What Are The Main Differences Between A Medicare Advantage Plan And A Medicare Cost Plan

The table below helps illustrate the main differences between a Medicare Advantage plan and a Medicare cost plan.

| Medicare Advantage Plan | Medicare Cost Plan | |

| Enrollment | To Enroll in a Medicare Advantage plan you must have both Medicare Part A and Part B. | You can enroll in a Medicare Cost plan even if you only have Medicare Part B. |

| When to enroll | You can generally only enroll in, switch, or disenroll from Medicare Advantage during certain times of the year. Learn more about Medicare Advantage enrollment periods. | You can enroll in a Medicare Cost Plan anytime the plan is accepting new members and you can leave at any time and return to Original Medicare. |

| Coverage | Medicare Advantage covers both hospital care and medical care . | Some types of Medicare Cost Plans only cover medical care while hospital care is covered through Original Medicare Part A. If you have this type of Medicare Cost Plan and dont have Medicare Part A, you may not be covered for hospital care. |

What Are Medicare Advantage Plans

If you have a Medicare Advantage plan, youre still enrolled in the Medicare program in fact, you must sign up for Medicare Part A and Part B to be eligible for a Medicare Advantage plan. The Medicare Advantage plan administers your benefits to you. Depending on the plan, Medicare Advantage can offer additional benefits beyond your Part A and Part B benefits, such as routine dental, vision, and hearing services, and even prescription drug coverage.

There are many different types of Medicare Advantage plans, described below:

- Health Maintenance Organizations require you to use health-care providers in a designated plan network and may require referrals from a primary care physician in order to see a specialist.

- Preferred Provider Organizations recommend the use of preferred health-care providers in an established network, and these plans are likely to cover more of your medical costs if you stay inside that network. You dont need a referral to see a specialist.

- Private Fee-for-Service plans determine how much they will pay health-care providers, and how much the beneficiary is responsible to cover out-of-pocket.

- Medical Savings Account plans deposit money into a health-care checking account that you use to pay for health-care costs before the deductible is met.

- Special Needs Plans are tailored health insurance plans designed for beneficiaries with certain health conditions.

When To Sign Up For Medicare

As you approach age 65, its important to know which enrollment deadlines apply to your circumstances. Begin by checking on your eligibility. To avoid costly penalties and gaps in coverage, most people should for Medicare Part A and Part B in the seven-month window that starts three months before the month you turn 65 and runs for another three months following your 65th birthday.

If you currently get Social Security, you will be automatically enrolled if not, you need to sign up either online or at your Social Security office.

Read Also: Does Medicare Cover Dexcom G6 Cgm

Just What Are Medicare Supplement Plans Anyhow

The first thing to do is understand the different options available to you. Medicare is available for people over 65, or who have certain types of conditions and receive Social Security Disability Insurance. They’re divided into three parts: A, B, and C. Part A covers approved inpatient costs, and Part B focuses on providing approximately 80% of your outpatient costs. Part C , isn’t really separate health insurance, but rather allows private health insurance companies to provide Medicare benefits.

Medicare Supplement Plans or Medigap were created to complement Original Medicare by addressing the places where its coverage falls short. Though these are private insurance plans and charge premiums, they are regulated by the government, and therefore must follow strict guidelines regarding coverage. Though you may have Medicare already, Medigap is only a guaranteed right for people over 65, within six months of enrolling in Medicare Part B. However, 27 states do currently require that insurers sell some sort of Medigap policy to beneficiaries under the age of 65.

How many Medicare Supplement Plans are there? And how are they different from each other?

What Is A Medicare Advantage Plan

Medicare Advantage is also called Medicare Part C. With Medicare Advantage, youll get your Medicare Part A and Medicare Part B through a private company and not through Original Medicare. Medicare Advantage plans also often provide coverage for Medicare Part D, prescription drugs, which Original Medicare usually doesnt cover. In addition, Medicare Advantage plans often offer extra benefits not generally covered by Original Medicare, such as vision, hearing, and sometimes dental. You must continue to pay your Medicare Part B premium.

Medicare beneficiaries with end-stage renal disease usually cannot enroll in Medicare Advantage.

Learn more about Medicare Advantage.

You May Like: Does Medicare Cover Depends For Incontinence

What Are The Benefits To Medicare Advantage

Medicare Advantage covers more than Medicare , allowing patients more options and flexibility. Patients can customize their Medicare Advantage to cover specific needs like wheelchair ramps, adult day care, and respite care. Additionally, the 2020 CARES Act expanded Medicare’s network to cover more telehealth services.

Learn About Medicare Supplement Plans Available Where You Live

TTY 711, 24/7

1 Freed M. et al. . Medicare Advantage 2022 Spotlight: First Look. Kaiser Family Foundation. https://www.kff.org/medicare/issue-brief/medicare-advantage-2022-spotlight-first-look.

2 AHIP. . State of Medigap: Trends in Enrollment and Demographics. Retrieved from https://www.ahip.org/wp-content/uploads/AHIP_State_of_Medigap-2020.pdf.

3 MedicareAdvantage.com’s The Best States for Medicare report. .

4 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Don’t Miss: How To Apply For Medicare Without Claiming Social Security

Having Medicaid Or A Medicare Savings Program

Medicare covers many services, but it doesnt cover long-term care benefits and can leave its enrollees with large cost-sharing expenses. Medicaid pays for some services that Medicare doesnt cover for enrollees whose incomes and assets make them eligible. If you have Medicaid or a Medicare Savings Program a program where Medicaid pays for Medicare premiums and cost-sharing then your enrollment options are different than if you only had Medicare.

Some Medicare Advantage plans specialize in covering low-income Medicare beneficiaries. These are known as Dual Eligible Special Needs Plans , and are available in every state. If you have Medicare and Medicaid, you should have few out-of-pocket expenses if you see providers enrolled in both programs regardless of whether you enroll in a D-SNP. Receiving coverage through a D-SNP requires you to see only providers who participate with the D-SNP insurer.

Some D-SNPs offer additional services, such as home care, dental or vision benefits. D-SNPs can also help coordinate all of the health services you receive. But low-income Medicare beneficiaries are better off with Original Medicare paired with regular Medicaid as secondary coverage if their providers accept those programs, but not D-SNP plans. In many states, the fee-for-service Medicaid benefit also covers dental or vision care.

Here is more information about programs available to Medicare beneficiaries with limited incomes and assets.

Which Path You Take Will Determine How You Get Your Medical Care And How Much It Costs

by Dena Bunis, AARP, Updated October 12, 2021

Getty/AARP

En español | As you think about how Medicare will cover your health care needs, your first major decision should be whether you want to enroll in federally run original Medicare or select a Medicare Advantage plan, the private insurance alternative.

Think of it as choosing between ordering the prix fixe meal at a restaurant, where the courses are already selected for you, or going to the buffet , where you must decide for yourself what you want.

If you elect to go with original Medicare, your buffet will include Part A , Part B and Part D . If you decide to go with Part C, a Medicare Advantage plan, it will be more like a set menu, since a private insurer has already bundled together parts A and B and almost always D into one comprehensive plan.

Some aspects of your care will be constant whichever plan you choose. Under both choices, any preexisting conditions you have will be covered and you’ll also be able to get coverage for prescription drugs.

But there are significant differences in the way you’ll use Medicare depending on whether you pick original or Advantage. Here’s a comparison of how each works.

Recommended Reading: How To Renew Medicare Benefits

Learn About These Plans

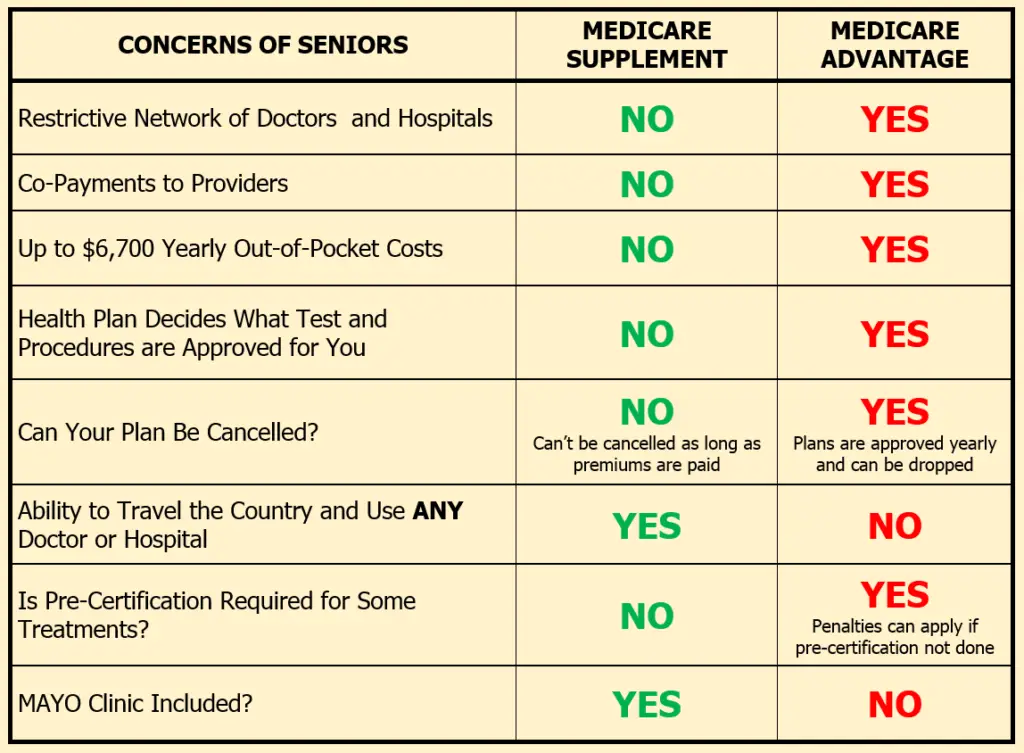

What is Medicare Advantage PPO vs Medicare Supplement Plans?

You might think a Medicare Advantage PPO plan is the same as a Medicare Supplement Plan. There are similarities, but there are a lot more differences than youd think. Lets look at the differences to determine whether you are more suited for a Medicare Advantage PPO vs a Medicare Supplement Plan.

How And When Should I Enroll

To be eligible for Medicare supplement plans or Medicare Advantage, seniors must be enrolled in or eligible for Medicare Parts A and B. Eligible seniors are at least 65 years old and have been legal U.S. citizens or residents for at least five consecutive years. They must also live within the service area for their preferred Medicare Advantage or Medicare supplement plan.

Upon turning 65 years old, a senior can enroll in a Medicare Advantage plan. They may also sign up for a new plan or switch plans during the two annual open enrollment periods, or if they qualify for special enrollment if they lose coverage due to moving outside their plans service area. To enroll, , select the Medicare Advantage plan option and provide your zip code.

Generally, seniors should enroll in a Medicare supplement plan during their open enrollment period, which is within six months of the month they turned 65. At this time, health insurance companies must sell Medicare supplement plans at the best rate, regardless of the enrollees health status, and their ability to exclude coverage for pre-existing conditions is limited. Plans can also be purchased within 63 days of losing certain types of health coverage. Outside of these windows, insurance companies can refuse to sell Medigap policies, charge higher premiums or impose waiting periods. To find plans, seniors can and enter their information.

Also Check: What Age Do You Apply For Medicare

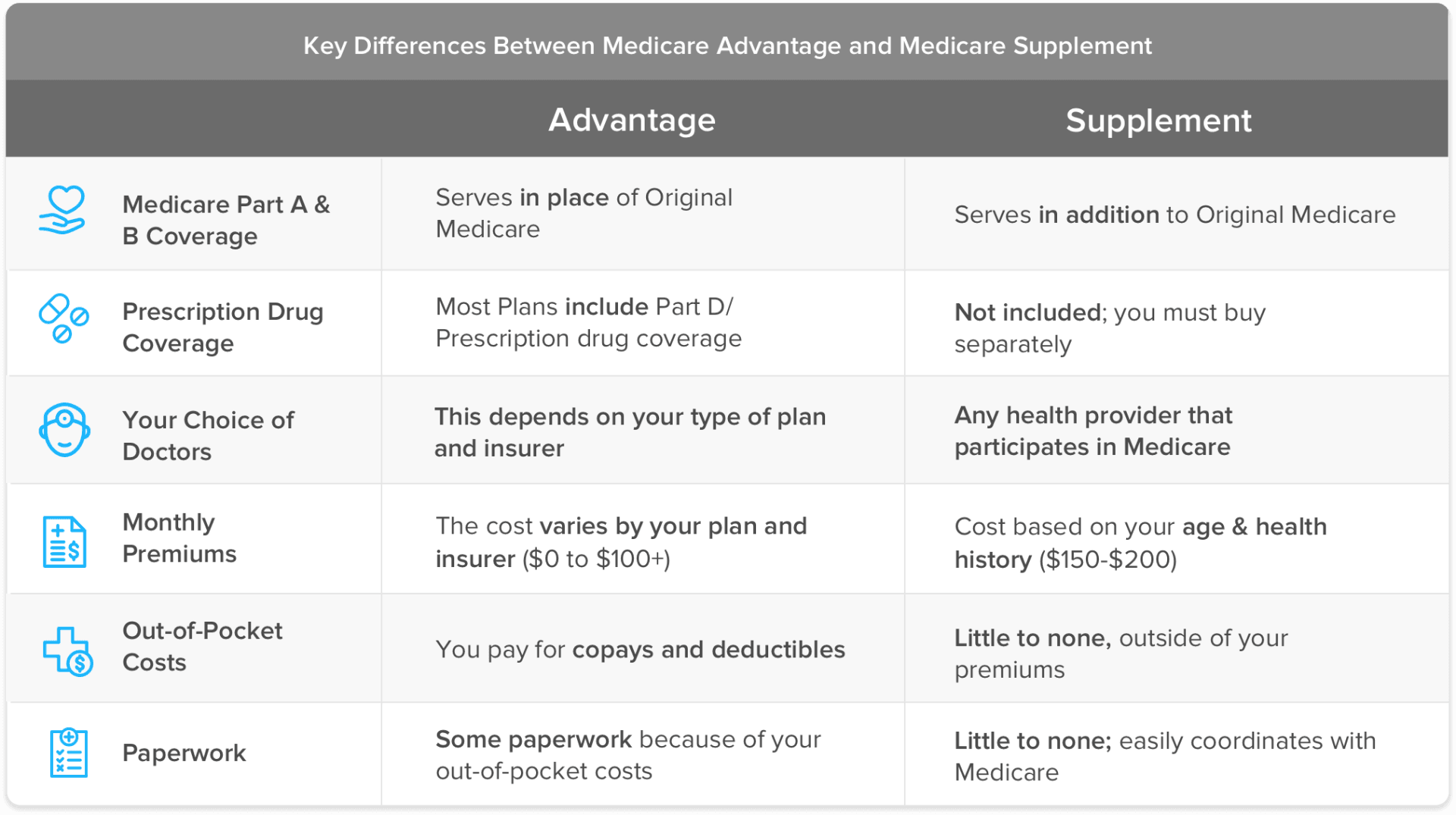

Medicare Advantage Vs Medicare Supplement: The Basics

Medicare Supplement insurance plans go alongside Original Medicare and help pay for out-of-pocket costs not typically covered by Original Medicare. Since Original Medicare has no out-of-pocket maximum, a Medicare Supplement plan could give you a safety net against high medical costs if you face a serious health setback.

Neither Original Medicare nor Medicare Supplement insurance plans typically cover the prescription drugs you take at home. If you want coverage for most prescription drugs, you will generally need to combine Original Medicare and a Medicare Supplement insurance plan with a stand-alone Medicare Part D prescription drug plan.

You coverage with a Medicare Supplement insurance plan and a stand-alone Medicare Part D prescription drug plan could look like this:

Medicare medical and hospital insurance + Medicare Supplement + stand-alone Medicare Part D prescription drug coverage = comprehensive Medicare coverage

This combination of insurance is quite comprehensive. You still may have some out-of-pocket Medicare costs. You generally pay separate premiums for Medicare Part B, Medicare Supplement insurance, and Medicare prescription drug coverage.

You coverage with a Medicare Advantage plans could look like this:

Medicare medical and hospital insurance + Medicare prescription drug coverage = comprehensive Medicare coverage

Medicare Advantage Vs Medicare Supplement Plans

COVID-19 Update: With social distancing and stay-at-home orders, many seniors are struggling with loneliness and isolation. Weve developed a list of products that caregivers or seniors can purchase to help older adults stay happy, healthy and connected, whether they are aging in place at home or in an assisted living community.

The high cost of healthcare in the United States makes health insurance coverage a necessity for most people, particularly seniors who are more prone to health problems and are more likely to live on fixed incomes. The federal government provides basic health insurance for adults aged 65 and over through Medicare Part A, which covers inpatient hospital care, and Part B, which covers outpatient medical care. However, this coverage is far from comprehensive, causing many retirees to seek additional coverage through either Medicare supplement plans or Medicare Advantage plans.

Medicare supplement plans, also called Medigap plans, and Medicare Advantage plans are both sold by private health insurance companies and provide coverage for a broad range of healthcare services. While Medicare supplement plans are purchased in addition to Original Medicare Parts A and B, Medicare Advantage plans are an alternative to Original Medicare. Both plans offer unique benefits and drawbacks, so its important for retirees to understand which type of coverage best suits their needs.

Read Also: Does Medicare Pay For Entyvio

Medicare Supplement Plans: Standardized Benefits

Every private insurance company that offers Medicare Supplement plans must follow federal and state laws designed to protect consumers. The policy must be clearly identified as Medicare Supplement Insurance. Insurance companies in most states can sell only standardized Medicare Supplement plans, identified by letter. You can find coverage details about all 10 standardized Medicare Supplement plans using the Medicare Supplement Plan Comparison Chart.

Whats The Difference Between Medicare Advantage And Medicare Supplement Insurance Plans

June 2, 2021 / 5 min read / Written by Anna L.

There are different ways that you can receive your Medicare coverage, or add onto that coverage. Medicare Advantage and Medicare Supplement insurance are options that may sound similar, but theyre quite different. They do have one main thing in common: theyre both offered by private insurance companies.

Recommended Reading: Does Medicare Cover Total Knee Replacement

Can I Switch Between Medicare Advantage And Medicare Supplement Plans

Switching from a Medicare supplement plan to Medicare Advantage is relatively simple and can be done during the annual open enrollment periods. Switching from Medicare Advantage to Original Medicare with a Medicare supplement plan is possible, but is considerably more challenging and may result in higher out-of-pocket costs.

Can You Change From A Medicare Advantage Plan To A Medicare Supplement Plan

During the Annual Enrollment Period, which runs from October 15 to December 7 each year, you are free to reconsider your Medicare coverage. If you decide you want to try a Medicare Supplement plan vs. Medicare Advantage plan, you can make that change during this period.4

Considering Medicare Advantage vs. Medicare Supplement? One is not better than the other. They provide different types of coverage. Finding the right fit for you depends on what kind of Medicare coverage youre seeking, as well as your health care needs. Review all details of plans when shopping and be open to considering alternatives when your needs change.

Recommended Reading: Does Medicare Cover Bladder Control Pads

How To Enroll In A Medicare Advantage Plan

Once youve done your research and found a Medicare Advantage Plan that fits your needs, there are various ways to enroll:

-

Use Medicares Plan Finder to find the plan in your area. Click on Enroll.

-

Go to the plans website to see if you can enroll online. Contact the plan to get a paper enrollment form. Fill it out and return it to the plan provider.

You will need your Medicare number and the date your Medicare Part A and/or Part B coverage started.

Keep in mind that you can only enroll in a Medicare Advantage Plan during your Initial Enrollment Period or during the Open Enrollment Period from Oct. 15 to Dec. 7. Once youre enrolled in a Medicare Advantage Plan, you can switch plans during Medicare Advantage Open Enrollment from Jan. 1 to March 31 each year.

How Do I Choose Between Medicare Advantage And Medigap

Do you want predictable costs, the freedom to choose any doctor that accepts Medicare, to avoid referrals, and have coverage while traveling? If you answered yes to those questions, you want Medigap. Are you okay with unpredictable copayments, strict doctor networks, and referrals? What if it includes Part D? If you answer Yes to these questions, Medicare Advantage could work for you.

The best part about working with agents that dont care which option you choose? Well, the non-biased recommendations, of course! First, our agents can answer all your Medicare questions. Then, when you work with your agent, theyll ask you a few questions to better understand your needs.

Once they know what youre looking for, they can make a recommendation based on your situation. For example, if youre looking for a Medigap plan that saves you money on premiums, our agents can make a few suggestions. But, of course, if youre looking for Medicare Advantage type coverage, we can help too.

Give us a call at the number above to learn about your best plan options today! Or, fill out an online rate form to compare rates now!

- Was this article helpful ?

Also Check: Is Blood Pressure Monitor Covered By Medicare

What Is The Downside To Medicare Advantage Plans

The downside to Medicare Advantage really depends on who you are and your health condition. Cost is a potential downside if you dont have assistance from Medicaid or an employer. Referrals are a potential downside if you need frequent care or you want a choice in the providers you use. These downsides do not exist with Original Medicare and a good Medigap policy, such as a Plan F or Plan C.

Another downside to Medicare Advantage is the annual open enrollmentIn health insurance, open enrollment is a period during which a person may enroll in or change their selection of health plan benefits. Health plan enrollment is ordinarily subject to restrictions…. period every Fall. This is when you can choose a new plan, but its also when insurers can change their plans. It is a big task comparing Part C HMO and PPO plans to make sure youre getting the coverage options you need with low health care costs.