When Will I Meet My Part D Deductible

When you meet your Part D deductible depends on:

- How much your deductible is

- What prescription drugs you take and how much they cost

- How many prescription drugs you take

The amount you pay towards your Medicare Part D deductible is for every calendar year and resets January 1.

Suppose your Part D deductible is the maximum allowed in 2021 .

Scenario 1:

Once you meet your deductible, you may not be covered 100%. You may still be responsible for copayments and coinsurance every time you fill a prescription.

Do you have any questions about your Medicare Part D deductibles? Feel free to enter your zip code on this page to start browsing Medicare Part D plans. Or, if you prefer to get personalized assistance, contact eHealth to speak with a licensed insurance agent. We can help you find Medicare plan options that address your Medicare needs.

* Medicare Index Report: Annual Enrollment Period for 2020 Coverage

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

Drawbacks Of High Deductible Plans

One drawback of a high deductible health plan? In a worst-case scenario or emergency situation, meeting the deductible or out-of- pocket maximum could pose a financial burden. Another drawback? Some people might skip making doctors appointments or filling prescriptions to avoid spending money risking their health in the process.

Medicare Deductible: Part B

Medicare Part B benefits include doctors office visits, preventive screenings, and durable medical equipment. For some of these services, a deductible will apply . Often, you will pay 20% of the Medicare-approved amount for a health-care service after this deductible is met. Make sure to check with your doctor and Medicare because each benefits coverage is different.

Read Also: Is Unitedhealthcare A Medicare Advantage Plan

Seek Out Help If You Have Questions

Its pretty prudent to get some good tax guidance, particularly in the startup years, to make sure youve identified most if not all the tax benefits, says Steber. Those benefits can really jump-start your savings, they can help preserve retirement income, and put a lot of income on your bottom line if you know where to look.

Taxes are intimidating to most of us, and each year brings changes in forms, new legislation, and a myriad of other alterations which seem to further complicate the process. Whether you file on your own, or seek the help of a tax professional if you are self-employed and paying Medicare premiums, being able to deduct the cost of those premiums can help your bottom line.

Start early, get your documents together, and if you had a life change even just a small one get some questions answered, its just a smarter way to save money.

This information is provided as background only. As with any issue related to your taxes, you should seek advice from a tax professional if you have questions about your specific circumstances.

Jesse Migneault is a journalist and editor who has written about business, government and healthcare including public and private-payer health insurance. His articles have appeared in HealthPayerIntelligence, the Hartford Courant, Portsmouth Herald, Seacoastonline.com, Fosters Daily Democrat, and York County Coast Star.

Deductibles For Drug Coverage And Medicare Advantage

Deductibles for Medicare Part C, also known as Medicare Advantage plans, and Medicare Part D prescription drug coverage varies based on the plan you purchase. Both Medicare Advantage and Part D plans are sold by private insurers that have contracts with the Medicare program.

Medicare Advantage plans may offer coverage that absorb some of your out-of-pocket costs. Though Medicare Advantage deductibles may vary, all plans must set a limit on your maximum out-of-pocket expenses. This is a total spread across your deductibles, coinsurance and copayments.

For 2021, the MOOP for Medicare Advantage plans is $7,550 for in-network care. It can be higher for out-of-network care or services. But once you hit your MOOP for the year, the plan has to cover 100 percent of all further costs.

Some Medicare Part D prescription drug plans dont have a deductible. Those that do may not have a deductible of more than $445 in 2021.

Prepare for Medicare Open Enrollment

Recommended Reading: Does Social Security Automatically Sign You Up For Medicare

How Does Medicare Coinsurance Work

Although original Medicare covers most of your medical costs, it doesnt cover everything. Medicare pays a portion of your medical costs, and youre responsible for the remaining amount.

With coinsurance, you pay a fixed percentage of the cost of every medical service you receive. Your insurance company is responsible for the remaining percentage. This is different from a copay or copayment, where you pay a set fee for a service, such as $15 for a primary care visit.

You can either pay out of your pocket or purchase a Medicare supplement plan to cover these costs.

Using Medigap To Pay Medicare Deductibles

Medigap, also known as Medicare Supplement plans, can help pay some of your out-of-pocket costs, including your Medicare Part A deductibles.

These plans are sold through private insurers. There are eight standardized plans across 47 states and the District of Columbia. There are different standardized plans for Minnesota, Massachusetts and Wisconsin.

Each plan has a letter for a name. Some of these plans may cover all or a portion of your Part A deductible.

Medigap Plan Coverage of Part A Deductibles

| A |

|---|

Also Check: How Much Is Medicare B Deductible

Explore Your Medicare Enrollment Options

If you have further questions about the Medicare Part B deductible or any other costs associated with Medicare, explore our guide to Medicare costs.

Learn more about your Medicare enrollment options. If you want to have Medicare health coverage without having to pay the Medicare Part B deductible, you may want to consider enrolling in a Medicare Advantage plan.

Find Medicare Advantage plans in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Medicare has neither reviewed nor endorsed this information.

What Is The Medicare Advantage Deductible

Medicare Advantage plans are a form of private insurance that act primary instead of Original Medicare. Each carrier can set its own deductible amount for a plan, and some plans offer $0 deductibles. However, if you select a plan with a $0 deductible, dont assume that you wont have any out-of-pocket expenses. You should review your plan for details on copayments, coinsurance, and out-of-pocket maximum limits.

If youre comparing insurance options, you should check tosee what the deductibles are. Deductibles arent the only form of out-of-pocketcosts that you can encounter, but knowing all of your costs can help you withyour decision-making process. If you like the coverage and benefits of OriginalMedicare but are concerned with the deductibles and the other gaps, a MedicareSupplement plan may be a good fit for you.

Nothing on this website should ever be used as a substitute for professional medical advice. You should always consult with your medical provider regarding diagnosis or treatment for a health condition, including decisions about the correct medication for your condition, as well as prior to undertaking any specific exercise or dietary routine.

Read Also: Can You Apply For Medicare After 65

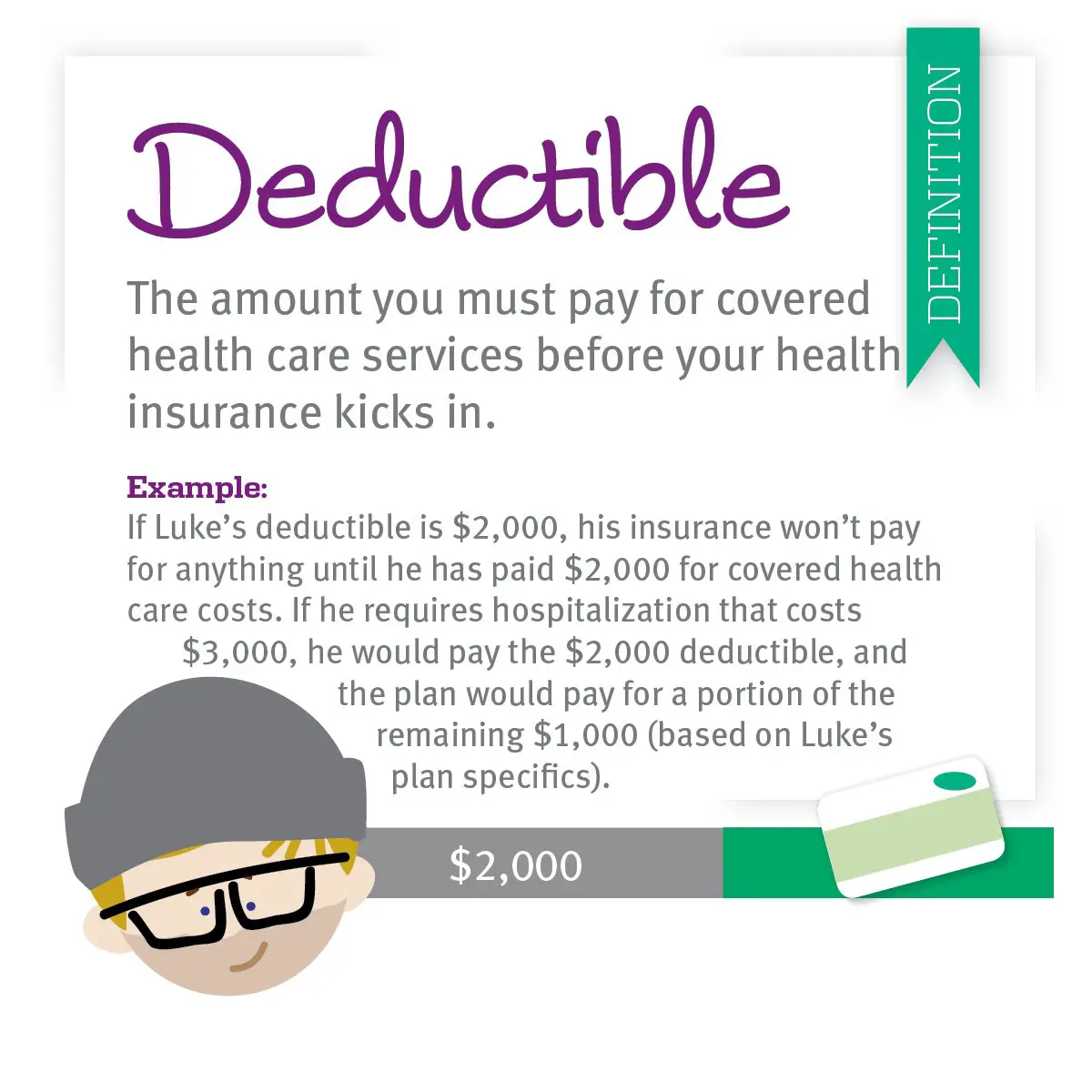

What Is A Deductible

A deductible is the amount you pay for health care services before your health insurance begins to pay.

How it works: If your plans deductible is $1,500, youll pay 100 percent of eligible health care expenses until the bills total $1,500. After that, you share the cost with your plan by paying coinsurance.

Medicare Part A Hospital Coverage

- What Medicare Part A covers: Part A covers expenses associated with hospital care. It includes coverage for services like nursing care and hospital stays. It also covers some hospital-related care that takes place outside a hospital setting, like skilled nursing care after you leave the hospital.

- What Medicare Part A costs: You generally wont have to pay a monthly premium for Medicare Part A if you or your spouse paid Medicare payroll taxes for 40 quarters or more. But you do need to pay deductibles before Medicare will cover any hospitalization costs.

Read Also: What’s The Eligibility For Medicare

Cover Your Medicare Out

There is one way that many Medicare enrollees get help covering their Medicare out-of-pocket costs.

Medigap insurance plans are a form of private health insurance that help supplement your Original Medicare coverage. You pay a premium to a private insurance company for enrollment in a Medigap plan, and the Medigap insurance helps pay for certain Medicare out-of-pocket costs including certain deductibles, copayments and coinsurance.

The chart below shows which Medigap plans cover certain Medicare costs including the ones previously discussed.

| 80% | 80% |

* Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

2 Plan K has an out-of-pocket yearly limit of $6,220 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

If you’re ready to get help paying for Medicare out-of-pocket costs, you can apply for a Medigap policy today.

Costs You May Pay With Medicare

Medicare Part B and most Medicare Part C, Part D and Medigap plans charge monthly premiums. In some cases, you may also have to pay a premium for Part A. A premium is a fixed amount you pay for coverage to either Medicare or a private insurance company, or both.

Youll also pay a share of the cost for your care, while your Medicare or Medigap coverage will pay the rest. There are three methods of cost sharing:

- DeductibleA set amount you pay out of pocket for covered services before Medicare or your plan begins to pay.

- CopayA fixed amount you pay at the time you receive a covered service or benefit. For example, you might pay $20 when you visit the doctor or $12 when you fill a prescription.

- CoinsuranceThe amount you may be required to pay as your share for the cost of a covered service. For example, Medicare Part B pays about 80% of the cost of a covered medical service and you would pay the rest.

Don’t Miss: Does Cigna Have A Medicare Supplement Plan

Another Alternative: Using Your Hsa Funds To Pay Medicare Premiums

If you have a health savings account , know that you can withdraw tax-free money from the account and use it to pay your premiums for Medicare Parts A, B, C, and D . This is an alternative to deducting your premiums on your tax return, since you cant do both. But its something to keep in mind if you would otherwise have to use after-tax money to cover your Medicare premiums.

You cant continue to contribute to your HSA after youre enrolled in Medicare, but you can continue to withdraw funds from your HSA. As long as you use them for a qualified medical expense, which includes premiums for Medicare Parts A, B, C, and D, you dont have to pay taxes on the money.

Can I Deduct My Medicare Premiums On My Tax Return

Since 2012, the IRS has allowed self-employed individuals to deduct all Medicare premiums from their federal taxes, including Medicare premiums for their spouses. | Image: Shutterstock

Reviewed by our health policy panel.

More than 63 million Americans are enrolled in Medicare. And although most of the cost of the program is covered by payroll taxes and general revenue, enrollees cover about 15% of the cost of Medicare with the premiums they pay each month. Those premiums can certainly add up over time. But unlike the employer-sponsored coverage that most Americans have during their working years, Medicare premiums are not typically paid with pre-tax dollars.

Also Check: How Do I Get A Second Opinion With Medicare

Is There A Copay With Medicare

- Medicare is a government-funded health insurance option for Americans age 65 and older and individuals with certain qualifying disabilities or health conditions.

- Medicare beneficiaries are responsible for out-of-pocket costs such as copayments, or copays for certain services and prescription drugs.

- There are financial assistance programs available for Medicare enrollees that can help pay for your copays, among other costs.

Medicare is one of the most popular health insurance options for adults age 65 and older in the United States. When you enroll in Medicare, you will owe various out-of-pocket costs for the services you receive.

A copayment, or copay, is a fixed amount of money that you pay out-of-pocket for a specific service. Copays generally apply to doctor visits, specialist visits, and prescription drug refills. Most copayment amounts are in the $10 to $45+ range, but the cost depends entirely on your plan.

Certain parts of Medicare, such as Part C and Part D, charge copays for covered services and medications. Deductibles, copays, and coinsurance fees all contribute to the out-of-pocket maximums for these plans.

In this article, well explore the parts of Medicare that charge copay fees, how to compare copay costs when enrolling in a Medicare plan, and how to find help paying your out-of-pocket costs.

Medicare Part C Changes For :

Fees for Plan B vary, and you must select a private plan provider.

Medicare Part C combines Medicare Parts A and B elements and adds coverage for benefits not included in other plans.

Due to the expense control exercised by private firms, little has changed in federal health care this year. This year, a significant shift will affect those with end-stage renal disease .

In 2021, they are eligible to enroll in Medicare Advantage plans due to a Congressional provision. Previously, most Medicare Advantage plan suppliers would not allow you to register or re-enroll solely because you had been diagnosed with ESRD.

Also Check: Will Medicare Pay For My Nebulizer

Are You Eligible For Medicare

Generally, you become eligible for Medicare when you turn 65 years old. But age isnt the only requirement you must meet:

- You must be a US citizen or a permanent legal resident who has lived in the US for at least five years

- You or your spouse must have worked long enough to be eligible for Social Security benefits , or you or your spouse is a government employee/retiree who has paid Medicare payroll taxes while working.

Many people assume Medicare only covers seniors. But Americans 65+ arent the only people eligible for Medicare. In certain circumstances, individuals under the age of 65 are eligible to enroll. You may be eligible to enroll early if youve been:

- Eligible for Social Security or Railroad Retirement Board disability benefits for 24 months

- Diagnosed with End stage renal disease. This is permanent kidney failure that requires a transplant or dialysis

- Diagnosed with Lou Gehrigs disease

Once youve verified that youre eligible for Original Medicare, the next step is to get to know your other options for Medicare coverage.

MORE ADVICE Discover more tips for comfortably aging in place

Does Everyone Have To Pay The Part B Deductible

Some Medicare enrollees arent directly responsible for the Part B deductible:

- Medigap plans C and F cover the deductible .

- Enrollees who have Medicaid or retiree health benefits from an employer generally dont have to pay the Part B deductible, as the other coverage picks up the tab.

- Some Medicare Advantage plans have no deductibles and low copays benefits into one plan for the enrollee, with cost-sharing that can differ greatly from the standard Original Medicare cost-sharing).

But according to a Kaiser Family Foundation analysis, about 19% of Original Medicare beneficiaries only have Medicare Parts A and B. They dont have Medigap coverage, retiree health benefits from a former employer, or Medicaid. These enrollees have to pay the full Part B deductible if and when they need services that are covered under Medicare Part B. For 2021, that deductible is $203.

After the enrollee pays the deductible, Medicare Part B generally covers 80% of the Medicare-approved amount for covered services, and the enrollee pays the other 20%. But again, supplemental coverage can pay some or all of this 20% cost, leaving the enrollee with far lower out-of-pocket costs than they would have under Part B by itself.

Read Also: What Are All The Medicare Parts

Medicare Part B Covering Your Doctor Visits And Beyond

- What Medicare Part B covers: Part B pays for services like:

- Doctor visits

- Outpatient procedures

- Lab services

- other testing