How Do Medicare Part B Give Back Plans Work

Part B giveback programs are private health plans that are provided instead of Medicare. Medicare Advantage plan beneficiaries can get original Medicare Part A or Part B insurance benefits along with some additional benefits.

This package of coverage provides complete coverage and helps reduce the out-of-pocket cost of hospital services. Other features include prescription coverage. GivingBack initiatives are a further additional benefit which separate the plans from others.

Who Can Join A Medicare Advantage Plan

Beneficiaries who have Medicare Part A and Part B can join a Medicare Advantage plan if they also:

- Live in the service area of the plan they want to join

- Are a U.S. citizen or legal resident who has lived here for at least 5 years

Not all Medicare Advantage plans are available in all areas. Most plans have a designated service area, or specific cities or zip codes, where they offer coverage. You must live within that service area in order to enroll in that plan.

If you live in another state for part of the year, or are curious about a plan’s service area, contact the plan directly.

Medicare Part A Premiums And Deductibles Are Going Up In 2023

While Medicare Part B is seeing a decrease in premiums next year, those who have to pay for Medicare Part A will see very slight premium increases in 2023. Those who’ve worked more than 30 calendar quarters will pay $278 a month, versus $274 in 2022. Those with less qualifying employment history will pay $506 a month, compared with $499 in 2022.

It’s important to note that 99% of Medicare recipients don’t have to pay anything for Part A because they’ve worked 40 calendar quarters while paying Medicare taxes.

The deductibles for Medicare Part A are also rising by about 2.8% each. Here’s a breakdown of what’s going up.

Inpatient hospital deductible: $1,600 in 2023, an increase of $44 from $1,556 in 2022.

Daily coinsurance for the 61st through the 90th day: $400 in 2023, an increase of $11 from $389 in 2022.

Daily coinsurance for lifetime reserve days: $800 in 2023, an increase of $22 from $778 in 2022.

Skilled Nursing Facility coinsurance: $200 in 2023, an increase of $5.50 from $194.50 in 2022.

Recommended Reading: How Long Does It Take To Get Your Medicare Card

What Services Does The Partnership Provide

- Medicare and Medicaid information and education

- Help with original Medicare eligibility, enrollment, benefits, complaints, rights and appeals

- Explain Medicare Supplemental insurance policy benefits and comparisons

- Explain Medicare Advantage and provide comparisons and help with enrollment and disenrollment

- Explain Medicare Prescription Drug coverage, help compare plans and search for other prescription help

- Information about long-term care insurance

The partnership also helps with the following programs. Benefit Counselors are specially trained to help you understand all the fine print to find and apply to a plan that works for you. They advocate for you with these programs and help you get the services you need.

What Do Medicare Parts A And B Cover

Medicare Part A covers inpatient hospital, skilled nursing facility, hospice, inpatient rehabilitation and some home health care services.

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment and certain other medical and health services not covered by Medicare Part A.

Medicare Part D helps cover prescription drug costs.

For more information, here’s when you can sign up for Affordable Care Act plans.

Get the So Money by CNET newsletter

Also Check: Are Canes Covered By Medicare

Does Medicaid Cover Nursing Homes

Yes, Medicaid covers nursing home costs if you qualify. Medicaid is the largest fund-source for nursing home care. For eligible seniors, Medicaid covers long-term nursing home care in Medicaid-certified facilities4 when medically necessary. Youll have to be under a certain income level and meet other state-specific requirements to qualify.5

All 50 states offer Medicaid, but nursing home services, cost coverage, and eligibility requirements vary widely by state. For example, New York has a Medicaid income limit of $10,600 for individuals age 65+ with a family size of one6 while Mississippis limit is $2,382. Not all nursing homes accept Medicaid, so check with each facility.

Unlike Medicare, Medicaid does not impose an official time limit on nursing home stays as long as theyre in a licensed and certified Medicaid nursing facility.

What Is Covered by Medicaid

- Long-term care covers nursing home stays for qualifying patients needing ongoing care for a chronic mental or physical condition.

- Skilled nursing and related medical care.

- Rehabilitation from illness, injury, or disability.

Dont Miss: When Is The Next Medicare Open Enrollment

Medicare Insurance Premium Payment Program

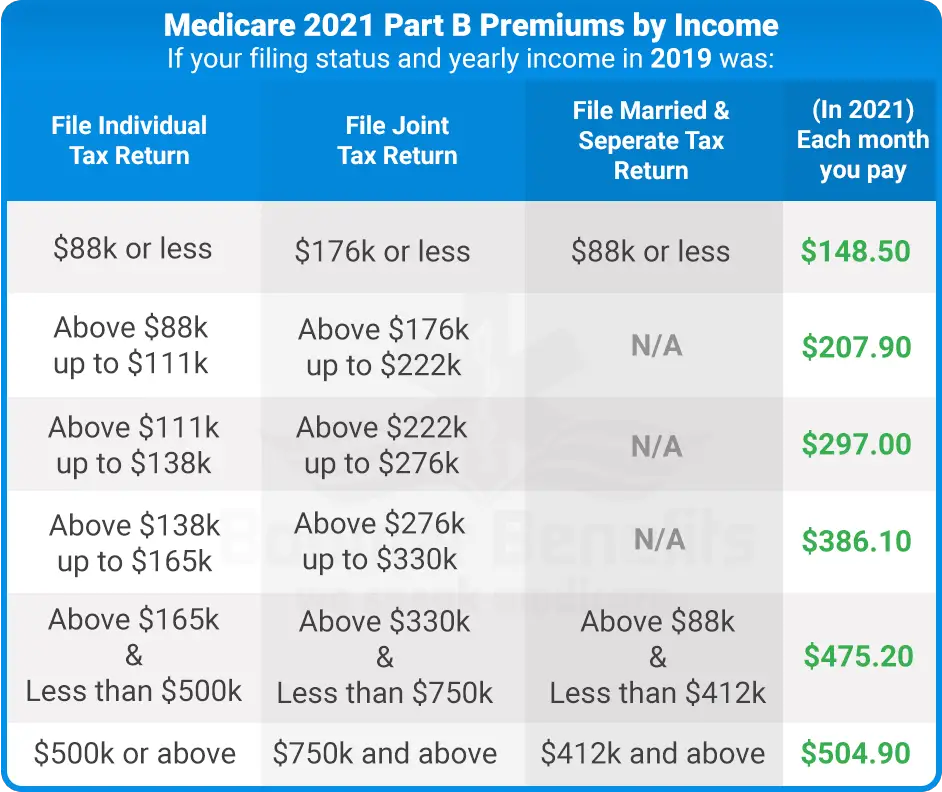

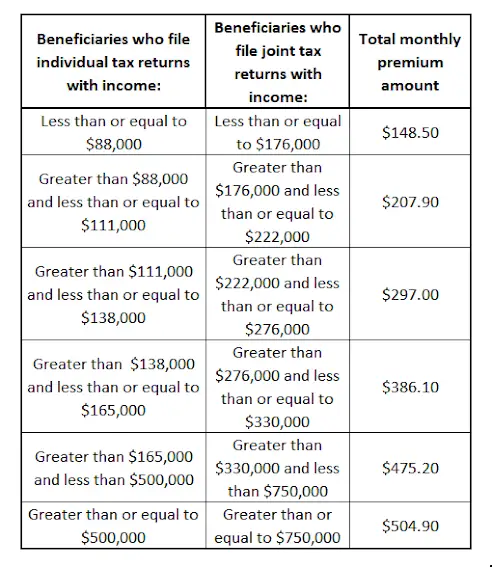

Some “dual eligible” beneficiaries are entitled to receive reimbursement of their Medicare Part B premiums from New York State through the Medicare Insurance Premium Payment Program . The Part B premium is $148.50 in 2021. MIPP is for some groups who are either not eligible for — or who are not yet enrolled in– the Medicare Savings Program , which is the main program that pays the Medicare Part B premium for low-income people. Some people are not eligible for an MSP even though they have full Medicaid with no spend down. This is because they are in a special Medicaid eligibility category — discussed below — with Medicaid income limits that are actually HIGHER than the MSP income limits. MIPP reimburses them for their Part B premium because they have full Medicaid but are ineligible for MSP because their income is above the MSP SLIMB level . Even if their income is under the QI-1 MSP level , someone cannot have both QI-1 and Medicaid). Instead, these consumers can have their Part B premium reimbursed through the MIPP program.

In this article:

Don’t Miss: Where Can I Go To Apply For Medicare

What If Im Also Enrolled In Medicaid

If you are enrolled in both Medicare and Medicaid at the same time, then Medicaid will pay your Part B premiums. If you are enrolled in Medicaid and Medicare, you will also automatically be eligible for enrollment in some Medicare Savings Programs.

Medicaid can also provide other forms of assistance aside from the Part B premium, including help with Part D and secondary insurance coverage. To coordinate these benefits and make sure that you are getting as much coverage as you can, you should contact your local Medicaid office.

If you are already enrolled in Medicaid before you enroll in Medicare, you should contact Medicaid as early as you can to make sure that your premiums are covered before you are billed. This also ensures proper billing and payment of your Medicare claims.

What Is The Texas Health Information Counseling And Advocacy Program

If you are eligible for Medicare, the Texas’ Health Information, Counseling and Advocacy Program can help you enroll, find information and provide counseling about your options. This partnership between the Texas Health and Human Services system, Texas Legal Services Center and the Area Agencies on Aging trains and oversees certified benefits counselors across the state.

You May Like: Does Medicare Pay For Memory Care Assisted Living

Manual For State Payment Of Medicare Premiums

On September 8, 2020, the Centers for Medicare & Medicaid Services released an updated version of the Manual for State Payment of Medicare Premiums . The manual updates information and instructions to states on federal policy, operations, and systems concerning the payment of Medicare Parts A and B premiums for individuals dually eligible for Medicare and Medicaid. The update to the manual is part of CMS Better Care for Dually Eligible Individuals Strategic Initiative aimed at improving quality, reducing costs, and improving customer experiences.

The prior version of this manual had not been fully updated since the 1990s. The updated manual clarifies various provisions of statute, regulation, and operations that have evolved over time. We redesigned the manual content to make it easier for states to discern federal requirements and find information, compliant with federal accessibility standards and fully available online for the first time.

The manual is part of the CMS Manual System, specifically Pub. 100-24. It is divided into the following sections:

Ways To Sign Up For Medicare Easy Pay:

It can take up to 6-8 weeks for your automatic deductions to start. Until your automatic deductions start, you’ll need to pay your premiums another way. If we can’t set up Medicare Easy Pay for you, we’ll send you a letter explaining why. Find other ways to pay premiums.

Don’t Miss: Will Medicare Pay For A Knee Walker

Understanding Medicare And Medicaid

Medicare is health and hospitalization insurance for people age 65 and older and those under 65 with certain disabilities or end-stage renal disease. Some portions of Medicare are free and others cost money, with premiums typically deducted from your Social Security benefit checks.

Even if you have private insurance you should apply for Medicare. If you wait until after your 65th birthday to apply, you may end up paying a late penalty or higher premiums. For most people, the initial enrollment period is the seven-month period that begins three months before the month in which they turn 65. If you miss that window, you may enroll between January 1 and March 31 each year, although your coverage wonât begin until July 1.

There are four types of Medicare coverage available.

Read Also: Is Humana Medicaid Or Medicare

How To Qualify For The 4 Medicare Savings Programs

In many cases, to qualify for a Medicare Savings Program, you must have income and resources below a certain limit, as described below. These limits go up each year.

You may still qualify for these programs even if your income or resources are higher than the limits listed. Some states dont count certain types or specific amounts of income or resources when deciding who qualifies.

Read Also: Does Aetna Follow Medicare Guidelines

Do You Have To Apply For An Msp During Medicare’s Annual Election Period

No. You can apply for MSP assistance anytime. As noted above, youll do this through your states Medicaid office, which accepts applications year-round.

But the marketing and outreach before and during Medicares annual election period can be a good reminder to seek help if you need it. You might decide to make a change to your coverage during the annual open enrollment period, and simultaneously check with your states Medicaid office to see if you might be eligible for an MSP or Extra Help with your drug coverage.

How Much Will I Pay For Premiums In 2022

Most people will pay the standard amount for their Medicare Part B premium. However, youll owe an IRMAA if you make more than $91,000 in a given year.

For Part D, youll pay the premium for the plan you select. Depending on your income, youll also pay an additional amount to Medicare.

The following table shows the income brackets and IRMAA amount youll pay for Part B and Part D in 2022:

| Yearly income in 2020: single | Yearly income in 2020: married, joint filing | 2022 Medicare Part B monthly premium | 2022 Medicare Part D monthly premium |

|---|---|---|---|

| $91,000 | |||

| $578.30 | your plans premium + $77.90 |

There are different brackets for married couples who file taxes separately. If this is your filing situation, youll pay the following amounts for Part B:

- $170.10 per month if you make $91,000 or less

- $544.30 per month if you make more than $91,000 and less than $409,000

- $578.30 per month if you make $409,000 or more

Your Part B premium costs will be deducted directly from your Social Security or Railroad Retirement Board benefits. If you dont receive either benefit, youll get a bill from Medicare every 3 months.

Just like with Part B, there are different brackets for married couples who file separately. In this case, youll pay the following premiums for Part D:

- only the plan premium if you make $91,000 or less

- your plan premium plus $71.30 if you make more than $91,000 and less than $409,000

- your plan premium plus $77.90 if you make $409,000 or more

You can request an appeal if:

Recommended Reading: Should I Get Medicare Supplemental Insurance

Medicaid Recipients Whose Medicaid Is Handled On The Nys Of Health Marketplace And Are Newly Enrolled In Medicare And Not Yet In A Medicare Savings Program

See GIS 18 MA/001 – 2018 Medicaid Managed Care Transition for Enrollees Gaining Medicare, #4 for an explanation of this process. That directive also clarified that reimbursement of the Part B premium will be made regardless of whether the individual is still in a Medicaid managed care plan.

Note: During the COVID-19 emergency, those who have Medicaid through the NYSOH marketplace and enroll in Medicare should NOT have their cases transitioned to the LDSS. They should keep the same MAGI budgeting and automatically receive MIPP payments. See GIS 20 MA/04 or this article on COVID eligibility changes

How To Find A Plan That Offers The Giveback Program

To find a plan, you can use our Find a Plan tool. In the Plan Details, under the “premiums” section, look for plans that have a “Part B premium reduction” listed. The amount shown is how much the premium giveback amount is.

Depending on how many Medicare Advantage plans are available in your area, you may have several options to choose from. Some zip codes have only one or two plans, while others may have dozens to research.

Even if you find a plan that offers the giveback program, it’s important to compare other factors as well in order to find the best plan and options for your unique needs. Other items to consider include:

These are just a few factors to consider when comparing plans. Take time to carefully compare plans in your zip code and all the features of the plan, not just the giveback program.

You May Like: Does Medicare Part C Cover Home Health Care

What Are The Medicaid Benefits

Federal Requirements

The federal government requires each state to cover certain health-related benefits. These are known as mandatory benefits and include:

- physician, nurse midwife, and nurse practitioner services

- laboratory and x-ray services

- ipatient and outpatient hospital services

- early and periodic screening, diagnostic, and treatment services for children, teens, and young adults under age 21

- family planning services and supplies

- services provided in community health centers and rural health clinics

- nursing facility services for people age 21 and older

State Options

Your state can provide coverage for additional health-related services that are approved by the federal government. These so-called optional services may include:

- prescription drugs

- eye glasses and vision care

- mental health services

Qualified Medicare Beneficiary Program

Helps pay for: Part A premiums Part B premiums, deductibles, coinsurance, and copayments .

Monthly income and resource limits for 2022:

| Your situation: |

|---|

* Limits slightly higher in Alaska and Hawaii

If you qualify for the QMB program:

- Medicare providers arent allowed to bill you for services and items Medicare covers, including deductibles, coinsurance, and copayments. What to do if you get a bill

- You may get a bill for a small Medicaid copayment, if one applies.

- You’ll also get Extra Help paying for your prescription drugs. Youll pay no more than $4 in 2022 for each drug covered by your Medicare drug plan.

You May Like: Does Medicare Pay For A Rollator

When The Part B Premium Reduces Countable Income To Below The Medicaid Limit

- Since the Part B premium can be used as a deduction from gross income, it may reduce someone’s countable income to below the Medicaid limit. The consumer should be paid the difference to bring her up to the Medicaid level . They will only be reimbursed for the difference between their countable income and $904, not necessarily the full amount of the premium.

How To Get A Free Mobility Scooter Through Medicaid

Many states use the Medicare payment rates when they cover mobility scooters. Many Medicaid recipients do not pay any costs for their medical coverage. Medicaid recipients cannot, however, just select a scooter that they want and hand over their Medicaid card for coverage. The provider, supplier, and physician must all accept Medicaid and be properly enrolled in the state program.

Are you a senior that receives Medicaid QMB? You may be able to get your scooter without cost if you do, since you do not pay deductibles, co-pays or other costs. Make sure that you give the physician, supplier and provider your Medicare card and your Medicaid QMB card.

You may qualify for this program if you are on Medicare and are income-eligible. The program, called Medicare Qualified Beneficiary, is administered through Medicaid. Many people that receive Medicare also receive Medicaid QMB benefits, which cover premiums, deductibles, and co-pays.

Contact Medicare to learn more about the program and you may be able to receive extra coverage, meaning that Medicaid pays for the costs of your scooter that is not covered by Medicare. The program does not cover benefits such as dental, vision, and hearing aid costs.

Recommended Reading: Does Medicare Cover Shingrix Cost

Who Is Eligible For Part B Give Back Benefit

To qualify to receive the benefits of the giveback plan, policies need certain criteria. You have to first enroll into Medicare and pay their own premiums. This does not make the premiums eligible for the program.

In addition, it’s essential you live in service areas with plans that offer premium-reduced rates. There are now 48 countries providing these benefits. Get a free quote Find the best Medicare Plan for you.

Alternative Medicare Assistance Programs

Programs outside of Medicare that can help pay premiums are generally for Medicare Part D plans. Depending on the state you live in, you may be able to get help with paying your Part D premiums through State Pharmaceutical Assistance Programs . These programs provide assistance to adults with disabilities and low-income seniors. States that offer Medicare premium assistance for Part D insurance make their own rules on who can qualify.

Some drug manufacturers also offer help with prescription drug costs, but this is for the cost of medicines instead of the actual premium for your Part D plan. If youre a senior citizen, have limited income, or a disability, you may qualify for discounted or free prescribed medicines through Patient Assistance Programs .

48191-HM-1121

Recommended Reading: Does Medicare Pay For Assisted Living Care