Medicare Supplement Plan N Enrollment

The best time to get a Medicare Supplement Plan N is during the Open enrollment period. The Open Enrollment Period is a 6-month window around your 65th birthday. Youll have a Plan N with no underwriting, regardless of your medical condition and get the best rate available.

Depending on your age, county and zip code, gender and other personal information, a Plan N policy may cost you between $80 and $200 monthly.

Now that you know all there is to know about Medicare Supplement Plan N let us help you pick the best plans for you. We consider your pre-existing conditions, preferences, location, travels, and more. Please tell us who you are and what you want, well help you get the best value possible.

How Does Medicare Supplement Plan N Compare To Other Medigap Plans

Medicare Supplement Plan N provides more coverage than Plans K and L. For example, it covers 100% of the Medicare Part B coinsurance and copayments, whereas K and L only pay 50% and 75%, respectively. The same is true with the Medicare Part A deductible.

Additionally, the only out-of-pocket expenses beyond the monthly premium are a $20 copay for office visits and a $50 copay for a trip to the ER.

The chart below will help you make comparisons.

When Should You Enroll In A Medigap Policy

The best time to purchase your Medicare Supplement plan is during the Medigap Open Enrollment Period, the six-month period that begins on the first day of the month in which you are 65 or older and enrolled in Medicare Part B. During those six months, private insurers cannot deny you an available policy for any reason, and you have more options and lower pricing. You may also have other options for purchasing a Medigap policy later, depending on your situation. For example, a canceled policy, a loss of insurance, an insurance carrier bankruptcy, and other circumstances may qualify.

But outside of open enrollment, insurers can use medical underwriting things like your age, gender, area of the country, and previous health conditions when deciding to sell a policy. That means you may be denied a policy or have to wait for preexisting condition coverage, often for six months after your policy is in effect, pay higher premiums, or have fewer options than when enrolling during the open enrollment period.5

Your state may have additional rules regarding open enrollment so check to be sure.

Also Check: Do I Need Medicare If I Have Medicaid

How Medicare Supplement Insurance Plans Work

So, how do these Medigap plans work? Remember that Medigap is simply another term for a Medicare supplement plan. Medicare beneficiaries often find themselves spending money out of their own pocket when they receive services from their physician or healthcare provider. Even though they have health insurance through Medicare, they are still responsible for copays, deductibles, and other out-of-pocket costs. These Medicare supplement plans exist to help those on Medicare benefits pay for these costs. Medicare supplemental insurance plans are not officially part of the Federal Medicare program. This means that they are not managed by the Centers for Medicare & Medicaid Services . Instead, they are managed and administered by private insurance companies.

Another important thing to remember is the eligibility criteria for Medigap plans. You must be enrolled in Medicare to be eligible for a Medigap policy. You must be enrolled in Original Medicare to purchase a Medigap policy. You cannot have both a Medicare Advantage plan and a Medigap plan. If you decide to purchase a Part C Advantage plan, you are not eligible to buy a Medigap policy. You can, however, have Original Medicare with a prescription drug plan and still sign up for Medigap.

Plan N: Who Is It For

- People who want a balance of cost and coverage. Plan N provides substantial coverage while offering low monthly premiums.

- People who can be flexible about the doctors they see. If a Plan N enrollee sees a provider who doesnt participate in Medicare, they will pay a little more. Therefore, people with Plan N need to choose their providers carefully.

- People who travel to foreign countries. Plan N covers 80% of emergency health care costs while in another country after a $250 deductible.1

William is 64, and planning to retire next year. Hes decided to apply for Medicare Part A and Part B, and hes researching Medicare supplement plans. Heart disease runs in his family, so William visits the doctor regularly. However, he is open to switching providers if it will save him money. He and his wife have been saving up for a retirement full of travel. William decides to purchase Medigap Plan N, as it will charge lower premiums yet still provide coverage for any health emergencies while he is out of the country.

Recommended Reading: Does Humana Offer A Medicare Supplement Plan

When Do I Enroll In Plan N

You can enroll in a Medicare Supplement plan at any time of the year. Yet, it is best to use your Medigap Open Enrollment Period or another time when you have guaranteed issue rights. Otherwise, youll need to answer underwriting questions and the carrier could deny your application because of health status.

A Brief Review Of Medicare Supplement Plans

When you turn 65, youre eligible to enroll in Medicare, a federally facilitated health insurance program. Original Medicare will cover some, but not all, of your medical expenses. The portion not covered is often referred to as a gap. Medicare Supplement plans, also called Medigap plans, are policies sold by private insurance companies to help pay for the expenses Medicare does not cover.

Also Check: How Much Copay For Medicare

Medicare Part A Coinsurance

After you meet your Medicare Part A deductible, youll have to pay daily coinsurance costs if youre in the hospital for longer than 60 days in the same benefit period. The coinsurance requirements for 2022 are $389 per day for days 61 through 90 of your stay, and $778 per day for each lifetime reserve day beyond day 90.

You have 60 lifetime reserve days to use over the course of your life, and you are then responsible for all inpatient costs once these days are exhausted.

Plan N provides 100% coverage of Medicare Part A coinsurance costs and also covers an additional 365 days of hospital costs after running out of lifetime reserve days.

Is Medicare Supplement Plan N A Good Fit For Me

Plan N may be right for you if:

- You want extensive coverage but don’t need or can’t afford the higher premium for a fully comprehensive plan.

- You want a Medigap plan that’s widely available. About 62% of Medicare supplement insurance providers have Plan N policies in force, according to AHIP.

- You’re a new Medicare enrollee looking for an alternative to the discontinued Plan F.

- You’re in relatively good health and don’t expect to require frequent visits to the doctor.

- You’re okay with incurring some additional cost sharing for medical care in exchange for lower premiums.

- You frequently travel abroad.

You May Like: What Is A Good Secondary Insurance To Medicare

How Much Does Medicare Supplement Plan N Cost

The premiums associated with Medicare Supplement plans differ by location and insurance company. As a general reference, in 2021, a non-smoking 65-year-old woman living in Floridas 32162 ZIP code would pay between $124 and $182 for Medicare Supplement Plan N monthly premiums.1

But how do companies set these prices? They use one of three price rating systems to set premiums:

There can be a wide variance in cost. Differences may exist based on whether or not the insurance company selling the policy offers discounts or uses medical underwriting.

Pro Tip: When shopping for a Medicare Supplement policy, always compare apples to apples. You want to be make certain you are comparing a Medigap Plan N from one company to a Medicare Plan N from another company. You dont want to compare Plan N at one company to Plan B at another because you wont get a clear comparison between the prices and benefits.

Want an easy way to shop for Medicare Plan N prices? Start comparing Medigap plans with HealthMarkets!

What To Know Before Enrolling In Medicare Supplement Plan N

If you are interested in enrolling in Medicare Supplement Plan N, or any Medigap plan, there are five things you should know beforehand:

47333-HM-1121

Also Check: Does Medicare Pay For Assisted Living Care

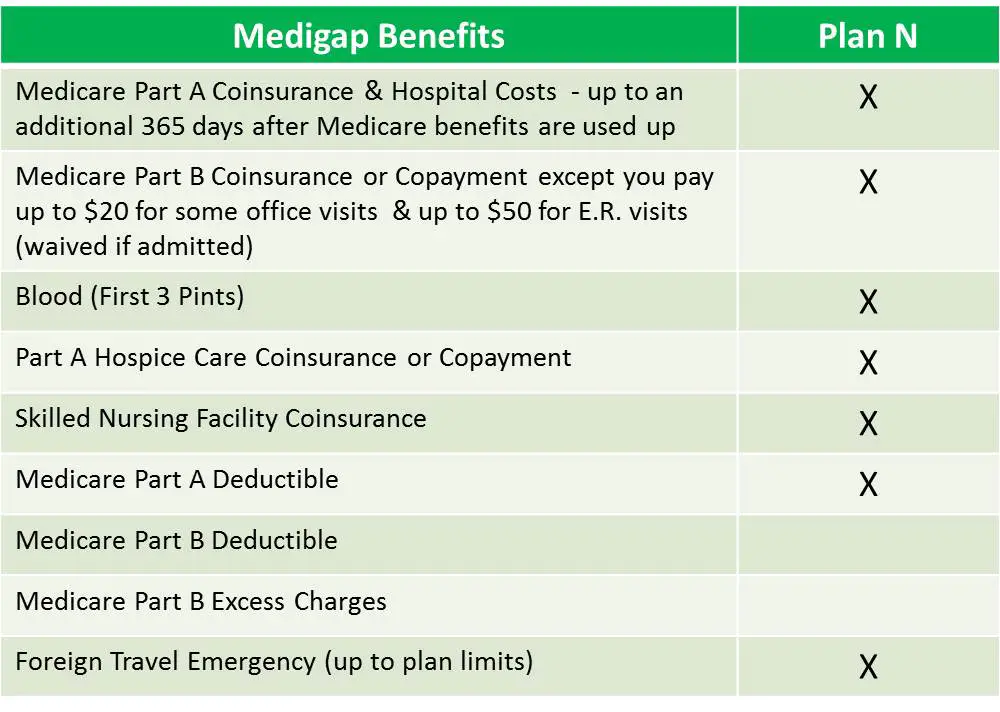

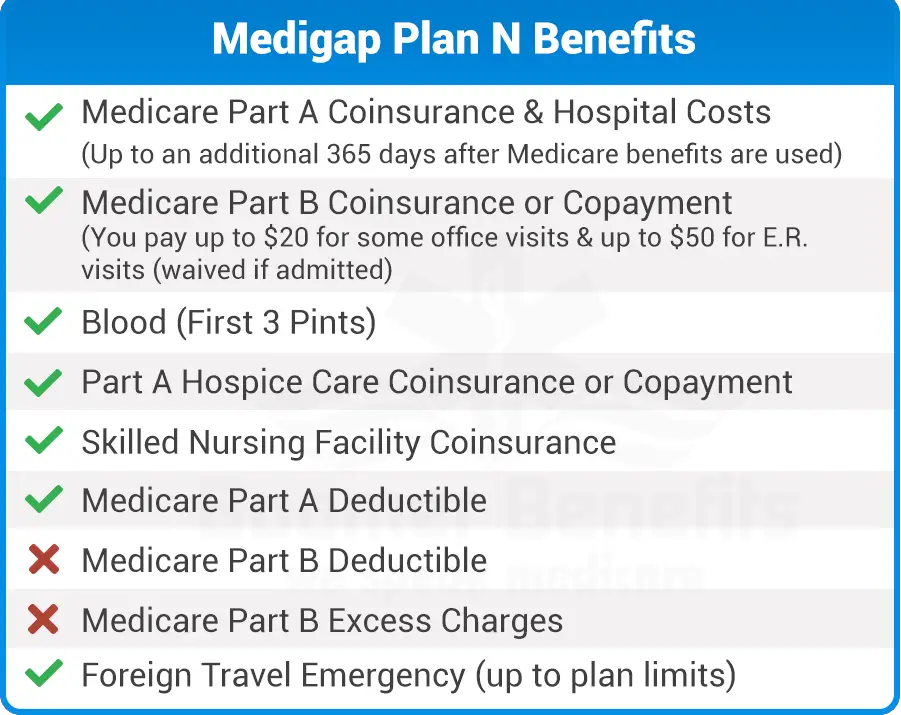

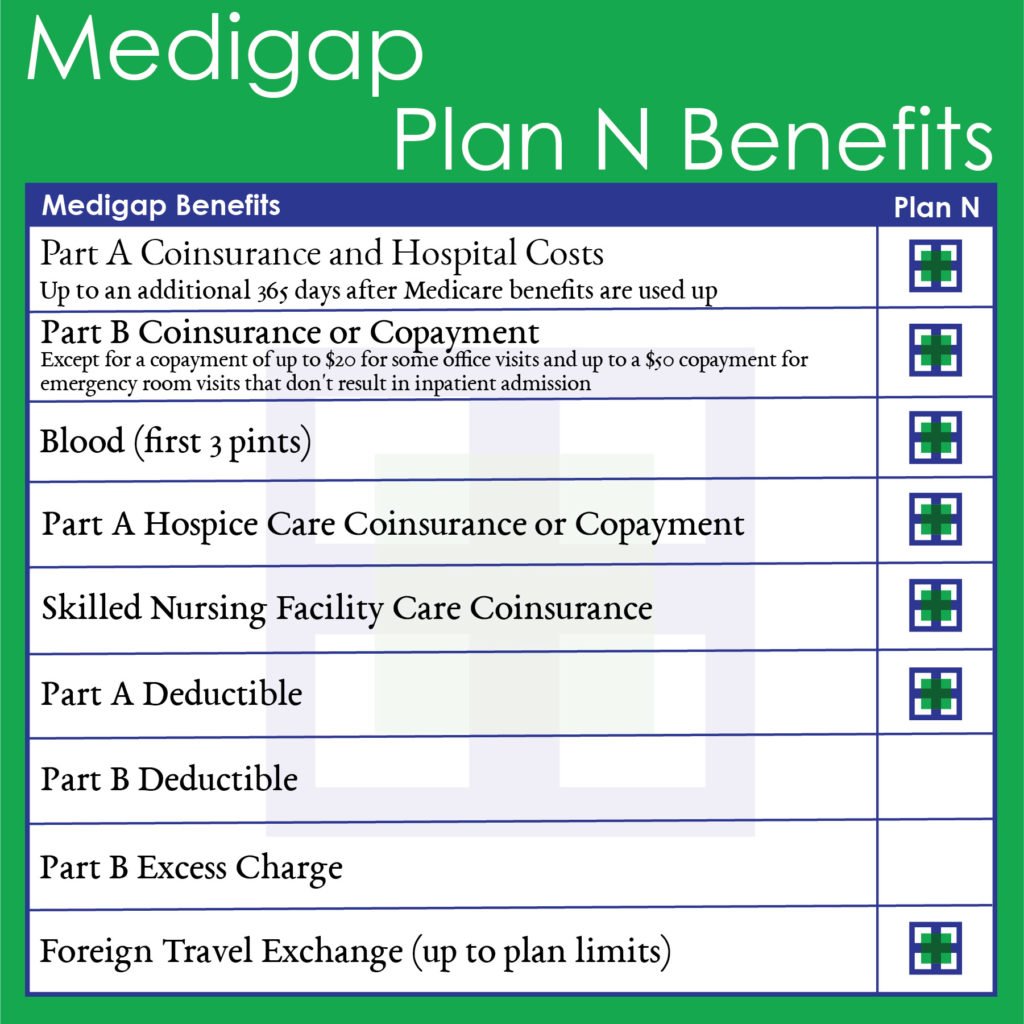

What Does Plan N Not Cover

Medicare supplement Plan N does not cover the following costs:

- Medicare Part B deductible. This is the amount you must pay out of pocket for outpatient medical services before your Medicare benefits kick in.

- Part B excess charge. Health care providers opting not to participate in Medicare can levy excess charges of up to 15% above Medicare’s allowable amounts for Part B medical services.

As with all other Medigap Policies, Plan N also doesn’t pay for vision, dental, prescription drugs or long-term care.

Who Can Sign Up For Plan N

Some requirements need to be fulfilled before you can sign up:

Part A and B requirement

You must have Original Medicare to sign up for Plan N.4

Plan service area requirement

Not all Medicare Supplement plans are available everywhere. It is possible that insurance companies in your service area do not offer Plan N. You can find out which insurance companies sell Medigap policies in your area, and which specific plans they sell, by using this Medicare tool.

Don’t Miss: What Age Can I Qualify For Medicare

Who Is Eligible For A Medigap Plan N

Anyone who is eligible for Medicare and enrolled in Part A and Part B may be eligible to purchase Medigap Plan N. If you miss your Medigap Open Enrollment period, you may not be able to purchase a policy depending on your health condition. You cannot have a Medigap policy and a Medicare Advantage Plan at the same time.

What Does Medicare Supplement Plan Cover

Like other Medigap plans, Plan N helps cover out-of-pocket costs from Medicare Part A and Medicare Part B. This includes:

Note: Medigap plans do not include outpatient prescription drug coverage. If you need prescription drugs, you will need to enroll in Part D separately from any Medigap plans you have.

The Plan N Medicare supplement helps cover most or all of several common Medicare costs and can be very useful if you ever experience a substantial medical event. Heres whats covered by Medicare Plan N:

Are you eligible for cost-saving Medicare subsidies?

Also Check: How Does United Medicare Advisors Make Money

Does Medigap Plan N Cover Excess Charges

Medicare Supplement Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount. Medicare Plan N will not cover the copay or coinsurance for doctors office and emergency room visits.

Where Can You Buy Medicare Supplement Plan N

The government doesnt sell Medigap policies. Youll have to buy the policy from a health insurance company. Once youve identified an insurer you may like to purchase the plan from, contact the company directly to apply for a policy.

The insurance company will then let you know what information they may need . If they approve you, they should give you an estimate of how much the monthly premium will be.

help choosing a Medigap plan

If you arent sure where to start in purchasing a Medigap plan or have questions along the way, there are many resources out there to help you, including:

- CMS. Call 800-633-4227 and ask for a copy of the CMS publication Choosing a Medigap Policy: A Guide to Health Insurance for People With Medicare.

- Your State Health Insurance Assistance Program . The SHIP program offers free counseling on Medicare concerns, including Medigap policy purchases. to find your local SHIP phone number.

- A trusted health insurance agent. Ask a local insurance agent about available Medigap Plan N policies in your area.

Don’t Miss: When Can I Apply For Medicare In California

How Does Plan N Work

Like other supplemental policies, Plan N fills coverage gaps in traditional Medicare, thus making it easier for beneficiaries to meet their overall health care expenses. Because only about 80% of medical costs are covered by Medicare Part A and Medicare Part B , supplemental plans can help pay for the remaining 20% of costs.

Among other benefits, Plan N covers the entire coinsurance costs for Medicare Part A, Medicare Part B, hospice care and skilled nursing facility. This means that instead of an enrollee being charged 20% of the bill as would happen with Original Medicare, the supplemental plan would pay that 20% of the bill.

One of the most important features of Medigap Plan N is its copays you pay a $20 copay for each physician visit and a $50 copay for each emergency room visit that does not result in hospitalization. Even though the supplemental plan pays the coinsurance charged by Original Medicare, the supplemental policy has its own copayments for these services. Most Medigap Plan N policies do not charge for visits to urgent care centers, though.

Beneficiaries buy supplemental Medigap plans through private insurance companies such as Aetna, Cigna and UnitedHealthcare, among others. Each supplemental plan category bears a distinct letter, denoting differences in coverage, monthly premiums and out-of-pocket expenses.

How supplemental policies work

Why Choose Plan N

Finding the right Medigap plan for your needs depends on the types of coverages you want, but there are several reasons you may choose Plan N, such as:

- While Plan N doesn’t cover the Medicare Part B deductible, the deductible cost is only $233 per year in 2022.

- Plan N doesn’t cover Part B excess charges, but you can typically avoid facing these excess charges by making sure you only visit health care providers who accept Medicare assignment. This means that they accept Medicare reimbursement as payment in full.Most providers who participate in Medicare accept Medicare assignment.

You May Like: When You Turn 65 Is Medicare Free

Is Plan N The Right Plan For Your Medigap Needs

The Plan N Medicare supplement provides a good amount of coverage while costing around 25% less than Plan F, the Medigap plan with the highest level of coverage.

However, savings comes at a trade-off. Plan N will not cover your Part B deductible, co-pays or your Part B excess charges.

If you feel comfortable being able to manage those excluded Part B expenses on your own, then Plan N is an excellent way to add strong, additional coverage to your Medicare insurance plan.

To learn more about Medicare Supplemental Plan N insurance or get a quote for a policy, contact Plan Medigap by calling today.

Why Emily Chose Medicare Plan N

Emily, 67, wasnt looking forward to navigating all the decisions she would have to make in order to go on Medicare. She knew about the gap in Original Medicare coverage and that she would have to choose between several Medicare Supplement Plans if she wanted the peace of mind of knowing shed be covered.

Her goal was two-fold: one, get the broadest coverage she could find, and two, make sure it was a plan she could afford on her limited budget.

One plan stood out above the others once Emily noted it contained terms like 100% covered when it came to hospital expenses and Medicare Part B coinsurance costs.

Because Emily has been relatively healthy, she wasnt concerned about the $20 copayment for any doctors office visits as well as the $50 copayment for emergency room visits.

This particular Medicare Supplement Plan is one of the most popular of all, which made Emily feel even better about it. For these reasons, Emily chose Medicare Supplement Plan N.

Also Check: Who Must Enroll In Medicare

Factors That Influence Plan N Costs

The following factors can affect the premiums an insurance company sets for a Plan N policy:

- Issue age: This means that the price depends on the age of an individual at the time they buy a plan. Although the price may increase with inflation, it will not rise as someone gets older.

- Attained age: This indicates that the price depends on a personâs current age. As an individual gets older, the price of the plan will increase.

- Discounts: Some companies offer discounts based on a variety of factors that may affect health, such as quitting smoking. Others reduce their rates if a person chooses to pay their premiums electronically, or if they have more than one policy.