Medicare Supplement Plan G Faq

How does Plan G compare to other plans?

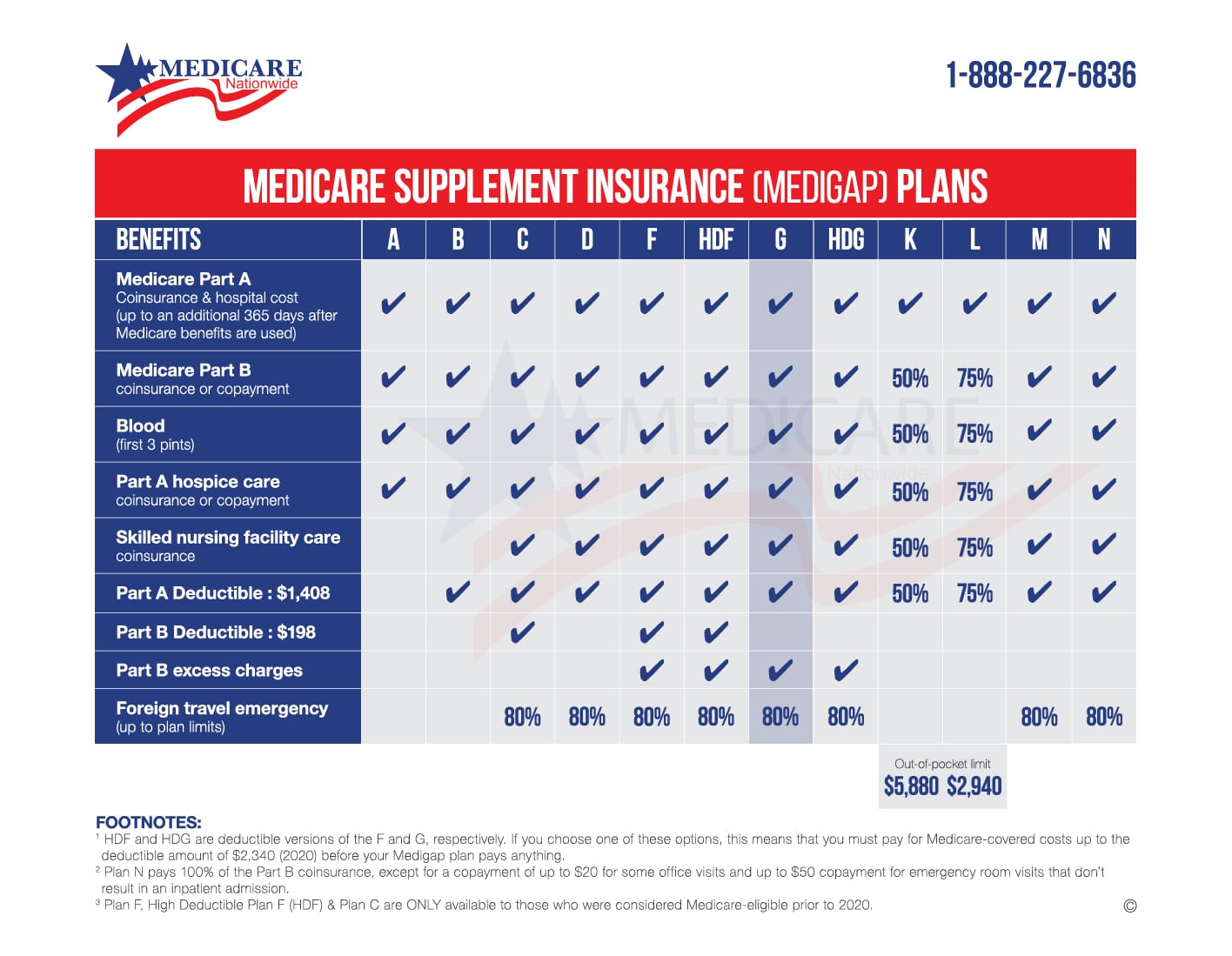

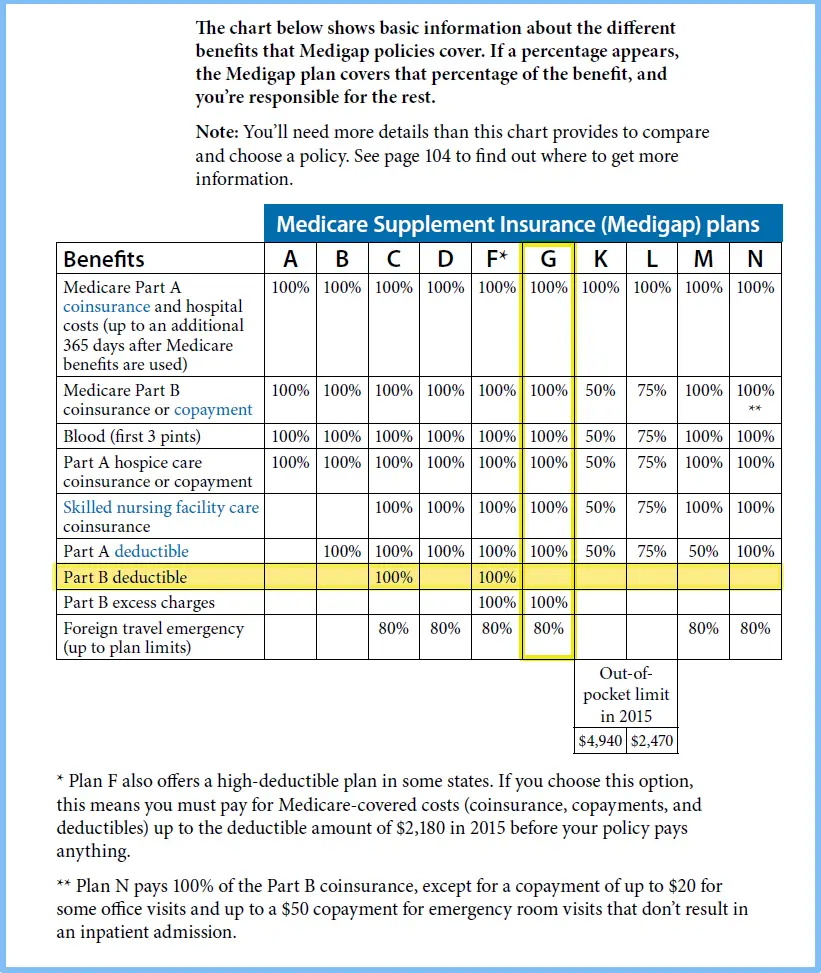

Plan G offers generous coverage compared to most other Medicare Supplement plans. However, more coverage generally means higher premiums. To help you determine which coverage you do and dont need, see a chart that compares Medicare Supplement plans.

Is Plan G better than Plan F?

Plan G is very similar to Plan F. The only difference is the Part B deductible, which Plan F covers and Plan G does not. You may be able to find a Plan G that makes up for the additional cost.

Does Plan G have a high-deductible option like Plan F?

Not currently. However, it might in the future as Plan G is expected to become even more popular, especially after Plan F is no longer available to new enrollees.

Best User Experience: Cigna

-

Household discount program

-

Two mobile apps

-

Limited high-deductible plans

-

Rates increase based on age

Cigna stands out for its customer service and user-friendly website that explains how Medicare Supplement plans work. Its customer support is rounded out by access to a 24/7 nursing line for your healthcare questions. It also offers two mobile apps, the myCigna Mobile app used to track your benefits, and the Cigna Wellbeing App that provides information about chronic conditions like diabetes, wellness tips, healthy recipes, telehealth consultations with a medical professional, and tools to track your weight, blood pressure, cholesterol, and blood sugar.

Founded in 1792, Cigna entered the healthcare industry in 1912. It offers Medicare Supplement Plan G in 46 statesMassachusetts, Minnesota, New York, and Wisconsin are excludedbut has limited options for High-Deductible Plan G, which is only available in North Carolina.

Its price structure is based on an attained model in the majority of states it serves. Under this model, prices increase regularly based on your age. Its quote process is a bit lengthy: you can request a quote online by providing your name, date of birth, zip code, phone number, email address, and start dates of Medicare Parts A and B coverage. You can also get a free quote by calling one of their representatives. Rates may vary by age, smoking status, and location.

Deductible Amount For Medigap High Deductible Options F G & J For Calendar Year 2022

Summary:

Medicare supplemental Plans F and G can be sold with a high deductible option. Before June 1, 2010, Medigap Plan J could also be sold with a high deductible. The high deductible version of Plan F is only available to those who are not new to Medicare before 1/1/2020. High deductible G is available to individuals who are new to Medicare on or after 1/1/2020. People new to Medicare are those who turn 65 on or after January 1, 2020, and those who first become eligible for Medicare benefits due to age, disability or ESRD on or after January 1, 2020.

Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses that a beneficiary must pay before these policies begin paying benefits. CMS updates the deductible amount for plans G, F and J each year, after release of the August Consumer Price Index for all Urban Consumers figures by the Bureau of Labor Statistics, which generally occurs in mid-September.

Calculation of the Deductible:

For Further Information:

Contact: Martha Wagley at 410-786-3778 for actuarial issues or Derrick Claggett at 786-2113 for policy related issues.

Don’t Miss: How To Make Medicare My Primary Insurance

Accendo Medicare Plan G 2022

Accendo came on the scene with a huge splash in 2020. Owned by CVS , Accedo offered people on Medicare yet another great option for Medigap insurance.

With extremely low premiums, especially for Medicare Plan N, and a whopping 14% household discount in many areas, Accendo should still be a fantastic option for people in 2022 for Medicare Plan G.

What Is The Difference Between Medicare Supplement Plans F & G

Medicare Supplement Plans F and G are identical with the exception of one thing: Plan G does not cover the Part B deductible . This means that you will have to pay $183 annually before Plan G begins to cover anything. However, once the Part B deductible for Plan G is paid for, you essentially have Plan F.

Why would someone choose Plan G? Plan G monthly premiums are typically much less expensive than the Plan F premiums sometimes half the cost. Therefore, even though you will have to pay a deductible, you can save money overall if Plan G has a lower premium than Plan F. However, because pricing varies among plans, states, and individuals, this isnt always true sometimes there will be minimal difference in the premium cost. Therefore, when you get a quote, compare the premium amount against the deductible to select the more cost-effective option.

Don’t Miss: Can You Have Two Medicare Advantage Plans

How To Enroll In A Medigap Plan

Private insurance companies must offer supplemental insurance policies, such as Plan G, during the Initial Enrollment Period . The standardized policy is guaranteed to be renewed each year when the premiums are paid.

A person should consider their current and future medical needs before deciding on a Medigap plan. Switching policies later may not be possible. Not all private insurance companies provide insurance in all states.

The State Health Insurance Assistance Program may help a person find a comparison guide for their state.

The Medicare online tool shows plans offered in a persons area, what is covered, the approximate cost, and the companys contact information.

The programs are standardized, but the premiums are not. This means the same policy offered by different companies can have different prices.

Private companies must use a clearly worded summary of the plans benefits and costs. A person should read it carefully to ensure they are buying the right policy for their needs.

The Best Medicare Plan For You: Plan G +rx

The recommended plan is the best fit based on a few questions. There are other personal circumstances that may change this recommendation, including receiving employer sponsored retiree benefits or having specific medical circumstances to consider. Please note that CMS will impose a penalty if you do not have prescription drug coverage . We strongly encourage you review all options with an agent before applying.

Also Check: Does Medicare Have Life Insurance

How Much Does Medigap Plan G Cost

Because Medigap Plan G offers the same coverage no matter what insurance company offers the plan, the main difference is cost. Insurance companies dont offer the plans at the same monthly premium, so it pays to shop around for the lowest-cost policy.

There are lots of factors that go into what an insurance company charges for Plan G. These include:

- your age

- your overall health

- what ZIP code you live in

- if the insurance company offers discounts for certain factors, such as being a nonsmoker or paying yearly instead of monthly

Once you choose a Medicare supplement plan, the deductibles can increase on a yearly basis. However, some people find it hard to change their coverage because they get older and they may find switching plans costs them more.

Because Medigap Plan G is one of the most comprehensive plans, its likely that health insurance companies may increase the costs over time. However, competition in the insurance marketplace may help to keep prices down.

Which Is Better: Medicare Plan F Vs Plan G

No Medicare Supplement plan is better than another. It really depends on your needs and budget. However, as of December 31, 2019, Plan F is no longer available for new enrollment. Here are two things to consider as you evaluate keeping your Medicare Plan F.

Recommended Reading: How Much Do Medicare Plans Cost

What Does Medicare Supplement Plan G Cover

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to, with one exception. With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203.

In their initial research phase, many people compare Plan G to Plan F, which covers the Part B deductible. However, the premiums for Plan G tend to be considerably less than that of Plan F. Because of this, many people find that even after they pay their deductible, Plan G is still the more cost-effective option.

Keep in mind: if you become eligible for Medicare in 2020 or later, you will not be able to get Plan F. This means that Plan G will be the plan with the most comprehensive coverage available to you. Additionally, you will have the option to sign up for a High Deductible Plan G. If you currently have a Plan F and are considering switching, we can help you evaluate your options.

Does It Matter Which Company I Select

Medicare Supplement plans are completely standardized, so the benefits will be the same from company to company. All Medicare Supplement plans, including Plan G, are standardized in the following ways:

- Benefits You dont have to worry about which company offers the best or most benefits. The benefits of a Plan G will be the same regardless of the company you select.

- Doctors Network Medicare Supplement insurance companies dont have their own doctors networks. Their plans are only supplements to your primary Medicare Parts A & B coverage. Your network is the nationwide Medicare network, so, you dont have to worry about whether one company has a better doctors network than another.

- Claims-Paying Process The Medicare Supplement claims process is highly automated. It is easy for you to use the coverage, and most people never see any paperwork. Once Medicare approves your claim, they will pay their portion and notify your provider of what they owe. The company must then pay the amount due per Medicares instructions. Due to the automation and standardization in this area, every company is equal in its claims-paying history.

To make it simple, Medicare is your primary coverage. The plans that each Medicare Supplement insurance carrier offers are identical from company to company, because they are standardized by the government.

Also Check: Is Medicare The Same As Ahcccs

Medicare Plan G Guaranteed Issue

Hopefully, you are aware that you have a one-time open enrollment periodDuring the Medicare Open Enrollment Period, Medicare Advantage and Part D plan members can change, switch, or drop a plan they chose during the Annual Election Period. OEP starts on January 1 and ends on… when you can buy a Medicare Plan G policy and not be turned down because of pre-existing health conditions. Most people only get this opportunity once.

Your personal open enrollmentIn health insurance, open enrollment is a period during which a person may enroll in or change their selection of health plan benefits. Health plan enrollment is ordinarily subject to restrictions…. window starts when you first enroll in Medicare Part B and lasts for six months. Once this window of time has passed, you no longer have a guaranteed-issue rightGuaranteed-issue is a right granted to Medicare beneficiaries and applies to Medicare Supplement insurance . All states and the federal government enforce this essential right, which protects Medicare beneficiaries from medical underwriting…., and insurance companies can ask you health questions. What that means is that an insurance company can and will put you through their medical underwriting process. And, if they dont like what they see, they can turn you down, ask you to accept less coverage, or not cover your condition for a period of time.

What Is Medicare Plan G

A Medicare Supplement Plan GIf you’re turning age 65 this year, Medicare Supplement Plan G is the most comprehensive Medicare supplement you can buy. It’s also the most popular. You might be thinking that Medicare Supplement Plan F is… policy pays everything in the list above except item #5, the annual Medicare Part B deductible. With Medicare Plan G, you pay this $198 costs out-of-pocket the first time you see your doctor each year. Once its paid, then Plan G acts just like a Plan F policy and covers all Medicare-approved costs. But heres the thing, for many people Plan G is actually cheaper overall. Thats what makes it better.

Also Check: Is Omnipod Covered By Medicare

What Is Included In Medicare Supplemental Plan G

Medicare Plan G covers almost everything Original Medicare does not. It doesnt extend the scope of care, just the amount of coverage included. Plan G coverage includes excess charges that are left over from the 80% that Original Medicare does not cover, including Part A and Part B copays and Part As deductible. The other big difference: Plan G does not cover the Part B deductible, which needs to be met. However, that payment does count toward the Plan G deductible as well.

The Plan B deductible for 2020 is $203, so youll have to pay at least this much, but that means you can subtract that amount from your expected Plan G deductible as well.

Medicare Plan F Vs Plan G: Which One Is Right For You

With so many Medicare plan options available, its hard to know which plan will meet your medical needsespecially when it comes to coverage. Plans F and G are known as Medicare Supplement plans. They cover the excess charges that Original Medicare does not, such as out-of-pocket costs for hospital and doctor’s office care.

Your search for affordable Health, Medicare and Life insurance starts here.

Call us 24/7 at or Find an Agent near you.

Its important to note that as of December 31, 2019, Plan F is no longer available for new enrollment. However, if you already have Plan F, you can keep it, making the decision between Medicare Plan F vs. Plan G an important one.

Read Also: When Can I Start Collecting Medicare Benefits

Who Can Sign Up For Plan G

If you qualify for Original Medicare, you may be able to enroll in Plan G. American citizens and legal residents of at least five years can qualify for Medicare. Having worked 10 or more years is a requirement for getting Part A without a premium. If you have not worked 10 years in the US, you may still be eligible for Medicare but you have to pay the Part A premium. And in most cases, you should either be turning 65 or have a disability that qualifies for Social Security disability benefits.

The only exception to getting Medicare without the 2-year wait is amyotrophic lateral sclerosis . Cancer and other diseases e.g. some cases of breast cancer, early-onset Alzheimers disease, may be considered a disability if it meets the SSDI criteria and the 24-month waiting period applies.5

How And When To Enroll In Plan G

The best time to enroll in Medigap Plan G or any Medigap plan is during your Open Enrollment Period . Your OEP begins when you turn 65, and your Medicare Part B is effective. Medicare enrollees 65 years or older can purchase a Medicare Supplement Plan at any time, though if you purchase the plan outside of your OEP, you may be subject to health screenings and medical underwriting. However, if you enrol during your OEP, then healthy individuals and those with health conditions alike will pay the same for Medigap Plan G.

If you are less than 65-years old but you have Medicare, you may still be able to enroll in a Medigap plan, depending on where you live. Some states may require Medigap insurance companies to sell Medigap plans to Medicare recipients under the age of 65. However, each state has its own rules for health screenings, rates, and Open Enrollment for Medicare beneficiaries younger than 65. Check with one of our licensed agents today to see if you qualify.

You May Like: When Can I Apply For Medicare In California

Learn More About Medigap Plans In Your Area

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Introducing A New Plan G Option: Plan G Plus

Beginning February 1st, 2021 all three Blue Medicare Supplement Plan Gs have Plus options. Plan G Plus plans have the same medical coverage as their regular versions as well as additional benefits and programs included so members can get more out of their Blue Medicare Supplement insurance plans. Additional benefits and programs include dental, vision, hearing, and fitness. Read this chart for more details:

| Benefit |

|---|

The out-of-pocket annual limit will increase each year for inflation.

Rates as of 04/01/2020. Rates are illustrative only. Actual rates are based on your age, where you live, and your choice of coverage. Please do not send money, you cannot obtain coverage under the above plans until an application is completed and approved. Benefit exclusions and limitations might apply.

Important Information About Quotes for Medicare Supplement Insurance Plans

Quoted prices are based on the criteria specified during your search. This illustration is subject to Blue Cross and Blue Shield of Illinois’s rating or underwriting and approval, as appropriate, and does not guarantee rates, coverage or effective date. Furthermore, rates are subject to change if any of the information you have provided changes when and if a policy is approved. In addition, Blue Cross and Blue Shield of Illinois reserves the right to change rates from time to time.

Recommended Reading: What Does Medicare Extra Help Pay For