If Youre 65 Or Older:

If you apply for Medigap coverage after your open enrollment period, theres no guarantee an insurance company will sell you a policy. Insurers can:

- Request your medical history as part of the conditions of issuing you a plan

- Refuse to sell you a policy

- Make you wait for coverage to start

- Charge you more

Can I Keep My Plan G If I Move To Another State Or Country

If you move to another state and your plan’s Supplement Plan G is available in your new location, you can keep your plan. If it’s not available in your new location, you may need to switch plans or providers if other companies offer Plan G coverage in your new area. You can keep your Medicare Plan G coverage if you move to another country, although it wouldn’t cover care other than emergency care visitsand that’s after a $250 deductible.

If you plan to move back to the U.S., it may be worth keeping Medicare Plans A and B, though Plan B may incur higher premiums. It depends on how long you plan to be gone and other insurance options for you in your new home country.

How We Chose The Best Medicare Supplement Plan G Companies

When we set out to select the five best Medicare Supplement Plan G providers, the first thing we looked at was geographical coverage. We made sure that the plans we mention here cover at least 40 states to allow for the most possible coverage for as many people as possible. From there, we determined the five best plans by studying pricing, ease of website use and application, educational information, extra benefits, and more.

Recommended Reading: How To Apply For Medicare Through Social Security

How To Switch Medicare Advantage Plans

If you want to change Medicare Advantage plans, you can do so once a year, either during Medicare’s fall open enrollment period or the Medicare Advantage open enrollment period .

You also can change to Original Medicare during these periods, but it could be hard to get a Medicare Supplemental Insurance policy if you switch after the first year. In most states, insurers are required to issue you Medigap policies only during your initial Medigap enrollment period , or if you switch out of your Medicare Advantage plan in the first year. After that, insurers may deny you a Medigap policy if you have health problems, or they can require a waiting period before your preexisting conditions are covered.

Medicare Supplement Plans: Availability And Costs

Each standardized, lettered Medicare Supplement plan must offer the same basic benefits, no matter which insurance company sells it. But the plan premiums may vary from one insurance company to another. So, once you have decided which standardized Medicare Supplement plan may best suit your needs, it may be a good idea to compare the plans offered where you live. By clicking on the Compare Plans or Find Plans link on this page, you can learn more about the availability and cost of Medicare Supplement plans in your area. This is an important step in your consideration for two reasons:

You May Like: Does Medicare Cover Dementia Care Facilities

What Is Included In Medicare Supplemental Plan G

Medicare Plan G covers almost everything Original Medicare does not. It doesnt extend the scope of care, just the amount of coverage included. Plan G coverage includes excess charges leftover from the 80% that Original Medicare does not cover, including Part A and Part B copays and Part As deductible. The other big difference: Plan G does not cover the Part B deductible, which needs to be met. However, that payment does count toward the Plan G deductible as well.

The Plan B deductible for 2022 is $233, so youll have to pay at least this much, but that means you can subtract that amount from your expected Plan G deductible as well.

How Do You Select A Medicare Supplement Insurance Company That Works For You

After youve researched and compared companies, you will select a supplemental insurance company that works best for you. You will want to consider things like the reputation and reviews of the insurance company as well as how easy it is to navigate their website and apply for coverage. Additional factors to consider include types of plans available, pricing, and deductibles. You may also want to select a company that has an app so you can manage your policy on the go.

Also Check: When Is The Enrollment Period For Medicare Part D

What Are The Benefits Of Buying A Medicare Supplement Plan

The benefit of a Medicare Supplement plan is that it pays for the costs that are not paid for by Original Medicare. These include coverage for prescription medications, hospital stays, hospice care, bloodwork, and emergency room visits. It can drastically limit the out-of-pocket expenses that you may be hit with.

Choosing Traditional Medicare Plus A Medigap Plan

As noted above, Original Medicare comprises Part A and Part B . You can supplement this coverage with a stand-alone Medicare Part D prescription drug plan and a Medigap supplemental insurance plan. While signing up for Medicare gets you into Parts A and B, you have to take action on your own to buy these supplemental policies.

Recommended Reading: Is It Medicaid Or Medicare

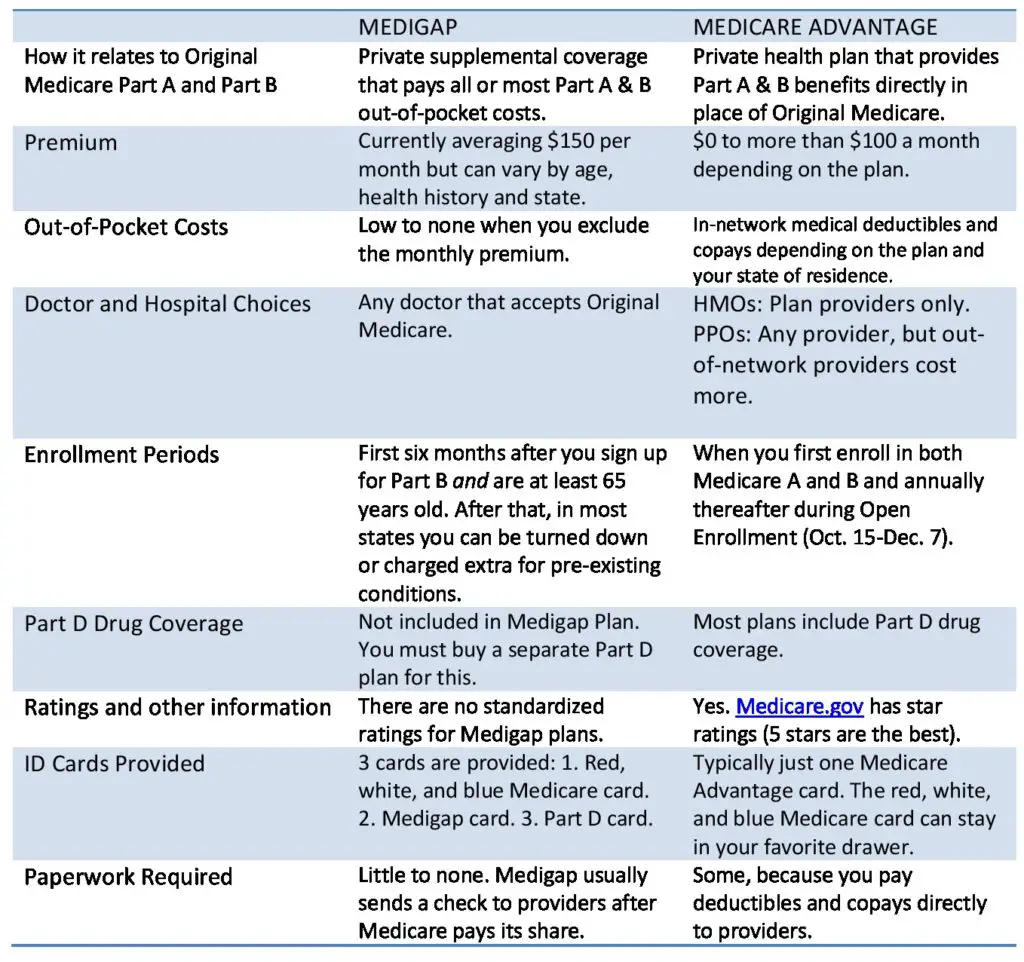

Potential Features Of Medigap Plans Vs Medicare Advantage Plans

Use the chart below to quickly and easily compare some of the key features that can differentiate Medicare Supplement Insurance plans vs. Medicare Advantage plans.

| Over 22 million Medicare beneficiaries 1 | 13.5 million Medicare beneficiaries2 | |

| Coverage of Medicare out-of-pocket costs | No coverage of Original Medicare out-of-pocket costs, but MA plan out-of-pocket costs may be more affordable than what Original Medicare includes | Coverage for Medicare Part A and B deductibles, copayments and coinsurance |

| Additional health benefits not found in Original Medicare | Can offer additional benefits, such as dental, vision, hearing and prescription drug coverage, among other benefits | No additional benefits to what Medicare offers, except for qualified emergency care received outside of the U.S. |

To learn more about Medicare Advantage plans and to find out about the plan options where you live, call to speak to a licensed insurance agent today.

Compare Medicare Advantage plans in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Best Discounts For Multiple Policyholders: Cigna

Cigna

-

Fewer plan options than some other companies

-

No pricing listed on the site without providing personal information

Cigna offers the best premium discounts for healthy policyholders as well as households with multiple policies through Cigna, including a 7% household discount and a 5% discount for online sign-up that remains in effect for the life of the policy . While Cigna offers fewer plans than some of its competitors its easy-to-use website has information clearly separated into categories, with an itemized breakdown of each plan when you click on “details” in the plan comparison chart. This allows for easy comparisons while avoiding presenting too much information at once. Cigna also offers a short educational video to explain “the basics of Medicare Supplement insurance.”

Cigna has been in business since 1792, making it one of the oldest companies we reviewed, and the company’s financial strength is currently an A according to AM Best. If youre willing to answer some detailed health history questions, you can see personalized quotes on the website, or you can contact them by phone.

You May Like: How To Pick The Best Medicare Plan

Best Overall: Mutual Of Omaha

Mutual_of_Omaha

- No. States Available: Enter zip code to find out

- Providers In Network: Not disclosed

The company offers multiple plans, a comprehensive website that is user-friendly, and customer discounts.

-

Comparison charts for different plans

-

Customer reviews on the plan information page

-

Multi-step process to pay online

-

No app for Medicare Supplement insurance

In business since 1909, Mutual of Omaha offers high quality, in-depth information through the company website. The website is simple, uncluttered, and includes a comparison checklist showing who each plan is best for, with the option to include further coverage . Mutual of Omaha also offers a 7% discount if your spouse or domestic partner has applied for, or is applying for, coverage with Mutual of Omaha or an affiliate company.

However, the company only offers three plans . To get price estimates, you need to include information on your gender, date of birth, and ZIP code. You can contact them online or over the phone for a personalized quote, but the company does not offer a mobile app for its Medigap customers. Mutual of Omaha is ranked by AM Best at A++ for financial health.

Cost Of Monthly Premiums

Medicare Advantage: When you have a Medicare Advantage plan, you will continue to pay your Medicare Part B premium. Some plans include additional monthly premiums and some do not. There are even certain plans that will help pay for your Medicare Part B premium.9 The average premium for a 2021 Medicare Advantage plan that includes prescription drug coverage is approximately $21.10

Medigap: When you have a Medigap plan, you will continue to pay your Medicare Part B premium and youll have a separate premium for your Medigap plan.2 Your Medigap premium will vary based on the plan, your age, location, and the insurance provider you select.8B

Read Also: Do Medicare Advantage Plans Cover Home Health Care

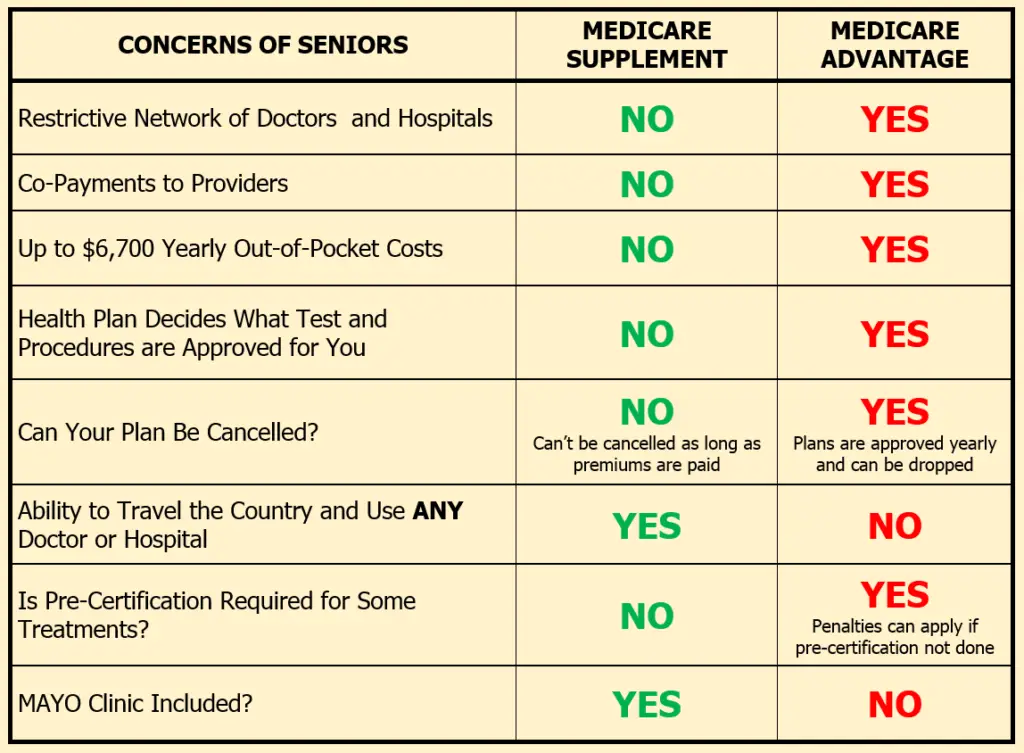

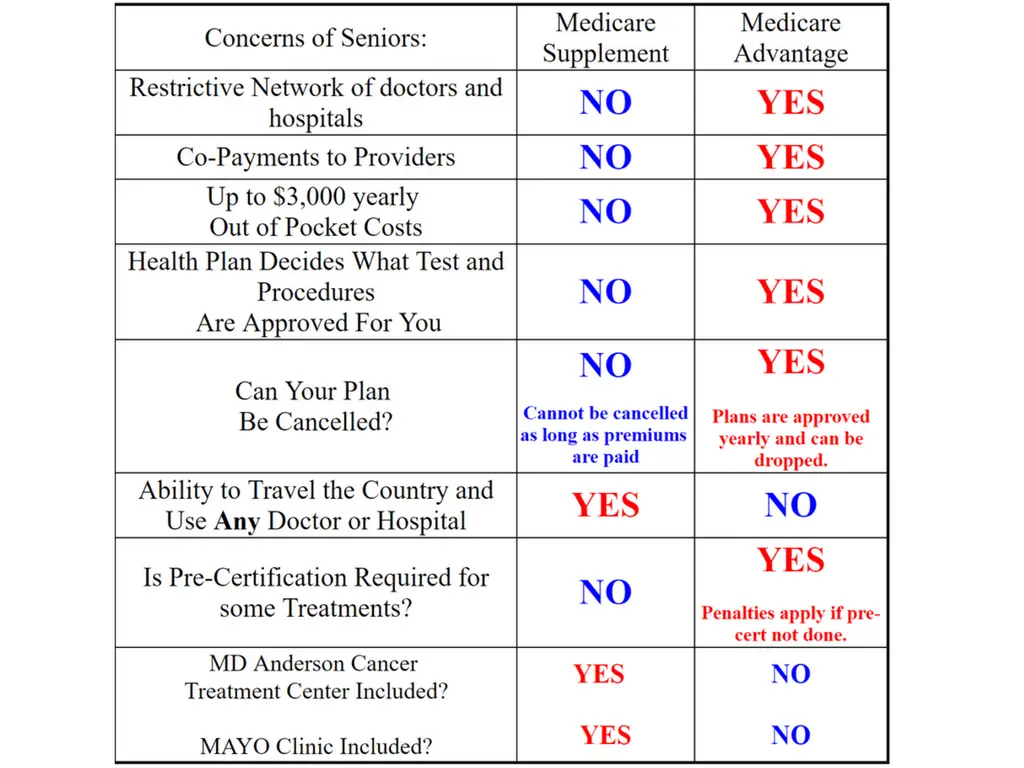

The Main Difference Between Medigap And Medicare Advantage

So whats the key difference between these two types of insurance?

- Medicare Advantage provides coverage for certain health care benefits, and some plans may offer additional benefits not covered by Original Medicare.

- Medicare Supplement Insurance provides coverage for certain out-of-pocketcosts not covered by Original Medicare.

In short, if youre satisfied with the benefits offered by Original Medicare but want some help paying for your out-of-pocket Medicare costs, a Medicare Supplement Insurance plan might be something for you to consider.

If you arent completely satisfied with your Original Medicare coverage and would like to find a health insurance plan with some additional coverage, you may want to consider a Medicare Advantage plan.

Its important to note that you cannot enroll in both a Medigap plan and a Medicare Advantage plan simultaneously.

Now that weve highlighted some of the main differences between these types of insurance, lets compare five additional features of each type of plan: cost, availability, eligibility, enrollment opportunities and popularity.

How Are Medicare Advantage And Medigap Different

The biggest difference between Medicare Advantage and Medicare supplemental insurance is the way they work.

Medigap is intended simply to cover some of the gaps that Original Medicare doesnt pay for coinsurance, copayments and deductibles, for instance. Original Medicare only pays 80 percent for Medicare-covered services such as doctors services and outpatient medical services and supplies.

Medicare Advantage plans are an alternative to Original Medicare. Sold by private insurers, these plans cover everything that Original Medicare does but may offer extra benefits for things that Medicare doesnt, including dental and vision care.

You may have fewer choices in terms of doctors and health care providers in some cases with Medicare Advantage plans. With Medigap, you have access to any doctor or provider who accepts Medicare.

Legally, you cannot have Medigap coverage with a Medicare Advantage plan. However, you may be able to switch between the two plans.

Biggest Differences Between Medicare Advantage and MedigapPrepare for the Medicare Advantage Open Enrollment Period

Read Also: Which Of The Following Is True Regarding Medicare Supplement Policies

Medigap Vs Medicare Advantage: Which One Should I Choose

The best advice we could give you is to speak with a licenced insurance agent to take you through the pros and cons of the two plans depending on your health situation.

Generally, people who have serious health issues that require expensive treatment may choose the coverage of Medigap plans and those you are in good health and do not have high care costs could go for the low-budget Medicare Advantage.

Is Medicare Advantage Or Medigap Coverage Your Best Choice

Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

Speaking with a licensed insurance agent about your particular health situation can help you decide which is best for you. Since you are not allowed to have Medicare Advantage and Medigap at the same time, you have to choose carefully to make sure you have suitable coverage for your specific situation.

Weighing what options are most important to you and talking with a licensed insurance agent about your particular wants and needs can help you make an informed choice between Medicare Advantage and Medigap.

Also Check: Does Medicare Part A Cover Doctors In Hospital

You Can’t Have Both So You Must Choose Wisely

Consumer ReportsOncology TimesMEDICAThe New York Times MagazinePsychology TodaySports Illustrated

Our editors independently research and recommend the best products and services. You can learn more about our independent review process and partners in our advertiser disclosure. We may receive commissions on purchases made from our chosen links.

Anyone who’s ready to sign up for Medicare has a lot of decisions to make. But one decision is especially importantshould you choose Medicare Advantage or use Medigap to supplement your Original Medicare plan?

What Is Medicare Advantage

Medicare Advantage, also called Medicare Part C, is a type of Medicare health plan offered by private insurance companies. It provides an alternative to Original Medicare for hospital insurance and medical insurance. Medicare Advantage plans have at least the same benefits as Original Medicare, but these types of plans typically offer more coverage. In addition to hospital and medical costs, many Medicare Advantage plans cover dental, vision, and hearing services. Most Medicare Advantage plans also include prescription drug coverage .

Medicare Advantage coverage is offered by Medicare-approved private insurance companies instead of being managed directly by the federal government. However, plans must follow Medicares coverage rules. Plans must also provide members with the same protections as Original Medicare. In most cases, Medicare Advantage enrollees will need to use health care providers that participate in the plans network and service area. Therefore, a Medicare Advantage plan typically offers a limited selection of physicians and facilities compared with Original Medicare.

People who are eligible for Original Medicare are also eligible to enroll in a Medicare Advantage plan if theyre at least 65 years old or have a qualifying disability. Enrollees must also:

- Live in an area where Medicare Advantage plans are sold

- Be a U.S. citizen or permanent resident

- Not have end-stage renal disease although SNPs may still be an option

- Not be enrolled in Medigap insurance

You May Like: Does Medicare Pay For Cpap Machines And Supplies

You Donthave To Do It Alone

Signing up for Medicare, figuring out Medicare benefits, and choosing the right plan for you can feel like youre all alone in a sea of technical terms and plan letters. But it doesnt have to be like that!

Once youhave a good grasp on the difference between Medigap and Medicare Advantage, youshould take some time to go through the official government website and use their tools to determine the price and coverage thatfits into your budget and lifestyle.

Each plan has positives and negatives, and there is no universal right or wrong answer here. Its all about what fits your lifestyle and your budget, so choose based on what is right for you, not for anyone else.

Continue Reading:

How Much Does Medicare Advantage Cost

Many Medicare Advantage plans have a $0 premium, so be sure to explore your options. Baethke explains it like this: If you enroll in a plan that does charge a premium, you must pay this fee every month in addition to your Medicare Part B premium, which is around $149 .

Medicare Part Bs coinsurance and the deductible is $203, according to Medicare.gov, and once they are met, your copay under Medicare Advantage is typically 20% of the Medicare-approved amount for most services and products, such as durable medical equipment like glucometers, walkers, hospital beds and more.

Read Also: Should I Get Medicare Part C

Best In Pricing: Aetna

Pricing can be challenging to estimate since everyone has a different personal situation, and costs may vary from state to state. Aetna offers competitive pricing when compared to other providers. As with other plans, there is both a standard option and a high-deductible option, and your monthly premium will be affected by your choice.

-

Plans are easy to compare

-

Only requires basic personal information to be entered once

-

Household discount available

-

Limited educational information available on the page

-

No way to select and purchase a plan directly from the comparison page a phone call is required

-

No extra benefits

While quotes are available online after entering personal detailslike gender, ZIP code, date of birth, and plan start datein the rate calculator, the option to continue the process from there is not. You will need to create an account or call a representative to move forward with the coverage process.

Aside from the household discount, there arent any extra benefits included with this plan. It only fills in the federal governments gaps for Medicare Part A and B coverage . If you need more discounts or extra support, it may be better to pay a bit more to get the exact coverage you need.