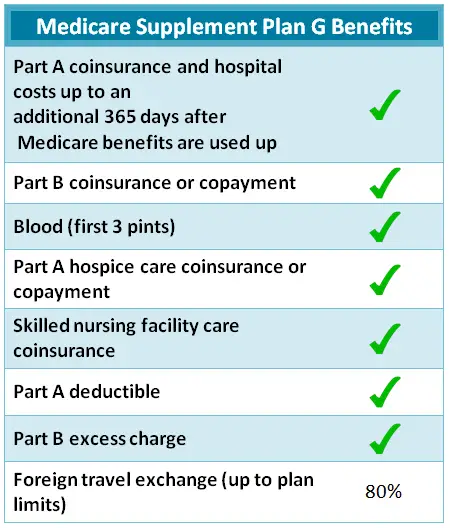

Medigap Plan G is a Medicare supplement plan that offers eight of the nine benefits available. This makes it one the most comprehensive Medigap plan offered.

Keep reading to find out more about Medigap Plan G, what it covers, and what it doesnt.

Is Medicare Plan F Being Discontinued

Yes, Medicare Plan F has been discontinued. The last possible day for new enrollment was December 31, 2019. If you currently have Medicare Plan F, you can continue with the plan, if you so decide. This distinction is worth noting when reviewing the differences involved with Medicare Plan F vs. Plan G.

Read Also: How To Get A Lift Chair From Medicare

Why Consider Plan G

Plan G is the top-of-the-line Medigap option if youre newly eligible for Medicare. Depending on where you live in the country, it can range from $99 per month to $476 per month for the plan premium, which is $1,188 to $5,712 per year. For the premium, which is higher than for other Medigap policies, youll get more comprehensive coverage.

Plan G covers nearly all out-of-pocket costs for services and treatment once you pay the Medicare Part B $203 deductible. This means you pay no copays or coinsurance.

If you dont need that level of coverage, though, you might want a plan with less coverage.

How Much Does Medicare Supplement Plan G Cost

What you pay for Medicare Supplement Plan G coverage is based on several factors, including:

- Where you buy it.

- Your gender.

- Whether or not you smoke.

Regarding that first bullet point, insurance companies can price MedSup Plan G policies as they please. Premiums, deductibles and copays for one Plan G policy may differ from company to company.

While shopping for these policies, keep in mind that insurance companies price them in three distinct ways. One way bases your Plan G premium on your age when you buy the plan. Another bases your premium on your current age, which means it will go up as you get older. And a third ignores your age and charges everyone the same monthly premium.

Insurance companies usually charge men more than women for MedSup policies. They also charge tobacco users more than people who dont use tobacco products. And they charge people in certain areas of the U.S. more than they charge people in other areas. Some insurers even base what they charge for a Plan G policy on how long someones been enrolled in Medicare Part B.

To figure out how much or how little youll pay for Plan G coverage, contact a number of insurers that sell the policies in your ZIP code. Compare the prices they quote you and then make your decision based on that information.

Don’t Miss: How Much Is Medicare B Deductible

What Does Plan G Cover

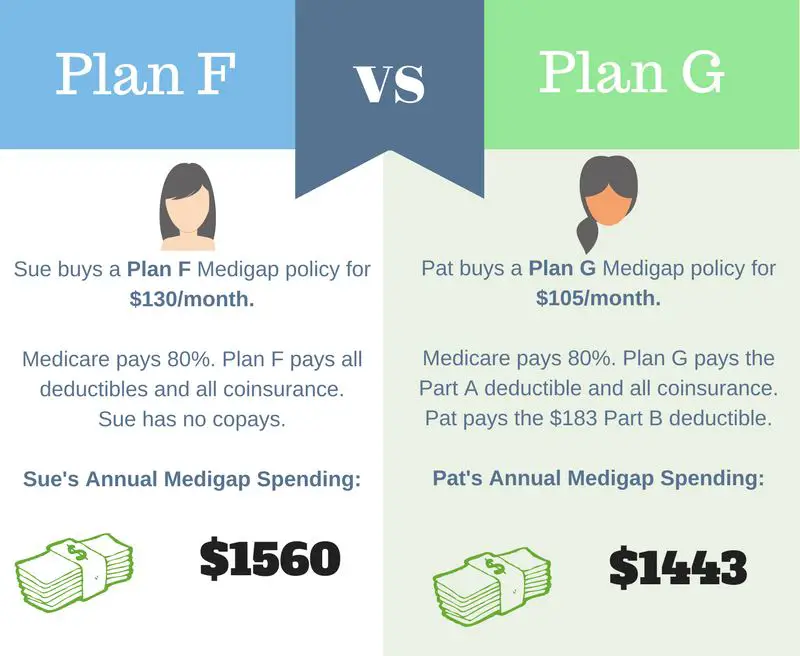

Plan F is considered the top-of-the-line Medigap policy. It covers 100% of the gaps in Medicare. Plan Gs coverage is nearly as good with one exception: Plan G does not cover the Part B deductible, which is $203 in 2021. Even with paying the Part B deductible, many Medicare enrollees find Plan G more cost-effective than Plan F when considering their respective premiums.

Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you wont pay anything out-of-pocket for covered services and treatments after you pay the deductible.

Like Medigap Plan F, Plan G also covers excess charges. Doctors who dont accept the full Medicare-approved amount as full payment can charge you up to 15% more than the Medicare-approved amount for services or procedures. This is known as the excess charge.3 Most doctors accept the Medicare-approved payment and cannot bill you the extra amount. Since 2016, excess charges are illegal in these states: Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont.

Top Coverage

Plan G offers top coverage for preventive visits, emergency care or chronic conditions.

Which Is Better Medicare Supplement Plan F Vs Plan G

When it comes to coverage, Plan F will give you the most coverage since its a first-dollar coverage plan and leaves you with zero out-of-pocket costs. However, when it comes to the monthly premium, if you think lower is better, then Plan G may be better for you. So, the answer to the question depends on you.

What do you consider better? More benefits, or a lower monthly premium. Depending on when you first became eligible for Medicare, you may not be eligible for Plan F. Therefore, the better option for you could be Plan G, or maybe Plan N.

Recommended Reading: Does Medicare Cover Oral Surgery Biopsy

How Does Medigap Plan G Cover Part B Excess Charges

Heres what you need to know about the excess charge MedSup Plan G pays for you.

Medicare agrees to pay a certain amount for each treatment. Thats what physicians and other care providers who accept assignment charge you for those services.

Physicians and providers who dont accept assignment, though, charge you more. By law, they can only charge you 15% more than the Medicare-approved amount.

The difference between the two amounts is the excess charge that Medicare Supplement Plan G pays for you.

What Medicare Plan G Supplements Do Not Cover:

Part B Deductible. The Part B deductible would still be an out-of-pocket expense. This is $198 in 2020 and increases slightly each year.

Prescription Drug Coverage. These are no longer covered under Medicare Supplements. Instead, there are standalone Prescription Drug Plans, such as Medicare Part D.

Also Check: Does Medicare Pay For Eyeglasses For Diabetics

What Is Medicare Part G And How Does It Work

Medicare is a federally financed health insurance program that has various segments each has its own set of benefits:

- Hospital insurance

- Medical insurance

- Medicare Advantage

- Prescription drug coverage

While Medicare covers a lot of bills, others dont. As a result, almost 90% of those on Medicare have some supplemental insurance.

Medigap insurance is a type of supplementary insurance that can help pay for items that Medicare doesnt cover. About one in every four persons with Medicare Parts A and B also has a Medigap policy.

There are ten different Medigap plans available, each with various sorts of additional coverage. Plan G is one of these strategies.

Read more to learn about the prices of Plan G and details on how to enroll.

Choose A Regular Or High

If you would like a Medicare Supplement Plan and choose Plan G, decide if you would like a Regular or a High-Deductible Plan G. High-deductible plans will pay your Medicare out-of-pocket costs after you pay an annual deductible, which was set at $2,370 for 2021. These plans will have lower monthly premiums than a regular plan. You will need to decide if paying more in monthly payments makes more sense financially than paying higher costs when you need care.

Don’t Miss: How Can I Get My Medicare Card Number

Best User Experience: Cigna

-

Household discount program

-

Two mobile apps

-

Limited high-deductible plans

-

Rates increase based on age

Cigna stands out for its customer service and user-friendly website that explains how Medicare Supplement plans work. Its customer support is rounded out by access to a 24/7 nursing line for your healthcare questions. It also offers two mobile apps, the myCigna Mobile app used to track your benefits, and the Cigna Wellbeing App that provides information about chronic conditions like diabetes, wellness tips, healthy recipes, telehealth consultations with a medical professional, and tools to track your weight, blood pressure, cholesterol, and blood sugar.

Founded in 1792, Cigna entered the healthcare industry in 1912. It offers Medicare Supplement Plan G in 46 statesMassachusetts, Minnesota, New York, and Wisconsin are excludedbut has limited options for High-Deductible Plan G, which is only available in North Carolina.

Its price structure is based on an attained model in the majority of states it serves. Under this model, prices increase regularly based on your age. Its quote process is a bit lengthy: you can request a quote online by providing your name, date of birth, zip code, phone number, email address, and start dates of Medicare Parts A and B coverage. You can also get a free quote by calling one of their representatives. Rates may vary by age, smoking status, and location.

Medigap Plan G: Everything You Need To Know

Original Medicare covers many different services, including hospital stays and doctorâs visits. But the cost of deductibles, coinsurance, and copays can still be high. Medigap policies, also known as Medicare Supplement, help fill in these coverage gapsâand sometimes offer additional services as well. Medigap Plan G offers a wider range of coverage than all Medigap plans except for Medigap Plan F.

Also Check: Why Is My First Medicare Bill So High

Medicare Supplement Plan G What It Pays

The following is a list of the rest of the items that Medicare Plan G pays. These are the most common things you might run into when using your coverage.

Medicare Part A

Plan G pays the following:

- Part A hospital deductible

Medicare Part B

- Part B coinsurance of 20%

- Any Part B excess charges

- Coinsurance for skilled nursing facilities

- Up to 3 pints of blood

With Medicare Plan G there are also emergency foreign travel benefits. This pays 80% of your emergency medical care after you pay a $250 deductible. There is a $ 50,000-lifetime max with this benefit.

To get started and see which plan is best for you, give us a call now!

So How Do I Decide Which Company To Choose

Selecting a company can be confusing, but there are two factors that can help you narrow down your decision. We recommend that you check the AM Best ratings for the companies you are comparing to ensure that the company has a positive standing, and then select the company that offers the lowest premium. To make this process easier for you, GoMedigap agents only work with top-rated companies, and we pride ourselves in finding low premiums for our clients.

Don’t Miss: Should I Enroll In Medicare If I Have Employer Insurance

Find Cheap Medicare Plans In Your Area

Medicare Plan G is one of 10 Medicare supplement policies that fill the coverage gaps in original Medicare. For this reason, many seniors choose to purchase Plan G to provide them financial support while being enrolled in Medicare.

Although Plan G is one of the most comprehensive policies available, the plan will not cover the Medicare Part B deductible.

Your Guide To Medicare Plan G Coverage And Benefits

Learn about Medicare Plan G supplement plans, coverage, deductibles, and enrollment before making decisions about your healthcare.

Everyday Health may earn a portion of revenue from purchases of featured products.

Medicare Plan G is a supplemental health insurance plan thats designed to offset expenses that arent covered by Original Medicare.

Plan G policies may be useful for people who are enrolled in Medicare Part A and Medicare Part Bbut need an extra plan to cover copays, coinsurance, and other expenses.

Here are the basics of Medicare Plan G coverage and benefits, deductible prices, and enrollment.

Which Is Better Medicare Supplement Plan G Vs Plan N

When you compare Plan G vs Plan N, youll see that Plan G comes with more coverage. However, Plan N will come with a lower monthly premium. In exchange for a lower monthly premium, you agree to pay small copays when visiting the doctor or hospital.

So, if you prefer to pay out less as you use the benefits, then Plan G may be better since you wont have any copays when visiting the doctor or hospital. If you prefer to have a lower premium and pay more out-of-pocket over time, then the Plan N benefits may be better for you.

According to the American Association for Medicare Supplement Insurance, in 2020, almost 59% of new Medicare beneficiaries enrolled in Plan G & almost 33% enrolled in Plan N.

How Much Does Medicare Plan G Cost

Medicare Plan G policies are sold by private insurance companies and are not offered through Medicare.gov, and premium prices vary based on multiple factors.

There are three ways that insurance companies set their prices. One is that they can all be the same price . Everyone pays the exact same amount regardless of age. Some are based on your age when you purchase your policy. If you start the plan younger, you pay less than if you start the plan when youre older. And the third way is based on your current age. As you grow older the cost of the plan increases.

Medicare Part G can either have no deductible or a high deductible. Additionally, it can be used to help pay for the deductible for Medicare Part A. It also pays for the coinsurance for Medicare parts A and B, essentially covering the gap left by those policies. This is especially helpful for those with very high medical costs who need help playing for the 20% coinsurance on Original Medicare.

What Does Medicare Part B Not Cover

Medicare Part B does not generally cover healthcare outside of the U.S. You may find this publication, Medicare Coverage Outside the US, helpful for specific examples of when Medicare covers healthcare outside the US.

If Original Medicare doesnt cover something, no Medicare Supplement plan will cover it. Medicare does not cover:

- Long-term care

What Is Medicare Supplement Plan G

Medicare Plan G is a Medigap policy, also known as supplemental Medicare insurance. There are currently 10 lettered Medigap policies , and Plan G is one of the best because it provides comprehensive coverage. Plan G pays for the gaps that are baked into Original MedicareOriginal Medicare is private fee-for-service health insurance for people on Medicare. It has two parts. Part A is hospital coverage. Part B is medical coverage…..

Lets talk a little more about the gaps in Medicare and why additional coverage is so important.

Medicare beneficiaries pay a monthly premium, deductibles, and coinsurance. Generally speaking, Original Medicare pays for about 80 percent of all covered services. That means you, the Medicare beneficiaryA person who has health care insurance through the Medicare or Medicaid programs…., are responsible for the other 20 percent.

Your 20 percent share is the gap in coverage, and it can be a significant amount of money. Its not too bad for most medical services , but it can be a whopper for inpatient care . Life-threatening medical care to treat a heart attack, stroke, or car accident can easily run up your out-of-pocket expenses into the thousands.

Savvy seniors prefer Medigap, and Plan G is as good as you can get if you got your Medicare benefits on or after 1 January 2020. There are other plan options, but Plan G is the best.

Who Can Enroll In Medicare Supplement Plan G

You can buy a MedSup Plan G policy if:

- Youre over 65.

- Youre not enrolled in a Medicare Advantage plan.

- You live in the plans service area.

Who cant buy a MedSup Plan G policy? One example is people under 65 with Medicare coverage due to a disability or end-stage renal disease. They may not be able to buy one of these plans. They may not be able to buy any MedSup or Medigap policy, period.

If youre in this situation and you want Plan G coverage, contact a few of the insurance companies in your area. They can tell you if youre allowed to buy one or not. If you cant, ask if you can buy any other MedSup policies.

What Does Medicare Part A Cover:

- Inpatient care in semi-private hospital room

- Skilled nursing facility care following a hospital stay of three or more days

- Inpatient care in a skilled nursing facility not custodial or long-term care

- Part-time home health care, i.e., occupational, physical, speech therapy, illness counseling. It does not include custodial, personal care or homemaker services.

- Blood for transfusions, after the first three pints

What Do Medicare Plan F And Plan G Cover

Medicare Plan F and Plan G are similar and offer the same basic coverage benefits, which include:

- Part A coinsurance and hospital costs.

- Part B coinsurance or copayment.

- Blood .

- Part A hospice care coinsurance or copayment.

- Skilled nursing facility care coinsurance.

- Part A deductible.

- Up to 80% of medical emergency costs during foreign travel.

- No out-of-pocket limit.