What Is The Best Medicare Advantage Plan

For 2023, Humana has the best Medicare Advantage plans for most people because of its combination of good ratings, low costs and good benefits. We also recommend AARP/UnitedHealthcare for its popular plans that are nearly as well-rated. Kaiser Permanente has the highest customer satisfaction but has limited availability and can be expensive.

Medicare Advantage Network Options

Medicare Advantage is similar to traditional health insurance and is available in many different formats. The two most common are health maintenance organizations and preferred provider organizations . An HMO requires using in-network providers, whereas PPO offers lower fees to see in-network providers.

Lesson

Other available Medicare Advantage plans include private fee-for-service , special needs plans , HMO point-of-service and medical savings account .

| Medicare Advantage Pros and Cons |

|---|

| Pros |

| Higher cost for some services |

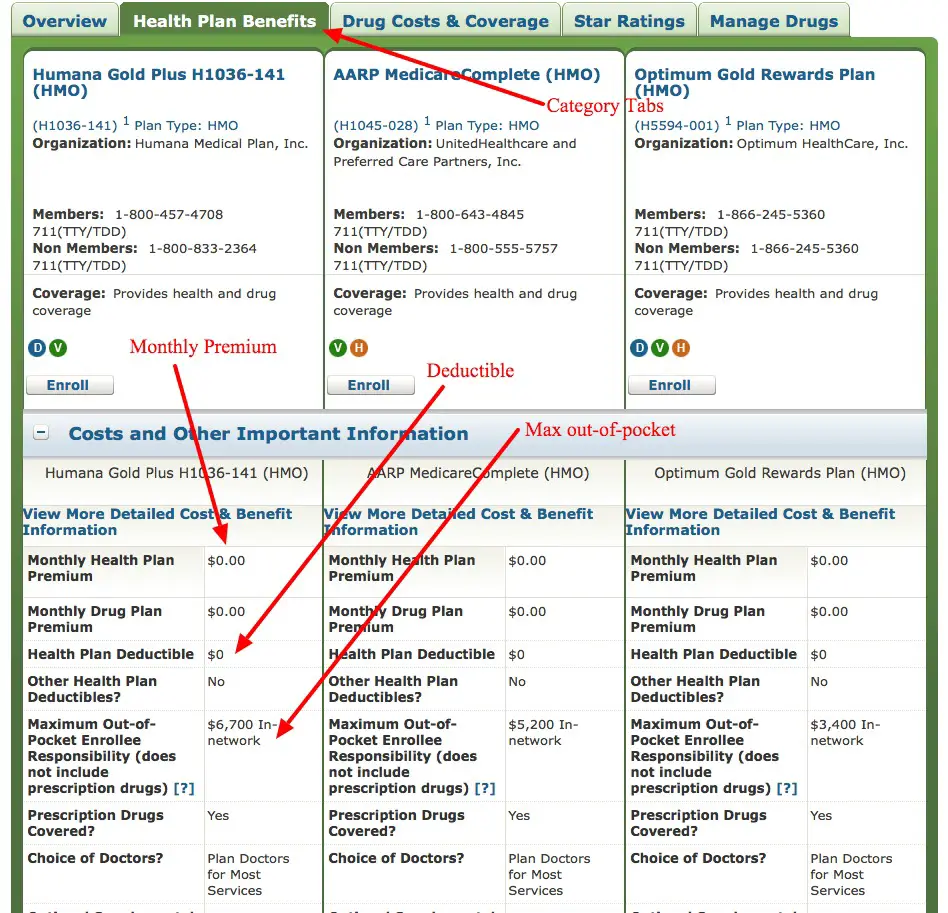

How To Find The Best Medicare Advantage Plans

Find a knowledgeable insurance agent, says Joe Valenzuela, co-owner of Vista Mutual Insurance Services in the San Francisco Bay area. Having an agent doesnt cost the member anything. Medicare insurance agents are subject matter expertsmany have spent years learning the ins and outs of each plan they represent. There are also many nuanced differences between Medicare Advantage plans. An agent can narrow down the search to only those plans that most closely align with the clients needs.

Valenzuela recommends asking what is most important to you when choosing a Medicare Advantage plan and keeping that priority top of mind. He also suggests paying attention to the fine print in the plan you select.

Once you narrow your search down to one or two plans, look through the plans benefits line by lineyou dont want any surprises, he says. For example, a plan may have a low premium and copayments but might cost you much more each month in prescription copays.

A couple of important benefits to look at are the plans annual out-of-pocket maximum and your prescription drug costs, adds Valenzuela. Check all your medications on the plans formulary so youre aware of the prescription copayments, deductibles and any restrictions.

Compare Top Medicare Plans From Blue Cross Blue Shield, a Forbes Health 5-Star Rated Carrier

Also Check: How Do You Qualify For Medicare In Texas

How Much Does Medicare Advantage Cost

Some Medicare Advantage plans may have lower out-of-pocket costs than Original Medicare, and some have a $0 monthly premium. Here are a few questions to consider before purchasing a plan.

- Does the plan have a monthly premium?

- Most have a $0 premium.

- Some pay your Part B premium.

- If you choose a plan with a premium, it will be paid separately from your Part B premium.

Once youre enrolled in a Medicare Advantage plan, it becomes your primary insurance. The provider handles paying all your claims, and the cost of your plan is likely to change every year. The plan provider sets the amounts charged for premiums, deductibles and services. An Annual Notice of Change is mailed to you each September, which goes into effect the following January 1.

Factors like location play a major role in determining the cost of a Medicare Advantage plan. Costs are typically lower when you use providers in your plans network and service area. To find the specific cost of a Medicare Advantage plan in your zip code, visit Medicare.gov.

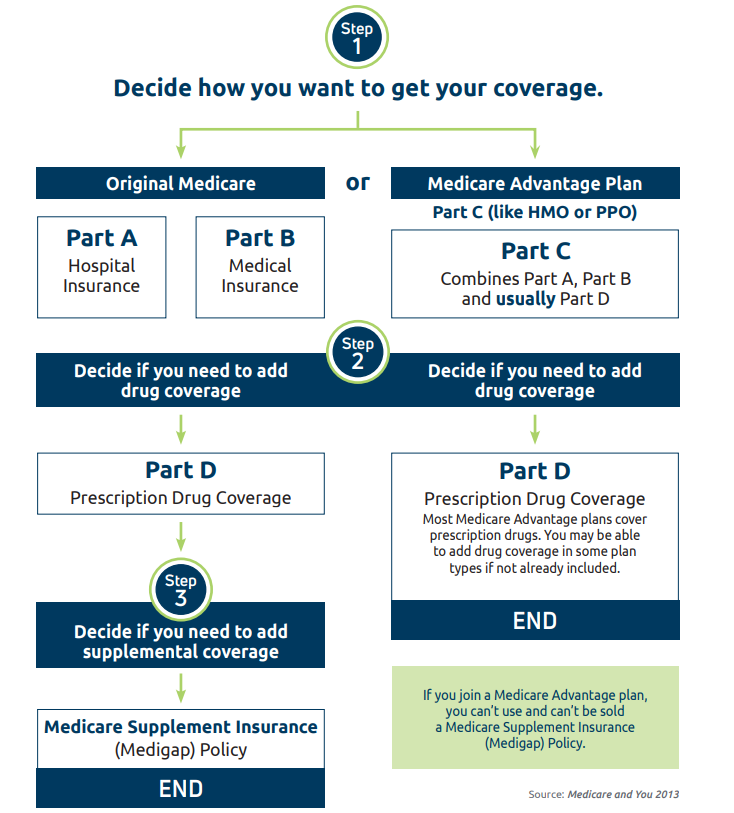

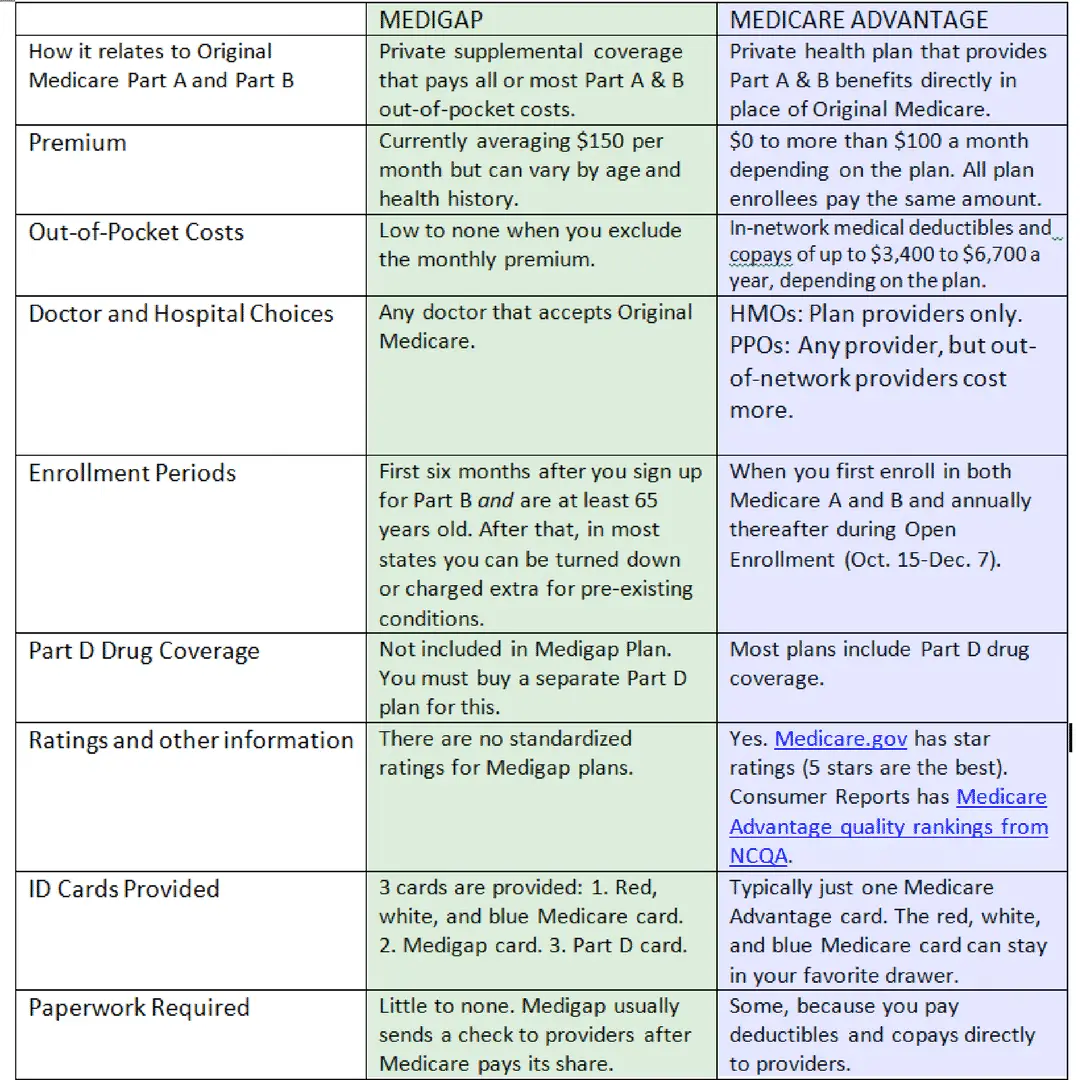

What Is Medicare Supplement

Medicare Supplement or Medigap is an insurance policy that is purchased to provide a way to cover things that are not included in the Original Medicare program. They apply only for Original Medicare and no other public policy. Medicare Part D is for prescription drugs and can be combined with an insurance benefit that offers drug protection and coverage for the elderly. Medicare Part C or Medigap plan differ from Medicare Advantage.

Also Check: What’s The Eligibility For Medicare

Are Any Medicare Managed Care Plans Available Where I Live

Currently, you can choose from three types of Medicare Managed Care:

- Cost Contract HMO

- Medicare Advantage PPO

- Medicare Advantage PFFS

These plans are available in selected counties of Indiana and it is important to know the differences between them.

Cost Contract HMO

Medicare will reimburse the plan for covered services you receive. You choose a primary care provider within the HMO network. When you stay within the network, you pay nothing except the plan premium and any small copayment amounts preset by the HMO.

You may also choose to use services outside of the network. When you choose to use a service or provider outside the Cost Contract HMO network, Medicare would still pay their usual share of the approved amount. You would be responsible for the Medicare deductibles and copayments. The Cost Contract HMO would not pay these. Cost Contract HMOs may enroll you if you don’t have Medicare Part A but have and pay for Medicare Part B. Cost Contract HMOs do not have to enroll you if you have end-stage kidney disease or are already enrolled in the Medicare hospice program.

Medicare Advantage PPO

This type of managed care plan maintains a list of preferred providers but lets you see doctors and hospitals outside the plan for an additional cost. If you choose to use a provider outside of the network, the plan will pay the same reimbursements as Original Medicare will unless you need emergency or urgent care.

Medicare Advantage PFFS

The Share Of Medicare Beneficiaries In Medicare Advantage Plans By State Ranges From 1% To 59%

The share of Medicare beneficiaries in Medicare Advantage plans varies across the country, but in 25 states, at least half of all Medicare beneficiaries are enrolled in Medicare Advantage plans. In contrast, Medicare Advantage enrollment is relatively low in four mostly rural states . Overall, Puerto Rico has the highest Medicare Advantage penetration, with 93 percent of Medicare beneficiaries enrolled in a Medicare Advantage plan. This may be due in part to the high share of beneficiaries in Puerto Rico with low incomes who are dually enrolled in Medicare and Medicaid, as noted above.

Read Also: What’s My Medicare Provider Number

Pros And Cons Of Medicare Advantage Plans Vs Original Medicare

In addition to the fact that Medicare Advantage insurance carriers are generally obligated to sell you a plan, they also bundle additional benefits, such as vision, dental, hearing, and a prescription drug plan . These are valuable benefits that Original Medicare does not cover. For healthy people, these extras make a Medicare Advantage plan a very good deal.

Many of the extra benefits that some insurance plans offer look very enticing, but they often come with limits or high out-of-pocket costs. For example, a plan may have excellent healthcare benefits and a poor Part D plan .

Also, it is important to understand that the extra benefits, including Part D prescriptions, are not included in the plans maximum out-of-pocket limit. So, lets say you use the plans dental coverage and pay $1,500 in copays for restoration work, that $1,500 is not included in your MOOP, nor are your Part D medications. This is why so many people feel that traditional Medicare, plus a supplement plan, dental plan, and a stand-alone Medicare Part DMedicare Part D plans are an option Medicare beneficiaries can use to get prescription drug coverage. Part D plans provide cost-sharing on covered medications in four different phases: deductible, initial coverage, coverage gap, and catastrophic. Each… plan are the best way to go.

Find Plansin your areawith your ZIP Code

Which Is The Best Medicare Supplement Plan

The most popular Medicare Supplement plan has the highest enrollment rates in the United States. Which one suits your individual needs depends on your beneficiaries. In general Plan F is the largest Medicare Supplement plan because it covers more out-of-pocket costs than all other Medicare plans. Unlike a typical plan, F covers Medicare copayments and deductible payments to help the beneficiaries avoid unnecessary medical and other expenses. Plan F has not been updated and cannot be accessed by a Medicare beneficiary enrolled after January 1, 2020.

Read Also: Should Retired Federal Employees Take Medicare Part B

How We Picked The Best Medicare Advantage Providers

To determine the best Medicare Advantage providers, the Forbes Health editorial team evaluated all insurance companies that offer plans nationwide in terms of:

- How many states in which they provide coverage

- The types of benefits their plans can offer

- How the Centers for Medicare & Medicaid Services ranked their plans, using an average to represent the company as a whole

- How agencies like A.M. Best ranked them in terms of their financial health

- How agencies like J.D. Power ranked them in terms of consumer feedback

We focused exclusively on providing general summaries of the companies and their reputations. In order to provide specific plan recommendations accurately, its important to take into account the ZIP code and demographic details of the individual seeking insurance coverage. To do so, we recommend using Medicare.govs plan finder tool or seeking the expertise of an independent, agnostic insurance agent.

How To Enroll In A Medicare Advantage Plan

Since Medicare Advantage plans are offered through private insurance companies, the costs may vary from plan to plan. The projected average premium for a Medicare Advantage plan in 2023 is $18 per month, but there are other costs to consider, including co-pays and deductibles.4 To get a comparison of costs between different Medicare Advantage and Medicare Part D plans, use

You May Like: Who Is Eligible For Medicare Extra Help

How Much Should I Expect To Pay For A Medicare Advantage Plan

The average premium for a Medicare Advantage plan in 2021 was $21.22 per month. For 2022 it will be $19 per month. Although this is the average, some premiums cost $0, and others cost well over $100. For more resources to help guide you through the complex world of medical insurance, visit our Medicare hub.

How Can I Purchase Medigap Insurance

Once you select your insurer and Medigap coverage, the only thing you need to do is apply. Usually it involves an online questionnaire that contains personal info including the health status of your family. If you applied during Open enrollment period, then an insurer cannot claim an unjustified denial of coverage. Your insurance carrier should send an explanation of your plan and its advantages when the claim is approved. Read it carefully if you need help deciding on coverage. Once the insurance company accepts your enrollment your policy will inform you of the payment way. You can usually choose either the checks or money orders, or you can use the cash.

Recommended Reading: How Much Does Medicare Cover For Knee Replacement

Medicare Advantage Plan Data

The only realistic way to assess a plans popularity is to look at historical data. The following information was obtained from a report by the Kaiser Family Foundation, entitled Medicare Advantage 2013 Spotlight: Medicare Market Update. The report is quite lengthy and Ive focused on plan popularity by firm or affiliate, type of plan and what may be responsible for some specific data.

The first thing to take away from the report is that Medicare Advantage Plans are gaining in popularity. Over 14 million people were enrolled in a Medicare Advantage Plan for 2013. This figure represents an increase of over 1 million people over 2012. Enrollment continues to grow even though enrollees have a fewer number of plans to choose from than from just a few years ago. On average a Medicare beneficiary has about 20 plans to choose from versus nearly 48 in 2009.

Plan Types

Some types of plans are more popular than others. In some cases this could be a function of the way benefits are received with each type of plan, but popularity may actually have more to due with what plans are offered by particular providers and which are more readily available in specific service areas. Here is the enrollment by plan type:

- 65% are enrolled in an HMO

- 22% are enrolled in a local PPO

- 7% are enrolled in a Regional PPO

- 4% are enrolled in PFFS

Best Medicare Advantage Plans For 2023

Lindsay MalzoneReviewed by: Rodolfo MarreroHomeFAQsPart C

The top Medicare Advantage Part C plan for beneficiaries is the policy that provides each person with the most value. Every man or woman wants their insurance to cover their doctors, have affordable costs, and provide quality benefits.

Generally, the more you pay in premiums, the less you pay when you use the insurance. Medicare Advantage bundles your benefits together and still boasts a low monthly premium.

Which Medicare Advantage plan will work best for you? Lets take a look!

Recommended Reading: How To Get Dental With Medicare

What Medicare Advantage Plan Has The Highest Rating

What Does a Five Star Medicare Advantage Plan Mean? Medicare Advantage plans are rated from 1 to 5 stars, with five stars being an excellent rating. This means a five-star plan has the highest overall score for how well it offers members access to healthcare and a positive customer service experience.

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

The chart below shows the coverage combination for the 10 types of standardized Medigap plans available in most states. Take note of how Plan F provides coverage in each area, and how Plan G covers all areas except one.

| 80% | 80% |

Recommended Reading: Is A Walk In Tub Covered By Medicare

How Does Medicare Advantage Differ From Medigap

Medicare Advantage, also known as Medicare Part C, is an all-in-one alternative to original Medicare. Private insurance companies offer Medicare Advantage plans that Medicare approves, and they bundle together Part A hospital coverage, Part B doctor and outpatient services, and usually Part D prescription drug coverage into one package.

If you decide to get coverage through a Medicare Advantage plan, youll still have to enroll in Medicare Parts A and B, including paying the premiums for Part A, if you dont qualify for it free, and Part B. But then you can choose a Medicare Advantage plan and sign up with a private insurer.

The federal government requires Medicare Advantage plans to cover everything that Medicare Parts A and B cover, but they may have different deductibles and copayments. Most Medicare Advantage plans cover prescription drugs, too, and many also help pay for services original Medicare doesnt cover, such as routine dental, hearing and vision care.

Unlike original Medicare, which covers any doctors and other providers who accept Medicare, most Medicare Advantage plans have a provider network and may charge more or not cover doctors or facilities outside of a plans network.

All Medicare Advantage plans have federal rules that limit annual out-of-pocket costs for services covered under Medicare Parts A and B. In 2022, this is $7,550 or less for in-network health services, and $11,300 or less for covered in-network and out-of-network services combined.

What About The Medicare Advantage Give Back Benefit

The give-back benefit allows some Medicare Advantage plans to offer plan members a rebate on their monthly Medicare Part B premium. Beneficiaries with a give-back plan receive the benefit through Social Security. No direct payments are allowed.

The technical term for the benefit is Medicare Part B premium reduction. When you enroll in one of these plans, the insurance carrier pays some or all of your premium. In the evidence of coverage document the plan is required to provide, you will find a section titled Part B Premium Buy-Down. This is where you will find the amount the plan contributed towards your Part B premium.

Plans with a give-back benefit are becoming more popular, but they are still not widespread. The largest companies offering these plans include Aetna, Cigna, and Humana. Give-back amounts range from as little as $.10 to as much as the full $164.90 standard Part B premium.

If you pay your own Part B premium you are eligible for a give-back plan. If you have full or partial Medicaid, including aid through a Medicare Savings Program, you are not eligible.

Recommended Reading: What Do Medicare Advantage Plans Cover

What Is The Medicare Donut Hole Or Coverage Gap

The Medicare coverage gap or “donut hole” refers to a period when there is a limit on drug coverage. It begins once the Medicare Advantage plan and member spend $4,430 on covered drugs. During this time, members are responsible for up to 25% of the cost of brand name and generic drugs. Some plans offer additional coverage in the gap, such as $0 copays on preferred brand name drugs and generics. The gap ends once the member spends $7,050 on covered drugs.

Great For Nationwide Coverage: Humana

-

Ranked 2nd by J.D. Power for customer satisfaction

-

Benefits for over-the-counter drugs

-

Wide range of plan types available

-

Few plans offer additional drug coverage in the gap

Humana is the second-largest provider of Medicare Advantage plans nationwide, with 18% of the market in 2022. It also stands out as the second-best company for customer satisfaction, according to J.D. Powers 2022 U.S. Medicare Advantage Study . HMO, PPO, and PFFS plans are available, depending on where you live, and Humana offers perks like an over-the-counter drug benefit.

The reason Humana doesnt score higher is that few of its Medicare Advantage plans with drug coverage offer any additional coverage in the coverage gap. Fewer than one third, in fact. If you rely on prescription drugs and they cost more than $4,660 in 2023, you could be on the hook for 25% of their cost in the coverage gap.

Plans are available in all states except for Alaska, Rhode Island, and Wyoming.

Read more in our Humana Medicare review.

Also Check: Does Medicare Cover Hearing Aids In 2020