What If An Employer Gives Me Money To Buy My Own Health Plan

A note about individual coverage: youll qualify for an SEP if you delayed Part B because you had employer-sponsored coverage through a group health plan . This is a specific type of insurance plan sponsored or run by your employer. It includes coverage your employer offers you through an insurer, and plans purchased from the Small Business Health Options Program marketplace.

Instead of offering GHP coverage, some employers provide you money to buy your own health insurance. They can reimburse you directly, in which case the money is taxed, or through a Qualified Small Employer Health Reimbursement Arrangement or an Individual Coverage Health Reimbursement Account . Coverage you buy on your own does not qualify you for the Part B SEP even if an employer paid for some or all of it. If you have individual coverage, you should sign up for Medicare when youre first eligible, and can enroll during your initial enrollment period or the general enrollment period.

Josh Schultz has a strong background in Medicare and the Affordable Care Act. He coordinated a Medicare ombudsman contract at the Medicare Rights Center in New York City, and represented clients in extensive Medicare claims and appeals. In addition to advocacy work, Josh worked on federal and state health insurance exchanges at the technology firm hCentive.

Contributions to healthinsurance.org and medicareresources.org represent only his own views.

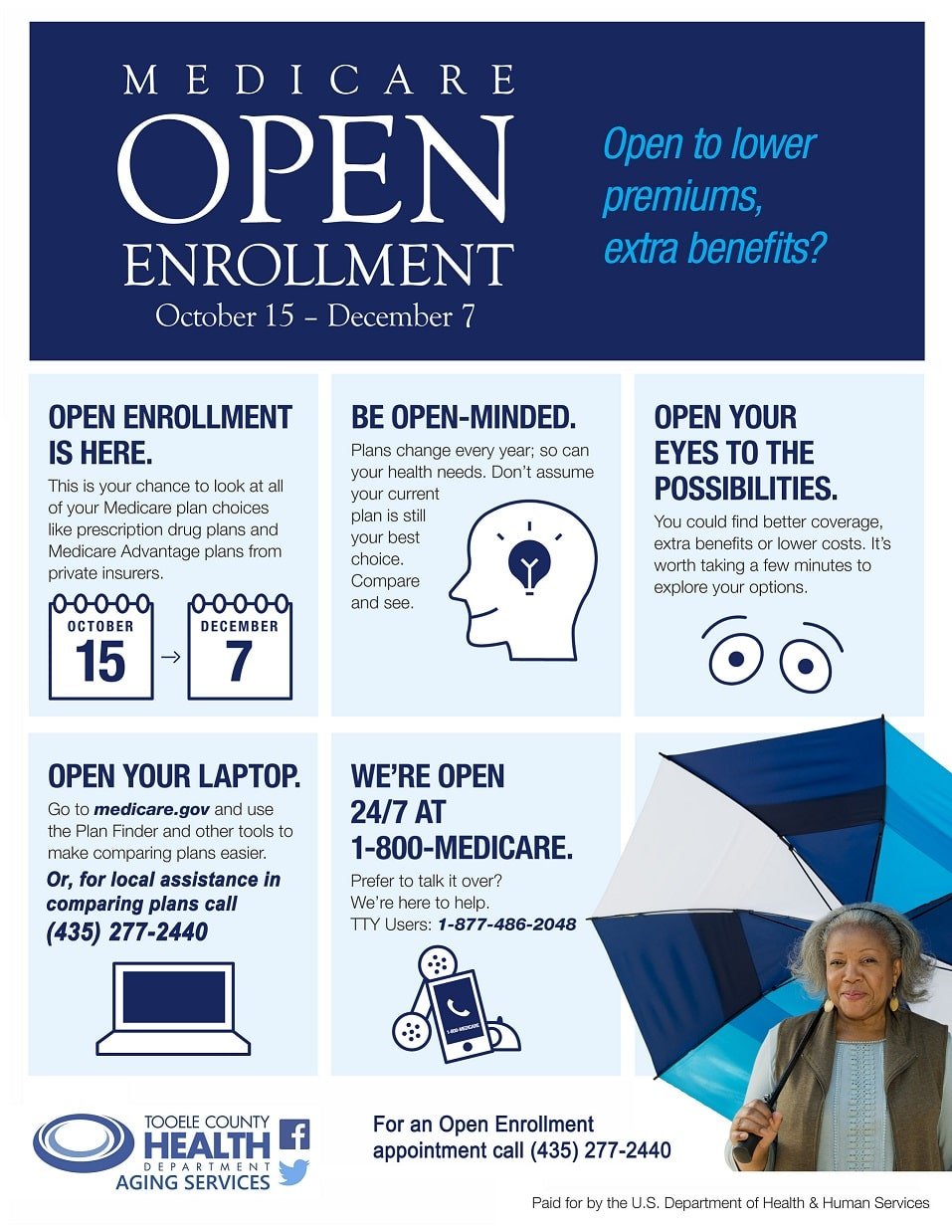

What Can You Do During Medicare Open Enrollment

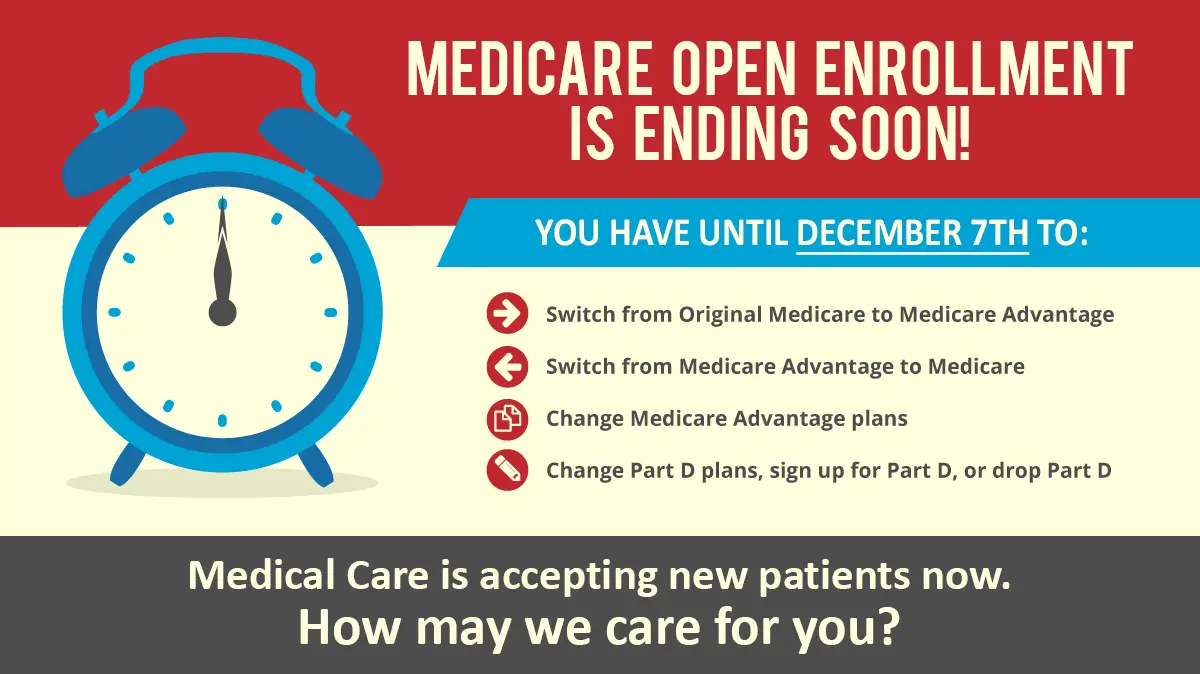

You can do the following during Medicare open enrollment:

-

Switch from Original Medicare to a Medicare Advantage plan, or vice versa.

-

Change from one Medicare Advantage plan to a different Medicare Advantage plan.

-

Change from a Medicare Advantage plan without drug coverage to a Medicare Advantage plan with drug coverage, or vice versa.

-

Enroll in a Medicare prescription drug plan.

-

Jump from one Medicare drug plan to a different Medicare drug plan.

-

Quit your Medicare prescription drug coverage.

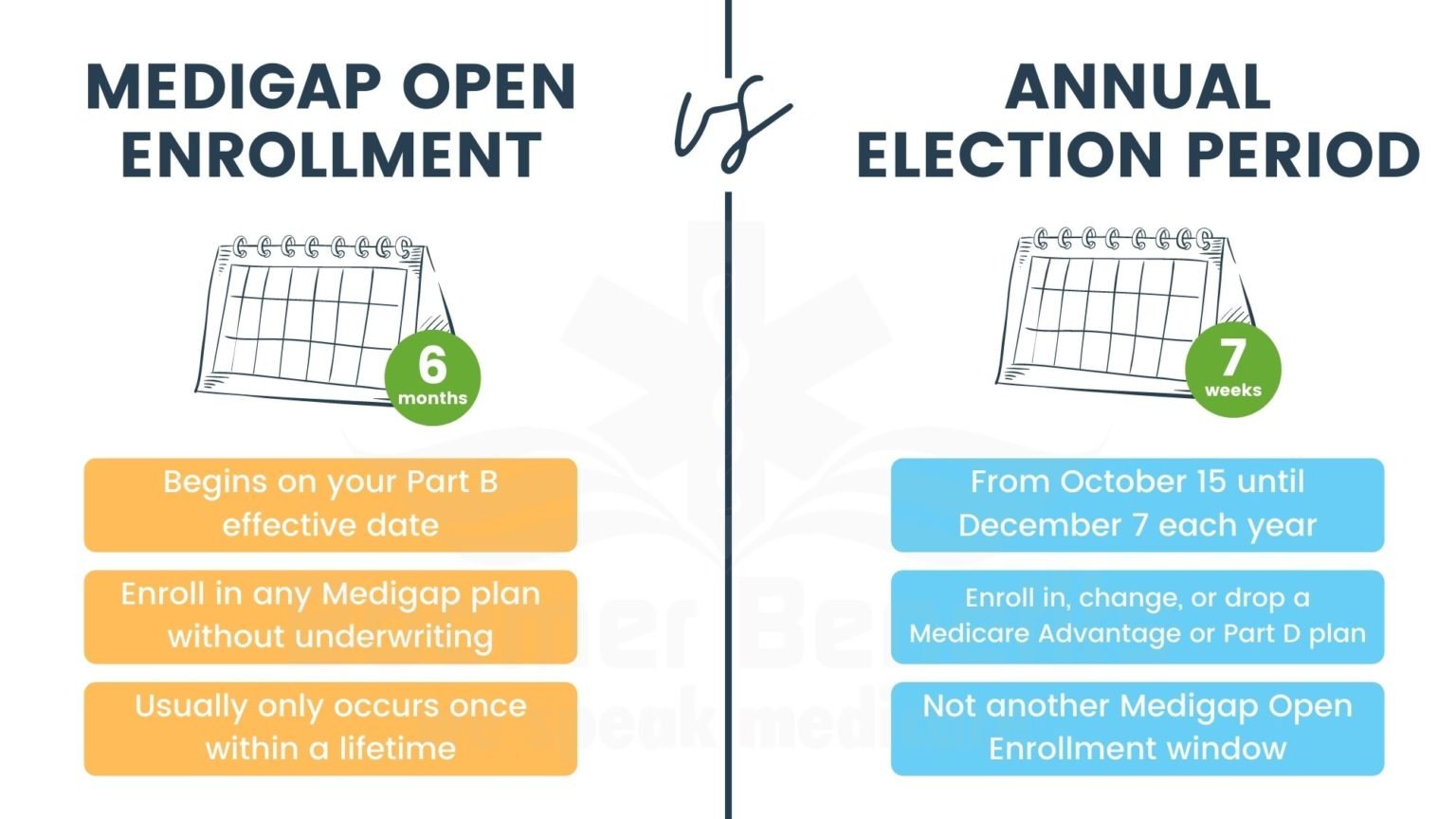

If you return to Original Medicare during this period and you want Medicare Supplement Insurance, also known as Medigap, you may pay more than you expected for a supplement policy, or you may be denied coverage.

Coverage will begin Jan. 1 for all changes made by Dec. 7.

If you find that youre not happy with your Medicare Advantage plan after the Medicare open enrollment period, you can make changes during the Medicare Advantage open enrollment period, which runs from Jan. 1 to March 31 each year.

How To Sign Up For And Change Medicare Plans

Once youre enrolled in Medicare, youll have various opportunities to change certain aspects of your coverage. Heres an overview:

- During the annual open enrollment period , you can make a variety of changes, none of which involve medical underwriting:

- Switch from Medicare Advantage to Original Medicare or vice versa.

- Switch from one Medicare Advantage plan to another.

- Switch from one Part D prescription plan to another. Its highly recommended that all beneficiaries use Medicares plan finder tool each year to compare the available Part D plans, as opposed to simply letting an existing drug plan auto-renew.

- Join a Medicare Part D plan.

- Drop your Part D coverage altogether.

Don’t Miss: How To Get Medicare Advantage Plan

What Changes Can You Make During Medicare Open Enrollment

During Medicare open enrollment, you can review your existing coverage and make changes to it. Specifically, you can switch from:

- Original Medicare to a Medicare Advantage plan.

- A Medicare Advantage plan to Original Medicare.

- One Medicare Advantage plan to another.

- One Medicare Part D drug plan to another.

You can also do the following during the Medicare open enrollment period in 2022 :

- Join a Part D drug plan.

- Drop your Part D coverage.

When Can I Join Switch Or Drop A Plan

You can join, switch, or drop a

with or without drug coverage during these times:

- Initial Enrollment Period. When you first become eligible for Medicare, you can join a plan.

- Open Enrollment Period. From October 15 December 7 each year, you can join, switch, or drop a plan. Your coverage will begin on January 1 .

- Medicare Advantage Open Enrollment Period. From January 1 March 31 each year, if youre enrolled in a Medicare Advantage Plan, you can switch to a different Medicare Advantage Plan or switch to Original Medicare once during this time.

Learn more below about enrollment periods below.

Recommended Reading: Do I Really Need A Medicare Supplement

When Is The Medicare Advantage Open Enrollment Period

Medicare Advantage open enrollment happens every year from January 1 to March 3.

During this enrollment window, anyone already enrolled in Medicare Advantage can change their coverage, but you won’t have as many options as the fall Medicare open enrollment period. The changes you make to your Medicare plan will start on the first day of the month after the insurer gets your request. For example, if your insurance company receives your change request in mid-February, your new plan will begin on March 1.

What Medicare Advantage changes can you make?

During Medicare Advantage open enrollment, you can switch Medicare Advantage plans, or you can change to an Original Medicare policy and add on a Part D prescription drug plan.

|

|

3 questions to ask during Medicare Advantage open enrollment

Fewer people use this open enrollment period at the beginning of the year, but it’s still a risk-free chance for Medicare beneficiaries to change their Medicare Advantage plan. Those considering updating their coverage can ask themselves:

If you missed the December 7 deadline to change your plan, the Medicare Advantage enrollment period in early 2022 is a chance to change your coverage for the remainder of the year.

What Dates To Know

Written by: PeopleKeep TeamOctober 18, 2019 at 12:00 PM

Its that time of year again. Open enrollment for most states is starting soon and in some states its already begun. You may be wondering why open enrollment matters and which deadlines apply to you.

Open enrollment is important because its the only time consumers can sign up for individual health insurance without experiencing a qualifying life event. A qualifying event triggers a special enrollment period that allows individuals and their dependents to enroll in coverage up to 60 days before or after the date of the event. Those who miss open enrollment deadlines and arent eligible for an SEP must wait until the following years open enrollment to sign up for coverage.

In this post, well discuss each states open enrollment periods as well as other information relating to QSEHRAs, ICHRAs, and alternate enrollment options.

Read Also: Can You Have Two Medicare Advantage Plans

What Happens If You Miss Medicare Open Enrollment

If you miss the Medicare open enrollment period for 2022, you may still be able to make changes to your coverage through a special enrollment period.

What if you dont qualify for a special enrollment period? Youll need to wait for the next general enrollment or open enrollment period to make changes to your Medicare plan.

Changes From Medicare Advantage Disenrollment Period

Those who have been on Medicare for many years may remember the Medicare Advantage Disenrollment Period . The MADP was replaced by the Medicare Advantage Open Enrollment Period in 2019.

The MADP previously gave beneficiaries the option to disenroll from Medicare Advantage and return to Original Medicare. This was previously possible between January 1 and February 14.

With the introduction of Medicare Advantage OEP, beneficiaries can switch to Original Medicare and other Medicare Advantage plans in a more extensive time window .

The change to Medicare Advantage OEP gives enrollees additional time to change and more flexibility to switch to different plans.

It is important to remember that only one change is possible during the new Medicare Advantage Open Enrollment Period, so time should be taken to ensure the switch is in your best interest.

Also Check: Is Unitedhealthcare A Medicare Advantage Plan

Don’t Miss: Do You Have To Resign Up For Medicare Every Year

Your First Chance To Sign Up

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Avoid the penaltyIf you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called Premium-Part A.

You Can Make The Changes During The Medicare Advantage Dis

Depending on what you wanted to do during the open enrollment period you are still able to accomplish a few things during the Medicare Advantage Dis-enrollment Period. The dis-enrollment period runs from of the following year.

In this period, you can:

- Sign up for a stand-alone prescription drug plan.

- Make the switch from a Medicare Advantage Plan to the original Medicare Plan.

Recommended Reading: Does Medicare Pay For Ambulance Calls

Fall Medicare Open Enrollment For Medicare Advantage Plans

Interested in signing up for a Medicare Advantage plan? There are certain times when you can enroll, and one of them is during Fall Medicare Open Enrollment .

You must be already enrolled in Part A and Part B, and live within the service area of the plan youre enrolling in to participate in the Fall Medicare Open Enrollment.

Besides enrolling in a Medicare Advantage plan, you can make other changes throughout the Fall Medicare Open Enrollment period, such as:

- Switch from a Medicare Advantage plan back to Original Medicare .

- Switch from one Medicare Advantage plan to another.

- Switch from a Medicare Advantage plan that doesnt offer prescription drug coverage to a Medicare Advantage Prescription Drug plan.

- Switch from a Medicare Advantage Prescription Drug plan to a Medicare Advantage plan that doesnt include prescription drug coverage.

What Is Medicare Open Enrollment

People already enrolled in Medicare can make changes to their coverage each year during the annual Medicare open enrollment period from Oct. 15 to Dec. 7. Its always a good idea to compare coverage and assess your health and prescription drug needs during this time to make sure you have the Medicare coverage thats best for you and your budget, says David Lipschutz, associate director of the Center for Medicare Advocacy.

Don’t Miss: What’s My Medicare Provider Number

Enrolling In Medicare Advantage

To join a Medicare Advantage Plan, you will need to have Original Medicare coverage and live in an area where an Advantage plan is offered.

A Medicare Advantage plan will wrap your Medicare Part A and Part B coverage into one plan. But youll still have to pay the government a premium for Part B, in addition to the premium you pay for Medicare Advantage .

You can enroll in a Medicare Advantage plan when youre first eligible for Medicare, or during the annual Medicare open enrollment period in the fall .

When Does Medicare Part D Open Enrollment Start

Medicare Part D Open Enrollment 2022 starts on October 15. This date began Medicares Annual Election Period or Annual Enrollment Period . To access Part D benefits during this time, you can:

Recommended Reading: Does Medicare Cover Dupuytren’s Contracture

Preview 2022 Health And Prescription Drug Plans

Medicare helps you compare coverage options and shop for health plans.

For a personalized search, log in to your account and create or access a list of your drugs, compare your current Medicare plan to others and see prices based on any help you get with drug costs.

There are several parts of Medicare.

Part A : This helps cover inpatient care in hospitals, skilled nursing facilities, hospice care, and home health care.

Part B : This helps cover:

- Services from doctors and other health care providers

- Outpatient care

- Durable medical equipment

- Many preventative services (like screenings, shots or vaccines and yearly wellness visits

Part C: This is also known as Medicare Advantage. This is a Medicare-approved plan from a private company that offers an alternative to original Medicare for your health and drug coverage.

These bundled plans include Part A, Part B, and usually Part D.

Part D : This helps you cover the cost of prescription drugs .

You can join a Medicare drug plan in addition to Original Medicare or you can get it by joining a Medicare Advantage Plan with drug coverage.

Plans that offer Medicare drug coverage are run by private insurance companies that follow rules set by Medicare.

Medicare Supplemental Insurance : This is extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare.

You pay a monthly premium for Medicare coverage and part of the cost each time you get a covered service.

Part A costs:

Part B costs:

Enrolling In A Medicare Supplement

During your initial Medigap enrollment period you cant be denied Medigap coverage or be charged more for the coverage because of your medical history.

But after that window ends, Medigap insurers in most states can use medical underwriting to determine your premiums and eligibility for coverage.

If youre under 65 and eligible for Medicare because of a disability, there are 33 states that provide some sort of guaranteed issue period during which you can purchase a Medigap plan. But in the majority of those states, the carriers can charge additional premiums for people under 65. You can click on a state on this map to see how Medigap plans are regulated in the state.

To find out about Medigap policies in your state, contact your State Department of Insurance or your State Health Insurance Assistance Program, or call 1-855-593-5633 to speak with one of our partners, who can help you find a plan in your area.

You May Like: Can I See A Doctor In Another State With Medicare

Should I Take Medicare Part B

You should take Medicare Part A when you are eligible. However, some people may not want to apply for Medicare Part B when they become eligible.

You can delay enrollment in Medicare Part B without penalty if you fit one of the following categories.

Employer group health plans may cover items normally not covered by Medicare Part B. If so, and you meet one of the categories above or below, then you may not need to enroll in Medicare Part B and pay the monthly premium.

If you are:

- a spouse of an active worker

- a disabled, active worker

- a disabled spouse of an active worker

and choose coverage under the employer group health plan, you can refuse Medicare Part B during the automatic or initial enrollment period. You wait to sign up for Medicare Part B during the special enrollment period, an eight month period that begins the month the group health coverage ends or the month employment ends, whichever comes first.

You will not be enrolling late, so you will not have any penalty.

If you choose coverage under the employer group health plan and are still working, Medicare will be the secondary payer, which means the employer plan pays first.

If the employer group health plan does not pay all the patients expenses, Medicare may pay the entire balance, a portion, or nothing. An employer group health plan must be primary or nothing.

Read Also: How Do I Find Medicare Number

When Does Medicare Part D Open Enrollment End

The 2022 AEP for Medicare Part D ended December 7. From the AEP start date , you have about eight weeks to enroll in Medicare Part D coverage before the AEP deadline. The coverage you choose during the Medicare Part D Enrollment will be effective the first day of the following year. For example, if you enrolled in a Part D drug plan by December 7, 2021, your coverage would start January 1, 2022.

You May Like: Is Wellcare The Same As Medicare

When Does Medicare Open Enrollment Begin And End

The annual Medicare Open Enrollment dates are usually between October 15th and December 7th.

For coverage in 2020, the open enrollment period will run from October 15th and December 7th 2019. You can choose to make changes to your Medicare coverage during this period.

MedicarePlan65 makes it easy for people to find Supplemental Medicare plans by connecting them with the best provider in their area.

When Is The Medicare Special Enrollment Period

You can qualify for Medicare special enrollment if you didnât enroll in Medicare when you became eligible at age 65 because you had health insurance through your job or your spouse’s job.

If you meet the qualifying circumstances, signing up for Medicare through a special enrollment period can help you avoid a Medicare Part B late penalty.

There are limits and specifics when navigating between Medicare and employer health coverage, and we recommend you talk to someone at Medicare or your State Health Insurance Assistance Program to discuss the timing and documentation needed for you to qualify for a special enrollment period.

Note that special enrollment will only help you avoid the Medicare Part B penalty. Thereâs no way to avoid the Medicare Part A penalty.

Read Also: Who Pays For Part A Medicare