Medicare Premiums By Type

Itâs important to note that most Medicare beneficiaries get Medicare Part A for free. Generally, if you paid Medicare taxes for 30-39 quarters you will not have to pay for your Medicare Part A coverage.

If you have been paying Medicare taxes for less than 39 quarters, the standard Part A premium is $274 for 2022.

f you have been paying Medicare taxes for less than 30 quarters, the standard Part A premium is $499 for 2022.

The standard Medicare Part B premium amount is $170.10 for 2022. However, if you are a Medicare beneficiary with an annual modified adjusted gross income above the IRMA threshold, you will have to pay more for your Medicare Part B coverage.

Help With Medicare Part A And Part B Costs

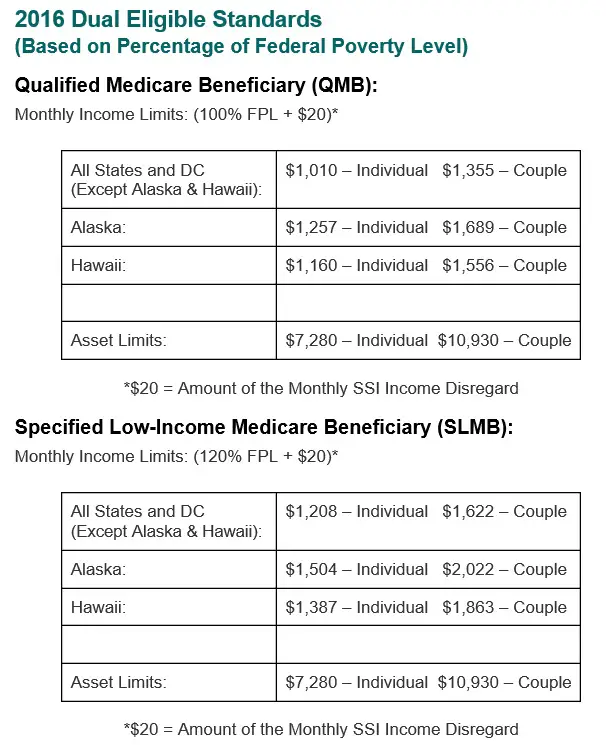

Please note that the income and resource limits listed here are for 2016.

If youre disabled or have a low income, you might qualify for a Medicare Savings Program through Medicaid. Besides helping with your Medicare Part A and/or Part B premiums, some MSPs might help with other Medicare Part A and Part B costs, such as coinsurance. There are four types of MSPs, each with different eligibility criteria:

Resources include, but arent limited to, money you have in the bank, stocks, and bonds they dont include certain possessions, such as your home. To find out if you qualify for a Medicare Savings Program, contact your state Medicaid office.

How Much Can You Expect To Pay For Medicare Coverage

Individuals making $88,000 or less and married couples who file a joint tax return and make $176,000 or less will pay the standard amount, i.e. their monthly payment will be $148.50. This is for Medicare part B. Individuals making between $88,000 and $111,000 and couples making between $176,000 to $222,000 will pay $207.90 a month, and the rates increase from there. A full breakdown of Medicares income limits and the corresponding IRMAA surcharges can be seen on pages 2 and 3 of this PDF, which is published by the official government website for Medicare.

Related: Do You Qualify For A Medicare Special Enrollment Period?

Part D prescription drug coverage is also affected by the aforementioned income limits. The additional amount you will pay for prescription coverage or Medicare part D ranges from $12.30 to $77.10, with the same income thresholds applied. Thats on top of any premium you pay, whether through a standalone plan or via the Advantage Plan, which typically includes drug coverage.

As for Medicare part A, most people do not pay for this coverage because they paid Medicare taxes while working. In order to receive free part A coverage you must have workedand paid Medicare taxesfor 10 years or more. If you dont get premium-free Part A, you may pay up to $471 each month.

You May Like: How Much Does Medicare Cost Annually

What Counts As An Asset

Medicare Savings Programs are only open to people who qualify based on income and asset requirements. So, what counts as an asset when it comes to qualifying?

- The house you live in

- One vehicle like a car, motor home or motorcycle

- Household items

- Burial funds up to $1,500 per person

There are four types of Medicare Savings Programs designed to help with paying costs for Original Medicare or Medicare Part B. They are distinguished by their income limits and what costs they help pay for. The programs include:

- Qualified Medicare Beneficiary Program

- This program helps to pay Part A and Part B premiums and copayments. It also helps to pay deductibles and coinsurance for both Part A and Part B.

- Asingle person can qualify for the program in 2022 with an income up to $1,153 per month.

- A couple can qualify with a combined income of $1,546 per month.

- The asset limits are $8,400 for an individual and $12,600 for a couple.

- Specified Low-Income Medicare Beneficiary Program

- This program helps to pay premiums for Part B.

- A single person can qualify in 2022 with an income up to $1,379 per month.

- A couple can qualify with a combined income of $1,851 per month.

- The asset limits are $8,400 for an individual and $12,600 for a couple.

It is important to note that income limits to qualify for these programs are slightly different in Alaska and Hawaii. To learn more about the income limits in those states, see details on the Social Security Administration website.

What Salary Is Considered Middle Class In Ny

In New York state, a two-person family would be considered middle class if the households income range is between $46,597 and $139,098. A three-person middle-class familys income would range from $55,155 to $164,644, and a four-person family in the middle tier would have income between $67,252.59 to $200,754.

Also Check: Who Is Entitled To Medicare Part A

How To Apply For Medicare Extra Help

To take advantage of Medicare Extra Help benefits you must be enrolled in a Medicare Part D prescription drug program. You could technically apply for Extra Help if youre not enrolled in Part D coverage yet. But if approved, your benefits wouldnt kick in until you have prescription drug coverage in place.

You can apply for Extra Help online if you:

- Are enrolled in Medicare Part or Medicare Part B

- Live in one of the 50 states or the District of Columbia

- Have combined financial resources of $15,510 or less if youre not married or dont live with your spouse and $30,950 if you are married and live with your spouse

You dont need to fill out the online application if you have Medicare and Medicaid or have Medicare and receive SSI benefits. In that case, you should receive a letter explaining that youre automatically approved for Medicare Extra Help.

If youre not able to submit an application for Extra Help online, you can apply over the phone by calling Social Security at 1-800-772-1213. You also have the option to submit a paper application by mail or visit your local Social Security office to apply, though you may need to have an appointment for that.

Here are the documents Social Security suggests collecting before you apply:

- Social Security card

- Statements for IRAs and other investment accounts

- Your most recent Social Security benefits award letter or statements for Railroad Retirement benefits, Veterans benefits, pensions and annuities

Monthly Medicare Premiums For 2022

The standard Part B premium for 2022 is $170.10. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $91,000 Married couples with a MAGI of $182,000 or less | 2022 standard premium = $170.10 |

| Your plan premium + $77.90 |

Also Check: Why Do Doctors Hate Medicare Advantage Plans

Income Limits For Medicare Savings Programs

There are four kinds of Medicare Savings Programs , each with its own income and resource qualifications. As with the Extra Help program, income and resources are assessed separately and you must meet both requirements to qualify for a savings program.

| Program |

|---|

|

|

Limits are slightly higher in Alaska and Hawaii. If you have income from working, you may qualify for benefits even if your income is higher than the limits listed.

MSPs are federally funded programs administered by individual state Medicaid agencies. These programs help people with limited income and resources pay Medicare costs that include premiums, deductibles, copayments and coinsurance.

You can apply for an MSP through your state’s Medicaid office. To find the contact information, select your state here and choose “Other insurance programs” from the menu on the left.

Is Medicare Eligibility Based On Income

Medicare eligibility is not based on income. As long as you meet the basic Medicare eligibility requirements, you are entitled to coverage.

However, your income will affect how much you pay for coverage. If you are a high earner and have an annual income over a specific limit, you will be responsible for additional premiums due to IRMAA.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

If you receive a monthly income below certain thresholds, you may become eligible for programs like low-income subsidies, Medicaid, and Medicare Savings Programs. These programs offer financial assistance to those on Medicare with low incomes to ensure coverage regardless of income.

Don’t Miss: How Much Does Medicare B Cost

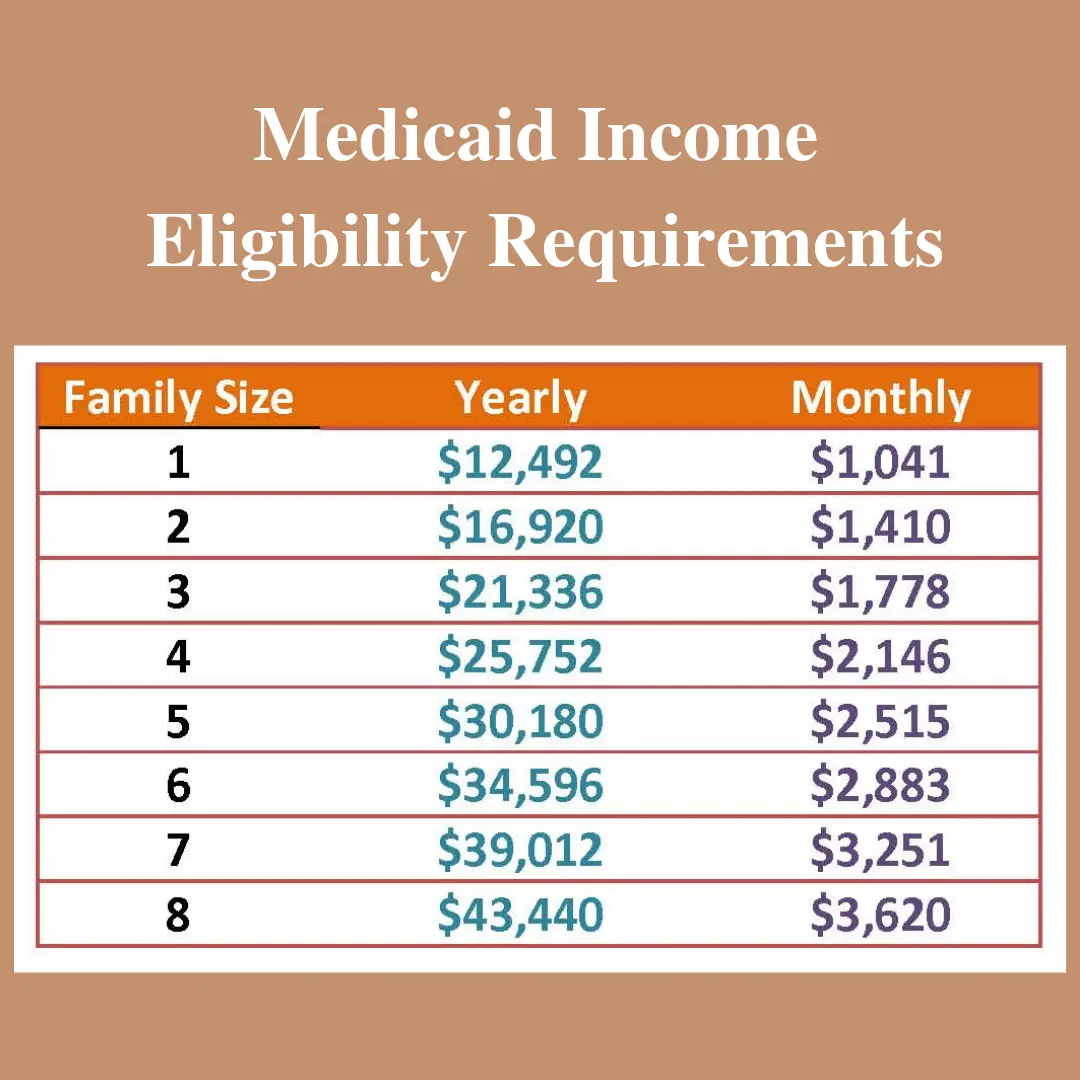

How Do You Calculate Your Medicaid Income Eligibility

Follow these steps to calculate whether or not your income may qualify you for Medicaid:

- Find the FPL for your household using the chart above

- Multiply that number by your states Medicaid income limit found below, and then divide by 100

For example, if there are two people living in your household and you live in Arizona, you would multiply $17,420 by 138 and then divide by 100. That equals $24,039.60.

You may also multiply $17,420 by 1.38.

Medicare Extra Help Income Limits

- Extra Help can help you pay for Medicare Part D if you have limited income and resources.

- Part D is the part of Medicare that covers prescription drugs.

- As an individual, you must make less than $19,320 and have less than $14,790 in resources to qualify.

- If youre married, you and your spouse will need to make less than $26,130 in total income and have less than $29,520 in combined resources.

If you need help paying for the costs of your Medicare Part D prescription drug plan, you might qualify for assistance through a program called Extra Help. To qualify for Extra Help, you need to meet certain financial requirements.

Read on to learn about Medicares Extra Help program, including this years income limits, how to qualify, enrollment information, and more.

When you have a Medicare Part D plan, youre responsible for monthly premiums, deductibles, copayments, and coinsurance amounts.

Medicare Extra Help can help you pay some or all of those costs.

The program is overseen by the Social Security Administration and is based on income. The SSA estimates that program participants can save as much as $5,000 per year.

Don’t Miss: Will Medicare Pay For Eye Exams

How Do You Qualify For $144 Back From Medicare

How do I qualify for the giveback?

Can a consumer who qualifies for low income subsidy receive financial assistance for Medicare Part D?

Eligible beneficiaries who have limited income may qualify for a government program that helps pay for Medicare Part D prescription drug costs. Medicare beneficiaries receiving the low-income subsidy get assistance in paying for their Part D monthly premium, annual deductible, coinsurance, and copayments.

What are the income limits to get extra help with Medicare?

What is the income limit? To qualify for Extra Help, your annual income must be limited to $19,320 for an individual or $26,130 for a married couple living together. Even if your annual income is higher, you may still be able to get some help.

What is the income limit to qualify for extra help with Medicare?

$19,320What is the income limit? To qualify for Extra Help, your annual income must be limited to $19,320 for an individual or $26,130 for a married couple living together. Even if your annual income is higher, you may still be able to get some help.

Why Does Medicare Impose Income Limits

The higher premiums for Part B took effect in 2007, under the Medicare Modernization Act. And for Part D, they took effect in 2011, under the Affordable Care Act. Medicare premiums cover only a small fraction of the cost of providing coverage, and the IRMAA rules were created to ensure that beneficiaries with the means to do so are required to pay a larger share of the cost of their coverage.

Beneficiaries premiums only cover about 26% of the cost of Part B, and about 17% of the cost of Part D . Most of the cost of Part B and Part D is covered by general revenues, and the IRMAA surcharges help to spread that cost to beneficiaries who can afford to pay a larger share of the cost of their coverage.

You May Like: How To Win A Medicare Appeal

Does Medicare Check Bank Accounts

Medicare will usually check your bank accounts, as well as your other assets, when you apply for financial assistance with Medicare costs. However, eligibility requirements and verification methods vary depending on what state you live in. Some states don’t have asset limits for Medicare savings programs.

Do Medicare Premiums Change Yearly Based On Income

Yes, your Medicare Part B premium will change based on your MAGI.

You can expect to pay more for your Medicare Part B premiums if your MAGI is over a certain amount of money. For 2022, the threshold for these income-related monthly adjustments will kick in for those individuals with a MAGI of $88,000 and for married couples filing jointly with a MAGI of $176,000.

To find coverage for the things that Medicare does not cover, start shopping with eHealth.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

Recommended Reading: Does Medicare Cover A Nebulizer

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

How To Apply For A Msp7

If you answer yes to the following questions, call your State Medicare Program to check if you qualify.

Note: If your income or resources are higher than the amounts listed, you may still apply to check if you qualify.

Also Check: Do You Pay For Medicare After 65

How To Find A Medicare Part D Prescription Drug Plan

Finding the right Medicare Part D plan can be confusing. Our licensed agents are Medicare experts dedicated to putting your needs first. We specialize in finding the best Medicare Part D plans for our clients. Our agents compare how each Medicare Part D plan covers prescriptions and dosages.We work with beneficiaries nationwide to find the best plan for their needs and budget. Call us today at the number above to compare plans from top-rated carriers. Or, complete our online rate form to compare policies today.

What Are The Income Limits For Medicare

Summary:

There is no income limit for Medicare. But there is a threshold where you might have to pay more for your Medicare coverage.

In 2022,Medicare beneficiaries with a modified adjusted gross income above $91,000 may have an income-related monthly adjustment added to their Medicare Part B premiums.

For couples who file a joint tax return, that threshold is $182,000 per year.

Note that the government looks at your income from two years prior to determine the IRMAA amount.

An IRMAA is a surcharge for those Medicare beneficiaries with a higher gross income.

Read Also: What Age Can I Take Medicare

What Is The Income Limit For Medicare Extra Help

Extra Help is a financial support program for those with Medicare. It helps people with limited resources manage the cost of prescribed drugs. An income limit is set which determines eligibility.

Extra Help is also known as a low income subsidy . This means that the amount of help a person receives from the government may vary as it depends on income and financial need.

Medicare Extra Help could save an individual a substantial amount of money each year by helping them to pay for premiums, deductibles, and copayments.

Even though the Extra Help program is beneficial, many individuals who qualify have not yet enrolled.

This article looks at the Medicare Extra Help program, the income limits, benefits, and how a person can apply to the LIS program to help with the cost of their prescriptions.

Original Medicare covers the costs of medication during a stay in the hospital, but there is limited coverage for take-home prescription drugs.

Medicare Part D is a plan that covers prescription drugs. The plan is also known as a prescription drug plan .

When a person has a PDP, they must usually pay monthly premiums, copayments, and deductibles.

Private insurance companies administer PDPs, and because of this, different benefits and coverage options may apply. Costs will also vary.

Each plan has a formulary that specifies which drugs the plan covers.

An individual should ensure that the plan they wish to enroll in covers the prescription drugs they need.