Blue Cross And Blue Shield Of Alabama’s Medicare Advantage Plan

Birmingham Blue Cross and Blue Shield of Alabama’s Blue Advantage PPO Plan, a Medicare Advantage Plan, is the only statewide plan in Alabama to receive a four-star quality rating from the Centers for Medicare and Medicaid Services . CMS uses a five-star system to measure the quality and performance of Medicare Advantage health and prescription drug plans that relies on more than 40 metrics, including member health, management of chronic conditions, plan responsiveness, prescription drug safety, and accuracy of drug pricing. “We are honored to receive this recognition because it further validates our ongoing commitment to our Medicare members to consistently deliver a quality experience, said Dr. Dow Briggs, Chief Business Officer, Blue Cross and Blue Shield of Alabama. “We remain dedicated to providing our Blue Advantage members the highest level of service, and we continue to look for ways to help our members improve their health.”Blue Cross will continue to offer a variety of additional services in 2016 to Blue Advantage members at affordable prices:

- Healthway’s SilverSneakers Fitness Program

- AirMed Transport Services and Assistance

- 24-hour Nurseline

- Supplemental Vision and Hearing Benefits

How Much Does Medicare Advantage Cost In Alabama

As mentioned previously, each Medicare Advantage plan is different, and so the cost can vary from plan to plan. Generally, you can expect the cost of a plan to come from the following sources:

- Monthly premium: This is the monthly cost of maintaining your insurance policy. When calculating the cost of a Medicare Advantage plan, its important to note that you will also need to pay for a Medicare Part B premium.

- Deductible: This is the amount of out-of-pocket costs you must pay in order to activate certain aspects of your plans coverage. These costs come from medical services . Once youve met your deductible, you can expect to pay significantly less for covered services, as your insurance policy will either cover or compensate you for costs.

- Coinsurance: Once you meet your plans deductible, your plan will begin to cover a percentage of covered services. Typically, your plan will pay for a large percentage of a specific medical cost, leaving you to pay the smaller percentage.

- Co-payments: As with coinsurance, co-payments can also require that you meet your plans deductible. Once youve done this, you will be able to pay for covered medical services through flat-rate payments.

- Out-of-pocket maximum: This is the absolute limit that you can pay out of pocket for medical services during the year. After you reach this maximum, the plan must begin covering 100 percent of subsequent medical costs.

Enrollment And Eligibility For Medicare Advantage In Alabama

Prior to enrolling in Medicare Advantage, seniors must first be enrolled in Original Medicare. Anyone who is eligible for Medicare Parts A and B is also eligible to enroll in Medicare Advantage. However, certain Medicare Advantage plans, such as SNPs, may have additional eligibility requirements.

Medicare Advantage has specific enrollment periods. One can only join a Medicare Advantage plan during the following periods:

- Initial Coverage Election Period: This is the 7-month period during which everyone is eligible to enroll in a Medicare Advantage plan. The period spans from 3 months before the month of ones 65th birthday to 3 months after ones birthday month.

- Annual Election Period : Also referred to as the Open Enrollment Period, the AEP runs from October 15-December 7 each year. During this period, anyone can enroll in Medicare Advantage for the first time or change to a new plan.

- Medicare Advantage Open Enrollment Period: From January 1-March 31 each year, anyone who is already enrolled in Medicare Advantage can switch to a different plan, or disenroll and switch back to Original Medicare. This period is not open to anyone who is not currently enrolled in Medicare Advantage.

- General Enrollment Period: In some circumstances, one can join Medicare Advantage between April 1-June 30. This enrollment period only applies to those who enrolled in Medicare Part B for the first time during Medicares Open Enrollment Period .

Read Also: Does Medicare Cover Handicap Ramps

Medicare Advantage In Alabama

Medicare Advantage plans combine the components of original Medicare with additional coverage, like prescription drugs, vision, and dental.

These plans are sold through and administered by private insurance providers and are considered a full replacement for original Medicare. You choose the insurance company and plan type that best suits your needs.

A number of private insurance companies offer MedicareAdvantage plans in Alabama, including:

- Pan-American

- State Farm

There are 12 total different plan options available throughout Alabama. You can search for those sold in your area by entering your ZIP code into Medicares Medigap plan finder tool.

You may qualify for Medicare plans in Alabama if you:

- are age 65 or older

- are any age and have certain disabilities for which youve collected Social Security Disability Insurance for at least 24 months

- are any age and have end stage renal disease or amyotrophic lateral sclerosis

When And How Do You Enroll In Medicare Advantage

In Alabama, there are multiple agencies that can help you enroll in Medicare Advantage, including the State Health Insurance Assistance Program, or SHIP. You can also find plans directly through the Medicare website.

A few terms to know:

- The Initial Enrollment Period, when youre first eligible for Medicare, is a seven-month window that begins three months before you turn 65 and ends three months after you turn 65.

- The Annual Election Period, or Open Enrollment Period, is the time when you can join a Medicare Advantage plan, add prescription drug coverage, switch plans, or go back to Original Medicare. This runs from October 15 to December 7.

- The Medicare Advantage Open Enrollment Period runs from January 1 to March 31. This is when you can switch to a different MA plan either with or without prescription drug coverage.

- The Medicare General Enrollment Period also runs January 1 to March 31, with coverage beginning July 1.

- The Special Enrollment Period allows you to enroll under certain circumstances, including:

- Relocation

- Loss of coverage, such as losing Medicaid eligibility

- Gain of coverage, such as qualifying for employer or union coverage

- Plan changes, such as Medicare termination of a current plans contract

- Other special circumstances, such as a chronic condition that would be best served by another plan

Read Also: Will Medicare Cover Cataract Surgery

Implementing Several Opioid Provisions Of The Support Act

The Substance Use-Disorder Prevention that Promotes Opioid Recovery and Treatment Act has enacted new requirements for Medicare Part D plans to educate Medicare beneficiaries about risk factors of opioids, alternative pain relief therapies and safe ways to dispose of prescription medications.

Previously included in the sub-regulatory guidance policy measures, CMS has decided to codify these policies in regulations to increase the stability and transparency of the Recovery and Treatment Program.

How Much Do Medicare Supplement Plans Cost In Alabama

Many beneficiaries find that Plan G makes the most sense financially. See, Plan F in Birmingham costs over $155 a month for a 65 year-old-man whereas Plan G is less than $120. $35 a month x 12 months = $420.

The Part B deductible is MUCH less than $420 a year. So, it makes more sense financially to purchase the Plan G and pay the deductible yourself. Now, some believe Plan N makes more sense because the premium is even lower than Plan G.

Read Also: Is A Nursing Home Covered By Medicare

Local Health Insurance Resources In Alabama

-

The state of Alabama staffs a group of SHIP volunteers who provide counseling and educational materials to older adults living in Alabama. This program can help Medicare beneficiaries better understand their Medicare coverage, rights and costs in order to get the most out of their benefits. You can contact Alabamas SHIP program at 800-243-5463.

-

You can also explore more information about the insurance industry in Alabama by visiting the states Department of Insurance

-

Alabama Prescription Drug Assistance ProgramsThe state of Alabama has a number of programs designed to help with the cost of prescription drugs. There are programs for both Medicare beneficiaries and non-Medicare beneficiaries alike that can cover the cost of premiums and cost-sharing or even lower the cost of the drugs themselves.

1 MedicareAdvantage.com’s The Best States for Medicare in 2021 report. .

2 Medicare evaluates plans based on a 5- star rating system.

Compare plans today.

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC is a licensed and certified representative of A Medicare Advantage organization and a stand-alone prescription drug plan with a Medicare contract. Enrollment in any plan depends on contract renewal.

Medicare has neither reviewed nor endorsed this information.

Alabama Senior Medicare Patrol

The Alabama SMP program exists to educate Medicare-eligible seniors about how to detect and prevent fraud, abuse or errors. The programs trained volunteers can help you address concerns about possible fraud or Medicare abuse by telemarketers, health care providers, medical equipment suppliers, and others. They can also help you sort out possible errors on your Medicare statements and related medical bills.

Contact Information:Website | 800-243-5463

Also Check: Does Medicare Have Silver Sneakers

Can Prescription Drug Coverage Be Purchased Separately

If you’re enrolled in a Medicare Advantage plan, your plan likely already includes prescription drug coverage. If you’re a beneficiary with Original Medicare, though, you may want to purchase a standalone Part D plan to manage your medication expenses.

You have 30 standalone Medicare Part D plans to choose from in Alabama. Every beneficiary has access to a prescription drug plan, and most will pay less for this coverage in 2021 than in previous years.

To see which Medicare Part D plans are available in your area, visit Medicare.gov and enter your ZIP code. You may also enter your current medications to see how much each plan would cost for you.

Is Medicare Advantage A Good Alternative Plan For You

Each year, the number of seniors in Alabama who forgo Original Medicare in favor of Medicare Advantage plans continues to rise. For many beneficiaries, Advantage plans offer the additional coverage they desire for a reasonable price.

For Medicare beneficiaries in Alabama in 2021, 71 different Medicare Advantage plans are available for you to choose from in the state. While the plans available to you will depend on the area in which you live, every Medicare beneficiary in Alabama has access to an Advantage plan, including one with a $0 monthly premium.

Here are a few of the insurers who offer Medicare coverage in your state:

- Aetna

- United Healthcare

- Viva

To find out which Medicare Advantage plans are available in your area, visit Medicare.gov and enter your ZIP code. After answering a few questions, you will be able to view the insurance options available where you live.

You May Like: Does Medicare Cover Full Body Scans

Open Enrollment Period Aka Annual Election Period

From October 7 to December 15 each year, you can make changes to existing plans during the Annual Election Period .

Anyone who did not enroll in Original Medicare during their IEP can do so during the Annual Election Period. People with Medicare Advantage plans can change from one plan to another or drop the Advantage plan to return to Original Medicare.

Enrollees with Original Medicare can purchase the prescription drug plan of their choice. Others can drop Part D without choosing a new plan.

What If I Want To Change My Medicare Advantage Plan

Whether youre switching from one Medicare Advantage plan to another Medicare Advantage plan, or switching from Medicare Advantage to Original Medicare, you may do so within the two Medicare enrollment periods each year: and .

You can apply for Original Medicare three months before you turn 65, the month of your birthday, and up to 3 months after you turn 65.

Read Also: Is Medicare A Federal Program

Medicare Advantage Vs Original Medicare With A Alabama Supplement

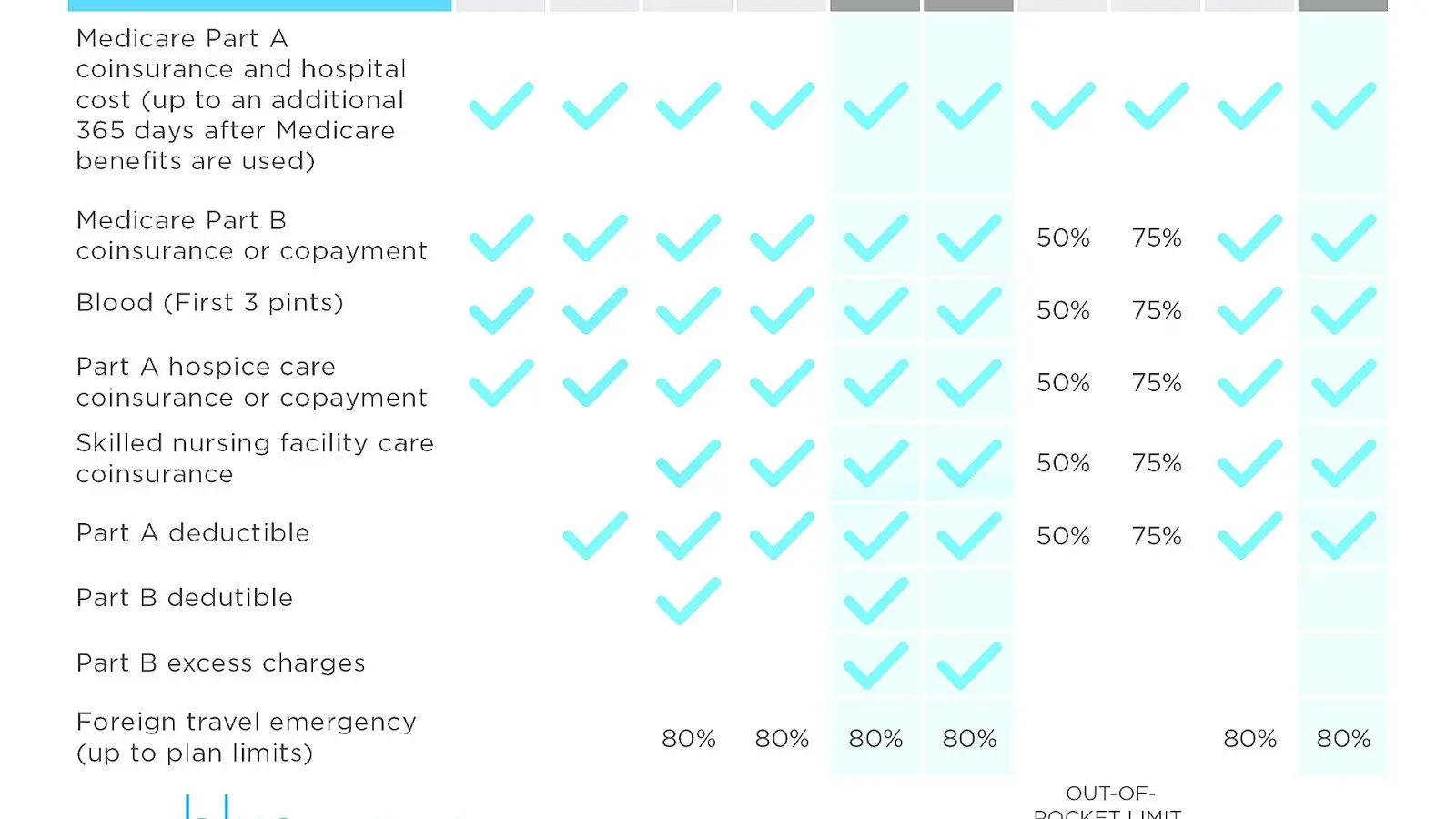

Medicare Advantage is one way to get full coverage healthcare. However, many people feel that Medicare Advantage plans in Lee County have too many disadvantages. So, you have the option to keep your Original Medicare benefits and upgrade your coverage with the best Medicare supplement available in Lee County and a Alabama Medicare drug plan for help with your prescription medications.

If you’re not familiar with Medigap policies, and how they protect you from medical care liability, please review our Medicare supplementsMedicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare health insurance coverage…. directory, where you can learn about and compare Medigap plans . All Medigap plans are standardized. That means you can choose the plan you need based on the best price without worrying about the benefits.

Medicare In Alabama 2021

Medicare continues to offer seniors and people with disabilities with flexibility and choices while providing high quality healthcare services. The Centers for Medicare & Medicaid Services , under President Trumpâs leadership, has taken several actions to improve the Medicare Advantage and Part D prescription drug programs that have resulted, overall, in an increase in plan choices and benefits, and lower costs in these popular programs. Delivering on President Trumpâs Executive Orders on Protecting and Improving Medicare, CMS has expanded opportunities for people with Medicare to choose Medicare Advantage plans that are providing more access to telehealth services, or for those people with diabetes to enroll in a plan that offers a broad set of insulins for no more than $35 per month per prescription.

CMS is empowering people with Medicare with price and quality information to make informed choices that best meet their healthcare needs. 1,059,950 beneficiaries in Alabama are enrolled in Medicare.

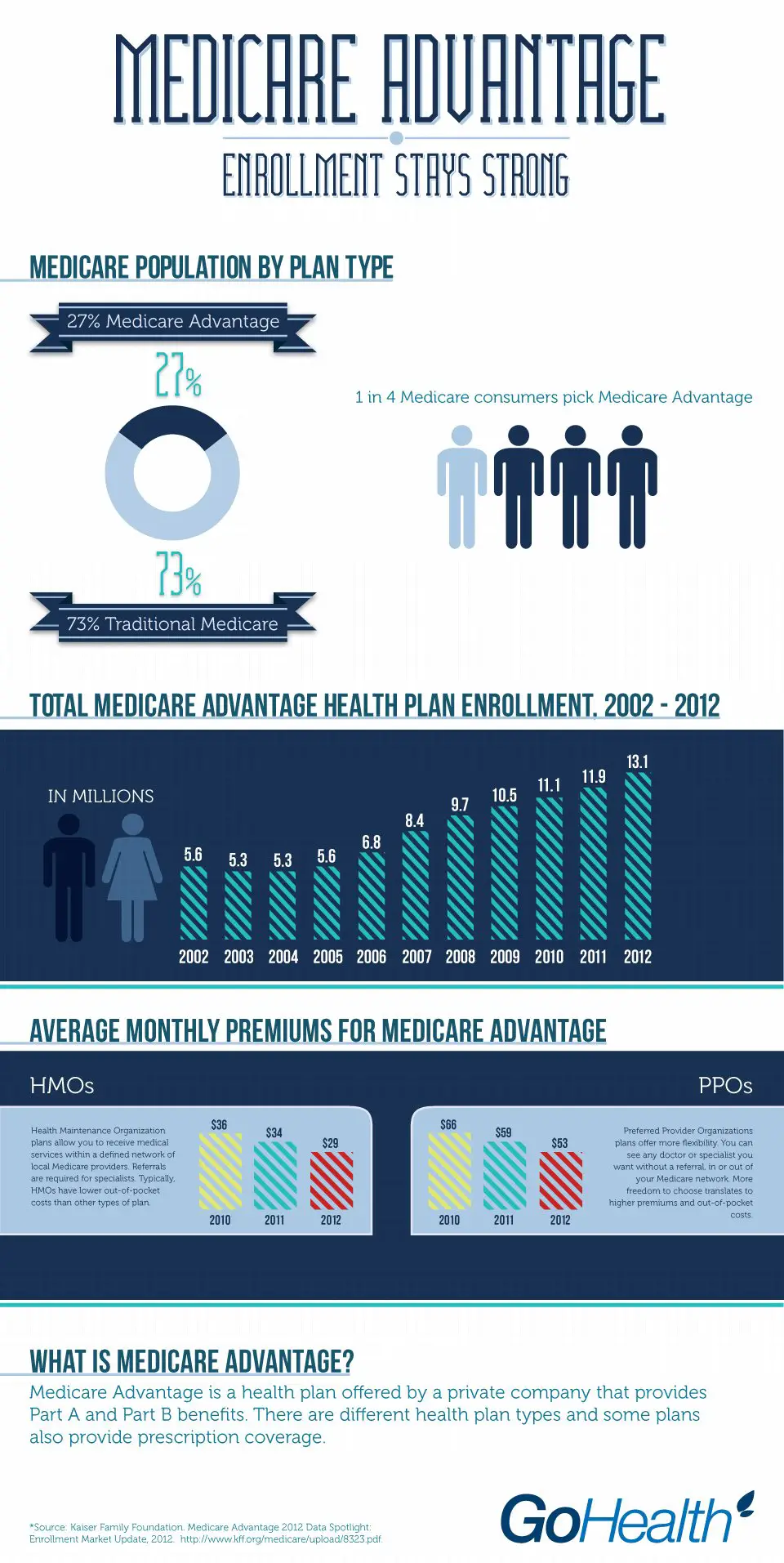

â¢The average monthly Medicare Advantage premium changed from $12.53 in 2020 to $11.06 in 2021. This represents a -11.74 percent change in average premium.

â¢82 Medicare Advantage plans are available in 2021, compared to 71 plans in 2020. This represents a 15.49 percent change in plan options.

â¢100 percent of people with Medicare have access to a Medicare Advantage plan.

â¢$0 is the lowest monthly premium for a Medicare Advantage plan.

Recommended Reading: How Much Can I Make On Medicare

Can I See My Own Doctor With A Medicare Advantage Plan

It depends. Most Medicare Advantage plans have a limited selection of providers within their network, but some of the bigger companies offer a wider range of options, both for facilities as well as health care providers.

So, before you decide on a Medicare Advantage plan, be sure to make a list of your preferred hospitals, doctors, and other health care providers, so you can check if they are within the network for the Medicare Advantage Plan you contact.

Private Insurance Companies Offer Medicare Advantage Plans In Alabama

Multiple insurance carriers may offer Medicare Advantage plans in Alabama, depending on the county in which you live.

Private insurance companies offer Medicare Advantage plans that may be unique to the plan area they serve, and your plan options may vary.

When youre shopping for Medicare Advantage plans in Alabama, you can use some of the following information as you compare plans from several different carriers:

- The Medicare Star Ratings can give you an sense of a plans overall quality.

- Agencies such as A.M. Best, Moodys and Standard & Poors provide information about the credit rating and financial standing of an insurance company.

- You can read through Medicare Advantage plan reviews and testimonials from customers

Recommended Reading: Does Medicare Pay For Blood Pressure Cuffs

Special Enrollment Periods If You Get Extra Help

Most Medicare recipients must make changes to their prescription drug coverage during an Open Enrollment Period. Those with Medicaid coverage or eligibility for Extra Help paying for Part D can request changes to their prescription drug coverage once during each of these periods:

This Special Enrollment Period does not occur from October through December, but all Medicare beneficiaries can make plan changes during that time.

Medicare In Alabama 2020

Medicare continues to offer seniors and people with disabilities with flexibility and choices while providing high quality healthcare services. The Centers for Medicare & Medicaid Services , under President Trumpâs leadership, has taken several actions to improve the Medicare Advantage and Part D prescription drug programs that have resulted, overall, in an increase in plan choices and lower costs in these popular programs. Leveraging new authorities in the Bipartisan Budget Act of 2018, CMS has expanded opportunities for people with Medicare to choose Medicare Advantage plans that are providing new supplemental benefits tailored to their specific needs to help them maintain their health or to address their social determinants of health, if they are chronically ill.

CMS is empowering people with Medicare with price and quality information to make informed choices that best meet their healthcare needs. 1,041,506 beneficiaries in Alabama are enrolled in Medicare.

In Alabama in 2020:

â¢The average monthly Medicare Advantage premium changed from $15.20 in 2019 to $13.24 in 2020.

â¢71 Medicare Advantage plans are available.

â¢100 percent of people with Medicare have access to a Medicare Advantage plan.

â¢$0 is the lowest monthly premium for a Medicare Advantage plan.

â¢100 percent of people with Medicare will have access to a Medicare Advantage plan with a $0 monthly premium.

â¢$13.20 is the lowest monthly premium for a stand-alone

Also Check: How To Apply For Medicare Without Claiming Social Security

Alabama Medicare Advantage Plans By County

The chart below provides some more information about 2021 Alabama Medicare Advantage plans by county.1

- Bibb County and Blount County have the MAPD plans with the lowest average monthly premiums in 2021.

- Cherokee and Dekalb Counties have the highest percentage of MAPD plans that are top rated in 2021.

| County |

|---|

Best For Simplicity And Clarity: Blue Cross Blue Shield

Blue Cross Blue Shield

-

No estimates available on the main page

-

Must go to individual plan websites for local details

-

No Medicare Advantage coverage in Mississippi and Wyoming

If you want Medicare information broken down clearly and in a straightforward manner, Blue Cross Blue Shield is the best company to go through for Medicare Advantage. We chose it primarily for features such as its Medicare Advantage Plans document, available for anyone to view on its website without having to enter any personal information. It gives a detailed look into the company’s plan offerings, explaining what types of plans are offered in which state, and who to contact if you want to enroll.

For example, in Florida, you have the option of going through multiple PPOs and HMOs as well as a HMO -D-SNP. Each of these options is sponsored by Florida Blue. Each organization may offer different plans and the plans can differ by ZIP code within the state too. So it’s important you gather information about the plans in your specific area.

The basic website is clean and easy to navigate, but its a little more complicated to actually get an estimate.

However, Blue Cross Blue Shield is actually an association of 35 independent insurance companies, not a single insurer. To get the details of your specific options, youll have to track down the BCBS affiliate in your market. Beware: BCBS affiliation may not be obvious from its name or how its commonly referred to, such as Anthem or Highmark.

Recommended Reading: Does Kelsey Seybold Accept Medicare