Medicare Advantage Plans Have An Out

When you enroll in a Medicare Advantage plan, you can ask about your specific policys out-of-pocket spending limit.

Original Medicare does not include an out-of-pocket spending limit. While its not common, you could potentially be responsible for thousands of dollars in out-of-pocket costs if you only have Original Medicare coverage and require extensive medical care throughout the year.

Limitations To The Monthly Cap

There are some important caveats that Medicare Part D insulin users need to know.

The $35 monthly cap applies to each prescription of insulin, so those who take two types, for instance, could pay up to $70 a month for their medications.

Part D plans also have until the end of March to update their systems to reflect the $35 cap, so enrollees might be charged a higher amount until then. But insurers must reimburse them within 30 days for any amount paid above the cap.

In addition, plans are not required to cover all insulin products. So enrollees should be sure that their policies cover the insulin their doctors prescribe for them. CMS is offering a special enrollment period this year to allow insulin users to switch plans if needed.

And the law does not cover non-insulin medications, such as Trulicity, that many diabetics use to control the disease. Advocates say that other provisions of the law, which take effectin coming years, will help seniors afford these drugs.

Among the biggest drawbacks is that the $35 cap only applies to Medicare enrollees. Democrats had wanted to broaden the provision to cover the commercial market as well, but it had to be narrowed after a challenge by GOP senators prevented the more comprehensive measure from being included in the package. Some lawmakers are already calling for Congress to take up legislation to widen the caps scope.

What Is The Average Cost Of Medicare Supplement Insurance Plans In Each State

There are 10 standardized Medicare Supplement Insurance plans available in most states.

Plan G is available in most states and is one of the most popular Medigap plans. Medigap Plan G is, in fact, the second-most popular Medigap plan. 22 percent of all Medigap beneficiaries are enrolled in Plan G.2

The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018.3

- Wisconsin, Hawaii and Iowa had the plans with the lowest average monthly premiums, around $102 per month.

- The highest average monthly Medigap premiums were in New York, at $304.72 per month.

| State |

|---|

| 25 |

Don’t Miss: Does Medicare Cover Dermatologist Check Ups

Find A $0 Premium Medicare Advantage Plan Today

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

How Much Will Medicare Cost In 2023

Find Cheap Medicare Plans in Your Area

For all Medicare plans, costs will vary depending on what plans you decide to purchase, the company you purchase your plan from, your income and sometimes your age. For this reason, you should carefully balance your coverage needs and the costs of the plans when choosing the right mix of Medicare policies. The good news in 2023 is the cost of Medicare Part B was reduced to $164.90 per month.

Also Check: Does Medicare Pay For Urolift Procedure

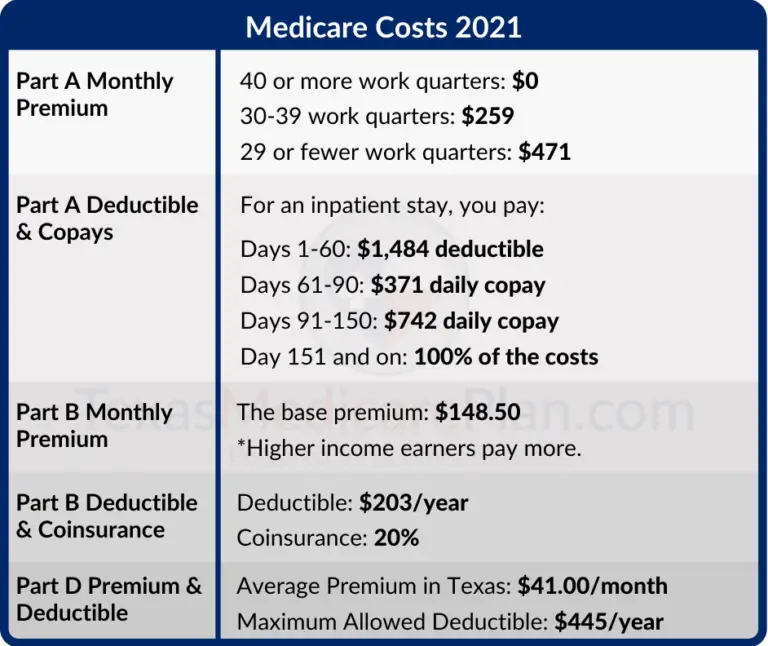

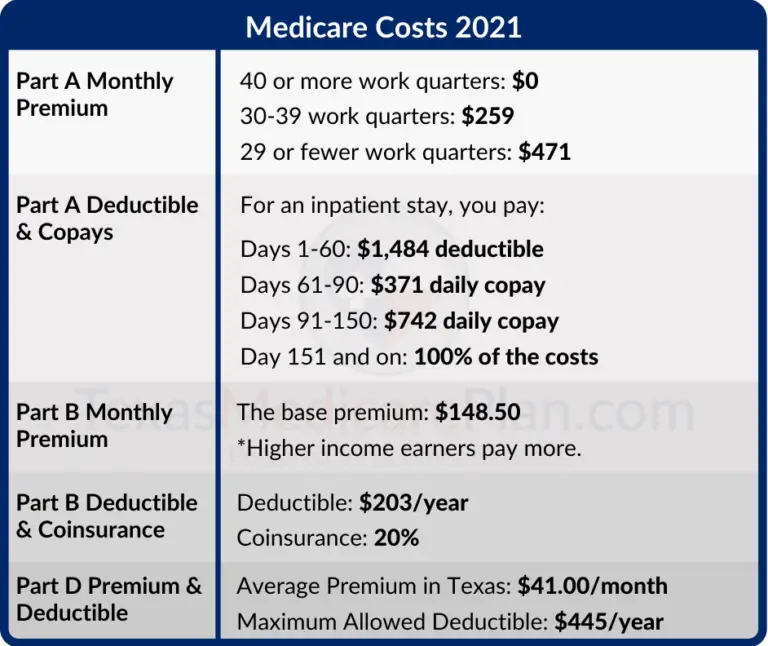

What Are Medicare Costs

It’s not just about premiums. Many Americans find that qualifying for Medicare eases some financial stress, as its possible to pay less and get more. However, there are still expenses you should be aware of.

Take a moment to familiarize yourself with the out-of-pocket costs associated with Medicare Parts A, B, C, and D, so that you can select a plan that is best suited for the type of retirement youre planning on. All costs listed here apply for 2023.

Medicare Part B Premium For 2023

In 2023, the standard Part B premium is $164.90 per month. Most people pay the standard premium amount. Its either deducted from your Social Security check or you may pay Medicare directly, depending on your situation.

People with tax-reported incomes over $97,000 and $194,000 must pay an income-related monthly adjustment amount . The table below shows Part B premiums for 2023 by filing status and income level. The IRMAA is based on your reported adjusted gross income from two years ago.

| Filing individual tax returns | Total monthly Part B premium |

|---|---|

|

$97,000 or less |

|

|

$750,000 or more |

$560.50 |

Part B premiums for high-income beneficiaries who are married, lived with their spouse at any time during the taxable year, but who are filing separate are shown in the table below.1

| Total monthly Part B premium |

|---|

|

$97,000 or less |

|

$560.50 |

Don’t Miss: Does Medicare Cover Non Emergency Transportation

What Is Part A Coinsurance

Medicare refers to the payments that you make when you see a doctor, stay in a skilled nursing facility, or have an extended hospital stay as coinsurance, although theyre fixed amounts rather than a percentage of costs. For the 61st to 90th day of inpatient hospital treatment with Medicare, you must pay coinsurance of $389 per day. The next 60 days are part of your lifetime reserve benefit, and youll owe $778 per day, up to 60 days over your lifetime.3

Youll also have to pay coinsurance for skilled nursing care for days 21 through 100 at a rate of $194.50 per day.4

What Is Part D Coinsurance

There are four payment stages or Part D policyholders.

- Your annual deductible: For 2022, it can be up to $480 per year. You pay this entirely out of pocket.

- Initial coverage, where youll pay your share of copay or coinsurance until the total amount spent on drugs reaches $4,430.

- The coverage gap , where you pay 25% of all costs until youve paid $7,050 out of pocket.

- Catastrophic coverage: For the rest of the year, youll owe 5% coinsurance or $3.95 for generic drugs and $9.85 for brand drugs, whichever is greater.

Don’t Miss: Does Medicare Cover Home Birth

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

Medicare Part D Donut Hole Coverage Gap Costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

After you and your plan combine to spend at least $4,660 on covered drugs in 2023, you enter the Part D coverage gap.

In 2023, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit, which is $7,400, on covered drugs.

Once you enter the catastrophic coverage phase, you pay only a limited copay for covered drugs for the rest of the year.

Don’t Miss: Does Medicare Pay For Maintenance Chiropractic Care

Sign Up For Kiplingers Free E

Profit and prosper with the best of Kiplingers expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of Kiplingers expert advice – straight to your e-mail.

CMS projects the average basic monthly premium for standard Part D coverage will be $31.50, compared to $32.08 in 2022.

Because of the Inflation Reduction Act, beneficiaries with Medicare prescription drug coverage will pay less for their drugs, including a $35 cost-sharing limit on a months supply of insulin. In addition, vaccines recommended by the Advisory Committee on Immunization Practices will be covered by Medicare with no cost sharing or deductibles.

How Much Does Medicare Part C Cost In 2022

The premium for Medicare Part C also called Medicare Advantage depends on your plan and the insurer, since these health plans are provided by private insurance companies.

Deductibles, copays and coinsurance for Medicare Part C vary by plan. However, there is a limit to how much you can spend on out-of-pocket expenses. After that limit, your Medicare Part C plan will pick up all the remaining cost of covered health care services. The out-of-pocket limit for Medicare Advantage cant exceed $7,550 a year for in-network services. That means you could save more money if you have a lower out-of-pocket expenses limit. The limit is $11,300 for out-of-network services.

The average out-of-pocket limit for Medicare Advantage enrollees was $5,059 in 2019, according to the Kaiser Family Foundation.

Learn more about Medicare Part C.

You May Like: Do You Get Medicare With Ssi

Medicare Premiums And Deductibles: What Youll Pay In 2023

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The costs and deductibles associated with the different parts of Medicare may change each year. The Centers for Medicare & Medicaid Services, or CMS, releases the new costs for Medicare Parts A and B and income-related monthly adjustment amounts every fall for the following year.

Medicare is the federal government health insurance program for people age 65 and older and younger people living with certain illnesses or disabilities. Medicare comes in four parts Part A, Part B, Part C and Part D. Theres also Medigap, or Medicare Supplement Insurance, which is an optional add-on to Original Medicare.

Below are Medicares premiums and deductibles for 2023.

What Youll Pay For Medicare Part B

Most people pay a standard monthly premium for Medicare Part B, which is $164.90 in 2023. Depending on your income, you may have to pay more. In 2023, Medicare beneficiaries with reported income of more than $97,000 or $194,000 in 2021 pay from $230.80 to $560.50 a month for Part B.

Your Part B premium is based on your modified adjusted gross income that was reported on your tax return two years prior. So the additional amount you pay for Part B called the Income Related Monthly Adjustment Amount, or IRMAA may vary.

There’s also a deductible for Part B. In 2023, the Part B deductible is $226.

Recommended Reading: Is Sonobello Covered By Medicare

Medicare Advantage Special Needs Plans May Have Lower Costs

A Medicare Special Needs Plan is a type of Medicare Advantage plan that is designed specifically for someone with a particular disease or financial circumstance.

Many Medicare SNPs cover most of the qualified health care costs for beneficiaries. All SNPs must include prescription drug coverage.

Some Medicare SNPs are designed for people who are dual-eligible, meaning they are eligible for both Medicare and Medicaid. These plans are commonly called Dual-Eligible Special Needs Plans .

Medicare Advantage Special Needs Plans can also cater more specifically to the needs of people with specific medical conditions, such as:

- Dependence issues with alcohol or other substances

- Autoimmune disorders

- Chronic lung disorders

Some SNPs can also be available to people who live in a long-term care facility such as a nursing home.

What Youll Pay For Medicare Part D

Medicare Part D is prescription drug coverage, and its sold by private health insurance companies, so premiums vary by policy. In 2023, the average Part D plan premium is $31.50 per month, but drug plan prices range from $1.60 to $201.10 per month.

Like Part B, youll pay more for your Part D coverage if you have a higher income. The same thresholds apply: If your 2021 income was more than $97,000 or $194,000 , youll pay an additional $12.20 to $76.40 per month, on top of your Part D premium.

Theres also a deductible for some Part D plans, which in 2023 can be no higher than $505.

» MORE:How much does Medicare Part D cost?

Recommended Reading: Do You Pay For Medicare Part B

B Coinsurance: Percentage Based

The Part B coinsurance is fairly simple to understand. Basically, Medicare will pay for 80 percent of your medically-necessary services, and you will pay the remaining 20 percent of the Medicare-approved cost after your deductible has been met. There may be some services that Medicare covers in full, but generally speaking, you should expect to pay this 20 percent cost.

Note that in addition to outpatient care, Part B covers durable medical equipment meaning the Part B coinsurance will apply.

Hospital Copays For Medicare Part A

Hospital copays are determined by the number of days youre in the hospital, and when you exceed 90 days, you begin to use your lifetime reserve days. These are a set number of covered hospital days you can use if youre in the hospital for more than 90 days in a single benefit period. You have 60 lifetime reserve days, and once you use them, theyre gone.

Copay per days in the hospital| Number of Days in Hospital | Part A Copay |

|---|

Read Also: Does Medicare Pay For Dental Services

Medicare Costs To Go Down In 2023

Lower-than-expected spending on an expensive drug and other things means beneficiaries will pay less next year.

Medicare beneficiaries are getting a rare bit of good news as their Part B premiums and deductibles will tick down next year after the government health insurance plan spent less than projected in 2022. Unfortunately, the cost reductions beneficiaries will see next year are much smaller than the increases they shouldered this year. But costs will also go down for Medicare Advantage and Medicare Part D prescription drug plans. At the same time, deductibles for hospitalization costs under Part A will be going up. If youre new to Medicare and wondering what these letters are all about, well get to that see Medicare Open Enrollment Presents Choices, below.

The Centers for Medicare and Medicaid Services has announced the standard Medicare premiums for Part B beneficiaries will be $164.90 a month in 2023, down $5.20 from the $170.10 monthly charge in 2022, or about 3% less. The annual deductible for all Medicare Part B beneficiaries will be $226 in 2023, which is $7 less than the 2022 deductible of $233.

Medicare Open Enrollment Presents Choices

Medicare Open Enrollment will be Oct. 15 through Dec. 7. During this time, Medicare enrollees are encouraged to review their coverage to determine if their needs have changed.

Medicare Part B is the general insurance that covers items like doctors and other health care providers, outpatient and home health care, as well as medical equipment and preventive services like vaccines and yearly wellness visits.

Part A covers inpatient hospitalizations, care in skilled nursing facilities, hospice, inpatient rehabilitation, and some home health care services. It generally does not impose a premium.

Part D provides prescription drug coverage through private insurance companies

The other option is known as Part C or Medicare Advantage. This is a private insurance plan that takes the place of Part B and often Part D.

According to CMS, the projected average premium for 2023 Medicare Advantage plans is $18 per month, a decline of nearly 8% from the 2022 average premium of $19.52.

Recommended Reading: What Part Of Medicare Covers Dental

How Much Does Medicare Advantage Cost

Medicare Advantage plans are private, Medicare-approved health insurance plans that provide Part A and Part B coverage, and may also include other types of coverage, such as vision or dental. The costs of these plans varies, depending on the benefits provided. Each plan offers different coverage and associated premiums, deductibles, and copay. Participants must also pay their Part B premium, along with the adjustment for high earners, if applicable.

Average premiums for 2022 are expected to drop to $19 a month.9

What Youll Pay For Medicare Part C

Medicare Advantage is a bundled alternative to Original Medicare that includes the benefits of Part A, Part B and usually Part D. These plans often include additional benefits, such as some coverage for dental or vision care. They’re sold by private health insurance companies, and premiums vary.

Although the average monthly premium for a Medicare Advantage plan is $18 in 2023, many available plans have a $0 premium. Youll pay your Medicare Advantage premium in addition to your Part B premium . That said, some plans will pay part or all of your Part B premiums.

In addition to the monthly premium, Medicare Advantage plans may come with deductibles, copays or coinsurance. Look through each plans fine print to understand what kind of charges youll pay for medical services.

Also Check: Must I Sign Up For Medicare At 65