How To Calculate Social Security Benefits

Suppose your FRA is 66. In the event that you begin claiming benefits at the age of 66 and your full monthly benefit is $2,000, then you will get $2,000 each month. In the event that you begin claiming benefits at age 62, which is four years ahead of schedule, then your benefit will be decreased to 75% of your full monthly benefit additionally called your primary insurance sum. All in all, you will get 25% less each month, and your check will be $1,500.

That decreased benefit will not increase once you turn 66 years old. Maybe, you will keep on getting it for the rest of your life. It might go up over the long run because of cost-of-living adjustments , however just marginally. You can figure it out for your own situation using the Social Security Administration Early or Late Retirement Calculator, one of various benefit calculators given by the SSA that can likewise assist you with finding your FRA, the SSAs estimate of your future for benefit computations, rough estimates of your retirement benefits, individualized projections of your benefits dependent on your own work record, and more.

Medicare Prescription Drug Coverage

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage .

Learn more about how to get Medicare drug coverage.

Each plan can vary in cost and specific drugs covered, but must give at least a standard level of coverage set by Medicare. Medicare drug coverage includes generic and brand-name drugs. Plans can vary the list of prescription drugs they cover and how they place drugs into different “tiers” on their formularies.

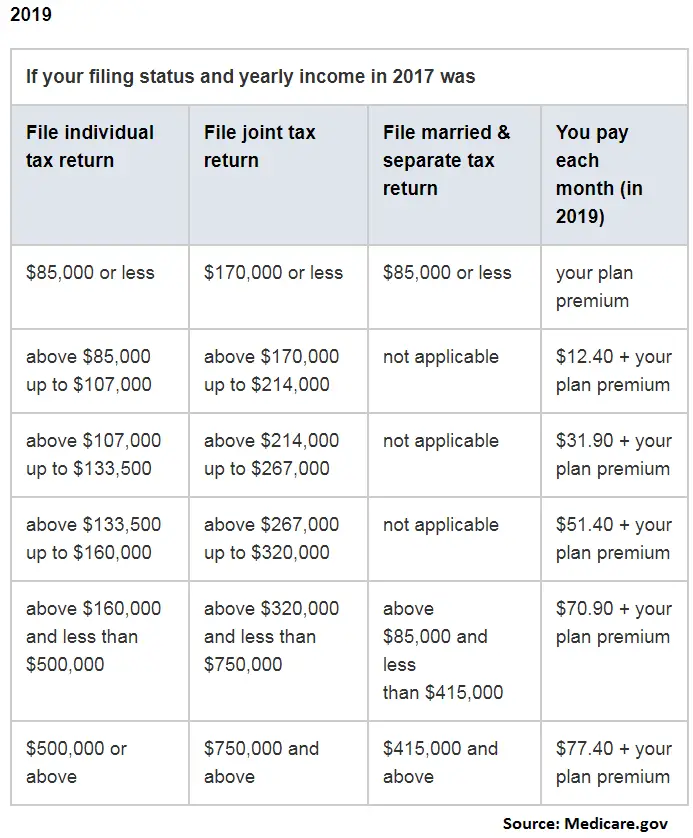

If My Spouse Is 65 And Im 62 How Can That Affect My Spouses Medicare Costs

Traditional Medicare refers to Part A and Part B. Almost everyone has to pay a Part B monthly premium. But most people donât have to pay a Part A monthly premium.

For Medicare Part A, your monthly premium amount depends on how long you or your spouse worked and paid taxes.

If youâve worked at least 10 years while paying Medicare taxes, you donât pay a monthly premium for your Medicare Part A benefits. But if you havenât worked, or worked less than 10 years, you may pay a premium.

Hereâs where your spouse might benefit from your work history, or vice versa. Say youâre age 62 or older, and your spouse is 65. Your Medicare-eligible spouse has worked for less than 10 years. You, on the other hand, arenât eligible for Medicare yet at age 62, but youâve worked at least 10 years while paying taxes.

Well, tell your spouse he or she owes you a grand night out on the town. Because of your work history, your spouse will qualify for premium-free Part A.

So, to summarize with an example:

- Bob is 65 years old. Heâs on Medicare, but he pays a monthly premium for his Medicare Part A benefits. He only worked for seven years and no longer works.

- His wife, Mary, has worked for over 30 years.

You May Like: Does Medicare Part B Pay For Eyeglasses

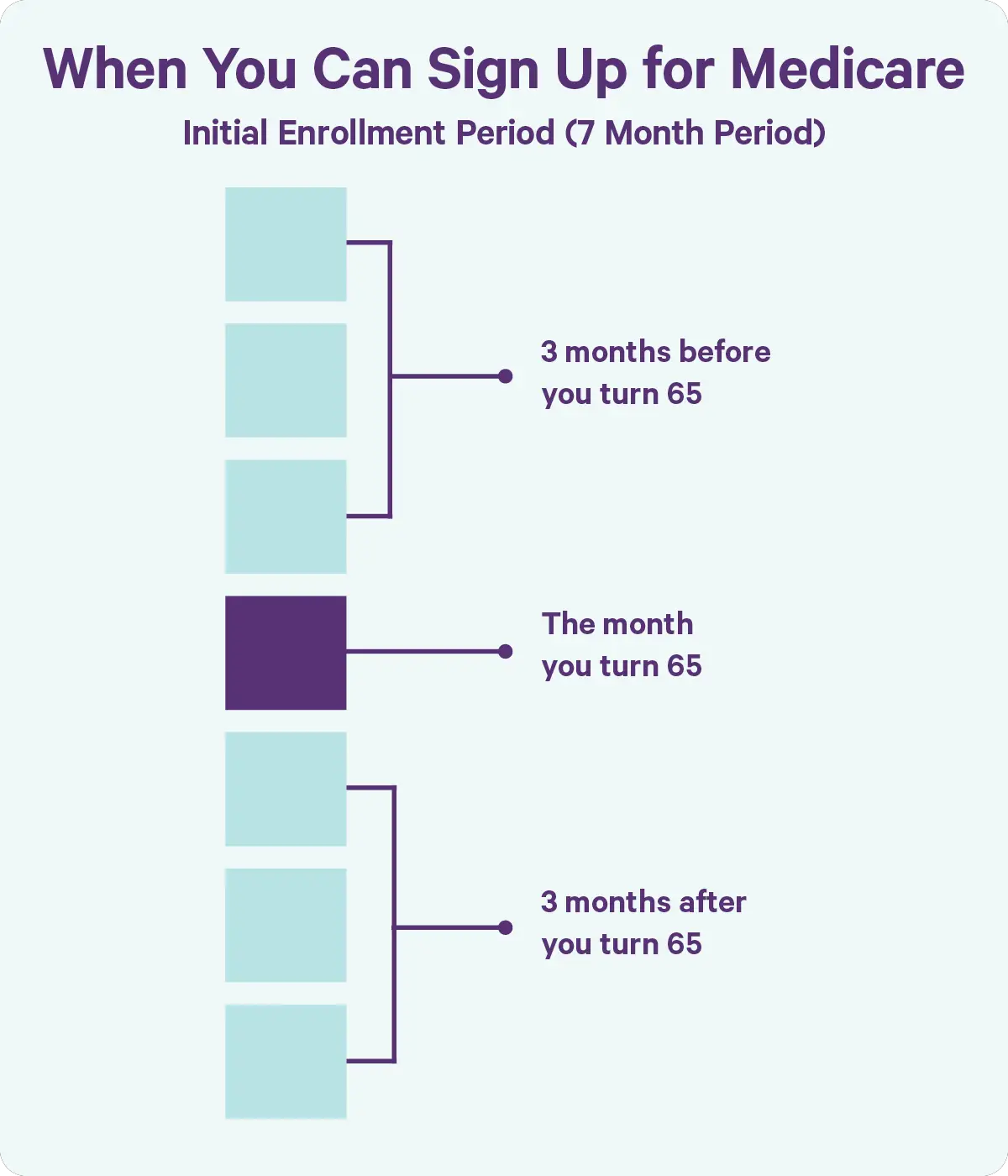

Your First Chance To Sign Up

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Avoid the penaltyIf you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called Premium-Part A.

Medicare Eligibility Before Age 65

If youre under 65 years old, you might be eligible for Medicare:

- If you receive disability benefits from Social Security or certain disability benefits from the Railroad Retirement Board for at least 24 months in a row

- If you have amyotrophic lateral sclerosis

- If you have end-stage renal disease . ESRD is permanent damage to the kidneys that requires regular dialysis or a kidney transplant

If youre eligible for Medicare because of any of these circumstances, you may receive health insurance through Medicare Part A and Medicare Part B , which make up Original Medicare. Your enrollment in Medicare may or may not be automatic, as explained below.

Don’t Miss: How To Get Medicare Number Without Card

What Age Can You Get Social Security

The minimum age to get Social Security benefits is 62. You can apply when you turn 61 years and 9 months of age. If you are turning 62 and you need the income from Social Security to support yourself, then you can start claiming your benefits now. Nevertheless, if you have enough income from other sources to keep you going until you are older, then it is suggested that you delay increasing the size of your monthly benefit.

If I Enroll Earlier Than Age 65 Is My Medicare Coverage Reduced

You donât have to worry about this, because you canât enroll in Medicare before youâre eligible.

If you qualify for Medicare before age 65 due to disability:

- You can get full Original Medicare benefits.

- If you want to buy a Medicare Supplement insurance plan , some states will let you do this and others wonât. You can check with your stateâs State Health Insurance Assistance Program agency to find out if you can get a Medicare Supplement insurance plan if youâre disabled and not yet 65.

Read Also: Does Humana Advantage Replace Medicare

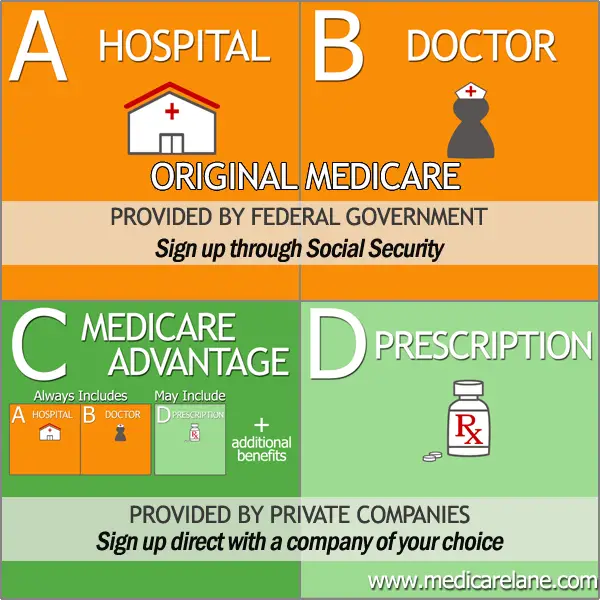

How Does Medicare Work

With Medicare, you have options in how you get your coverage. Once you enroll, youll need to decide how youll get your Medicare coverage. There are 2 main ways:

- Original Medicare

-

Original Medicare includes Medicare Part A and Medicare Part B . You pay for services as you get them. When you get services, youll pay a

deductible

at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance. If you want drug coverage, you can add a separate drug plan .

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles. Some Medigap policies also cover services that Original Medicare doesn’t cover, like emergency medical care when you travel outside the U.S.

Does The Eligibility Age Change For Types Of Medicare Coverage

No. You need to have Medicare Part A and Part B if you want to sign up for a Medicare Advantage plan or a Medicare Supplement insurance plan. If you sign up for a stand-alone Medicare prescription drug plan, you need Part A and/or Part B.

So, itâs not like you can get a Medicare Advantage plan, for example, when youâre younger than 65 unless you qualify by disability.

You May Like: Do We Have To Pay For Medicare

How Could Lowering The Medicare Age Affect Provider Networks For Current Medicaid Enrollees

What is current policy? People may have access to different provider networks in Medicare vs. Medicaid, due to different managed care and network adequacy rules. Once eligible for coverage, Medicare allows enrollees to choose whether to receive benefits under the traditional Medicare program, or enroll in a Medicare Advantage managed care plan. Traditional Medicare offers access to a broad provider network, while Medicare Advantage plans have restricted provider networks. States may require Medicaid enrollees to enroll in managed care, which can further restrict provider networks beyond those that participate in the states fee-for-service Medicaid program.

What are the key policy choices and implications? People could gain access to a broader provider network through traditional Medicare compared to their states Medicaid program. If moving from Medicaid to Medicare, individuals could experience changes in delivery systems and provider networks, depending on whether they opt for Medicare Advantage or traditional Medicare, which could mean disruptions in care.

Important Things To Know About Social Security Benefits

Now before we dive into how this may impact Medicare decisions, there are three things to keep in mind.

Also Check: When Do I Have To Enroll In Medicare

Will I Get Medicare At 62 If I Retire Then

No. Even if your spouse is eligible for Medicare when you retire at 62 , youâre not eligible unless you qualify by disability.

if you retire before age 65, you may be able to continue to get medical insurance coverage through your employer, or you can purchase coverage from a private insurance company until you turn 65. While waiting for Medicare enrollment eligibility, you might want to visit healthcare.gov, or your state insurance agency on your stateâs official website, to learn about your options.

Sign Up: Within 8 Months After You Or Your Spouse Stop Working

- Most people dont have to pay a premium for Part A . So, you may want to sign up for Part A when you turn 65, even if you or your spouse are still working.

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Read Also: Is Silver Sneakers Available To Anyone On Medicare

When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

In 2022: 2 months after you sign up Starting January 1, 2023: the next month |

|

2 or 3 months after you turn 65 |

In 2022: 3 months after you sign up Starting January 1, 2023: the next month |

How To Enroll For Medicare

If you meet the requirements for those 65 and older, you can receive Medicare Part A without paying any premiums. However, if you or your spouse did not pay Medicare taxes, you may have to pay for Part A. Medicare Part A covers hospital insurance. Medicare part B covers things like outpatient care, preventive services and medical equipment. It can also cover part-time home health services and physical therapy. Should you decide you also want Medicare Part B, you must pay a monthly premium.

If you have received Social Security disability benefits for 24 months, you will automatically be enrolled in Medicare at the start of the 25th month. If you have Lou Gehrigs disease, you are automatically enrolled the first month you begin receiving benefits. For these situations, enrollment includes both Medicare Part A and Part B. However, if you have end-stage renal disease, your Medicare benefits are determined on a case-by-case basis. In this case, you will need to manually apply.

Recommended Reading: Is The Medicare Helpline Legit

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

Note: Important Upcoming Change Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month youre first eligible. Beginning January 1, 2023, if you sign up during the month you turn 65 or during the last three months of your IEP, your coverage starts the first day of the month after you sign up.

The following chart shows when your Medicare Part B becomes effective in 2022:

| In 2022, if you sign up during this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| One to three months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65 | One month after the month you turn age 65. |

| One month after you reach age 65 | Two months after the month of enrollment. |

| Two or three months after you reach age 65 | Three months after the month of enrollment. |

The following chart shows when your Medicare Part B becomes effective in 2023:

Effects On The Budget

Implementing either of the two alternatives would reduce federal budget deficits between 2023 and 2028, according to estimates by the Congressional Budget Office and the staff of the Joint Committee on Taxation . The net reduction in deficits would result from the combined effect of changes to outlays and revenues, both of which would decrease over that period. The reduction in outlays would stem from decreases in spending for Medicare and Social Security . The reduction in revenues would largely stem from increases in federal subsidies for insurance purchased through the marketplaces, a portion of which is provided in the form of reductions in recipients’ tax payments.

CBO and JCT estimate that under the first alternative, deficits would decrease by $15 billion between 2023 and 2028 that reduction comprises an $18 billion decrease in outlays and a $3 billion decrease in revenues. The agencies estimate that under the second alternative, deficits would decline by an additional $7 billion over the same period because the decrease in outlays and the partially offsetting decrease in revenues would be $8 billion and $1 billion greater, respectively. The estimated reduction in deficits between 2023 and 2028 would be greater under the second alternative because of a larger reduction in Medicare enrollment over that period.

You May Like: What Is My Deductible For Medicare

Get Started With Medicare

Medicare is health insurance for people 65 or older. Youre first eligible to sign up for Medicare 3 months before you turn 65. You may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease , or ALS .

Follow these steps to learn about Medicare, how to sign up, and your coverage options. Learn about it at your own pace.

Who Would Be Eligible For Medicare At 60

When someone with U.S. citizenship of at least five years reaches age 65, they become eligible for Medicare. Currently, it seems as though the age would be lowered to 60 without any additional requirements.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Therefore, millions more Americans could obtain Medicare coverage. Additionally, it is unclear if the penalties people must pay for delaying enrollment would become effective when they turn 60 rather than 65.

Now, those who lack creditable coverage and do not enroll when they age in at 65 pay late penalties through increased premiums. With this potential change, the penalties may start at 60 or remain for those who wait until after 65 to enroll.

Recommended Reading: How Can Medicare Advantage Be Free

How Much Does Medicare Cost At Age 65

The standard premium for Part B modestly increases year over year. Part A costs also can increase, including the annual deductible and other coinsurance. Known as hospital insurance, Part A doesnt require a monthly premium as long as you have paid Medicare taxes through employment for at least 10 years.

Part B, known as medical insurance, typically pays 80% of the covered cost while you pay the deductible and then 20%.

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

Also Check: Which Medicare Part Covers Prescriptions

Born In 1955 Or Later You May Have To Work Until Youre 67

Once upon a time, turning 65 years old meant you could get your full Social Security retirement benefits and Medicare coverage at the same time. But over the last couple of years, the Social Security Administration changed the full retirement age twice first to age 66 for people born from 1948 to 1954, then again to age 67 for people born in 1955 or later.

No matter what full retirement age is required for you to get full Social Security benefits , Medicare eligibility still begins at age 65.1

Retirement age by year of birth| Year of birth | |

|---|---|

|

66 years and 2 months |

|

|

1956 |

66 years and 4 months |

|

1957 |

66 years and 6 months |

|

1958 |

66 years and 8 months |

|

1959 |

66 years and 10 months |

|

1960 |

67 years |