Changes To Your Eligibility

Based on your income tax information from the CRA, your eligibility for supplementary benefits may change. For example, if your net income for the previous year was higher than usual , it could affect your eligibility for supplementary benefits for a period of time.

If your tax return has been reassessed and you think this might change your eligibility, send a copy of the Notice of Reassessment for you to Health Insurance BC. If you dont think the information about your Notice of Assessment or Notice of Reassessment from CRA is correct, contact Health Insurance BC.

Read Also: What Is The Cost Of Medicare Part C For 2020

Who Is Eligible For Qmb

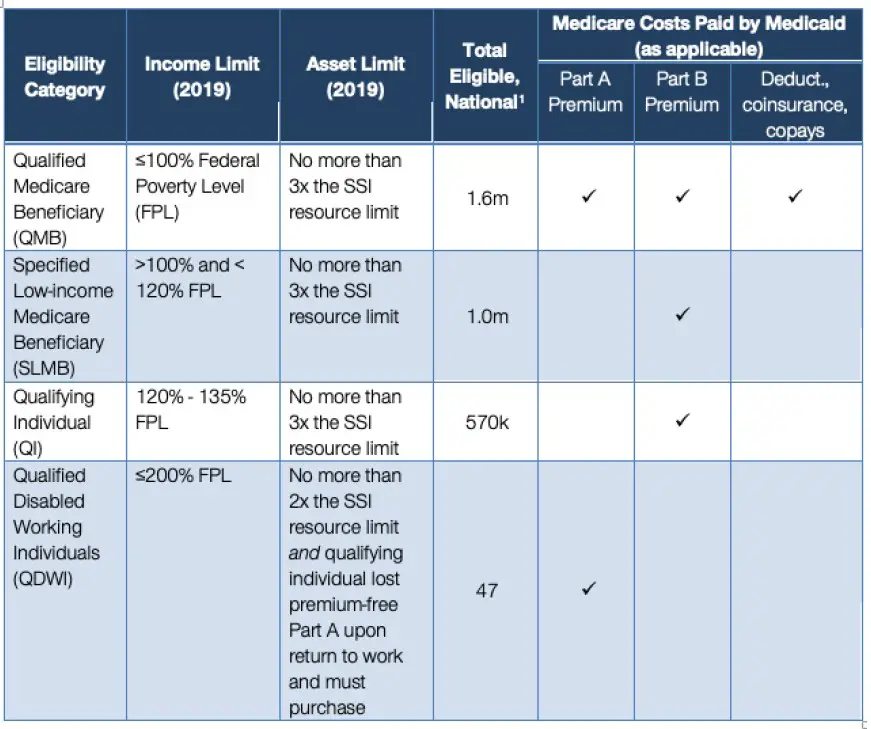

You must be eligible for both Medicare and Medicaid to be eligible for QMB benefits. While Medicares eligibility requirements are federally mandated, each state may set its own qualifying restrictions for Medicaid.

You must also meet the QMB income and resource limits in 2022:

- The individual monthly income limit is $1,094

- The value of an individuals combined resources are capped at $7,970

To apply for the QMB program, contact your state Medicaid program. Please not that if your income or financial resources are close to the totals listed above, you should still apply, as you may potentially be eligible.

Qualified Medicare Beneficiary Program

Helps pay for: Part A premiums Part B premiums, deductibles, coinsurance, and copayments .

Monthly income and resource limits for 2022:

| Your situation: |

|---|

* Limits slightly higher in Alaska and Hawaii

If you qualify for the QMB program:

- Medicare providers arent allowed to bill you for services and items Medicare covers, including deductibles, coinsurance, and copayments. What to do if you get a bill

- You may get a bill for a small Medicaid copayment, if one applies.

- You’ll also get Extra Help paying for your prescription drugs. Youll pay no more than $4 in 2022 for each drug covered by your Medicare drug plan.

Recommended Reading: Does Aetna Medicare Advantage Cover Silver Sneakers

Medicaid For The Elderly And People With Disabilities Handbook

- Chapter Q, Medicare Savings ProgramMenu button for Chapter Q, Medicare Savings Program”>

- Q-2000, Qualified Medicare Beneficiaries MC-QMBMenu button for Q-2000, Qualified Medicare Beneficiaries MC-QMB”>

Revision 21-2 Effective June 1, 2021

The Qualified Medicare Beneficiary Program pays Medicare premiums, deductibles and coinsurance for a person who meets the requirements of this section.

To be eligible for QMB coverage, a person must:

- be entitled to benefits under Medicare Part A and

- meet income and resources requirements.

The income limits for QMB are based on 100 percent of the federal poverty level , and are updated annually.

The resource limits are based on the consumer price index and are updated annually.

The person must provide proof of Medicare Part A entitlement to enroll for Medicare Part A. They may have a Medicare card or an enrollment letter from the Social Security Administration showing entitlement to Part A.

If the person has no proof of entitlement, refer them to SSA for Part A enrollment if they:

- have a disability or

- have chronic renal disease.

The person must enroll themselves. HHSC is not allowed to enroll the person for Part A as it can for Part B.

A person receiving Medicaid may also be eligible for QMB benefits if they meet the requirements of this section, including the following recipients:

How To Get Help Paying Your Medicare Premiums And Other Costs

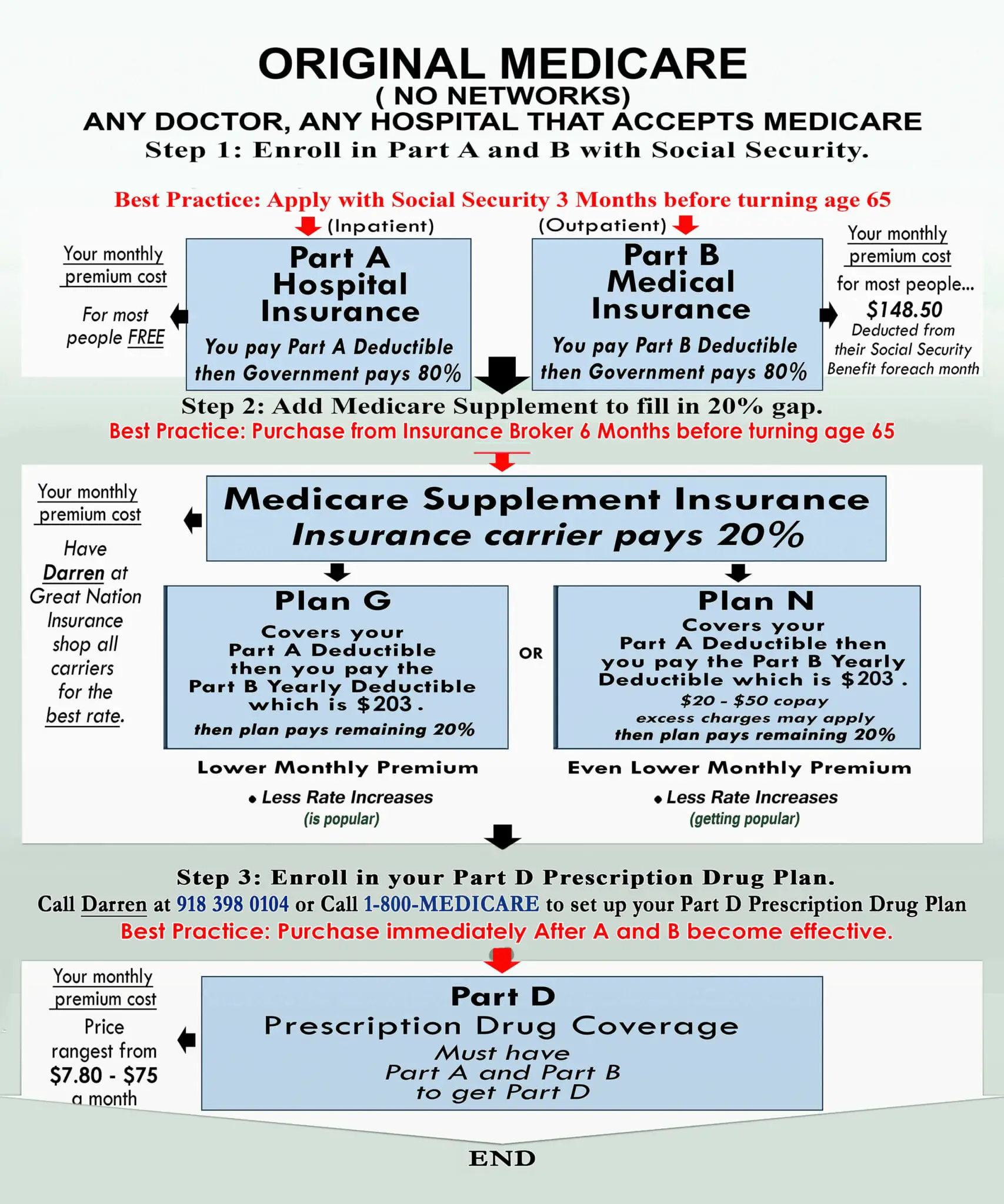

When you first sign up for Medicare, be prepared for some sticker shock. Because youve been paying Medicare taxes all through your working life, you may have assumed that once you retire, all your health care costs will be covered.

It can come as a rude awakening to learn that all those taxes you paid only cover one part of your Medicare costs Medicare Part A, or hospital insurance. You must continue to pay premiums for Medicare Part B and Part D , as well as other expenses like deductibles, copayments, and coinsurance.

All these expenses can add up to quite a sizable sum. According to a 2020 AARP analysis, people using traditional Medicare spent an average of $5,801 on health care costs in 2017. For about 1 in 10 people, total costs extended to five figures.

For many senior citizens, especially those on fixed incomes, this amount of money is a serious financial burden. According to AARP, half of all people on traditional Medicare in 2017 spent at least 16% of their income on health care. For 1 in 10 beneficiaries, health care costs ate up more than half their income.

Fortunately, there are several federal and state programs to help Medicare recipients with these unmanageable costs. If youve crunched the numbers and found that the total out-of-pocket cost for Medicare looks like more than you can afford, its worth looking into whether one of these programs can help you.

Read Also: Should I Carry My Medicare Card With Me

Is Qmb Full Medicaid

No, QMB and Medicaid are two different programs. If you are part of a QMB program, you will not receive regular Medicaid benefits. The Medicaid program covers out-of-pocket Medicare costs for beneficiaries of the QMB program. Deductible or coinsurance payments for services covered by your State Plan are not limited by Medicaid.

What Is Covered By The Qmb Program

The QMB program covers Medicare Parts A and B premiums, deductibles, copayments, and coinsurance. In short, almost all your Medicare bills will be covered if youre eligible for this program. You will receive a QMB card that you will show providers alongside your Medicare card, or you will show them both your Medicare and Medicaid cards to let them know that you are part of the Qualified Medicare Beneficiary Program.

Recommended Reading: How Does Medicare D Work

Qmb Slmb And Qi Programs

Assistance with Meeting the Costs of Medicare Premiums and Deductibles

The Qualified Medicare Beneficiary program , Specified Low-Income Medicare Beneficiary program , and Qualified Individual program , help Medicare beneficiaries of modest means pay all or some of Medicares cost sharing amounts . To qualify an individual must be eligible for Medicare and must meet certain income guidelines which change annually. The income guidelines, which are based on the Federal Poverty Level, change April 1 each year and can be found here.

Please note that the eligibility criteria listed below are federal standards states may have more, but not less, generous standards .

The QMB Program Provides:

- Payment of Medicare Part A monthly premiums .

- Payment of Medicare Part B monthly premiums and annual deductible.

- Payment of co-insurance and deductible amounts for services covered under both Medicare Parts A and B.

Eligibility Criteria for QMB

Note: Individuals who are eligible for Medicare Part A but not enrolled, may conditionally enroll in Medicare Part A at any time during the year and then apply for QMB to cover the cost of the Medicare Part A premium which must otherwise be paid by voluntary enrollees .This process, called the Medicare Part A buy-in is complex. For more information on the Part A buy-in see:

If an individual is enrolled in the QMB program, purchasing additional Medigap coverage for Medicare premiums, deductibles, and/or co-payments is unnecessary.

Medicare Savings Programs: Qmb / Slmb / Almb

All Medicare Savings Programs save the Medicare beneficiary money by paying for the Part B premium. MSPs also pay for Part A premiums. For most people, Part A is free, but if the beneficiary or the beneficiarys spouse has not worked enough, he or she must pay a Part A premium.

There are three different MSPs eligibility depends upon income.

These following income limits are effective in March 2022:

QMB :Pays both Medicare Part A and Part B premiums, deductibles and co-insurances.QMB income limits Q01:Single person $2,390/month

*************************************************ALMB also known as Q4:Pays Medicare Part B premiums. Note: ALMB is not an entitlement program and the funding is limited. When available funds are exhausted applications will be denied.ALMB income limits Q04:Single person $2,786 /monthMarried couple $3,754/monthNO ASSET LIMIT

To Apply: an application form in English or Spanish, can be downloaded from the DSS website . Applicants may also apply by going to the Connecticut Department of Social Services office that serves their town.

To Find Application Sites in Connecticuts Community Resources Database:

- Search by service term: Medicare Savings Programs

Don’t Miss: How To Change Medicare Direct Deposit

Qmb Income Limits 2022

To be eligible for a QMB program, you must qualify for Medicare Part A. Your monthly income must be at or below $1,153 as an individual and $1,526 as a married couple. Your resources must not total more than $8,400 as an individual or $12,600 as a married couple.

Keep in mind that income and resource requirements for the QMB program are subject to increase each year. Thus, members must go through a redetermination to continue receiving benefits for the following year. This process includes providing your local Medicaid office with updated information about your monthly income and total resources.

If someone doesnt have Medicare Part A but is eligible, they can choose to sign up anytime throughout the year. Once theyve signed up for Part A, they can proceed to apply for the QMB program. If they need to pay a premium for Part A, the QMB program can cover it.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

How To Apply For Qmb

To apply for the Qualified Medicare Beneficiary program, contact your state Medicaid agency. Medicare encourages you to fill out an application if you think you might be eligible, even if your resources exceed the limits posted on their website.

For more information about this program, call Medicare at 1-800-633-4227.

Recommended Reading: How Much Does Medicare Cost The Average Person

The Extra Help Program

If you qualify for the Qualified Medicare Beneficiary Program, you are automatically qualified to get Extra Help paying for Medicare prescription drug coverage. According to medicare.gov, the Extra Help program is a program that helps those with limited income and resources pay for their Medicare prescription drug program costs, such as premiums, deductibles, and coinsurance. Those who are enrolled in the Extra Help program but arent sure theyre paying the right amount can call their drug plan. If this applies to you, your plan may ask you to give information to help them check the level of Extra Help you should get.

If your monthly income is up to $1615 in 2020, or $2175 for couples, and your assets are below specific limits, you may be eligible for Extra Help. These limits include a $20 income disregard that the Social Security Administration automatically subtract from your monthly unearned income, or retirement income.

If you are enrolled in Medicaid, supplemental security income , or a Medicare Savings Program , it means you automatically qualify for Extra Help regardless of whether you meet Extra Helps eligibility requirements. You should receive a purple colored notice from the centers for Medicare and Medicaid services, or CMS, informing you that you do not need to apply for Extra Help.

Who Qualifies For Medicare Extra Help

You will automatically qualify for Medicare Extra Help if you have Medicare and also meetany of these conditions:

-

You have full Medicaid coverage.

-

You use a Medicare Savings Program to help pay your Part B premiums.

-

You get Supplemental Security Income benefits.

To learn more about whether or not you qualify for Medicaid, check our state-by-state guide to Medicaid.

If you are a part of any Medicare Savings Programs, or MSPs, to help pay for your Medicare Part A and B costs, you will automatically receive Medicare Extra Help.

If you donât qualify for Extra Help based on the criteria above, you may still qualify if you are at least 65 years old, live in the U.S., have Medicare Part A and Part B, and your annual income is within the annual income and total asset limits.

Income and asset limits are based on the federal poverty guidelines . The poverty guidelines change each year, so make sure to check again around February or March.

Recession-proof your money. Get the free ebook.

Get the all-new ebook from Easy Money by Policygenius: 50 money moves to make in a recession.

Get your copy

You May Like: Does Medicaid Pay For Part B Medicare

Obtaining Qmb Slmb And Qi Benefits

Requests for applications for QMB, SLMB, or QI benefits are made to the state Medicaid agency. Eligibility for QMB is effective on the first day of the month following the month in which the Medicaid agency has all the information and verification necessary to determine eligibility. This should not take more than 45 days. SLMB and QI entitlement may be retroactive up to three months prior to the date of application if the person is otherwise eligible.

Remember income levels change April 1st each year.

For more information, please telephone your local Medicaid office. You can find your local Medicaid office at .

Automatic Eligibility for the Low-Income Subsidy

Individuals enrolled in Medicaid or a Medicare Savings Program are automatically entitled to the full Part D Low-Income Subsidy, also called Extra Help. This means they should not have to apply for Extra Help through the Social Security Administration. The Low Income Subsidy can save Medicare beneficiaries thousands of dollars a year in Part D drug expenses Eligibility for extra help should go retroactive to the date of MSP entitlement.

What Is Included In The Medicare Savings Programs Assets Definition

When determining your eligibility for MSP, the following resources are counted:

- Money received for housing assistance

- Household and personal items

The eligibility rules vary from state to state. Some do not even apply resource limits. However, just like income limits, the resource limits change yearly, so its essential to stay up to date on whether you still qualify.

Dont Miss: Does Medicare Cover Annual Gyn Exam

Also Check: Does Medicare Cover Orthovisc Injections

Who Qualifies For Medicare Savings Programs

The Qualified Medicare Beneficiary program provides the most benefits. It helps in paying for Medicare Part A premiums, as well as your Medicare Part B premiums and out-of-pocket costs .

The QMB program requires your income to be 100% of the Federal Poverty Line or lower. Specifically, your income and resource are below the following limits:

- If you are single:

Billing Protections For Qmbs

Federal law forbids Medicare providers and suppliers, including pharmacies, from billing people in the QMB program for Medicare cost sharing. Medicare beneficiaries enrolled in the QMB program have no legal obligation to pay Medicare Part A or Part B deductibles, coinsurance, or copays for any Medicare-covered items and services.

Despite the federal law, our July 2015 study found that those in the QMB program were still being wrongly billed and that confusion about billing rules continued. We have taken several steps since to help Medicare providers and beneficiaries better understand the QMB protections, including through many of the resources below.

You May Like: Does Medicare Advantage Pay For Incontinence Supplies

If Your Provider Charges You And Youre In The Qmb Program

Inform who is requesting payment that youre in the QMB program. If youve already paid, youre entitled to a refund.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

To ensure this does not happen, show your QMB card or Medicare and Medicaid card to your providers each time you receive care. Your Medicare Summary Notice can also prove that youre in the QMB program. You can access your MSN electronically through your MyMedicare.gov account.

If a provider continues to bill you, call Medicares toll-free number. They will confirm your QMB status and request cessation of billing and/or refunds from your provider. In the case that debt collectors wrongly pursue payment, you can submit a complaint to the Consumer Financial Protection Bureau online or via telephone.

How Does Qmb Work With Medicare Advantage

Many people wonder whether they can enroll in a Medicare Advantage plan if they qualify for the QMB program. The answer is yes! If you are a qualified Medicare beneficiary, you might still choose to enroll in a Medicare Advantage plan. The best Medicare Advantage plans for those individuals are typically the special needs plans for dual-enrollment in Medicare and Medicaid. Many people choose these plans for their additional benefits, like dental and vision coverage. Medicaid should still pay your monthly premium associated with the Advantage plan you choose, but you can always contact your Medicaid office to be sure.

You May Like: How Do I Check On My Medicare Application

Medical Billing & The Qmb Program

So, how does billing work when a qualified Medicare beneficiary receives medical services? Once you present your QMB card to your Medicare provider, they are not allowed to send you a bill of any kind. If you are enrolled in the QMB program, you should never receive a bill for medical services as long as you visit a Medicare provider. Federal law prohibits these health care providers from sending you a bill, and this law also includes pharmacies as well. If you are enrolled in this program, you are not required to pay your Medicare Part A premium, Part B premium, or any Medicare cost-sharing expense related to medical services.

How Does Qmb Work With Medicare Advantage Plans

If youre currently in the QMB program, you can enroll in a Medicare Advantage plan. There are unique plans for those with Medicare and Medicaid. A Medicare Advantage Special Needs Plan for dual-eligible individuals could be a fantastic option. Generally, there is a premium for the plan, but the Medicaid program will pay that premium.

Many people choose this extra coverage because it provides routine dental and vision care, and some come with a gym membership. While not every policy has these benefits, there may be one available in your area!

You May Like: What Is The Most Popular Medicare Supplement Plan