What Does Medicare Part B Cover

Part B services covered at 80% include outpatient care in an emergency room or hospital, and diagnostic tests such as X-rays. For many preventive services, the coinsurance and the deductible do not apply such as standard flu shots, mammograms, bone density tests, glaucoma tests, and many cancer screenings. Some preventive services have criteria you need to meet before getting the preventive service without the coinsurance and/or deductible. If you dont meet the criteria, the service will be covered under Part B but with the coinsurance and deductible.

Part B also covers doctors visits, ambulances, mental healthcare, outpatient surgeries, home health care, durable medical equipment such as blood sugar monitors and test strips, lancet devices, walkers, and wheelchairs. Home health care is also covered under Medicare Part A if certain conditions are met.

What It Will Cost You

Nationwide, the average premium for the most popular Medigap F plan costs roughly $326 a month. There is also a high-deductible F plan , and that premium averages about $68 a month. Premiums are based on three pricing systems and vary widely based on where you live.

- Community rated: The same monthly premium is charged to everyone who has this policy, regardless of age.

- Issue-age rated: This premium is based on your age when you first buy the policy. The younger you are, the lower the initial premium. Any premium increases in the future will not be based on your age.

- Attained-age rated: This premium is initially based on your current age but can rise as you get older.

Experts suggest that you ask a potential insurer which pricing system it uses before buying a Medigap policy. That way youll know whether to expect increases as you age.

Compare Medigap Plan G With Other Medicare Supplement Plans

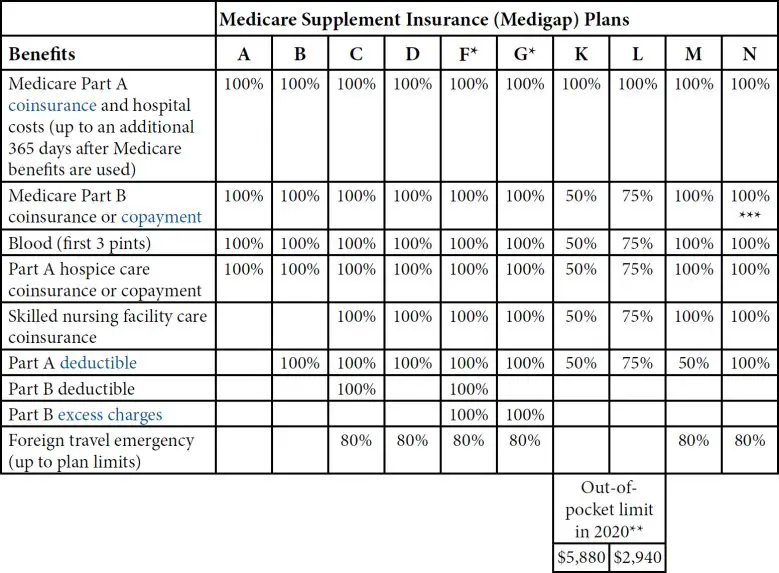

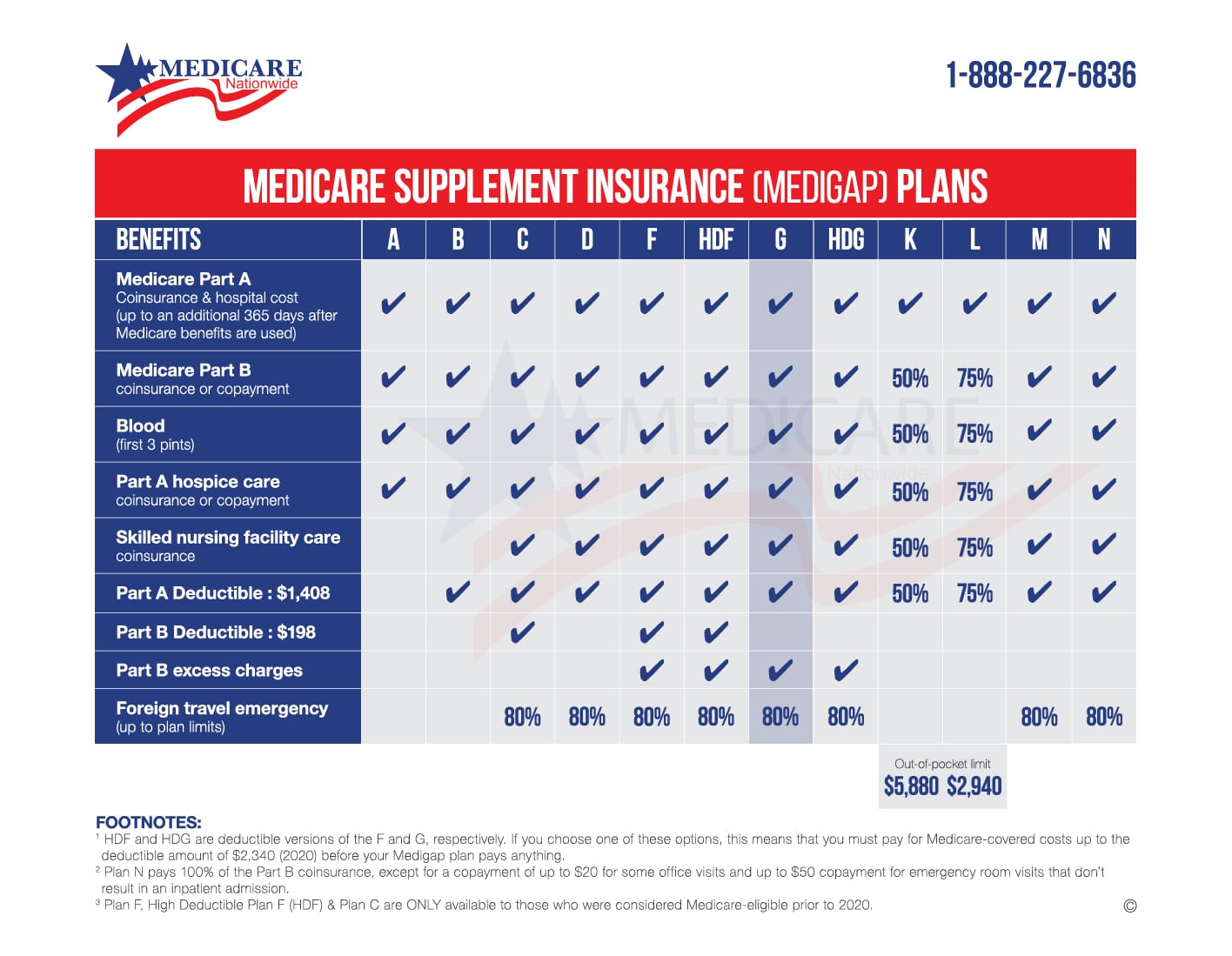

All 10 Medigap policies must follow federal and state laws designed to protect the policy holder. Basic benefit details of each plan letter must be the same no matter where the plan is purchased. Cost is generally the only difference between Medigap policies of the same letter, as the insurance companies may charge different rates for these plans.

Recommended Reading: Does Medicare Part D Cover Shingrix

Supplemental Insurance Will Cover Some Deductibles And Copays

by Dena Bunis, AARP, Updated July 6, 2020

Josh Dickinson

En español | If you decide to enroll in Original Medicare, one way you can help pay the extra costs the program doesnt cover is to buy a supplemental or Medigap insurance policy.

Medigap policies are sold by private insurers, but they are strictly regulated by states and the federal government. These plans are available for people enrolled in Medicare Parts A and B, not for those who elect a Medicare Advantage plan. Medigap plans pay for costs such as deductibles and copays and other charges that Medicare doesnt cover.

In 2010 the federal government standardized the types of Medigap plans, creating 10 options designated by A, B, C, D, F, G, K, L, M and N. Beginning in January, 2020 two of the more comprehensive and popular plans, C and F, stopped being available to people newly eligible for the program. Thats because in 2015, Congress decided to prohibit Medigap from covering the annual deductible for Part B, which pays for doctor visits and other outpatient services.

Of the 10 Medigap plans, C and F currently pay that deductible, which is $198 for 2020. The difference between plans C and F is that C does not cover the 15 percent in excess charges that doctors who dont participate in Medicare are allowed to charge their patients Plan F does.

If you think a Medigap policy might be right for you, here is some basic information youll need to know to make your decision.

Finding Medicare Supplement Plan G

Remember, like other Medicare Supplement insurance plans, basic benefits are standardized across each letter category. So Plan G basic benefits are exactly the same, no matter which insurance company you purchase the policy from. However, keep in mind that costs and availability will vary by insurance company and location, so its important to shop around to find the best value for the Medigap plan youre considering.

One easy way to research plan options is to use our plan finder tool to view Medigap plans in your service area and compare plan benefits side-by-side. Simply enter your zip code into the tool on this page to see how Plan Gs basic benefits stack up against the other nine Medicare Supplement insurance plans. Need assistance more quickly? You can always pick up the phone to call eHealth and get your Medicare questions answered from a licensed insurance agent.

The product and service descriptions, if any, provided on these eHealth web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

Don’t Miss: How To Sign Up For Medicare Part B Online

Medicare Plan G What You Need To Know

If you are a recent Medicare Part B enrollee and want to switch plans, Plan G is the way to go. There are no co-pays or deductibles with Plan G, and you can take advantage of its generous coverage. If you are not sure whether you qualify for Medicare plan F, you can call eHealths licensed insurance agents to learn more about your options. You can also check out the coverage chart below to see how Plan F compares to Plan A. Read More ponbee.com/medicare-supplement-plans/

What Does Medicare Part A Cover:

- Inpatient care in semi-private hospital room

- Skilled nursing facility care following a hospital stay of three or more days

- Inpatient care in a skilled nursing facility not custodial or long-term care

- Part-time home health care, i.e., occupational, physical, speech therapy, illness counseling. It does not include custodial, personal care or homemaker services.

- Blood for transfusions, after the first three pints

Don’t Miss: Which Insulin Pumps Are Covered By Medicare

How To Shop For Medicare Plan G

The most important thing to consider when shopping for Medigap insurance is the fact that every company has identical coverage, but they all charge different rates for it.

Why pay more than you should?

There is only one best way to shop for Medigap insurance, and thats to allow us to help. Its FREE!

Well shop all the top carriers rates to make sure you pay the lowest amount each year. Each company has rate increases every year, so if you dont allow us to help youll be back on the internet trying to search again next year.

Our service is entirely FREE but our clients love it. We watch it all so you dont have to!

What Does Medicare Supplement Plan G Cover

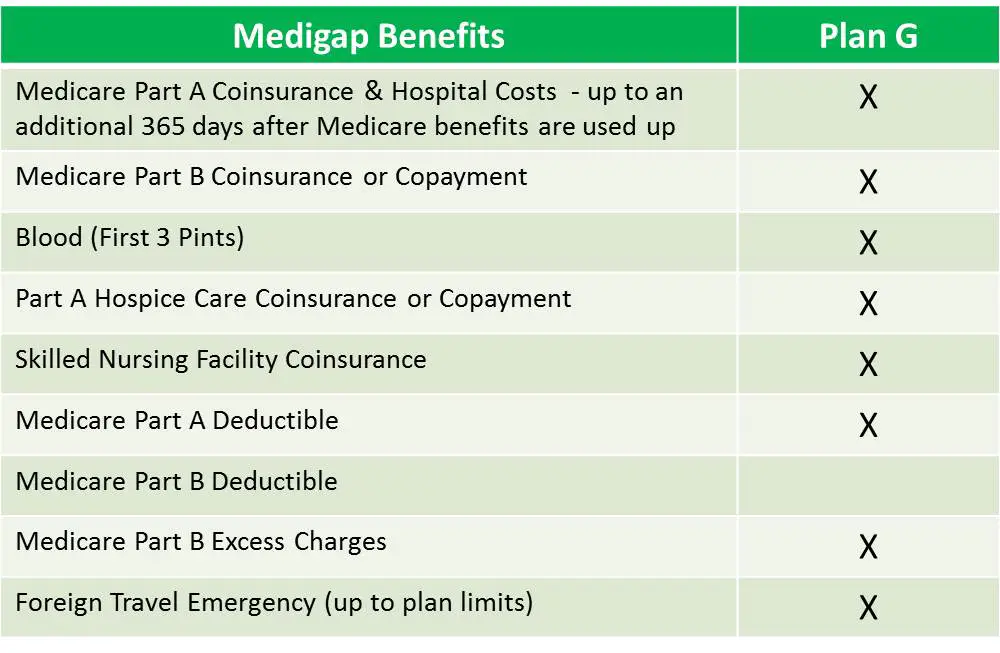

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to, with one exception. With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203.

In their initial research phase, many people compare Plan G to Plan F, which covers the Part B deductible. However, the premiums for Plan G tend to be considerably less than that of Plan F. Because of this, many people find that even after they pay their deductible, Plan G is still the more cost-effective option.

Keep in mind: if you become eligible for Medicare in 2020 or later, you will not be able to get Plan F. This means that Plan G will be the plan with the most comprehensive coverage available to you. Additionally, you will have the option to sign up for a High Deductible Plan G. If you currently have a Plan F and are considering switching, we can help you evaluate your options.

Recommended Reading: Does Medicare Offer Dental Plans

Medicare Costs And Medicare Supplement

Original Medicare doesn’t pay for everything. When you have a Medigap plan to work with Original Medicare it can help with some of the following costs that you would have to pay on your own:

- About 20% in out-of-pocket expenses not paid by Medicare Part B for doctor and outpatient medical expenses .

- Part A coinsurance, and most plans include a benefit for the Part A deductible

- Hospital coverage up to an additional 365 days after Medicare benefits are used up.

- Part A hospice/respite care coinsurance or copayment.

Medicare Advantage Or Medigap Plan G

If you are new to Medicare, you may just be learning the differences between Medicare supplements and Medicare Advantage plans. Both offer benefits beyond Original Medicare Parts A and B. Medicare supplements are meant to fill in the gaps left by Original Medicare, while Medicare Advantage plans actually take the place of Original Medicare and offer additional benefits.

In this article, well quickly review the key differences between the two types of plans and then compare one of the more popular Medigap plans, Plan G, with the most common coverage seen in Medicare Advantage plans.

You May Like: When Does Medicare Coverage Start

Rates For Medicare Supplement Plan G

While the benefits of Medicare Supplement Plan G remain the same regardless of your insurance company , in some states the premium you pay may vary according to a number of factors, including age, location, gender, and overall health.

Cigna offers competitive rates and, in some states, a 7% household premium discount5 may be available for qualified applicants.

So How Do I Decide Which Company To Choose

Selecting a company can be confusing, but there are two factors that can help you narrow down your decision. We recommend that you check the AM Best ratings for the companies you are comparing to ensure that the company has a positive standing, and then select the company that offers the lowest premium. To make this process easier for you, GoMedigap agents only work with top-rated companies, and we pride ourselves in finding low premiums for our clients.

You May Like: Does Medicare Part A Cover Doctors In Hospital

Why Medicare Is Discontinuing Plan F

In April 2015, Congress passed the Medicare Access and CHIP Reauthorization Act to reduce some Medicare expenses. As part of that act, from January 1, 2020, insurers couldn’t sell a policy that covers the annual Medicare Part B deductible to new Medicare beneficiaries.

This ruling effectively meant insurers couldn’t offer Plan F or Medigap Plan C to people who become eligible for Medicare after January 1, 2020, because both plans cover the Part B deductible.

Beneficiaries who already had Plan F or Plan C before January 1, 2020 are able to keep their plan. If someone became eligible for Medicare before 2020, they can still apply for Plan F or Plan C if either plan is available where they live.

Can I Enroll In Medsup Plan G If I Have A Medicare Advantage Plan

If youre enrolled in a Medicare Advantage plan, you cant enroll in a Medicare Supplement plan, too.

What if youre enrolled in Original Medicare and a MedSup plan and you want to switch to a Medicare Advantage plan with similar coverage? You can do that. Drop the MedSup plan before you buy the Medicare Advantage plan, though. The former won’t pay out after you enroll in the latter.

Also Check: Should I Get Medicare Supplemental Insurance

What Is The Deductible For High Deductible Plan G In 2021

The deductible for High Deductible Plan G is $2,370. Beneficiaries reaching this deductible is what keeps the premiums low for this plan. Alternatively, if youre more comfortable with higher monthly premiums and would rather not pay the higher deductible, standard Plan G would be the better choice for you.

Other Medicare Supplement Plans

1 Insured by Cigna Health and Life Insurance Company, American Retirement Life Insurance Company, Loyal American Life Insurance Company or Cigna National Health Insurance Company. In Kansas and Pennsylvania, Medicare Supplement insurance policies are insured by Cigna National Life Insurance Company. American Retirement Life Insurance Company, Loyal American Life Insurance Company and Cigna Health and Life Insurance Company plans are not available to residents of Kansas or Pennsylvania.

2 A benefit period begins on the first day you receive service as an inpatient in a hospital and ends after you have been out of the hospital and have not received skilled care in any other facility for 60 days in a row.

3 NOTICE: When your Medicare Part A hospital benefits are exhausted, the insurer stands in the place of Medicare and will pay whatever amount Medicare would have paid for up to an additional 365 days as provided in the policys Core Benefits. During this time, the hospital is prohibited from billing you for the balance based on any difference between its billed charges and the amount Medicare would have paid.

4 Once you have been billed $203 of Medicare-approved amounts for covered services, your Part B deductible will have been met for the calendar year.

5 State variations apply. The Household Discount is not available in HI, ID, MN, and VT. For residents of WA, the discount only applies to spouses .

- Customer Plan Links

Recommended Reading: Does Medicare Advantage Plan Replace Part B

How To Qualify For Medicare Plan G

The most important thing to remember about this plan is that it is guaranteed to accept all applicants, regardless of health history. If you have been living in the US for more than five years, you are likely to qualify for Original Medicare without paying a premium. However, if you were a non-US worker for at least five years, you will need to pay the Part A premium. You must also enroll in Medicare Part B first. You can only enroll in Medicare plan G once youve finished enrolling in the Part A and B programs.

The main difference between Plan G and Plan F is that Plan G is available only in some areas of the country. If you live in a state that has a different standardized Medigap plan, then you may not be able to get Plan G. In those states, you can sign up for any Medigap plan, regardless of age. Just be sure to compare plans carefully before you choose the right one. Keep in mind that it is possible to save a significant amount of money on your Medicare Supplement Insurance policy.

Best Detailed Plan Descriptions: Cigna

Cigna

-

No quotes or comparisons without entering personal contact information

-

No other extra benefits

-

Household discount not available in four states, and is only available to spouses for residents in the state of Washington

Cigna gives potential customers plenty of information, providing lots of detail and background information for each of its plans and the coverage available with each benefit. While this helps to compare coverage, Cigna does not offer the ability to get a free quote without entering personal information such as age, gender, Plans A and B start date, and your current insurance situation. You also must provide your email address and phone number, which then allows Cigna to contact you to discuss your plan options.

If youre fairly confident in Cigna as one of your final options, this is a fair request, since most providers need that information at some point during the enrollment process. However, you may find it disquieting to provide that much information to Cigna if youre still undecided about which plan to choose.

Household discounts are not available in Hawaii, Idaho, Minnesota, and Vermont.

Recommended Reading: Does Medicare Cover Outside Usa

Applying For A Medicare Supplement Insurance Plan

The best time to enroll in a Medicare Supplement plan is during your Medicare Supplement Open Enrollment period because your acceptance is guaranteed. It starts on the first day of the month in which you’re both age 65 or older and enrolled in Medicare Part B. Some states have additional Open Enrollment periods and Guaranteed Issue requirements.

If you apply outside of Open Enrollment or Guaranteed Issue periods, you may be denied coverage or charged more based on your health history. This does not apply to residents of Connecticut and New York where Open Enrollment and Guaranteed Issue is ongoing and Medicare supplement plans are guaranteed available.

Scroll for Important Disclosures

UnitedHealthcare pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers.

AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals.

Please note that each insurer has sole financial responsibility for its products.

AARP® Medicare Supplement Insurance Plans

AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare.

In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease.

WB27382ST

Medicare Supplement Plan G: What Are The Facts

Summary: Medicare Supplement Plan G is one of the most popular Medicare Supplement plans. This plan covers:

- Medicare Part A coinsurance and hospital costs

- Medicare Part B coinsurance or copayment

- Blood

- Part A hospice care coinsurance or copayment

- Skilled nursing facility care coinsurance

- Part A deductible

- Foreign travel emergency

You May Like: When Is Open Enrollment For Medicare Supplement Plans

Whats The Difference Between Medicare Plan F And Plan G

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you’re getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

This much coverage means that Plan F may come with a higher premium. However, choosing a high-deductible option for Plan F could help keep your premium down. If youre currently enrolled in the Plan F high-deductible option for 2021, you are required to pay for Medicare-covered costs up to the deductible amount of $2,370 before your Medigap plan begins to cover any expenses. If youre not enrolled in Plan F, this will not affect you as it is no longer available for new enrollment as of December 31, 2019.