Medicare Part D Late Enrollment Penalty Example Cost Calculation

A hypothetical example can make this a bit easier to understand If you were without drug coverage for 10 months, in 2022 you would be charged 1% of the national base beneficiary premium, $33.37 for the 10 months. This would be 1% x $33.37 = around $3.33 per month that must be paid in addition to your Medicare Part D premium. The longer you are without creditable coverage, the higher the penalty youll have.

Medicare calculates your penalty amount each year and reports it to your Medicare Part D Prescription Drug plan or Medicare Advantage plan. Your Medicare Part D Prescription Drug plan will then send you a letter detailing the amount of your penalty.Just in case youre casually scrolling this article, let me be super clear: your Medicare Part D Late Enrollment Penalty is permanent.Below are the national base average Medicare Part D Prescription Drug plan premium values used to calculate the late enrollment penalties for the past few years:

| 2022 |

Are There Any Exceptions To The Medicare Late Enrollment Penalties

For Parts A and B, you may not have to pay a late enrollment penalty if you qualify for a Special Enrollment Period. You might qualify for a Special Enrollment Period if you were eligible for Medicare but didnt enroll because you were still working. This would exempt you from penalties.

For example, if you or your spouse recently stopped working and were previously covered by your jobs insurance plan, your Special Enrollment Period begins anytime you are still covered by your jobs plan, or during an eight-month period starting the month your employment or your coverage ends.

For Part D, you will not have to pay a late enrollment period if you qualify for Extra Help.

How Do I Appeal The Medicare Part B Penalty

If you feel that the Medicare Part B penalty should not apply, you may request a review. Medicare has reconsideration request forms to file an appeal.

Unfortunately, you will still pay the Medicare Part B penalty while waiting for your appeal to process. Additionally, there is no timeline by which Medicare must abide when processing your appeal.

- Was this article helpful ?

Also Check: Where Do I Get Medicare Part D

How Do I Avoid Getting A Late Enrollment Penalty For Medicare Part D

First, you should try to sign up during the initial enrollment period, which starts three months before the month you turn 65 and lasts three months after the end of that month. If you have creditable drug coverage under a plan other than Medicare, make sure to sign up for Medicare Part D within 63 days after the creditable drug coverage ends. Lastly, make sure to have proof of creditable drug coverage to avoid a late enrollment penalty.

How Much More Will I Pay For A Late Enrollment Penalty

The cost of the late enrollment penalty depends on how long you didnt have creditable prescription drug coverage. Currently, the late enrollment penalty is calculated by multiplying 1% of the national base beneficiary premium by the number of full, uncovered months that you were eligible but didnt enroll in Medicare drug coverage and went without other creditable prescription drug coverage. The final amount is rounded to the nearest $.10 and added to your monthly premium. Since the national base beneficiary premium may increase each year, the penalty amount may also increase each year. After you enroll in Medicare drug coverage, the plan will tell you if you owe a penalty and what your premium will be.

Example: Mrs. Martinez is currently eligible for Medicare, and her Initial Enrollment Period ended on May 31, 2017. She doesnt have prescription drug coverage from any other source. She didnt join by May 31, 2017, and instead joined during the Open Enrollment Period that ended December 7, 2019. Her drug coverage was effective January 1, 2020.

2020

Since Mrs. Martinez was without creditable prescription drug coverage from June 2017December 2019, her penalty in 2020 was 31% of $32.74 or $10.15.

Since the monthly penalty is always rounded to the nearest $0.10, she paid $10.20 each month in addition to her plans monthly premium.

Heres the math: .31 × $32.74 = $10.15

$10.15 rounded to the nearest $0.10 = $10.20

2021

Heres the math: .31 × $33.06 = $10.25

Read Also: Can You Apply For Medicare Part B Online

How Can I Avoid The Medicare Part B Penalty

One way to avoid the Medicare Part B Penalty is to enroll during your Initial Enrollment Period. If youre turning 65, you can enroll in Medicare Part B during this enrollment period.

Your Initial Enrollment Period begins on the first day of the month, three months before you turn 65. It then lasts through your birth month and ends on the last day of the third month following your birth month. This means that if your 65th birthday is June 15, you can enroll between March 1 and September 30.

Suppose you do not enroll in Medicare Part B during your Initial Enrollment Period. In that case, you usually must wait for the General Enrollment Period before you can sign up unless you are eligible for a Special Enrollment Period. If so, your Special Enrollment Period may protect you from the late enrollment penalty.

General Enrollment runs from January 1 through March 31 each year. When you use this window to sign up for Medicare Part B, your coverage will be active on July 1. The General Enrollment Period is available to those who delayed Medicare benefits without creditable coverage.

Suppose your Initial Enrollment Period ended on November 30. If you wait to enroll until the General Election Period which starts January 1 the following year, you did not let an entire 12-month period go by before your Medicare Part B coverage was effective. Thus, you will avoid the Medicare Part B penalty.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Do I Have To Sign Up For Medicare When I Turn 65

It depends. Most people whove worked and paid taxes are eligible for premium-free

, on the other hand, requires that you pay a monthly premium , so if you feel you dont want it or need it, you may assume you can just delay your enrollment.

But depending on your circumstances, it may be in your best interest to to avoid any late enrollment penalties.

Don’t Miss: Does Medicare Cover Medical Massage

What Are Exceptions To The Part A Late Enrollment Penalty

If you dont qualify for premium-free Part A, you may have to pay a late enrollment penalty if you dont enroll in Part A during your initial enrollment period, which is the three months before to the three months after the month you turn 65. Here are the exceptions:

- Employer coverage. If you or your spouse actively works and receives medical insurance, you have the right to delay Part A as well as Part B enrollment until the employment ends. If you or your spouse has earned 40 work credits by that time, you can sign up for Part A without paying premiums or incurring late penalties. If neither of you has earned 40 credits by then, you will not pay late penalties retroactively. But you must enroll in Part A during your eight-month special enrollment period to avoid penalties going forward.

- Medicaid. If you are part of the federally financed but state-run health program for people with incomes under a certain amount, you do not pay Part A premiums and cannot pay late penalties.

- Medicare Savings Programs. If your state pays your Part A premiums under one of the Medicare Savings Programs, you are not liable for late penalties.

- Living abroad. If you live outside the United States and are not entitled to premium-free Part A, you cannot enroll in Part A or Part B as long as you live abroad. Instead, you get a special enrollment period of up to three months after you return to the U.S. to sign up. If you enroll in Part A at that time, you are not liable for late penalties.

What Is The Medicare Part D Premium Penalty

The Medicare Part D late enrollment penalty is a permanent premium surcharge added to the bills of those who go too long before signing for coverage. The simplest way to avoid this surcharge is to enroll in Medicare Part D during Medicare’s initial enrollment period. This starts three months before the month of your 65th birthday and ends three months from the end of the birthday month. That means you have seven months, including your birthday month, to enroll without a penalty. For example, if your birthday is in April, then your initial enrollment period runs from Jan. 1 through July 31.

From that point on, you cant go without prescription drug coverage for more than 63 days in a row, or youll owe a penalty. The penalty is a lifetime surcharge on your Part D premiums once you enroll.

You May Like: Is A Psa Test Covered By Medicare

Medicare Part B Penalty

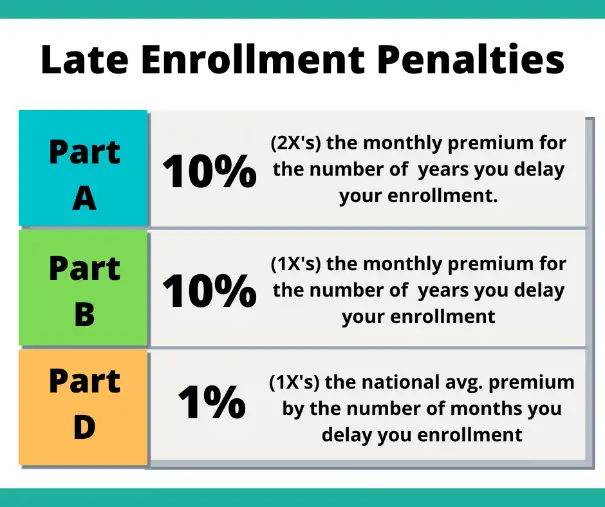

The penalty for late enrollment in Medicare Part B is lifelong. For every full year that you delay Part B enrollment, your monthly premium increases 10 percent. You will pay this higher premium for as long as you have Medicare Part B.

Late enrollment for Medicare Part B also delays the start of your coverage. Once you miss the initial enrollment period, you cannot enroll in Part B until the general enrollment period . Coverage does not start until July 1 of that year.

When Can You Sign Up For Medicare

The first time you can enroll in Medicare is during your Initial Enrollment Period . Your IEP is unique to you and lasts seven months, starting three months before the month you turn 65 and ending three months after your birth month.

So, if you were born in July, your IEP would start April 1 and end October 31. The exception is if your birthday falls on the first of the month, in which case your enrollment window opens and closes one month earlier, March 1 through September 30.

Once you’ve signed up for Original Medicare, you may then choose a Part C and/or Part D plan. This is also the best time to enroll in a Medigap plan, if you decide you want supplemental coverage.

Please note that, if you do not sign up for a Part D plan during your Initial Enrollment Period AND do not have prescription drug coverage elsewhere, you may end up with lifelong late enrollment penalties when you do finally join a Part D plan.

Recommended Reading: What Is The Maximum Out Of Pocket For Medicare

Can I Get A Part B Penalty Waived

People make Medicare enrollment errors for a variety of reasons, and equitable relief is not available for all of them.

If you find yourself without Part B coverage or are paying a penalty because you received bad advice from the federal government, Social Security may be able to waive your Part B penalty, enroll you into Part B, or do both things. This can be a big help if you would have otherwise had to wait to enroll during the GEP.

You can ask to be enrolled in Part B with a retroactive effective date if bad advice caused you to have a gap in coverage. If you do this, youll need to pay Part B premiums for the entire time you want to be enrolled. Alternatively, you can ask to have the Part B penalty waived and just be enrolled going forward. Be sure to clearly specify what it is you want Social Security to do when you make your request.

D Late Enrollment Penalty Reconsideration Notice

The Part D Late Enrollment Penalty reconsideration notice provides a detailed explanation of an enrollee’s right to request a reconsideration of his or her Late Enrollment Penalty. A Part D plan sponsor must complete the notice and send it to an enrollee when the plan first sends the enrollee a letter notifying him or her about the imposition of a Late Enrollment Penalty. Microsoft Word and Adobe PDF versions of this notice are available in the “Downloads” section below.

Read Also: How To Get A Copy Of Medicare Card

How Much Is The Medicare Part B Penalty

The penalty for late enrollment in Part B is an additional 10% for each 12-month period that you delay it.

Lets say your Initial Enrollment Period ended September 30, 2010, for example. Then you enroll in Part B during the General Enrollment PeriodThis is when you can enroll in Medicare if you didnt sign up during your Initial Enrollment Period. The General Enrollment Period is January 1 March 31 every year. You may have to pay a penalty for late enrollment. Coverage takes effect on July 1. in March 2013. Your late enrollment penalty would be 20% of the Part B premium, or 2 x 10%. This is because you waited 30 months to sign up, and that time period included 2 full 12-month periods.

In most cases, you have to pay the penalty every month for as long as you have Part B. If youre under 65 and disabled, any Part B penalty ends once you turn 65 because youll have another Initial Enrollment Period based on your age.

Medicare Part D Late Enrollment

Like Part B, the Part D late enrollment penalty is permanent.

The late enrollment penalty is decided by how long youve been eligible for Medicare, and how long its been since youve had creditable drug coverage since being eligible for Medicare. Creditable drug coverage is where your monthly coverage costs roughly just as much or more than the standard Part D premium.

The penalty increases by 1% per month youve been without creditable drug coverage. That percentage is multiplied by the current standard Part D premium, then rounded to the nearest dime, and then that figure is added onto your premium.

Example The 2021 base premium is $33.06. This is how your fees would be calculated if you were 14 months late:

- 14 months . $33.06 x .14 is $4.62

- $4.62 rounded to nearest $0.10 is $4.60

- $4.60 is the late enrollment penalty

- $33.06 + $4.60 is $37.66

Don’t Miss: Does Medicare Advantage Pay For Hearing Aids

Medicare Supplement Insurance Has No Late Enrollment Penalty

Medicare Supplement Insurance does not have any late enrollment penalties. However, theres a good reason to sign up for a Medigap policy when youre first eligible.

During your Medigap Open Enrollment Period , insurance companies are not allowed to use medical underwriting to determine your Medigap plan rates.

If you apply for a Medigap plan after your Medigap Open Enrollment Period, insurance companies can use your health to determine your plan premiums. They could even potentially deny you coverage altogether.

Although there is technically not a late enrollment penalty for Medigap, its easy to see how enrolling in a Medigap plan as soon as you are eligible can be beneficial.

What Is The Medicare Part D Late Enrollment Penalty

The rule: Youll pay an extra 1% of the average Part D premium for each month you dont enroll and dont have creditable coverage.

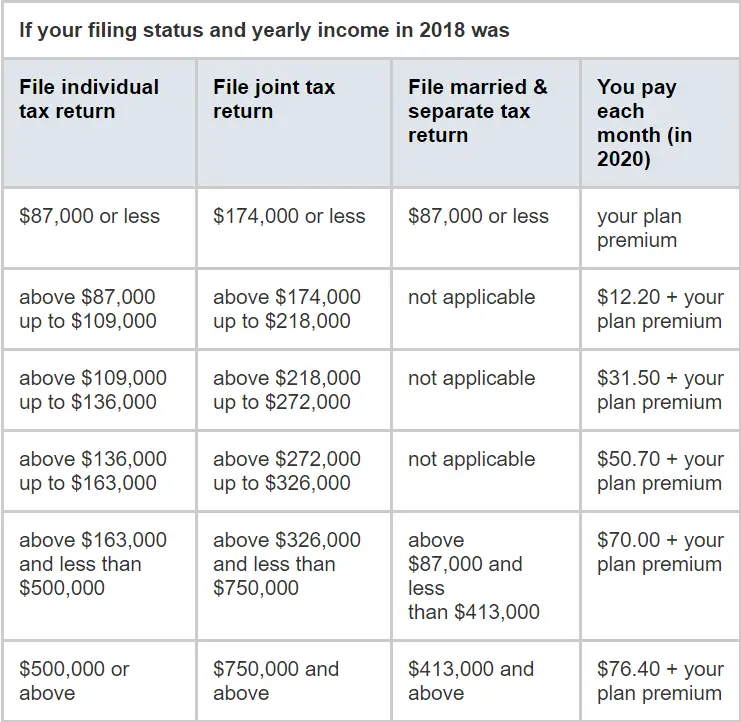

Medicare Part D covers prescription drugs and has its own monthly premium. And like Part B, your Medicare Part D cost is partly based on your income. But Part D doesnt have a standard charge. Instead, youll pay an Income-Related Monthly Adjustment Amount if you make $91,000 per year or more. These range from $12.40 to $77.90 per month .

Because theres not a standard payment amount, the Medicare Part D penalty is calculated using the national average for Part D premiums. That amount is $33.00 in 2022.

Read Also: Does Unitedhealthcare Medicare Advantage Cover Cataract Surgery

What Happens If You Lose Your Creditable Prescription Drug Coverage

If you retire or are laid off, or your spousal coverage ends, then your days of having creditable prescription drug coverage are numbered. However, youll have access to a special enrollment period to sign up for Medicare, including Part D, without penalty. This period lasts for two full months from when your coverage ends.

This special enrollment period will also apply when COBRA runs out if you enroll in COBRA and retain your former employers creditable coverage.

If your employers coverage changes and is no longer creditable, youll also have a two-month special enrollment period to sign up for Part D without penalty.

There Are Several Connections Between Medicare And Social Security But Medicare Is Its Own Entity

In short, no Medicare and Social Security are two separate programs. They do, however, work closely together and are often tied in people’s minds, so it makes sense that many assume the services are linked.

Medicare enrollment is done through Social Security, and you qualify for Medicare if you qualify for Social Security Disability Income regardless of whether you are 65.

If you are already collecting Social Security benefits when you turn 65, Medicare enrollment is automatic assuming you began receiving retirement benefits at least four months before turning 65. Your Medicare premiums come directly from your Social Security benefit if you are already drawing retirement.

Remember to keep your address information up to date, since Medicare uses the address on file with the Social Security Administration for all communication.

Read Also: Can You Get Dental Implants With Medicare

Find A $0 Premium Medicare Advantage Plan Today

1 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.