Extra Help For Medicare Part D

Extra Help is an assistance program that helps lower income individuals more easily afford Medicare Part D. Extra Help helps pay for Part D premiums, deductibles and copayments/coinsurance.

Learn more about Medicare Part D Extra Help, including how to qualify, where Extra Help is offered and how to find other assistance programs designed to help cover Part D prescription drug costs.

Medicare Advantage Plan :

- Monthly premiums vary based on which plan you join. The amount can change each year.

- You must keep paying your Part B premium to stay in your plan.

- Deductibles, coinsurance, and copayments vary based on which plan you join.

- Plans also have a yearly limit on what you pay out-of-pocket. Once you pay the plans limit, the plan pays 100% for covered health services for the rest of the year.

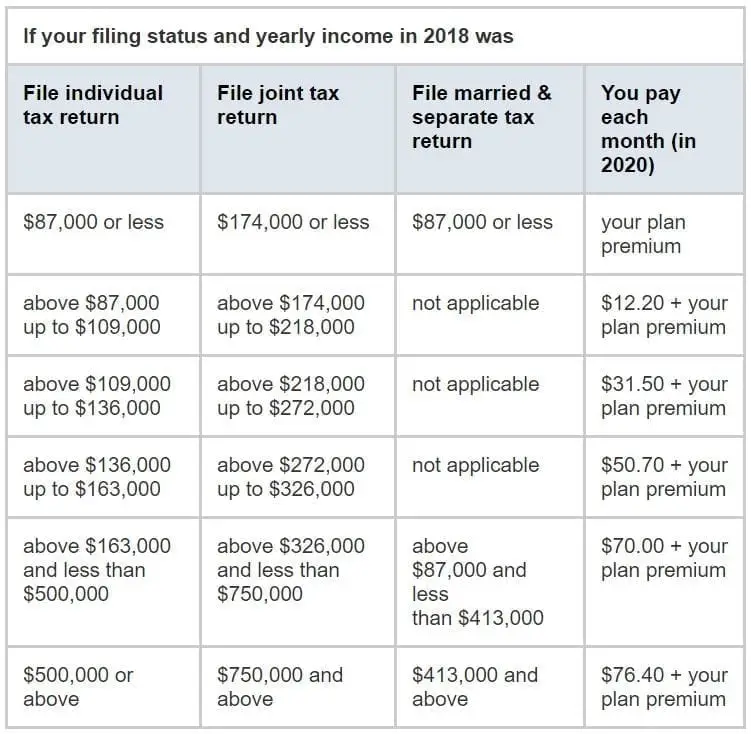

How Are Medicare Part D Rates Calculated

Medicare sets your Part D rate based on your reported income, similar to how Medicare Part B rates are determined. The income you reported for 2021 will be used to set your Part D costs for 2023.

Say you reported a 2021 income of $100,000 and are enrolled in a Part D plan for $50 per month. Based on your income, you would pay the cost of your plan plus an income adjustment of $12.20, for a total Part D premium of $62.20.

Note that you pay the $50 to your insurance company, while the income adjustment fee goes directly to Medicare.

| Individual taxable income | |

|---|---|

| $12.20 + your basic plan cost | |

| $123,001 to $153,000 | $31.50 + your basic plan cost |

| $153,001 to $183,000 | $50.70 + your basic plan cost |

| $183,001 to $500,000 | $70.00 + your basic plan cost |

| $500,001 or above | $76.40 + your basic plan cost |

You May Like: Can Medicare Be Used Out Of State

Medicare Part B Costs Will Decrease In 2023

Medicares Part B standard monthly premium will fall to $164.90 in 2023, a $5.20 decrease from 2022, the Centers for Medicare & Medicaid Services announced on Sept. 27. The open enrollment period to make any changes to next years Medicare coverage begins on Oct. 15 and goes through Dec. 7.The premium drop comes in the wake of the big 2022 increase, the largest dollar increase in the history of the program. Part B covers doctor visits, diagnostic tests, and other outpatient services. Most Medicare beneficiaries have Part B premiums deducted directly from their monthly Social Security payments.

Next years premium decrease makes good on statements this year by Health and Human Services Secretary Xavier Becerra that the money Medicare was saving because spending on Aduhelm, a new Alzheimers drug, was not going to be as high as expected would be passed on to beneficiaries in 2023. Spending on other Part B services is also projected to be less than anticipated.

AARP had called on CMS to lower the Part B premium for 2022 after Aduhelms manufacturer lowered the price and the agency approved the medication on a limited basis.

Most Medicare enrollees must pay the Part B premium whether they have original Medicare or a private Medicare Advantage plan. Some Advantage plans offer a giveback benefit where the insurer covers part or all of a members Part B monthly premium. Consumers can find those plans on the Medicare plan finder. Deductibles in Medicare Advantage vary by plan.

Who Is Eligible For A Medicare Part D Plan

You should plan to enroll in a Medicare prescription drug plan when youre eligible, which is either when you turn 65 or when your through an employer ends. If you miss the cutoff, youll pay a late enrollment penalty that will continue for the entire time you receive Medicare drug coverage, which may be the rest of your life.

You must be eligible for Medicare and enrolled in Original Medicare Part A and/or B to join a standalone Medicare Part D plan. You can search for an available plan in your area on the Medicare website.

If you choose to get your drug coverage benefit through a Medicare Advantage plan, you must be enrolled in Original Medicare Parts A and B. You can search for a MA-PD plan in your area on the Medicare website.

Recommended Reading: Do You Have To Pay For Medicare At Age 65

The Medicare Donut Hole And Catastrophic Coverage

In addition to the premium, the deductible, copays, the formulary, and the different drug tiers, you should consider the coverage gap to understand how Part D plans work and how much yours will cost. The donut hole indicates when there’s a temporary limit on the coverage offered by your Part D plan.

The Medicare donut hole starts when you and the plan have spent $4,430 total on covered prescriptions in 2022, and it ends once youve spent $7,050 out of pocket. The thresholds increase to $4,660 and $7,400 respectively in 2023. Youll generally pay no more than 25% toward the cost of prescription drugs during this time.

You’ll enter another level of Part D called Catastrophic Coverage after you leave the coverage gap. You’ll be charged a small coinsurance amount or copayment, such as the greater of 5% or a small copay for the remainder of the coverage year, at this level.

How Medicare Part D Works

Meredith Mangan is a senior editor for The Balance, focusing on insurance product reviews. She brings to the job 15 years of experience in finance, media, and financial markets. Prior to her editing career, Meredith was a licensed financial advisor and a licensed insurance agent in accident and health, variable, and life contracts. Meredith also spent five years as the managing editor for Money Crashers.

David J. Rubin is a fact checker for The Balance with more than 30 years in editing and publishing. The majority of his experience lies within the legal and financial spaces. At legal publisher Matthew Bender & Co./LexisNexis, he was a manager of R& D, programmer analyst, and senior copy editor.

Johner Images / Getty Images

Medicare Part D is optional prescription drug coverage available to Medicare recipients for an extra cost.

Read Also: How Do I Apply For Medicare In Missouri

Issues For The Future

Since its inception, the Medicare drug benefit has helped to limit growth in average out-of-pocket drug spending by Medicare beneficiaries enrolled in Part D plans. More recently, however, a combination of factors, including rising drug prices, more plans charging coinsurance rather than flat copayments for covered brand-name drugs, and annual increases in the out-of-pocket spending threshold, has increased the out-of-pocket cost burden faced by some enrollees, especially those with high drug costs.

Provisions in the Inflation Reduction Act that will be rolling out over the next several years are designed to address several concerns related to Part D, including the lack of a hard cap on out-of-pocket spending for Part D enrollees the inability of the federal government to negotiate drug prices with manufacturers the significant increase in Medicare spending for Part D enrollees with high drug costs prices for many Part D covered drugs rising faster than the rate of inflation and the relatively weak financial incentives faced by Part D plan sponsors to control high drug costs. Understanding how well Part D continues to meet the needs of people on Medicare as the laws various provisions are implemented will be informed by ongoing analysis of the Part D plan marketplace, formulary coverage and costs for new and existing medications, and trends in Medicare beneficiaries out-of-pocket drug spending.

Topics

What If I Don’t Agree With The Late Enrollment Penalty

You may be able to ask for a “reconsideration.” Your drug plan will send information about how to request a reconsideration.

Complete the form, and return it to the address or fax number listed on the form. You must do this within 60 days from the date on the letter telling you that you have to pay a late enrollment penalty. Also send any proof that supports your case, like a copy of your notice of creditable prescription drug coverage from an employer or union plan.

You May Like: How Much Does Medicare Pay For Dentures

Find The Right Medicare Plan For You

See your options to find savings.

What You Need to Know Medicare beneficiaries still face a coverage gap…

Updated: December 21st, 2021ByKate Ashford×

We do not sell insurance products, but there may be forms that will connect you with partners of healthcare.com who do sell insurance products. You may submit your information through this form, or call 855-617-1871 to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

Our mission is to provide information that will help everyday people make better decisions about buying and keeping their health coverage. Our editorial staff is comprised of industry professionals and experts on the ACA, private health insurance markets, and government policy. Learn more about our content.

Does Medicare Cover Prescription Drugs

En español No, Medicare doesnt automatically cover prescription drugs you get at a pharmacy, but you can buy a Medicare Part D plan from a private insurer to help cover those expenses. You can either get a stand-alone Part D plan or purchase a Medicare Advantage plan that provides medical and drug coverage in its benefits package.

Medicare introduced these prescription drug coverage benefits in 2006. In 2021, 77 percent of all Medicare beneficiaries 48 million people were enrolled in Part D plans. Half had stand-alone Part D plans, and half were in Medicare Advantage drug plans, according to the Kaiser Family Foundation.

Specific coverage varies by plan, and you usually have many to choose from, depending on your location. In 2022 the average Medicare beneficiary had a choice of 23 stand-alone Part D plans and 31 Medicare Advantage plans. Find out about the plans available in your area by typing your zip code into Medicares Plan Finder.

Other parts of Medicare generally cover drugs that medical professionals provide at a doctors office, hospital or specialty clinic. For example, Medicare Part B covers chemotherapy, dialysis and other medications injected or given intravenously at a doctors office or outpatient center.

Read Also: How Do I Cancel Medicare Part A

Protect Yourself Against Fraud

Companies approved to offer the Medicare prescription drug benefit can only contract with state licensed agents to sell their plans. Agents are required to follow state and federal laws when selling these plans. Ask agents to show proof of their license and verify the information by calling our Help Line at 800-252-3439.

If you believe you’ve been the victim of insurance fraud or attempted insurance fraud, report it to TDI.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: When Is The Deadline To Enroll In Medicare

Annual Notice Of Change

Your plan must send your ANOC out before the Annual Enrollment Period, and the ANOC will outline the changes to Medicare Part D that will occur in your current program. These changes can include pricing, changes to your covered drugs on the formulary, new tier determinations, and more.

Of course, in most cases, you can remain on your current plan if the changes are acceptable. Still, you could miss out on more comprehensive coverage. Remember, every plan is making changes, so there may be other options that will cover your prescription medications better.

How Much Do Medicare Part D Plans Cost

Medicare drug coverage carries premiums beyond what you pay for original Medicare. Part D premiums vary by plan. In 2022 the average base premium was $33 a month, according to the Centers for Medicare & Medicaid Services.

The base rate is the amount that most people pay for their Part D plan. But if you earn more than a certain amount, you are subject to a rate adjustment that Medicare sets annually.

In 2022 this adjustment starts at $12.40 a month above your regular Part D premium if your modified adjusted gross income for your last tax return on file was more than $91,000 as a single filer or $182,000 as a married couple filing jointly. The surcharge adds $12.40 to $77.90 a month to your premiums, based on your income.

You pay the base premiums for Part D to the insurance company, but you pay the high-income surcharge to Medicare. If your income has dropped since your last tax return on file because of certain life-changing events such as retirement or death of a spouse, divorce, job loss or marriage you can apply to have this income-related monthly adjustment amount reduced.

You may also have to pay a deductible and copayments for your medications, which vary by plan. You can use the Medicare Plan Finder to learn more about each plans drug coverage and out-of-pocket costs for your medications. You can switch plans every year during open enrollment, which runs Oct. 15 to Dec. 7 for coverage starting Jan. 1.

Keep in mind

Also Check: How To Enroll In Medicare Part D

What Is The Medicare Deductible For 2021 Part D

Medicare Part D, also known as prescription drug coverage, is the part of Medicare that helps you pay for prescription drugs. When you enroll in a Part D plan, you are responsible for paying your deductible, premium, copayment, and coinsurance amounts. The maximum Medicare Part D deductible for 2021 is $445.

Are Part D Plans Expensive

In general, no at least, not compared with standard premiums for Part B, which are $170.10 per month in 2022 for most Medicare recipients. However, these Part D plans aren’t premium-free, like Part A generally is, and some can be costly.

Each plan determines its own premium and deductible. While you can have these premiums deducted from your Social Security payment rather than paying an insurance company directly, this generally isn’t the best option. Drug insurers typically change which drugs and how much is covered every year. And pharmacies often change their preferred status, making it critical for you to shop every year for a new drug plan or Medicare Advantage prescription drug plan to get your prescriptions covered at the best price.

The process of setting up payments through Social Security and potentially switching plans while using Social Security payment is slow and clunky its more efficient to set up automatic payments with your Part D insurer directly.

In general, plans with lower premiums have higher deductibles. But no plan can charge more than the maximum rate determined by the CMS. In 2022, the maximum deductible is $480 for the year. While the upfront premium costs might be lower, the coverage won’t kick in until you hit the deductible. However, your drugs are often favorably priced because you have the insurance. You can see your own prescription drug costs, premiums and deductible in Medicares plan finding tool.

You May Like: Who Is Entitled To Medicare Part A

How Much Are My Part D Premiums

Your premiums will depend on which plan you choose and where you live. Most people will pay the standard monthly Medicare Prescription Drug Plan premium, but you may have to pay extra if you didnt sign up for Part D when you first became eligible and you have a late enrollment penalty. You will receive a notice if this penalty applies to you.

If you receive Extra Help, the table below does not show your premiums. For more information, contact us at , 7 days a week from 8 am – 8 pm, ET.

Note: You may have an additional fee calculated based on your yearly earnings. If this applies to you, the Social Security Administration will send you a letter telling you what the amount will be and how to separately pay it. It cannot be paid with your monthly Part D premium.

How Do Medicare Part D Plans Work

Even if youre a healthy person with a healthy lifestyle, illnesses and accidents are facts of life, and the medications you may need to treat unexpected medical events can be expensive. If youre already covered by Medicare Part A and/or Part B, youre eligible for Medicare Part Da unique and specific, four-stage add-on to your regular Medicare coverage. Also known as prescription drug coverage, Medicare Part D plans require monthly premiums but offer additional coverage not provided by Medicare or supplement plans.

for more information about Part D coverage stages.

Don’t Miss: Can You Be Denied Medicare Coverage

Understanding The Part D Coverage Stages

During the year, you may go through different drug coverage stages. There are four stages, and it’s important to understand how each impact your prescription drug costs. You may not go through all the stages. People who take few prescription drugs may remain in the deductible stage or move only to the initial coverage stage. People with many medications may move into the coverage gap and/or catastrophic stage.

The coverage stage cycle starts over at the beginning of each plan year, usually January 1st.

Annual Deductible

You pay the full cost for drugs until you reach the deductible amount. Then you move to the Initial Coverage stage.

Initial Coverage

In this stage, the plan pays its share of the cost and you pay your copay or coinsurance. You generally stay in this stage until your year-to-date total drug cost reaches $4,660. Then you move to the Coverage Gap stage.

Coverage Gap

You pay no more than 25% coinsurance for any generic or brand name drugs until your total out-of-pocket costs reach $7,400. Then you move to the Catastrophic Coverage stage.

Catastrophic Coverage

In this stage, you pay 5% of the cost for each of your drugs, or $4.15 for generic and $10.35 for all other drugs . You stay in this stage for the rest of the plan year.

*If you get Extra Help from Medicare, the coverage gap doesn’t apply to you.