Reason : They Make You Get A Referral

In the case of HMO plans and some PPO plans, this is true. According to the Kaiser Family Foundation, nearly all Medicare Advantage plan enrollees are in plans that require prior authorizationPrior authorization is a process used by health plans to control healthcare costs. Most HMO plans and some PPO plans require authorization before receiving certain treatments, medical services, or prescription drugs…. for some services. Health plans are in the business of making money and this is one of the primary ways they have to control costs.

By the way, Congress implemented a similar cost-saving measure with Medicare supplement insuranceMedicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare health insurance coverage….. As of 1 January 2020, new Medicare beneficiaries cannot buy a Medigap plan that covers the Part B deductible. The hope is that this change will reduce unnecessary doctor visits.

Types Of Medicare Advantage Plans

There are different types of Medicare Advantage plans to choose from, including:

- Health Maintenance Organization .HMO plans utilize in-network doctors and require referrals for specialists.

- Preferred Provider Organization .PPO plans charge different rates based on in-network or out-of-network services.

- Private Fee-for-Service .PFFS plans are special payment plans that offer provider flexibility.

- Special Needs Plans .SNPs help with long-term medical costs for chronic conditions.

- Medical Savings Account .MSA plans are medical savings accounts paired with high deductible health plans.

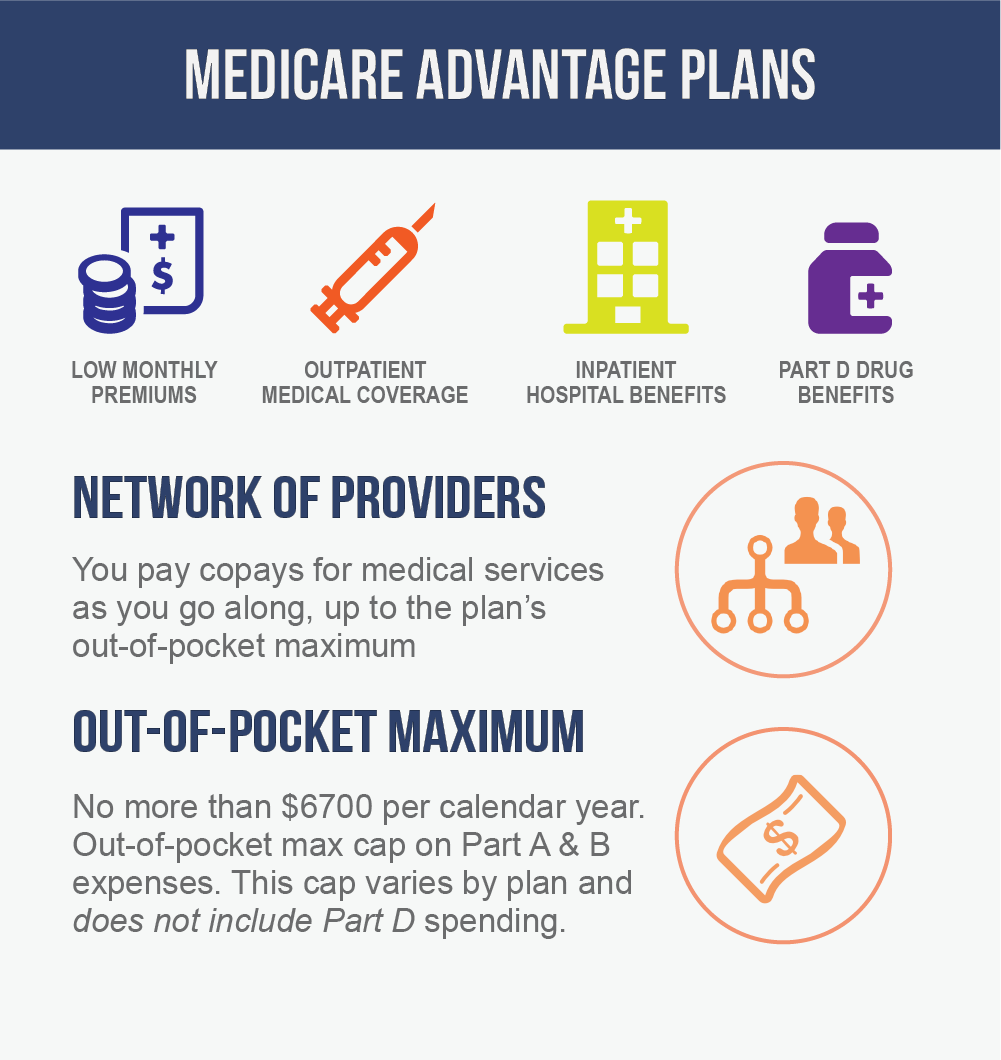

Compared to original Medicare, there may be advantages if you choose a Medicare Advantage plan.

Medicare Advantage And Cancer: What You Should Know

If you or someone you know has cancer, you may be wondering about Medicare cancer coverage. Medicare Advantage plans offer an alternative to Original Medicare that works better for the finances and care needs of some. Read on to learn about how Medicare Advantage can cover life-saving services and treatments.

Also Check: How To Apply For Medicare In Alaska

How Do Medicare Advantage Plans Provide Extra Benefits At A Reasonable Price

Medicare Advantage plans harness the power of care networks. These are groups of doctors and other health care professionals who contract with your plan. These networks help keep costs down. It also means your care may not be covered if you go outside your plans network. So before you sign up, make sure your favorite doctors are in a plans network.

Its also important to remember that not all plans are alike. Two of the most common types are Health Maintenance Organizations and Preferred Provider Organizations .

Whats The Difference Between An Hmo And Ppo Plan

Medicare Advantage HMO plans generally require you to stay within the network. And you may need to get referrals to see specialists. But, there are exceptions for emergency care or out-of-area urgent care.

Medicare Advantage PPO plans generally have higher monthly premiums than HMO plans. But you have more flexibility to see doctors without a referral. And you may see health care providers outside your plans network. You usually pay more if you do.

Recommended Reading: What Age Does A Person Qualify For Medicare

A Review Of Medicare Advantage Vs Original Medicare And Medigap

One of the best ways weve discovered to figure out if a Medicare Advantage plan is right for you is to compare them directly with Original Medicare and a Medigap plan. So, lets do that by digging into the advantages and disadvantages of Medicare Advantage plans so we can figure out what is real and what isnt, and help you find the best Medicare plan for you and your situation.

Only then can you understand if Medicare Advantage plans are good for you. Well also answer these popular questions:

There is no debate when it comes to which plan offers better coverage. Original Medicare and a supplement plan offer the best coverage, but it costs more up-front. For a complete breakdown of the differences between Medicare Advantage plans and Medigap plans, read: Medicare Advantage vs Medigap: Which is Best for You?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death. To discover all of the pros and cons of Medicare Advantage, read: What are the Advantages and Disadvantages of Medicare Advantage Plans?

MA Plan ProsLearn more in this article.

What Is The Difference Between Medicare Supplement Insurance & Medicare Advantage Plans

A Medicare Supplement Insurance Plan and a Medicare Advantage Plan are two very different types of insurance that many individuals confuse as being the same. It is important to understand what each plan is and is not in order to purchase the best coverage for your needs. Put simply, a Medicare Supplement Insurance plan is a secondary insurance plan sold by private insurance companies. This plan type is designed to fill in the gaps left by original Medicare A & B. Again, Medicare does not cover 100% of everything, and so it is important to purchase a Medicare Supplement to fill those gaps. On the other hand, a Medicare Advantage Plan is a type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits. If you enroll in a Medicare Advantage Plan, most Medicare services are covered through the plan. Medicare services are not paid for by Original Medicare. Most Medicare Advantage plans offer prescription drug coverage.

Also Check: Does Cigna Have A Medicare Supplement Plan

What Is Medicare Advantage & How Does It Work

Medicare Advantage are health plans provided by private insurance companies who have a contract with Medicare. The private company receives a set amount of money from the government in exchange for providing health coverage.

The plans that they design must at least have the same or better coverage that Medicare provides. You are still “on Medicare,” but it now becomes the insurance company that is paying the provider and not Medicare.

Things To Know About Medicare Advantage Plans

Don’t Miss: What Age Do You Apply For Medicare

What Is The Best Medicare Advantage Plan

If youve read this far, youre probably wondering which Medicare Advantage plan is the best. Is it Humana, AARP, Aetna, Blue Cross Blue Shield, Cigna, Wellcare, or Kaiser?

Its easy to answer the question, What is the best Medicare supplement insurance plan? Its Plan F. It offers the most coverage.

We wish the answer was as clear-cut with Medicare Advantage, but its not. Heres why.

When you combine all of the standard Medicare Advantage plans, employer plans, and Special Needs Plans, there are literally over 70,000 plan options. Its a truly staggering number.

The good news is that all of those plans are organized across nearly 2,800 U.S. counties. Why? Because most plans use local provider networks, making county boundaries the most logical way to organize private health insurance.

To find the best private health plan for you, use our Plan Finder tool. It will show you all of the plans in your area, their 5-star rating, premiums, copaymentsA copayment, also known as a copay, is a set dollar amount you are required to pay for a medical service…., and extra benefits, too. If you have both Medicare and Medicaid, use the SNP Plan Finder. Plus, every plan page has a free PDF document you can download with basic cost and coverage information.

Medicare Advantage Vs Medicare Supplement: Bonus Benefits

Medicare Supplement insurance plans generally only cover out-of-pocket costs, such as copayments, coinsurance, and deductibles, for services that Original Medicare already covers.

For example, a Medicare Supplement insurance plan may cover your Medicare Part B coinsurance or copayment and your skilled nursing facility care coinsurance. The only bonus benefit that Medicare Supplement insurance plans generally cover is foreign travel emergencies at 80%, up to plan limits. However, some plans might offer additional benefits.

When it comes to bonus benefits, Medicare Advantage plans more commonly include them. Medicare Advantage plans may cover the following benefits Medicare Part A and Part B typically dont cover:

- Routine vision, including eye glasses, contacts, and eye exams

- Routine hearing, including hearing aids

- Routine dental care

- Prescription drugs and some over the counter medications

- Fitness classes and gym memberships

- Meal delivery to your home

- Transportation to doctor visits

Not every Medicare Advantage plan offers all of these extra benefits.

Read Also: How Often Does Medicare Pay For A1c Blood Test

Medigap & Medicare Advantage Plans

Medigap policies can’t work with Medicare Advantage Plans. If you have a Medigap policy and join a

, you may want to drop your Medigap policy. Your Medigap policy can’t be used to pay your Medicare Advantage Plan copayments, deductibles, and premiums.

If you want to cancel your Medigap policy, contact your insurance company. If you leave the Medicare Advantage Plan, you might not be able to get the same, or in some cases, any Medigap policy back unless you have a “trial right.“

If you have a Medicare Advantage Plan, it’s illegal for anyone to sell you a Medigap policy unless you’re switching back to

. Contact your State Insurance Department if this happens to you.

If you want to switch to Original Medicare and buy a Medigap policy, contact your Medicare Advantage Plan to see if you’re able to disenroll.

If you join a Medicare Advantage Plan for the first time, and you arent happy with the plan, youll have special rights under federal law to buy a Medigap policy. You have these rights if you return to Original Medicare within 12 months of joining.

| Note |

|---|

| If you dont drop your Medicare Advantage Plan and return to Original Medicare within 12 months of joining, generally, you must keep your Medicare Advantage Plan for the rest of the year. You can disenroll or change plans during the Open Enrollment Period or if you qualify for a Special Enrollment Period. Depending on the type of Special Enrollment Period, you may or may not have the right to buy a Medigap policy. |

Medicare Advantage Plans Are A Pay

One of the biggest misconceptions of Medicare Advantage is that it saves you money. This is completely false.

As we will discuss in the next section, MA plans will protect you with an annual cap, but the cap can be very high. The Medicare coverage provided by an MA plan must offer all of the same basic benefits as Original Medicare, but plans do not have to cover the benefits in the same way.

The cost-saving misunderstanding is rooted in the zero-dollar premium feature of many plans. A zero-dollar premium simply means that the entire cost of the plan is covered by what Medicare pays the plan and the monthly Medicare Part B premium paid by the beneficiaryA person who has health care insurance through the Medicare or Medicaid programs…..

Unfortunately, many people see the $0 monthly price tag, and mistakenly think that all or most costs are covered. Or they dont take into account their personal health situation and how that will translate into copays when they use health services.

Is pay-as-you-go healthcare a good thing or a bad thing? It all depends on the state of your health. For healthy, younger seniors who are accustomed to using HMO-style employer group plans, Medicare Advantage is a great way to save money.

Also Check: How Do I Know If I Have Part D Medicare

Most Medicare Advantage Plans Bundle Prescription Drug Coverage With The Health Plan

At first glance, it might seem like having your prescriptions included with your health insurance plan is a good thing. And for many people, particularly healthy seniors, it works out just fine. However, what happens if your Advantage plan has favorable copays for the health services you use but the prescription drug plan portion has unfavorable copays on the medications you need most? Or vice versa.

This is exactly the position many seniors find themselves in with their Medicare Advantage plan, and it happens because plan features are difficult to compare, and insurers know it. It also happens when a healthy person joins a plan, because it has a zero-dollar premium, and is later diagnosed with a chronic illness.

The simple fact is that bundling Medicare Part DMedicare Part D plans are an option Medicare beneficiaries can use to get prescription drug coverage. Part D plans provide cost-sharing on covered medications in four different phases: deductible, initial coverage, coverage gap, and catastrophic. Each… prescription drug plans with Medicare Advantage plans makes it infinitely more difficult to choose the best plan. It works out great when you are healthy and your prescription needs are few, but the onset of chronic health issues makes plan selection challenging.

Medicare Advantage Ppo Vs Hmo Plans: What’s The Difference

Medicare Advantage offers Medicare through a private insurer. Sometimes called Medicare Part C, these all-in-one plans often provide services original Medicare does not, such as vision and dental insurance and prescription drug coverage.

There are differences between Medicare Advantage plans. The specific structure of the plan you choose dictates how much you pay for care and where you can seek treatment. HMO plans limit you to a specific network of providers, while PPO plans offer lower rates to beneficiaries who seek care from a preferred provider.

Don’t Miss: How Much Does Medicare Part B Cost At Age 65

How Many Types Of Medicare Advantage Plans Are There

Insurance companies offer six different approaches to Medicare Advantage plans, although not all of them are available in all areas: an HMO , a PPO , an HMOPOS , a PFFS , an MSA , or an SNP .

You need to choose your own primary care doctor with an SNP, HMO, or HMOPOS, but not with an MSA, a PPO, or a PFFS. HMOs and SNPs are the only plans that require a referral prior to seeing a specialist, and the HMO plan is the only plan in which you must only receive care from doctors in that network.

In most instances, prescription drug coverage is included in Medicare Advantage plans, with the exception of the MSA plan and some PFFS plans. If you want to have prescription drug coverage and youre choosing an HMO or PPO Medicare Advantage plan, its important to select a plan that includes prescription coverage , because you cant purchase stand-alone Medicare Part D if you have an HMO or PPO Advantage plan. SNPs are required to cover prescriptions. PFFS plans sometimes cover prescriptions, but if you have one that doesnt, you can supplement it with a Medicare Part D plan. MSAs do not include prescription coverage, but you can buy a Part D plan to supplement your MSA plan.

Medicare Vs Medicare Advantage: How To Choose

Original Medicare comes in two parts: Part A and Part B. Part A covers a portion of hospitalization expenses, and Part B applies to doctor bills and other medical expenses, such as lab tests and some preventive screenings.

But some individuals may find better value in Medicare Advantage plans. Such plans are run by private insurance companies regulated by the government, and they must offer coverage that’s comparable to Original Medicare parts A and B. Most Medicare Advantage plans also include prescription drug coverage, called Part D, which is also available to beneficiaries who keep Original Medicare. With Original Medicare, patients are able to see any provider in the country that accepts Medicare with no restrictions.

Medicare Advantage Plans

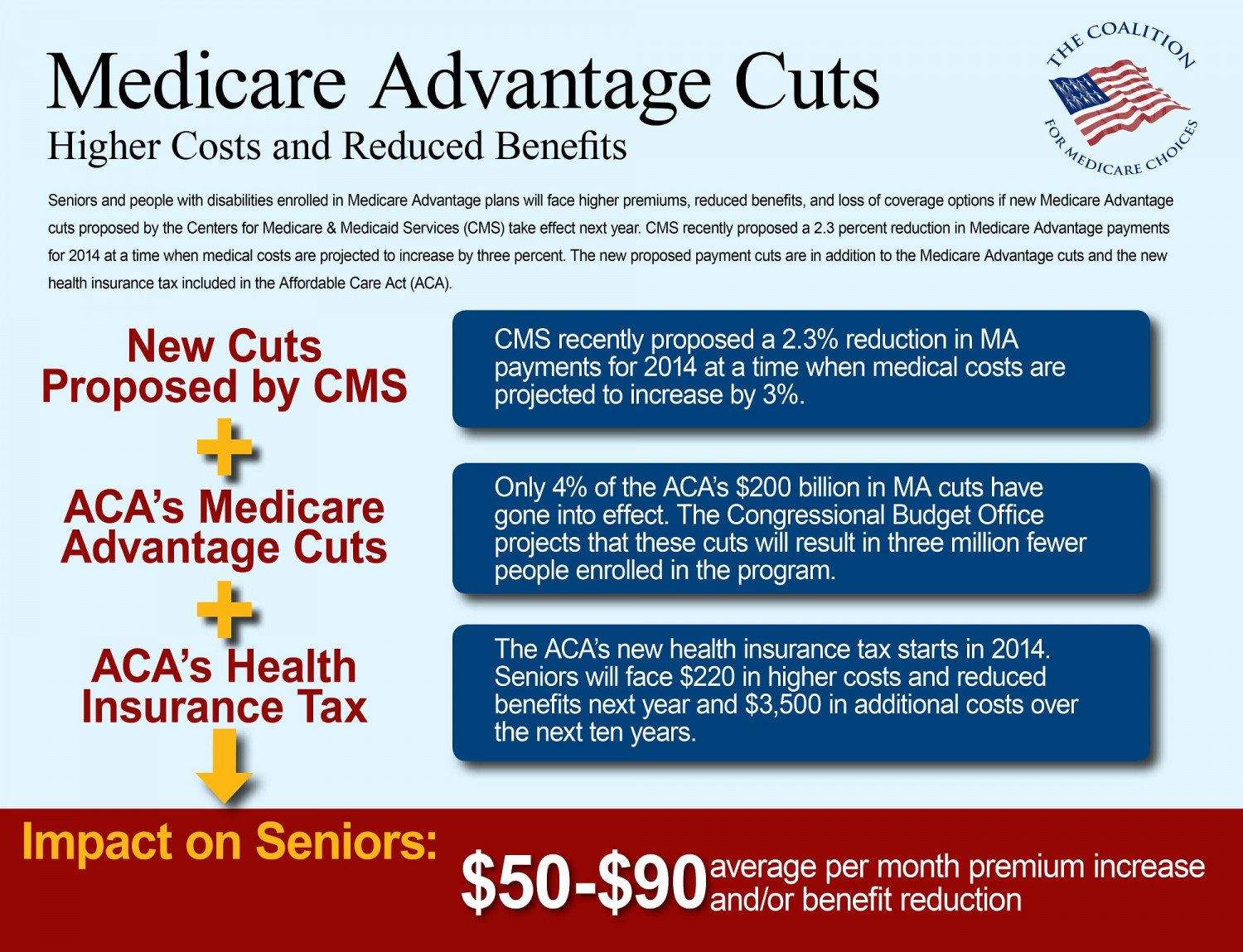

Some Medicare Advantage plans have a $0 monthly premium, while others come with a higher monthly premium. You must continue to pay your Part B premium, which is $148.50 per month for most beneficiaries in 2021. Medicare Advantage plans are similar to individual health insurance policies you may have received through your employer or signed up for on your own through the individual insurance market, in that they have different monthly premiums, provider networks, copays, coinsurance and out-of-pocket limits. The trade-off for a lower plan premium could include higher copays or coinsurance, smaller provider networks, more restrictions on use of services, higher out-of-pocket limits or less generous coverage of prescription drugs.

You May Like: Does Medicare Pay For Foot Care

What Are The Cons Of Medicare Advantage

- Restricted service area, which may be an issue if you travel or reside in a different area for part of the year

- The in-network benefit of cost containment can mean limited choice of providers.

- You may have to wait for prior authorizations for medications and treatments, or spend time up-front trying to get advance plan approval.

- You most likely will need a referral prior to seeing a specialist.

- If you had Original Medicare with a Medigap plan previously, then choose a Medicare Advantage plan, it may be difficult to switch back and return to your previous Medigap plan.

- Featured Sources